Market Overview

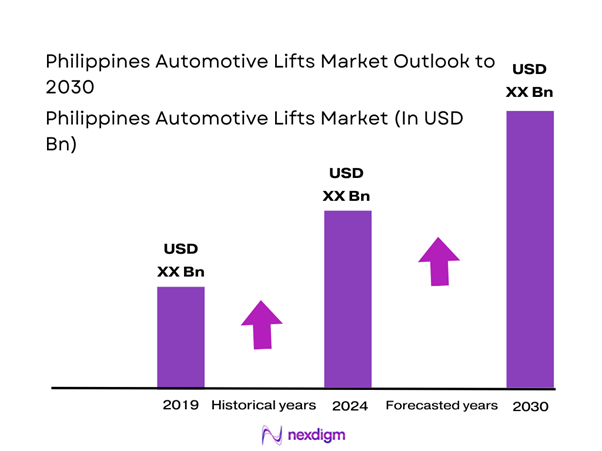

The Philippines Automotive Lifts market is valued at USD ~, reflecting its role as a core productivity asset within the country’s automotive service ecosystem. Automotive lifts are essential for preventive maintenance, underbody inspection, tire and suspension work, and mechanical repairs across independent garages, dealership service centers, and fleet workshops. Market demand is structurally linked to vehicle parc growth, service frequency, and workshop density. The market size for the Philippines Automotive Lifts market is estimated at USD ~ based on consolidation of distributor revenues, installed base expansion, and workshop bay additions, with demand supported by rising service intensity and replacement of aging equipment.

Within the Philippines, demand is concentrated in Metro Manila due to the highest density of vehicles, dealerships, fleet depots, and independent workshops, supported by strong commercial and logistics activity. CALABARZON and Central Luzon follow due to industrial zones, transport corridors, and growing suburban vehicle ownership driving workshop expansion. Cebu and Davao act as regional hubs serving Visayas and Mindanao. Supply and technology influence are shaped by global manufacturing centers, particularly from North America, Europe, and East Asia, which dominate lift design standards, safety systems, and capacity engineering, making imported equipment the backbone of the domestic market.

Market Segmentation

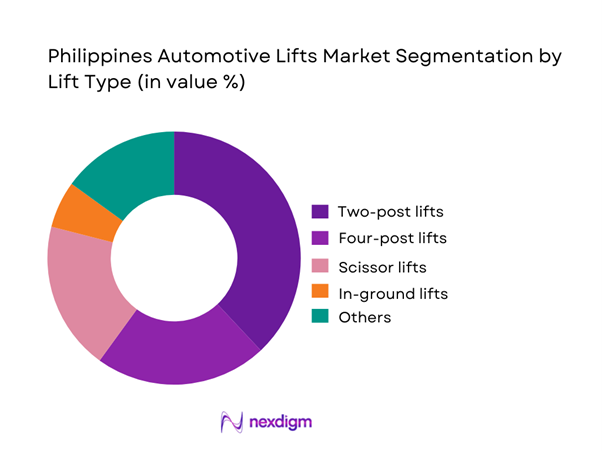

By Lift Type

The Philippines Automotive Lifts market by lift type is segmented into two-post lifts, four-post lifts, scissor lifts, in-ground lifts, mobile column lifts, and motorcycle or specialty lifts. Two-post lifts dominate this segmentation because they offer optimal balance between space efficiency, lifting versatility, and cost-effectiveness for most Philippine workshops. Independent garages and mid-sized service centers favor two-post lifts as they enable fast access to underbody components while fitting into constrained workshop layouts common in urban areas. Their compatibility with a wide range of passenger vehicles and light commercial vehicles further strengthens adoption. Additionally, two-post lifts have lower installation complexity and shorter commissioning times, making them the preferred choice for workshops seeking rapid capacity expansion without extensive civil modification.

