Market Overview

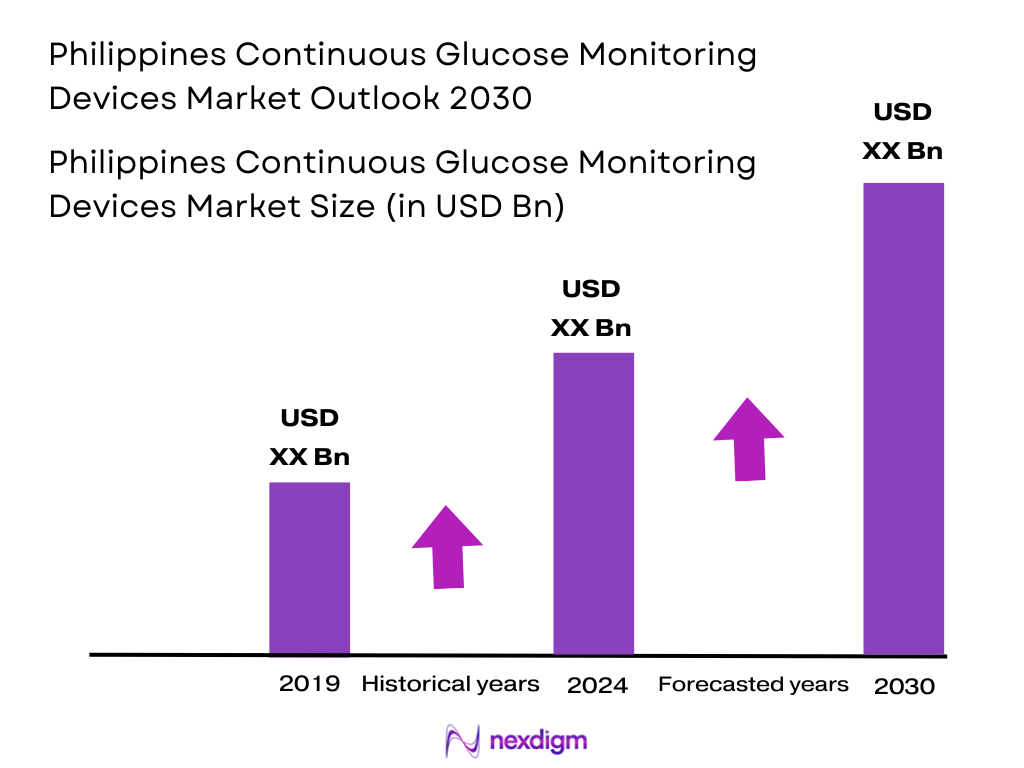

Based on a recent historical assessment, the Philippines continuous glucose monitoring devices market was valued at USD ~ million, using the national diabetes care devices market size as a proxy due to the absence of publicly disclosed standalone CGM valuation. Market expansion is primarily driven by the rising prevalence of diabetes, increasing physician adoption of real-time glucose tracking technologies, and growing patient preference for minimally invasive monitoring solutions. Improved access to private healthcare facilities and gradual integration of digital health platforms further support sustained demand.

The market is concentrated in major urban centers including Metro Manila, Cebu, and Davao, where higher healthcare spending capacity, stronger private hospital networks, and greater availability of endocrinology specialists accelerate adoption. Metro Manila dominates due to advanced diagnostic infrastructure, early technology uptake, and strong presence of multinational medical device distributors. Urban regions benefit from higher awareness of diabetes management technologies, better insurance penetration, and stronger connectivity infrastructure supporting app-based and cloud-enabled monitoring systems.

