Market Overview

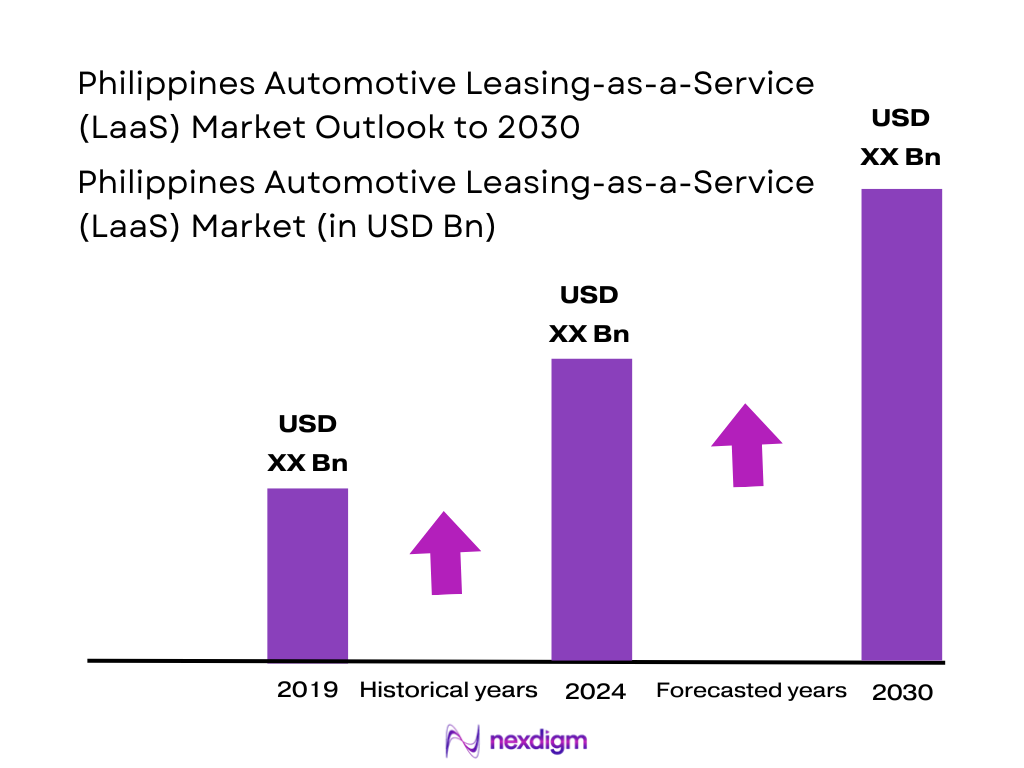

The Philippines Automotive Leasing-as-a-Service Market is valued at around USD ~ billion, based on a five-year historical analysis of car rental and leasing activity. This sits within a wider automotive ecosystem where new vehicle sales range from roughly 441,400 to 475,000 units annually, supported by rising incomes and a growing middle class. Demand is driven by urban congestion, the cost of ownership, and a shift from asset purchase to usage-based access, especially among corporates, SMEs, and mobility platforms seeking predictable operating costs and outsourced fleet management.

The Philippines Automotive Leasing-as-a-Service Market is heavily concentrated in Metro Manila, Cebu, and Davao, which anchor the country’s economic and mobility activity. Metro Manila alone accounts for about 31.1% of national GDP, with Luzon’s key industrial regions (CALABARZON and Central Luzon) lifting the broader corridor’s share to nearly 59.3% of GDP, creating dense corporate and commuter demand for leased fleets. Cebu and Davao act as regional logistics and tourism hubs, with strong IT-BPM, trade, and airport connectivity, making them natural growth poles for LaaS adoption.

