Market Overview

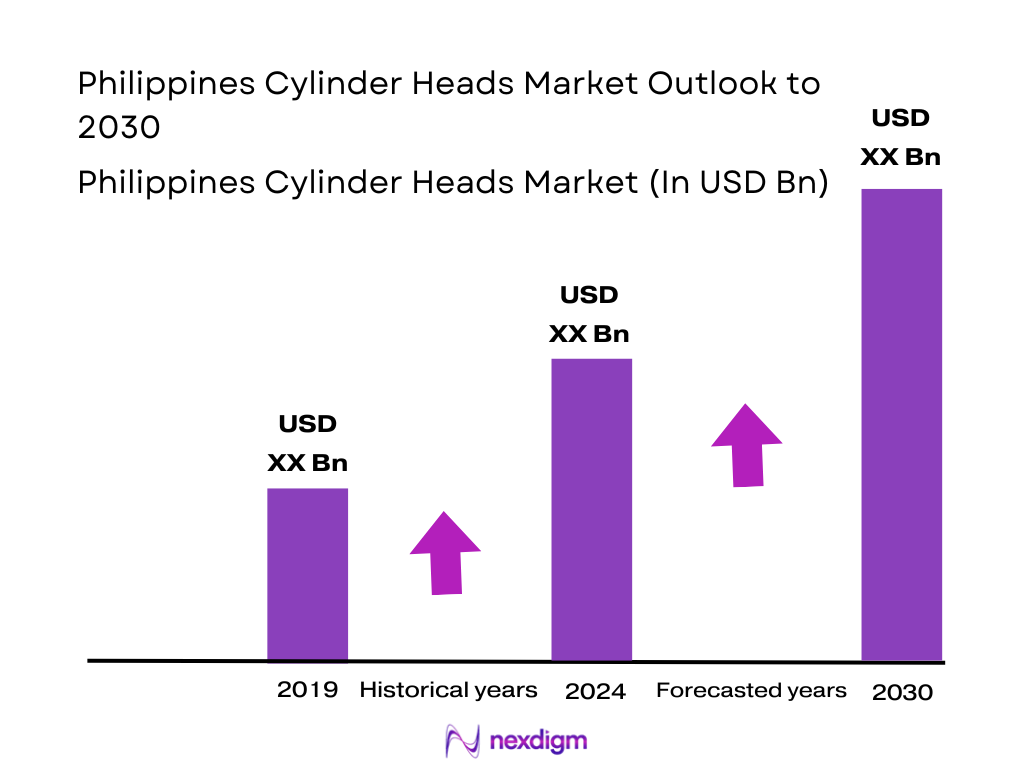

The Philippines Cylinder Heads Market is structurally tied to both global engine-component demand and the country’s expanding automotive base. Globally, the automotive cylinder heads market is reported at about USD ~ billion in the most recent year, up from roughly USD ~ billion in the prior year. Within the Philippines, motor vehicle production has risen from around 110,350 units to 126,571 units and new vehicle sales from about 352,596 units to 429,807 units, creating structural demand for OEM and replacement cylinder heads across passenger, commercial and industrial applications.

Cylinder head demand in the Philippines is concentrated around a few industrial and logistics corridors and a tight set of import relationships. Domestically, the auto-parts industry clusters around Laguna–Cavite and other CALABARZON zones, where 256 auto-parts companies manufacture roughly 330 different components, including engine parts, for both OEMs and the replacement market. On the trade side, cylinder heads and gaskets are largely supplied through Japanese, Thai and Chinese value chains, with import data showing brands tied to Toyota, Yamaha, Honda and other Asian OEMs as major cylinder-head gasket consignees, reinforcing the dominance of Japanese and regional platforms in the Philippine engine parc.

