Market Overview

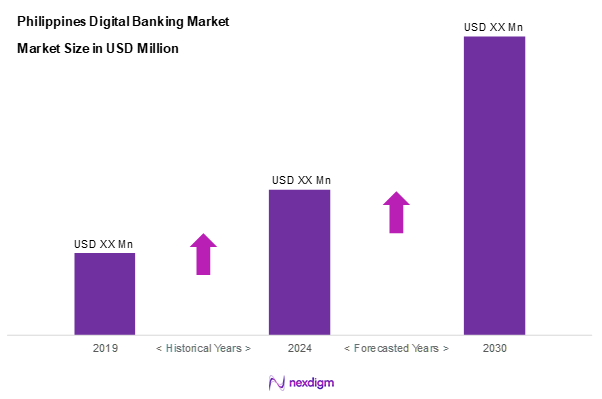

As of 2024, the Philippines digital banking market is valued at USD 540.6 Million, with a growing CAGR of 14.1% from 2024 to 2030, reflecting robust growth driven by the increasing internet penetration and the government’s favourable fin-tech policies to increase financial inclusion. The demand for convenient and accessible banking technology has significantly contributed to this market’s growth, supported by a population keenly adopting mobile and online financial services.

Metro Manila dominates the Philippines’ digital banking landscape due to its vibrant economic activity and higher internet connectivity. This concentration is a result of the city’s role as a central business hub, where financial technology is readily adopted by a dense population of young professionals. Other emerging cities with active adoption include Cebu and Davao, driven by growing urbanization and rising local business activities.

Market Segmentation

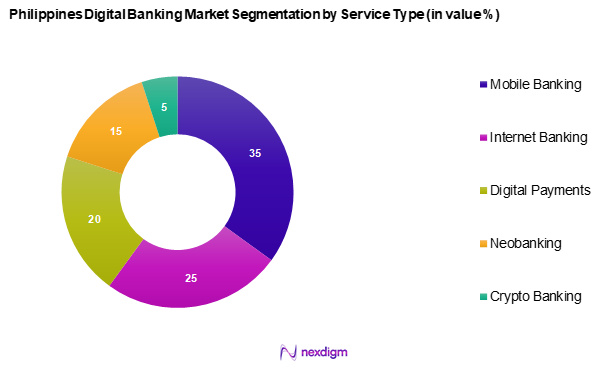

By Service Type

The Philippines digital banking market is segmented into mobile banking, internet banking, digital payments, neobanking, and crypto banking entrants. Mobile banking commands a dominant share due to widespread smartphone usage and the convenience it offers. The proliferation of affordable smartphones and competitive data plans has enabled much of the population to turn to mobile platforms for their banking needs, adapting quickly to services like GCash and PayMaya for everyday transactions.

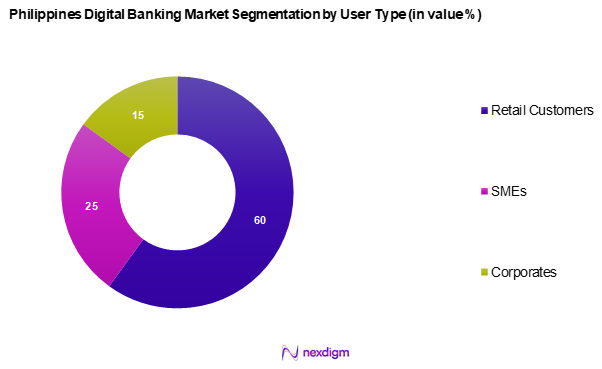

By User Type

The Philippines digital banking market is segmented into retail customers, SMEs, and corporates. Retail customers dominate the segment as digital banking solutions offer them unparalleled convenience in managing personal finances. The introduction of user-friendly apps and the ease of managing everyday financial activities through smartphones have enticed consumers to migrate to digital platforms, circumventing traditional banking challenges.

