Market Overview

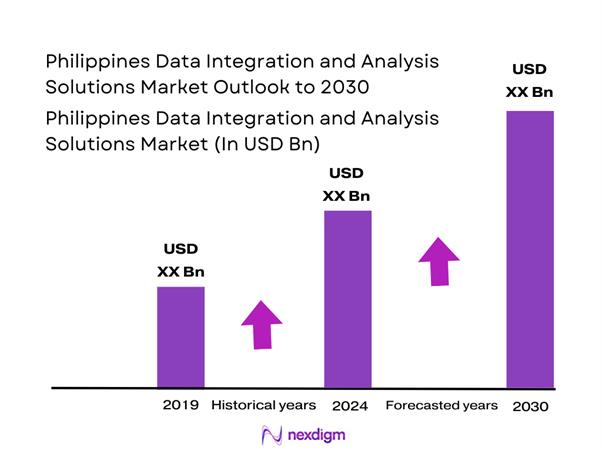

The Philippines Data Integration and Analysis Solutions market is valued at USD ~ billion. The market is critical for enabling organizations to handle vast amounts of data, improving decision-making, operational efficiency, and customer experiences. The demand is driven by the need for businesses to leverage data analytics and integrate diverse sources of information in real-time. In addition, industries across the Philippines are undergoing digital transformation, which further enhances the market’s relevance and importance.

Metro Manila remains the dominant region, housing the headquarters of major companies, government institutions, and most of the country’s tech infrastructure. Additionally, other regions such as Central Luzon and Mindanao also influence the market due to the growing presence of SMEs and the adoption of digital solutions by local governments. Leading global technology players such as Amazon Web Services, Microsoft, and Google are key suppliers of cloud services, which influence local demand for data integration tools.

Market Segmentation

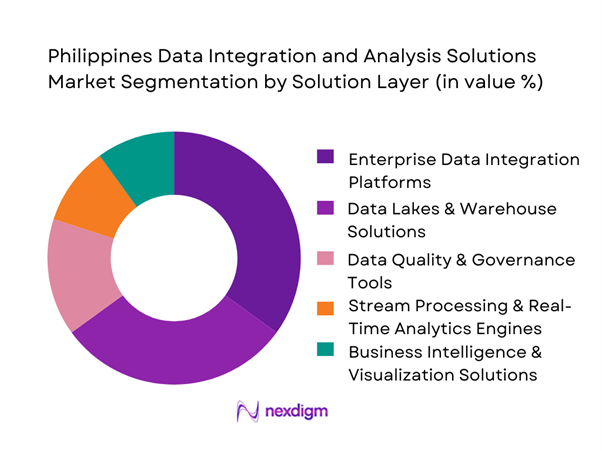

By Solution Layer

The Philippines Data Integration and Analysis Solutions Market is segmented by solution layer into Enterprise Data Integration Platforms, Data Lakes & Warehouse Solutions, Data Quality & Governance Tools, Stream Processing & Real-Time Analytics Engines, and Business Intelligence & Visualization Solutions. Enterprise Data Integration Platforms dominate as they are critical for businesses in telecommunications, finance, and e-commerce that require seamless integration across diverse data sources to drive data-driven decision-making. These platforms ensure that data from multiple channels is unified, making it accessible for further analysis.

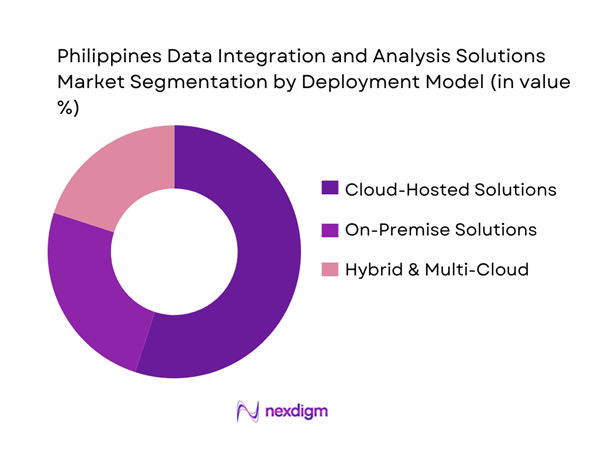

By Deployment Model

The market is segmented by deployment model into Cloud-Hosted Solutions (SaaS/PaaS), On-Premise Solutions, and Hybrid & Multi-Cloud Solutions. Cloud-Hosted Solutions (SaaS/PaaS) dominate because they offer scalability, cost-effectiveness, and flexibility, making them ideal for e-commerce, telecommunications, and retail sectors. As more businesses in the Philippines shift towards cloud-first strategies, cloud solutions have become the go-to choice for companies of all sizes. On-premise solutions continue to maintain a steady share, especially among large enterprises in banking and telecom, who prioritize security and compliance with strict industry regulations.

