Market Overview

The Philippines crankshafts market is valued at approximately USD ~ million in 2024, based on the local “transmission shafts and cranks” import/consumption data. This market size is driven by rising local vehicle production and aftermarket replacement demand, as well as increasing imports of engine-and-transmission components into the Philippines. The rebound in automotive assembly and component supply chain activity underpins the crankshaft requirement.

Key cities and regions dominate the market: the CALABARZON industrial belt (Laguna, Batangas) hosts the major automotive OEMs and component suppliers, while Metro Manila is the hub for aftermarket distribution and remanufacturing. These locations dominate due to their strong production clusters, access to port and logistics infrastructure, and concentration of skilled machining/metal-working capabilities.

Market Segmentation

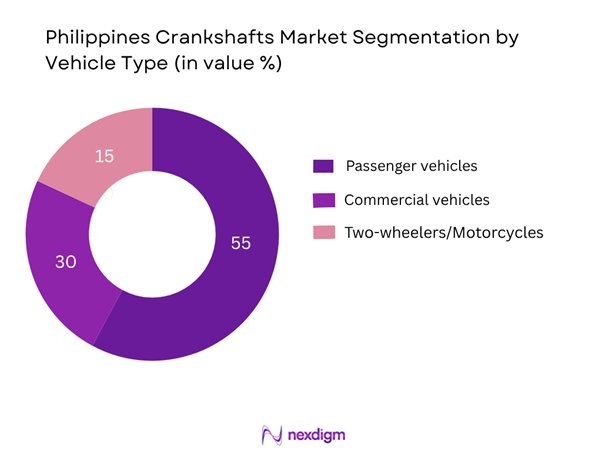

By Vehicle Type

In 2024, the passenger vehicles segment dominates the market share because the largest portion of engine assembly and replacement parts in the Philippines centres around passenger car production and the aftermarket for cars. The growth in personal vehicle ownership, expansion of vehicle financing and improved road infrastructure are supporting this segment. Commercial vehicle manufacturing and heavy-duty aftermarket remain smaller in volume, and two-wheelers require simpler crankshaft designs with less sophisticated machining, reducing their relative share of value-chain crankshaft demand.

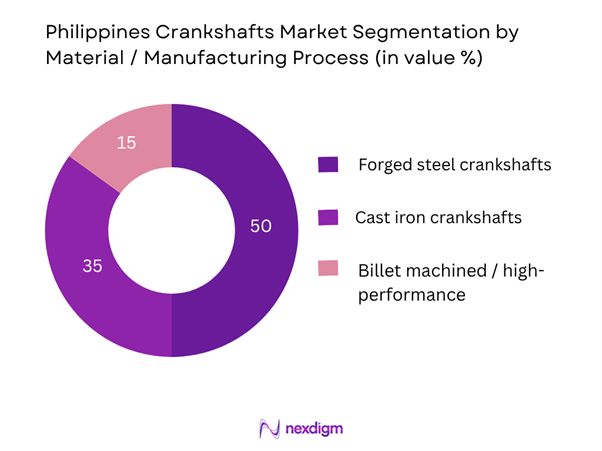

By Material / Manufacturing Process

The forged steel crankshafts sub-segment leads in 2024 because OEMs and Tier-1 suppliers servicing the Philippines increasingly specify forged steel to meet durability, vibration (NVH) and service life demands for both passenger and commercial vehicles. Cast-iron still holds significant share due to cost-sensitive aftermarket replacement and older engine lines. The billet/high-performance sub-segment is smaller because it caters to niche remanufacturing, high-performance engines or export-oriented fabrication, rather than the mass domestic market.

Competitive Landscape

The Philippine crankshafts market is characterised by a mix of local metal-machining firms, remanufacturers, component importers, and global forging material suppliers. A handful of key players exert influence on supply-chain standards, local content sourcing, and aftermarket distribution, thereby shaping competitiveness and localisation of crankshaft supply.

|

Philippines Crankshafts Market Analysis

Growth Drivers

Rising vehicle production/registration

The Philippines new motor-vehicle sales reached 475,094 units in 2024, up from 441,393 units in 2023. This expansion in the automotive sector drives increased demand for engine components such as crankshafts, as more vehicles assembled implies higher upstream component requirements. In addition, motor-vehicle production in the Philippines rose 17.3% in the first eight months of 2024 (86,585 units from 73,789 units a year earlier). The combination of stronger production and registration means more OEM demand and subsequent aftermarket replacement cycles, making the crankshaft segment more active.

