Market Overview

The Philippines Crash Boxes market current size stands at around USD ~ million, reflecting steady momentum supported by rising safety integration across passenger and commercial vehicles. In the most recent year, the market expanded to nearly USD ~ million, driven by increased installation volumes of ~ units across OEM and aftermarket channels. Growth has been reinforced by higher deployment of crash management systems in ~ vehicles, alongside expanding imports of lightweight aluminum and hybrid crash structures, indicating a gradual shift toward higher-value safety components.

Market activity is primarily concentrated in Metro Manila, Central Luzon, and CALABARZON, where vehicle assembly hubs, logistics corridors, and major dealership networks are located. These regions benefit from stronger repair ecosystems, higher fleet density, and faster adoption of safety-focused vehicle platforms. The presence of major ports and industrial parks also supports smoother inflow of crash box components, while regulatory alignment with international vehicle safety frameworks further strengthens demand concentration in these urban and peri-urban automotive clusters.

Market Segmentation

By Fleet Type

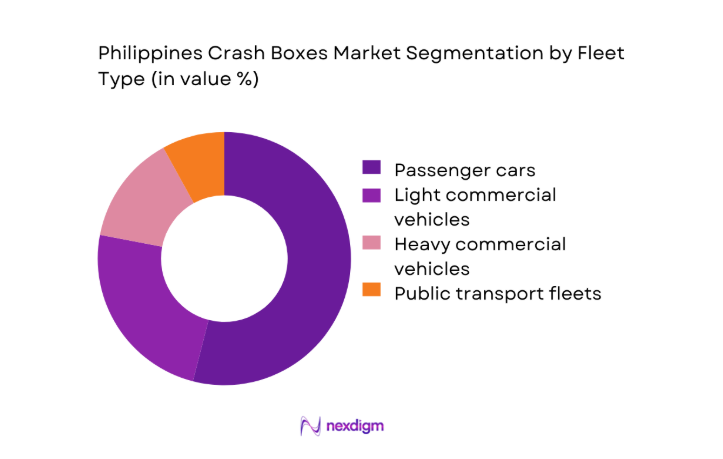

Passenger cars dominate the Philippines crash boxes market due to their significantly larger parc size and higher replacement frequency following minor and moderate collisions. The segment benefits from consistent demand across both OEM fitment and aftermarket repair channels, supported by urban traffic density and increasing insurance penetration. Light commercial vehicles follow closely, driven by last-mile delivery expansion and fleet modernization programs. Heavy commercial vehicles and public transport fleets contribute steadily, particularly through refurbishment cycles rather than new installations. Overall, fleet-based demand remains structurally tied to accident exposure, vehicle utilization intensity, and the growing emphasis on cost-efficient crash repair systems.

By Technology Architecture

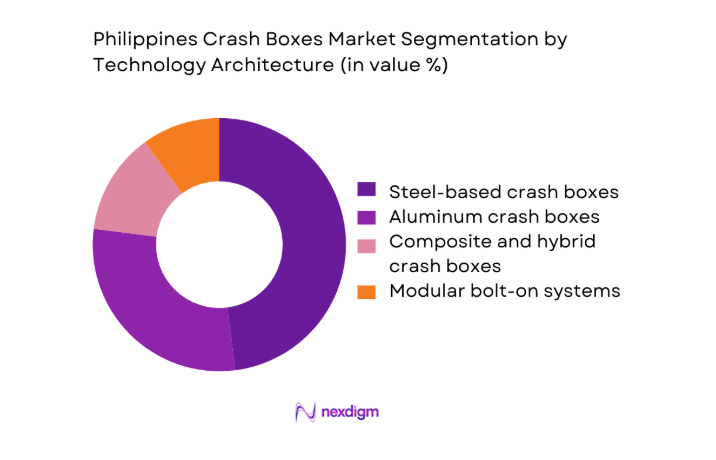

Steel-based crash boxes continue to lead the market due to cost efficiency and compatibility with mass-market vehicle platforms. However, aluminum crash boxes are gaining traction as OEMs prioritize weight reduction and improved energy absorption performance. Composite and hybrid material systems remain niche but are increasingly specified in premium and electric vehicle platforms. Modular bolt-on crash box systems are also expanding rapidly, particularly in the aftermarket, as they reduce repair time and total replacement cost. This technology shift reflects a broader transition toward repair-friendly and performance-optimized crash management architectures.

