Market Overview

A Philippines-specific automotive hand tools market size for 2024 is valued at USD ~ million. Market demand is strongly supported by continuous replenishment of high-wear tools such as sockets, wrenches, screwdrivers, and pliers used in daily mechanical servicing. Trade data indicates consistent import inflows for core hand tool categories; for instance, the Philippines imported screwdrivers valued at USD ~ million, highlighting steady replacement cycles driven by workshop usage intensity and expanding vehicle servicing activity across urban and provincial repair hubs. These inflows align with the growing servicing requirements of the country’s expanding vehicle base and increasing repair complexity.

On the supply side, the Philippines’ automotive hand tools ecosystem is import-led, so dominance is visible through origin patterns in widely used SKUs. For instance, in 2023, China and Japan were leading sources for Philippines screwdriver imports by value, supported by scale manufacturing, competitive pricing tiers, and strong distributor availability. For select “tools for working in the hand” flows, 2024 UN Comtrade-based series also shows sustained inflows from key Asian manufacturing hubs into the Philippines market’s retail and workshop channels.

Market Segmentation

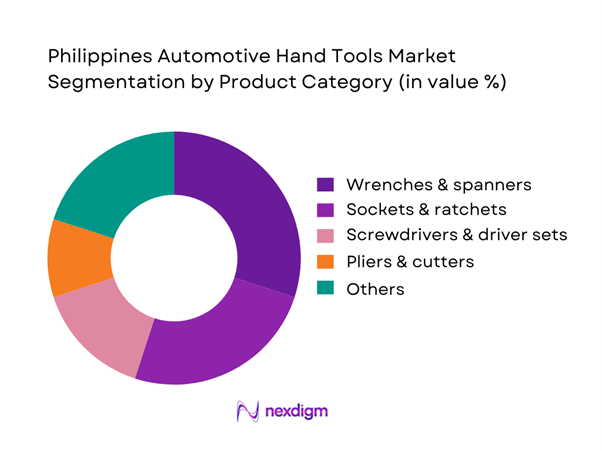

By Product Category

Sockets & ratchets typically dominate “automotive hand tools” baskets in the Philippines because workshop work orders frequently include fastener-heavy tasks (suspension, brakes, engine bay, underchassis), and sockets enable faster job throughput than fixed spanners—especially in cramped compartments common in compact vehicles and motorcycles. The segment also benefits from “set economics”: technicians and DIY buyers often purchase socket sets as an entry kit, which lifts ticket sizes and repeat purchases (missing sockets, worn ratchets, upgraded drive sizes). Distribution favors sockets because they are easy to range across price tiers—from value sets for informal garages to higher-grade chrome vanadium sets for dealership workshops—allowing retailers to stock breadth without complex sizing. Import-led availability also supports rapid replenishment for high-turn SKUs. (Import evidence for adjacent hand-tool categories indicates consistent inflows into the Philippines.)

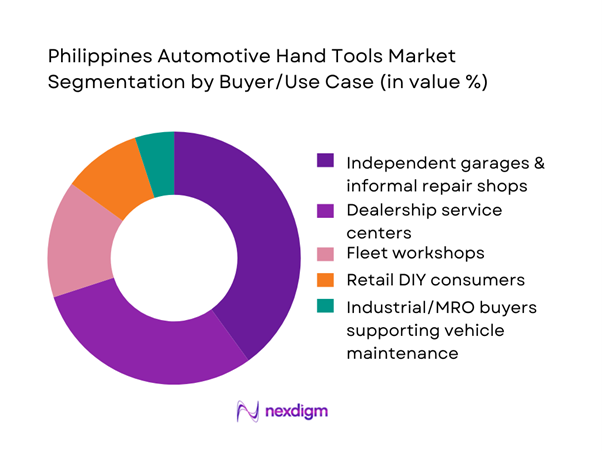

By Buyer/Use Case

Independent garages & informal repair shops usually dominate demand volume in the Philippines because vehicle maintenance is highly decentralized—large numbers of small workshops handle routine mechanical work, motorcycle servicing, and quick repairs. These buyers purchase tools as operational consumables: ratchets wear out, screwdriver tips strip, and sockets get lost, creating steady replacement cycles. They also tend to multi-source: tools are bought from local hardware chains, auto parts hubs, and online marketplaces, reinforcing broad availability and frequent “top-up” purchasing rather than periodic procurement. Unlike dealership workshops that standardize on specific brands and calibration policies, independent garages buy across price tiers and prioritize availability, breadth of sizes, and value-for-money kits. This makes them the largest addressable channel for mass-market tool brands and distributors, with demand spread across Metro Manila and major provincial urban centers.

