Market Overview

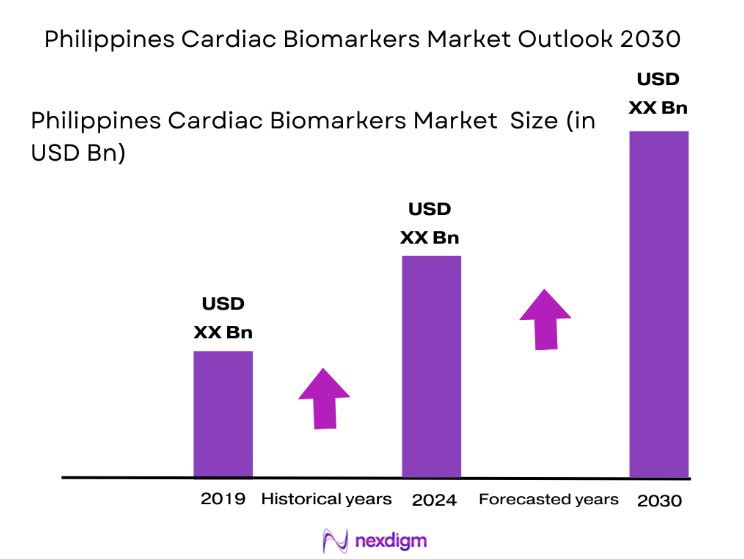

The Philippines Cardiac Biomarkers Market is valued at USD ~ in 2025, driven by the increasing incidence of cardiovascular diseases (CVD) such as heart failure, myocardial infarction, and acute coronary syndromes. The market’s growth is primarily driven by an aging population, rising healthcare awareness, and technological advancements in diagnostic tools. The government’s push for universal health coverage and the adoption of cutting-edge diagnostic solutions by healthcare providers further contribute to the market’s expansion. High demand for point-of-care diagnostics and laboratory testing services is expected to sustain market growth in the coming years.

Metro Manila, Davao, and Cebu are the primary regions driving the demand for cardiac biomarkers in the Philippines. Metro Manila, being the capital, has the highest concentration of healthcare facilities, including advanced diagnostic centers and hospitals that are early adopters of new medical technologies. Davao and Cebu, with their rapidly growing healthcare infrastructure, are emerging as key regional hubs for healthcare services. Their demand is driven by increasing healthcare awareness, a growing middle-class population, and higher disposable income enabling access to advanced diagnostics. These cities are vital in meeting the rising healthcare needs in the Philippines, driving the demand for cardiac biomarker tests.

Market Segmentation

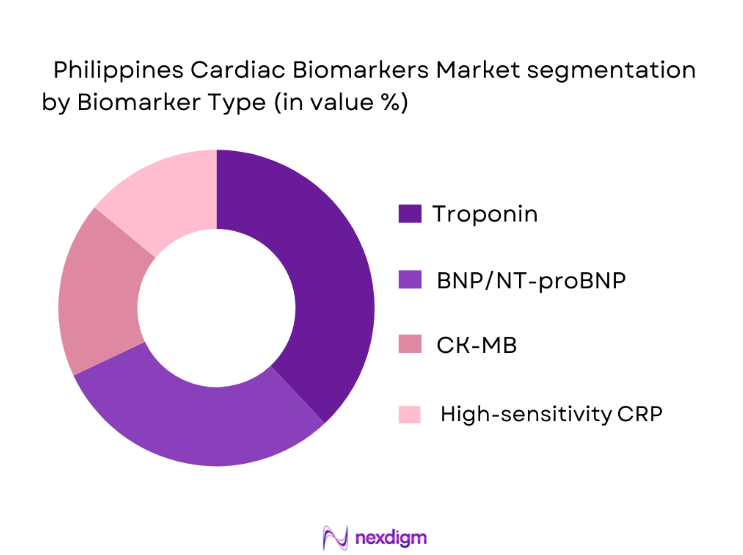

By Biomarker Type

The Philippines Cardiac Biomarkers Market is segmented into various biomarkers used for diagnosing cardiovascular diseases, including Troponin, BNP/NT-proBNP, CK-MB, and High-sensitivity CRP. Among these, Troponin-based tests dominate the market. This dominance is due to Troponin’s high diagnostic sensitivity and specificity, particularly in diagnosing myocardial infarction and heart damage. As the gold standard in cardiac marker testing, Troponin tests are extensively used in emergency departments and hospitals across the Philippines for real-time diagnosis and patient management. The continuous advancements in Troponin assays, along with lower costs and quicker turnaround times, have solidified their widespread adoption in clinical settings, maintaining their market-leading position.