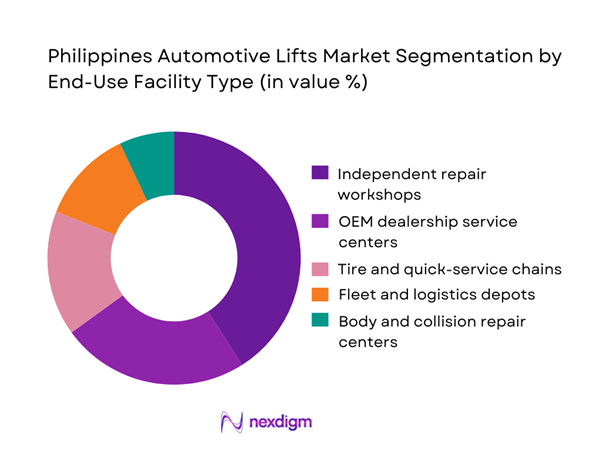

By End-Use Facility Type

By end-use facility type, the market is segmented into independent repair workshops, OEM dealership service centers, tire and quick-service chains, fleet and logistics depots, and body and collision repair centers. Independent repair workshops dominate this segmentation due to their sheer volume and geographic spread across urban and semi-urban areas. These workshops rely heavily on automotive lifts as their primary productivity asset and often invest incrementally, adding lifts as service demand increases. Independent operators also experience higher lift utilization rates, accelerating replacement cycles and sustaining recurring demand. Their preference for distributor-supported equipment with flexible pricing and localized service further reinforces their dominance in overall lift procurement.

Competitive Landscape

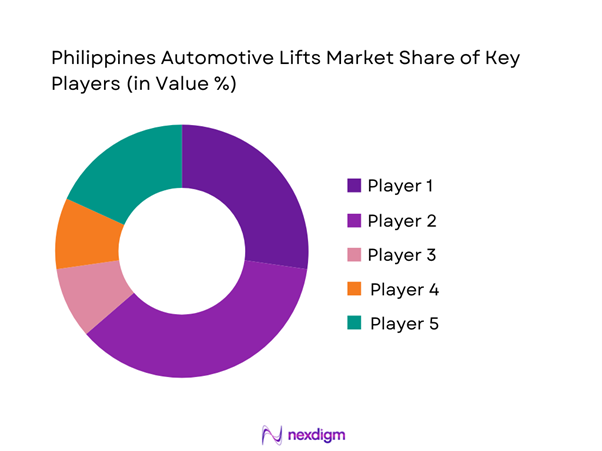

The Philippines Automotive Lifts market is dominated by a few major players, including Rotary Lift and global or regional brands like BendPak, Ravaglioli, Nussbaum, and Launch Tech. This consolidation highlights the significant influence of these key companies.

| Company / Brand | Est. Year | Headquarters | Primary Lift Portfolio | Typical Capacity Coverage | Certification / Compliance Positioning | Route-to-Market in PH | After-Sales Model | Best-Fit End Users |

| Rotary Lift (Vehicle Service Group ecosystem) | 1925 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| BendPak / Ranger | 1965 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Ravaglioli | 1958 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Nussbaum | 1943+ | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Launch Tech / Regional lift lines | 1990s | China | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Automotive Lifts Market Analysis

Growth Drivers

Expansion of automotive workshop density

The steady expansion of automotive workshops across metropolitan, secondary, and peri-urban areas is a structural driver for automotive lift demand. As vehicle ownership spreads beyond major city cores, service activity is becoming more decentralized, resulting in the proliferation of independent garages, franchise-led service chains, and specialized repair centers. Workshop operators are increasingly constrained by limited floor area and rising real estate costs, making vertical lifting solutions more attractive than physical expansion. Automotive lifts enable workshops to increase bay utilization, reduce service turnaround times, and standardize technician workflows. This trend is particularly pronounced in multi-bay independent garages and fast-growing service chains, where incremental lift installations deliver immediate operational benefits. As workshops compete on speed, safety, and service quality, lift adoption is no longer discretionary but a foundational requirement for sustaining throughput and profitability.

