Market Overview

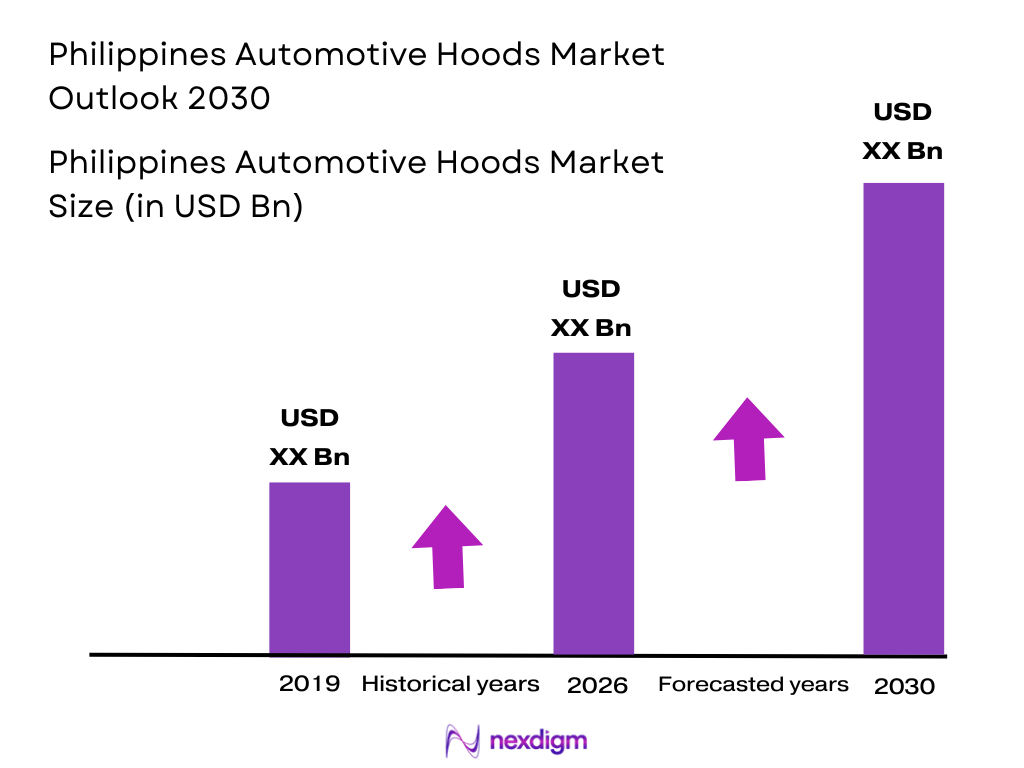

The Philippines automotive hoods market has grown significantly, reaching a valuation of approximately USD ~ billion. The growth of the market is primarily driven by the increasing automotive production and the shift towards lightweight vehicle components. Major factors include the booming automotive manufacturing industry, especially in Metro Manila and surrounding provinces, as well as rising demand for passenger cars, SUVs, and commercial vehicles. The market is also influenced by government incentives for automakers, alongside innovations in materials like aluminum and composites, which improve fuel efficiency and safety standards.

Metro Manila, Cavite, and Laguna are key cities driving the automotive hoods market in the Philippines. These cities are home to the majority of automotive manufacturing plants and assembly lines, including those of leading global automotive brands such as Toyota, Honda, and Mitsubishi. The reason for their dominance is the concentration of local and international manufacturers in these regions, making them central hubs for vehicle production. Additionally, Metro Manila’s role as an economic center and export gateway further enhances the demand for automotive parts.

