Market Overview

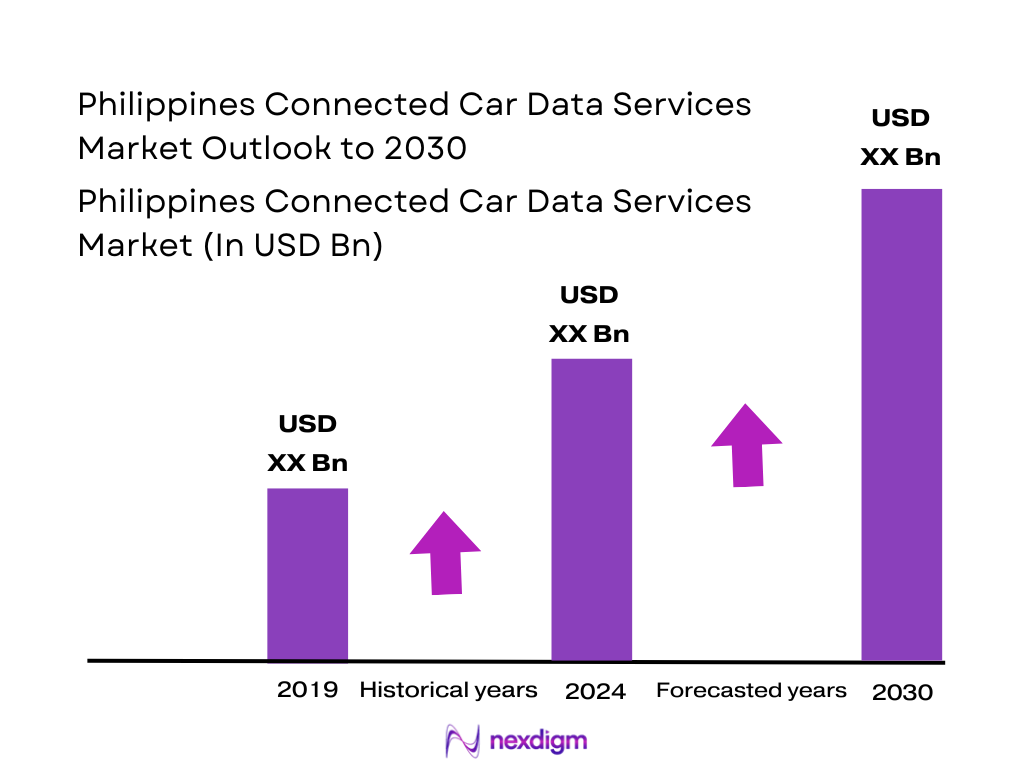

Based on regional benchmarking, this report adopts a Philippines Connected Car Data Services Market size of around USD ~ billion in the latest assessment period. This is derived from the Asia-Pacific connected car market, valued at USD ~ billion with a high-teens growth trajectory, and the Philippines’ rapidly expanding automotive base, which now sells about 475,000 vehicles annually and has over ~ million registered vehicles on the road. Strong digitalisation—over ~ million internet users and widespread smartphone adoption—underpins demand for telematics, navigation, infotainment, and usage-based services, especially as fleets and OEMs seek real-time data for safety, efficiency and customer engagement.

The Philippines Connected Car Data Services Market is anchored in Metro Manila and its surrounding growth corridors, where dense vehicle ownership, congestion and higher incomes create the strongest business case for telematics and connected services. The National Capital Region alone contributes just over 31% of national GDP, or roughly USD ~ billion, and is home to the largest concentration of dealerships, logistics hubs and ride-hailing activity. Emerging secondary hubs such as Calabarzon and Central Luzon add industrial estates, expressway corridors and growing logistics activity, while Cebu and Davao are increasingly important for regional fleets, inter-island logistics and tourism-linked mobility services.