Rising vehicle parc and service intensity

The continuous increase in vehicles in active circulation has led to higher service frequency, greater workshop footfall, and more complex maintenance requirements. As vehicles accumulate mileage, preventive maintenance schedules tighten and corrective repairs become more intensive, increasing demand for efficient underbody access. Automotive lifts support faster inspections, accurate diagnostics, and safer execution of suspension, braking, drivetrain, and exhaust-related jobs. Additionally, the growing mix of SUVs, pickup vehicles, and light commercial units requires lifting systems capable of handling higher loads and varied chassis designs. Service intensity is further amplified by fleet vehicles that operate on tighter uptime requirements, compelling workshops to optimize workflow efficiency. In this environment, lifts function as productivity multipliers, enabling technicians to handle higher job volumes without compromising service consistency or safety standards.

Challenges

High upfront equipment and installation costs

Automotive lifts involve significant upfront expenditure that extends beyond the purchase of the equipment itself. Installation often requires reinforced flooring, precise anchoring, electrical upgrades, hydraulic setup, and commissioning procedures that meet safety and operational standards. For smaller workshops and first-time entrants, this capital burden can act as a deterrent, leading to delayed investment decisions or selection of lower-capacity and lower-specification systems. Inadequate installation or compromised specifications may result in reduced operational lifespan and elevated safety risks. Additionally, cost sensitivity can discourage adoption of preventive maintenance contracts, increasing the likelihood of unplanned downtime. This challenge is particularly relevant in price-competitive service markets, where workshops must balance capital allocation between customer-facing improvements and back-end productivity infrastructure.

After-sales service and spare-parts dependency

Automotive lifts are mission-critical assets, and any malfunction directly disrupts workshop operations and revenue generation. Dependence on timely after-sales service, availability of critical spare parts, and qualified technicians remains a persistent challenge. In many cases, workshop owners rely heavily on distributor capability rather than direct manufacturer support, making service quality uneven across regions. Delays in procuring components such as hydraulic seals, locking mechanisms, cables, or control units can extend downtime and erode confidence in certain brands. This dependency also influences purchasing behavior, with workshops prioritizing suppliers that demonstrate strong local service infrastructure over purely technical specifications. Ensuring consistent lifecycle support remains a key challenge, particularly as equipment complexity increases and workshops demand faster service resolution.

Opportunities

Retrofit and replacement demand in aging workshops

A substantial number of workshops operate with aging lifting equipment that no longer aligns with current safety expectations, capacity requirements, or productivity benchmarks. This creates a strong opportunity for retrofit and replacement-driven demand. Unlike new installations, replacement decisions are often driven by operational necessity rather than price sensitivity, allowing suppliers to emphasize safety enhancements, higher load ratings, and improved ergonomics. Workshops upgrading older systems also tend to adopt structured preventive maintenance programs and extended service agreements, creating recurring revenue streams for suppliers. Additionally, retrofitting existing bays with modern lifts enables workshops to handle a broader mix of vehicles and services without expanding their footprint. As regulatory awareness and technician safety considerations increase, replacement demand is expected to remain a resilient growth avenue.

Integration of alignment and diagnostics with lifts

Workshops are increasingly shifting toward integrated service models that combine lifting systems with wheel alignment, inspection, and diagnostic capabilities. This integration streamlines workflow by reducing vehicle movement between bays, improving job accuracy, and shortening service cycles. Suppliers offering bundled lift-alignment or lift-diagnostics solutions gain a competitive advantage by simplifying procurement and reducing coordination between multiple equipment vendors. For workshop owners, integrated systems support higher ticket services such as suspension calibration and steering correction, improving overall service mix quality. This trend is especially relevant for tire service centers and quick-service chains seeking standardized bay layouts. As workshops aim to maximize revenue per bay and reduce operational complexity, integrated lift-centric systems represent a compelling opportunity for equipment providers.

Future Outlook

Over the coming years, the Philippines Automotive Lifts market is expected to strengthen as workshops prioritize productivity, safety, and service quality. Demand will increasingly shift toward higher-capacity and technologically integrated lift systems, supported by distributor-led service ecosystems and preventive maintenance contracts that reduce downtime and enhance equipment lifecycle value.