Market Segmentation

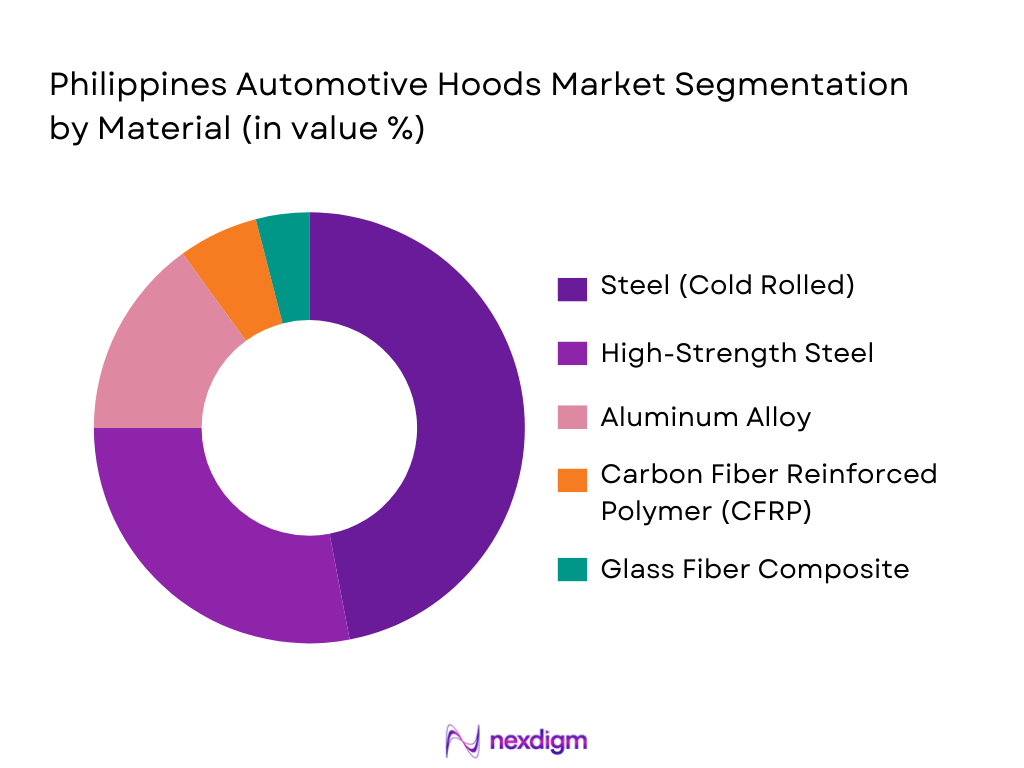

By Material

The Philippines automotive hoods market is segmented by material type into steel, aluminum, carbon fiber reinforced polymer (CFRP), and glass fiber composites. Among these, steel continues to dominate the market. Steel is still preferred for its cost-effectiveness and strength, making it a standard material for many vehicle types, especially in the entry-level segments. However, aluminum is seeing increased adoption due to its lightweight properties, contributing to better fuel efficiency, a crucial factor in the growing demand for fuel-efficient vehicles. CFRP and glass fiber composites are emerging, especially for high-end vehicles and electric vehicles (EVs), where weight reduction is critical to enhancing performance and range.