Market Segmentation

By End-User Type

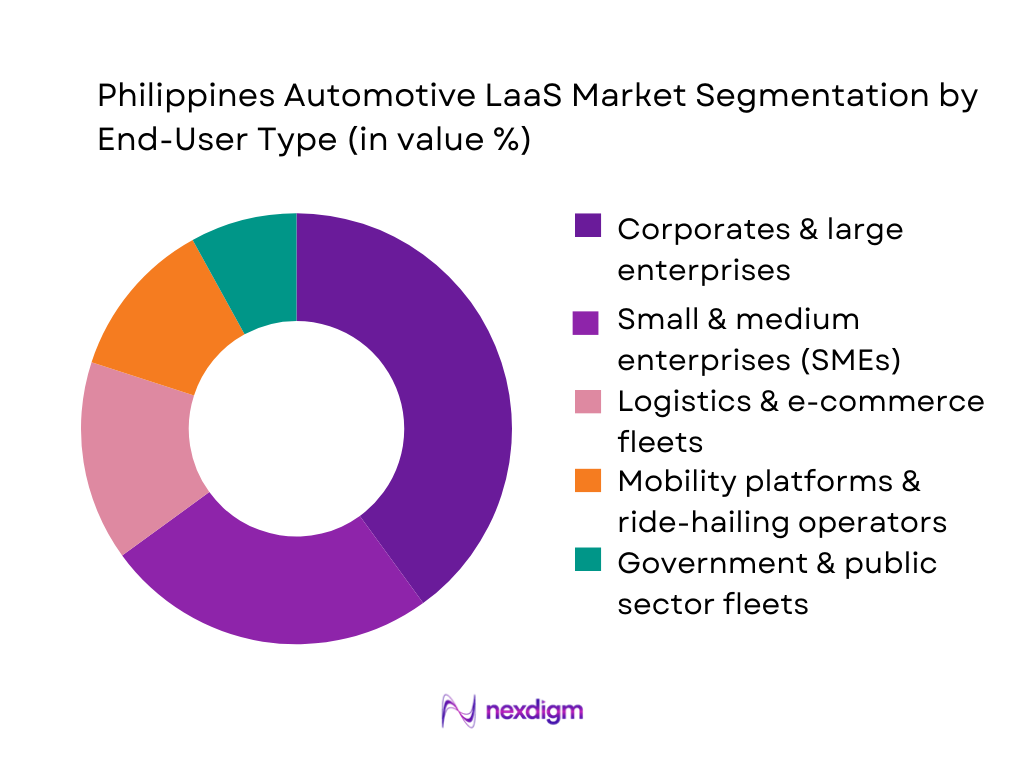

The Philippines Automotive Leasing-as-a-Service Market is segmented by end-user into corporates and large enterprises, SMEs, logistics and e-commerce fleets, mobility platforms and ride-hailing operators, and government and public sector fleets. Corporates and large enterprises currently hold the dominant share as they operate sizeable car and light-commercial fleets across Metro Manila, CALABARZON and key regional hubs, often outsourcing fleet management to specialist lessors to avoid capex and complexity. Rapid expansion of shared-services centers, IT-BPM firms and multinational headquarters in NCR and Cebu has further entrenched multi-year operating lease contracts as the preferred mode of access over outright purchase.

