Market Overview

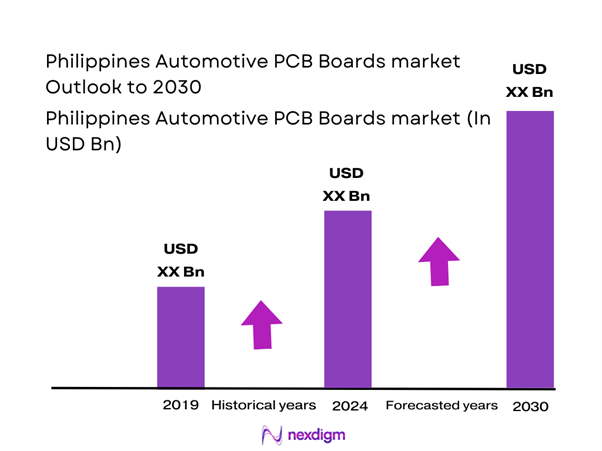

The Philippines Automotive PCB Boards market is valued at USD ~ billion, sits at the intersection of two measurable realities: rapidly rising electronic content per vehicle globally, and the Philippines’ established participation in regional PCB/PCBA supply chains. At the global level (used as the closest audited benchmark for automotive-specific PCB demand), the automotive printed circuit board market was valued at USD ~ billion in the previous year and USD ~ billion in the latest year, driven by higher PCB area per vehicle from ADAS, electrified powertrains, and connectivity-heavy infotainment architectures.

In the Philippines context, automotive PCB demand is concentrated around Metro Manila–CALABARZON and Central Luzon electronics/EMS corridors, where export-oriented manufacturing ecosystems (industrial parks, logistics access, and labor pools) support board assembly and electronics integration. While audited “automotive-only PCB” figures are rarely published for the Philippines as a standalone market, the country’s PCB trade footprint signals relevant capacity: Printed circuits exports were USD ~ in the previous year and USD ~ (thousand) in the latest year. Dominant global automotive electronics hubs (China, Japan, Korea, Germany) still lead due to deeper automotive OEM tiering, materials ecosystems, and HDI-scale fabrication.

Market Segmentation

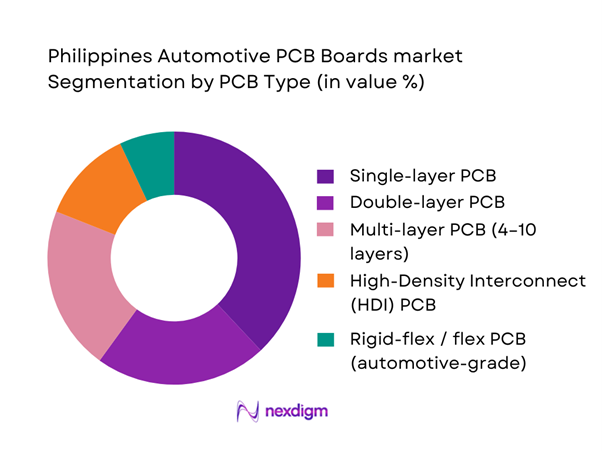

By PCB Type

Single-layer boards lead by volume because a large portion of automotive electronics still resides in “high-volume, cost-sensitive, reliability-first” modules: lighting (including LED driver boards), basic body electronics, simple sensor interfaces, and distributed control nodes where routing density remains modest. These applications favor standardized stack-ups, high yields, and fast cycle times—critical for suppliers serving price-pressured vehicle platforms and aftermarket service demand. Even as EVs and ADAS push growth toward multi-layer and HDI formats, the installed base of conventional vehicles keeps steady pull for simpler boards used across harness-adjacent control points. Single-layer boards held ~% share in ~ in the automotive PCB market benchmark, reflecting the persistence of these cost-optimized architectures alongside premium, high-layer designs.