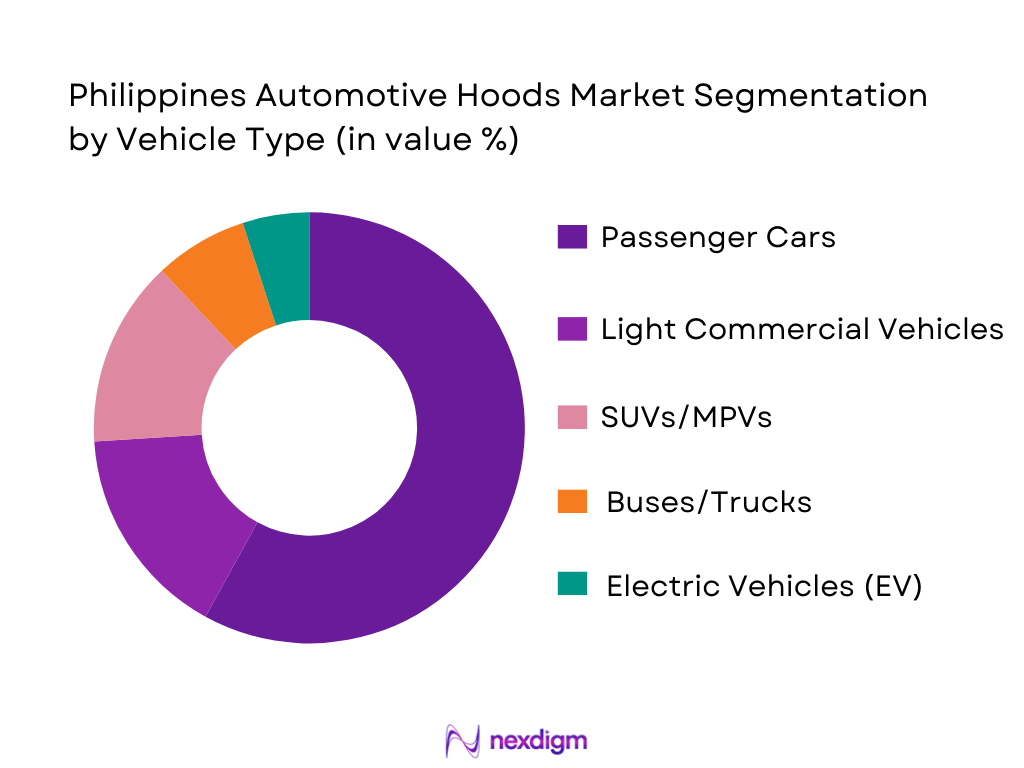

By Vehicle Type

The market for automotive hoods is segmented by vehicle type into passenger cars, light commercial vehicles (LCV), SUVs/MPVs, buses/trucks, and electric vehicles (EVs). Among these, passenger cars dominate the market, largely due to their high production volumes and the increasing consumer preference for personal mobility solutions. The rise of SUVs and MPVs is also contributing to the demand for automotive hoods, as these vehicles often require larger hoods. The EV market is expanding, with significant growth expected due to government incentives and the push for greener technologies.

