Market Overview

The Philippines biomarkers market is valued at USD ~ million, driven by the increasing prevalence of chronic diseases, advancements in medical technologies, and greater emphasis on precision medicine. With the Philippines being one of the fastest-growing healthcare markets in Southeast Asia, biomarkers are becoming an integral part of diagnostics and personalized medicine. The growing demand for non-invasive diagnostic tools, such as liquid biopsy and genetic testing, has spurred market growth. Additionally, the government’s push toward improving healthcare infrastructure, in line with the Universal Healthcare Act, further supports market expansion. The market is poised to grow as diagnostics improve, fueled by an aging population and rising awareness of personalized treatment options.

The Philippines’ biomarker market is primarily dominated by Metro Manila, which houses major hospitals, diagnostic laboratories, and research centers. Manila serves as the epicenter for healthcare services, research, and diagnostics due to its high population density and concentration of medical institutions. The Metro is also a hub for international pharmaceutical and biotech companies that are developing and testing biomarkers. Cebu and Davao are emerging as important players in the healthcare space, driven by growing healthcare facilities and demand for advanced diagnostic services. These regions benefit from increasing urbanization, access to medical research, and improving healthcare infrastructure, making them dominant forces in the biomarkers market.

Market Segmentation

By Biomarker Type

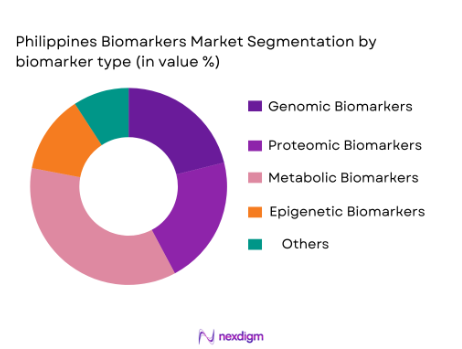

The biomarkers market in the Philippines is segmented by biomarker type into genomic biomarkers, proteomic biomarkers, metabolic biomarkers, epigenetic biomarkers, and others, including circulating tumor DNA and miRNA. Among these, genomic biomarkers dominate the market due to their significant role in cancer diagnostics, hereditary diseases, and personalized medicine. With the increasing availability of next-generation sequencing (NGS) technology, genomic biomarkers provide highly accurate results, making them indispensable in clinical diagnostics. As of 2024, the growing adoption of precision medicine, particularly in oncology, is reinforcing the dominance of genomic biomarkers.

By Technology Platform

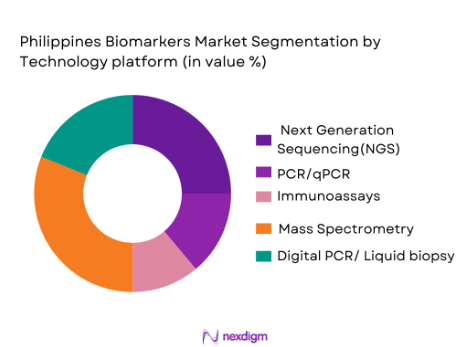

The biomarkers market in the Philippines is also segmented by technology platforms into PCR/qPCR, immunoassays, next-generation sequencing (NGS), mass spectrometry, and digital PCR/liquid biopsy platforms. Among these, next-generation sequencing (NGS) is rapidly gaining traction due to its ability to sequence large amounts of DNA or RNA quickly and accurately. NGS enables precise genetic profiling, which is crucial for cancer diagnostics, rare disease detection, and pharmacogenomics. The growing affordability of NGS platforms and the increasing number of clinical applications drive the adoption of NGS technology. By 2024, NGS is expected to capture a significant portion of the market due to the growing demand for genetic testing.

Competitive Landscape

The competitive landscape is characterized by the presence of both multinational corporations and emerging local players who are targeting the expanding healthcare and diagnostics markets. The biomarkers market in the Philippines is marked by a competitive landscape with several key players dominating the space, including global leaders in diagnostics such as Thermo Fisher Scientific, Roche Diagnostics, Illumina, Bio-Rad Laboratories, and QIAGEN. These companies have established strong brand recognition, extensive distribution networks, and significant investments in research and development. Their dominance is driven by their advanced technologies, strategic partnerships with local medical institutions, and comprehensive portfolios in genetic testing and biomarker discovery.

| Company Name | Establishment Year | Headquarters | Revenue (USD) | Product Portfolio | Market Penetration | Technology Focus |

| Thermo Fisher Scientific | 1956 | Waltham, Massachusetts | ~ | ~ | ~ | ~ |

| Roche Diagnostics | 1896 | Basel, Switzerland | ~ | ~ | ~ | ~ |

| Illumina | 1998 | San Diego, California | ~ | ~ | ~ | ~ |

| Bio-Rad Laboratories | 1952 | Hercules, California | ~ | ~ | ~ | ~ |

| QIAGEN | 1984 | Hilden, Germany | ~ | ~ | ~ | ~ |

Philippines Biomarkers Market Analysis

Growth Drivers

Significant rise in the prevalence of chronic diseases

The Philippines has seen a significant rise in the prevalence of chronic diseases, including cancer, diabetes, and cardiovascular diseases. According to the World Health Organization (WHO), non-communicable diseases (NCDs) accounted for 68% of all deaths in the Philippines in 2022, with cardiovascular diseases and cancers leading the causes of death. This rising burden has increased the demand for biomarkers, particularly for early detection, treatment, and monitoring of these diseases. The adoption of precision medicine is also growing as a way to provide tailored treatments for individuals based on their biomarker profiles. The expansion of precision medicine in the Philippines is driven by both government and private sector investments in healthcare infrastructure and research.