Competitive Landscape

The Philippines automotive hand tools market is highly fragmented at the retail/distribution level, while brand power is concentrated among a set of global tool brands plus value-focused Asian entrants. Competition is shaped by (i) breadth of SKU coverage (drive sizes, tool sets), (ii) distributor reach into workshop clusters, (iii) warranty/after-sales credibility, and (iv) ability to serve multiple price tiers—from informal garages to dealer-grade requirements.

| Company | Est. Year | HQ | Brand positioning (Pro / Prosumer / Value) | Core automotive categories | Go-to-market in PH | Warranty posture | Typical buyer focus | Differentiation lever |

| Snap-on | 1920 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Stanley (Stanley Black & Decker) | 1843 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Bosch | 1886 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| KNIPEX | 1882 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| King Tony | 1976 | Taiwan | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Automotive Hand Tools Market Analysis

Growth Drivers

Vehicle Parc Servicing Load

The Philippines’ automotive hand tools demand is structurally supported by the scale of the in-use vehicle parc that must be serviced and repaired. Government-reported registration data shows ~ registered vehicles versus ~ registered vehicles in 2023, which translates into a larger annual maintenance workload across independent garages, dealership workshops, and fleet depots. Servicing intensity is reinforced by the fuel-mix of the parc: ~ gasoline vehicles and ~ diesel vehicles are recorded, both of which are heavily dependent on routine mechanical upkeep (brakes, suspension, driveline, underchassis), directly translating into repeat consumption of sockets, wrenches, ratchets, and drivers. On the macro side, the Philippines economy generated USD ~ of output and supported a population of ~, which underpins daily transport usage, logistics flows, and the repair economy that keeps mobility running. Inflation dynamics matter for service frequency and parts/tool replenishment; average inflation eased to ~ versus ~ earlier, supporting steadier servicing and workshop activity rather than deferrals that disrupt tool turnover.

Increasing Repair Complexity

Repair complexity is rising as the parc diversifies beyond conventional gasoline/diesel and as electronics content increases in mainstream vehicles—raising the need for better-fit tools (precision drivers, specialty pliers, trim tools, torque tools, extractor kits) and increasing tool wear from tighter tolerances and fastener variety. In the Philippines, government-cited registration data shows alternative powertrains accelerating: ~ electric vehicle registrations versus ~ earlier, and ~ hybrid registrations versus ~ earlier. Even when EV volumes are still small relative to the total parc, these units introduce new service requirements—HV-safe handling practices, insulated tools for certain workflows, and torque-controlled fastening standards that are less forgiving to “generic” hand tools. At the macro level, the economy’s scale (USD ~) and a large population base (~) supports continued vehicle inflows and technology diffusion that increases the diversity of repair jobs. Meanwhile, urban concentration amplifies complexity because multi-brand vehicles and fleet models concentrate in larger metros; the urbanization level is reported at ~, consistent with higher workshop throughput and more complex service mixes in urban corridors.

Challenges

Counterfeit and Gray Market Presence

Counterfeit/gray market activity undermines legitimate tool brands, distorts price expectations in informal garages, and increases failure risk (rounded fasteners, tool breakage, inconsistent metallurgy). Enforcement data confirms the scale of the counterfeit economy: seized counterfeit products across the year amounted to PHP ~, exceeding 2023 records, which indicates a high baseline of illicit trade that can include tool categories mixed into broader shipments and retail channels. In another enforcement datapoint, counterfeit goods worth about PHP ~ were seized in an operation in Manila, showing that major trade nodes feeding Metro Manila retail can carry high volumes of counterfeit goods. For market context, the registered vehicle parc is ~, meaning a very large service base where low-priced counterfeit tools can circulate quickly through workshops and roadside repair clusters. Macro pressure amplifies the issue: the economy is large (USD ~) and urbanization is ~, creating dense demand centers that counterfeit networks target through fast-moving SKUs.