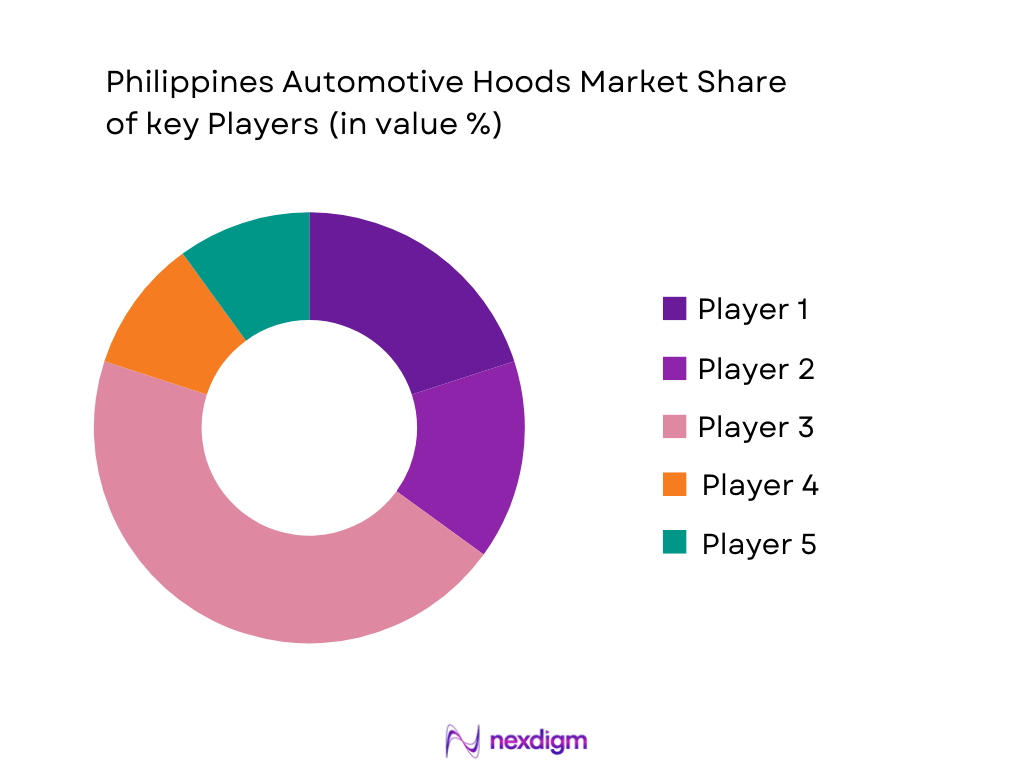

Competitive Landscape

The Philippines automotive hoods market is dominated by both international players and local manufacturers. Key players include global giants such as Magna International, Aisin Seiki, and Denso Corp., who supply high-quality components to OEMs. Local manufacturers such as Almazora Motors and Francisco Motors contribute significantly to the aftermarket. The market is highly competitive, with companies focusing on material innovation, cost reduction, and timely supply chains to cater to both OEM and aftermarket demands.

| Company | Establishment Year | Headquarters | Product Range | Manufacturing Locations | Key Markets Served | Technology Innovation |

| Magna International | 1957 | Canada | ~ | ~ | ~ | ~ |

| Aisin Seiki Co. | 1949 | Japan | ~ | ~ | ~ | ~ |

| Denso Corp. | 1949 | Japan | ~ | ~ | ~ | ~ |

| Almazora Motors | 1970 | Philippines | ~ | ~ | ~ | ~ |

| Francisco Motors | 1954 | Philippines | ~ | ~ | ~ | ~ |

Philippines Automotive Hoods Market Analysis

Growth Drivers

Urbanization

Urbanization is a significant driver for the Philippines automotive hoods market, as more people in urban areas opt for private vehicles due to convenience and rising incomes. As of 2025, the urban population in the Philippines stands at over ~ million, accounting for approximately ~ % of the total population, according to the World Bank. The rapid urban growth is fueling demand for personal transportation, particularly cars, and consequently, automotive components like hoods. The Philippine government has also implemented various urban infrastructure projects that will improve transportation networks, further increasing vehicle ownership. Urbanization not only boosts demand for vehicles but also drives the need for vehicle components to match the growing population’s needs.

Industrialization

Industrialization in the Philippines is accelerating, significantly boosting the automotive sector, including the demand for automotive hoods. Industrial production in the country grew by ~ % in 2025, as reported by the Philippine Statistics Authority (PSA). The expansion of manufacturing hubs, particularly in automotive and parts production in areas like Laguna and Cavite, is contributing to the growth of this sector. The Philippines is also focusing on strengthening its automotive manufacturing capability with investments in technology and infrastructure, which enhances vehicle production and, by extension, the demand for automotive components like hoods. As industrialization advances, the local automotive parts market will see increased demand for components tailored to both domestic and export vehicles.

Restraints

High Initial Costs

A significant restraint to the Philippines automotive hoods market is the high initial costs associated with manufacturing and material procurement. The cost of raw materials like steel and aluminum has fluctuated significantly, with steel prices reaching around USD ~ per ton in early 2025, as per the International Trade Administration. Additionally, high import duties on raw materials and components create a cost burden for local manufacturers, limiting their ability to scale production and pass on affordable prices to consumers. These high initial costs are particularly challenging for small and medium-sized enterprises (SMEs) in the automotive sector, which limits their competitiveness in the market.

