Market Overview

The Philippines automotive painting equipment market size is valued at PHP ~ million. Philippines’ imports for HS 842420 were USD ~ (trade value, current) in 2024 accessible annual record, reflecting steady replenishment demand from collision repair, truck/bus repainting, and expanding multi-branch bodyshop networks.

Demand concentrates in Metro Manila and nearby industrial corridors (CALABARZON and Central Luzon) because these zones host the densest parc, insurer-linked collision work, and the highest concentration of dealership bodyshops and fleet maintenance hubs—creating higher throughput utilization for booths, compressors, prep systems, and curing. On the supply side, China is a major origin for spray-gun imports into the Philippines, supported by broad SKU availability and price-band coverage, while Japan/EU/US-origin tools are typically preferred for premium refinishing consistency, transfer efficiency, and service support via local distributors.

Market Segmentation

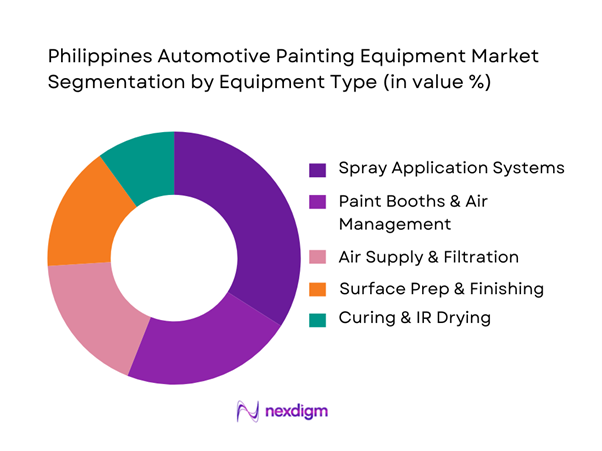

By Equipment Type

Spray application systems—especially HVLP spray guns—lead because they sit at the center of daily repaint throughput and are replaced or added more frequently than fixed assets like booths. Bodyshops prioritize repeatable atomization, stable fan pattern, and lower rework risk when matching OEM colors and handling pearl or metallic coats, which drives continual upgrading from entry-level units to branded or “compliant” variants. HVLP also aligns with operator training availability and the practical need to control overspray in constrained workshop footprints common in dense urban corridors. Import visibility for “spray guns and similar appliances” further supports the segment’s role as a measurable demand proxy for the broader painting-equipment stack, reinforcing why distributors typically lead with guns, consumables, and rebuild kits as the highest-velocity revenue line.

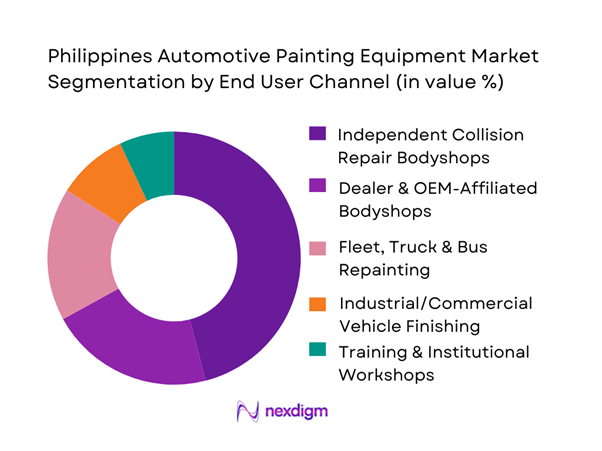

By End User Channel

Independent collision repair bodyshops dominate because they account for the highest count of repaint touchpoints—minor collisions, panel repainting, bumper refinishing, and full-side repairs—driving recurring consumption of guns, air prep, sanding, and curing equipment. Unlike OEM or dealer shops that standardize on fewer, higher-ticket capex projects, independents scale demand through high-frequency, small-ticket purchases (spray guns, regulators, dryers, DA sanders, IR lamps) and periodic upgrades as they pursue faster cycle times and better finish quality to meet insurer KPIs and customer expectations. They also operate across diverse paint systems and job mixes (spot repair to full respray), which expands tool variety per site. This channel structure makes independents the primary engine for distributor-led sales, service, and spare-part pull-through in the Philippines.

Competitive Landscape

The Philippines automotive painting equipment market is distribution-led and service-driven, with global equipment brands competing through local channel partners on uptime, parts availability, training, and finish-quality consistency. Competitive intensity is highest in spray guns, prep tools, and air-treatment packages, while booths and curing solutions differentiate on installation quality, filtration performance, energy draw, and after-sales maintenance.

| Company | Est. Year | HQ | PH Route-to-Market | Core Strength | Service/Spare Depth | Flagship Offer in Painting | Typical Buyer | Differentiation Lever |

| Anest Iwata | 1926 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| SATA | 1907 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Graco | 1926 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| 3M | 1902 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Sames Kremlin | 1925 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Automotive Painting Equipment Market Analysis

