- Forecast Market Value 2026-2030

- Forecast Installed Units 2026-2030

- Price Forecast by System Tier 2026-2030

- Future Demand by Platform 2026-2030

Market Overview

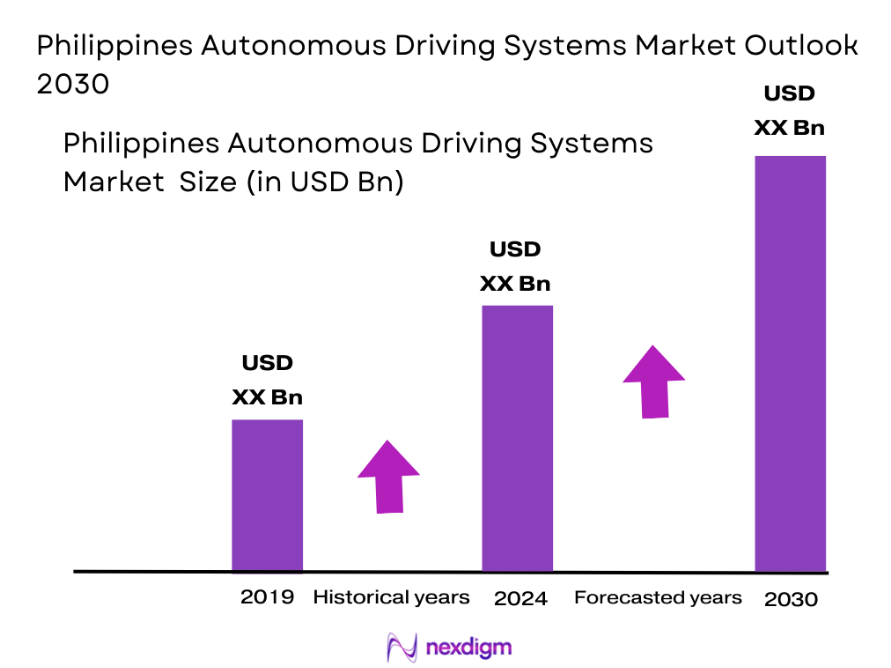

The Philippines Autonomous Driving Systems market is valued at approximately USD ~ in 2025. The market’s growth trajectory is fueled by increasing demand for intelligent transportation solutions due to rising urbanization, road congestion, and environmental sustainability concerns. The government’s ongoing initiatives to promote electric vehicle (EV) adoption, coupled with advancements in 5G connectivity, contribute to the expansion of autonomous vehicles (AV) in urban and industrial settings. Continued research and development in autonomous vehicle technology, along with strategic partnerships between OEMs and tech companies, are expected to drive the market forward.

Metro Manila, CALABARZON, and the Clark-Subic zones are the dominant regions driving the Philippines Autonomous Driving Systems market. These areas represent major economic hubs where traffic congestion is severe, making the adoption of autonomous vehicles an attractive solution for improving mobility and logistics. Metro Manila, as the largest urban center, serves as the testing ground for autonomous vehicle technologies. Meanwhile, CALABARZON and Clark-Subic offer ideal environments for autonomous vehicle deployment in controlled and semi-controlled zones, including industrial parks and airports.