Philippines’ genomic and molecular diagnostic infrastructure

There has been a notable expansion in the Philippines’ genomic and molecular diagnostic infrastructure, driven by the increasing demand for advanced testing methods and technologies like Next-Generation Sequencing (NGS). In 2023, the Philippines Department of Health (DOH) initiated several programs to enhance the country’s diagnostic capacity, including the establishment of new genomics labs and the introduction of NGS for clinical use. This expansion is critical for providing access to molecular diagnostics for cancer, genetic disorders, and infectious diseases. With growing government support and international collaborations, these advancements have contributed to the growth of the biomarkers market in the region.

Market Challenges

Fragmented Reimbursement & Out-of-Pocket Barriers

Despite the rapid growth of the biomarkers market, one of the major challenges is the fragmented reimbursement system and the high out-of-pocket costs for patients. Many biomarker tests, particularly for cancer and genetic disorders, are expensive and not fully covered by the public health insurance system (PhilHealth). As of 2024, out-of-pocket expenditures on health services in the Philippines remain high, with many patients unable to afford advanced diagnostic tests without financial assistance. This limits the widespread adoption of biomarker testing, especially among low-income populations, thus restricting the market’s full potential.

Limited Localized Biomarker Validation Data

The lack of locally validated biomarker data is another significant challenge. While there is a growing body of global biomarker research, much of it is not adapted to the unique genetic, environmental, and epidemiological context of the Philippines. Many biomarkers that are widely used globally have yet to undergo extensive validation in the local population. This poses barriers to clinical adoption, particularly in precision medicine, where biomarker accuracy and relevance are crucial for treatment decisions. The absence of strong local data is hindering the development and use of biomarkers tailored specifically for Filipino patients.

Market Opportunities

Liquid Biopsy & Non-Invasive Biomarker Testing

Liquid biopsy is a rapidly emerging opportunity in the Philippines biomarkers market, offering non-invasive alternatives to traditional tissue biopsies. Liquid biopsy tests, which detect genetic mutations, cancer markers, and other diseases in blood samples, have gained popularity due to their less invasive nature and ability to provide real-time monitoring. In 2023, several diagnostic companies introduced liquid biopsy technologies to the Philippine market, with strong demand for cancer diagnostics and monitoring. As healthcare providers seek to reduce costs and improve patient comfort, liquid biopsy will likely become a cornerstone of future diagnostic practices in the Philippines.

AI/ML Integration for Biomarker Analytics

The integration of artificial intelligence (AI) and machine learning (ML) into biomarker analytics is expected to drive future growth in the Philippines. These technologies are being increasingly adopted to enhance the accuracy of biomarker detection, streamline diagnostics, and personalize treatment plans. AI algorithms can analyze complex biomarker data faster and more accurately than traditional methods, enabling healthcare providers to make quicker and more informed decisions. In 2023, multiple healthcare institutions in the Philippines began exploring AI/ML tools for genomic data analysis, which promises to improve early disease detection and therapeutic intervention.

Future Outlook

Over the next few years, the biomarkers market in the Philippines is expected to experience substantial growth, driven by advancements in diagnostic technologies, increased healthcare spending, and a shift towards personalized medicine. As genomic and proteomic biomarkers become more integrated into clinical practices, particularly in cancer, infectious disease, and genetic disorder diagnostics, the market will expand significantly. The government’s focus on strengthening healthcare infrastructure, along with initiatives to provide universal healthcare, is expected to further drive adoption of biomarkers in clinical settings. Moreover, the growing demand for non-invasive tests, such as liquid biopsies and digital PCR, will continue to shape the future of the biomarkers market in the country.

Major Players in the Market

- Thermo Fisher Scientific

- Roche Diagnostics

- Illumina

- Bio-Rad Laboratories

- QIAGEN

- Abbott Laboratories

- Danaher Corporation

- PerkinElmer

- Siemens Healthineers

- GE Healthcare

- Merck Group

- Becton Dickinson

- Agilent Technologies

- Beckman Coulter

- F. Hoffmann-La Roche AG

Key Target Audience

- Government Agencies (e.g., Department of Health (DOH), Philippine Food and Drug Administration (FDA))

- Pharmaceutical and Biotechnology Companies

- Diagnostic Laboratories and Research Institutions

Research Methodology

Step 1: Identification of Key Variables

This phase includes identifying and mapping critical stakeholders within the Philippines biomarkers market, including healthcare providers, diagnostic labs, and suppliers. The objective is to understand the key variables affecting market dynamics, such as technological advancements, regulatory environment, and demand for precision medicine.