Import Dependence and Lead Times

The Philippines automotive hand tools market is structurally import-led, so availability and lead times depend on global manufacturing and shipping conditions, distributor working capital, and customs clearance stability. Product-trade evidence indicates meaningful inflows of tool categories into the Philippines: for example, imports of “hand held tools n.e.s., parts thereof” were USD ~ in, confirming reliance on international supply for tool assortment replenishment. Even narrower tool lines show continued import dependence; “files, rasps and similar tools” imports were USD ~ in 2024 record, reflecting ongoing purchasing of workshop consumables and finishing tools used in repairs and fabrication. When the market is import-dependent, lead time shocks translate into stock-outs of fast movers (socket sizes, driver bits, plier variants), forcing workshops to substitute lower-grade tools or buy gray-market stock. Macro signals matter here: with GDP at USD ~ and population at ~, the Philippines runs a high-volume import economy, so any disruption has broad effects; inflation easing to ~ supports steadier restocking but does not remove logistical risk.

Opportunities

Torque and Calibration Services

Torque and calibration services are a growth opportunity because the parc is expanding and becoming more complex while workshops face productivity and liability pressures—creating a business case for “trustable torque” as a service, not just a tool purchase. Demand fundamentals are visible in the vehicle base: ~ registered vehicles versus ~ earlier means more wheel/tire, suspension, and brake jobs where torque specification matters. The shift toward newer powertrains strengthens the requirement for correct procedures: ~ EV registrations and ~ hybrid registrations imply growing volumes of vehicles serviced by technicians who must follow stricter fastening and component-handling practices to avoid expensive failures. Macro context supports commercial viability: GDP at USD ~ and an urbanization level of ~ indicate dense metro repair corridors where calibration centers can reach high workshop density and build recurring service routes. Enforcement against counterfeits also strengthens the case for verified tools and services: with PHP ~ counterfeit seizures reported across the year, workshops and fleets have more incentive to shift to authenticity-checked tools and documented calibration, which can be bundled into service contracts (pickup, calibration, return, certification).

Professional Tool Kit Bundling

Professional tool kit bundling (starter-to-progression kits for technicians; standardized kits for fleets; bay-ready sets for independent garages) is a practical growth lever because it addresses affordability constraints while improving workshop productivity and reducing tool-mismatch downtime. The market base is large and still growing: ~ registered vehicles implies sustained servicing volume that rewards workshops that can complete jobs faster with complete kits rather than piecemeal tools. The workforce pipeline supports recurring kit demand: a large annual graduate base, including ~ graduates for a cited automotive qualification line, typically translates into first-time purchases of socket sets, wrench sets, and driver kits—then upgrades into torque tools and specialty kits as technicians specialize. Bundling also mitigates the counterfeit problem by packaging authenticity checks into kits, relevant in an enforcement environment where PHP ~ counterfeit goods were seized in a single major operation and PHP ~ were seized across the year—conditions that can erode buyer confidence in loose, unverified tools. Macro indicators support scalable distribution: GDP of USD ~ and urbanization ~ point to high-density retail and e-commerce corridors where bundles can be distributed efficiently via tool distributors, hardware chains, and online channels.

Future Outlook

Over the next five years, the Philippines automotive hand tools market outlook is supported by continued vehicle parc servicing needs, the expansion of workshop digitization and parts retailing, and growing penetration of e-commerce for tool replenishment. Product demand will increasingly polarize into (i) value tool kits for informal garages and DIY, and (ii) higher-durability, warranty-backed lines for professional bays and fleets. Import dependence will remain a key feature, reinforcing the importance of distributor reach, SKU availability, and pricing discipline.

Major Players

- Snap-on

- Stanley

- Bosch

- KNIPEX

- King Tony

- Bahco

- GEDORE

- FACOM

- Wiha Tools

- Wera Tools

- Apex Tool Group

- Total Tools

- INGCO

- Makita

Key Target Audience

- Independent automotive garage owners & multi-bay workshop chains

- OEM-authorized dealership service center procurement teams

- Fleet maintenance heads

- Automotive parts retailers and auto supply chains

- E-commerce automotive sellers and marketplace “auto accessories/tools” operators

- Industrial MRO procurement teams supporting vehicle/equipment upkeep

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We begin by building an ecosystem map of the Philippines automotive hand tools market, covering brands, importers, distributors, retailers, workshops, and fleet buyers. Desk research is conducted across trade statistics, company catalogs, retail assortment mapping, and regulatory references to define demand variables such as SKU velocity, tool-kit adoption, and warranty expectations.

