Market Overview

The Philippines camshafts market is tightly linked to domestic vehicle production, vehicle parc expansion, and the broader automotive parts export base. Over the last two reported periods, motor vehicle production has risen from about 110,350 units to 126,571 units, according to CEIC, while automotive parts exports are projected to reach USD ~ billion in the latest period. These volumes, combined with the global automotive camshaft market value of USD ~ billion for the latest period provide the backdrop for a growing Philippines camshaft demand embedded in OEM supply chains and the replacement aftermarket.

Camshaft demand in the Philippines is concentrated in regions where vehicle assembly, logistics, and aftermarket ecosystems are densest. The country ranks among the larger automotive markets in Asia-Pacific, with a benchmark of roughly 273,400 vehicles sold in a recent pre-pandemic year and about 436,000 registered vehicles in the latest reported period, indicating a sizeable operating fleet. Metro Manila, CALABARZON, and Central Luzon dominate due to the presence of assemblers, tier-1/2 suppliers, and high truck usage, while key logistics and mining corridors in Cebu and Mindanao create strong diesel engine camshaft replacement demand.

Market Segmentation

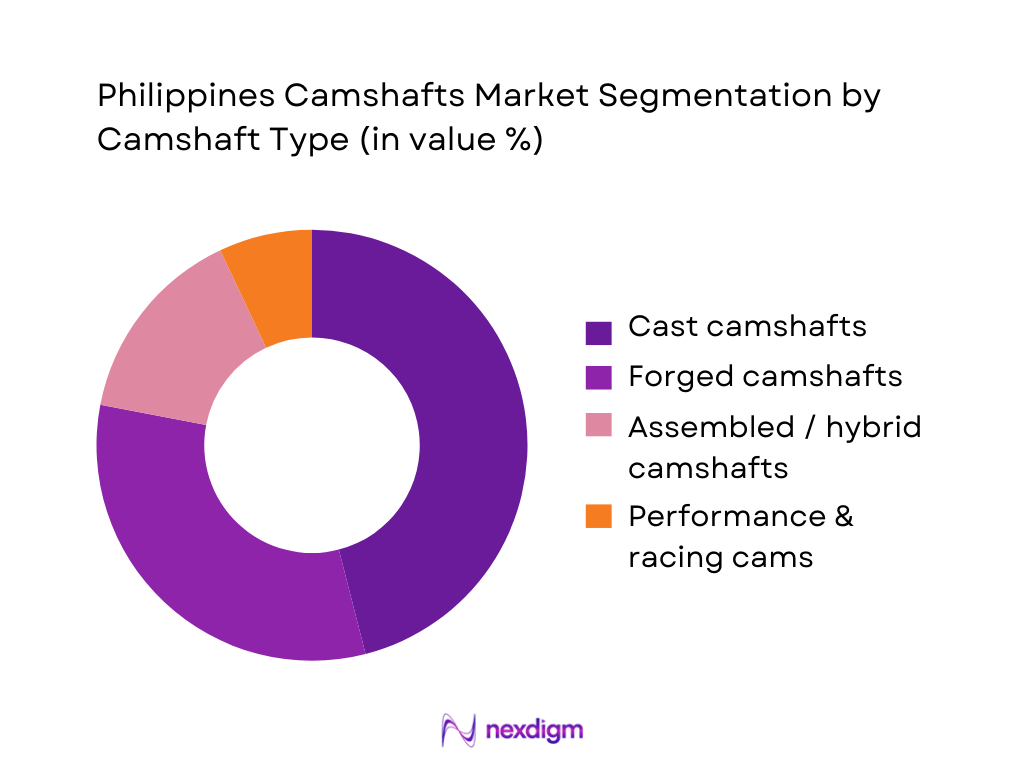

By Camshaft Type

The Philippines camshafts market is segmented by camshaft type into cast camshafts, forged camshafts, assembled / hybrid camshafts, and performance & racing camshafts. Cast camshafts hold the dominant share as they remain the standard fitment in mass-market passenger cars, light commercial vehicles, and many diesel utility engines assembled for the Philippines and imported into the market. Global suppliers such as thyssenkrupp, MAHLE and Schaeffler continue to deliver high-volume cast and assembled designs to OEMs worldwide, with assembled units increasingly integrated into cylinder-head modules. In the domestic aftermarket, importers and distributors source cast units in bulk for Japanese, Korean, and Chinese platforms that dominate the local parc, reinforcing cast camshafts’ share across both OEM and replacement channels.

