Market Overview

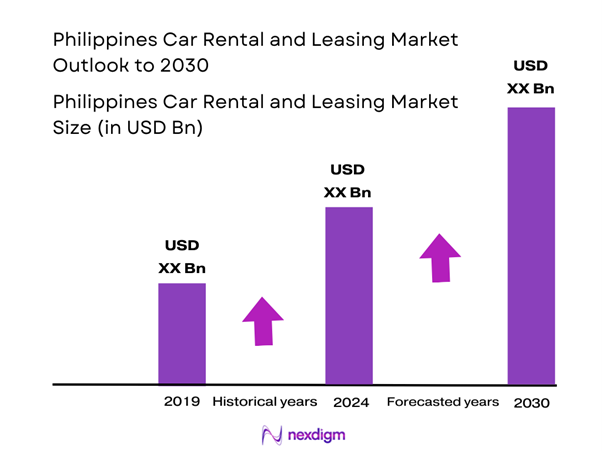

The Philippines Car Rental and Leasing Market is valued at USD 682.27 million in 2025 with an approximated compound annual growth rate (CAGR) of 7.70% from 2025-2030. The market is driven by a surge in domestic tourism and business travel, coupled with a growing urban population that demands flexible mobility solutions. Additionally, an increasing number of international visitors has significantly contributed to the market’s growth, with rental services being a preferred option for both locals and tourists.

The market is predominantly concentrated in key urban areas such as Metro Manila, Cebu, and Davao. These cities are characterized by high population density, robust economic activities, and a growing expatriate community, all of which fuel demand for car rentals and leasing. Metro Manila, as the capital and largest city, serves as the primary hub for business and leisure travel, making it a focal point for car rental services. The well-developed transportation infrastructure and the increasing availability of ride-sharing alternatives also enhance the appeal of car rental options in these regions.

The e-commerce landscape in the Philippines is rapidly evolving, with online retail sales expected to reach USD 21.4 billion in 2023, according to the Philippine Statistics Authority. This surge in e-commerce is driving demand for logistics and transportation services, including car rentals, to facilitate the movement of goods. Companies offer delivery services and require rental vehicles to manage their fleets effectively, indicating a growing symbiotic relationship between the e-commerce and car rental sectors, propelling growth in both markets.

Market Segmentation

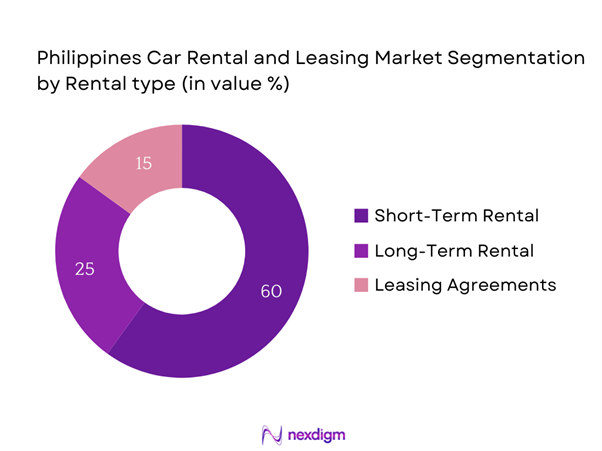

By Rental Type

The Philippines Car Rental and Leasing Market is segmented by rental type into short-term rental, long-term rental, and leasing agreements. Short-term rentals account for the largest market share due to the burgeoning tourism sector and increasing business travel. This segment has risen in popularity as consumers value flexibility for short trips, events, and emergencies. Companies like Avis and Hertz have established prominent footholds, providing comprehensive packages that align with consumer demands for convenience and accessibility.

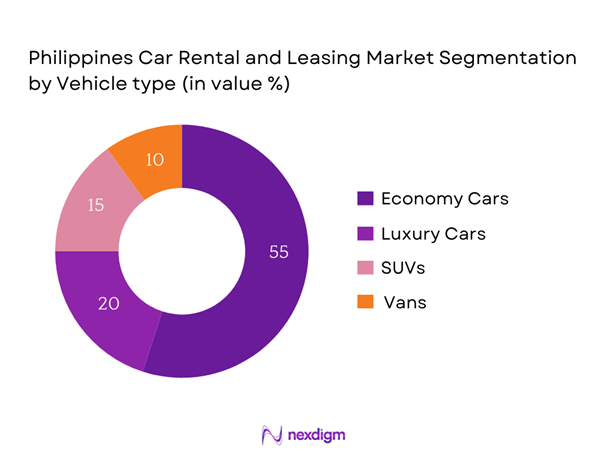

By Vehicle Type

The market is also segmented by vehicle type into economy cars, luxury cars, SUVs, and vans. The economy cars segment holds a dominant market share, driven by its affordability and fuel efficiency. This demand is largely fueled by budget-conscious customers, especially families and solo travelers, who favor compact vehicles for city driving. Additionally, the increasing availability of versatile economy models from major brands ensures continuous consumer interest and loyalty towards this sub-segment.