Competitive Landscape

The Philippines crash boxes market shows moderate concentration, with a mix of global automotive safety suppliers and regional component manufacturers serving OEM and aftermarket demand. Competitive intensity is shaped by technology depth, supply chain reliability, and long-term platform approvals rather than price competition alone.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Autoliv | 1953 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

| ZF Friedrichshafen | 1915 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Magna International | 1957 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Gestamp Automoción | 1997 | Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Hyundai Mobis | 1977 | South Korea | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Crash Boxes Market Analysis

Growth Drivers

Rising vehicle safety awareness among Filipino consumers

Growing awareness of vehicle safety has translated into higher demand for crash protection components across new and existing vehicles. In recent years, installations of crash management systems reached ~ units annually, reflecting adoption across ~ vehicles in urban centers. Insurance-linked repair mandates have also driven the replacement of damaged crash boxes valued at USD ~ million each year. As safety awareness deepens, workshops report servicing volumes exceeding ~ systems annually, reinforcing steady aftermarket consumption. This behavioral shift has created a measurable uplift in unit movement and has strengthened the business case for OEMs to standardize crash box integration across mid-range vehicle platforms.

Increasing adoption of global NCAP-aligned safety standards by OEMs

OEM alignment with international crash performance benchmarks has directly expanded demand for standardized energy absorption components. Platform upgrades have led to the installation of crash boxes in ~ vehicles annually, up from ~ vehicles in earlier cycles. This transition has supported procurement volumes of ~ units per year across assembly operations, translating into market value expansion of USD ~ million through higher-specification parts. The push for improved frontal and rear impact ratings has also increased average system complexity, raising installed base figures to ~ systems nationwide and accelerating the shift toward modular crash management solutions.

Challenges

Limited local manufacturing base for advanced crash box technologies

The domestic supply chain remains constrained, with most advanced crash boxes imported, resulting in dependence on ~ shipments annually from overseas suppliers. This reliance has pushed logistics-related expenditures to around USD ~ million per year, affecting lead times and inventory stability. Local fabrication capacity accounts for only ~ units annually, insufficient to meet rising OEM and aftermarket demand. As a result, service centers often face component shortages impacting ~ vehicles each month, creating operational bottlenecks. The lack of localized production also limits technology transfer and slows the adoption of lightweight and composite crash box systems.

Price sensitivity in mass-market vehicle segments

Cost considerations heavily influence purchasing decisions, particularly in entry-level passenger vehicles where crash box replacement budgets average USD ~ million across the repair ecosystem annually. Workshops typically service ~ units per year using lower-cost alternatives, which constrains penetration of premium safety components. Fleet operators managing ~ vehicles prioritize affordability over advanced material specifications, limiting demand for higher-priced aluminum and hybrid crash boxes. This sensitivity suppresses margin expansion for suppliers and restricts investment in localized manufacturing, reinforcing a cycle of dependency on imported, cost-optimized components rather than innovation-led upgrades.

Opportunities

Localization of crash box manufacturing within ASEAN supply chains

The expansion of regional automotive manufacturing presents strong potential for localized crash box production. Establishing facilities capable of producing ~ units annually could reduce import dependence by a significant margin and retain USD ~ million within the domestic value chain. Proximity to vehicle assembly clusters would shorten delivery cycles for ~ systems each year, improving supply resilience. Localization also supports the development of skilled labor pools across ~ plants and enables faster customization for platform-specific requirements, positioning the Philippines as a competitive node in the broader ASEAN automotive safety components network.

Rising electrification creating demand for lightweight crash structures

The gradual shift toward electric and hybrid vehicles is increasing demand for lightweight crash management systems designed to protect battery packs. Recent platform introductions have driven installations of ~ units of aluminum and hybrid crash boxes across ~ vehicles annually. This segment already represents USD ~ million in emerging value, with strong growth potential as electrified fleets expand. Lightweight structures also support range efficiency, making them strategically important for OEMs. As electrification accelerates, suppliers positioned in advanced materials stand to capture a growing share of next-generation crash safety demand.

Future Outlook

The Philippines crash boxes market is expected to evolve steadily toward higher-value safety components as vehicle platforms modernize and regulatory alignment deepens. Growing electrification, expanding fleet renewal programs, and rising insurance-linked repair standards will shape long-term demand. Over the coming years, the market will increasingly favor modular, lightweight, and repair-friendly crash management systems, strengthening opportunities for suppliers that can combine localized production with advanced engineering capabilities.