Market Segmentation

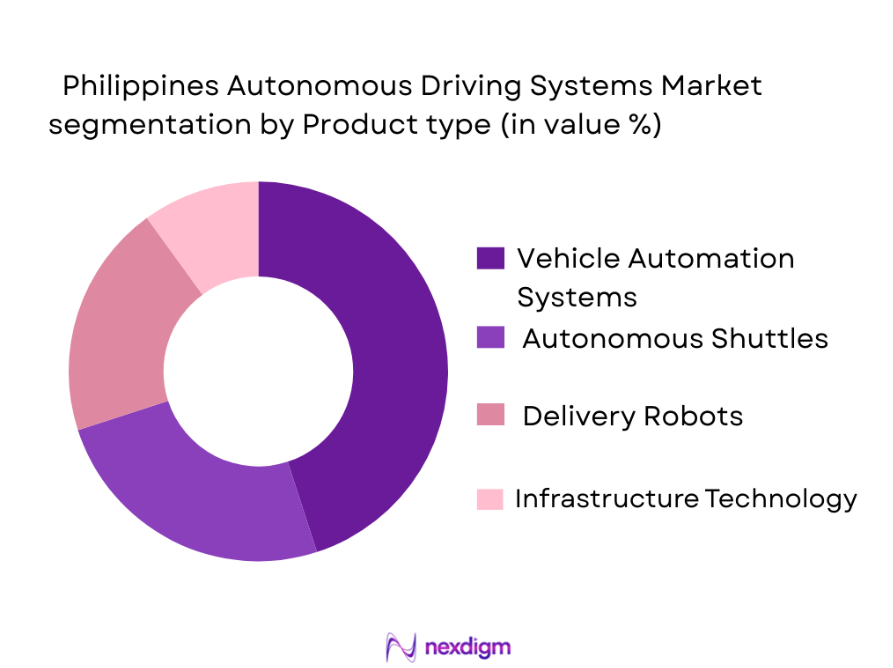

By Product Type

The Autonomous Driving Systems market in the Philippines is segmented into several key product types, including vehicle automation systems, autonomous shuttles, delivery robots, and infrastructure technology (including sensors, connectivity, and AI solutions). Among these, the vehicle automation systems segment is dominating the market in 2025. The increased focus on advanced driver assistance systems (ADAS) as the stepping-stone toward full autonomy has contributed significantly to this segment’s dominance. Furthermore, the ongoing development of mixed-traffic ODDs (Operational Design Domains) that cover urban roads is accelerating the adoption of automation technologies in passenger vehicles. Companies like NVIDIA, Qualcomm, and Mobileye, along with local players, are driving innovation in sensor and computing technologies for these systems.

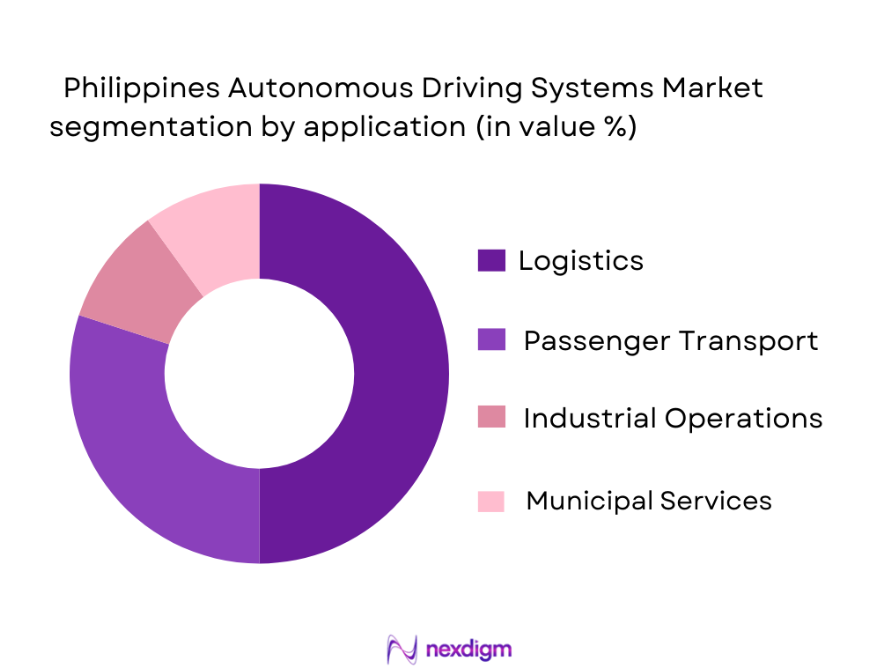

By Application

The application of autonomous driving systems in the Philippines is primarily segmented into logistics, passenger transport, industrial operations, and municipal services. Among these, logistics has the largest share in 2025. This is largely due to the high demand for autonomous systems in improving last-mile delivery and streamlining logistics operations in congested areas like Metro Manila. Autonomous trucks and last-mile delivery robots are gaining significant traction in industrial zones like CALABARZON, contributing to this segment’s prominence. Moreover, the Philippines’ expanding e-commerce industry has further driven the need for autonomous logistics solutions to reduce transportation costs and improve efficiency.