Engine downsizing trends

While global automotive trends favour smaller-capacity engines with higher efficiency, in the Philippine context manufacturers focusing on compact and mid-sized vehicles means greater absolute volume of crankshafts needed per engine variant. With over 59,875 passenger vehicles sold in the first half of 2024 and representing strong year-on-year growth, there is a shift in engine technology which often prompts newer crankshaft specifications (lighter weight, higher strength) and thus stimulates demand in the crankshaft manufacturing and supply chain. As local vehicle OEMs upgrade models and variants, the requirement for improved crankshaft materials and machining increases, pushing component demand upwards.

Market Challenges

Shift to EVs reducing ICE crankshaft demand

As global automotive trends pivot toward electric vehicles (EVs), internal-combustion engine (ICE) crankshaft demand faces a structural headwind. In the Philippines, for instance, the government has extended a zero-tariff policy for EVs and parts until 2028, signifying policy support for electrification. Although ICE vehicles still dominate the market, this shift implies that over time crankshaft demand may taper for certain segments. The automotive OEMs may reduce ICE engine production or shift to hybrid/EV powertrains which require fewer or different crankshaft configurations, presenting a challenge for traditional crankshaft suppliers.

Supply chain disruptions for steel billets

The Philippine steel industry is heavily import-dependent: in 2023 the country imported about 7.1024 million metric tonnes of steel with a value of US$4.6907 billion. For crankshaft manufacturing, access to high-quality steel billets and forgings is critical. Disruptions in import flows, foreign exchange fluctuations, or logistical issues can delay production of crankshafts, increase costs or reduce margins. Given that the Philippines exports only ~80,000 tonnes of steel in 2023 and falls far short of domestic demand, the reliance on imported raw material heightens vulnerability for the crankshaft segment.

Market Opportunities

Remanufacturing growth

With the Philippine vehicle fleet increasing (for example, new vehicle sales of 475,094 units in 2024) the aftermarket and remanufacturing segment for engine components including crankshafts presents a substantial opportunity. Older vehicles needing refurbishment or engine overhauls create demand for remanufactured crankshafts which often offer cost-advantages and sustainability benefits. Furthermore, local manufacturing houses can capture this segment by offering remanufacturing services, aligning with circular economy practices. With the large in-use fleet and increasing maintenance activity, this segment represents a growth opportunity for crankshaft suppliers beyond OEM work.

Lightweight materials

As OEMs aim to meet stricter fuel efficiency and emissions targets, the demand for lightweight and high-strength materials in crankshafts (e.g., forged steel, billet machining, aluminium-alloy integration) is rising. The Philippines steel market size reached approximately US$19,488 million in 2024. This scale of steel market demonstrates availability of raw-material investment and potential for value-added component manufacturing. For crankshaft suppliers, shifting from cast iron to forged steel or billet machining offers differentiation and higher margins, enabling local firms to upgrade capability and capture premium segments.

Future Outlook

Over the next decade the Philippines crankshafts market is expected to show steady growth, driven by rising vehicle production, increasing aftermarket replacement demand, and gradual localisation of engine component manufacturing. The push by automotive OEMs and Tier-1 suppliers to increase local content, mitigate supply-chain risks, and support export-oriented engine assembly in ASEAN will underpin expansion. Moreover, the transition in engine technology (downsizing, hybridisation) will place pressure on crankshaft design and manufacturing, opening opportunities for higher-value forged or machined products.

Major Players

- Yutivo Corporation

- Precision Foundry of the Philippines

- Takahashi Machineries Philippines Inc.

- Goodyear Steel Pipe Corporation

- Daido Steel Co. Ltd. (via Philippine supply chain)

- Sumitomo Metal Industries / Nippon Steel Corporation (ASEAN Division)

- Riken Motor Sales Philippines

- Federal-Mogul / Tenneco Powertrain (Philippine Distribution)

- Mahle Group (ASEAN Region)

- Toyota Motor Philippines Corporation (OEM / powertrain assembly)

- Isuzu Philippines Corporation

- Honda Cars Philippines Inc.

- Mitsubishi Motors Philippines Corporation

- MD Juan Enterprises (Aftermarket crankshaft reconditioning)

- AISIN Philippines Corporation

Key Target Audience

- Automotive OEMs (assembly & engine manufacturers)

- Tier-1 and Tier-2 crankshaft suppliers (metal-working & forging houses)

- Aftermarket component distributors and remanufacturers

- Investment and venture capital firms evaluating component-manufacturing opportunities

- Government and regulatory bodies (such as the Board of Investments Philippines, Department of Trade and Industry)

- Export-oriented metal-component manufacturers & clusters

- Industrial real-estate developers in automotive parks (CALABARZON and beyond)

- Engineering procurement and supply-chain managers in automotive component sourcing

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Philippines crankshafts market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics (e.g., vehicle production volumes, aftermarket replacement cycles, import flows, local manufacturing capacity).