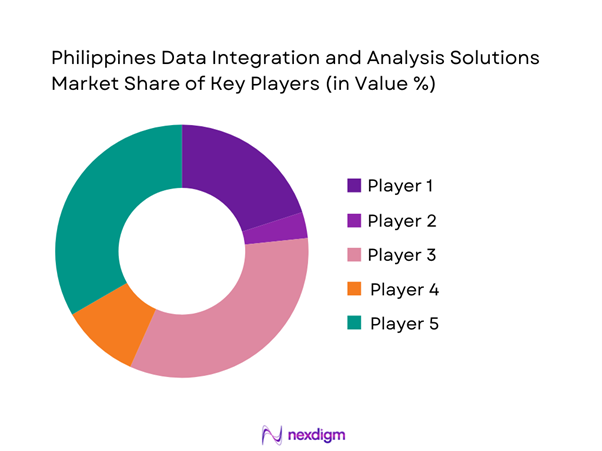

Competitive Landscape

The Philippines Data Integration and Analysis Solutions market is dominated by a few major players, including SAP and global or regional brands like Microsoft, IBM, and Oracle. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | Solution Type Focus | Revenue in 2024 | Market Position |

| SAP | 1972 | Philippines | ~ | ~ | ~ |

| Microsoft | 1975 | Philippines | ~ | ~ | ~ |

| IBM | 1911 | Philippines | ~ | ~ | ~ |

| Oracle | 1977 | Philippines | ~ | ~ | ~ |

| Pointwest | 2003 | Philippines | ~ | ~ | ~ |

Philippines Data Integration and Analysis Solutions Market Analysis

Growth Drivers

Rise in demand for data-driven decision making

The increasing importance of data-driven decision-making is one of the key growth drivers in the Philippines Data Integration and Analysis Solutions Market. As businesses across various sectors, including finance, telecommunications, and retail, strive to enhance operational efficiency and customer satisfaction, they are turning to advanced data analytics solutions. These solutions help organizations analyze large datasets, uncover patterns, and gain insights that drive strategic decisions. With competition intensifying, businesses are prioritizing real-time insights and data integration to stay ahead in the market, making data-driven decision-making a critical factor for success.

Adoption of cloud solutions in various industries

The widespread adoption of cloud solutions across industries is another significant driver for the growth of the Data Integration and Analysis Solutions Market in the Philippines. Companies are moving away from traditional on-premise systems to cloud-based solutions due to the scalability, cost-effectiveness, and flexibility they offer. The cloud allows businesses to access and analyze vast amounts of data without the constraints of physical infrastructure. As industries such as e-commerce, telecommunications, and banking continue to embrace cloud technologies, the demand for cloud-based data integration and analytics platforms will grow, driving the market further.

Challenges

High cost of implementation for SMEs

A significant challenge for small and medium enterprises (SMEs) in the Philippines is the high cost associated with implementing data integration and analysis solutions. Many SMEs lack the financial resources required to invest in sophisticated tools and platforms that are essential for data-driven decision-making. While larger enterprises can afford extensive integration solutions, SMEs often face budget constraints that prevent them from adopting advanced technologies. This disparity in investment capability limits their ability to fully leverage the power of data analytics, hindering their competitiveness in an increasingly data-driven business environment.

Lack of skilled workforce

The shortage of skilled professionals in data analytics, data engineering, and data governance presents another challenge for the Philippines Data Integration and Analysis Solutions Market. As businesses embrace cloud technologies and real-time data processing, they require expertise to manage and optimize these systems. However, the talent gap in the country results in a lack of qualified personnel capable of implementing, managing, and interpreting data solutions effectively. This issue affects businesses’ ability to harness the full potential of their data, making it a barrier to further market growth and technological adoption.

Opportunities

Increased demand for advanced analytics

As businesses continue to collect vast amounts of data, there is a growing demand for advanced analytics solutions that go beyond basic reporting and visualization. Companies in industries such as retail, finance, and telecommunications are increasingly seeking solutions that provide predictive analytics, machine learning, and AI-driven insights to stay competitive. These advanced analytics tools allow businesses to gain deeper insights into customer behavior, market trends, and operational efficiencies, presenting a significant growth opportunity for providers of data integration and analytics solutions. The need for smarter, more actionable insights will drive demand for cutting-edge technologies.

