Market Overview

The Philippines Blockchain in Automotive market is currently valued at approximately USD ~ million. The growth is mainly driven by the increasing integration of blockchain technology into various facets of the automotive industry, particularly in supply chain management, vehicle telematics, and digital payments for vehicles. Government initiatives, such as digital infrastructure projects, and the rising demand for connected vehicles are playing a significant role in this growth. The automotive sector is rapidly adopting blockchain to improve transparency, traceability, and security in vehicle ownership records, maintenance, and the supply chain. The continuous rise in the number of electric vehicles (EVs) and smart vehicles further accelerates the blockchain adoption in automotive applications.

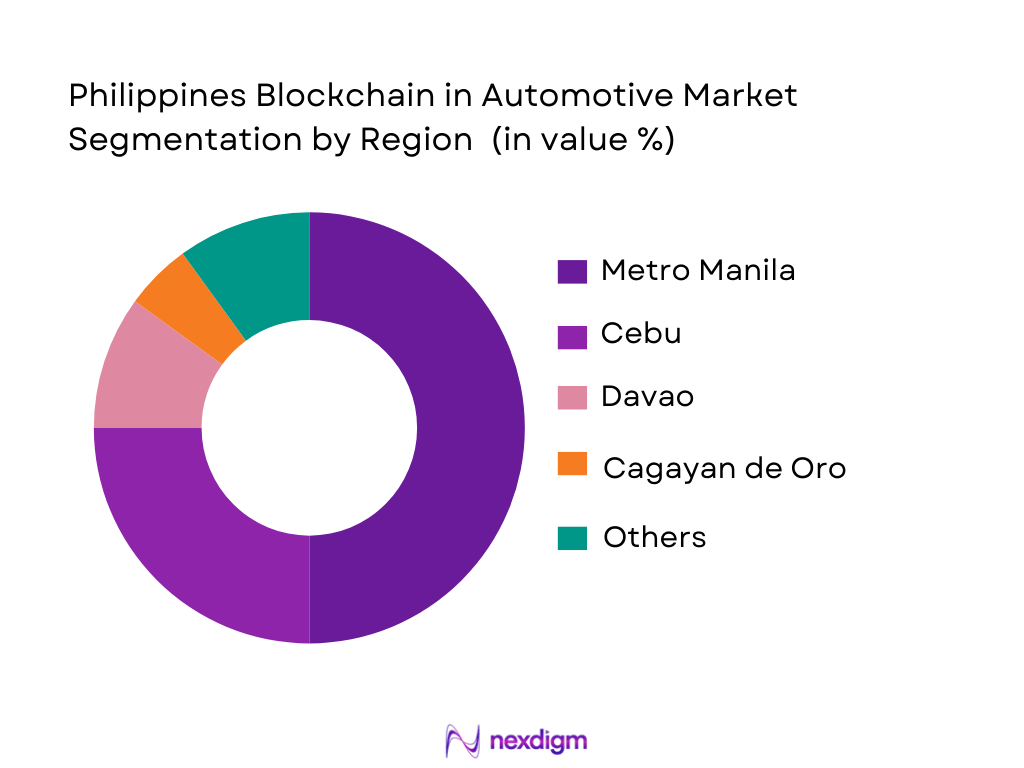

Metro Manila and Cebu are the dominant regions for blockchain integration in the automotive sector within the Philippines. Metro Manila leads the charge due to its established infrastructure and the presence of key players such as telecommunications companies and financial institutions actively developing blockchain-based solutions. Cebu, being a hub for tech innovation, also shows promising growth with a strong focus on digital transformation. Additionally, these areas benefit from government initiatives aimed at modernizing transport and infrastructure, boosting the adoption of blockchain in the sector.

