Market Overview

The Philippines Automotive Diagnostic Tools Market is valued at USD ~ million. The market demand is driven by the increasing vehicle ownership and the growing complexity of modern vehicles, which require specialized diagnostic tools for maintenance and repairs. As the automotive repair industry continues to grow in the Philippines, the demand for advanced diagnostic tools, such as OBD scanners and diagnostic software, is rising. Moreover, the need for emissions testing, especially in response to stricter environmental regulations, is also contributing to market expansion. The widespread adoption of automotive diagnostic tools is seen in both small-scale repair shops and large fleets, as businesses seek efficient and reliable diagnostics to maintain vehicle performance and minimize downtime.

The National Capital Region (NCR) is the dominant region in the Philippines Automotive Diagnostic Tools Market due to its high concentration of automotive repair shops, fleet management companies, and vehicle owners. Metro Manila’s extensive automotive service sector drives much of the demand for diagnostic tools. Additionally, regions like Cebu, Davao, and Iloilo are becoming increasingly important due to urbanization and an expanding automotive sector. The growth of the Philippines automotive aftermarket and technological advancements, such as cloud-based diagnostics and AI-powered tools, are influenced by global leaders in diagnostic tool development.

Market Segmentation

By Product Type

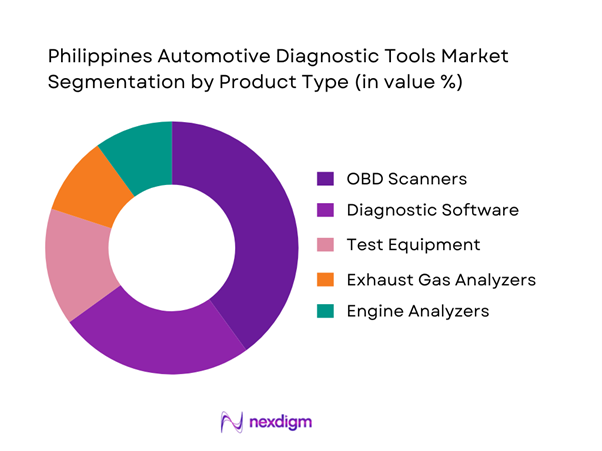

The Philippines Automotive Diagnostic Tools Market is segmented by product type into OBD scanners, diagnostic software, test equipment, exhaust gas analyzers, and engine analyzers. OBD scanners hold the largest share of the market due to their widespread adoption across automotive repair shops. These tools provide essential vehicle diagnostics by scanning onboard computers and generating detailed reports, making them crucial for both small repair businesses and large service centers. As the most cost-effective and user-friendly diagnostic tools available, OBD scanners are the primary choice for many service providers.

By Application

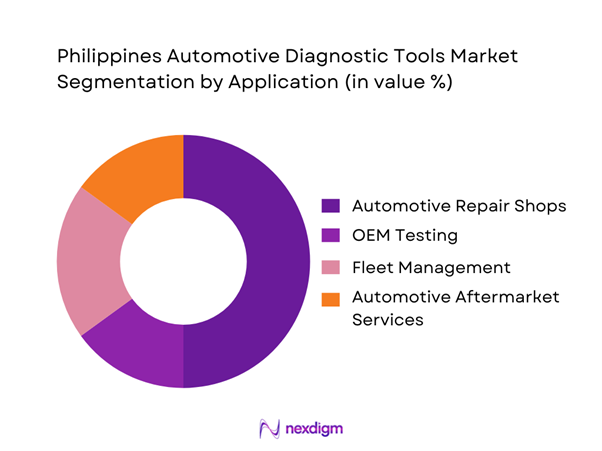

The market is also segmented by application, which includes automotive repair shops, OEM testing, fleet management, and automotive aftermarket services. Automotive repair shops dominate this segment due to the high demand for diagnostic tools that help service providers identify vehicle issues quickly and accurately. The increasing complexity of vehicles and the need for specialized equipment to perform advanced diagnostics have made repair shops the largest users of automotive diagnostic tools. This segment’s continued growth is driven by the rise in vehicle numbers and the demand for timely repairs and maintenance.

