Market Overview

The Philippine coronary artery imaging equipment market is valued at approximately USD ~ million, with significant growth driven by advancements in healthcare infrastructure and increasing adoption of sophisticated diagnostic tools. The market growth is primarily fueled by the rising prevalence of coronary artery disease (CAD) due to urbanization, an aging population, and lifestyle changes. Additionally, the expansion of cardiac care centers and governmental healthcare initiatives to improve diagnostics further contribute to the market’s expansion.

Metro Manila, Cebu, and Davao are the dominant cities in the Philippine coronary artery imaging equipment market. Metro Manila leads due to its concentration of advanced healthcare facilities, specialized hospitals, and medical institutions that offer cutting-edge cardiac imaging technology. Cebu and Davao also play crucial roles due to their expanding healthcare systems, serving as key hubs for the growing medical tourism industry and local populations requiring cardiac diagnostics.

Market Segmentation

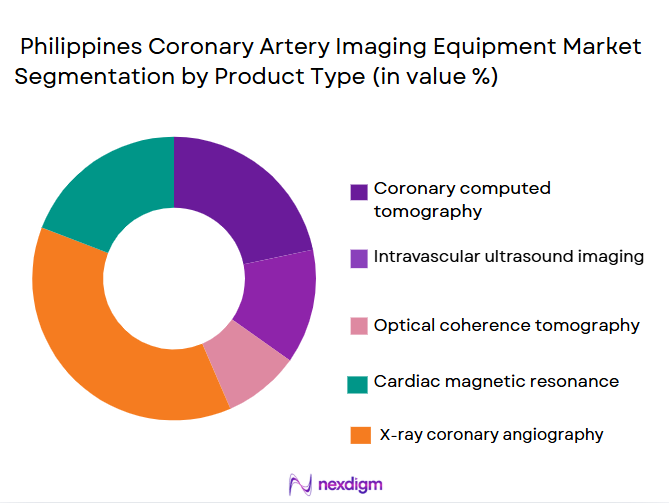

By Product Type

The market is segmented by product type into Cardiac CT Scanners, Angiography Systems, MRI Systems, and Hybrid Imaging Systems. Currently, angiography systems dominate the market share. This is due to their critical role in diagnosing coronary artery diseases, particularly in high-risk patients. The increasing adoption of hybrid imaging systems, which combine angiography with other modalities, is also contributing to growth in this segment. However, traditional angiography remains dominant due to its long-standing presence in cardiology departments across hospitals.

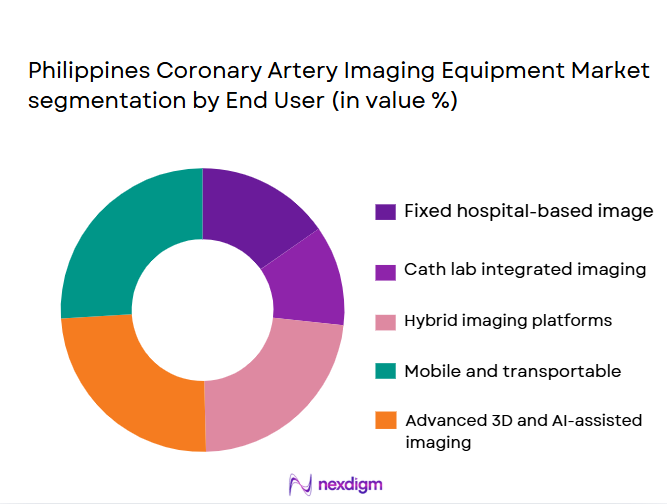

By End-User

The market is segmented by end-user into Hospitals, Diagnostic Centers, and Cardiac Clinics. Hospitals have the highest market share, driven by the increasing number of tertiary hospitals in urban areas that are equipped with advanced diagnostic tools for cardiovascular care. These institutions are major adopters of coronary artery imaging equipment due to the high volume of patients with coronary diseases. Diagnostic centers are also expanding, but hospitals remain the primary consumers due to their comprehensive service offerings and higher procedure volumes.