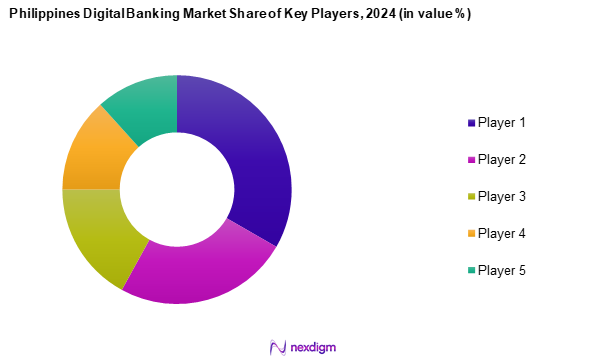

Competitive Landscape

The Philippines digital banking market is dominated by a select group of players that wield significant influence due to their technological capabilities and expansive customer bases. Among these are BDO Unibank and UnionBank of the Philippines, which leverage strong brand recognition and innovative offerings.

| Major Player | Establishment Year | Headquarters | Market Position | Revenue | Innovation Index | Customer Base |

| BDO Unibank | 1976 | Manila, Philippines | – | – | – | – |

| Citibank PH | 1902 | Taguig City, Philippines | – | – | – | – |

| GCash | 2004 | Rizal, Philippines | – | – | – | – |

| UnionBank of the Philippines | 1968 | Pasig, Philippines | – | – | – | – |

| Maya Bank | 2021 | Manila, Philippines | – | – | – | – |

Philippines Digital Banking Market Analysis

Growth Drivers

Government Policies and Initiatives

The Philippine government continues to play a crucial role in advancing digital banking through strategic policies and initiatives focused on financial inclusion. The central bank has introduced a roadmap aimed at significantly increasing digital payments and broadening financial accessibility. This initiative is aligned with national goals to reduce reliance on cash transactions while fostering innovation in financial technology solutions. By creating a supportive regulatory environment and encouraging digital transformation, the government is laying a strong foundation for the sector’s expansion.

Rise in Smartphone Penetration

The increasing adoption of smartphones across the country has been a key driver of digital banking growth. The availability of affordable mobile devices, coupled with enhanced network infrastructure, has enabled a broader segment of the population to access financial services digitally. Mobile banking applications have seen a surge in adoption, making transactions more convenient and fostering greater consumer engagement with digital financial platforms.

Market Challenges

Data Security Concerns

Cybersecurity remains a major concern within the digital banking landscape, as financial transactions continue to shift online. The rise in digital transactions has exposed consumers and institutions to heightened risks, including phishing attempts, data breaches, and identity theft. Addressing these security threats is essential to maintaining consumer confidence and ensuring the continued adoption of digital banking solutions.

Regulatory Compliance Issues

Adhering to regulatory requirements poses significant challenges for digital banks operating in the Philippines. The financial sector is required to comply with multiple regulatory frameworks designed to protect consumers and maintain market stability. However, financial institutions often face difficulties in adapting to evolving compliance standards, managing reporting obligations, and meeting anti-money laundering regulations. The complexity of regulatory expectations underscores the need for streamlined compliance strategies and clearer guidelines to support digital banking expansion.

Opportunities

Expansion in Underbanked Regions

A significant portion of the Philippine population remains underserved by traditional banking institutions, creating a vast opportunity for digital banking expansion. With limited access to brick-and-mortar financial services, consumers in remote and underbanked areas stand to benefit from mobile-based banking solutions. By tailoring financial products to meet the needs of these communities, digital banks can enhance financial inclusion and drive further market penetration.

Integration of AI and Blockchain

The adoption of advanced technologies such as artificial intelligence (AI) and blockchain is poised to transform the digital banking landscape. AI-driven solutions, including chatbots and data analytics, are enhancing customer service and personalization, while blockchain technology is improving transaction security and efficiency. These innovations not only streamline banking operations but also address key concerns related to data security, positioning digital banking as a more reliable and efficient alternative to traditional financial services.

Future Outlook

Over the next five years, the Philippines digital banking market is anticipated to experience substantial growth due to ongoing technological advancements and government initiatives boosting financial inclusivity. The market is set to benefit from the integration of artificial intelligence and blockchain technology, facilitating more secure and efficient banking experiences. Moreover, a push towards digital transformation among both consumers and enterprises is expected to drive further expansion in this sector.

Major Players

- BDO Unibank

- Citibank PH

- GCash

- Maya Bank

- UnionBank of the Philippines

- Philippine National Bank (PNB)

- RCBC

- Security Bank

- Metrobank

- Tonik

- ING

- EastWest Bank

- Land Bank of the Philippines

- Bank of the Philippine Islands (BPI)

- GrabPay

Key Target Audience

- Financial Institutions

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Bangko Sentral ng Pilipinas)

- Commercial Banks

- Technology Providers

- Fintech Startups

- Mobile Service Providers

- Digital Payment Solutions Providers

Research Methodology

Step 1: Identification of Key Variables

The first step in the research involves mapping out the current ecosystem of stakeholders in the Philippines’ digital banking market. This includes extensive desk research, compiling data from various credible sources to define key variables affecting the market.