Technical Challenges

The automotive hoods market in the Philippines also faces technical challenges in terms of material innovation and manufacturing processes. The transition from traditional steel to lightweight materials like aluminum and composites poses challenges in terms of production capabilities. As of 2025, the cost of aluminum remained high, and the technology for mass-producing high-quality composite materials is still being refined. Furthermore, the expertise required for manufacturing such materials is limited within the Philippines, and there is a reliance on foreign suppliers for these advanced components. These technical gaps hinder the full potential of the automotive sector, including the hoods market, in achieving efficiency and performance at competitive price points.

Opportunities

Technological Advancements

Technological advancements offer significant opportunities for growth in the Philippines automotive hoods market. The country is increasingly adopting advanced manufacturing technologies, including automation and robotics, to improve production efficiency. In 2025, the Philippines’ manufacturing sector saw a ~ % increase in the adoption of automation and robotics, as per the Philippine Department of Trade and Industry. Moreover, the development of lightweight composite materials is progressing, driven by global trends toward reducing vehicle weight for better fuel efficiency. The rising demand for electric vehicles (EVs) and more eco-friendly solutions further provides opportunities for local manufacturers to innovate in hood designs and materials that cater specifically to EV requirements, such as improved aerodynamics and safety standards.

International Collaborations

International collaborations present a major opportunity for the Philippines automotive hoods market. The Philippines is positioning itself as a growing hub for automotive manufacturing in Southeast Asia, attracting investments from global automakers. For instance, in 2025, the Philippines received USD ~ billion in foreign direct investment (FDI) in the manufacturing sector, with a significant portion directed towards automotive and parts production. Collaborations with global suppliers of materials, advanced technologies, and research and development initiatives will enable local manufacturers to access cutting-edge technologies and expand their production capabilities. Such collaborations can help overcome challenges related to technical expertise and material costs, thereby fostering growth in the automotive hoods market.

Future Outlook

Over the next 5 years, the Philippines automotive hoods market is expected to witness steady growth, driven by an increase in vehicle production, particularly in the EV sector. This growth is supported by the country’s continued efforts to promote electric vehicle adoption and its expanding automotive manufacturing sector. Innovations in lightweight materials such as aluminum and composites will also play a key role in shaping the market, as they enhance vehicle fuel efficiency and safety standards. The market will also benefit from the growing demand for SUVs and MPVs, which require larger and more advanced hood designs.

Major Players in the Market

- Magna International

- Aisin Seiki Co.

- Denso Corp.

- Plastic Omnium

- Gestamp Automoción

- YAPP Automotive

- NHK Spring Co., Ltd.

- SGL Carbon

- Benteler Automotive

- Toyota Motor Philippines

- Mitsubishi Motors Philippines

- Honda Cars Philippines

- Nissan Philippines

- Almazora Motors

- Francisco Motors

Key Target Audience

- Automotive Manufacturers (OEMs)

- Tier 1 Automotive Suppliers

- Auto Parts Retailers (Authorized & Independent)

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Trade and Industry, Board of Investments)

- Automotive Aftermarket Companies

- EV Manufacturers and Battery Providers

- Commercial Fleet Operators

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying critical stakeholders and variables affecting the automotive hoods market in the Philippines. This includes analyzing the material types, vehicle categories, and production trends. Secondary data sources, such as industry reports, OEM publications, and government databases, will be utilized to create an accurate ecosystem map.

Step 2: Market Analysis and Construction

Data related to historical trends, vehicle production figures, and demand patterns will be gathered and analyzed. This phase also includes assessing material preferences (steel, aluminum, composites) and identifying the key drivers behind their adoption. Market sizing will be performed using bottom-up and top-down approaches.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through in-depth interviews with industry experts, OEM representatives, and Tier-1 suppliers. The goal is to gather firsthand insights on material selection, regional production capacities, and the impact of government policies.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data into a coherent report, ensuring that the insights derived from the data are aligned with the latest industry trends. Expert consultations will help validate key assumptions and provide further depth to the findings.