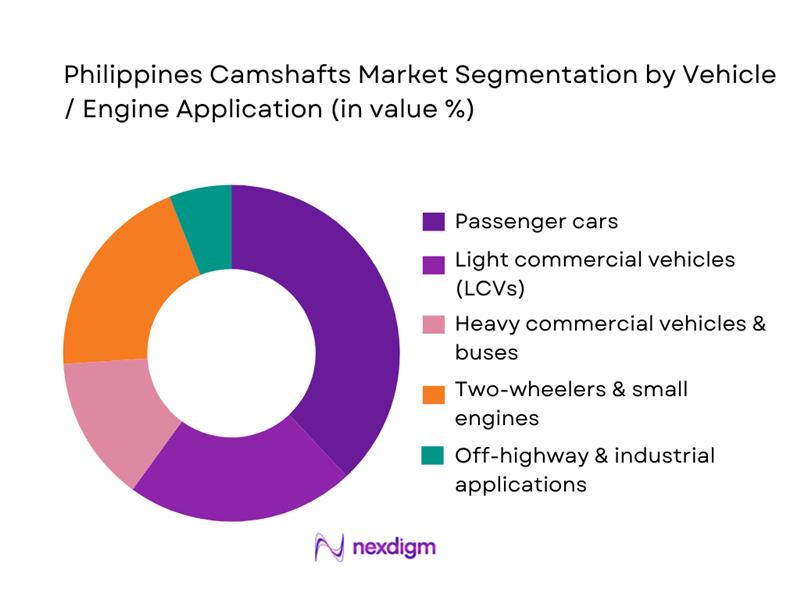

By Vehicle / Engine Application

The Philippines camshafts market is segmented by vehicle / engine application into passenger cars, light commercial vehicles, heavy commercial vehicles & buses, two-wheelers & small engines, and off-highway & industrial engines. Passenger cars form the largest segment, supported by a sizable vehicle parc, strong imports from Japan and other ASEAN hubs, and rising registration counts from roughly 436,000 vehicles in the recent baseline towards approximately 499,000 in the medium term. However, commercial diesel engines—particularly fleets operating in logistics corridors and construction—contribute disproportionately to high-value camshaft demand because of harsher duty cycles and higher failure rates. Two-wheelers, while numerous, rely on lower-value camshafts, so their revenue contribution remains smaller relative to their volume.

Competitive Landscape

The Philippines camshafts market is characterized by import-led supply, with global camshaft and engine-component majors selling through distributors, and a smaller cluster of local machining and engineering firms supporting remanufacturing and niche locomotive or industrial engine requirements. Global leaders like thyssenkrupp, MAHLE, and Schaeffler dominate OEM supply worldwide, with their camshafts embedded in vehicles sold and operated in the Philippines. In the aftermarket, brands such as Raceorly and various Asian engine-parts suppliers offer camshafts, while domestic firms like ACASales Technologies and industrial outfits serving crankshaft/camshaft systems support specific applications. The market thus combines concentrated global technology leadership with a fragmented local distribution and service structure.

| Company / Brand | Establishment Year | Global HQ (Country) | Primary Role in PH Camshafts Chain | Core Product Focus (Camshaft-Related) | Primary PH Channel Focus | Technology / Design Strengths | Relevance to PH Engine Parc | Value-Chain Position (OEM / Aftermarket / Both) |

| thyssenkrupp (Camshafts business) | 1999 (group) | Essen / Duisburg, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| MAHLE Group | 1920 | Stuttgart, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Schaeffler (INA brand) | 1946 | Herzogenaurach, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Raceorly (Guangzhou Imale Trading) | 2008 | Guangzhou, China | ~ | ~ | ~ | ~ | ~ | ~ |

| ACASales Technologies Inc. (PH) | 2015 | Muntinlupa, Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Camshafts Market Dynamics & Analysis

Growth Drivers

Growth in vehicle parc

The addressable base for camshafts in the Philippines expands with the road vehicle parc. Official data show 5,460,301 registered motor vehicles in the country, based on the latest consolidated Land Transportation Office series for 2022, up from just under 5.0 million units a year earlier, an increase of about 487,000 vehicles in one year. This sits on a macro backdrop where national GDP has reached USD ~ billion and population 115,843,670 people, supporting rising mobility and motorisation that feeds both OEM and aftermarket camshaft demand.

