Market Overview

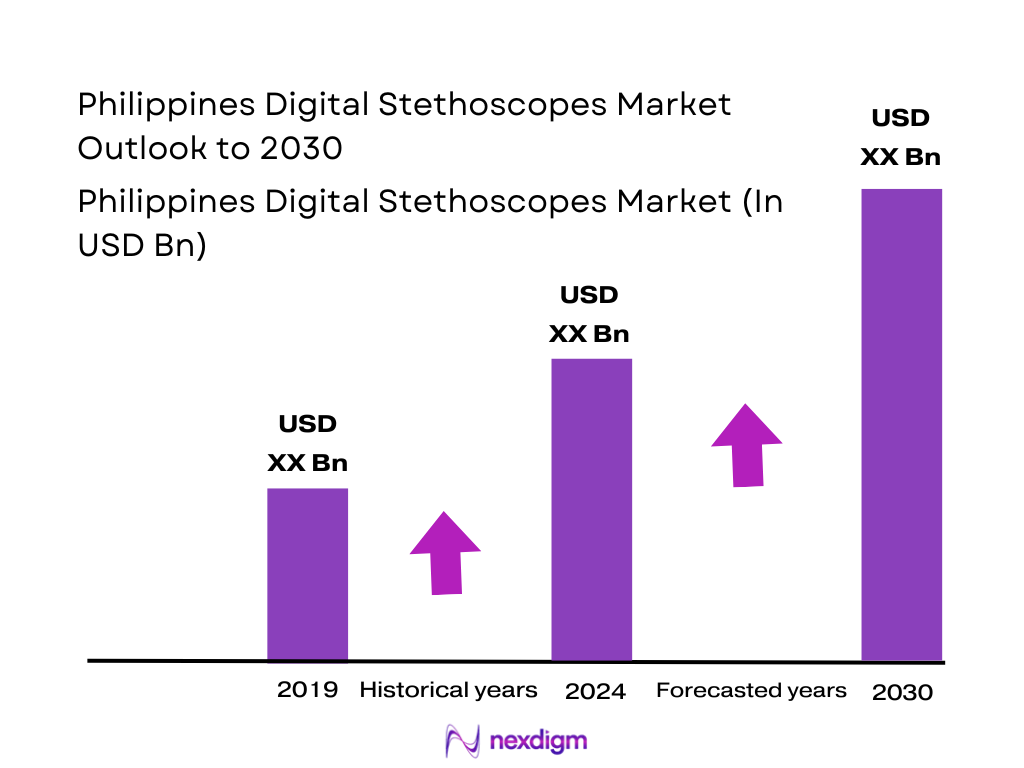

The digital stethoscopes market sits at the intersection of global med-tech innovation and the Philippines’ fast-growing digital health ecosystem. Globally, digital stethoscopes generate between about USD ~ million in annual revenue, depending on methodology, with several firms converging around a sub-USD ~ million valuation and mid-single-digit growth rates. In the Philippines, digital devices ride on a healthcare market valued at roughly USD ~ billion and a telemedicine sector already exceeding USD ~ million in annual revenues, underpinned by millions of remote consultations and a dedicated government digital-health budget exceeding USD ~ billion.

Demand for digital stethoscopes in the Philippines is concentrated in metropolitan hubs where tertiary care, digital infrastructure and private investment intersect. Metro Manila alone hosts about ~ of roughly ~ hospitals nationwide, reflecting a dense cluster of large private groups and DOH-retained referral centers with higher equipment budgets and IT readiness. Cebu and Davao anchor regional adoption through expanding private hospital chains, medical schools and specialty centers, while urban telehealth platforms and virtual clinics disproportionately target these cities, where internet penetration, smartphone ownership and digital-health literacy are highest.