- Executive Summary

- Research Methodology (Market Definitions & Scope Boundaries, Philippines Auto OEM vs Aftermarket Definitions, Data Sources: Import Trade Data, OEM Build Sheets, Dealership Channel Analytics, Vehicle Production & Registration Database Method, Survey Panel: OEM Purchasing, Tier‑1/2 Supplier Interviews, Market Sizing & Forecasting Framework, Limitations & Assumptions)

- Automotive Hoods (Front Cladding Coverage Parameters & Functional Requirements)

- Role in Vehicle Safety, Aerodynamics, Pedestrian Regulations

- Philippines Automotive Industry Structure & Hoods Demand Drivers

- Evolution of Hood Materials (Steel → Aluminum → Composites)

- Regulatory & Compliance Landscape

- Import Tariffs & Zero‑Duty EV/Parts Policy (Philippines)

- Standards for Panel Fit & Corrosion Resistance

- Benchmark Hoods Value Chain Analysis

- Raw Materials (Steel, Aluminum, CFRP)

- Tier‑2 Fasteners & Seals

- OEM Assembly & Aftermarket Channels

- Growth Drivers

Philippines Vehicle Sales Growth & Production Recovery

Shift to Lightweight & Fuel‑Efficiency (Aluminum/Composites)

EV/Hybrid Penetration & Zero‑Duty Parts Policy

- Market Challenges

High Import Dependency of Body Panels

Volatile Steel/Aluminum & Composite Raw Material Prices

- Opportunities

Local Supplier Clustering (Metro Manila

- Market Trends

Material Shift: Steel → Hybrid/CompositeSmart/Active Hood Adoption (Pedestrian Safety / Aerodynamic Gains)

Integration of Sensors & Foams

- Porter’s Five Forces (Market Specific)

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Material Steel (In Value %)

High‑Strength Steel

Aluminum Alloy

Carbon Fiber Reinforced Polymer (CFRP)

Glass Fiber Composite - By Vehicle Type (In Value %)

Passenger Cars

Light Commercial Vehicles (LCV)

SUVs/MPVs

Buses/Trucks

EV & Hybrid Vehicles - By End Market (In Value %)

OEM (New Vehicle Assembly)

Aftermarket Replacement

Export Supply - By Distribution Channel (In Value %)

OEM Direct Supply

Tier‑1 Supply

Authorized Aftermarket Retailers

Online Aftermarket Platforms - By Installation Type (In Value %)

Standard Hood

Active/Smart Hood (Safety/Aero)Hood With Integrated Sensors - By Sales Channel (In Value %)

Dealer Attach Parts

Independent Aftermarket

E‑commerce Auto Parts Marketplace

- Market Share Value & Volume by Competitor

- Cross‑Comparison Parameters (Company Profile & Ownership Structure, Product Breadth (Steel/Aluminum/Composite Hood SKUs), ASP by Material Type, Distribution Footprint (OEM, Tier‑1, Aftermarket), Number of OEM Programs Supplied, Import vs Local Sourcing Ratio, Manufacturing/Assembly/Localization Facilities, Strategic Alliances & Technology Partnerships)

- Detailed Company Profiles

Magna International (Hood Panel Supplier)

Aisin Seiki Co.

Denso Corp.

Plastic Omnium

Gestamp Automoción

YAPP Automotive

NHK Spring Co., Ltd.

SGL Carbon

Benteler Automotive

Local OEM Supplier Consortium (Philippines)

Aftermarket Group: Pilipinas Autogroup

Toyota Motor Philippines Parts Division

Mitsubishi Motors Philippines Parts

Almazora Automotive Panels (Body Builder/Panel Maker)

Francisco Motors Automotive Parts (Local Body Panels)

- OEM Repurchasing Logic (Cost, Vehicle Program, Local Content)

- Aftermarket Consumer Price Elasticity

- Fleet & Commercial Buyer Preferences

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030