Market Segmentation

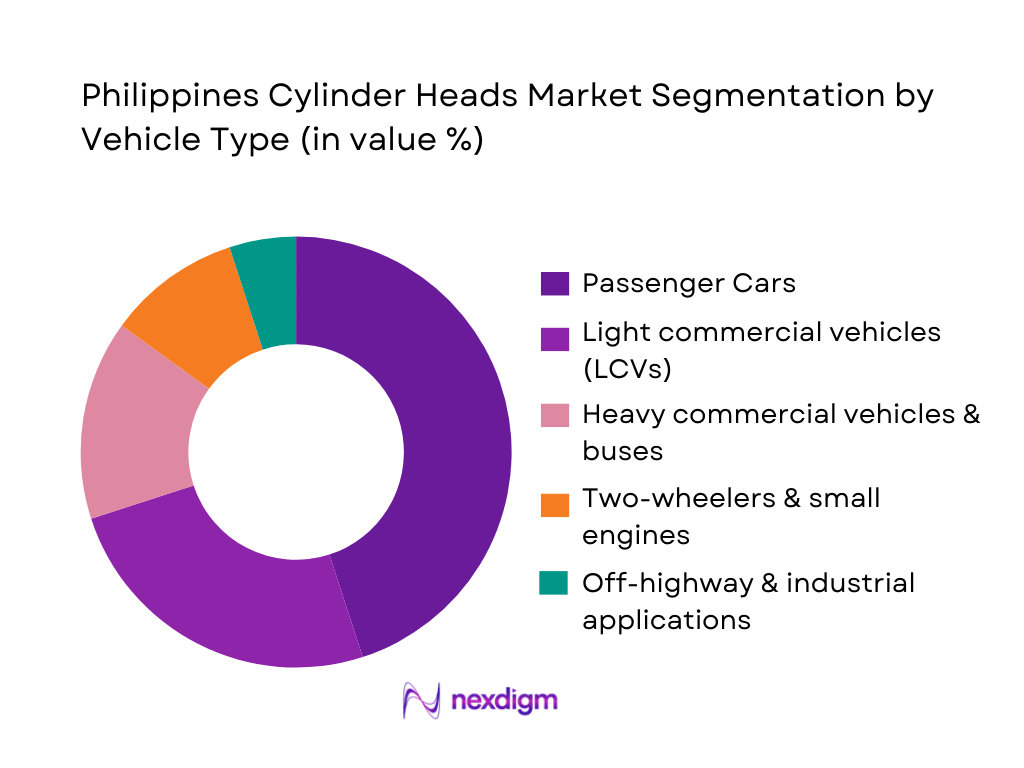

By Vehicle Type

The Philippines Cylinder Heads Market is segmented by vehicle type into passenger cars, light commercial vehicles, heavy commercial vehicles, two-wheelers and three-wheel utility vehicles, and off-highway and industrial engines. In this segmentation, passenger cars account for the largest share of cylinder head demand, reflecting strong new-vehicle sales of over 400,000 units and the predominance of small gasoline and diesel engines in urban mobility. Light and heavy commercial vehicles add further volume, supported by expanding logistics, construction and public transport fleets, while tricycles and motorcycle-based utility vehicles sustain steady replacement demand in provincial routes. Off-highway and industrial engines, including gensets and construction equipment, represent a smaller but high-value niche where cylinder head durability requirements are more stringent. The dominance of passenger-car cylinder heads is reinforced by Japanese and Korean platforms assembled or imported into the Philippines and serviced by dense dealer and aftermarket networks.

