Market Overview

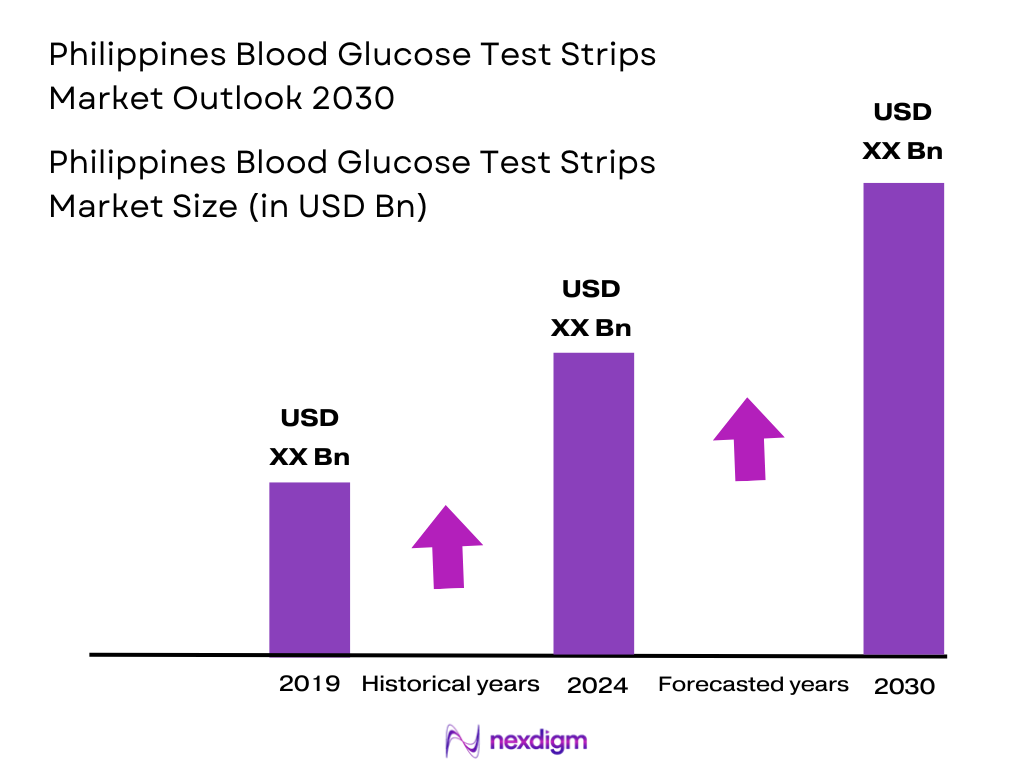

Based on a recent historical assessment, the Philippines Blood Glucose Test Strips market was valued at approximately USD ~ million, supported by rising diabetes prevalence, sustained demand for self-monitoring consumables, and continuous purchases driven by daily testing requirements. Market activity is reinforced by expanding outpatient care, improved diagnostic awareness, and wider pharmacy penetration across urban and semi-urban areas. Recurring consumption patterns and physician recommendations continue to anchor stable demand for glucose test strips within routine diabetes management practices.

Market demand is concentrated in Metro Manila, Cebu, and Davao, where higher population density, stronger healthcare infrastructure, and greater access to private hospitals and retail pharmacies support consistent utilization of glucose monitoring supplies. These locations benefit from higher diagnostic rates, stronger purchasing power, and established distribution networks. The presence of multinational suppliers, organized pharmacy chains, and government-supported diabetes programs further strengthens adoption, while logistics connectivity enables efficient nationwide product flow from these urban centers.