Aging vehicle fleet leading to replacement

An expanding but unevenly modernised vehicle parc keeps camshaft replacement volumes structurally high. A 2023–2025 assessment of public transport modernisation notes that around 60% of Filipinos reported public transit (buses, trains and related services) as their primary mode of daily travel, indicating intense utilisation of legacy fleets that continue to operate until scrappage. At the same time, the Philippine Development Plan 2023–2028 and the Road Safety Action Plan 2023–2028 explicitly stress vehicle inspection, maintenance and scrappage schemes, creating regulatory pressure to refurbish or replace worn engine components such as camshafts in high-mileage fleets.

Market Challenges

Dependence on imports

The Philippines remains structurally reliant on imported automotive parts, including camshafts, within an economy characterised by a persistent external deficit. Total imports of goods and services reached well above USD ~ billion, while the country recorded a trade deficit of USD 61,827 million, reflecting heavy inward flows of manufactured products versus limited local industrial depth. Transport-related climate and logistics plans—such as the National Logistics Master Plan and Philippine Development Plan 2023–2028—explicitly prioritise import-intensive road-infrastructure and vehicle investments, making local camshaft producers compete against entrenched global supply chains, OEM sourcing hubs and regional parts exporters.

Price sensitivity in aftermarket; cost competition with imports or remanufactured parts

Household purchasing power directly shapes camshaft buying behaviour. With GDP per capita at USD ~ and personal remittances representing 8.7 of GDP, a substantial share of disposable income depends on overseas workers, making large unplanned engine repairs financially stressful. Inflation at 3.2 in the latest reading and unemployment at 2.2 mask underemployment and informality, pushing many vehicle owners to choose low-cost imported camshafts, “surplus” engines or remanufactured parts over new premium components. This macro reality forces both local distributors and potential domestic manufacturers to compete on aggressive price points and extended credit terms to capture share in the camshafts value chain.

Opportunities

Establishment of local foundry and machining capabilities

Rising vehicle production and long-term transport-infrastructure investments create headroom for more localised camshaft value addition. The Philippines’ GDP has grown to USD ~ billion, and transport-sector public–private partnership investments reach several thousand million USD cumulatively over recent decades, with road projects accounting for the bulk of commitments. At the same time, total registered vehicles have climbed to 5,460,301 units, while domestic motor-vehicle production is tracked in dedicated national series, signalling potential volumes for locally machined camshafts, cast cores and regrind services. Anchoring camshaft machining or casting near OEM assemblers and large fleet hubs can lower lead times, reduce foreign-exchange exposure and support industrial-policy goals around deeper automotive localisation.

Growing demand for performance and reliability in intensive-use fleets

The heavy reliance on road transport and diesel engines is driving fleet operators to seek higher-durability valve-train components that withstand long operating hours. Between 2002 and 2022, road transport has consistently dominated transport energy use and CO₂ emissions in the Philippines, with road modes accounting for the overwhelming majority of sector emissions in 2016–2022. Diesel’s 53.0–60.8 share of road-fuel consumption points to high-torque, high-compression engines where camshaft profiles directly influence fuel efficiency, power and emissions. As public-transport reforms and freight-logistics improvements under the Philippine Development Plan 2023–2028 are implemented, fleets are incentivised to upgrade to camshafts with improved metallurgy, grind quality and lobe-profile accuracy to reduce downtime and meet inspection standards, opening a niche for performance-grade camshaft suppliers.

Future Outlook

Over the next several years, the Philippines camshafts market is expected to grow steadily, supported by rising vehicle registrations, gradual localization of automotive value chains, and sustained demand for diesel and gasoline internal-combustion engines in logistics, public transport, and off-highway applications. As the global automotive camshaft market grows at around 4.45% CAGR, and Asia-Pacific automotive parts and components expand at roughly 6% CAGR, the Philippines market is likely to track slightly above the global average.

Major Players

- thyssenkrupp

- MAHLE Group

- Schaeffler Group

- Raceorly

- Jereh Power-Tech

- CWC Textron Castings

- BGA

- Costex Tractor Parts

- Lamspeed Racing

- KR Auto Spares

- ACASales Technologies Inc.

- OSA Industries Phils. Inc.

- Rail Associates Enterprises

- Makoto Philippines

- RS8

Key Target Audience

- Engine and Powertrain OEMs and Tier-1 Suppliers

- Independent Engine Rebuilders and Large Workshop Chains

- Fleet Operators and Logistics Companies

- Mining, Construction and Agricultural Equipment Owners

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Automotive Parts Importers, Distributors and Retail Chains

- Industrial Parks and Special Economic Zone Developers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map for the Philippines Camshafts Market, covering OEM engine assemblers, automotive parts exporters, importers, workshops, and industrial engine users. Extensive desk research leverages global camshaft reports, Philippine automotive market intelligence, and databases like OICA, CEIC, and trade-council sources. The objective is to define critical variables such as vehicle production, parc structure, engine mix, replacement cycles, and camshaft value per engine.