Major Players

- Rotary Lift

- BendPak

- Ravaglioli

- Nussbaum

- Launch Tech

- Hunter Engineering

- Challenger Lifts

- Mohawk Lifts

- Stertil-Koni

- Atlas Automotive Equipment

- PEAK Corporation

- Twin Busch

Key Target Audience

- Independent automotive workshop owners

- OEM dealership groups

- Fleet and logistics operators

- Tire and quick-service chains

- Body and collision repair networks

- Automotive equipment distributors and installers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The study begins by mapping the automotive service ecosystem, identifying workshops, distributors, and end users. Key variables influencing lift demand and utilization are defined through desk research and industry mapping.

Step 2: Market Analysis and Construction

Historical data on workshop expansion and equipment adoption are analyzed using bottom-up and top-down approaches. Revenue attribution is aligned with lift types, end-use facilities, and distribution models.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through structured interviews with distributors, installers, and workshop operators, focusing on demand drivers, pricing behavior, and replacement cycles.

Step 4: Research Synthesis and Final Output

All insights are synthesized, cross-validated, and structured into a cohesive market narrative, ensuring internal consistency and client-ready clarity.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Automotive Workshop Usage and Service Value-Chain Mapping

- Business Cycle and Demand Seasonality

- Philippines Automotive Service and Workshop Architecture

- Growth Drivers

Expansion of automotive workshop density

Rising vehicle parc and service intensity

Shift toward productivity-driven bay optimization

Growth of organized service chains

Fleet professionalization and in-house maintenance - Challenges

High upfront equipment and installation costs

Workshop infrastructure and floor-load limitations

After-sales service and spare-parts dependency

Technician skill gaps and safety compliance

Import lead times and supply volatility - Opportunities

Retrofit and replacement demand in aging workshops

Adoption of higher-capacity lifts for SUVs and LCVs

Integration of alignment and diagnostics with lifts

Service contract and preventive maintenance models

Regional workshop expansion outside NCR - Trends

- Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Units Installed / Units Sold, 2019–2024

- By Average Selling Price (ASP) and Installed Cost, 2019–2024

- By Lift Type (in Value %)

Two-post lifts

Four-post lifts

Scissor lifts

In-ground lifts

Mobile column lifts

Motorcycle and specialty lifts - By End-Use Facility Type (in Value %)

Independent repair workshops

OEM dealership service centers

Tire and quick-service chains

Fleet and logistics depots

Body and collision repair centers - By Technology / Product Type (in Value %)

Electro-hydraulic lifts

Hydraulic-only lifts

Clear-floor lift systems

Alignment-integrated lift systems

Portable and modular lift systems - By Distribution Model (in Value %)

Authorized distributors

Direct importers

Installer-integrator partners

Online and catalog-based sales - By End-Use Industry / Customer Type (in Value %)

Passenger vehicle service

Commercial vehicle service

Public transport maintenance

Logistics and fleet maintenance

Automotive training institutions - By Region (in Value %)

National Capital Region

CALABARZON

Central Luzon

Visayas

Mindanao

- Competition ecosystem overview

- Cross Comparison Parameters (Product portfolio breadth, lifting capacity range, safety and locking systems, installation and commissioning capability, after-sales service coverage, spare-parts availability, warranty structure, total cost of ownership)

- SWOT analysis of major players

Pricing and commercial model benchmarking - Detailed Profiles of Major Companies

Rotary Lift

BendPak

Ravaglioli

Nussbaum

Launch Tech

Hunter Engineering

Challenger Lifts

Mohawk Lifts

Stertil-Koni

Atlas Automotive Equipment

PEAK Corporation

Twin Busch

Bosch Service Solutions

Local Philippine equipment distributors

Private-label imported lift brands

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Units Installed / Units Sold, 2025–2030

- By Average Selling Price (ASP) and Installed Cost, 2025–2030