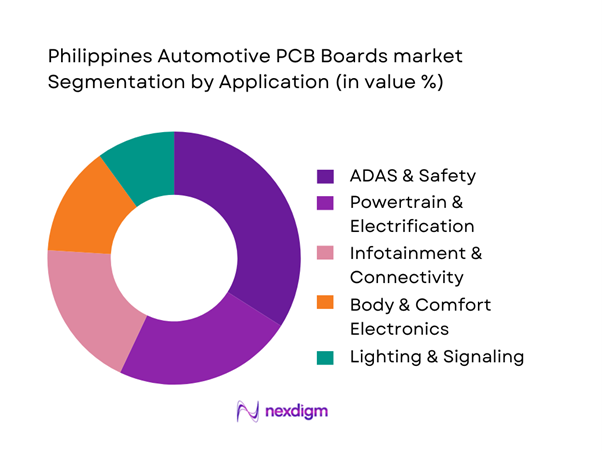

By Application

ADAS & safety dominates value capture because these systems demand higher-performance boards (layer count, signal integrity, RF constraints, and reliability testing), and they are expanding from premium trims into mass-market vehicles as safety expectations harden. Radar and camera processing increase PCB complexity through tighter impedance control, higher-speed interfaces, and stricter thermal/reliability requirements—raising average board value per vehicle versus many body modules. Even where the Philippines is not the primary locus of ADAS PCB fabrication, it participates via electronics manufacturing services, sub-assembly, and regional sourcing links that feed Tier-1 supply chains. In the benchmark dataset, ADAS & safety systems accounted for ~% share in ~, underscoring how regulation-driven adoption and sensor compute growth concentrate demand in the safety electronics stack.

Competitive Landscape

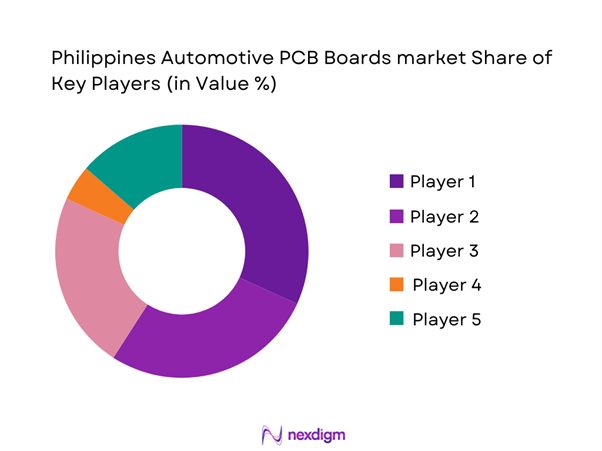

The Philippines Automotive PCB Boards ecosystem is best viewed as a supply-chain market: global automotive PCB fabricators and automotive-grade laminate/material players compete alongside EMS/PCBA integrators and Tier-1 electronics manufacturers that influence sourcing through quality approvals (IATF ~ / ISO ~ readiness), traceability, and long-term program awards. Globally, consolidation is reinforced because OEMs and Tier-1s prefer fewer partners capable of delivering DFM/DFT support, automotive PPAP discipline, and stable yield at scale.

| Company | Est. Year | HQ | Role in Automotive PCB Value Chain | Automotive-Grade Capability Signals | Typical Automotive PCB Types | Strength in High-Reliability QA | Scale & Program Support | Regional Manufacturing Footprint |

| Samsung Electro-Mechanics | — | South Korea | ~ | ~ | ~ | ~ | ~ | ~ |

| Unimicron Technology | — | Taiwan | ~ | ~ | ~ | ~ | ~ | ~ |

| Meiko Electronics | — | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| TTM Technologies | — | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Amitron Corporation | — | USA | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Automotive PCB Boards Market Analysis

Growth Drivers

ECU proliferation

The Philippines’ vehicle parc keeps expanding and modernizing, raising the number of electronic control units (ECUs) that need automotive-grade PCBAs (engine/airbag/body control/lighting modules). New vehicle demand stayed elevated, with CAMPI–TMA new-vehicle sales at ~ units and then ~ units, which expands the install base that ultimately drives ECU replacement, service PCBA demand, and tier-~ / EMS assembly programs. On the macro side, the Philippines’ economy provides the consumption and fleet-utilization pull: GDP at USD ~ billion and GDP per capita at USD ~, while population at ~ sustains high mobility intensity (commuter flows, last-mile delivery, SME fleets). Manufacturing depth also matters because ECU/PCBA work is typically done in export-processing/EMS ecosystems: manufacturing value added rose from USD ~ billion to USD ~ billion, indicating a larger industrial base able to absorb automotive-electronics quality systems, ESD controls, traceability, and controlled processes needed for ECU boards (AOI, X-ray, conformal coating, burn-in). Together, these ~ signals—vehicle throughput (units), macro demand capacity (USD), and a growing manufacturing base (USD)—explain why ECU proliferation is a structural driver for automotive PCB boards and assembly value chains in the Philippines, even when advanced substrates are still imported.