Step 2: Market Analysis and Construction

In this phase, historical and latest data on global camshaft values, regional automotive parts markets, and Philippine vehicle production and registrations are compiled. We estimate the Philippines camshaft demand by combining top-down benchmarks (global camshaft value per vehicle, share of Asia-Pacific, and ratio to motor-vehicle parts value) with bottom-up indicators (domestic production units, imported CBU volumes, and diesel vs gasoline share). This yields preliminary estimates of market size, segmentation by camshaft type, and application.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on OEM/aftermarket splits, camshaft type mix, and dominant applications are validated through interviews and structured questionnaires with Philippine engine rebuilders, truck-fleet maintenance heads, and component importers. These discussions focus on failure modes, replacement intervals, brand preferences, and price tiers, along with cross-checking global suppliers such as thyssenkrupp, MAHLE, Schaeffler and Raceorly that are visible in the local supply chain. Feedback is then used to adjust model inputs and segmentation shares.

Step 4: Research Synthesis and Final Output

The final phase triangulates all data points into a consolidated market model. OEM volumes, vehicle parc data, and replacement rates are combined to derive country-level camshaft demand by type and application. Global camshaft CAGR benchmarks and Asia-Pacific automotive-parts growth rates are used to frame a Philippines-specific 2024–2030 CAGR band. Structured validation reviews with select stakeholders ensure that the final outputs—market size, segmentation, competitive landscape, and outlook—are coherent, business-ready, and aligned with on-ground realities of the Philippines camshafts ecosystem.

- Executive Summary

- Research Methodology (Market Definitions & Scope, Data Sources, Market Sizing & Forecasting Approach, Segmentation Logic & Classification Assumptions, Limitations, Risk Factors & Future Assumptions)

- Definition and Scope

- Market Genesis and Evolution in Philippines

- Automotive Value Chain & Supply Chain Structure

- Regulatory & Standards Landscape

- Demand Drivers Specific to Philippines

- Growth Drivers

Growth in vehicle parc

Aging vehicle fleet leading to replacement

Rising use of diesel

Demand for cost-effective alternatives - Market Challenges & Restraints

Dependence on imports

Price sensitivity in aftermarket; cost competition with imports or remanufactured parts

Regulatory certification barriers for imported parts or local manufacturing standards

Competition from remanufactured - Opportunities

Establishment of local foundry

Growing demand for performance

Aftermarket growth driven by rising vehicle age, maintenance demand, and increasing number of independent repair shops

Collaboration opportunities with regional suppliers - Trends

Shift toward higher precision camshafts

Use of advanced materials

Growth of aftermarket channel

Potential impact of alternative powertrains - Competitive Landscape & Market Structure

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Realisation/Price per Unit, 2019-2024

- Historic Growth Trends & Annual Growth Rate, 2019-2024

- By Camshaft Type (in Value %)

Cast Camshafts

Forged Camshafts

Assembled / Modular Camshafts - By Vehicle Type (in Value %)

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

Two-Wheelers / Motorcycles - By Fuel Type / Engine Type (in Value %)

Gasoline / Petrol engines

Diesel engines - By Sales Channel (in Value %)

OEM

Aftermarket & Replacement Market - By Origin / Source (in Value %)

Locally manufactured

Imported

- Market Share — estimated share by major players

- Cross-Comparison Parameters (Company Overview, Product Portfolio, Manufacturing / Sourcing Strategy , Quality Standards & Certifications / Compliance, Distribution Network & Channel Presence, Pricing Strategy / Price per SKU / Price Range, Production / Supply Capacity, Value Proposition / Unique Selling Proposition)

- SWOT Analysis of Major Competitors

- Pricing Benchmarking — SKU-level price comparison

- Detailed Company Profiles

thyssenkrupp

MAHLE Group

Schaeffler Group

Raceorly

Jereh Power-Tech

CWC Textron Castings

BGA

Costex Tractor Parts

Lamspeed Racing

KR Auto Spares

ACASales Technologies Inc.

OSA Industries Phils. Inc.

Rail Associates Enterprises

Makoto Philippines

RS8

- OEM Demand Scenario

- Aftermarket & Replacement Demand Scenario

- Fleet & Commercial Vehicle Demand

- Consumer & Buyer Behavior

- Decision-Making Process & Purchase Drivers

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Realisation/Price per Unit, 2025-2030

- Historic Growth Trends & Annual Growth Rate, 2025-2030