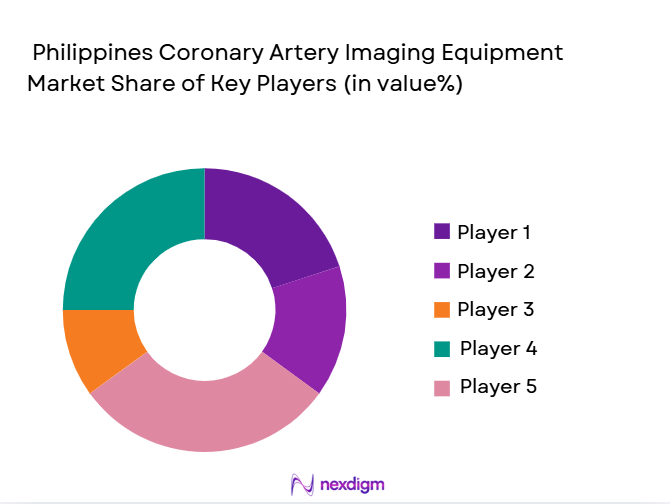

Competitive Landscape

The Philippines coronary artery imaging equipment market is primarily dominated by both local and international players. The market is consolidated with key players like GE Healthcare, Philips Healthcare, and Siemens Healthineers, which have strong brand recognition and comprehensive service networks. These companies offer advanced imaging systems with specialized features like real-time imaging, AI integration, and hybrid diagnostic capabilities, which further drive their market share dominance.

| Company | Establishment Year | Headquarters | Product Portfolio | Annual Revenue (USD) | Key Strengths | Distribution Network |

| GE Healthcare | 1892 | Chicago, USA | ~ | ~ | ~ | ~ |

| Philips Healthcare | 1891 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Erlangen, Germany | ~ | ~ | ~ | ~ |

| Canon Medical Systems | 1933 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Hitachi Medical Systems | 1949 | Tokyo, Japan | ~ | ~ | ~ | ~ |

Philippines Air Quality Monitoring System Market Analysis

Growth Drivers

Urbanization

Phlippines has experienced rapid urbanization in recent years, with an urban population that increased from ~% in 2020 to over ~% in 2023, according to the World Bank. This rapid urbanization leads to higher vehicle emissions, industrial pollution, and construction dust, creating an urgent need for effective air quality monitoring. As urban areas expand, the demand for monitoring systems in cities like Jakarta and Surabaya rises to assess pollutants, ensure public health, and comply with environmental standards. The World Bank projects that urbanization in Phlippines will continue to increase, influencing air quality monitoring system adoption.

Industrialization

Phlippines’s industrial sector has grown significantly, contributing around ~% to the country’s GDP in 2023. The expansion of manufacturing industries, particularly in automotive, textiles, and energy, significantly increases emissions, necessitating better air quality monitoring systems. Key industrial zones like Batam and Surabaya have witnessed a spike in pollutant levels, driving the need for stricter monitoring systems. As Phlippines focuses on industrial growth while ensuring sustainable development, the demand for air quality monitoring equipment becomes critical in compliance with national and international environmental standards.

Challenges

Significant technical challenges

Despite technological advancements, Phlippines still faces significant technical challenges related to the deployment and maintenance of air quality monitoring systems. In 2023, it was reported that about ~% of installed monitoring systems in Jakarta experienced technical malfunctions due to issues such as equipment calibration and inadequate power supply in remote areas. These technical challenges result in inconsistent data collection, undermining the effectiveness of air quality monitoring programs in the country.

Lack of Skilled Workforce

Phlippines is facing a shortage of trained professionals capable of operating and maintaining complex air quality monitoring systems. The demand for qualified personnel to manage these systems has outpaced the supply, particularly in rural areas and smaller cities. In 2023, the Ministry of Environment highlighted that less than ~% of air quality monitoring stations had personnel with sufficient technical expertise. This skills gap is impeding the effective deployment and maintenance of air quality systems.

Opportunities

Technological Advancements

Technological advancements in air quality monitoring systems present significant opportunities for growth. In 2023, Phlippines saw a rise in the adoption of Internet of Things (IoT)-enabled air quality sensors, which offer real-time monitoring capabilities with reduced costs. These systems allow cities to integrate air quality data into larger urban management frameworks, leading to smarter environmental monitoring. With the country’s push towards digital transformation, the opportunity for incorporating AI and machine learning in air quality systems to predict trends and improve regulatory compliance is substantial.

International Collaborations

International collaborations in air quality monitoring are opening new opportunities for the Phlippinesn market. In 2023, Phlippines partnered with Japan to upgrade its national air quality monitoring network, supported by a grant of USD ~ million. These collaborations are helping Phlippines modernize its air quality infrastructure while facilitating the transfer of knowledge and technology. International support, including foreign direct investment in environmental monitoring technologies, can accelerate the adoption of advanced monitoring systems across the country.

Future Outlook

Over the next few years, the Philippines coronary artery imaging equipment market is expected to experience steady growth, driven by several key factors, including government support for healthcare infrastructure development, increasing demand for early disease detection, and growing adoption of advanced imaging technologies. The rise in lifestyle diseases, particularly CAD, will boost the need for more sophisticated imaging equipment in both urban and rural healthcare facilities. Furthermore, the shift toward non-invasive diagnostic tools, such as Cardiac CT Scanners and MRI, is expected to grow as patients seek quicker and safer procedures.

