Market Overview

The Philippines biosensors market is witnessing remarkable growth, driven by increasing demand for diagnostic tools and health monitoring solutions. The market has reached a value of USD ~ million and is expected to continue expanding due to technological advancements in medical diagnostics, government investments in healthcare infrastructure, and a rising trend toward personalized health solutions. The increasing prevalence of chronic diseases such as diabetes, cardiac conditions, and infections further propels the adoption of biosensors, which enable non-invasive and real-time health monitoring.

Metro Manila, Cebu, and Davao are key urban centers in the Philippines where the demand for biosensors is highest. These cities dominate the market due to their well-established healthcare infrastructure, including hospitals, diagnostic centers, and research institutions. Metro Manila, in particular, is the healthcare hub of the country, housing the majority of medical device manufacturers, distributors, and healthcare professionals. Furthermore, the ongoing expansion of healthcare facilities and government initiatives in these regions contributes to their dominance in the biosensor market.

Market Segmentation

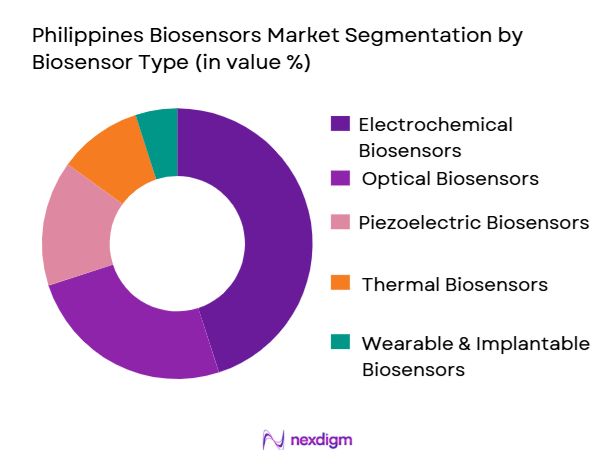

By Biosensor Type

The Philippines biosensors market is segmented into various biosensor types, with electrochemical biosensors holding the dominant share in the market. Electrochemical biosensors are preferred due to their widespread application in glucose monitoring for diabetic patients, which is a significant concern in the Philippines. These sensors offer high accuracy, affordability, and ease of use, making them ideal for home healthcare users and clinical settings. The popularity of electrochemical biosensors is also enhanced by their relatively low manufacturing costs and high demand from hospitals, clinics, and diagnostic laboratories across the country.

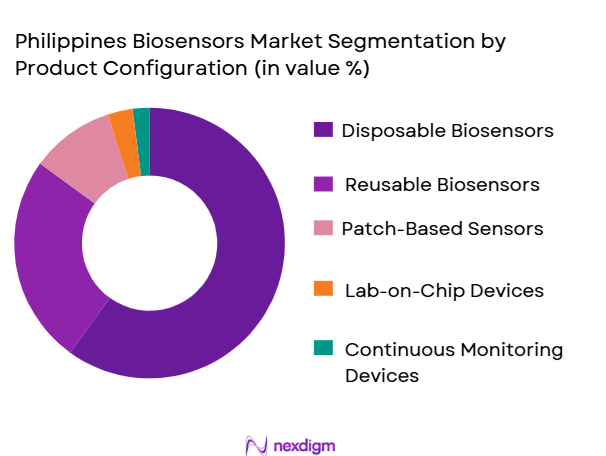

By Product Configuration

The product configuration segment in the Philippines biosensors market is primarily dominated by disposable biosensors. Disposable biosensors are preferred due to their cost-effectiveness, ease of use, and increasing applications in remote patient monitoring and point-of-care diagnostics. These sensors are typically used for single-use applications, ensuring high hygiene standards and eliminating the need for calibration. With the growing demand for home healthcare solutions, disposable biosensors are becoming the go-to choice for both consumers and healthcare providers.

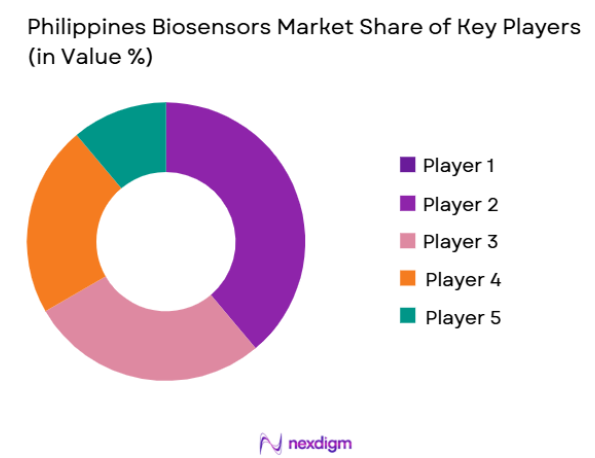

Competitive Landscape

The Philippines biosensors market is competitive, with both local and global players vying for market share. Key players include large multinational companies such as Abbott Laboratories, Roche Diagnostics, and Medtronic, as well as local firms making strides in biosensor manufacturing and distribution. These companies differentiate themselves through technological innovation, strategic partnerships, and strong distribution networks in key urban centers.