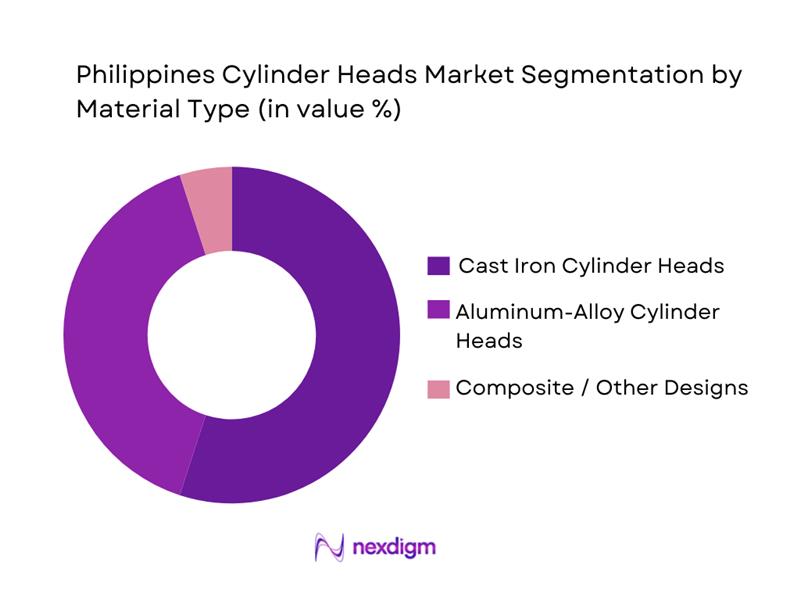

By Material Type

By material type, the Philippines Cylinder Heads Market is segmented into cast-iron cylinder heads, aluminum-alloy cylinder heads and composite/other specialty designs. Cast-iron heads retain the largest share, driven by their use in diesel commercial vehicles, jeepneys, older passenger platforms and stationary engines where thermal robustness and low upfront cost are prioritised. Aluminum-alloy heads, however, are gaining ground due to their weight reduction, better heat dissipation and compatibility with modern multi-valve gasoline engines imported from Japan, Korea and increasingly China. Composite and hybrid designs remain niche, mostly in performance and industrial applications. The dominance of cast iron is reinforced by the large installed base of legacy diesel fleets and power-generation sets, while the fastest growth is observed in aluminum heads aligned with newer Euro-aligned emission standards and OEM engine upgrades.

Competitive Landscape

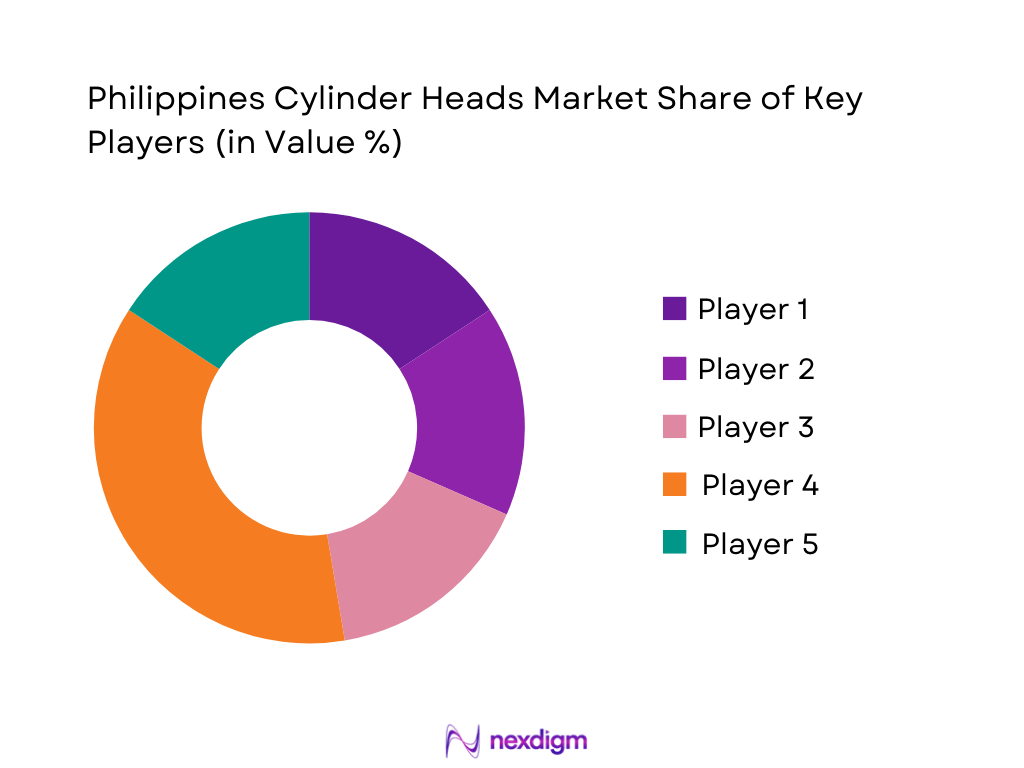

The Philippines Cylinder Heads Market is characterised by a hybrid structure where global OEMs, Tier-1 engine component suppliers and regional aftermarket brands collectively shape demand. On the OEM side, Japanese and Korean carmakers linked to global cylinder-head supply chains dominate via vehicle assembly and import programmes, while local transmission and engine-related plants, such as those historically tied to Toyota and Aisin, anchor some powertrain manufacturing activity. In the aftermarket, European and Japanese engine-parts specialists supply cylinder heads, valves, gaskets and related kits through distributors and e-commerce platforms, supported by a network of machine shops and engine rebuilders. Import records for cylinder head gaskets reveal a long tail of over 200 importers, indicating fragmented distribution despite the dominance of a few large brands.