Market Segmentation

By Blockchain Use Case

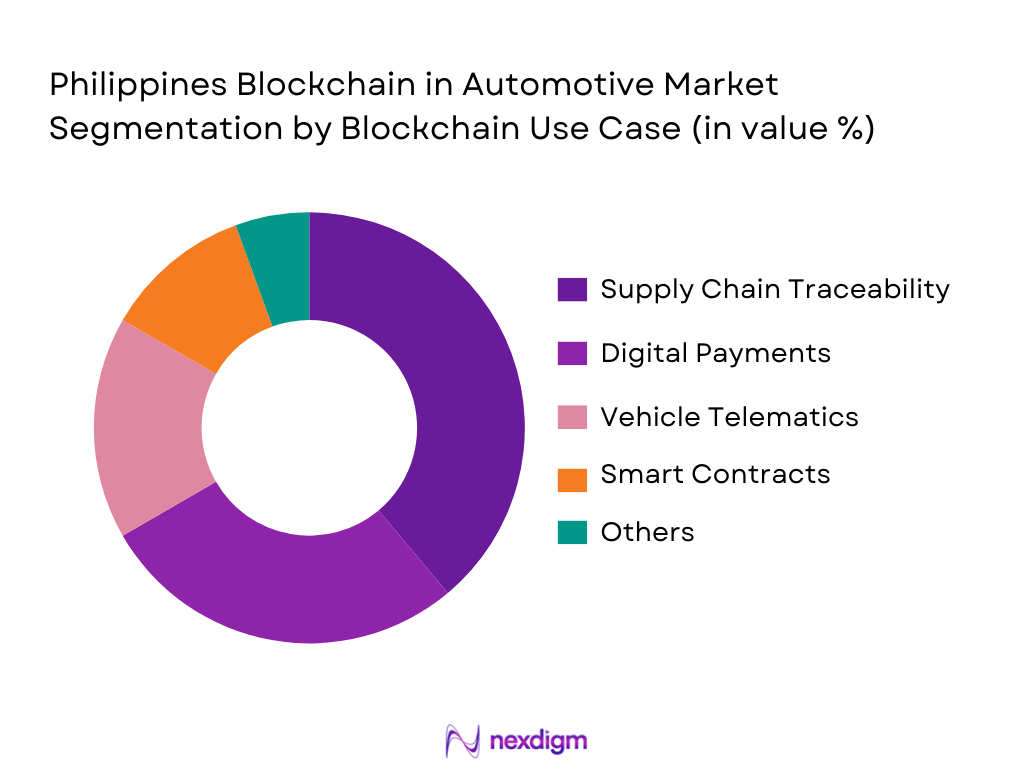

The Philippines Blockchain in Automotive market is segmented by various use cases, including supply chain traceability, digital payments, vehicle telematics, and smart contracts. Among these, supply chain traceability has the largest share in the market, with the automotive industry looking for transparent solutions for parts and components sourcing. Blockchain provides a decentralized platform for tracking the provenance of auto parts, ensuring authenticity and reducing counterfeit risks. The market for in-vehicle payments and telematics systems is also growing, but supply chain applications remain the primary focus of blockchain adoption in the automotive sector.

By Region

The regional segmentation shows Metro Manila dominating the blockchain adoption in the automotive sector due to its proximity to government institutions and major automotive OEMs. The region’s infrastructure is most advanced, making it conducive for the adoption of blockchain technologies for vehicle identification, telematics, and digital payments. Other regions like Visayas, particularly Cebu, are showing rising adoption rates due to increasing governmental initiatives and a growing tech ecosystem. Mindanao’s blockchain integration is still nascent but holds potential due to its strategic location for cross-border trade.

Competitive Landscape

The Philippines Blockchain in Automotive market is characterized by a combination of established global players and local companies leading the charge in blockchain adoption. The market is predominantly driven by technology giants, including IBM, Oracle, and SAP, along with local innovators such as GCash and Maya, which have ventured into blockchain-based payment systems for vehicles. The presence of such large players ensures a competitive yet dynamic market where different solutions are offered for supply chain transparency, digital payments, and more.

| Company Name | Year Established | Headquarters | Blockchain Use Case | Technology Stack | Key Partnerships | Revenue (USD) |

| IBM | 1911 | USA | ~ | ~ | ~ | ~ |

| Oracle | 1977 | USA | ~ | ~ | ~ | ~ |

| SAP | 1972 | Germany | ~ | ~ | ~ | ~ |

| GCash | 2004 | Philippines | ~ | ~ | ~ | ~ |

| Maya | 2003 | Philippines | ~ | ~ | ~ | ~ |

Philippines Blockchain in Automotive Market Analysis

Growth Drivers

Urbanization

Urbanization in the Philippines has steadily increased, with the total population reaching ~ and the annual population growth rate at ~ % in 2024, according to World Bank data. Rapid urban expansion — where cities like Metro Manila and Cebu host a significant share of economic activity — drives demand for smart mobility solutions and digital infrastructure, including blockchain applications in the automotive sector such as secure vehicle identity and telematics data tracking. Urban areas account for a majority of consumer demand for connected services, prompting automotive businesses and logistics providers to adopt blockchain systems to improve efficiency and transparency in urban transport networks. This trend is reflected in wider digital adoption and investment into connected vehicle technologies as urban economies expand.

Industrialization

The Philippines continues transitioning toward a more industrialized economy, with manufacturing value‑added at ~ % of GDP in 2024 — indicating a solid base for tech‑enabled sectors such as automotive and digital logistics. Blockchain adoption in automotive supply chains hinges on industrial capacity and digital transformation of manufacturing and parts distribution. As industrial production expands, more complex supply networks arise, increasing the need for secure, automated tracking systems. Furthermore, the industry sector’s growing contribution — supported by stable GDP growth of ~ % in 2024 — fosters investment in advanced technologies like blockchain for traceability, secure documentation, and interoperability between OEMs and suppliers. Industry modernization efforts promote blockchain integration to enhance efficiency, reduce fraud, and improve collaboration across automotive manufacturing networks.