Market Segmentation

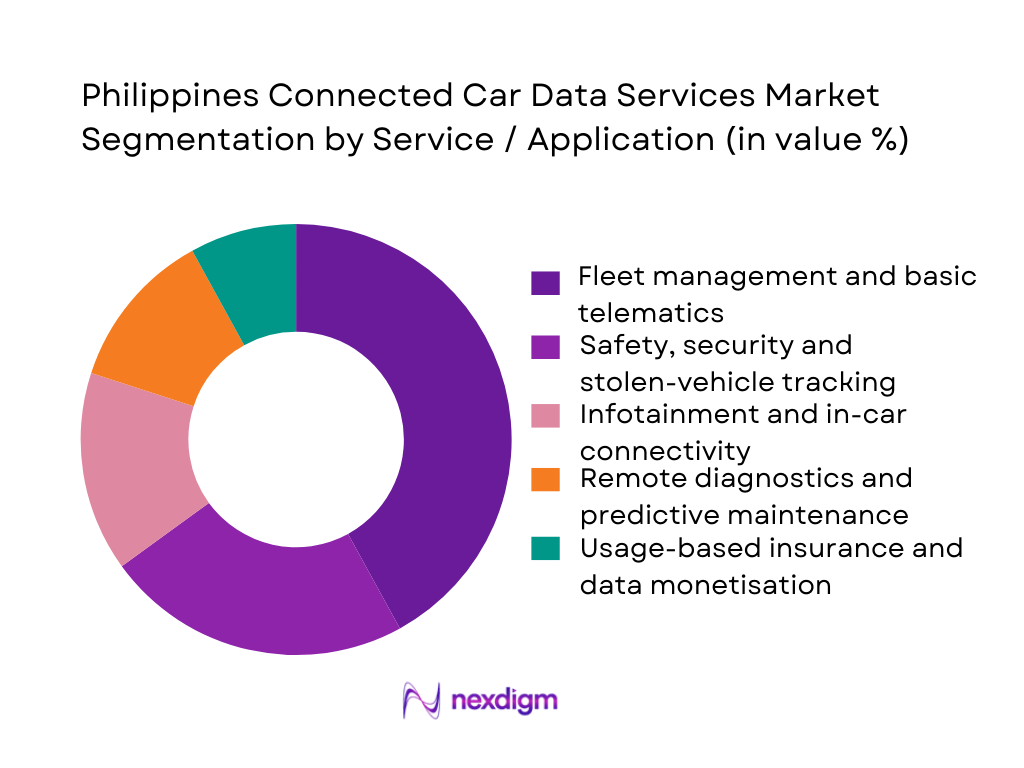

By Service / Application

The Philippines Connected Car Data Services Market is segmented by service into fleet management and basic telematics, safety and security tracking, infotainment and connectivity, remote diagnostics and predictive maintenance, and usage-based insurance and data monetisation. Fleet management and basic telematics currently dominate because commercial vehicles account for a large share of the national vehicle parc, and business users are highly focused on fuel efficiency, route optimisation and driver behaviour. CAMPI-TMA and industry sources show that commercial vehicles represent the bulk of new registrations and are central to booming logistics, e-commerce and construction activity. Local fleets use GPS tracking, driver scorecards and engine-hour data to cut idle time, deter theft and meet SLAs, making telematics platforms and SIM-connected devices the most monetised data-service layer today.