Market Segmentation

By Product Architecture

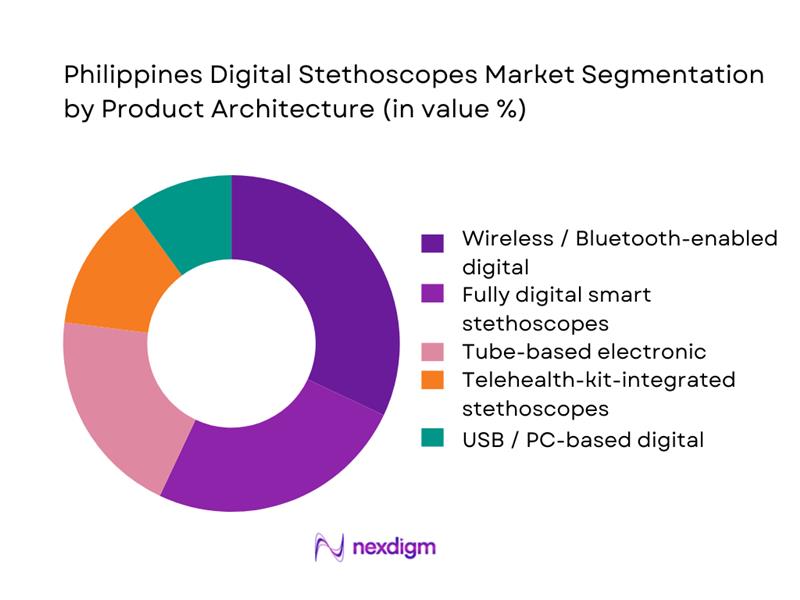

The Philippines Digital Stethoscopes Market can be segmented into tube-based electronic stethoscopes, fully digital smart stethoscopes, wireless/Bluetooth-enabled devices, USB/PC-based devices and telehealth-kit-integrated stethoscopes. Wireless/Bluetooth-enabled units hold the dominant share in this structure. They align best with the country’s app-centric telemedicine usage, where over ~ million remote consultations have already been recorded and mobile internet is the primary gateway to care. Clinicians value these devices’ ability to stream auscultation data into platforms like KonsultaMD/VSee or AMD telemedicine carts, supporting remote cardiopulmonary assessments and documentation in digital health records. Their compatibility with Android and iOS ecosystems, rechargeable batteries, and AI-ready audio outputs makes them the default choice for hospitals piloting hospital-at-home and RPM programs, while still being affordable enough for early adopters in private practice compared with fully integrated telehealth kits.