The market is primarily dominated by global brands due to their advanced technology and established presence in the region. Local players, on the other hand, are gaining traction by offering affordable solutions and leveraging the government’s support for local manufacturing initiatives. The consolidation of market players and the introduction of advanced technologies such as AI-enabled biosensors are key aspects of the competitive landscape.

| Company Name | Establishment Year | Headquarters | Market-Specific Parameters |

| Abbott Laboratories | 1888 | ~ | ~ |

| Roche Diagnostics | 1896 | ~ | ~ |

| Medtronic | 1949 | ~ | ~ |

| Bio-Rad Laboratories | 1952 | ~ | ~ |

| Nova Biomedical | 1976 | ~ | ~ |

Philippines Biosensors Market Analysis

Growth Drivers

Urbanization

The Philippines has been experiencing rapid urbanization, with the urban population reaching over ~million in 2022. This urban growth is contributing significantly to the increasing demand for healthcare solutions, including biosensors. Metro Manila and other urban centers are experiencing higher rates of chronic diseases, such as diabetes and cardiovascular conditions, which are further driving the need for advanced diagnostic tools like biosensors. The rise in urbanization is leading to greater access to healthcare facilities and more awareness among the urban population about advanced health monitoring solutions. The Philippines’ urban population is projected to grow at a steady rate, further driving demand for biosensors.

Industrialization

The industrialization of the Philippines, particularly in the manufacturing and healthcare sectors, has created an environment conducive to the growth of the biosensors market. In 2022, the Philippine manufacturing sector contributed approximately 23.6% to the country’s GDP. This growth in industrial activity has led to an increased focus on health and safety standards, thereby boosting the demand for biosensors. Industrial sectors, such as food production, pharmaceuticals, and environmental monitoring, are adopting biosensors for quality control and safety applications. Furthermore, the government’s push for industry 4.0 and automation will further expand the scope of biosensor applications in industrial sectors.

Restraints

High Initial Costs

Despite the growth of the biosensors market in the Philippines, one significant restraint is the high initial costs associated with advanced biosensor devices. While the cost of some basic biosensors has decreased, more advanced, integrated biosensors remain expensive for widespread adoption, particularly in rural areas where affordability remains a concern. The high price of imported biosensors further exacerbates the issue. The Philippine government is yet to implement large-scale subsidies for medical devices, which limits accessibility for lower-income groups and small healthcare providers. The cost issue also affects the ability of many consumers to purchase continuous health monitoring devices.

Technical Challenges

The technical complexity of biosensor technologies also poses a barrier to their adoption. While the Philippines has made strides in advancing healthcare technology, the country still faces challenges in terms of technical expertise and infrastructure. Many local healthcare facilities, especially in rural areas, lack the technical capacity to use and maintain advanced biosensors. There is also a lack of trained personnel to interpret the data provided by these devices, which can lead to errors in diagnosis. These challenges hinder the effective integration of biosensors into the healthcare system.

Opportunities

Technological Advancements

Technological advancements are playing a crucial role in expanding the biosensors market in the Philippines. In 2022, the Philippines saw significant growth in the development of wearable biosensors and IoT-enabled devices, spurred by increased healthcare investments and research. Wearable health devices, such as continuous glucose monitors and smartwatches, are gaining popularity due to their non-intrusive nature and ability to provide real-time health data. The growing collaboration between local tech startups and global biosensor manufacturers is fostering innovation, enabling the production of more affordable and efficient biosensor devices. This trend is expected to continue, driving the adoption of biosensors in both healthcare and wellness sectors.

International Collaborations

The Philippines has been strengthening its international collaborations in the medical device sector, opening doors for the importation of advanced biosensor technologies. In 2022, the Philippines signed an agreement with Japan and South Korea to enhance the exchange of medical technologies and expertise, which includes biosensors. These collaborations are expected to increase the availability of cutting-edge biosensor devices in the local market, thereby reducing reliance on expensive imports. The partnership also aims to establish local production capabilities for biosensors, reducing costs and improving accessibility.

Future Outlook

Over the next 5 years, the Philippines biosensors market is expected to witness strong growth driven by advancements in sensor technologies, an increase in chronic diseases, and rising demand for wearable healthcare devices. The shift towards continuous monitoring systems and non-invasive diagnostic tools will drive further market penetration. With support from the government in terms of incentives for local manufacturing, the market will also see the development of affordable, locally produced biosensors, making healthcare solutions more accessible to a wider population.