Growth Drivers

Collision repair throughput expansion

Collision-linked repaint demand in the Philippines is structurally supported by the sheer volume of urban road crashes that feed bodyshop backlogs. In Metro Manila alone, road accident counts along key corridors reached ~ incidents on EDSA and ~ incidents on C-5, with additional high-incident arterials including Commonwealth Avenue (~) and Quezon Avenue (~), creating a sustained throughput driver for spray booths, curing or IR drying, compressors, and surface-prep systems used in panel repair and refinishing. Parallel to this, the vehicle parc continues to refresh, with new-vehicle sales reported at ~ units over a recent comparable period versus ~ units in the prior comparable period, expanding the serviced base that eventually cycles into collision and cosmetic repair. From a macro capacity-to-spend lens, the Philippines’ economic scale supports sustained aftermarket activity, with nominal output measured by national accounts at USD ~ and USD ~, providing the income pool that underwrites vehicle ownership, repair affordability, and fleet utilization intensity.

Insurance-led repaint demand

Insurance formalization increases repaint conversion because claim workflows often specify OEM-grade processes such as booth-controlled refinishing, compliant filtration, bake cycles, and documented material handling. Non-life insurance reporting in the Philippines shows Motor Car-related premium volume remaining large, with Motor Car net premiums written at PHP ~ million and PHP ~ million, indicating a broad insured vehicle base exposed to accident and comprehensive claims that frequently include panel repair and repaint scopes. In practice, higher insured penetration raises the share of repairs routed through accredited or insurer-recognized shops that invest in higher-capability painting equipment such as downdraft booths, HVLP guns, air treatment, and mixing systems to meet cycle-time and rework KPIs. Macro stability matters because insurers and repair networks scale capacity when operating conditions are predictable, with inflation characterized at ~ (annual average), supporting steadier claims servicing and capex planning by larger collision networks.

Challenges

High capital expenditure sensitivity

Automotive painting equipment such as spray booths, bake systems, compressors, air dryers, filtration, and mixing rooms is capex-heavy, and purchasing appetite is highly sensitive to broader financing and operating conditions. The macro environment shows why smaller workshops delay upgrades, with nominal output at USD ~ after USD ~, while inflation around ~ (annual average) still affects consumables planning and raises the hurdle rate for long-payback investments. Import dependence also amplifies the capex barrier because many critical painting tools and parts are sourced abroad; imports of HS 842420 totaled USD ~ thousand and ~ items, demonstrating both the scale of demand and the structural reliance on externally sourced equipment lines that can be exposed to FX volatility and supply lead times, making cash-based small shops cautious about major upgrades.

Power reliability and booth uptime constraints

Spray booths and curing systems are uptime-sensitive, as airflow stability, bake cycles, compressor duty cycles, and lighting loads all suffer when power quality or interruptions occur, increasing rework risk and lowering throughput. Reliability performance varies by area; even in a relatively strong utility franchise, SAIDI improved from ~ minutes to ~ minutes and SAIFI from ~ to ~, which remains meaningful when a single interruption can halt a bake cycle and force respray or extended cure. This constraint matters because the densest collision and fleet repair demand is concentrated in major corridors where crash volumes are highest, with ~ incidents on EDSA and ~ incidents on C-5, creating pressure for cycle time that is hard to meet if power interruptions disrupt booth scheduling and compressor availability. Macro conditions set the investment context, with nominal output at USD ~ supporting demand but slowing broad-based booth modernization outside larger chains.

Opportunities

Spray booth upgrades for compliance and quality

An investable opportunity is the upgrade cycle from open-bay spraying to controlled-environment booths driven by rework reduction, insurer or OEM process expectations, and the need to stabilize outcomes under wet tropical conditions. Climate stress is evident, with mean annual rainfall at ~ mm, elevating moisture contamination and increasing the value of filtration, airflow control, and curing discipline. Operational pressure is also high because collision volumes keep workshops busy, with ~ incidents on EDSA and ~ incidents on C-5, supporting steady booth utilization once installed. Power reliability improvements in major commercial zones further strengthen the upgrade case, with SAIDI improving from ~ minutes to ~ minutes and SAIFI from ~ to ~, enabling more predictable booth scheduling. The macro base, with nominal output at USD ~, supports sustained demand for higher-quality refinishing capacity in dense repair corridors.

Waterborne conversion and retrofit packages

Waterborne and low-solvent process conversions create a retrofit-driven equipment opportunity, including gun systems optimized for waterborne atomization, upgraded air movement, filtration, humidity control, and faster curing support, especially in coastal and high-rainfall conditions where defect risk is elevated. The wet operating environment, with mean annual rainfall of ~ mm, increases the value of controlled flash-off, temperature stability, and airflow management that typically accompany professional-grade waterborne-capable booth retrofits. At the same time, the installed base of spray tools is large and import-fed, with HS 842420 imports totaling USD ~ thousand and ~ items, including major sourcing from China at USD ~ thousand and ~ items, indicating a broad market where upgrade kits and compliant systems can displace inconsistent tools. Macro stability, with inflation around ~ (annual average), supports steadier consumables planning and reduces volatility that typically delays process change.