Safety feature uptake

Safety systems are PCBA-intensive because they require high-reliability boards in modules such as airbags (SRS), ABS/ESC, electronic power steering, radar/camera domain controllers, and sensor gateways. The Philippines’ expanding new-vehicle pipeline—~ new vehicles sold under CAMPI–TMA’s reporting—raises the number of safety-enabled platforms on roads, which increases demand for automotive-grade PCBAs across OEM production, collision repair, and module refurbishment channels. Macro capacity and institutional enforcement also shape safety electronics adoption: with GDP at USD ~ billion and GDP per capita at USD ~, consumers and fleets can sustain higher-content trims, while government border and enforcement actions highlight the parallel need for authentic electronics in safety pathways. In enforcement data relevant to the risk environment, the government reported PHP ~ billion worth of smuggled goods seizures, with “vehicles and accessories” among top seized commodities—signals that compliance, provenance, and traceability are increasingly central for parts supply chains, including electronic modules. On the anti-counterfeit front, the National Committee on Intellectual Property Rights reported PHP ~ billion worth of counterfeit products seized over a full-year cycle, reinforcing why safety-related electronics procurement is shifting toward validated suppliers and documented BOM control. For automotive PCB boards, these forces translate to higher qualification requirements and more PCBA content per vehicle as safety features become baseline rather than optional.

Challenges

Import dependency for advanced boards

A structural constraint for Philippine automotive PCB boards is continued reliance on imported advanced laminates/substrates and certain high-complexity board types (fine-line HDI, specialized RF materials, heavy-copper power boards, automotive-grade microvia builds). This dependence is visible in official trade statistics that show electronics as a dominant import category; for example, trade releases regularly highlight electronic products among top import groups, with month-level import values for electronic products reaching USD ~ billion in a single reported month window. For automotive PCBAs, this import intensity shows up as longer lead times for critical materials (high-Tg laminates, automotive connectors, specific MCU/ASIC supply), higher exposure to FX logistics shocks, and limited domestic substitution when a qualified material is delayed. Macro conditions don’t remove this, even with a large economy: GDP at USD ~ billion and manufacturing value added at USD ~ billion show scale, but not necessarily deep upstream materials capacity for advanced boards. Additionally, the domestic vehicle market size—~ new vehicles—is significant, yet still smaller than the volumes that typically justify local substrate fabrication plants. Therefore, the market often localizes downstream steps (SMT, test, box-build) while importing critical board materials and some assembled boards, especially for safety/ADAS/power electronics where validated material stacks are non-negotiable.

Long qualification cycles

Automotive electronics qualification is slow by design—OEM/tier programs require stable process capability, documentation, and repeatability across materials, solder paste, reflow profiles, AOI/X-ray, and functional test. In the Philippines, the challenge is not only technical but also economic: capital-intensive validation and process control must be funded over long cycles before revenue ramps, which is harder when supply chains face enforcement and anti-counterfeit pressures that demand stronger controls. The government’s border-protection reporting shows significant enforcement volume, including PHP ~ billion in smuggled-goods seizures, and reported PHP ~ billion in counterfeit-product seizures—both reinforcing why automotive customers demand end-to-end traceability and verified supplier controls, extending onboarding timelines. Meanwhile, the domestic market’s annual new-vehicle volume of ~ units supports scale but also creates a high-stakes quality environment (recall risk, safety liability). Macro indicators show the Philippines has the industrial base to build capability—manufacturing value added at USD ~ billion—but qualification lead times remain a gating factor for shifting more automotive PCBA programs into local EMS lines. As a result, many EMS plants pursue automotive business as a staged roadmap: start with less safety-critical assemblies, then add process audits, reliability testing regimes, and extended traceability to graduate to ADAS/airbag/power electronics boards.