Competitive Landscape

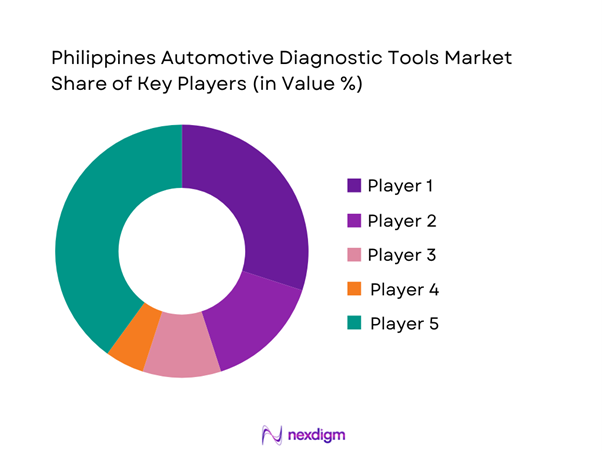

The Philippines Automotive Diagnostic Tools market is dominated by a few major players, including Bosch Automotive Service Solutions, Snap-on Tools, and global brands like Autel, Delphi Automotive, and Launch Tech Co. Ltd. This consolidation highlights the significant influence of these key companies, which offer a wide range of diagnostic tools, from OBD scanners to specialized equipment like exhaust gas analyzers. These companies have strong brand recognition, broad distribution networks, and continue to innovate in diagnostic technology, setting them apart in the competitive landscape.

| Company | Establishment Year | Headquarters | Product Range | Distribution Network | Innovation Focus | Market Position | Manufacturing Capacity | Revenue 2024 |

| Bosch Automotive | 1886 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Snap-on Tools | 1920 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Autel | 2004 | China | ~ | ~ | ~ | ~ | ~ | ~ |

| Delphi Automotive | 1994 | UK | ~ | ~ | ~ | ~ | ~ | ~ |

| Launch Tech Co. Ltd | 1992 | China | ~ | ~ | ~ | ~ | ~ |

Philippines Automotive Diagnostic Tools Market Analysis

Growth Drivers

Increasing Vehicle Ownership

The rising vehicle ownership in the Philippines significantly contributes to the demand for automotive diagnostic tools. With more vehicles on the road, the need for maintenance and repair services grows, driving the adoption of diagnostic tools. Vehicle owners and automotive repair shops increasingly rely on advanced diagnostic equipment to identify and resolve issues quickly and accurately. This trend is particularly evident in urban areas like Metro Manila, where vehicle ownership continues to increase due to urbanization and improved economic conditions. The growing number of vehicles translates into a larger customer base for automotive diagnostic services, fueling market expansion.

Technological Advancements in Diagnostic Tools

Technological advancements in automotive diagnostic tools are revolutionizing the repair and maintenance processes. The integration of software, sensors, and real-time data analysis has significantly enhanced the efficiency of diagnostics. Modern tools, such as OBD-II scanners and ECU (engine control unit) programming tools, offer deeper insights into vehicle performance and can detect complex issues faster than traditional methods. As vehicles become more sophisticated, with increasingly complex electronic and mechanical systems, the demand for advanced diagnostic equipment continues to grow. These innovations also improve the accuracy and speed of vehicle repairs, providing significant value to both repair shops and consumers.

Market Challenges

High Initial Investment in Diagnostic Tools

One of the primary challenges in the Philippines Automotive Diagnostic Tools Market is the high initial investment required for advanced diagnostic equipment. Many small and medium-sized automotive repair shops face difficulty in acquiring the necessary diagnostic tools due to their high upfront cost. These tools, such as OBD scanners and engine analyzers, require significant capital investment, which may not be feasible for smaller businesses that operate on tight budgets. As a result, the adoption of high-end diagnostic tools is often limited to larger repair centers or those with more substantial financial resources, restricting market growth at the grassroots level.

Lack of Skilled Technicians

Another major challenge in the market is the shortage of skilled technicians who are proficient in using advanced diagnostic tools. While the tools themselves are becoming more sophisticated, many automotive technicians in the Philippines lack the specialized training necessary to operate these diagnostic systems effectively. This skills gap results in inaccurate diagnostics, longer repair times, and reduced customer satisfaction. The lack of qualified technicians also affects the ability of repair shops to fully capitalize on the benefits of advanced diagnostic equipment, ultimately limiting the overall potential of the market. Efforts to address this issue, such as training and certification programs, are crucial for market growth.

Opportunities

Growing Automotive Aftermarket Services

The automotive aftermarket services sector in the Philippines presents a significant opportunity for growth in the diagnostic tools market. As the number of vehicles in the country continues to rise, so does the demand for replacement parts, repairs, and maintenance services. Automotive aftermarket service providers increasingly rely on diagnostic tools to provide accurate services and identify vehicle issues. This sector, which includes independent repair shops and dealerships, is expected to continue expanding due to increasing vehicle ownership and the trend toward vehicle customization and maintenance. With the right tools, aftermarket service providers can enhance their offerings, tapping into a growing customer base.