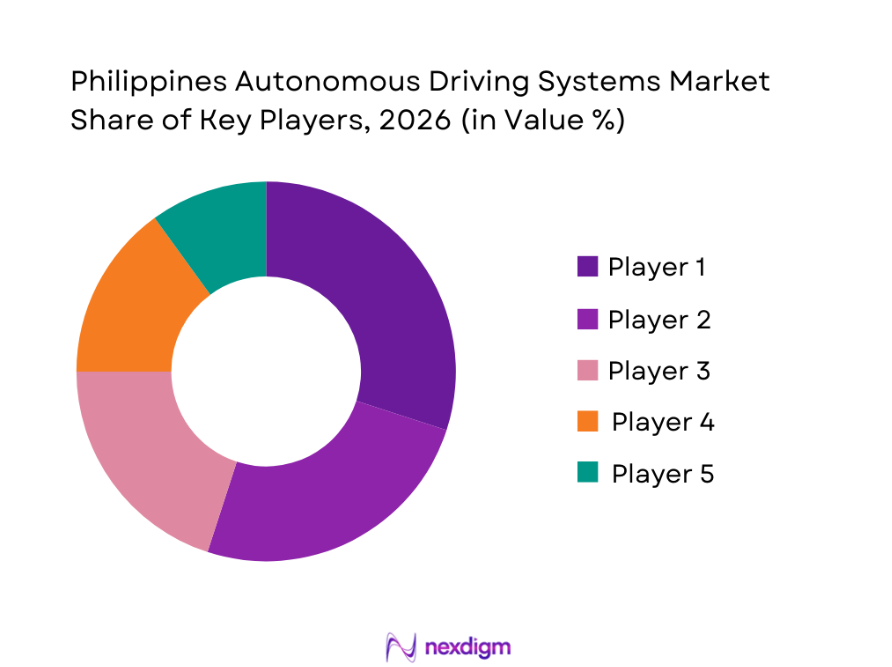

Competitive Landscape

The Autonomous Driving Systems market in the Philippines is witnessing a competitive landscape with both local and international players vying for market share. The market is led by global tech companies such as NVIDIA and Qualcomm, which provide the underlying hardware and software for autonomous systems. Additionally, local firms like I-Auto and Filipino electric vehicle startup Ayala Corporation are gaining ground by leveraging government incentives for EV deployment and autonomous vehicle testing.

The market is largely characterized by technology integration, where partnerships between automakers and tech companies are becoming essential for product development. This consolidation points to a strong presence of industry leaders, such as Waymo, Tesla, and Baidu Apollo, with their advanced autonomous systems, which have captured a significant portion of the market.

| Company Name | Establishment Year | Headquarters | Key Technologies | Fleet Size | Regional Coverage | Revenue Model |

| Waymo | 2009 | USA | ~ | ~ | ~ | ~ |

| Tesla | 2003 | USA | ~ | ~ | ~ | ~ |

| Baidu Apollo | 2000 | China | ~ | ~ | ~ | ~ |

| Qualcomm | 1985 | USA | ~ | ~ | ~ | ~ |

| Ayala Corp | 1834 | Philippines | ~ | ~ | ~ | ~ |

Philippines Autonomous Driving Systems Market Analysis

Growth Drivers

Urban Mobility Stress & Fleet Automation Demand

The Philippines’ urban areas, particularly Metro Manila, face severe traffic congestion, with traffic speeds averaging just 14 km/h in peak hours. In response to this growing issue, there is a rising demand for fleet automation and intelligent transport systems. According to the Philippine Statistics Authority, Metro Manila’s population in 2025 reached over ~ , a major contributor to road traffic and infrastructure strain. The Department of Transportation (DOTr) has been advocating for smart mobility solutions, aiming for the widespread adoption of autonomous vehicles and electric public transport systems. These efforts are essential in alleviating congestion and enhancing fleet operations across the country. With continuous investments in EV infrastructure and fleet automation, urban mobility is expected to improve over the next few years.

Logistics Throughput in Ports/Air Cargo

The logistics sector in the Philippines is growing rapidly due to increasing trade and e-commerce activities. In 2025, the Philippines’ ports handled over ~ metric tons of cargo, and the volume of air cargo processed at Ninoy Aquino International Airport (NAIA) was approximately ~ metric tons. The growth in logistics, especially with an emphasis on last-mile delivery, has significantly contributed to the demand for autonomous systems. The automation of delivery fleets, including autonomous trucks and drones, is critical in improving efficiency and addressing the rising demand for faster, more reliable logistics services in the Philippines. The increasing reliance on autonomous systems to streamline logistics is expected to continue as the economy expands.

Market Challenges

High Safety Validation Bar Due to Baseline Road Safety Risk

The safety concerns associated with autonomous vehicles in the Philippines remain high. In 2025, road accidents in the country resulted in over 4,000 fatalities, with a significant portion attributed to human error. The Department of Transportation (DOTr) continues to advocate for rigorous safety protocols in autonomous vehicle deployment, given the country’s challenging road conditions. In particular, the implementation of full self-driving technologies faces hurdles in terms of ensuring vehicles can reliably navigate Manila’s congested streets, which are filled with pedestrians, motorcycles, and informal transport vehicles. Validation of safety protocols for autonomous operations is critical, as regulatory bodies require extensive testing to guarantee vehicle safety before widespread deployment.