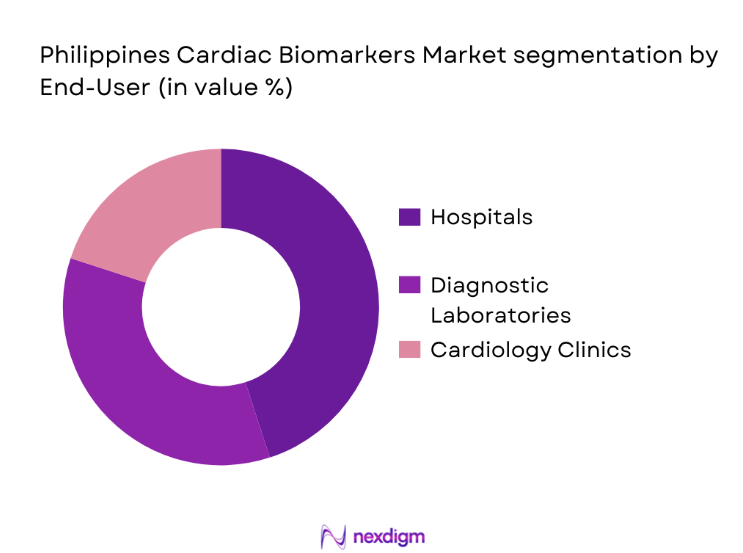

By End-User

The market is segmented by end-users into hospitals, diagnostic laboratories, and cardiology clinics. Hospitals account for the largest share in the Philippines Cardiac Biomarkers Market. The dominance of hospitals in this segment is primarily attributed to the higher volume of patients requiring emergency care for heart-related conditions. Hospitals are equipped with advanced diagnostic equipment, providing accurate and timely results for patients presenting with symptoms of heart attacks or heart failure. Furthermore, the integration of cardiac biomarker testing into routine diagnostic procedures within hospital settings contributes to the segment’s leading market share, as these tests are a critical part of patient management and treatment.

Competitive Landscape

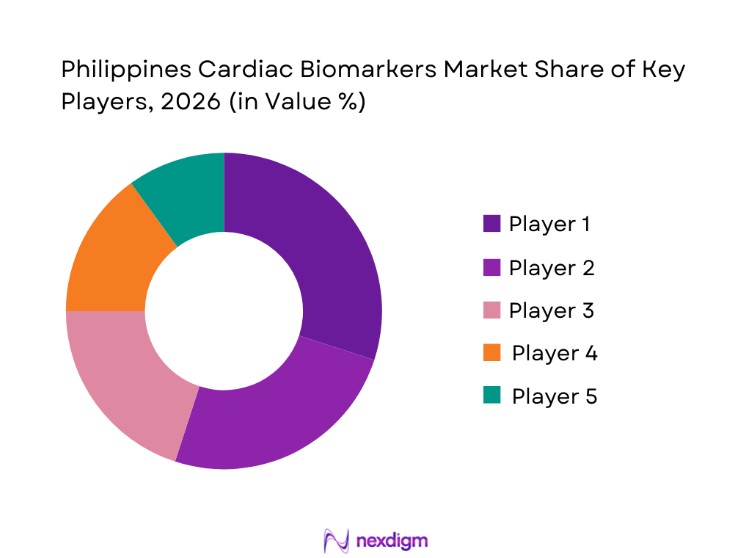

The Philippines Cardiac Biomarkers Market is characterized by a few major players, with both international companies and local players holding significant positions. These include global giants like Roche Diagnostics, Abbott Laboratories, and Siemens Healthineers, which dominate the market due to their comprehensive product portfolios, advanced technologies, and widespread distribution networks. Local players such as Unilab and MedLab are also gaining traction by offering affordable solutions tailored to the specific needs of the local healthcare system.

| Company Name | Establishment Year | Headquarters | Market Share (%) | Product Portfolio | Distribution Channels | Pricing Strategy |

| Roche Diagnostics | 1896 | Basel, Switzerland | ~ | ~ | ~ | ~ |

| Abbott Laboratories | 1888 | Chicago, USA | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Erlangen, Germany | ~ | ~ | ~ | ~ |

| Unilab | 1945 | Quezon City, PH | ~ | ~ | ~ | ~ |

| MedLab | 1990 | Makati, PH | ~ | ~ | ~ | ~ |

Philippines Cardiac Biomarkers Market Analysis

Growth Drivers

Rising Cardiovascular Disease Incidence in the Philippines

The incidence of cardiovascular diseases (CVD) is significantly rising in the Philippines. According to the World Health Organization (WHO), CVDs are the leading cause of death in the country, accounting for ~ of total mortality in 2024. The rise in CVD cases is primarily attributed to the aging population, unhealthy lifestyles, and increased prevalence of risk factors such as hypertension, diabetes, and obesity. As of 2023, it was reported that around ~ Filipinos suffer from hypertension, a major risk factor for cardiovascular diseases. This increasing burden on the healthcare system drives the demand for early diagnostic tools like cardiac biomarkers for timely diagnosis and effective treatment.