Market Segmentation

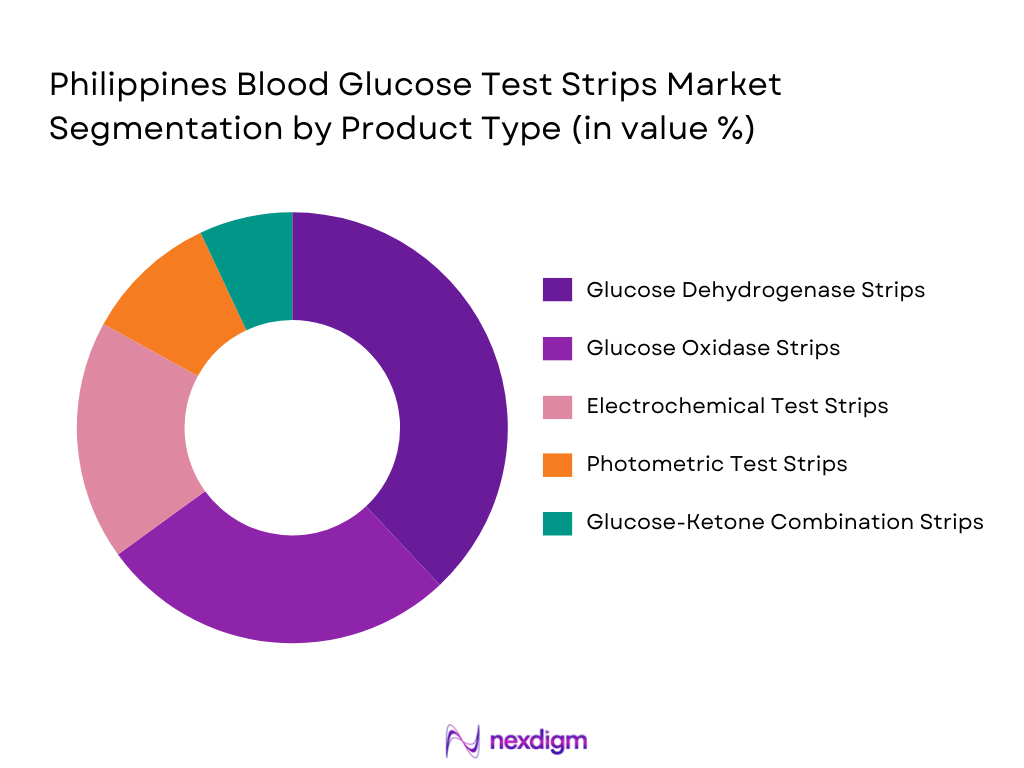

By Product Type

Philippines Blood Glucose Test Strips market is segmented by product type into enzyme-based glucose oxidase strips, glucose dehydrogenase strips, photometric test strips, electrochemical test strips, and multi-parameter glucose-ketone strips. Recently, enzyme-based glucose dehydrogenase strips have a dominant market share due to higher accuracy across wider hematocrit ranges, faster reaction times, and strong brand availability through retail pharmacy networks. These strips are widely recommended by clinicians because of reduced interference from oxygen variation and common medications, making them suitable for both home and clinical use. Established multinational manufacturers prioritize this product category in the Philippines due to compatibility with popular glucose meters already in circulation. Consistent supply, consumer trust, and familiarity further reinforce repeat purchases. In addition, government and private health programs favor enzyme-efficient strips for long-term diabetes monitoring, strengthening their dominance.