Growth in the healthcare and financial sectors

The healthcare and financial sectors in the Philippines present substantial opportunities for data integration and analysis solution providers. Both industries are undergoing significant digital transformation, driven by the need for real-time data processing, regulatory compliance, and enhanced patient/customer experience. In healthcare, the demand for integrated data solutions to manage electronic health records and ensure accurate patient data is growing. Similarly, the financial sector is increasingly relying on data analytics for fraud detection, risk management, and customer insights, creating significant opportunities for data integration vendors to cater to these high-growth sectors.

Future Outlook

The future of the Philippines Data Integration and Analysis Solutions market looks promising. With the continuous growth of digital transformation and cloud adoption, the market will see expanded opportunities for both local and global players to offer cutting-edge solutions.

Major Players

- SAP

- Microsoft

- IBM

- Oracle

- Pointwest

- Massive Insights

- Accenture

- Oracle

- Atlan

- Holistics

- Navsoft

- KMS

- Info Alchemy Corporation

- Intelegencia

- Qlik

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Financial institutions

- Healthcare organizations

- Educational institutions

- Manufacturing companies

- Retailers

- Technology vendors

Research Methodology

Step 1: Identification of Key Variables

In this phase, we focus on identifying the primary factors influencing the demand for data integration and analysis solutions in the Philippines, including regulatory, technological, and market drivers. We employ secondary research to identify key market dynamics.

Step 2: Market Analysis and Construction

We gather and analyze historical data from trusted sources, such as government reports, industry publications, and market research firms, to build an accurate market framework that reflects the current state of the market.

Step 3: Hypothesis Validation and Expert Consultation

We validate our hypotheses through interviews and discussions with industry experts, consultants, and solution providers who offer insights into current trends, challenges, and market opportunities.

Step 4: Research Synthesis and Final Output

This final step synthesizes the data from previous phases into a comprehensive and actionable report, incorporating feedback from industry experts to ensure accuracy and relevance in market forecasting and analysis.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Data Integration and Analysis Usage / Value-Chain / Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- Philippines Industry / Service / Delivery Architecture

- Growth Drivers

Rise in demand for data-driven decision making

Adoption of cloud solutions in various industries

Growth of e-commerce and digital transformation

Increasing importance of data security and privacy

Government initiatives promoting digital transformation - Challenges

High cost of implementation for SMEs

Lack of skilled workforce

Integration challenges across diverse data sources

Data privacy concerns

Slow adoption in non-urban regions - Opportunities

Increased demand for advanced analytics

Growth in the healthcare and financial sectors

Expansion of government and educational initiatives

Rising investments in artificial intelligence and machine learning

Development of affordable cloud-based solutions - Trends

Rise of RealTime Integration & Streaming Data Models

Embedded Analytics & Augmented BI Adoption

Local Cloud Service Provider Ecosystem Expansion

APIFirst IntegrationGovernance Alignment - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume/Install Base, 2019–2024

- Cloud vs OnPremise Adoption Metrics, 2019–2024

- By Technology / Product / Platform Type (in Value %)

Data analytics platforms

Artificial intelligence-driven solutions

Business intelligence tools

Data integration software

Cloud platforms - By Deployment / Delivery / Distribution Model (in Value %)

Cloud-based deployment

On-premise deployment

Hybrid deployment

Managed services

Software-as-a-Service (SaaS) - By End-Use Industry / Customer Type (in Value %)

Healthcare

Retail

Manufacturing

BFSI (Banking, Financial Services, and Insurance)

Telecom - By Region (in Value %)

Metro Manila

Central Luzon

Southern Luzon

Visayas

Mindanao

- Competition ecosystem overview

- Cross Comparison Parameters (Platform reliability, scalability, customer support, pricing, user interface, integration ease, security features, data accuracy, vendor reputation, industry-specific offerings)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

SAP

Microsoft

IBM

Oracle

Pointwest

Massive Insights

Accenture

Oracle

Atlan

Holistics

Navsoft

KMS

Info Alchemy Corporation

Intelegencia

Qlik

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Volume/Install Base, 2025–2030

- Cloud vs OnPremise Adoption Metrics, 2025–2030