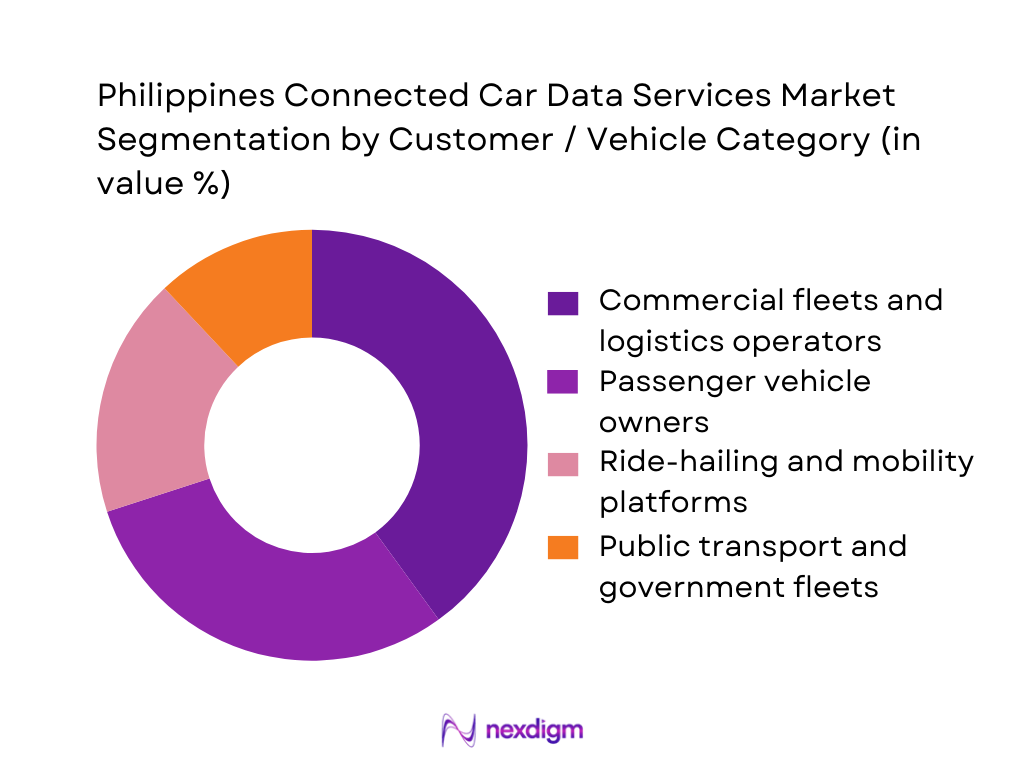

Customer / Vehicle Category

The Philippines Connected Car Data Services Market is segmented by customer/vehicle into commercial fleets and logistics operators, passenger vehicle owners, ride-hailing and mobility platforms, and public transport and government fleets. Commercial fleets and logistics operators hold the dominant share because freight and delivery vehicles clock the highest annual mileage and operate across long-haul expressways and dense urban routes. ASEAN automotive snapshots show Philippines emerging as a key growth market within a ~-million-unit ASEAN light-vehicle landscape, with strong momentum in trucks and LCVs serving e-commerce, FMCG and industrial clients. Fleet operators are under pressure to manage fuel, driver safety, compliance and service levels, making continuous data feeds—from GPS, CAN-bus, dashcams and fuel sensors—mission-critical and justifying recurring SaaS and connectivity spend more than in private-owner segments.