Major Players in the Market

- Abbott Laboratories

- Roche Diagnostics

- Medtronic

- Bio-Rad Laboratories

- Nova Biomedical

- Dexcom

- LifeScan

- ARKRAY

- Senseonics

- Ascensia Diabetes Care

- Thermo Fisher Scientific

- Sysmex

- EKF Diagnostics

- Siemens Healthineers

- Johnson & Johnson

Key Target Audience

- Healthcare Providers (Hospitals, Clinics, Diagnostic Laboratories)

- Medical Device Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Health – Philippines, Philippine Food and Drug Administration)

- Healthcare Equipment Distributors

- Pharmaceutical Companies

- Research and Development Organizations

- Private Healthcare Insurance Providers

Research Methodology

Step 1: Identification of Key Variables

The initial step involves identifying and mapping the critical factors affecting the Philippines biosensors market. This includes gathering data from secondary and proprietary databases to define the market scope and variables such as product types, technologies, and key stakeholders.

Step 2: Market Analysis and Construction

In this phase, historical data on biosensor market performance in the Philippines is compiled and analyzed. Key parameters such as adoption rates, market growth, and regional trends will be assessed, providing the foundation for future projections.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations will be conducted with key players in the biosensors and medical device industries. These interviews will help validate hypotheses regarding market trends, technologies, and future growth prospects.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the findings from the previous steps and consulting with industry experts to finalize a comprehensive report. This will provide actionable insights for market participants to make informed decisions.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Philippines-Specific Terminologies, Abbreviations, Market Sizing Logic, Bottom-Up & Top-Down Validation, Triangulation Framework, Primary Interviews Across Hospitals–Labs–OEMs–Distributors, Demand-Side & Supply-Side Weightage, Data Reliability Index, Limitations & Forward-Looking Assumptions)

- Definition and Scope

- Market Genesis and Evolution Pathway

- Philippines Biosensors Industry Timeline

- Biosensors Industry Business Cycle

- Biosensors Supply Chain & Value Chain Analysis

- Key Growth Drivers

Regulatory Approval Timelines

Cost of Miniaturization

Calibration Complexity - Market Opportunities

Local Manufacturing Incentives

Remote Patient Monitoring

Precision Medicine Demand - Key Trends

Wearable Adoption

Continuous Monitoring Shift

AI-Driven Diagnostics

- Regulatory & Policy Landscape

FDA Approvals

Philippine Medical Device Regulations

Import Compliance - SWOT Analysis

Technology Strength

Commercial Scalability

Market Access

- Porter’s Five Forces

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Selling Price, 2019-2025

- By Biosensor Type (In Value %)

Electrochemical Biosensors

Optical Biosensors

Piezoelectric Biosensors

Thermal Biosensors

Wearable & Implantable Biosensors - By Product Configuration (In Value %)

Disposable Biosensors

Reusable Biosensors

Patch-Based Sensors

Lab-on-Chip Devices

Continuous Monitoring Devices

- By Application Area (In Value %)

Glucose Monitoring

Cardiac Biomarker Detection

Infectious Disease Diagnostics

Oncology Diagnostics

Environmental & Food Safety Testing - By End User (In Value %)

Hospitals & Clinics

Diagnostic Laboratories

Home Healthcare Users

Research Institutes & Universities

Food & Environmental Testing Agencies - By Technology Platform (In Value %)

Enzymatic Biosensors

Immunosensors

DNA/RNA Biosensors

Nanomaterial-Based Biosensors

AI-Enabled Smart Biosensors

- Market Share Analysis (Value & Volume Contribution)

- Cross Comparison Parameters(Product Portfolio Breadth, Sensor Accuracy & Sensitivity, Regulatory Approvals in the Philippines, Pricing & Reimbursement Alignment, Local Distribution Footprint, Manufacturing & Localization Capability, R&D Investment Intensity, Strategic Partnerships & Alliances)

- SWOT Analysis of Key Players

Pricing Analysis

Detailed Company Profiles

Abbott Laboratories

Roche Diagnostics

Siemens Healthineers

Medtronic

Johnson & Johnson

Bio-Rad Laboratories

Nova Biomedical

Dexcom

LifeScan

ARKRAY

Senseonics

Ascensia Diabetes Care

Thermo Fisher Scientific

Sysmex

EKF Diagnostics

- Demand Pattern & Utilization Metrics

- Procurement Models & Purchasing Cycles

- Compliance & Certification Expectations

- Needs, Desires & Pain-Point Mapping

- Clinical & Non-Clinical Decision-Making Framework

- By Value (2026-2030)

- By Volume (2026-2030)

- By Average Selling Price (2026-2030)