Step 2: Market Analysis and Construction

In this step, historical data on market trends and service adoption rates are analysed to construct a comprehensive overview of market dynamics. This includes examining market penetration rates, revenue trends, and service adoption metrics to ensure the reliability and precision of the projected market figures.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses derived from the initial data analysis are validated through expert consultations and interviews with industry leaders. This qualitative input is essential for refining data interpretations and understanding intricate market factors influencing growth and operational strategies.

Step 4: Research Synthesis and Final Output

The final stage synthesizes research findings into a cohesive analysis, engaging directly with digital banking providers to cross-verify collected data. This step ensures a robust and factual representation of market conditions, supported by extensive qualitative and quantitative inputs.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Proprietary Market Sizing Approach, Consolidated Research Approach, Stakeholder Interviews and Insights, Primary and Secondary Research Approach)

- Definition and Scope

- Evolution and Key Milestones

- Market Dynamics

- Ecosystem and Value Chain Analysis

- Growth Drivers

Government Policies and Initiatives

Rise in Smartphone Penetration - Market Challenges

Data Security Concerns

Regulatory Compliance Issues - Opportunities

Expansion in Underbanked Regions

Integration of AI and Blockchain - Trends

Rise of FinTech Collaboration

Increasing Adoption of Biometrics - Government Regulation

Central Bank Digital Currency (CBDC) Exploration

E-Wallet Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Total Transaction Value (USD Billion), 2019–2024

- By Number of Digital Banking Users, 2019–2024

- By Number of Transactions, 2019–2024

- By Service Type (In Value %)

Mobile Banking

– Mobile Wallet Services

– Account Management Apps

– Real-time Fund Transfers

– QR Code Payment Interfaces

Internet Banking

– Desktop-based Online Portals

– Business Internet Banking Platforms

– Scheduled Bill Payments

– Statement Downloads & e-Services

Digital Payments

– Peer-to-Peer (P2P) Payments

– Merchant Payments via UPI/QR

– Utility Bill Payments

– Government Transactions

Neobanking

– Fully Digital Banking Apps

– Zero-Balance Accounts

– API-Based Financial Services

– Micro-Savings & Lending Tools

Crypto Banking Entrants

– Bitcoin/Altcoin Wallet Integrations

– Crypto-Fiat Exchange Banking

– DeFi Lending Platforms

– Token-Based Rewards Systems - By User Type (In Value %)

Retail Customers

– Salaried Individuals

– Students and Youth Accounts

– Unbanked/Underbanked Segments

SMEs (Small and Medium Enterprises)

– MSME Digital Loan Users

– Digital Payroll & Expense Solutions

– SME Payment Gateways

Corporates

– Treasury Management Tools

– Enterprise-Level Digital Onboarding

– Corporate Investment Portals - By Device Used (In Value %)

Smartphones

Laptops and Desktops

Tablets - By Application Type (In Value %)

Personal Finance

– Budget Trackers

– Spending Analyzers

– Goal-Based Saving Apps

Professional Services

– Digital Invoicing

– GST/Tax Management

– Business Bank Account Services

Insurance & Investment Apps

– Life & Health Insurance Policies

– Mutual Funds & Robo-Advisors

– Stock & Crypto Portfolio Managers - By Distribution Channel (In Value %)

Direct-to-Customer (D2C)

– Digital-Only Banks

– Standalone FinTech Wallets

– In-App Account Creation

Partner-Based Channels

– Telecom-Bank Collaborations

– Retail Chains with Co-Branded Cards

– Loan Aggregators and NBFCs

Third-Party Apps

– E-commerce Embedded Finance

– Ride-Hailing & Delivery Platform Wallets

– Lifestyle SuperApps with Banking Features

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Service Segment, 2024 - Cross Comparison Parameters (Market Position, Technological Capabilities, Innovation Index, Customer Base, Partnerships, Revenue, Profit Margins, Product Offerings, Customer Support)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

BDO Unibank

Citibank PH

GCash

Maya Bank

UnionBank of the Philippines

Philippine National Bank (PNB)

RCBC

Security Bank

Metrobank

Tonik

Ing

EastWest Bank

Land Bank of the Philippines

Bank of the Philippine Islands (BPI)

GrabPay

- Consumer Adoption & Behaviors

- Budget Allocation and Prioritization

- User Experience and Satisfaction

- Decision-Making Criteria

- By Total Transaction Value (USD Billion), 2025-2030

- By Number of Digital Banking Users, 2025-2030

- By Number of Transactions, 2025-2030