Competitive Landscape

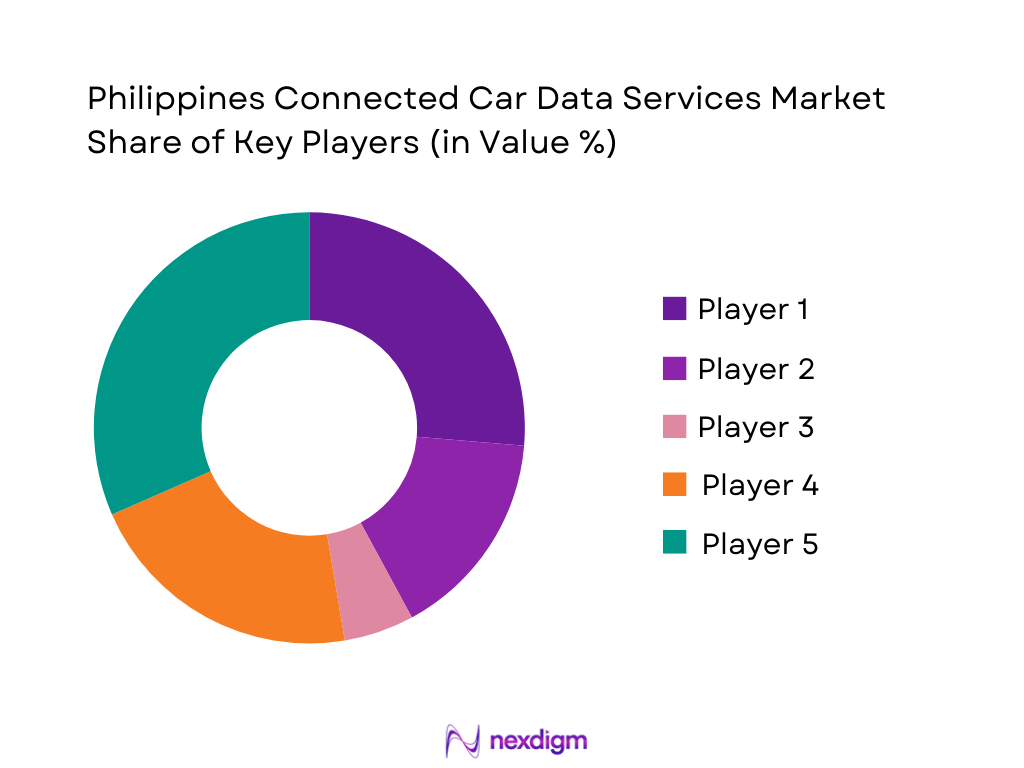

The Philippines Connected Car Data Services Market is shaped by a mix of OEM-driven connected services, telco-centric IoT platforms, and specialist telematics providers. Toyota Motor Philippines, working with PLDT Enterprise and Smart Communications, offers factory-linked connected services such as myTOYOTA Connect, while independent platforms like Cartrack, AVLView, V3 Smart Technologies and Tramigo power GPS tracking, driver behaviour analytics and video telematics for thousands of vehicles. Global data-analytics and platform providers such as Geotab, Wialon and Funtoro increasingly plug into this ecosystem, often via local partners, enabling advanced reporting, AI-driven insight and integration with insurance and fuel-card programs.

| Company | Establishment Year | Headquarters | Primary Role in PH Connected Car Data | Core Service Focus in PH | Main Customer Segments | Connectivity Approach (Embedded / Aftermarket / App) | Notable Partnerships / Programs in PH | Strengths in Data & Analytics |

| Toyota Motor Philippines | 1988 | Santa Rosa, Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| PLDT Enterprise / Smart IoT | 1928 (PLDT) | Makati, Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Cartrack Philippines | 2004 (Group) | Singapore (Regional HQ) | ~ | ~ | ~ | ~ | ~ | ~ |

| AVLView Philippines | 2012 (Brand) | Singapore | ~ | ~ | ~ | ~ | ~ | ~ |

| V3 Smart Technologies | 2002 | Singapore | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Connected Car Data Services Market Dynamics & Key Drivers

Growth Drivers

Increasing demand for vehicle connectivity and “smart mobility”

High digital adoption in the Philippines is creating a natural base for connected-car and data-driven mobility services. Individuals using the internet reached about 84 out of every 100 residents in the country, indicating deep online integration into daily life. Mobile-cellular subscriptions still exceed the population, at around 117 subscriptions per 100 inhabitants in the most recent data, supporting always-on smartphone usage that serves as the primary human–vehicle interface for app-based telematics and navigation. At the same time, digital payments already account for over 52.8 out of every 100 retail payment transactions and rose further to 57.4, showing that Filipinos increasingly transact over digital rails. This combination of dense mobile connectivity, high internet use, and rapid digital-payment uptake underpins demand for connected-car apps such as usage-based insurance, in-car commerce, and app-mediated fleet control, positioning data services as a logical extension of existing digital behavior.

Growth of commercial fleets, logistics, last-mile delivery, and e-commerce

The transport and logistics backbone that feeds demand for vehicle data services is expanding quickly. Gross value added from transportation and storage activities rose from about PHP ~ billion to PHP ~ billion in one year, pointing to rising freight and passenger movement that require tighter fleet control and routing. Overall services GVA climbed to around PHP ~ trillion, with wholesale and retail trade and logistics-related services forming a major share, reinforcing the importance of efficient movement of goods. The government’s e-commerce roadmap projects gross e-commerce value in the hundreds of billions of pesos, with targets above PHP ~ billion around the roadmap horizon, supported by the Department of Trade and Industry’s aim for more than 1,000,000 e-commerce enterprises. As online retail scales out from Metro Manila into CALABARZON and Central Luzon, same-day and next-day delivery fleets intensify urban congestion and last-mile complexity, driving logistics operators to deploy telematics, route optimization, and proof-of-delivery data platforms to protect margins and service levels in an increasingly time-sensitive market.