Weather & Environmental Impacts on Sensor Reliability (Typhoons)

The Philippines is prone to frequent and severe weather conditions, including typhoons, floods, and heavy rains. In 2025, the country experienced 7 typhoons, which caused significant disruptions in transportation systems. These environmental challenges impact the reliability of autonomous vehicle sensors, which must be able to operate in adverse weather conditions. The performance of sensors, such as LiDAR, radar, and cameras, can degrade due to rain, fog, and strong winds, complicating the development of autonomous systems for use in the Philippines. Companies developing autonomous vehicles are focusing on enhancing sensor technologies that can operate effectively in these conditions, but the challenge remains significant for mass deployment.

Market Opportunities

Controlled ODD Rollouts (SEZs, Ports, Campuses)

The Philippines offers substantial opportunities for controlled rollouts of autonomous vehicles in special economic zones (SEZs), ports, and campuses. SEZs like the Clark Freeport Zone and Subic Bay Freeport Zone offer controlled environments with less complex traffic patterns, making them ideal for autonomous vehicle pilots. These zones are equipped with necessary infrastructure and smart road systems, allowing for smoother integration of autonomous vehicles. Additionally, major ports like the Port of Manila and Davao are actively exploring automation solutions to streamline cargo handling and reduce labor costs. These controlled environments provide a safe testing ground and are expected to serve as models for future deployments in urban areas.

Hybrid Autonomy (Tele-ops + Human Guard)

In the Philippines, hybrid autonomy, where autonomous systems are supported by teleoperation and human oversight, offers significant growth opportunities. The country’s unique road conditions and traffic patterns necessitate a blend of autonomy and human intervention. For instance, in logistics operations, autonomous trucks can navigate controlled routes, while human operators can remotely take control in complex scenarios. This hybrid model ensures safety and flexibility, allowing for a gradual transition to full autonomy. The deployment of such systems in industrial areas and designated corridors is expected to grow as infrastructure and telecommunication networks improve.

Future Outlook

Over the next 5 years, the Philippines Autonomous Driving Systems market is expected to show significant growth. This expansion will be driven by continuous government support for electric vehicle policies, advancements in autonomous vehicle technologies, and increasing consumer demand for eco-friendly and efficient transportation solutions. The Philippines is expected to emerge as a hub for autonomous vehicle testing, with companies seeking to leverage the country’s regulatory environment for pilot programs. With evolving infrastructure, improved safety protocols, and stronger public-private partnerships, the market is poised for sustained growth.

Major Players in the Market

- Waymo

- Tesla

- Baidu Apollo

- Qualcomm

- NVIDIA

- I-Auto

- Ayala Corporation

- Mobileye (Intel)

- Motional

- Cruise (GM)

- Zoox (Amazon)

- Pony.ai

- EasyMile

- Hyundai Motor Group

- Ford Motor Company

Key Target Audience

- Automotive OEMs

- Investments and Venture Capitalist Firms

- Technology Integrators and Solution Providers

- Government and Regulatory Bodies

- Fleet Operators

- E-commerce Firms

- Municipalities and Urban Development Agencies

- Telecommunication Providers

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying and mapping all critical stakeholders in the autonomous driving ecosystem. This includes OEMs, technology developers, regulatory bodies, and end-users in logistics, transportation, and municipal services. Secondary research, leveraging industry reports and proprietary databases, provides comprehensive data for market analysis.

Step 2: Market Analysis and Construction

In this phase, historical market data is compiled and analyzed to establish penetration rates, fleet deployments, and revenue streams. This analysis includes assessing trends in vehicle automation levels, sensor adoption, and advancements in connectivity technologies such as 5G and C-V2X.

Step 3: Hypothesis Validation and Expert Consultation

Developed hypotheses are tested through consultations with industry experts from OEMs, technology providers, and regulatory bodies. These consultations, conducted via phone interviews and surveys, help validate initial assumptions and offer operational insights to refine market data.

Step 4: Research Synthesis and Final Output

The final phase integrates primary and secondary research findings. Direct engagement with key players in the autonomous vehicle industry ensures that all data is validated and comprehensive, providing actionable insights into future market developments and trends.