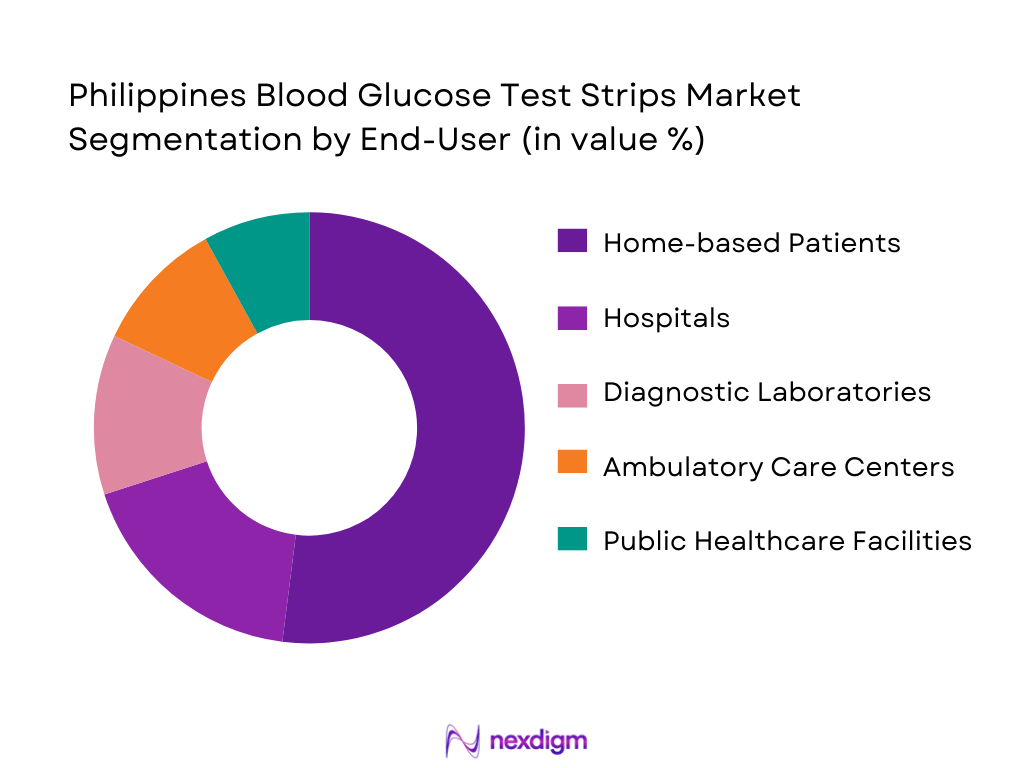

By End User

Philippines Blood Glucose Test Strips market is segmented by end user into home-based patients, hospitals, diagnostic laboratories, ambulatory care centers, and public healthcare facilities. Recently, home-based patients have a dominant market share due to the chronic nature of diabetes and the need for frequent daily monitoring outside clinical environments. Rising awareness of self-management, physician guidance encouraging regular testing, and increasing affordability of monitoring kits support strong household-level demand. Urban households with access to pharmacies and online platforms purchase test strips in recurring cycles, driving volume consumption. Government education initiatives and NGO-led diabetes programs further promote home testing. Convenience, privacy, and reduced hospital visits continue to make home-based usage the most preferred option across the country.

Competitive Landscape

The Philippines Blood Glucose Test Strips market shows moderate consolidation, with multinational diagnostic companies holding strong positions through brand recognition, established distribution partnerships, and wide product portfolios. Global players influence pricing benchmarks, technology standards, and regulatory compliance, while regional and Asian manufacturers compete on affordability and accessibility. Long-term supply agreements with pharmacy chains and hospitals strengthen competitive positioning, and innovation is primarily focused on accuracy, strip efficiency, and compatibility with digital monitoring platforms.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Abbott Laboratories | 1888 | USA | ~ | ~ | ~ | ~ | ~ |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Ascensia Diabetes Care | 2016 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| LifeScan | 1981 | USA | ~ | ~ | ~ | ~ | ~ |

| Sinocare | 2002 | China | ~ | ~ | ~ | ~ | ~ |

Philippines Blood Glucose Test Strips Market Analysis

Growth Drivers

Rising Diabetes Prevalence and Self-Monitoring Adoption

Rising diabetes prevalence and self-monitoring adoption continue to drive sustained demand for blood glucose test strips across the Philippines healthcare ecosystem as patients increasingly require routine and frequent monitoring for effective disease management. Urbanization, lifestyle changes, and dietary shifts have contributed to a growing diabetic population requiring daily testing, reinforcing recurring consumption of test strips rather than one-time purchases. Physicians consistently recommend self-monitoring to prevent complications, which directly increases strip utilization among insulin-dependent and non-insulin-dependent patients. Expanding outpatient care and shortened hospital stays further transfer monitoring responsibility to households. Pharmacies and e-commerce platforms improve accessibility, ensuring uninterrupted supply. Public health awareness campaigns emphasize early detection and continuous monitoring, increasing compliance. Affordability improvements through competitive imports support broader adoption. Together, these factors create structurally stable demand anchored in medical necessity rather than discretionary spending.