| Player | Establishment Year | Headquarters | Primary Role in PH Cylinder Heads Market | Core Cylinder-Head / Valve-Train Portfolio | Primary Customer Segments in Philippines | Channel Focus (OEM / Aftermarket) | PH Presence Type (Plant / JV / Distributor / Import) | Notable Strength in Cylinder Heads Value Chain |

| Toyota Motor Corporation | 1937 | Toyota City, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Isuzu Motors Limited | 1934 | Yokohama, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Hyundai Mobis / Hyundai Group | 1977 | Seoul, South Korea | ~ | ~ | ~ | ~ | ~ | ~ |

| MAHLE GmbH | 1920 | Stuttgart, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Federal-Mogul (Tenneco) | 1899 | Southfield, USA | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Cylinder Heads Market Analysis

Growth Drivers

Cylinder Head Heat Dissipation Requirements

The Philippines runs hot and congested, which amplifies thermal stress on cylinder heads. The national meteorological agency reported a mean annual temperature of 27.76°C in the country, making it one of the warmest years on record, while observational data show recent averages reaching around 27.16°C with peak monthly means above 28°C in the hottest months. At the same time, the registered vehicle fleet reached 14.56 million units, of which 11.45 million are gasoline-powered and 3.08 million diesel units, placing continuous thermal load on combustion chambers and cylinder heads in stop-and-go traffic. Metro Manila’s average driving speed around 19 km/h in rush hours means engines often idle or run at low airflow, limiting convective cooling while combustion temperatures remain high. These conditions increase the importance of head alloys, cooling-jacket design, and machining tolerances for local engine builders and rebuilders.

Emission Norm Shifts

Cylinder head design in the Philippines is increasingly shaped by tightening emission and fuel-efficiency policies. The vehicle fleet of ~ million includes only 6,697 electric vehicles and 17,590 hybrids, underscoring the dominance of combustion engines that must meet newer fuel and emission requirements. Public transport modernization requires phasing out public utility vehicles older than 15 years and replacing them with units meeting Euro IV-equivalent standards or fully electric jeepneys, directly affecting combustion-chamber geometry, valve-seat materials, and head cooling passages for compliant engines. On the import side, transport equipment brought in USD ~ billion in value, accounting for 8.9% of total goods imports of USD ~ billion, reflecting strong ongoing replacement and upgrading of engine platforms that rely on compliant cylinder head technologies.

Market Challenges

Crack Propensity in Aluminum Heads

Thermal and mechanical conditions in the Philippines create a challenging environment for aluminum cylinder heads, increasing crack risk. With national mean temperatures consistently near 27°C and hotter urban microclimates, engine components operate close to their thermal limits during extended idling and heavy loading. The vehicle fleet of ~ million units is overwhelmingly combustion-based, dominated by ~ million gasoline engines that typically use aluminum heads to save weight and improve efficiency. Congestion metrics showing average speeds around 19 km/h in Metro Manila mean frequent hot-soak cycles and limited airflow through radiators, amplifying head-gasket stress and localized hot spots. As a result, workshops report strong demand for crack testing, welding, and replacement of aluminum heads, especially on high-compression gasoline and turbocharged diesel platforms that operate daily under these harsh conditions.

Lack of High-Precision CNC Machining in Provinces

High-precision CNC machining capacity in the Philippines is concentrated around Metro Manila and nearby industrial belts, leaving many provincial rebuilders dependent on basic equipment. MSME statistics indicate 204,844 business establishments in the National Capital Region, 163,710 in CALABARZON and 139,912 in Central Luzon; together with Central and Western Visayas, these top five regions hold 60.06% of all MSMEs. Meanwhile, provincial regions beyond these hubs each host far fewer enterprises, implying limited access to advanced machining centres capable of multi-axis surfacing, seat cutting, and guide boring for modern multivalve heads. Banking data show manufacturing’s gross value added at more than PHP 3.95 trillion, rising to roughly PHP 4.15 trillion, yet a large part of this industrial base is still clustered in major corridors. This spatial imbalance raises logistics costs and lead times for provincial workshops that must ship heads to urban centres for precision work.