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to vehicle production, import/consumption of crankshaft-and-transmission components in the Philippines were compiled and analysed. This includes assessing manufacturing throughput, automotive OEM assembly trends, and resultant revenue generation for crankshaft suppliers. Furthermore, trade and import-data were evaluated to ensure reliability of the estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses (such as growth of localisation, import substitution, aftermarket remanufacturing growth) were developed and subsequently validated through telephone interviews (CATI) with industry experts representing automotive OEMs, component suppliers, and metal-working firms operating in the Philippines and ASEAN region. These consultations provided operational and financial insights directly from industry practitioners, instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple component manufacturers, automotive OEMs, and supply-chain stakeholders to acquire detailed insights into production capacity, supply-chain constraints, and future plans. This interaction served to verify and complement the bottom-up statistical estimates, thereby ensuring a comprehensive, accurate, and validated analysis of the Philippines crankshafts market.

- Executive Summary

- Research Methodology (Market definitions and assumptions, Abbreviations and glossary, Market sizing approach, Data sources: Primary research, Secondary research, Consolidated research approach: triangulation of supply-side, demand-side, trade flows, local manufacturing capacity, Research limitations and assumptions)

- Definition and Scope of the Market

- Market Genesis & Evolution in the Philippines

- Timeline of Major Developments

- Industry Value Chain & Supply-Chain Structure

- Stakeholder Ecosystem

- Growth Drivers

Rising vehicle production/registration

Engine downsizing trends

Aftermarket replacement demand

Export-oriented engine assembly - Market Challenges

Shift to EVs reducing ICE crankshaft demand

Supply chain disruptions for steel billets

Import-duty/regulation pressures - Opportunities

Remanufacturing growth

Lightweight materials

Export potential to ASEAN

Niche high-performance crankshafts - Key Trends

Material substitution

Consolidation of Tier-1 suppliers

Localization of manufacturing in Philippines

Engine downsizing/hybrid integration) - Regulatory & Policy Landscape

Philippine import tariffs

Local content requirements

Emissions standards impacting ICE engines - Porter’s Five Forces Analysis

- SWOT Analysis

- By Value (PHP billion / USD million), 2019-2024

- By Volume (units / tonnes), 2019-2024

- By Average Selling Price (PHP/USD), 2019-2024

- By Vehicle Type (In value %)

Passenger vehicles

Commercial vehicles

Two-wheelers / Motorcycles - By Material Type (In value %)

Cast iron crankshafts

Forged steel crankshafts

Billet machined crankshafts / high-performance alloys - By Manufacturing Process (In value %)

Precision forging

Casting

CNC machining & heat-treatment/surface finishing - By End-Use (In value %)

OEM (original equipment)

Aftermarket (replacement and remanufactured crankshafts) - By Region / Location within Philippines (In value %)

Luzon region

Visayas region

Mindanao region - By Import vs Local Manufacturing (In value %)

Fully imported crankshafts

Locally manufactured crankshafts

Remanufactured / re-conditioned crankshafts

- Market Share of Major Players (by value & volume) – Philippine region

- Cross Comparison Parameters (Company overview, Business strategies, Recent developments, Strengths & weaknesses, Manufacturing plant location(s) in Philippines / ASEAN / global, Production capacity (units / tonnes) and utilisation, Geographical footprint, Product portfolio, Average selling price / margin profile, Supply-chain integration, Local content percentage & import dependency, Distribution & service network, Environmental / sustainability credentials)

- Detailed Profiles of Major Companies:

Toyota Motor Philippines Corporation

Isuzu Philippines Corporation

Mitsubishi Motors Philippines Corporation

Honda Cars Philippines Inc.

Yutivo Corporation

MD Juan Enterprises

Precision Foundry of the Philippines

Goodyear Steel Pipe Corporation

Takahashi Machineries Philippines Inc.

Daido Steel Co. Ltd.

Sumitomo Metal Industries / Nippon Steel Corporation

Riken Motor Sales Philippines

Federal-Mogul / Tenneco Powertrain

Mahle Group

AISIN Philippines Corporation

- OEM Demand Profile

- Aftermarket Demand Profile

- Purchasing Behaviour & Budget Allocation

- Decision-Making & Procurement Process

- Pain-Points & Buyer Requirements

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030