Market Overview

The Philippines Curtain Walls Market recorded an assessed market value of USD ~ billion based on a recent historical assessment, supported by construction expenditure data from the Philippine Statistics Authority and project pipeline disclosures from the Department of Public Works and Highways. Market expansion is driven by sustained high-rise commercial development, large-scale residential condominium projects, and mixed-use urban complexes. Strong demand for energy-efficient façades, compliance with updated building codes, and increased adoption of unitized curtain wall systems continue to support procurement volumes. Imports of aluminum systems and architectural glass remain critical to meeting specification requirements.

Metro Manila dominates the Philippines Curtain Walls Market due to concentrated commercial real estate development, infrastructure density, and the presence of major property developers. Cities such as Makati, Bonifacio Global City, and Ortigas serve as primary demand centers driven by office towers, premium residential buildings, and mixed-use developments. Cebu and Davao follow as secondary hubs due to regional urbanization and tourism-linked construction. Dominance is further supported by access to skilled façade contractors, logistics infrastructure, proximity to ports, and alignment with international architectural and safety standards.

Market Segmentation

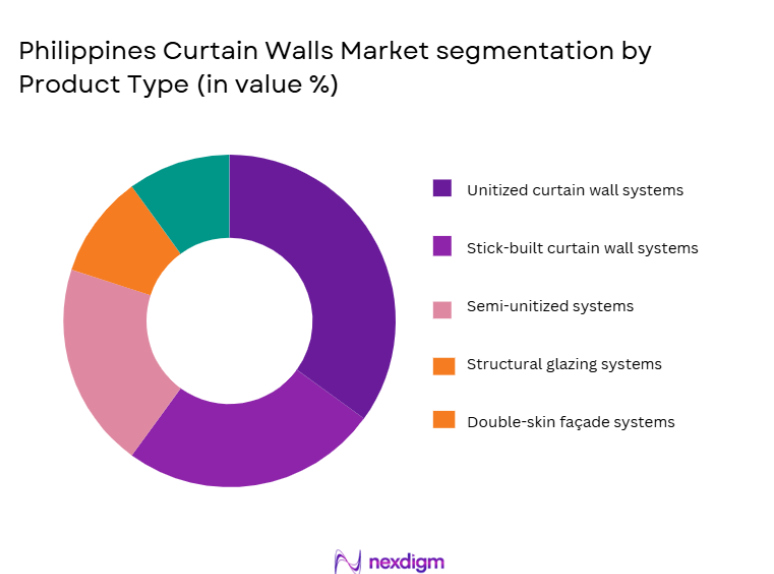

By Product Type

By product type, the Philippines Curtain Walls Market is segmented into unitized curtain wall systems, stick-built curtain wall systems, semi-unitized systems, structural glazing systems, and double-skin façade systems. Recently, unitized curtain wall systems have held a dominant market share due to faster installation timelines, superior quality control, and reduced on-site labor dependency. Large-scale commercial and residential high-rise projects increasingly favor unitized systems because they are factory-assembled, ensuring consistency and compliance with performance standards. The ability to handle wind load, seismic considerations, and water penetration efficiently makes them suitable for dense urban environments. Developers also prefer unitized systems for predictable project scheduling, reduced construction risk, and compatibility with modern architectural designs. These advantages collectively reinforce their dominance.

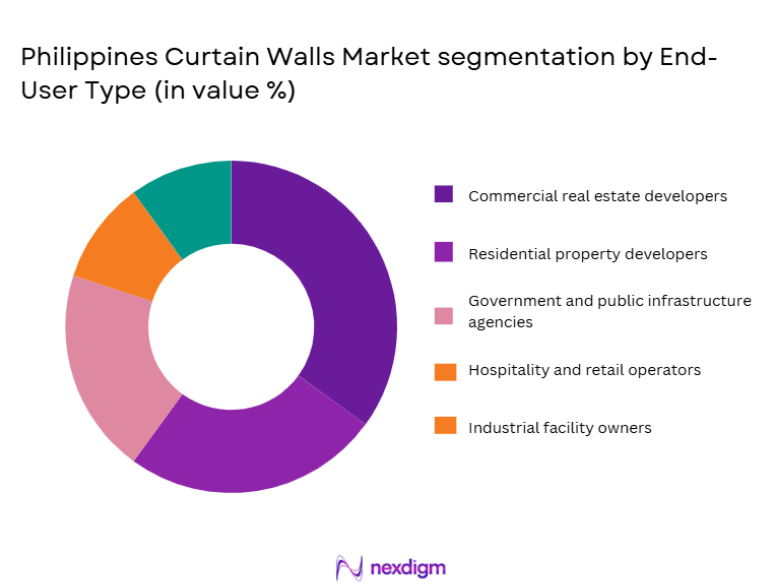

By End User

By end user, the Philippines Curtain Walls Market is segmented into commercial real estate developers, residential property developers, government and public infrastructure agencies, hospitality and retail operators, and industrial facility owners. Recently, commercial real estate developers have accounted for the dominant market share due to sustained investment in office towers, business districts, and mixed-use developments. Demand is driven by requirements for high-performance façades that enhance building aesthetics, thermal efficiency, and long-term asset value. Commercial developers prioritize premium materials and advanced glazing to meet tenant expectations and international building standards. The concentration of corporate offices and multinational tenants further strengthens this segment’s influence. Continuous redevelopment and vertical expansion support its leading position.