By Vehicle Type

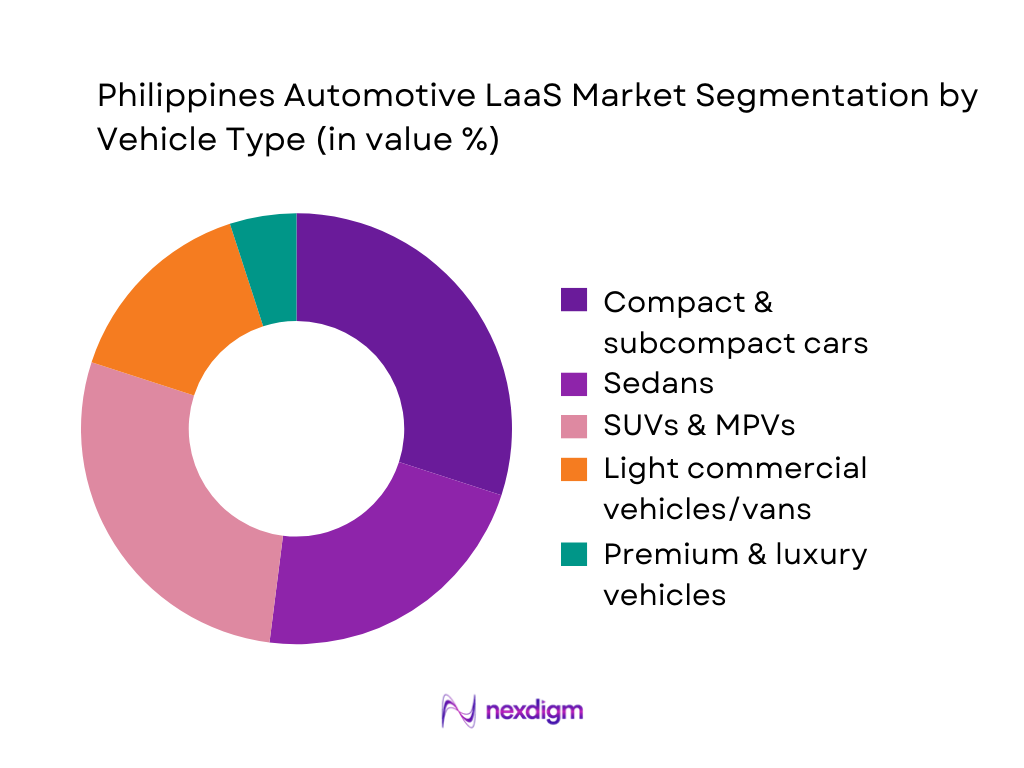

The Philippines Automotive Leasing-as-a-Service Market is segmented by vehicle type into compact & subcompact cars, sedans, SUVs & MPVs, light commercial vehicles & vans, and premium & luxury vehicles. SUVs & MPVs now account for a leading share because they align with Filipino preferences for multi-purpose family and corporate people-mover vehicles, and are widely used by BPO transportation, corporate shuttles, tourism operators, and provincial route services. Compact cars and sedans remain critical in Metro Manila and Cebu for fuel-efficient city travel, while LCVs and vans underpin logistics, cold-chain and last-mile delivery linked to booming e-commerce and food distribution. Premium vehicles are a niche but growing segment for executive leasing and hospitality.

Competitive Landscape

The Philippines Automotive Leasing-as-a-Service Market is fragmented but competitive, with a mix of global brands (Avis, Hertz, Budget, Europcar, National, Sixt) and strong local operators (Diamond Rent a Car, Drive Manila, Anis Trans Service, Nissan Rent a Car Philippines, EasyRent, Viajero, ZC Mobility, PhilCar Rentals, MyCar Rental). International brands leverage global systems and corporate contracts, while domestic players win via long-term full-service operating leases (FSOL), localized service, and nationwide coverage. Corporate operating leases, airport- and hotel-based rentals, and direct corporate contracts are particularly important channels, with technology (online platforms, telematics, fleet optimization) now a major differentiator.

| Company | Establishment Year | Headquarters (Philippines) | Primary Service Model | Key Vehicle Focus | Core Client Segments | Digital / Telematics Capabilities | Notable Strength |

| Diamond Rent a Car | 1978 | Parañaque / NCR | ~ | ~ | ~ | ~ | ~ |

| Safari Rent A Car, Inc. | 1993 | Makati / NCR | ~ | ~ | ~ | ~ | ~ |

| Alamo Transport Leasing Services | 1997 | Parañaque / NCR | ~ | ~ | ~ | ~ | ~ |

| Hertz Philippines | 2003 (PH) | Makati / NCR | ~ | ~ | ~ | ~ | ~ |

| Toyota Mobility Solutions PH (KINTO One) | 2022 | Makati / NCR | ~ | ~ | ~ | ~ | ~ |

Philippines Automotive Leasing-as-a-Service (LaaS) Market Analysis

Growth Drivers

Fleet Outsourcing Demand

The Philippines’ economy is large and services-heavy, creating strong structural demand for outsourced vehicle fleets. National GDP is about ~ billion current US dollars, with services contributing more than half of output and urban residents accounting for roughly 49 percent of the population. At the same time, there are 11.23 million registered gasoline vehicles and 3.03 million diesel vehicles on Philippine roads, indicating a sizeable vehicle base that businesses must manage. The expanding digital economy, valued at about 2.25 trillion pesos in gross value added, with around 11.3 million workers, pushes enterprises toward asset-light, data-driven fleet outsourcing rather than owning and administrating large in-house vehicle pools.

BPO Sector Expansion

The IT-BPM/BPO sector directly drives LaaS demand through employee shuttles, corporate mobility, and client-dedicated fleets. Industry revenues reached about 32.5 billion US dollars with 1.57 million full-time employees and then grew further to roughly 38 billion US dollars and 1.82 million jobs, according to the industry association. These workers are concentrated in Metro Manila, Cebu, and other IT corridors that operate 24/7, requiring reliable, scheduled transport to comply with security and labor standards. As BPO offices sign multi-year leases and expand headcount, they increasingly prefer long-term operating leases and manage transportation over capital-intensive vehicle ownership, which aligns closely with LaaS models.