Expansion of Retail Pharmacy and Digital Health Infrastructure

Expansion of retail pharmacy and digital health infrastructure has significantly strengthened distribution efficiency and consumer access to blood glucose test strips across urban and semi-urban Philippines. Organized pharmacy chains continue to expand footprints in high-density regions, ensuring consistent availability of branded and generic strips. Online pharmacies and digital marketplaces support repeat purchasing behavior through subscription models and home delivery, reducing access barriers. Integration of digital glucose meters with mobile applications encourages frequent testing, indirectly increasing strip usage. Healthcare providers increasingly partner with retail networks for chronic disease support programs. Improved cold-chain and logistics capabilities enhance nationwide reach. The convergence of physical and digital channels reinforces continuous consumption patterns. This infrastructure-driven accessibility plays a central role in market expansion.

Market Challenges

Price Sensitivity and Limited Reimbursement Coverage

Price sensitivity and limited reimbursement coverage remain a critical challenge in the Philippines Blood Glucose Test Strips market, particularly among low- and middle-income patient groups who require frequent testing but face out-of-pocket expenditure burdens. Unlike durable medical devices, test strips are consumables requiring continuous replacement, amplifying long-term cost concerns. Public insurance coverage for diabetes monitoring supplies remains limited, placing financial responsibility on patients. Imported strips are exposed to currency fluctuations, affecting retail prices. Generic alternatives exist but face trust and accuracy of perception barriers. Hospitals prioritize cost control, limiting bulk procurement. Price competition compresses manufacturer margins. These dynamics constrain volume growth despite underlying medical demand.

Dependence on Imports and Supply Chain Vulnerability

Dependence on imports and supply chain vulnerability pose structural challenges for the Philippines Blood Glucose Test Strips market due to limited domestic manufacturing capacity for diagnostic consumables. Most test strips are sourced from multinational suppliers, exposing the market to international logistics disruptions. Regulatory clearance timelines can delay new product entry. Import duties and compliance costs affect final pricing. Global raw material shortages impact production cycles. Distribution of inefficiencies can cause regional stock imbalances. Smaller distributors face working capital pressure. These factors collectively increase operational risk and reduce supply resilience.

Opportunities

Government-Supported Diabetes Screening and Monitoring Programs

Government-supported diabetes screening and monitoring programs represent a strong opportunity for the Philippines Blood Glucose Test Strips market by expanding structured demand beyond private consumption. Public health agencies increasingly recognize diabetes as a priority condition requiring long-term monitoring. Community-based screening initiatives generate newly diagnosed patients who require ongoing testing supplies. Integration of monitoring tools into primary healthcare centers supports recurring procurement. Subsidized distribution programs improve affordability. Partnerships with manufacturers can stabilize volumes. NGO collaborations enhance rural outreach. Policy alignment with preventive care strengthens long-term demand foundations.

Growth of Connected and Smart Glucose Monitoring Ecosystems

Growth of connected and smart glucose monitoring ecosystems presents a meaningful opportunity as technology adoption reshapes diabetes management practices in the Philippines. Smartphone penetration enables integration of meters with mobile health platforms. Data-driven monitoring encourages frequent testing behavior. Telemedicine adoption supports remote physician oversight. Younger patient demographics favor digital solutions. Manufacturers offering compatible strips gain competitive advantage. Private insurers support digital monitoring pilots. This ecosystem expansion directly increases strip consumption through higher testing frequency.

Future Outlook

The Philippines Blood Glucose Test Strips market is expected to maintain steady growth over the next five years, supported by rising chronic disease burden, expanding self-care practices, and improved healthcare access. Technological advancements in strip accuracy and digital integration will enhance user compliance. Regulatory support for medical device availability and preventive healthcare programs will strengthen adoption. Demand-side momentum will remain anchored in recurring consumption and expanding outpatient care models.