Challenges

Low consumer awareness and comparatively slow adoption among private-car owners

Despite widespread smartphone use, connected-car penetration among private vehicle owners remains limited. As of mid-2022, there were already more than ~ million registered motor vehicles in the Philippines, with motorcycles and tricycles comprising about 60 out of every 100 vehicles and private cars and SUVs forming roughly 16 out of every 100. Yet many of these vehicles are legacy models without embedded connectivity and rely only on basic head units rather than telematics control units or app-linked OBD devices. Internet use has reached 83.8 per 100 inhabitants and digital payments now account for more than half of retail transactions, but connected in-car subscriptions and data-based services have not scaled at a comparable pace, as they are rarely bundled into mass-market vehicle purchases and awareness of benefits like stolen-vehicle tracking, crash alerts, or remote diagnostics remains low outside premium segments.

High upfront cost of OEM-integrated connectivity and aftermarket devices

Affordability remains a barrier for many Filipino households and small fleet owners evaluating connected-car hardware or OEM subscription packages. The World Bank reports GDP per capita at roughly USD ~, while gross national income per capita stands near USD ~, underscoring that a large share of motorists remain highly price-sensitive when considering add-ons beyond the basic vehicle purchase. Passenger vehicle sales rebounded to 441,408 units and then 475,094 units in successive years, but many purchases are financed over long tenors, leaving limited budget for telematics subscriptions or premium connectivity plans. At the same time, the transport and storage sector accounts for over PHP ~ billion in GVA, much of it generated by MSME operators who individually run fewer vehicles and must tightly manage capital expenditure. This combination of modest incomes, credit constraints, and MSME-dominated logistics structures makes the upfront cost of embedded telematics units, dash-cams with cellular backhaul, and recurring data plans a significant hurdle to mainstream adoption of connected car data services.

Opportunities

Expansion of integrated fleet digitization across logistics and SME fleets

The scale and economic weight of MSME-led logistics, combined with rising safety and efficiency pressures, create a strong runway for end-to-end fleet digitization. MSMEs number over ~ million enterprises, with 546,863 engaged in wholesale and retail trade and repair of motor vehicles and motorcycles, directly tied to goods movement and vehicle operations. Transport and storage activities generate more than PHP ~ billion in GVA, while services as a whole contribute about PHP ~ trillion, underscoring how even small productivity gains in routing, fuel management, and vehicle uptime can cascade into billions of pesos in value. Road crashes causing 13,125 deaths in 2023—up by 885 fatalities from the previous year—highlight the urgent need for technology-enhanced safety, such as real-time driver scoring, fatigue monitoring, and automated incident reporting. Against this backdrop, integrated fleet platforms that combine GPS tracking, video telematics, driver-behavior analytics, and maintenance scheduling into a single dashboard create a compelling proposition for logistics SMEs seeking to professionalize operations, meet tighter SLAs for e-commerce deliveries, and comply with emerging regulatory expectations around road safety and emissions reporting without needing to build in-house data capabilities.

OEM-embedded connectivity and subscription monetization

The shift of automotive revenue models towards software and services offers OEMs in the Philippines a chance to treat connectivity as a recurring revenue stream rather than a one-time option. Vehicle demand has recovered strongly, with total automobile sales climbing to 441,408 units and then 475,094 units over recent years, giving OEMs a growing installed base into which they can embed connected modules and over-the-air update capability at the factory level. At the same time, EV registrations have reached 24,286 units, with an additional 29,715 EVs registered in just the first seven months of the subsequent year, highlighting a cohort of vehicles already relying heavily on software for energy management and diagnostics. Digital-payments policy aims for 60 to 70 out of every 100 retail transactions to be digital by 2028, while the share is already 57.4, meaning consumers are becoming comfortable with app-based, recurring payments for subscriptions. This environment supports OEM strategies that bundle free trial periods for telematics packages, then shift to monthly or annual fees for services such as remote diagnostics, advanced navigation, concierge services, and usage-based insurance data sharing, turning connected-car data services into a long-term monetization pillar across mainstream and EV line-ups.