Major Players

- Autoliv

- ZF Friedrichshafen

- Magna International

- Gestamp Automoción

- Benteler Automotive

- thyssenkrupp Automotive Technology

- Martinrea International

- CIE Automotive

- Aisin Corporation

- Toyoda Gosei

- Hyundai Mobis

- KIRCHHOFF Automotive

- Autokiniton

- OPmobility

- Valeo

Key Target Audience

- Automotive OEMs and vehicle assemblers

- Tier I and Tier II automotive component suppliers

- Fleet operators and logistics companies

- Public transport authorities and fleet modernization agencies

- Automotive aftermarket distributors and service chains

- Insurance companies and accident repair networks

- Investments and venture capital firms

- Government and regulatory bodies including the Department of Transportation and the Land Transportation Office

Research Methodology

Step 1: Identification of Key Variables

Core demand drivers, supply constraints, and regulatory influences were mapped across OEM and aftermarket channels. Key performance indicators included installation volumes, replacement frequency, and material adoption trends. Market boundaries were defined by vehicle classes and crash management system architectures.

Step 2: Market Analysis and Construction

Historical and current market behavior was analyzed using bottom-up aggregation of component demand. Supply chain flows, import dependency, and localization potential were assessed to build a comprehensive market structure model aligned with industry realities.

Step 3: Hypothesis Validation and Expert Consultation

Industry practitioners across manufacturing, repair networks, and fleet operations were consulted to validate assumptions. Their inputs helped refine demand elasticity, technology adoption timelines, and operational bottlenecks influencing market performance.

Step 4: Research Synthesis and Final Output

All findings were consolidated into a unified analytical framework. Insights were stress-tested for consistency and relevance, ensuring the final output reflects practical market dynamics and strategic decision-making needs.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, crash box taxonomy across front rear and modular energy absorbers, market sizing logic by vehicle production and crash module content value, revenue attribution across components materials and service parts, primary interview program with OEMs Tier 1 suppliers and body structure specialists, data triangulation validation assumptions and limitations)

- Definition and scope of automotive crash box systems

- Market evolution in relation to vehicle safety standards

- Usage pathways across OEM and aftermarket channels

- Ecosystem structure including Tier I, Tier II, and assemblers

- Supply chain and localization dynamics in ASEAN context

- Regulatory and road safety environment in the Philippines

- Growth Drivers

Rising vehicle safety awareness among Filipino consumers

Increasing adoption of global NCAP-aligned safety standards by OEMs

Growth in light commercial vehicle and fleet-based transport demand

Expansion of local vehicle assembly and CKD operations

Higher accident rates driving demand for crash repair and replacement parts

Integration of crash management systems with modern vehicle platforms - Challenges

Limited local manufacturing base for advanced crash box technologies

Price sensitivity in mass-market vehicle segments

Dependence on imported steel and aluminum components

Fragmented aftermarket with quality consistency issues

Slow regulatory enforcement of advanced safety components

Logistics and supply chain disruptions affecting Tier II suppliers - Opportunities

Localization of crash box manufacturing within ASEAN supply chains

Rising electrification creating demand for lightweight crash structures

Growth in fleet renewal programs for public transport modernization

Aftermarket premiumization for certified safety components

Partnerships between global Tier I suppliers and local assemblers

Expansion of export-oriented production for Southeast Asia - Trends

Shift from steel to aluminum and hybrid crash box materials

Increased modularization of front-end crash management systems

Greater OEM focus on repair-friendly crash box designs

Integration of crash structures with pedestrian safety systems

Use of simulation and digital twin tools in crash box design

Standardization of crash performance metrics across platforms - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Passenger cars

Light commercial vehicles

Heavy commercial vehicles

Public transport fleets including buses and jeepneys - By Application (in Value %)

Front crash management systems

Rear crash management systems

Side impact energy absorption systems - By Technology Architecture (in Value %)

Steel-based crash boxes

Aluminum crash boxes

Composite and hybrid material crash boxes

Modular bolt-on crash box systems - By End-Use Industry (in Value %)

Automotive OEMs

Aftermarket replacement suppliers

Fleet operators and transport companies

Bus and truck body builders - By Connectivity Type (in Value %)

Non-connected passive crash boxes

Sensor-integrated crash boxes for ADAS alignment - By Region (in Value %)

National Capital Region

Luzon

Visayas

Mindanao

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (material type, energy absorption rating, component weight, unit cost, localization rate, OEM platform approvals, production capacity in ASEAN, aftermarket coverage)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Autoliv

ZF Friedrichshafen

Magna International

Gestamp Automoción

Benteler Automotive

thyssenkrupp Automotive Technology

Martinrea International

CIE Automotive

Aisin Corporation

Toyoda Gosei

Hyundai Mobis

KIRCHHOFF Automotive

Autokiniton

OPmobility

Valeo

- Demand and utilization drivers across OEM and fleet segments

- Procurement and tender dynamics among vehicle assemblers

- Buying criteria including safety certification and lifecycle cost

- Budget allocation and financing preferences in fleet upgrades

- Implementation barriers and risk factors in aftermarket adoption

- Post-purchase service and warranty expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030