Opportunities

Localized Lightweight Head Manufacturing

The Philippines’ growing industrial base and heavy import bill for metals and transport equipment create room for local production of lightweight cylinder heads. Central bank data place manufacturing’s gross value added at about PHP 3.95 trillion, increasing to roughly PHP 4.15 trillion, within an industry sector exceeding PHP 7.32 trillion, signalling robust capacity for metalworking, casting, and precision machining. National trade accounts show total goods imports at USD ~ billion, with electronic products at USD ~ billion, mineral fuels at USD ~ billion, and transport equipment at USD ~ billion, while iron and steel alone reached USD ~ billion in import value. By capturing even a modest share of imported castings, semi-finished heads and high-spec alloys, domestic foundries and CNC shops could substitute imported units, leveraging lower logistics costs to serve the 14.56 million-strong vehicle fleet with locally engineered lightweight heads optimized for tropical heat and local fuel quality.

High-Performance Aftermarket

A large and renewing vehicle base, plus emerging performance and commercial niches, gives significant upside to high-performance cylinder head and valvetrain offerings. Country-level registration statistics indicate 14.56 million vehicles on the road, with annual new registrations around 418,249 units, adding substantial cohorts of modern engines that will eventually need upgraded heads for fleet, motorsport, or heavy-duty use. Electric and hybrid registrations, while growing quickly to 6,697 and 17,590 units respectively, remain a small fraction of the total, meaning more than 14.5 million internal combustion engines still dominate the park. At the same time, motor-vehicle parts and accessories imports of around USD ~ million and transport equipment imports of USD ~ billion show strong willingness to invest in components, spares, and upgrades. This combination of a large installed base, increasing incomes in industrial regions, and active motorsport and logistics communities creates a fertile aftermarket for performance-oriented multivalve heads, ported castings, and hardened seats tailored to local fuels and duty cycles.

Future Outlook

Over the next several years, the Philippines Cylinder Heads Market is expected to expand steadily, underpinned by rising vehicle production, sustained growth in new-vehicle sales and the ageing of the in-use fleet, which drives recurring top-end engine work. Global forecasts indicate that the automotive cylinder head market will grow at around 2.8% annually over the coming six-year cycle, reaching roughly USD ~ billion worldwide, with Asia-Pacific remaining the centre of gravity. Within this context, the Philippines will increasingly leverage its auto-parts manufacturing base, improving logistics networks and integration with regional supply chains to capture a larger share of OEM and aftermarket cylinder-head flows, especially in light commercial and diesel applications.

Major Players

- Toyota Motor Corporation

- Mitsubishi Motors Corporation

- Isuzu Motors Limited

- Nissan Motor Co.

- Honda Motor Co.

- Hyundai Motor Group

- Kia Corporation

- Suzuki Motor Corporation

- Ford Motor Company

- MAHLE GmbH

- Federal-Mogul

- Aisin Group

- Nippon Piston Ring Co., Ltd.

- AJUSA

- Cummins

Key Target Audience

- Global and Regional Automotive OEMs

- Tier-1 and Tier-2 Engine Component Manufacturers

- Engine Rebuilders, Machine Shops and Independent Service Garages

- Power-Generation, Construction and Industrial Equipment Operators

- Fleet Owners and Transport & Logistics Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Trade and Industry Associations

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on mapping the full Philippines Cylinder Heads Market ecosystem, including OEMs, Tier-1 suppliers, machine shops, importers and fleet operators. Extensive desk research draws on global cylinder-head studies, Philippine automotive statistics, trade databases and policy documents from agencies such as DTI, BOI and LTO. This step identifies critical variables such as vehicle parc by fuel type, engine configuration, import flows of cylinder heads and gaskets, and regional cluster development.

Step 2: Market Analysis and Construction

In this phase, historical data on vehicle production, new-vehicle sales and engine applications in the Philippines are compiled and benchmarked against global cylinder-head market trends. Ratios between vehicle stock, engine rebuild frequency and cylinder-head replacement cycles are used to construct a bottom-up view of OEM and aftermarket demand. Regional segmentation, by key industrial corridors and fleet hubs, refines the revenue model and highlights differing demand profiles between passenger, commercial and industrial engines.