Future Outlook

Over the next several years, the Philippines Connected Car Data Services Market is expected to grow rapidly as connected features become standard in new vehicles and aftermarket installations deepen penetration across the legacy vehicle parc. Asia-Pacific connected car spending, already above USD ~ billion, is forecast to grow at a CAGR of roughly 19.5%, and the Philippines will benefit from similar tailwinds as its automotive market moves towards one million annual units over the coming decade. Expansion of 4G/5G coverage, the government’s digital-infrastructure push, stricter safety and emissions focus and the spread of e-commerce logistics will significantly increase demand for real-time vehicle data, analytics and over-the-air services.

Major Players

- Toyota Motor Philippines

- PLDT Enterprise / Smart Communications

- Globe Telecom

- Cartrack Philippines

- Shell Fleet Solutions Philippines

- AVLView Philippines

- V3 Smart Technologies

- Tramigo

- Geotab

- Wialon / Gurtam

- Funtoro (MSI)

- Jimi IoT / Geoplan Philippines

- FleetHunt Philippines

- Local GPS tracking and dashcam integrators

Key Target Audience

- Automotive OEMs and distributors

- Telecommunications and IoT connectivity providers

- Fleet operators and logistics companies

- Ride-hailing and mobility platforms

- Auto insurers and usage-based insurance providers

- Fuel, charging and service-network operators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The initial step involved mapping the Philippines Connected Car Data Services ecosystem, covering OEMs, telcos, telematics vendors, insurers, regulators and fleet end-users. Extensive desk research drew on regional connected car reports, Philippines automotive statistics, digital-penetration datasets and official regulatory documents to identify critical variables such as installed connectivity base, fleet composition, data-service monetisation models and regulatory triggers for telematics adoption.

Step 2: Market Analysis and Construction

In this phase, we compiled and reconciled historical data on auto sales, registered vehicles, ASEAN automotive trends and Asia-Pacific connected car spending. ASEAN-6 vehicle statistics, Philippines auto-industry data connected car market values formed the top-down backbone, while analysis of local telematics deployment, case studies and product portfolios of key providers informed bottom-up revenue allocation between hardware, connectivity and data services.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on penetration rates, ARPU bands and segment splits (fleet vs retail, OEM vs aftermarket, service mix) were stress-tested through secondary interviews, published statements and case examples from OEMs, telcos and telematics vendors active in the Philippines. Partnerships such as myTOYOTA Connect with PLDT Enterprise, as well as public domain insights from Cartrack, Tramigo, AVLView and V3 Smart Technologies, were used to refine adoption curves, service-mix assumptions and growth drivers for specific customer segments.

Step 4: Research Synthesis and Final Output

The final phase integrated top-down regional connected car market figures with bottom-up Philippines-specific vehicle, connectivity and telematics data to arrive at a reconciled market size and growth outlook for the Philippines Connected Car Data Services Market. Sensitivity checks were run around adoption timing, pricing bands and regulatory catalysts, and cross-referenced with Asia-Pacific growth benchmarks to ensure internal consistency. The resulting analysis provides a coherent, defendable view of current market size, segment structure and expected CAGR, tailored for investors, OEMs, telcos and policy-makers.