Competitive Landscape

The Philippines Curtain Walls Market exhibits moderate consolidation, with international façade system providers and established regional manufacturers exerting strong influence through technology leadership and project execution capabilities. Global players partner with local fabricators and contractors to strengthen market reach and compliance. Competitive intensity is shaped by pricing, customization capability, supply reliability, and after-sales technical support.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Local Manufacturing Presence |

| AGC Flat Glass Philippines | 1907 | Philippines | ~

|

~

|

~

|

~

|

~

|

| Saint-Gobain Philippines | 1665 | France | ~

|

~

|

~

|

~

|

~

|

| Guardian Glass Philippines | 1932 | USA | ~

|

~

|

~

|

~

|

~

|

| YKK AP Asia Pacific | 1934 | Japan | ~

|

~

|

~

|

~

|

~

|

| Schüco Philippines | 1951 | Germany | ~

|

~

|

~

|

~

|

~

|

Philippines Curtain Walls Market Analysis

Growth Drivers

Urban High-Rise Construction and Commercial Real Estate Expansion

The Philippines Curtain Walls Market is strongly supported by sustained vertical development in major metropolitan centers driven by population density, land constraints, and corporate expansion. Developers increasingly favor high-rise structures to optimize land use and improve commercial returns. Curtain wall systems enable modern architectural designs while meeting structural and safety requirements in dense urban environments. Office towers, mixed-use complexes, and premium residential buildings require high-performance façades to address wind load, seismic conditions, and thermal efficiency. Public and private investments in business districts reinforce continuous construction activity. The demand for faster construction timelines further supports the adoption of advanced curtain wall technologies. Regulatory compliance and international building standards increase the use of certified façade systems. These combined factors maintain consistent procurement volumes. The resulting ecosystem supports manufacturers, fabricators, and installers across the value chain.

Energy Efficiency and Building Performance Regulations

Regulatory emphasis on sustainable construction directly accelerates demand in the Philippines Curtain Walls Market by mandating higher thermal and energy performance standards. Curtain wall systems with advanced glazing help reduce heat gain and energy consumption in commercial buildings. Developers adopt these systems to comply with green building certifications and national energy efficiency frameworks. Improved indoor comfort and reduced operational costs enhance building value and tenant appeal. Government incentives and awareness programs support the adoption of compliant materials. Architectural firms increasingly specify high-performance façades during design stages. Imported glazing technologies further elevate performance benchmarks. Compliance-driven procurement reduces substitution risk. These regulatory dynamics create long-term structural demand.

Market Challenges

Dependence on Imported Façade Materials and Components

The Philippines Curtain Walls Market faces operational constraints due to heavy reliance on imported aluminum systems and architectural glass. Global supply chain disruptions can affect project timelines and cost predictability. Currency fluctuations influence procurement budgets and pricing stability. Limited domestic manufacturing capacity restricts rapid response to demand surges. Import documentation and customs procedures add administrative complexity. Developers must manage extended lead times for specialized components. Technical specifications often require international certification, narrowing supplier options. These factors increase project execution risk. The challenge impacts both large and mid-scale developers.

High Installation Costs and Skilled Labor Constraints

Curtain wall installations require specialized engineering, precision fabrication, and experienced installation teams. The limited availability of trained façade professionals increases labor costs and scheduling risks. Complex building geometries demand advanced installation expertise. Safety compliance and quality assurance requirements further raise operational expenses. Smaller contractors face barriers to entry due to capital and training needs. Project delays can escalate costs and affect developer margins. Training programs remain insufficient to meet growing demand. These constraints slow market scalability. Cost sensitivity remains a persistent challenge.

Opportunities

Adoption of Smart and High-Performance Façade Technologies

The Philippines Curtain Walls Market presents strong opportunities through integration of smart glass and adaptive façade systems. Developers increasingly seek façades that enhance energy efficiency and occupant comfort. Technologies such as low-emissivity coatings and dynamic glazing attract premium projects. Smart façades support building automation and sustainability goals. International technology transfer enhances local capability. Demand from commercial and institutional buildings accelerates adoption. Suppliers offering integrated solutions gain competitive advantage. Innovation-driven differentiation strengthens market positioning. This opportunity supports value-added growth.