Market Challenges

High Vehicle Import Costs

The Philippines relies heavily on imported vehicles and components, leaving fleet operators and LaaS providers exposed to currency and trade-cost volatility. Imports of road motor vehicles for transporting ten or more persons under HS code 8702 reached about 397.00 million US dollars, up from 294.60 million. Imports of vehicle transmissions (HS 870840) climbed to roughly 44.90 million US dollars. The central bank reported a current account deficit of about 1.7 billion US dollars, or −1.6 percent of GDP for one recent quarter, underlining external vulnerability. In this context, exchange-rate swings and import-cost spikes complicate vehicle replacement planning and residual-value management for leasing portfolios.

Regulatory Uncertainty

LaaS operators must navigate evolving rules around vehicle standards, EV incentives, and data governance. The Electric Vehicle Industry Development Act (EVIDA) is operationalized alongside other transport and environment policies, and Land Transportation Office data indicates 7,515 registered electric vehicles in the country, including 1,359 newly registered units in a recent year. At the same time, energy-transition roadmaps and city-level traffic and emissions initiatives continue to shift compliance requirements for fleet composition, emission standards, and parking/road-use restrictions. These moving policy targets create uncertainty about the optimal mix of internal-combustion and electric units in long-term leases, the tax treatment of leased EVs, and the data-privacy implications of vehicle tracking—exposing LaaS providers to regulatory risk that must be priced into contracts.

Future Outlook

Over the 2024–2030 horizon, the Philippines Automotive Leasing-as-a-Service Market is expected to expand steadily, supported by projected real GDP growth around 6%, continued urbanization, and rising vehicle demand. Regulatory reforms like the Public Utility Vehicle Modernization Program (PUVMP) are accelerating fleet renewal and encouraging operators to adopt modern, safer, and cleaner vehicles—many of which will be acquired via leasing or FSOL rather than outright purchase. Increasing digitalization—online booking, telematics, automated fleet management, and data-driven route optimization—will deepen LaaS penetration across corporate fleets, logistics operators, and mobility platforms. EV readiness, including incentives and pilot programs for electric fleets, will create new niches in green leasing and subscription-based EV access, particularly for last-mile delivery and corporate sustainability commitments.

Major Players

- Avis Philippines

- Hertz Philippines

- Budget Rent a Car Philippines

- Europcar Philippines

- National Car Rental Philippines

- Sixt Rent a Car Philippines

- Drive Manila

- Anis Trans Service (ATS) Corporation

- Diamond Rent a Car

- Nissan Rent a Car Philippines

- EasyRent Philippines

- Viajero Rent a Car

- ZC Mobility Philippines Corporation

- PhilCar Rentals

- MyCar Rental

Key Target Audience

- Automobile manufacturers and captive finance arms (e.g., Toyota Motor Philippines, Honda Cars Philippines, Nissan Philippines)

- Car rental and leasing operators (international brands and local FSOL providers)

- Logistics, delivery, and e-commerce companies (parcel, food delivery, cold-chain operators)

- Corporate and SME fleet managers across IT-BPM, manufacturing, construction, and services

- Investment and venture capitalist firms (evaluating mobility, fleet-tech, and LaaS platforms)

- Government and regulatory bodies – Department of Transportation (DOTr), Land Transportation Franchising and Regulatory Board (LTFRB), Land Transportation Office (LTO), Board of Investments (BOI)

- Telematics, mobility-tech, and SaaS fleet management providers (route optimization, tracking, usage-based leasing)

- Banks and non-bank financial institutions (auto finance, fleet leasing, and structured FSOL products)

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the full ecosystem of the Philippines Automotive Leasing-as-a-Service Market, including rental operators, FSOL providers, OEMs, fleet-tech platforms, financiers, and regulators. Extensive desk research is conducted using secondary and proprietary databases (government statistics, multilateral reports, industry studies) to identify critical variables such as fleet size, lease penetration, booking channels, utilization rates, ADRs, and macro drivers like GDP and vehicle sales.

Step 2: Market Analysis and Construction

Historical data on car rental and leasing revenues, new vehicle sales volumes, and fleet expansion are compiled to construct the market size and structure for the Philippines Automotive Leasing-as-a-Service Market. Ratios such as leased vehicles to new registrations, corporate vs retail usage, and short-term vs long-term contracts are used to derive revenue pools. Service quality indicators, utilization rates, and yield metrics (e.g., average daily rate) from leading operators inform calibration of the market model.