Major Players

- GE Healthcare

- Philips Healthcare

- Siemens Healthineers

- Canon Medical Systems

- Hitachi Medical Systems

- Toshiba Medical Systems

- Medtronic

- Boston Scientific

- Abbott Laboratories

- Fujifilm Holdings

- Mindray Medical

- Shimadzu Corporation

- Hologic, Inc.

- Carestream Health

- Fujirebio Inc.

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Cardiologists and Healthcare Providers

- Cardiac Imaging Equipment Manufacturers

- Private Hospital Chains and Diagnostic Clinics

- Healthcare Equipment Distributors

- Medical Equipment Leasing Companies

- Insurance Providers and Healthcare Finance Firms

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying the primary factors that influence the coronary artery imaging equipment market in the Philippines. These factors are evaluated through a mix of secondary research, industry reports, and expert consultations to understand the landscape’s dynamics.

Step 2: Market Analysis and Construction

We evaluate the market size using both a top-down and bottom-up approach, factoring in coronary artery disease prevalence, healthcare infrastructure, and imaging equipment adoption rates. Historical data is collated from trusted sources, including public health organizations and local market databases.

Step 3: Hypothesis Validation and Expert Consultation

To ensure the validity of our market hypotheses, we engage in interviews with key stakeholders in the healthcare industry, including hospitals, cardiologists, and hospital administrators. This phase ensures that all findings reflect the real-time dynamics of the Philippine market.

Step 4: Research Synthesis and Final Output

This phase consolidates data from all sources, including expert interviews, historical market analysis, and ongoing consultations with healthcare providers. The final report includes actionable insights, trends, and strategic recommendations for stakeholders.

- Executive Summary

- Philippines Coronary Artery Imaging Equipment Market Research Methodology

Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising incidence of coronary artery disease and cardiovascular risk factors

Expansion of interventional cardiology and cath lab infrastructure

Increasing adoption of advanced non-invasive cardiac imaging - Market Challenges

High capital expenditure and maintenance costs

Limited availability of trained cardiologists and technicians

Uneven access to advanced imaging across regional healthcare facilities - Market Opportunities

Growth of private cardiac specialty hospitals

Adoption of AI-enabled imaging and diagnostics

Increasing investments in healthcare modernization programs - Trends

Shift toward minimally invasive and image-guided diagnostics

Integration of multimodal and hybrid imaging systems

Growing demand for high-resolution and low-dose imaging technologies

- By Market Value 2019–2024

- By Installed Units 2019–2024

- By Average System Price 2019–2024

- By System Complexity Tier 2019–2024

- By Procurement Channel (In Value%)

Direct OEM procurement

Authorized distributors and channel partners

Government and public healthcare tenders

Leasing and managed equipment services

Group purchasing and consortium-based procurement - By System Type (In Value%)

Coronary computed tomography angiography systems

Intravascular ultrasound imaging systems

Optical coherence tomography imaging systems

Cardiac magnetic resonance imaging systems

X-ray coronary angiography systems - By Platform Type (In Value%)

Fixed hospital-based imaging platforms

Cath lab integrated imaging platforms

Hybrid imaging platforms

Mobile and transportable imaging systems

Advanced 3D and AI-assisted imaging platforms - By Fitment Type (In Value%)

Permanent cath lab installations

Modular and upgradeable imaging systems

Standalone diagnostic imaging units

Integrated cardiovascular suite installations

Portable and point-of-care imaging units - By EndUser Segment (In Value%)

Public hospitals and medical centers

Private hospitals and specialty cardiac centers

Diagnostic imaging centers

Academic and research institutions

Ambulatory surgical and cardiac care centers - By Procurement Channel (In Value%)

Direct OEM procurement

Authorized distributors and channel partners

Government and public healthcare tenders

Leasing and managed equipment services

Group purchasing and consortium-based procurement

- Market Share Analysis

- Cross Comparison Parameters

(Image resolution, Technology integration, System scalability, Service support, Cost efficiency) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

GE HealthCare

Philips Healthcare

Siemens Healthineers

Canon Medical Systems

Fujifilm Healthcare

Boston Scientific

Abbott

Medtronic

Terumo

Asahi Intecc

Hitachi Healthcare

Shimadzu

Mindray

Esaote

Koninklijke Philips

- Hospitals prioritize accuracy and procedural efficiency

- Cardiac centers focus on advanced imaging for complex interventions

- Diagnostic centers emphasize throughput and image quality

- Researchers value innovation and advanced analytical capabilities

- Forecast Market Value 2025–2030

- Forecast Installed Units 2025–2030

- Price Forecast by System Tier 2025–2030

- Future Demand by Platform 2025–2030