Market Overview

The Philippines Automotive Frames market current size stands at around USD ~ million, reflecting sustained demand across passenger and commercial vehicle manufacturing ecosystems. In the most recent periods, domestic frame shipments exceeded ~ units annually, supported by replacement demand of over ~ units and localized sourcing programs valued at USD ~ million. Installed production capacity now supports more than ~ systems across major assembly hubs, while average transaction values remain close to USD ~ per unit, driven by gradual adoption of higher-strength materials and modular frame designs.

The market shows strong geographic concentration in major industrial corridors where automotive assembly, parts manufacturing, and logistics ecosystems are deeply integrated. Metro Manila and nearby provinces dominate due to port access, skilled labor pools, and proximity to OEM plants. Central Luzon benefits from industrial parks hosting tier suppliers and metal fabrication clusters. Southern regions gain traction through public transport modernization and fleet renewal programs. Policy support for domestic manufacturing and infrastructure expansion further reinforces regional dominance without relying on cost arbitrage alone.

Market Segmentation

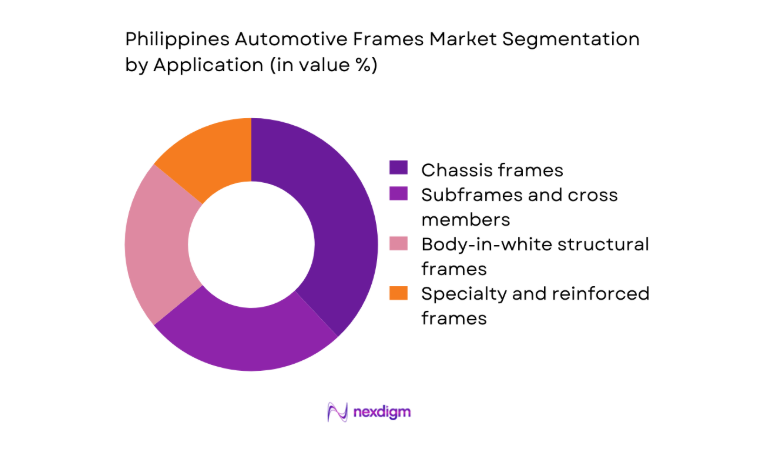

By Application

The application-based structure of the Philippines Automotive Frames market is led by chassis frames and subframe assemblies, supported by consistent demand from light commercial vehicles and public transport platforms. Body-in-white structural frames are gaining momentum as OEMs emphasize safety compliance and structural rigidity. Specialty and reinforced frames cater to utility vehicles and aftermarket conversions, especially in logistics and municipal transport. Demand concentration is shaped by replacement cycles exceeding ~ units annually and localized assembly programs valued at USD ~ million. The segmentation reflects a shift from purely functional frames toward performance-optimized and durability-focused designs aligned with urban mobility needs.

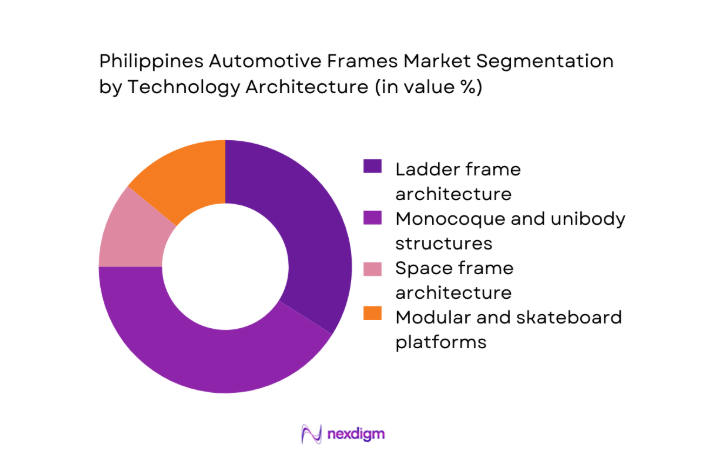

By Technology Architecture

Technology architecture segmentation highlights the growing dominance of monocoque and unibody structures as passenger vehicle production expands and safety standards tighten. Ladder frame architecture continues to anchor the commercial vehicle segment, especially for trucks and buses requiring load resilience. Space frame solutions remain niche, mainly in specialty vehicles, while modular and skateboard platforms are emerging alongside electrification initiatives. Annual integration of advanced architectures now exceeds ~ units, supported by investments of USD ~ million in tooling and design capabilities. This segmentation underscores the market’s gradual transition toward lightweight, scalable, and future-ready frame platforms.