Market Segmentation

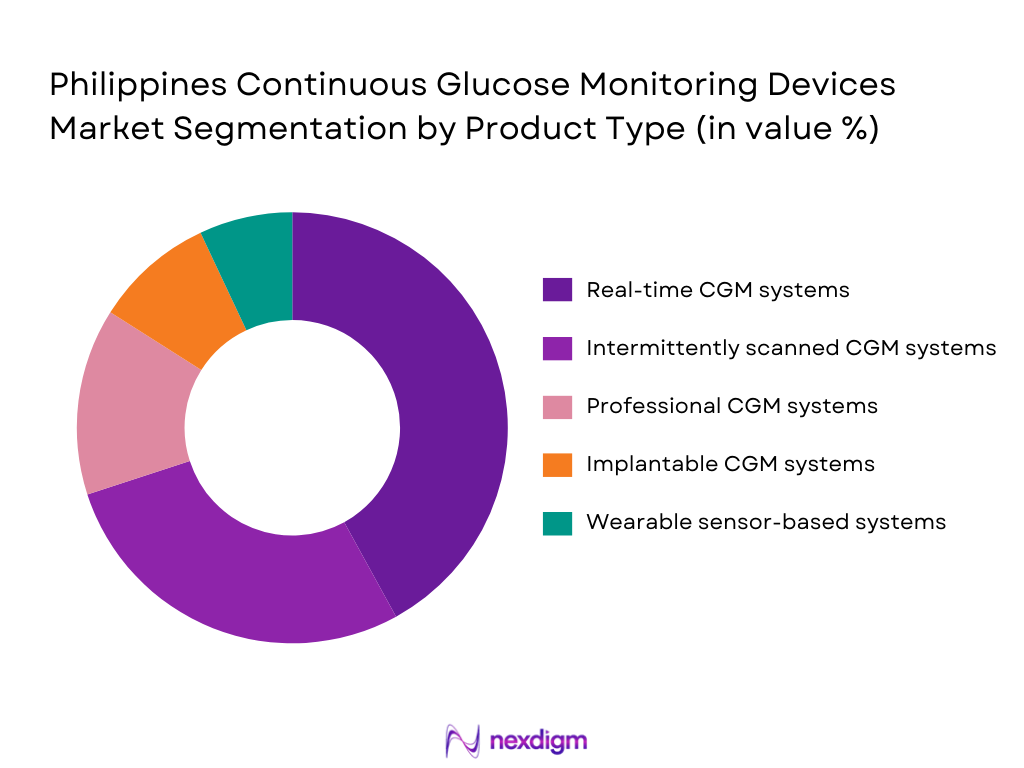

By Product Type

The Philippines Continuous Glucose Monitoring Devices market is segmented by product type into real-time continuous glucose monitoring systems, intermittently scanned continuous glucose monitoring systems, professional continuous glucose monitoring systems, implantable continuous glucose monitoring systems, and wearable sensor-based glucose monitoring systems. Recently, real-time continuous glucose monitoring systems have a dominant market share due to continuous data availability, real-time alerts, and higher clinical trust among endocrinologists. These systems support proactive glycemic control, reduce hypoglycemia risks, and integrate seamlessly with smartphones and cloud platforms, making them highly preferred in both hospital and home-care environments across urban healthcare settings.