Step 3: Hypothesis Validation and Expert Consultation

Working hypotheses on growth drivers, segment shares, and competitive dynamics are validated through interviews and structured questionnaires with senior executives at leasing operators, OEM fleet teams, logistics firms, and fleet-tech platforms. These interactions provide operational insights on contract tenors, risk management practices, regulatory pain points, and adoption of EVs and telematics. Feedback is integrated to refine assumptions on segment dominance (e.g., corporate FSOL, SUVs & MPVs) and projected CAGR for 2024–2030.

Step 4: Research Synthesis and Final Output

The final phase synthesizes bottom-up company and segment analyses with top-down macro indicators (GDP, tourism inflows, vehicle sales) to produce a fully reconciled view of the Philippines Automotive Leasing-as-a-Service Market. Cross-checks against published market assessments (e.g., Philippines Car Rental & Leasing Market) ensure consistency of the 2024 base value of USD 1.3 billion. Scenario analysis is then applied to derive an indicative 2024–2030 CAGR of about 6%, considering global leasing benchmarks, regulatory reforms, and expected shifts toward EVs and digital LaaS platforms.

- Executive Summary

- Research Methodology (Market Definitions & Scope for LaaS, Operating Models in Fleet Leasing, Assumptions for Fleet Turnover Cycles, Market Sizing Approach for Contracted Vehicles, Hybrid Top-Down & Bottom-Up Validation, Corporate Procurement Interviews, Primary Expert Consultations, Limitations & Data Triangulation)

- Definition & Scope

- Market Genesis & Evolution

- Timeline of Major Players in Philippine LaaS

- Business & Economic Cycle Mapping

- Supply Chain & Value Chain Analysis

- Growth Drivers

Fleet Outsourcing Demand

BPO Sector Expansion

E-Commerce Vehicle Demand

Cost Optimization Needs

Digital Telematics Adoption - Market Challenges

High Vehicle Import Costs

Regulatory Uncertainty

Insurance Claim Delays

Road Infrastructure Constraints

Residual Value Volatility - Opportunities

EV Leasing

Ride-Hailing Fleet Partnerships

SME Fleet Digitization

Subscription-Based Ownership Shifts - Trends

Connected Fleet Platforms

Real-Time Diagnostics

Predictive Maintenance

Flexible Mobility Models - Government Regulation

DOTr Mobility Directives

BIR & Leasing Rules

Import Tariff Environment

EV Incentives - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- Competition Ecosystem

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Contract Value, 2019-2024

- By Leasing Model (in Value %)

Operating Lease

Finance Lease

Full-Service Lease

Fleet Subscription

Short-Term Corporate Lease - By Vehicle Type (in Value %)

Passenger Cars

SUVs

LCVs

Vans

Pickup Trucks

Premium Vehicles - By End-User Sector (in Value %)

Corporate Enterprises

Logistics & E-Commerce

MSMEs

BPO Sector

Ride-Hailing & Mobility Operators - By Contract Duration (in Value %)

Short-Term Leasing

Mid-Term Contracting

Long-Term Corporate Contracts

Flexible Subscription Terms - By Service Add-Ons (in Value %)

Telematics & GPS

Maintenance & Repair

Insurance & Accident Management

Fuel Management

Driver Management - By Region (in Value %)

Metro Manila/NCR

Luzon

Visayas

Mindanao

- Market Share by Value & Volume

Market Share by Leasing Model - Cross Comparison Parameters (Fleet Size (Active Contracted Vehicles), Vehicle Mix (Passenger/LCV/SUV Share), Technology Integration Level (Telematics Penetration), Contract Tenure Strength (Average Duration), Service Offering Depth (Repair, Insurance, Driver Management), SME vs Enterprise Coverage, Geographic Footprint (NCR, Luzon, Visayas, Mindanao), Fleet Turnover Efficiency (Replacement & Downtime KPIs)

- SWOT Analysis of Major Players

- Pricing Architecture Analysis

- Detailed Profiles of 15 Major Companies

Orix Metro Leasing

Toyota Financial Services / Toyota Rental

Diamond Rent-A-Car

Avis Philippines

Hertz Philippines

Europcar Philippines

Global Mobility Service (GMS)

GrabRentals Philippines

LTFRB-Accredited Fleet Operators

Filinvest Fleet Leasing

MTF Fleet Solutions

Ford Fleet Philippines

Hyundai Fleet Solutions

Lalamove Fleet Leasing Partners

Premier Fleet Rentals

- Fleet Procurement Triggers

- Budget Allocation & Corporate Fleet Policies

- Regulatory & Compliance Requirements)

- Pain Points & Purchasing Behavior

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Contract Value, 2025-2030