Opportunities

Automotive-grade PCBA exports

A high-upside opportunity is expanding automotive-grade PCBA exports by leveraging the Philippines’ established electronics manufacturing base (SMT, test engineering, box-build) and aligning it with automotive quality systems and traceability. Export competitiveness is grounded in macro-industrial scale: manufacturing value added at USD ~ billion and GDP at USD ~ billion indicate capacity to sustain capex for advanced placement, inspection, and functional test infrastructure. The domestic automotive market also provides a learning platform—~ new vehicles sold—supporting local experience in warranty-driven supply and aftersales electronics handling. Electrification and connected-mobility create exportable assembly niches (telematics, power electronics control boards, sensor gateways), and official data indicates electrified vehicle presence across categories: ~ SUVs/UVs and ~ cars/sedans, plus ~ motorcycles/tricycles, showing that automotive electronics complexity is rising locally as well. Critically, anti-counterfeit enforcement scale—PHP ~ billion in counterfeit seizures—helps legitimize export pathways by rewarding documented supply chains and audited processes, which are preconditions for exporting automotive-grade assemblies to OEM/tier networks.

ADAS and telematics assemblies

ADAS and telematics are among the most attractive near-term growth pockets because they sit at the intersection of safety regulation, fleet ROI, and connectivity upgrades—each requiring dense, high-reliability PCBAs and rigorous test coverage. The Philippine vehicle market throughput—~ new vehicles—creates a steady flow of platforms where ADAS/telematics content is rising (camera/radar controllers, gateway ECUs, fleet trackers, dashcams, V2X-ready modules), increasing demand for automotive-grade PCB boards in both OEM and retrofit channels. Electrification and modern fleet management accelerate the same direction; EV presence is documented in registration figures such as ~ SUVs/UVs and ~ cars/sedans, reflecting more electronics-heavy architectures that often bundle advanced sensing and connectivity. On the macro side, scale and industrial base support assembly localization: GDP at USD ~ billion and manufacturing value added at USD ~ billion indicate capacity for EMS specialization in ADAS/telematics assemblies (AOI/X-ray coverage, firmware provisioning, end-of-line functional test, traceability systems). Enforcement data also supports a “trusted supply chain” opportunity: PHP ~ billion in smuggled-goods seizures and PHP ~ billion in counterfeit seizures reinforce why fleets and OEM-linked channels increasingly favor documented electronics assemblies, creating room for compliant local EMS players to win ADAS/telematics box-build and PCBA work.

Future Outlook

Over the next planning cycle, the Philippines Automotive PCB Boards market opportunity will increasingly be shaped by vehicle electrification that lifts power PCB demand (thermal management, thick copper, higher-voltage insulation), ADAS compute that drives HDI and signal-integrity requirements, and supply-chain diversification (“China+1”) that strengthens Southeast Asia’s role in electronics manufacturing. Globally, the automotive printed circuit board market is projected to expand from USD ~ billion to USD ~ billion, at a ~ CAGR, reinforcing multi-year program visibility for qualified suppliers.

Major Players

- Samsung Electro-Mechanics

- Unimicron Technology

- Meiko Electronics

- TTM Technologies

- Amitron Corporation

- Tripod Technology

- Zhen Ding Technology Holding

- CMK Corporation

- Chin Poon Industrial

- KCE Electronics

- NOK Corporation

- Schweizer Electronic

- Sierra Circuits

- Suzhou Dongshan Precision Manufacturing

Key Target Audience

- Automotive OEM regional sourcing & supplier quality teams

- Tier-~ automotive electronics suppliers procurement heads

- EV power electronics and charging hardware manufacturers

- Automotive EMS/PCBA operators and plant directors

- Automotive aftermarket electronics brands and distributors

- Semiconductor & module companies requiring automotive-grade board partners

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We build an ecosystem map of the Philippines automotive electronics and PCB/PCBA stakeholders—OEM/Tier-1 linkages, EMS clusters, materials inputs, and logistics nodes. Secondary research is combined with industry databases to define the variables that shape demand (ADAS penetration, EV electronics content, quality standards) and supply (capacity, yields, certifications).