Public Infrastructure and Urban Redevelopment Initiatives

Government-led urban renewal and infrastructure programs create new demand channels for curtain wall systems. Transport hubs, civic buildings, and public complexes increasingly adopt modern façade designs. Compliance with safety and durability standards supports advanced system adoption. Public-private partnerships expand project pipelines. Urban regeneration increases construction density in established cities. Façade aesthetics contribute to city branding objectives. Standardization improves procurement efficiency. These initiatives broaden market participation. Long-term visibility supports investment planning.

Future Outlook

The Philippines Curtain Walls Market is expected to maintain stable growth over the next five years, supported by continued urbanization and infrastructure investment. Advancements in energy-efficient glazing and unitized systems will shape procurement preferences. Regulatory alignment with sustainability goals will reinforce demand for high-performance façades. Increasing private and public sector construction activity is expected to sustain consistent market momentum.

Major Players

- AGC Flat Glass Philippines

- Saint-Gobain Philippines

- Guardian Glass Philippines

- YKK AP Asia Pacific

- Schüco Philippines

- Reynaers Aluminium

- AluK Asia

- Alutech Systems Philippines

- Union Galvasteel Corporation

- Metro Glass & Aluminum Supply

- MGlass Philippines

- Alumina Glass Philippines

- DMCI Homes Façade Systems

- EEI Corporation

- Megawide Construction Corporation

Key Target Audience

- Commercial real estate developers

- Residential property developers

- Infrastructure project developers

- Investments and venture capitalist firms

- Government and regulatory bodies

- Construction contractors

- Architectural and façade engineering firms

- Building material suppliers

Research Methodology

Step 1: Identification of Key Variables

Market variables were identified through analysis of construction activity, façade specifications, and regulatory requirements influencing curtain wall adoption.

Step 2: Market Analysis and Construction

Data from government construction statistics, company disclosures, and trade data were analyzed to structure the market and segment demand drivers.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, contractors, and material suppliers were consulted to validate assumptions and ensure technical accuracy.

Step 4: Research Synthesis and Final Output

Findings were consolidated into a structured market framework ensuring consistency, relevance, and clarity.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Urban high-rise construction expansion

Rising demand for energy-efficient building envelopes

Growth in mixed-use and commercial real estate developments - Market Challenges

High initial installation and material costs

Dependence on imported façade components

Skilled labor and technical expertise constraints - Market Opportunities

Adoption of sustainable and green building façades

Integration of smart glass and advanced glazing technologies

Public infrastructure and urban redevelopment projects - Trends

Increasing use of unitized curtain wall systems

Rising preference for high-performance glazing

Integration of façade aesthetics with energy performance - Government Regulations

Building code compliance and façade safety standards

Energy efficiency and green building regulations

Import standards and material certification requirements

- By Market Value 2020-2025

- By Volume, 2020-2025

By System Type (In Value%)

Unitized curtain wall systems

Stick-built curtain wall systems

Semi-unitized curtain wall systems

Structural glazing systems

Double-skin curtain wall systems

By Platform Type (In Value%)

Commercial high-rise buildings

Residential towers and condominiums

Mixed-use developments

Institutional buildings

Hospitality and retail complexes

By Fitment Type (In Value%)

New construction installations

Retrofit and renovation projects

Façade replacement projects

Energy-efficiency upgrade installations

Seismic and wind-load reinforcement fitments

By EndUser Segment (In Value%)

Commercial real estate developers

Residential property developers

Government and public infrastructure agencies

Hospitality and retail operators

Industrial and logistics facility owners

By Procurement Channel (In Value%)

Direct procurement from manufacturers

EPC and turnkey contractors

Façade engineering consultants

Authorized distributors and suppliers

Public tender and government contracts

- Market Share of Major Players in Philippines Curtain Walls Market Basis Value/Volume, 2020-2025

- Competitive Benchmarking of Key Players Basis Parameters including

- Company Overview

- Business Strategies

- Revenues

- Future Plans

- Revenue by Project Type and Revenues by Region

- Manufacturing Plant

- Key Clients

- Number of Employees

- Pricing analysis

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Seapac

Shiny Curtainwall

Leicorv

SOTA

Lakshmi BEMT

Intact

JN STW

AGC Flat Glass Philippines

Saint-Gobain Philippines

Guardian Glass Philippines

YKK AP Asia Pacific

Schüco Philippines

AluK Asia

Reynaers Aluminium Asia

Alutech Systems Philippines

CW Home Depot Building Solutions

Metro Glass & Aluminum Supply

Alumina Glass Philippines

Philippine Foremost Milling Glass Division

Union Galvasteel Corporation

MGlass Philippines

DMCI Homes Façade Systems

- Commercial developers prioritize façade performance and aesthetics

- Residential developers focus on cost efficiency and thermal comfort

- Public sector emphasizes safety and regulatory compliance

- Hospitality sector demands customized and premium façade designs

Forecast Market Value 2026-2035

Forecast Volume 2026-2035