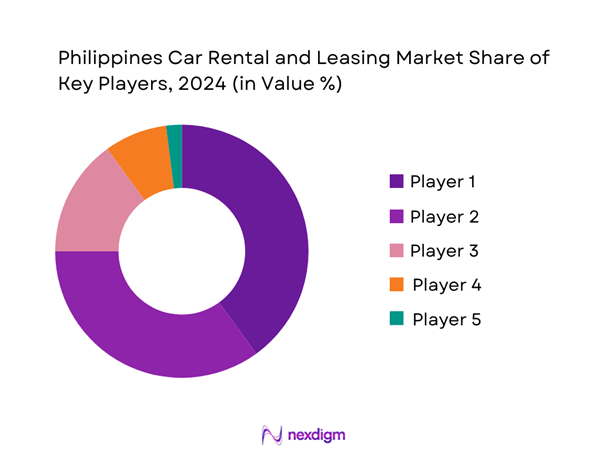

Competitive Landscape

The Philippines Car Rental and Leasing Market is dominated by several major players, including international giants and local firms, showcasing a competitive landscape. The key players include Avis, Budget, Hertz, and local brands such as Rent a Car Philippines. The consolidation of these companies emphasizes the significant influence they have on shaping market dynamics.

| Company | Year Established | Headquarters | Fleet Size | Market Presence | Service Offerings |

| Avis | 1946 | Los Angeles, USA | – | – | – |

| Budget | 1958 | St. Louis, USA | – | – | – |

| Hertz | 1918 | Estero, Florida, USA | – | – | – |

| Rent a Car Philippines | 1980 | Manila, Philippines | – | – | – |

| Sixt | 1912 | Pullach, Germany | – | – | – |

Philippines Car Rental and Leasing Market Analysis

Growth Drivers

Rising Travel and Tourism

The Philippine tourism sector has seen substantial growth, contributing significantly to the economy. As of recent reports, the Philippines recorded approximately 8 million international tourist arrivals in 2022, showcasing a strong rebound in travel post-pandemic. The Department of Tourism anticipates even more visitors in 2024, as global travel restrictions ease and more promotional activities are launched. Importantly, the tourism sector is projected to account for 12.7% of the GDP, highlighting the increasing inclination towards car rentals among tourists for ease of travel.

Increased Urbanization

The urbanization rate in the Philippines has climbed to around 50.6% as of 2023, with estimates from the World Bank indicating that this figure will rise in the coming years as more people migrate to urban centers for better economic opportunities. This urban migration has led to increased demand for transportation solutions, particularly car rentals, as individuals seek easy mobility options within increasingly congested cities. Improved infrastructure and an expanding metro network also support this demand, making car rentals a more attractive choice for urban dwellers and businesses alike.

Market Challenges

Vehicle Maintenance Costs

Vehicle maintenance costs have seen a significant increase, with the Philippines experiencing a 15% rise in automobile repair and maintenance expenses in 2023, according to industry reports. These rising costs can largely be attributed to inflation and increased prices for spare parts and labor. Car rental businesses must manage these escalating costs carefully, as they directly impact profitability and operational efficiency. Additionally, unexpected vehicle breakdowns can lead to revenue loss and customer dissatisfaction, making effective maintenance a crucial area for operators.

Regulatory Hurdles

The car rental industry in the Philippines faces various regulatory challenges, including stringent licensing requirements and compliance with safety standards. As of 2024, operators must navigate a complex framework of regulations from the Land Transportation Office that impedes market entry and operation. For instance, obtaining operating permits can take months, delaying business setups. Furthermore, regulatory compliance costs can consume up to 10% of total revenue for smaller rental companies, limiting their ability to invest in growth and competitive pricing strategies.