Step 3: Hypothesis Validation and Expert Consultation

Draft hypotheses regarding segment shares, material mix, price bands and growth drivers are validated through structured interviews with engine rebuilders, component importers, OEM service managers and fleet maintenance heads. Wherever possible, computer-assisted interviews are used to standardise response capture on failure modes, top-end overhaul intervals and adoption of aluminum versus cast-iron heads. These consultations provide first-hand insight into warranty patterns, common service practices and constraints in local machining and testing capacity, which are then reconciled with secondary data.

Step 4: Research Synthesis and Final Output

The final phase integrates global cylinder-head market benchmarks with Philippines-specific vehicle, trade and industry findings to deliver a coherent market narrative. Global size and CAGR metrics are sourced from published cylinder-head market studies, while local insights are aligned with auto-parts roadmaps and investment pipelines. Detailed segmentation, competition mapping and forward-looking scenarios are then constructed, supported by cross-checks with OEM and aftermarket stakeholders, to provide a robust decision-support tool for investors, manufacturers and fleet operators across the Philippines Cylinder Heads Market.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions; Cylinder Head Metallurgy Parameters; Engine Displacement Brackets; ICE Replacement Cycles; In-Country Machining Standards; Primary & Secondary Research Approach; Value Chain Interviews; Forecasting Logic Using Vehicle Parc, Import Data & Engine Rebuild Rates; Limitations & Future Assumptions)

- Definition & Scope

- Industry Genesis & Evolution

- Cylinder Head Architecture

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Cylinder Head Heat Dissipation Requirements

Emission Norm Shifts

Fleet Ageing

Engine Rebuild Frequency

Import Growth in Castings - Market Challenges

Crack Propensity in Aluminum Heads

Lack of High-Precision CNC Machining in Provinces

Inconsistent Aftermarket Quality Grades

Dependence on Chinese Imports - Opportunities

Localized Lightweight Head Manufacturing

High-Performance Aftermarket

Fleet Modernization Programs

Cylinder Head Remanufacturing Hubs - Trends

Shift Toward Aluminum Alloy Heads

Multi-Valve Configurations

Thermal Coating

Digitization of Engine Rebuild Shops

CNC Porting Adoption - Government Regulations

- SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Vehicle Type (in Value %)

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

Motorcycles/2-Wheelers

Off-Highway/Construction Equipment - By Fuel Type (in Value %)

Gasoline Engines

Diesel Engines

Alternative Fuel Engines

LPG Engines

High-Compression GDI Engines - By Material Type (in Value %)

Cast Iron Heads

Aluminum Alloy Heads

Hybrid Composite Heads

Heat-Treated High-Silicon Heads

CNC-Machined Billet Heads - By Sales Channel (in Value %)

OEM Supply

Authorized Service Center Replacements

Independent Aftermarket

Importers/Distributors

Local Machine Shops & Reconditioners - By Engine Displacement Category (in Value %)

Below 1500 cc

1500–2000 cc

2000–3000 cc

Above 3000 cc

Multi-Cylinder High-Performance Blocks

- Market Share of Major Players

Market Share by Cylinder Head Type - Cross-Comparison Parameters (Cylinder Head Material Innovation, Casting Plant Location, Machining Precision Level, Valve Train Integration Capabilities, Philippine Distribution Density, OEM Tie-Ups, Import-Dependence Ratio, Cylinder Head Failure Warranty Coverage)

- SWOT Analysis of Major Players

- Pricing Analysis

- Detailed Profiles of Major Companies

Toyota Genuine Parts

Mitsubishi Fuso

Isuzu Genuine Parts

Hyundai Mobis

Nissan Auto Parts

Mahle

Yamaha

Federal-Mogul

Ajusa

NPR / NDC Engine Parts

DNJ Engine Components

BluePrint Engine Components

Edelbrock

OEM Surplus / China-Based Casting Factories

- Engine Rebuilders & Reconditioners’ Requirements

- Fleet Operators’ Replacement Cycles

- OEM Procurement Patterns & Supplier Quality Requirements

- Pain-Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030