Major Players

- Abbott Laboratories

- Roche Diagnostics

- Ascensia Diabetes Care

- LifeScan

- Sinocare

- Terumo Corporation

- B. Braun Medical

- Arkray

- SD Biosensor

- Nova Biomedical

- Ypsomed

- Acon Laboratories

- i-SENS

- Allmedicus

- 77 Elektronika

Key Target Audience

- Hospitals and healthcare providers

- Retail pharmacy chains

- Diagnostic laboratories

- Medical device distributors

- Health insurance companies

- Investments and venture capitalist firms

- Government and regulatory bodies

- Digital health platform providers

Research Methodology

Step 1: Identification of Key Variables

Key variables including product types, end users, pricing trends, and distribution channels were identified through secondary research and industry databases to define the analytical scope.

Step 2: Market Analysis and Construction

Market structure was developed using triangulation of demand drivers, healthcare utilization patterns, and supply-side dynamics across public and private sectors.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through consultations with healthcare professionals, distributors, and industry experts familiar with diabetes care markets.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into structured market intelligence outputs, ensuring consistency, accuracy, and relevance for decision-makers.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising diabetes prevalence across urban and semi-urban regions

Expansion of home-based chronic disease monitoring

Improved access to retail and online diagnostic products - Market Challenges

Price sensitivity and reimbursement limitations

Dependence on imported diagnostic consumables

Product compatibility and standardization issues - Market Opportunities

Expansion of government-supported diabetes screening programs

Growth of digital and connected glucose monitoring ecosystems

Private sector investment in preventive healthcare - Trends

Shift toward enzyme-efficient and low-sample strips

Increasing adoption of connected glucose monitoring

Growth of e-pharmacy based distribution - Government Regulations

Medical device registration and approval requirements

Import regulations and quality compliance standards

Public health policies supporting diabetes management - SWOT Analysis

- Porter’s Five Forces

- By Market Value ,2019-2025

- By Installed Units ,2019-2025

- By Average System Price ,2019-2025

- By System Complexity Tier ,2019-2025

- By System Type (In Value%)

Electrochemical glucose test strips

Photometric glucose test strips

Enzyme-specific glucose oxidase strips

Enzyme-specific glucose dehydrogenase strips

Multi-parameter glucose-ketone strips - By Platform Type (In Value%)

Standalone home glucose monitoring systems

Hospital-based glucose monitoring platforms

Point-of-care diagnostic platforms

Connected digital glucose monitoring platforms

Pharmacy-dispensed monitoring platforms - By Fitment Type (In Value%)

Brand-specific proprietary strips

Universal compatible test strips

Meter-bundled test strip kits

Refill pack test strips

Subscription-based supply strips - By End-user Segment (In Value%)

Home-based diabetic patients

Hospitals and specialty clinics

Diagnostic laboratories

Ambulatory care centers

Public healthcare institutions - By Procurement Channel (In Value%)

Hospital procurement contracts

Retail pharmacies

Online pharmacies and e-commerce

Government tenders and public programs

Distributor and wholesaler networks

- Market Share Analysis

- Cross Comparison Parameters ((Product Accuracy, Strip Compatibility, Pricing Range, Distribution Reach, Brand Presence, Meter Connectivity, Regulatory Compliance, Supply Reliability, Packaging Size Options, Shelf-Life Stability, Storage Requirements, Import Dependency, After-Sales Support, Availability Across Pharmacy Chains, Online Channel Presence, Reimbursement Acceptance, Quality Certification Standards, Localization of Instructions)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Abbott Laboratories

Roche Diagnostics

Ascensia Diabetes Care

LifeScan

Terumo Corporation

B. Braun Medical

SD Biosensor

Sinocare

Acon Laboratories

Arkray

Ypsomed

77 Elektronika

Nova Biomedical

i-SENS

Allmedicus

- High reliance on self-monitoring among insulin-dependent patients

- Growing role of pharmacies as primary access points

- Increasing adoption in secondary and tertiary hospitals

- Rising awareness through public health campaigns

- Forecast Market Value ,2026-2030

- Forecast Installed Units ,2026-2030

- Price Forecast by System Tier ,2026-2030

- Future Demand by Platform ,2026-2030