Opportunities

Growth in Ride-Sharing Services

Ride-sharing platforms have gained significant traction in the Philippines, with revenue from this segment reaching USD 1.8 billion in 2023. This growth signifies a reshaping of the transportation landscape and presents opportunities for traditional car rental companies to pivot towards ride-sharing models or partnerships. As commuting patterns evolve, more car rental businesses are likely to consider fleet-sharing options, diversifying their service offerings. The increasing acceptance of digital payment systems further facilitates this transition, providing rental services with innovative ways to attract customers.

Technological Advancements in Booking Systems

The implementation of advanced booking systems in the car rental market is essential for enhancing customer experience and operational efficiency. As of 2023, over 60% of rental businesses have upgraded their platforms to include mobile apps and online reservation systems. This digitization process is paramount in meeting the expectations of tech-savvy customers who prefer seamless experiences. Furthermore, incorporating AI and machine learning algorithms into these platforms can optimize fleet management and personalize customer interactions, promoting competitive growth within the sector.

Future Outlook

Over the next five years, the Philippines Car Rental and Leasing Market is expected to experience significant growth, driven by the rise of domestic tourism, technological advancements in booking platforms, and an increasing demand for personalized transportation solutions. Additionally, the ongoing urbanization trend is likely to escalate the number of rented vehicle users, thereby expanding market opportunities for rental companies and enhancing their service offerings.

Major Players

- Avis

- Budget

- Hertz

- Rent a Car Philippines

- Sixt

- Europcar

- National Car Rental

- Alamo Rent a Car

- Thrifty

- Dollar Rent a Car

- Enterprise Rent-A-Car

- DriveMyCar

- Manila Rent A Car

- Gocar

- Asialink

Key Target Audience

- Corporate Clients

- Individual Consumers

- Travel Agencies

- Airlines (for partnerships)

- Event Management Companies

- Transportation Service Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Tourism, Land Transportation Office)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Philippines Car Rental and Leasing Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Philippines Car Rental and Leasing Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple rental companies to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Philippines Car Rental and Leasing Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Travel and Tourism

Increased Urbanization

Growing E-commerce Logistics - Market Challenges

Vehicle Maintenance Costs

Regulatory Hurdles - Opportunities

Growth in Ride-Sharing Services

Technological Advancements in Booking Systems - Trends

Shift Towards Electric and Hybrid Vehicles

Rise of Flexible Rental Options - Government Regulation

Licensing and Insurance Requirements - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Daily Rental Rate, 2019-2024

- By Rental Type (In Value %)

Short-Term Rental

– Hourly & Daily Rentals

– Weekend/Weekend-Plus Rentals

Long-Term Rental

– Monthly Rentals

– Annual Rentals

Leasing Agreements

– Operating Leases

– Finance Leases - By Vehicle Type (In Value %)

Economy Cars

– Compact Sedans

– Hatchbacks

Luxury Cars

– Premium Sedans

– Executive SUVs

SUVs

– Compact SUVs

– Full-Size SUVs

Vans

– Multi-Purpose Vans (MPVs)

– Passenger Vans - By Distribution Channel (In Value %)

Online Platforms

– Mobile Apps

– Online Aggregators

Physical Rental Locations

– Airport Kiosks

– City/Hotel-Based Outlets

Travel Agencies

– Brick-and-Mortar Travel Agents

– Tour Operators - By Region (In Value %)

National Capital Region (NCR)

Luzon

Visayas

Mindanao - By Customer Type (In Value %)

Corporate Clients

– SMEs

– Large Enterprises

Individual Consumers

– Business Travelers

– Leisure Travelers

Government Contracts

– National Government Agencies

– Local Government Units (LGUs)

- Market Share of Major Players by Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenue by Customer Type, Distribution Channels, Fleet Size and Composition, Number of Locations, Fleet Utilization Rate, Customer Service Metrics, Technology and Booking Platforms, Partnerships and Tie-ups, Unique Value Proposition)

- SWOT Analysis of Major Players

- Pricing Analysis by Vehicle Type for Major Players

- Detailed Profiles of Major Companies

Avis

Budget

Hertz

Europcar

Gocar

Rent a Car Philippines

Sixt

Alamo

National

Enterprise

Philippine Car Rental

Thrify

DriveMyCar

Manila Rent A Car

Asialink

- Market Demand and Utilization

- Purchasing Behavior and Drivers

- Regulatory and Compliance Requirements

- Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Daily Rental Rate, 2025-2030