Restraints

High Initial Costs

Blockchain implementation in the Philippines’ automotive ecosystem is restrained by high upfront investment requirements, especially for infrastructure upgrades such as secure distributed ledgers and integration with emerging vehicle telematics systems. While macroeconomic indicators show GDP per capita at USD ~ in 2024, many automotive SMEs and supply chain participants lack the financial capacity to immediately adopt such technologies at scale without external support or financing. The relatively modest manufacturing base — where the sector contributes ~ % to GDP — further implies limited capital availability for digital infrastructure projects compared to larger ASEAN economies. These high initial costs can delay the adoption of blockchain in supply chain and vehicle data platforms until more affordable solutions or financing models become more accessible to a broader range of stakeholders.

Technical Challenges

Technical barriers hamper blockchain’s full deployment in the Philippine automotive market, particularly because integrating distributed ledger technologies with existing vehicle data systems requires specialized skills and infrastructure. Despite the Philippines ranking ~ in the Global Innovation Index 2024, innovation inputs like R&D investment and advanced technology adoption remain relatively modest — underscoring challenges in scaling blockchain across diverse automotive applications. Moreover, inconsistent industrial digital maturity, especially among tier‑2 parts manufacturers and logistics SMEs, limits effective integration of blockchain with vehicle telematics, IoT sensors, and secure data platforms. This digital skills gap and technological variability across regions and automotive sub‑sectors complicate the deployment of robust, interoperable blockchain solutions.

Opportunities

Technological Advancements

The Philippines’ continuing digital transformation presents a strong foundation for blockchain opportunities in the automotive sector. The country is improving its digital infrastructure and innovation capabilities, as evidenced by its global innovation ranking and recognition in digital transformation strategies across Asia. As automotive technologies evolve toward connected, IoT‑enabled systems — encompassing telematics, secure data exchanges, and automated contract execution — blockchain can play a central role in ensuring data integrity and trust across distributed automotive platforms. The rise in smartphone penetration and internet connectivity — which facilitates access to in‑vehicle digital services — further amplifies the opportunity for blockchain integration into automotive telematics, secure data sharing, and payment systems. Blockchain’s ability to streamline cross‑enterprise processes positions it as a strategic enabler in the Philippines’ digital mobility ecosystem.

International Collaborations

International collaboration initiatives represent a significant opportunity for the Philippines to accelerate blockchain adoption in automotive applications. Leveraging partnerships with global technology firms, multinational automotive OEMs, and ASEAN regional programs can facilitate knowledge transfer and access to advanced blockchain platforms tailored to automotive supply chains and connected services. Such collaborations also align with the Philippines’ broader push for foreign direct investment and digital infrastructure development, which has been highlighted in national economic planning documents and supported by macroeconomic growth trends (with GDP expansion of ~ % in 2024). These strategic alliances — whether through joint automotive innovation projects, regional technology hubs, or public‑private initiatives — can mitigate domestic capability gaps and introduce international best practices for distributed ledger applications in the automotive ecosystem.

Future Outlook

Over the next 5 years, the Philippines Blockchain in Automotive market is expected to witness substantial growth. The increasing adoption of connected and electric vehicles (EVs), alongside government backing for digital transformation, will drive market demand for blockchain solutions. Furthermore, regulatory developments favoring blockchain-based applications for vehicle identity and ownership management will further enhance growth. The shift towards secure and transparent vehicle telematics and supply chain management will result in the increased use of blockchain in the automotive sector. Strong government initiatives, like the Digital Pilipinas program and ongoing EV policy support, will catalyze this transition.

Major Players

- IBM

- Oracle

- SAP

- Microsoft

- Accenture

- VeChain

- ConsenSys

- Hyperledger

- Deloitte

- EY

- Gartner

- PwC

- CitiTata Consultancy Services

- Maya

Key Target Audience

- Automotive Original Equipment Manufacturers (OEMs)

- Telecom Operators

- Automotive Suppliers (Tier 1 & Tier 2)

- Digital Payment Solution Providers (e.g., GCash, Maya)

- Technology Startups in Blockchain

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Department of Trade and Industry, Department of Transportation)

- Automotive Service Providers

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identify the key players and market dynamics in the Philippines Blockchain in Automotive market. This includes mapping major stakeholders, identifying blockchain applications, and studying their impact on automotive services like telematics, digital payments, and supply chain.

Step 2: Market Analysis and Construction

We analyze historical data on blockchain adoption in the automotive sector. This includes evaluating blockchain penetration in vehicle registration systems, the rise of digital wallets for vehicles, and the role of connected vehicle technologies.