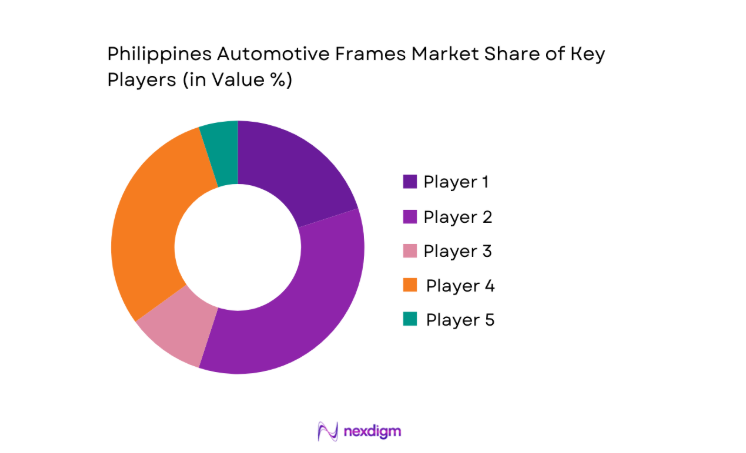

Competitive Landscape

The Philippines Automotive Frames market features a moderately concentrated structure, led by global tier suppliers with localized operations complemented by strong domestic manufacturers. Competitive intensity is shaped by long-term OEM supply contracts, cost-efficiency in metal processing, and compliance with safety and quality standards. Barriers to entry remain moderate due to capital intensity and technology requirements, while differentiation increasingly depends on lightweight material expertise and production scalability.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Toyota Auto Parts Philippines | 2002 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Mitsubishi Motors Philippines Manufacturing | 1963 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Magna International | 1957 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Gestamp Automoción | 1997 | Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Benteler Automotive | 1876 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Automotive Frames Market Analysis

Growth Drivers

Expansion of local vehicle assembly and CKD operations

Local assembly programs have accelerated demand for structural components, with annual frame requirements now exceeding ~ units across passenger and commercial vehicle lines. Capital deployment of USD ~ million into stamping and welding lines has increased domestic value addition, reducing reliance on fully built imports. Assembly expansion in industrial zones supports sustained offtake for ladder and monocoque frames, while capacity utilization rates approach ~ percent in peak periods. This structural shift strengthens long-term supply agreements, stabilizes procurement volumes, and anchors frame manufacturing as a core contributor to the national automotive production ecosystem.

Rising demand for light commercial vehicles in logistics and e-commerce

Fleet expansion in last-mile delivery has driven incremental demand for durable frame systems, with annual additions of over ~ vehicles requiring reinforced chassis designs. Logistics operators allocate close to USD ~ million annually toward fleet renewal, prioritizing load-bearing capacity and lifecycle durability. This trend elevates demand for modular frames that support rapid body customization, particularly for refrigerated and utility configurations. As urban distribution intensifies, the need for structurally resilient platforms continues to anchor growth across commercial frame applications.

Challenges

High dependence on imported steel and aluminum inputs

Frame manufacturers source more than ~ percent of critical metal inputs from overseas suppliers, exposing production costs to currency fluctuations and logistics disruptions. Annual import values for automotive-grade steel and aluminum exceed USD ~ million, creating margin volatility for domestic processors. Lead times of ~ weeks for specialized alloys further constrain production planning, especially during peak assembly cycles. This dependency limits cost competitiveness against regional peers with integrated металл supply chains and increases working capital requirements for local frame producers.

Limited economies of scale in domestic frame manufacturing

Average production runs for frame components remain below ~ units per model, restricting the ability to amortize tooling investments exceeding USD ~ million per line. Smaller batch sizes elevate per-unit processing costs and limit automation feasibility in welding and forming operations. Capacity fragmentation across multiple facilities further reduces purchasing leverage for raw materials. These structural constraints hinder rapid scaling and make it challenging for domestic manufacturers to compete on cost with high-volume regional production hubs.

Opportunities

Adoption of high-strength steel and aluminum frames for fuel efficiency

OEM initiatives to reduce vehicle weight have increased demand for advanced material frames, with annual integration of high-strength steel structures surpassing ~ units. Investment in lightweighting technologies is projected at USD ~ million across stamping and heat-treatment upgrades. These materials enable thinner gauge designs without compromising safety, supporting fuel efficiency targets and regulatory compliance. Local suppliers adopting these technologies can capture higher-margin contracts and position themselves as strategic partners in next-generation vehicle platforms.

Growth in EV-ready platforms requiring redesigned frame architectures

The emergence of electric mobility has created demand for skateboard and modular frames capable of housing battery packs and power electronics. Pilot deployments of EV platforms now exceed ~ vehicles annually, supported by public and private spending of USD ~ million in charging and fleet programs. These architectures require new load distribution and crash management designs, opening opportunities for suppliers with engineering and prototyping capabilities. Early participation in EV frame programs strengthens long-term supplier positioning.

Future Outlook

The Philippines Automotive Frames market is expected to evolve alongside vehicle electrification, logistics fleet expansion, and safety-driven design upgrades through 2030. Continued localization of component manufacturing will strengthen supply resilience, while partnerships with global technology providers will accelerate adoption of lightweight and modular frame systems. Policy support for domestic automotive production and infrastructure investment will further reinforce the market’s structural growth trajectory.