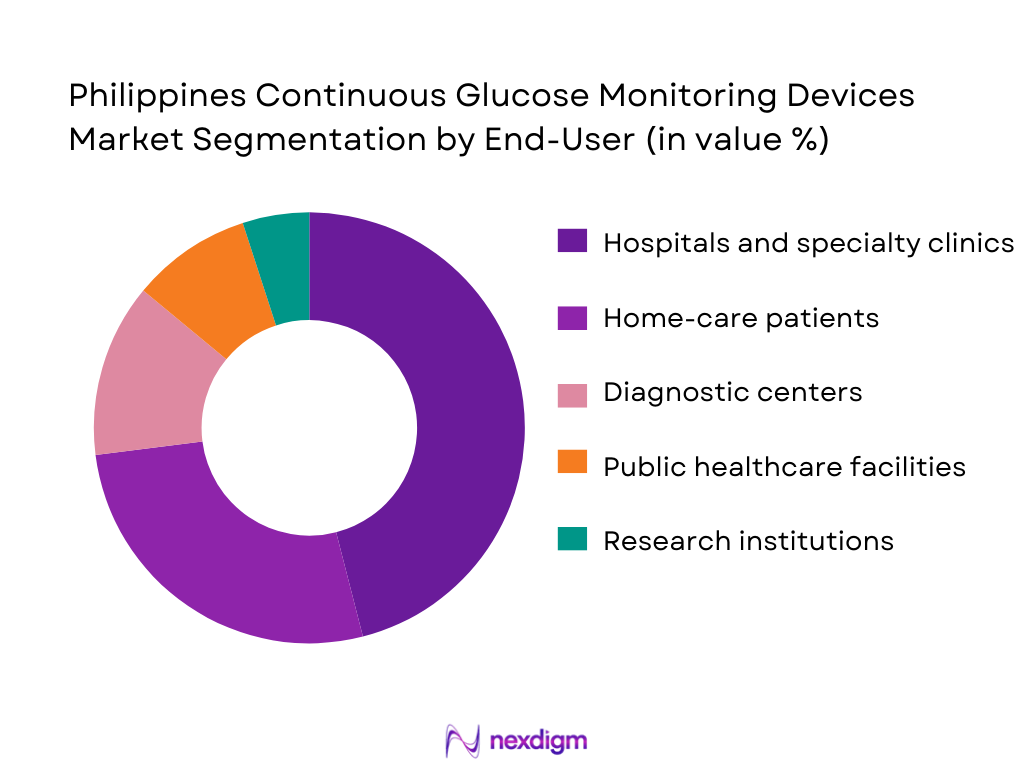

By End User

The Philippines Continuous Glucose Monitoring Devices market is segmented by end user into hospitals and specialty clinics, home-care patients, diagnostic centers, research institutions, and public healthcare facilities. Hospitals and specialty clinics currently dominate market share due to their role as primary diagnosis and treatment centers for diabetes management. These facilities drive CGM adoption through physician recommendations, structured diabetes programs, and patient education initiatives. Their ability to bundle CGM devices with treatment plans and follow-up care reinforces sustained procurement volumes and long-term usage.

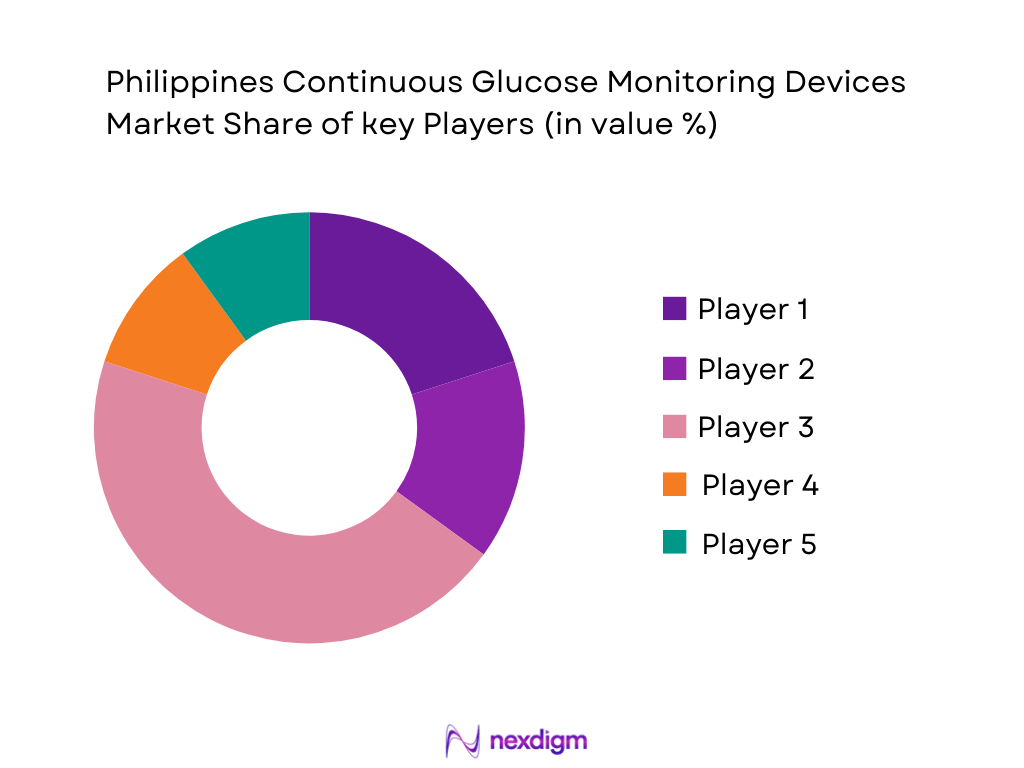

Competitive Landscape

The Philippines continuous glucose monitoring devices market is moderately consolidated, with a small number of global manufacturers controlling core sensor technologies and software platforms while local distributors focus on market access and after-sales support. Established multinational players benefit from strong brand recognition, clinical validation, and long-standing relationships with private hospitals. Competitive intensity is shaped by pricing strategies, sensor accuracy, and integration capabilities rather than volume-based competition.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Distribution Strength |

| Abbott Diabetes Care | 1981 | United States | ~ | ~ | ~ | ~ | ~ |

| Dexcom | 1999 | United States | ~ | ~ | ~ | ~ | ~ |

| Medtronic Diabetes | 1949 | Ireland | ~ | ~ | ~ | ~ | ~ |

| Roche Diabetes Care | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Ascensia Diabetes Care | 2016 | Switzerland | ~ | ~ | ~ | ~ | ~ |