Future Outlook

Over the next planning cycle, the Philippines automotive painting equipment market is expected to expand on three structural forces: rising collision and refurbishment activity in dense urban corridors, professionalization of bodyshops via insurer accreditation and multi-branch scaling, and gradual tightening of environmental and workplace controls that lifts demand for better filtration, dust extraction, and controlled spray environments. Growth will be strongest in booth retrofits, air-treatment upgrades, dust-free prep systems, and faster curing solutions, as shops pursue throughput and first-time-right repaint quality.

Major Players

- Anest Iwata

- SATA

- DeVilbiss

- Binks

- Graco

- Sames Kremlin

- 3M

- Mirka

- Festool

- Sagola

- Walcom

- Nordson

- GYS

- Colad

Key Target Audience

- Independent collision repair and repainting chains

- Automotive dealership bodyshops and OEM-certified collision centers

- Fleet owners and maintenance operators

- Automotive importers or distributors with aftersales service networks

- Paint and coatings distributors managing refinish ecosystems

- Equipment distributors or system integrators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We map the full refinishing ecosystem—bodyshops, dealers, fleets, coatings distributors, and equipment integrators—then define demand variables such as repaint throughput drivers, equipment replacement cycles, and typical bay-level tooling stacks. Desk research uses trade databases, brand catalogs, distributor line cards, and regulatory references to lock definitions and boundaries.

Step 2: Market Analysis and Construction

We consolidate historical signals using import proxies for core equipment categories alongside channel expansion indicators such as dealer bodyshop scaling, multi-branch independents, and fleet repaint needs. We build a structured model linking repaint activity to required equipment intensity by shop tier and job mix.

Step 3: Hypothesis Validation and Expert Consultation

We validate assumptions through structured expert interviews with distributors, shop owners, paint technicians, and installation or maintenance providers to confirm SKU velocity, downtime pain points, and adoption triggers for booths, filtration, and curing tools.

Step 4: Research Synthesis and Final Output

We triangulate findings across bottom-up channel sizing, supplier feedback, and import statistics to produce a consistent market view. Final outputs include segmentation, competitive positioning, procurement criteria, and an investment roadmap aligned to buyer decision journeys.

- Executive Summary

- Research Methodology (Market definitions and scope boundary, equipment taxonomy and HS/proxy mapping, data triangulation framework, primary interview design with bodyshops dealers and painters, distributor channel checks, pricing basket design for spray guns booths IR dryers compressors, installed base estimation approach, limitations and assumptions)

- Definition and Scope

- Market Genesis and Evolution

- Industry Value Chain and Channel Structure

- Operating Environment and Compliance Landscape

- Technology Adoption Context

- Growth Drivers

Collision repair throughput expansion

Insurance-led repaint demand

OEM bodyshop certification requirements

High repaint frequency in humid coastal conditions

Fleet repaint and refurbishment cycles - Challenges

High capital expenditure sensitivity

Power reliability and booth uptime constraints

After-sales service and spare parts delays

Skilled painter availability gaps

Counterfeit and gray market equipment penetration - Opportunities

Spray booth upgrades for compliance and quality

Waterborne conversion and retrofit packages

Dust-control and filtration retrofits

Training and certification services

Fleet repaint outsourcing contracts - Trends

Automated paint mixing systems

Quick cup spray gun technologies

Energy-efficient booth retrofits

Hybrid IR and UV curing adoption

Digital color matching integration - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- By Equipment Type (in Value %)

Spray Booths and Spray Ovens

Spray Guns and Applicators

Air Systems

Surface Preparation and Dust Extraction

Paint Booth Filtration and Booth Protection - By Technology Architecture (in Value %)

HVLP RP Airless Air-assisted Airless Electrostatic-ready

Solvent-borne Compatible Systems

Waterborne Compatible Systems

Heated Booths

Non-heated Booths - By End-Use Industry (in Value %)

OEM-authorized Dealer Bodyshops

Multi-site Collision Repair Chains

Independent Body and Paint Shops

Fleet Workshops

Motorcycle and Light Vehicle Refinishers - By Connectivity Type (in Value %)

Brand-authorized Distributors

Industrial Tools and Equipment Retailers

Paint System Dealers

Online Marketplaces - By Region (in Value %)

NCR

CALABARZON

Central Luzon

Visayas

Mindanao

- Market share assessment by value and volume

- Cross Comparison Parameters (Booth airflow design and balance, filtration architecture, heating and curing configuration, waterborne readiness, spray application performance, energy and operating cost levers, after-sales service footprint, compliance alignment)

- Strategic group analysis

- SWOT analysis of key players

- Pricing and SKU benchmarking

- Company Profiles

3M Philippines

SATA Philippines

Anest Iwata

DeVilbiss

Graco

WAGNER

Nordson

Festool

Timpla Paint Supply

KHM Megatools

GIGATOOLS

Auto Premium Supply

WELCOME EXPORT INC

FinishSource

Weilongda

- Market demand and utilization patterns

- Budget allocation behavior

- Quality control and rework economics

- Operational pain points

- Purchase decision-making process

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price, 2025–2030