Adoption of High‑Sensitivity Biomarker Assays

The growing adoption of high-sensitivity cardiac biomarker assays in the Philippines is propelled by the increasing need for accurate and reliable diagnostics in emergency settings. In 2024, studies showed that nearly ~ of heart attack patients in the Philippines presented with non-specific symptoms, which prompted the need for more precise diagnostic tools such as high-sensitivity troponin tests. Furthermore, advances in biomarker assays, like Troponin I and BNP/NT-proBNP, have allowed for quicker diagnoses, essential for proper treatment. The demand for high-sensitivity assays is bolstered by the continuous improvements in assay technology, resulting in faster and more accurate results, which are increasingly being adopted in both urban and rural healthcare settings.

Market Restraints & Barriers

Reimbursement Complexity & Cost Sensitivity

Reimbursement complexity remains a significant barrier in the Philippines Cardiac Biomarkers Market. While the government’s Universal Health Care Act aims to address healthcare accessibility, the reimbursement process for advanced diagnostic tests like cardiac biomarkers is still evolving. In 2024, the Philippine Health Insurance Corporation (PhilHealth) was reported to provide partial reimbursement for only a limited range of diagnostic tests. As a result, patients in lower-income groups face high out-of-pocket expenses for these tests. This cost sensitivity limits the widespread adoption of advanced biomarkers in the market, particularly in underserved rural areas. Furthermore, the lengthy approval process for reimbursement coverage creates an obstacle for companies seeking to introduce new tests to the market.

Test Standardization & Regulatory Hurdles

Test standardization and regulatory challenges continue to impede the growth of the Philippines Cardiac Biomarkers Market. The Philippine Food and Drug Administration (FDA) has stringent regulations for approving new diagnostic tests, which can delay market entry for innovative cardiac biomarkers. In 2025, only ~ of the new diagnostic devices submitted for approval were cleared within the expected timeline, with many companies facing delays due to insufficient data or regulatory discrepancies. Additionally, the lack of standardized testing protocols across hospitals and clinics contributes to inconsistent diagnostic results, affecting the reliability of tests and overall market growth.

Opportunities

Multiplex Assay Panels & Biomarker Discovery

This is an opportunity because multiplex assay panels and biomarker discovery represent emerging areas with significant growth potential in the cardiac biomarkers market. These innovations offer the opportunity to improve diagnostic accuracy, reduce time-to-diagnosis, and allow for more comprehensive and personalized healthcare solutions. These advancements present a strong opportunity for market expansion, particularly as demand for multi-biomarker panels increases, enabling early and more effective detection of cardiovascular diseases.

Expansion of Point-of-Care (POC) Testing Solutions

The growing demand for rapid, on-site diagnostics has opened up significant opportunities for point-of-care testing solutions. POC tests for cardiac biomarkers are increasingly popular due to their ability to provide immediate results, crucial in emergency medical situations such as heart attacks. These tests are particularly beneficial in rural and underserved areas where access to centralized healthcare facilities may be limited. The ongoing development of portable and user-friendly diagnostic devices further boosts the adoption of POC testing, offering opportunities for manufacturers to tap into a broader, more diverse consumer base. As the healthcare infrastructure improves, the Philippines presents a large market for expanding POC biomarker tests, which will enhance the speed and effectiveness of patient care.

Future Outlook

Over the next few years, the Philippines Cardiac Biomarkers Market is expected to witness significant growth driven by advancements in diagnostic technologies and increasing healthcare access across the country. The rising prevalence of cardiovascular diseases, along with a growing middle-class population, will push the demand for more accurate, fast, and affordable diagnostic tests. Furthermore, government initiatives aimed at improving healthcare infrastructure and expanding the reach of diagnostic services, particularly in rural areas, will be key factors in the market’s continued expansion. With the integration of Artificial Intelligence (AI) and other digital technologies into diagnostic platforms, the market will see a rise in point-of-care and home-based testing solutions, creating further growth opportunities.