Philippines Continuous Glucose Monitoring Devices Market Analysis

Growth Drivers

Rising diabetes prevalence and chronic disease burden

The increasing incidence of type 1 and type 2 diabetes across the Philippines has significantly intensified demand for advanced glucose monitoring solutions as healthcare providers seek more effective long-term disease management tools. Lifestyle changes, urbanization, dietary shifts, and reduced physical activity have contributed to higher diagnosis rates, increasing the patient base requiring continuous glucose tracking. CGM devices offer real-time insights that improve glycemic control and reduce complications, making them clinically attractive. Physicians increasingly recommend CGM systems for both insulin-dependent and non-insulin-dependent patients. Early detection of glucose fluctuations supports preventive care strategies. Hospitals favor CGM adoption to reduce emergency admissions related to hypoglycemia. Private insurers increasingly recognize CGM as a value-added monitoring tool. Growing patient awareness further reinforces sustained adoption momentum.

Digital health integration and remote monitoring adoption

The rapid integration of digital health platforms into Philippine healthcare systems has accelerated acceptance of CGM devices as connected medical technologies. Smartphone penetration and mobile health applications enable patients to monitor glucose levels remotely and share data with clinicians. CGM platforms support cloud-based analytics that enhance treatment personalization. Telemedicine adoption has strengthened demand for continuous data-driven monitoring solutions. Healthcare providers leverage CGM data for virtual consultations and therapy adjustments. Remote monitoring reduces clinic visits and improves patient convenience. Device manufacturers emphasize interoperability with mobile ecosystems. Digital literacy improvements among urban populations further support market growth.

Market Challenges

High device and consumable cost sensitivity

The relatively high upfront cost of CGM systems and recurring sensor replacement expenses pose a major challenge in the price-sensitive Philippine healthcare market. Many patients rely on out-of-pocket payments, limiting adoption beyond affluent urban populations. Public healthcare reimbursement coverage remains limited for advanced monitoring technologies. Cost concerns affect long-term adherence among patients. Hospitals face budget constraints when scaling CGM programs. Import duties and logistics costs add pricing pressure. Manufacturers must balance affordability with technological innovation. Price sensitivity remains a structural barrier to mass-market penetration.

Limited reimbursement and regulatory complexity

Reimbursement frameworks for CGM devices remain underdeveloped, creating uncertainty for both providers and patients. Public insurance programs prioritize essential care, limiting coverage for advanced monitoring devices. Regulatory approval processes for medical devices can be time-intensive, delaying product launches. Compliance with data privacy and cybersecurity regulations adds complexity for connected CGM systems. Smaller distributors face administrative burdens. These factors slow adoption in public hospitals. Market expansion depends on policy evolution. Regulatory alignment remains a key challenge.

Opportunities

Expansion of home-based diabetes management solutions

Growing preference for home-based healthcare presents a strong opportunity for CGM adoption among self-monitoring patients. Aging populations and chronic disease management trends favor continuous monitoring outside hospital settings. CGM devices enable independent disease control. Home-care programs reduce healthcare system burden. Manufacturers can target subscription-based sensor models. Digital platforms support long-term patient engagement. Home monitoring aligns with telehealth growth. This segment offers scalable growth potential.

Integration with telemedicine and digital care platforms

The expansion of telemedicine services creates opportunities for CGM manufacturers to integrate data streams into virtual care ecosystems. CGM data enhances remote diagnosis accuracy. Providers value continuous data access. Partnerships with telehealth platforms increase device relevance. Cloud analytics support predictive insights. Integration improves treatment outcomes. Digital health policies support this trend. The opportunity strengthens market differentiation.

Future Outlook

The Philippines continuous glucose monitoring devices market is expected to experience steady growth over the next five years, supported by increasing diabetes prevalence, gradual reimbursement improvements, and expanding digital healthcare infrastructure. Advancements in sensor accuracy, affordability initiatives, and mobile integration will enhance adoption. Regulatory support for digital health and rising private healthcare investments will further strengthen demand. Urban markets will continue leading growth while gradual expansion into secondary cities is anticipated.