Step 2: Market Analysis and Construction

We compile historical indicators that proxy the PCB ecosystem (trade flows of printed circuits, electronics exports, and manufacturing corridor activity) and reconcile them with automotive electronics adoption patterns. We structure the market into definable segments (PCB type, application) and map how each translates into revenue pools and qualification barriers.

Step 3: Hypothesis Validation and Expert Consultation

We validate assumptions through CATI-style interviews with EMS leaders, supplier quality managers, and program sourcing stakeholders. These discussions confirm purchasing criteria (PPAP readiness, traceability, failure rates, lead times), and refine segment dynamics such as ADAS-driven HDI demand and electrification-driven thermal requirements.

Step 4: Research Synthesis and Final Output

We triangulate findings using buyer-supplier feedback loops and cross-check against credible published benchmarks and Philippines trade statistics. Final outputs include market sizing anchors, competition mapping, segmentation logic, and investment/entry implications tailored for business decision-makers.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, assumptions and exclusions, abbreviations, demand-side build vehicle parc production imports, BOM-based PCB content mapping, supply-side triangulation fab EMS channel, primary interview program OEMs Tier-1 EMS distributors, pricing and yield normalization approach, validation logic multi-source reconciliation, limitations and confidence scoring)

- Definition and Scope

- Market Genesis and Electronics Localization Context

- Automotive Electronics Business Cycle Mapping

- Value Chain and Stakeholder Map

- Philippines Manufacturing Footprint Context

- Growth Drivers

ECU proliferation

Safety feature uptake

Connectivity and infotainment upgrades

Electrification electronics content

Localization and EMS export programs - Challenges

Import dependency for advanced boards

Long qualification cycles

Cost-down pressure

Counterfeit penetration

Supply chain disruptions - Opportunities

Automotive-grade PCBA exports

ADAS and telematics assemblies

Power electronics and thermal boards

Repair and remanufacturing

High-mix low-volume niches - Trends

HDI migration

Miniaturization

Conformal coating adoption

Functional safety documentation

Cybersecurity-driven architecture changes - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- By Local Manufacturing vs Import Supply Split, 2019–2024

- By Fleet Type (in Value %)

Rigid FR-4 and high-Tg laminates

Flexible FPC

Rigid-Flex

HDI and microvia boards

Metal-Core and thermal boards - By Application (in Value %)

Passenger Vehicles

Commercial Vehicles

Motorcycles and Two-Wheelers

Off-highway and industrial vehicles

Aftermarket retrofit applications - By Technology Architecture (in Value %)

Powertrain and engine management

Body electronics

Chassis and safety systems

Infotainment and connectivity

ADAS and sensing modules - By Connectivity Type (in Value %)

One to two layer boards

Four to six layer boards

Eight plus layer boards

High-frequency and impedance-controlled boards

High-reliability harsh-environment boards - By End-Use Industry (in Value %)

Local PCBA and EMS manufacturing

Imported bare PCB with local assembly

Fully imported PCBA

Tier-1 captive sourcing

Distributor-led spot buying - By Region (in Value %)

OEM and Tier-1 direct programs

EMS procurement routes

Authorized distributors

Aftermarket service channels

E-commerce and broker channels

- Competitive positioning map

Market share snapshot - Cross Comparison Parameters (Automotive quality readiness, HDI and fine-line capability, layer-count and impedance-control capability, reliability validation stack, traceability depth, environmental and protection processes, NPI agility, supply assurance strength)

- Pricing and Commercial Benchmarking

- SWOT Analysis of Key Players

- Strategic Moves and Recent Developments

- Risk Matrix by Supplier

- Detailed Profiles of Major Companies

Integrated Micro-Electronics Inc

Ionics EMS Inc

EMS Group Philippines

Fastech Synergy Philippines

Cirtek Electronics Corporation

Jabil

Flex

Benchmark Electronics

Sanmina

TTM Technologies

Unimicron Technology

AT&S

Zhen Ding Technology

Pegatron

- OEM and Tier-1 qualification journey

- Purchasing criteria stack

- Contracting and pricing mechanics

- Pain points and unmet needs

- Supplier scorecard framework

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price, 2025–2030

- By Local Manufacturing vs Import Supply Split, 2025–2030