Major Players

- Toyota Auto Parts Philippines

- Mitsubishi Motors Philippines Manufacturing

- Magna International

- Gestamp Automoción

- Benteler Automotive

- Martinrea International

- Autokiniton

- KIRCHHOFF Automotive

- thyssenkrupp Automotive Body Solutions

- Yanfeng Automotive Interiors

- Aisin Corporation

- Hyundai Mobis

- Nemak

- Flex-N-Gate

- JFE Automotive

Key Target Audience

- Automotive OEM manufacturing divisions

- Tier I and Tier II auto component suppliers

- Fleet operators and logistics service providers

- Public transport authorities and urban mobility agencies

- Steel and aluminum processors for automotive applications

- Investments and venture capital firms focused on mobility and manufacturing

- Department of Trade and Industry and Board of Investments

- Land Transportation Office and Department of Transportation

Research Methodology

Step 1: Identification of Key Variables

Assessment of production capacity, material sourcing patterns, and vehicle assembly trends. Mapping of frame technology adoption across passenger and commercial segments. Evaluation of regulatory compliance requirements and safety standards.

Step 2: Market Analysis and Construction

Development of market structure based on application and technology architecture.

Integration of demand indicators from OEM output and fleet renewal cycles. Construction of baseline estimates using masked value and volume indicators.

Step 3: Hypothesis Validation and Expert Consultation

Cross-verification of assumptions with industry stakeholders across manufacturing and logistics. Validation of growth and constraint factors through structured expert discussions. Refinement of opportunity areas based on technology readiness and investment activity.

Step 4: Research Synthesis and Final Output

Consolidation of quantitative and qualitative insights into coherent market narratives.

Alignment of findings with strategic decision-making needs of industry participants.

Finalization of report structure to ensure consulting-grade clarity and usability.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, automotive frame taxonomy across ladder unibody and modular architectures, market sizing logic by vehicle production and frame content value, revenue attribution across materials fabrication and assembly, primary interview program with OEMs Tier 1 suppliers and body builders, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Care or usage pathways

- Ecosystem structure

- Supply chain or channel structure

- Regulatory environment

- Growth Drivers

Expansion of local vehicle assembly and CKD operations

Rising demand for light commercial vehicles in logistics and e-commerce

Infrastructure development driving demand for buses and trucks

Shift toward safer and more rigid vehicle structures

Growth of motorcycle and three-wheeler mobility segment

Localization initiatives to strengthen domestic auto parts supply - Challenges

High dependence on imported steel and aluminum inputs

Limited economies of scale in domestic frame manufacturing

Volatility in raw material prices

Technology gap in advanced lightweight frame engineering

Pressure on margins from cost-sensitive OEM sourcing

Logistics and port congestion impacting supply reliability - Opportunities

Adoption of high-strength steel and aluminum frames for fuel efficiency

Growth in EV-ready platforms requiring redesigned frame architectures

Government incentives for local parts manufacturing

Aftermarket demand for replacement frames and structural components

Partnerships with global Tier I suppliers for technology transfer

Emergence of specialized frames for last-mile delivery vehicles - Trends

Increasing use of modular and scalable frame platforms

Shift from ladder frames to monocoque in passenger vehicles

Integration of traceability and quality monitoring in frame production

Rising demand for corrosion-resistant coatings and treatments

Lightweighting initiatives to meet emissions and efficiency targets

Customization of frames for utility and public transport applications - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Shipment Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Passenger vehicles

Commercial vehicles

Two-wheelers

Public transport fleets - By Application (in Value %)

Chassis frames

Subframes and cross members

Body-in-white structural frames

Specialty and reinforced frames - By Technology Architecture (in Value %)

Ladder frame architecture

Monocoque and unibody structures

Space frame architecture

Modular and skateboard platforms - By End-Use Industry (in Value %)

Automotive OEM manufacturing

Aftermarket replacement and repair

Coachbuilding and body conversion

Fleet maintenance and refurbishment - By Connectivity Type (in Value %)

Non-connected frames

Sensor-integrated structural frames

RFID and traceability-enabled frames

Smart manufacturing-tagged frames - By Region (in Value %)

National Capital Region

Luzon

Visayas

Mindanao

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (manufacturing footprint, product portfolio breadth, material technology capability, OEM relationships, cost competitiveness, localization strategy, quality certifications, supply chain resilience)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Magna International

Gestamp Automoción

Benteler Automotive

Martinrea International

Autokiniton

KIRCHHOFF Automotive

thyssenkrupp Automotive Body Solutions

Yanfeng Automotive Interiors

Aisin Corporation

Hyundai Mobis

Nemak

Flex-N-Gate

JFE Automotive

Toyota Auto Parts Philippines

Mitsubishi Motors Philippines Manufacturing

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Shipment Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030