Major Players

- Abbott Diabetes Care

- Dexcom

- Medtronic Diabetes

- Roche Diabetes Care

- Ascensia Diabetes Care

- Senseonics

- Insulet Corporation

- Ypsomed

- Novo Nordisk Devices

- Terumo Corporation

- Nipro Diagnostics

- Medtrum Technologies

- i-SENS

- AgaMatrix

- B. Braun Medical

Key Target Audience

- Investments and venture capitalist firm

- Government and regulatory bodies

- Medical device manufacturers

- Hospital procurement teams

- Private healthcare providers

- Digital health platform providers

- Diabetes specialty clinics

- Medical distributors

Research Methodology

Step 1: Identification of Key Variables

Key variables including disease prevalence, device adoption rates, healthcare infrastructure, pricing dynamics, and regulatory frameworks were identified to define market boundaries and analysis scope.

Step 2: Market Analysis and Construction

Secondary research from industry databases, healthcare reports, and company disclosures was combined with regional healthcare insights to construct market structure and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through expert opinions from healthcare professionals, distributors, and industry analysts to ensure accuracy and relevance.

Step 4: Research Synthesis and Final Output

All findings were synthesized into a structured framework, ensuring consistency, factual accuracy, and alignment with market dynamics.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising prevalence of diabetes and prediabetes population

Increasing adoption of digital health and remote monitoring

Growing awareness of continuous glucose monitoring benefits

- Market Challenges

High device and sensor replacement costs

Limited reimbursement coverage across public healthcare

Technical and data privacy concerns in connected devices

- Market Opportunities

Expansion of home based diabetes management solutions

Integration of CGM data with telemedicine platforms

Penetration into underserved rural healthcare settings

- Trends

Shift toward smartphone integrated CGM ecosystems

Growing use of cloud analytics and AI driven glucose insights

Miniaturization and improved sensor accuracy

- Government Regulations

Medical device registration under national regulatory authority

Compliance with data protection and patient privacy laws

Import and quality standards for diagnostic medical devices

- SWOT Analysis

- Porter’s Five Forces

- By Market Value ,2019-2025

- By Installed Units ,2019-2025

- By Average System Price ,2019-2025

- By System Complexity Tier ,2019-2025

- By System Type (In Value%)

Real time continuous glucose monitoring systems

Intermittently scanned continuous glucose monitoring systems

Professional continuous glucose monitoring systems

Implantable continuous glucose monitoring systems

Wearable sensor-based glucose monitoring systems - By Platform Type (In Value%)

Standalone CGM receiver-based platforms

Smartphone integrated CGM platforms

Cloud connected remote monitoring platforms

Hospital information system integrated platforms

Telehealth enabled CGM platforms - By Fitment Type (In Value%)

Disposable sensor based systems

Reusable transmitter-based systems

Fully integrated disposable systems

Implantable long term sensor systems

Hybrid sensor transmitter systems - By EndUser Segment (In Value%)

Hospitals and specialty diabetes clinics

Home care and self-monitoring patients

Diagnostic centers and ambulatory care units

Research institutes and clinical trial centers

Public healthcare facilities - By Procurement Channel (In Value%)

Direct hospital procurement

Pharmacy and retail medical stores

Online medical device platforms

Government tenders and public procurement

Distributor and dealer networks

- Market Share Analysis

- Cross Comparison Parameters (Product Accuracy, Sensor Lifespan, Calibration Requirement, Connectivity Features, Data Analytics Capability, Interoperability with Insulin Pumps, User Interface Experience, Pricing Structure, Reimbursement Compatibility, After Sales Support, Regulatory Compliance, Supply Chain Reliability)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Abbott Diabetes Care

Dexcom

Medtronic Diabetes

Roche Diabetes Care

Ascensia Diabetes Care

Senseonics

Insulet Corporation

Ypsomed

Novo Nordisk Devices

Nipro Diagnostics

Medtrum Technologies

i-SENS

AgaMatrix

Terumo Corporation

B. Braun Medical

- Hospitals focus on CGM for intensive diabetes management and monitoring

- Home care users prioritize ease of use and real time alerts

- Clinics adopt CGM to support personalized treatment planning

- Public healthcare centers emphasize cost effective monitoring solutions

- Forecast Market Value ,2026-2030

- Forecast Installed Units ,2026-2030

- Price Forecast by System Tier ,2026-2030

- Future Demand by Platform ,2026-2030