Step 2: Market Analysis and Construction

Historical data will be gathered, focusing on the Philippines market’s size, penetration rates, and adoption levels for genomic and proteomic biomarkers. We will analyze disease-specific market trends and their respective growth rates to assess current and future market potential.

Step 3: Hypothesis Validation and Expert Consultation

Consultations will be conducted with key industry experts, including clinical practitioners, lab directors, and biomarker manufacturers, to validate hypotheses around adoption drivers and barriers in the Philippine healthcare market.

Step 4: Research Synthesis and Final Output

After gathering primary and secondary data, we will synthesize findings and finalize insights for the report. Direct engagement with local healthcare institutions and international biomarker companies will ensure the robustness of the data and the final conclusions of the report.

- Executive Summary

- Research Methodology (Market Definitions & Biomarker Taxonomy, Abbreviations & Clinical Terminology, Market Sizing & Forecasting Methodology, Secondary Research Sources & Data Validation Protocols, Primary Research, Limitations, Assumptions & Data Confidence Scores, Triangulation & Quality Assurance)

- Definition and Scope of Biomarkers

- Genesis of Biomarker Adoption in Philippines Healthcare

- Timeline of Technology Integration

- Clinical Utilization & Reimbursement Pathways

- Supply Chain & Distribution Networks

- Healthcare Infrastructure & Biomarker Testing Value Chain

- Growth Drivers

Rising Chronic Disease Burden & Precision Medicine Adoption

Expansion of Genomic & Molecular Diagnostic Infrastructure

Pharmaceutical R&D & Clinical Trial Expansion

Government Health Initiatives & Public Health Screening - Market Challenges

Fragmented Reimbursement & Out‑of‑Pocket Barriers

Limited Localized Biomarker Validation Data

Infrastructure & Skilled Workforce Constraints - Market Opportunities

Liquid Biopsy & Non‑Invasive Biomarker Testing

AI/ML Integration for Biomarker Analytics

Companion Diagnostics & Targeted Therapy Partnerships

Biomarker Panels for Population‑Level Screening - Trends

Shift to Multi‑Omics Platforms

Rise of Point‑of‑Care Biomarker Diagnostics

Decentralized Laboratory Testing Models - Government Regulation & Healthcare Policy

Regulatory Framework (FDA Philippines)

Universal Healthcare Act Impact

Public Health Screening Guidelines

- Market Value (USD), 2019-2024

- Volume Metrics, 2019-2024

- Average Selling Price, 2019-2024

- Utilization by Clinical Area, 2019-2024

- Technology Adoption, 2019-2024

- By Biomarker Type (In Value %)

Genomic Biomarkers

Proteomic Biomarkers

Metabolomic Biomarkers

Epigenetic Biomarkers

Others - By Technology Platform (In Value %)

PCR & QPCR

Immunoassays

Next‑Generation Sequencing (NGS)

Mass Spectrometry

Digital PCR / Liquid Biopsy Platforms - By Disease Application (In Value %)

Oncology (Cancer Biomarkers)

Infectious Diseases (HBV, HIV, TB)

Cardiovascular Disorders

Neurological Disorders

Metabolic & Autoimmune Diseases - By End User (In Value %)

Hospitals & Clinical Labs

Diagnostic Laboratories

Research & Academic Institutions

Pharmaceutical & Biotech Companies

Contract Research Organizations (CROs) [Adoption Intensity] - By Distribution Channel (In Value %)

Direct OEM Supply

Distributors & Channel Partners

E‑Commerce & Online Procurement

Hospital & Lab Group Consortiums

Government Procurement [Channel Efficacy & Penetration]

- Market Share of Major Players

Cross‑Comparison Parameters (Company Overview & Legal Structure, Revenue & Growth Trajectory, Product/Assay Portfolio Breadth, PCR/NGS/Proteomics, Service Support & Training Capabilities, Ongoing R&D & Innovation Pipeline, Collaborations with Hospitals, CROs, Biotech) - SWOT Analysis of Key Players

- Detailed Company Profiles

Abbott Laboratories

Thermo Fisher Scientific

Roche Diagnostics

QIAGEN N.V.

Illumina, Inc.

Bio‑Rad Laboratories

Agilent Technologies

Danaher Corporation

Becton, Dickinson and Company

PerkinElmer, Inc.

Hoffmann‑La Roche AG

SomaLogic

Myriad Genetics

Guardant Health

NeoGenomics Laboratories

- Biomarker Test Utilization Trends

- End User Purchasing Parameters & Budget Allocation

- Pricing & Reimbursement Dynamics

- Clinical Needs, Barriers & Adoption Drivers

- Decision‑Making & Technology Adoption Pathways

- Future Market Value (Revenue Projection), 2026-2030

- Forecast by Biomarker Type, 2026-2030

- Forecast by Technology Platform, 2026-2030