- Executive Summary

- Research Methodology (Market Definitions & Scope, Assumptions & Delimitations, Data Sources: Primary, Market Sizing Approach, Consolidated Research Approach, Limitations & Considerations)

- Definition and Scope of “Connected Car Data Services”

- Market Genesis & Evolution in the Philippines

- Key Enablers

- Market Value Chain and Service Ecosystem

- Infrastructure & Connectivity Context

- Growth Drivers

Increasing demand for vehicle connectivity and “smart mobility”

Growth of commercial fleets, logistics, last-mile delivery, and e-commerce

Rising adoption of EVs and electrification initiatives

Enhanced mobile and IoT infrastructure

Need for cost optimization, fuel efficiency, safety, and compliance - Challenges

Low consumer awareness & comparatively slow adoption of connected-car devices High upfront cost of OEM-integrated connectivity / aftermarket devices

Limited connectivity / network coverage / infrastructure constraints

Data privacy, security, and regulatory compliance concerns

Fragmented ecosystem - Opportunities

Expansion of Integrated Fleet Digitization Across Logistics & SME Fleets

OEM-Embedded Connectivity & Subscription Monetization

Usage-Based Insurance (UBI) and Insurer Data Partnerships

Acceleration of Video Telematics Adoption

EV-Linked Data Services - Trends

Shift from hardware-only telematics to integrated data-service platforms

Rising popularity of fleet-oriented connectivity & MaaS-based subscription models Increasing adoption of video telematics

OEMs + Telcos partnership

Growing regulatory support and improved connectivity infrastructure

- By Value, 2019-2024

- By Service Type / Offering, 2019-2024

- Market Breakdown by Customer Type, 2019-2024

- Market Penetration, 2019-2024

- By Connectivity Technology (in Value %)

Embedded / OEM-installed

Tethered

Aftermarket 3rd-party devices

- By Communication Network / Protocol (in Value %)

4G-LTE / Cellular

5G

Wi-Fi/Hotspot

eSIM/IoT-SIM

DSRC / V2X where applicable

- By Data Service / Application (in Value %)

Telematics & GPS

Remote Diagnostics & Predictive Maintenance

Infotainment & Data Services

Fleet Management / Fleet Analytics

Driver Behavior & Safety Monitoring

- By Customer Segment (in Value %)

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles / Trucks

Fleet Operators / Logistics

MaaS / Ride-hailing & Car-Sharing Providers

- By Deployment Model (in Value %)

OEM-integrated

Aftermarket retrofit devices

Fleet-as-a-Service subscription

MaaS-provider bundled services

- By Region / Geography within the Philippines (in Value %)

Metro Manila / NCR

Cebu / Visayas

Davao / Mindanao

Other emerging urban centers / provinces

- Competitive Market Share (by value / device deployments / subscriptions)

- Cross-Comparison of Key Players (Company Overview & Ownership Structure, Range of Services / Solutions, Technology Stack & Connectivity Protocols, Fleet & Device Penetration / Installed Base, Service Offering Breadth, Partnerships & Alliances, Data & Analytics Capabilities, Revenue Model & Monetization, Pricing / Subscription Fees / Device Cost, Unique Value Proposition / Differentiators / Competitive Strengths, Weaknesses or Gaps)

- SWOT Analysis of Key Players & Overall Market Ecosystem

- Stakeholder Ecosystem

- Value-Chain Analysis

- Partnership & Collaboration Models

- aftermarket + telco, fleet-service + analytics, MaaS collaborations.

- Key Players

Toyota Motor Philippines

Bosch Philippines

Telit Philippines

PLDT Enterprise / Smart Communications

Geotab

Cartrack Philippines

Large OEM importers / distributors in PH

Fleet-management & logistics firms using telematics

Insurance providers / insurtech players offering usage-based insurance

Aftermarket telematics & device importers / integrators

Connectivity / IoT platform providers

Data analytics / telematics-software providers

EV-related service providers

MaaS / ride-hailing / car-sharing operators offering data-driven services

- Passenger Vehicle Owners

- Commercial Fleets & Logistics Operators

- MaaS / Ride-Hailing / Car-Sharing Operators

- Insurance Providers & UBI Users

- Regional / Urban vs Rural / Secondary Cities

- By Value, 2025-2030

- By Service Type / Offering, 2025-2030

- Market Breakdown by Customer Type, 2025-2030

- Market Penetration, 2025-2030