Major Players

- Roche Diagnostics

- Abbott Laboratories

- Siemens Healthineers

- Unilab

- MedLab

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- Danaher Corporation

- Ortho Clinical Diagnostics

- BioMérieux

- Hologic

- Quidel

- Randox Laboratories

- SeraCare Life Sciences

- ACON Laboratories

Key Target Audience

- Healthcare Providers

- Cardiologists and Heart Disease Specialists

- Government and Regulatory Bodies

- Medical Device Manufacturers

- Pharmaceutical Companies

- Insurance Companies and Health Insurers

- Investments and Venture Capitalist Firms

- Healthcare Procurement Managers and Hospital Administrators

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing an ecosystem map of all major stakeholders in the Philippines Cardiac Biomarkers Market. The focus is on identifying market drivers, product trends, and the regulatory environment. The data is collected from credible secondary sources, including industry reports, databases, and previous studies.

Step 2: Market Analysis and Construction

In this step, historical data regarding the market’s performance, growth trends, and key indicators are analyzed. We also examine the market’s future potential by evaluating key drivers such as government initiatives, healthcare expenditures, and technological advancements.

Step 3: Hypothesis Validation and Expert Consultation

After forming initial market hypotheses, we conduct interviews with healthcare professionals, industry experts, and market participants. These consultations provide in-depth insights into the evolving trends and factors affecting the market’s growth.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all data points and insights gathered from primary and secondary research. The market size, trends, competitive landscape, and future forecasts are compiled into the final report, ensuring the accuracy and comprehensiveness of the analysis.

- Executive Summary

- Research Methodology (Market Definition & Sector Scope, Primary vs Secondary Research Framework, Data Normalization & Conversion Standards, Confidence Levels and Forecasting Assumptions, Interviewee Profile Matrix, Estimation Approach for Unreported Segments)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Rising Cardiovascular Disease Incidence in Philippines

Adoption of High‑Sensitivity Biomarker Assays

Expansion of Decentralized Testing & POC Platforms

Government & Insurance Screening Initiatives - Market Challenges

Reimbursement Complexity & Cost Sensitivity

Test Standardization & Regulatory Hurdles - Opportunities

Multiplex Assay Panels & Biomarker Discovery

Expansion of Point-of-Care (POC) Testing Solutions - Trends

Digital Integration with EHR & Clinical Decision Support

AI / Machine Learning in Predictive Diagnosis - SWOT Analysis

- Porter’s five forces

- Market Size by Value, 2019-2025

- Market Growth Trends & CAGR Analysis ,2019-2025

- Market Volume by Units ,2019-2025

- Price Trend Analysis, 2019-2025

- Market Elasticity vs Healthcare Spend Patterns, 2019-2025

- By Biomarker Type (In value %)

Troponin (T & I) Tests

BNP / NT‑proBNP

CK‑MB

High‑Sensitivity CRP

Emerging Multi‑Analyte Panels - By Technology & Platform (In value %)

Immunoassay Platforms

Rapid/Point‑of‑Care Diagnostics (POC)

Electrochemiluminescence Platforms

AI‑Integrated Digital Interpretation Systems - By End‑User / Healthcare Setting (In value %)

Hospitals & Acute Care Centers

Diagnostic Laboratories

Cardiology Clinics

Emergency Response & Ambulance Testing

Research Institutions & Academia - By Clinical Application (In value %)

Myocardial Infarction Diagnosis

Heart Failure Monitoring

ACS & Cardiovascular Risk Stratification

Preventive Screening Programs

Post‑Operative/Chronic Care Monitoring - By Distribution & Channel Reach (In value %)

Direct Institutional Procurement

Medical Device Distributors

E‑Commerce & POC Kit Retail Channels

- Market Share by Company (Local & MNC)

- Segment Leadership by Biomarker Type

- Cross‑Comparison Parameters (Portfolio Breadth, Assay Sensitivity & Specificity Benchmarks, POC vs Lab Platform Penetration, Philippines Distribution Network Depth, Regulatory Approvals & Local Licensing, Contract Pricing / Reimbursement Positioning, R&D Investment & Innovation Pipeline, Service & Training Support Infrastructure)

- Pricing analysis of major players

- SWOT Profiles of Leading Competitors

- Major Players

Roche Diagnostics

Abbott Laboratories

Thermo Fisher Scientific

Siemens Healthineers

Bio‑Rad Laboratories

Danaher Corporation

BioMérieux SA

QuidelOrtho Corporation

Randox Laboratories Ltd

SeraCare Life Sciences

Ortho Clinical Diagnostics

Hologic, Inc.

Local Philippines Diagnostic Suppliers

Emerging POC Cardiac Device Innovators

Regional Test Kit Manufacturers

- Cardiology Diagnostics Capacity Mapping

- Lab Accreditation & Quality Compliance

- Referral Pathways & Acute Care Protocols

- Outpatient vs Inpatient Utilization Patterns

- Future Market Size (Value & Units) ,2026-2030

- By Volume, 2026-2030

- Price & Cost Outlook ,2026-2030