- Executive Summary

- Research Methodology (Market Definitions and Autonomous Driving Scope, Assumptions, Primary & Secondary Research Approach, Data Normalization, Limitations & Future Research Needs)

- Genesis of Autonomous Driving in the Philippines

- Urban Congestion & Logistics Intensity as Adoption Catalysts

- Value Chain & Sensor‑Compute Stack

- Operational Design Domain (ODD) Stratification

- Regulatory & Standardization Framework

- Growth Drivers

Urban mobility stress & fleet automation demand

Logistics throughput in ports/air cargo

Connectivity base (mobile broadband penetration, 5G expansion)

EV & Zero Tariff Policies boosting electrified autonomy ecosystem - Market Challenges

High safety validation bar due to baseline road safety risk

Weather & environmental impacts on sensor reliability (typhoons)

Digital mapping & lane‑marking consistency gaps

Insurance & liability clarity for autonomous operations - Opportunities

Controlled ODD rollouts (SEZs, ports, campuses)

Hybrid autonomy (tele‑ops + human guard)

Data service & predictive maintenance monetization - Trends

Sensor consolidation & cost‑curve improvement

AI/ML routing & safety stack optimization

OEM‑Integrator Partnerships

Outcome‑based mobility metrics (uptime, safety events, route efficiency) - Government Regulation & Policy Mapping

Pilot permitting process & safety case thresholds

Spectrum allocation & connected infrastructure support

Local standards for digital mapping and homologation - Porters Five Forces (Market Structure for Autonomous Driving Firms)

- SWOT Analysis

- By Value, 2019-2025

- By Volume , 2019-2025

- Segment Average Price, 2019-2025

- Sensor Stack Revenue, 2019-2025

- By Automation Level (In Value %)

Level 2+ / ADAS‑Enabled Vehicles

Level 3 Conditional Autonomy (Highway/Corridor ODD)

Level 4 Geo‑fenced Operation (Campus/SEZ/Pilot)

Level 5 Full Autonomy (Development pipeline) - By Application / Use Case (In Value %)

Logistics & Last‑Mile AVs

Passenger Shuttles (Airport, Campus, Estate)

Robotaxi / On‑Demand (Pilot Corridor)

Industrial & Port Yard Robotics

Autonomous Trucks (Highway ODD)

Municipal Services (Inspection/Broom/Bulk Ops) - By Connectivity & Tech Tier (In Value %)

C‑V2X Enabled Fleets

5G Tele‑ops & Edge Compute Platforms

Sensor Stack Tiers (Standard, Redundant, AI‑Augmented) - By Deployment Domain (In Value %)

Closed‑Campus

Public‑Road Pilot Zones

Mixed Traffic Environments - By Region (Philippines) (In Value %)

NCR / Metro Manila

CALABARZON

Clark‑Subic Zone

Cebu / Visayas

Mindanao / Davao

- Competitive Analysis

- Cross‑Comparison Parameters (Company Overview, Autonomous Tech Stack, ODD Readiness, Regulatory Approvals / Local Permits, Fleet Deployment Count & Route Types, Sensor + Connectivity Penetration, Safety Metric Performance, Local Partnership & Telco Integration, Tele‑ops Infrastructure & Coverage, Price / Service Model, Data Services Revenue Streams, Localization Strategy, R&D & Roadmap Differentiators)

- Market share of major players

- SWOT of Major Competitors

- Pricing & Go‑to‑Market Models (Service, Platform, Integration Costs)

- Detailed Profiles of Key Players

Waymo

Cruise (GM)

Mobileye (Intel)

May Mobility

Huawei ADS

NVIDIA (Drive)

Qualcomm (Snapdragon Auto)

Pony.ai

Baidu Apollo

Motional

AutoX

Zoox

EasyMile

Local Integrator / Tech Startup (Philippines)

Regional OEM Partner (Japan / Korea auto firms active locally)

- Automotive Manufacturers Increasing Focus on ADAS

- Ride-Hailing Services Adopting Autonomous Technology

- Logistics and Delivery Platforms Exploring Autonomous Solutions

- Private Vehicle Owners Seeking Advanced Driver Assistance Systems

The Philippines Autonomous Driving Systems market is valued at approximately USD ~ in 2025. It is primarily driven by the government’s push for electric vehicles, urban mobility needs, and the demand for innovative logistics solutions in congested urban areas.

The market faces challenges such as regulatory uncertainties, high development costs for autonomous technologies, and the slow pace of infrastructure upgrades, especially in terms of 5G connectivity and smart road systems.

Major players include global leaders such as Waymo, Tesla, and Baidu Apollo, along with regional firms like Ayala Corporation and I-Auto. These players are driving technological advancements and contributing to pilot programs in key urban and industrial zones in the Philippines.

Key growth drivers include the government’s push for EV adoption, increasing urbanization, and the need for more efficient transportation systems. Moreover, advancements in AI, 5G connectivity, and sensor technologies are enabling rapid development in autonomous driving systems.

Over the next five years, the Philippines Autonomous Driving Systems market is expected to experience strong growth due to advancements in autonomous technologies, regulatory support, and an increasing focus on sustainable transportation solutions in major urban centers.