Step 2: Market Analysis and Construction

We compile historical signals using import proxies for hand-tool categories and triangulate with channel checks across hardware chains, auto supply clusters, and online marketplaces. This phase converts category movement into market structure insights—product mix, buyer mix, price-tier bands, and channel splits—aligned to automotive-use tool baskets.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through CATI interviews with distributors, workshop owners, parts retailers, and fleet maintenance teams. These interviews capture purchasing cadence, preferred brands, failure modes, and service policies (e.g., torque tool calibration practices), refining segment dominance and channel behavior.

Step 4: Research Synthesis and Final Output

We synthesize quantitative signals (trade/assortment/pricing benchmarks) with primary insights to finalize the market narrative, competitive positioning, and actionable segmentation. Findings are cross-verified via retailer assortment audits and distributor confirmations to ensure consistency and decision-useful conclusions.

- Executive Summary

- Research Methodology (Market Definitions and Scope Boundaries, Automotive Workshop Tool-Set Assumptions, Abbreviations, Market Sizing Framework (Top-Down/Bottom-Up), Price–Volume Normalization Logic (SKU-to-Kit), Primary Research Approach (Workshop Interviews, Dealer Checks, Fleet Maintenance Inputs), Secondary Research Sources, Data Triangulation and Validation, Channel Mapping Approach, Limitations and Confidence Scoring)

- Definition and Scope

- Market Genesis and Evolution

- Business Cycle and Demand Seasonality

- Ecosystem Snapshot

- Macro Context

- Growth Drivers

Vehicle Parc Servicing Load

Increasing Repair Complexity

Workshop Productivity Pressure

Tool Kit Upgrade Cycles - Challenges

Counterfeit and Gray Market Presence

Import Dependence and Lead Times

High Price Sensitivity of Informal Garages

Limited After-Sales and Calibration Infrastructure - Opportunities

Torque and Calibration Services

Professional Tool Kit Bundling

EV-Ready Insulated Tool Adoption

Fleet Maintenance Standardization - Trends

Ratcheting Tool Adoption

Modular Tool Set Demand

Anti-Slip and Ergonomic Designs

Digital Channel-Led Assortment Expansion - Regulatory & Policy Landscape

- Supply Chain and Value Chain Analysis

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Realized Price, 2019–2024

- Price Band Mix, 2019–2024

- By Application (in Value %)

Socket Sets and Accessories

Wrenches

Screwdrivers and Bits

Pliers and Cutters

Torque Tools - By End-Use Industry (in Value %)

Dealership Workshops

Independent Garages

Fleet Maintenance and Logistics Depots

Auto Parts Retailers and Installers

Technical Schools and Training Centers - By Technology Architecture (in Value %)

Manual Hand Tools

Precision Torque Tools

Insulated and VDE Tools

Heavy-Duty and Industrial Tools

Specialty Automotive Service Tools - By Connectivity Type (in Value %)

Offline Physical Retail

Distributor-Led Supply

E-commerce Platforms

Direct Enterprise Procurement

Hybrid Omni-Channel Procurement - By Region (in Value %)

NCR

Luzon (Non-NCR)

Visayas

Mindanao

- Market Share Snapshot

- Cross Comparison Parameters (Automotive SKU Depth, Torque Accuracy and Calibration Support, Warranty Coverage and Claim Process, Counterfeit Protection Mechanisms, Channel Footprint, Assortment Availability, Pricing Architecture, After-Sales Capability)

- Strategic Positioning Map

- Product and Kit Benchmarking

- Distributor and Channel Strategy Review

- Competitive SWOT Analysis

- Pricing and Promotion Intelligence

- Detailed Profiles of Major Companies

STANLEY

DEWALT

Bosch Power Tools

Makita

Snap-on

SATA

TOPTUL

INGCO

Crescent Tools

Milwaukee Tool

Würth Philippines

HansTools

GEDORE

KNIPEX

Ronix

- Workshop Tool Basket Composition

- Procurement Journey

- Pain Point Analysis

- Decision-Making Unit Analysis

- Service Model Expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Realized Price, 2025–2030

- Price Band Mix, 2025–2030