Step 3: Hypothesis Validation and Expert Consultation

validate market hypotheses through interviews with industry experts. These consultations include discussions with automotive OEMs, technology providers, and government representatives to verify market trends and adoption rates.

Step 4: Research Synthesis and Final Output

This step synthesizes the data gathered from secondary research and expert consultations. The final report is compiled using data from both top-down and bottom-up research, ensuring that all market trends and future forecasts are accurately represented.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions (Blockchain Use Cases, Automotive Telematics & Security), Abbreviations, Blockchain Market Sizing Approach (Value & Transaction Volume), Consolidated Primary & Secondary Research Framework, Data Triangulation, Limitations & Future Scope)

- Definition and Scope

- Market Genesis & Technology Adoption Journey

- Regulatory & Policy Timeline

- Automotive Value Chain Integration

- Blockchain Use Case Value Chain

- Growth Drivers

Rise of Connected & Electric Vehicles

Demand for Supply Chain Transparency & Anti‑Counterfeit Sourcing

Digital Payments & Fintech Integration (Automotive Fintech Growth)

Regulatory Support for EVs & Blockchain Sandbox Initiatives

- Market Challenges

Regulatory Uncertainty & Compliance

Cybersecurity & Data Privacy

Legacy System Integration Complexity

Skill Gap in Blockchain Deployment

- Market Opportunities

Smart Contract Adoption for Warranty & After‑Sales

Telematics‑Linked Insurance (UBI)

Cross‑Border Vehicle Document Verification Networks

Blockchain‑Enabled EV Charging & Subscription Platforms

- Market Trends

Tokenization of Mobility Assets

Blockchain + IoT + AI Hybrid Solutions

Blockchain‑Enabled Digital Identity for Vehicles

Green Blockchain & Sustainability Data Ledgering - Government Regime & Regulation

Blockchain Regulatory Sandbox Initiatives

Data Protection & Cybersecurity Frameworks (DPA Compliance)

EV Incentives & Zero Tariff Policy Impact on Blockchain‑Based EV Ecosystems

- SWOT Analysis (Philippines Blockchain in Automotive)

- Value Chain Stakeholder Mapping

- Porter’s Five Forces (Market Competitive Dynamics)

- Ecosystem Players & Blockchain Consortiums

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Blockchain Use Case (In Value %)

Supply Chain Traceability (Parts, Components Provenance)

Connected Vehicle Data Security

In‑Vehicle Payments (Digital Wallet, Toll, Parking)

Vehicle Identity & History Ledger (Title, Warranty)

Usage‑Based Insurance & Telematics Premiums

- By Blockchain Type (In Value %)

Public Blockchain (Transparency, Decentralized Data

Private/Consortium Blockchain (OEM & Supplier Networks)

Hybrid Blockchain (Interoperable Solutions)

- By Deployment Mode (In Value %)

Cloud‑Hosted Platforms

On‑Premise Enterprise Blockchain

Edge & Vehicle‑Embedded Ledger Nodes

- By Integration Tier (In Value %)

OEM Integrated Systems

Aftermarket Platforms

Automotive Fintech & Digital Wallet Partners (GCash, Maya)

Mobility Service Providers (Fleet & Ride‑Hailing) - By End User (In Value %)

OEMs & Automotive Manufacturers

Tier‑1 & Tier‑2 Parts Suppliers

Dealership & Aftermarket Service Providers

Fleet Operators & Commercial Logistics

Individual Vehicle Owners

- Market Share (Value & Volume) – Blockchain in Automotive Philippines

- Cross‑Comparison Parameters (Competitive Benchmarking Across:

Company Overview, Blockchain Use Cases Portfolio, Technology Stack, Strategic Partnerships (OEMs, Fintech, Telcos), R&D Investments, Deployment Footprint, Revenue by Use Case, Integration APIs, Network Nodes, Nodes per OEM, Scalable Protocols, Security Certifications) - SWOT Profiles

- Pricing & Cost Benchmarking (Blockchain Solution Stack)

- Detailed Company Profiles

IBM (Blockchain & Supply Chain)

Accenture (Automotive Blockchain Integration)

Microsoft Azure Blockchain Services

Oracle Blockchain Platform

SAP (Automotive Data Ledger)

R3 (Consortium Blockchain)

VeChain (Supply Chain Traceability)

ConsenSys (Ethereum Solutions)

Hyperledger (Linux Foundation Projects)

Deloitte Blockchain Services

EY Blockchain Solutions

GCash / Mynt (In‑Vehicle Payments)

Maya (Digital Payments)

PLDT/Smart (Connected Vehicle Data Platforms)

Globe Telecom (IoT & Telematics Connectivity)

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030