Emerging Electric Vehicle (EV) Diagnostic Needs

As the Philippines sees a gradual shift toward electric vehicles (EVs), there is a growing need for specialized diagnostic tools to address the unique requirements of EV maintenance. Traditional diagnostic tools are not equipped to handle the intricacies of EV systems, such as battery management, electric powertrains, and regenerative braking systems. This opens up a significant opportunity for innovation in diagnostic tools tailored to EVs. As the adoption of electric vehicles grows in response to environmental concerns and government incentives, the demand for advanced diagnostic equipment capable of servicing these vehicles will increase. This trend represents a key growth area in the automotive diagnostic tools market.

Future Outlook

The future of the Philippines Automotive Diagnostic Tools Market looks promising, with significant growth expected due to the increasing vehicle population, the expansion of the automotive repair sector, and the growing demand for specialized diagnostic tools. As vehicle technology continues to evolve, there will be an increasing need for advanced tools capable of diagnosing new types of vehicles, such as electric and hybrid models. Additionally, the trend of remote diagnostics and cloud-based solutions is likely to drive further innovation in the market. The Philippines market is expected to see substantial growth over the next few years, with the continued development of smart diagnostic tools and the expansion of the automotive aftermarket services sector.

Major Players

- Bosch Automotive Service Solutions

- Snap-on Tools

- Autel

- Delphi Automotive

- Launch Tech Co. Ltd

- Honeywell

- Fluke Corporation

- Sykes-Pickavant

- Launch USA

- Car-O-Liner

- KTI Systems

- Nextech Systems

- Vetronix

- Autodiagnos

- Pico Technology

Key Target Audience

- Automotive Repair Shops

- OEMs (Original Equipment Manufacturers)

- Fleet Owners

- Distributors and Dealers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Transportation, Department of Trade and Industry)

- Automotive Aftermarket Service Providers

- Vehicle Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying critical variables influencing the Philippines Automotive Diagnostic Tools Market. These include technological trends, market penetration, and regional adoption rates.

Step 2: Market Analysis and Construction

We analyze historical data on product adoption and market trends, considering key drivers like vehicle ownership, environmental regulations, and technological advancements in diagnostic tools.

Step 3: Hypothesis Validation and Expert Consultation

We validate market hypotheses through expert interviews with industry leaders, technicians, and business owners. These consultations provide valuable insights into current market dynamics.

Step 4: Research Synthesis and Final Output

The final phase synthesizes research findings from secondary sources, industry experts, and company reports to create a comprehensive and accurate market analysis.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Key Industry Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Vehicle Ownership

Technological Advancements in Diagnostic Tools

Rising Demand for Accurate Diagnostics

Expansion of the Automotive Aftermarket - Market Challenges

High Initial Investment in Diagnostic Tools

Lack of Skilled Technicians

High Competition in the Diagnostic Tools Market - Opportunities

Growing Automotive Aftermarket Services

Emerging Electric Vehicle (EV) Diagnostic Needs - Trends

Shift Towards Smart Diagnostic Tools

Integration of AI and Machine Learning in Diagnostics - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- Installed Base / Active Usage Metric, 2019–2024

- Service / Revenue Mix, 2019–2024

- By Product Type (in Value %)

OBD Scanners

Diagnostic Software

Test Equipment (Oscilloscopes, Multimeters, etc.)

Exhaust Gas Analyzers

Engine Analyzers - By Application (in Value %)

Automotive Repair Shops

OEM Testing

Fleet Management

Automotive Aftermarket Services - By Technology / Product / Platform Type (in Value %)

OBD Scanners

Diagnostic Software

Test Equipment

Exhaust Gas Analyzers

Engine Analyzers - By Deployment / Delivery / Distribution Model (in Value %)

Direct Sales

Online Retail

Wholesale - By End-Use Industry / Customer Type (in Value %)

Automotive Repair Shops

OEM Testing

Fleet Management

Aftermarket Service Providers

Government Agencies - By Region (in Value %)

National Capital Region (NCR)

Northern Luzon

Southern Luzon

Visayas

Mindanao

- Competition ecosystem overview

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Distribution Channels, Production Plants, Number of Dealers and Distributors, Margins, Unique Value Offerings)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Bosch Automotive Service Solutions

Snap-on Tools

Autel

Delphi Automotive

Launch Tech Co. Ltd

Honeywell

Fluke Corporation

Sykes-Pickavant

Launch USA

Car-O-Liner

KTI Systems

Nextech Systems

Vetronix

Autodiagnos

Pico Technology

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- Installed Base / Active Usage Metric, 2025–2030

- Service / Revenue Mix, 2025–2030