By Care Setting

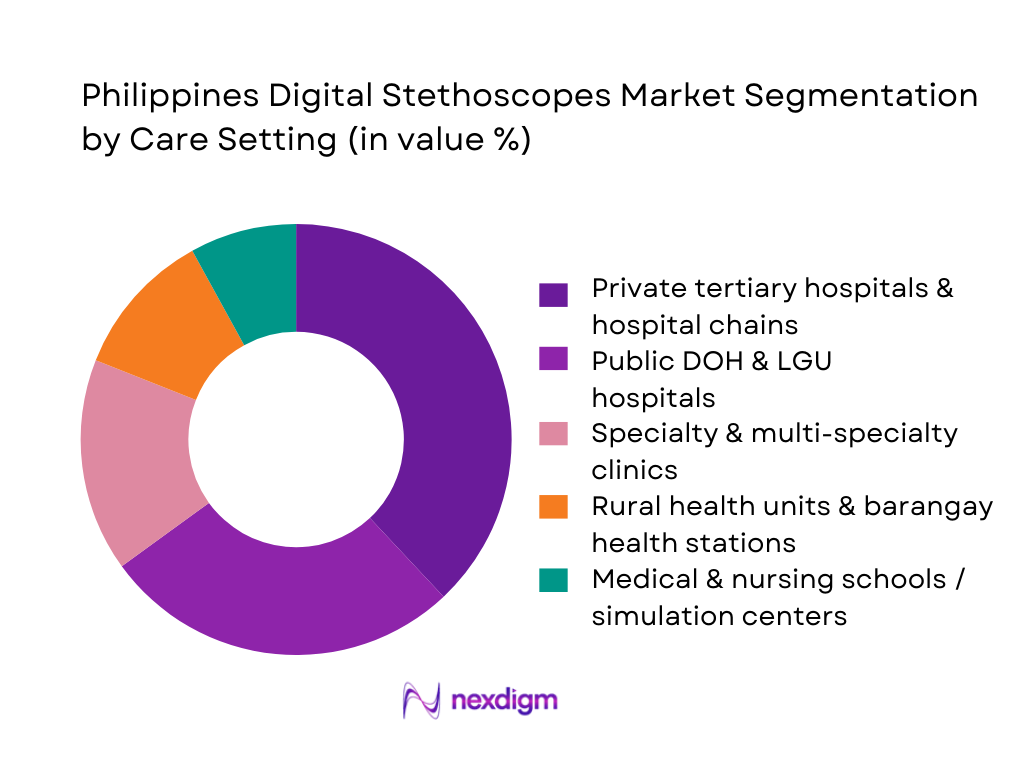

The Philippines Digital Stethoscopes Market can be segmented into private tertiary hospitals and hospital chains, public DOH and LGU hospitals, specialty and multi-specialty clinics, rural health units (RHUs) and barangay health stations, and medical/nursing schools and simulation centers. Private tertiary hospitals and chains currently dominate. They command a disproportionate share of bed capacity and invest aggressively in digital diagnostics, driven by competitive positioning, higher paying case-mix and accreditation requirements. Many of these facilities partner with telehealth platforms to extend specialist consultations nationwide, where devices like AMD’s interactive digital stethoscope, Littmann CORE, Eko and similar smart devices are deployed in EDs, ICUs, tele-ICU pods and outreach programs. Public hospitals and RHUs are catching up through DOH digital-health funding, but procurement cycles, budget ceilings and IT-readiness gaps mean that high-end connected devices still skew toward private networks.

Competitive Landscape

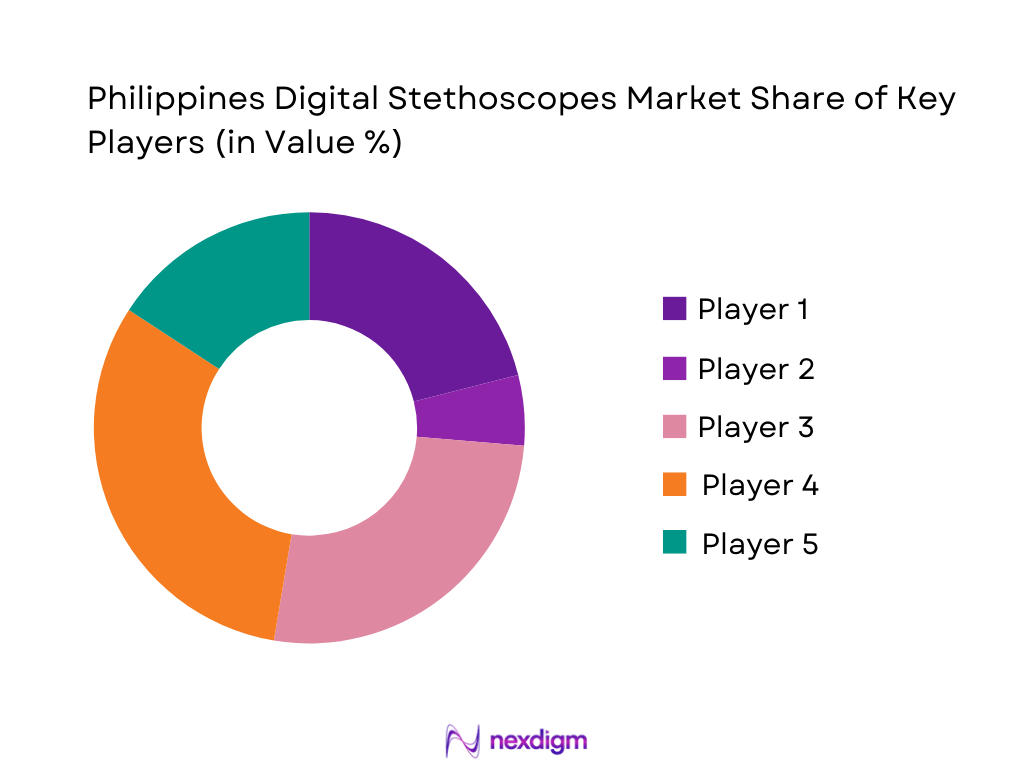

The Philippines Digital Stethoscopes Market is influenced by a concentrated group of global innovators whose products reach the country through distributors, telehealth solution providers and online channels. 3M Littmann (now under Solventum) provides premium cardiology-grade devices; Eko Health, Thinklabs and HD Medical emphasize AI-augmented cardiology and remote auscultation; M3DICINE’s Stethee and similar platforms integrate deeply into telehealth and training. Their influence is magnified by partnerships with telehealth platforms such as VSee/KonsultaMD and AMD Global Telemedicine that actively target Filipino hospitals and virtual clinics with connected carts and remote stethoscope capabilities.

| Company | Establishment Year | Headquarters (Global) | Core Offering in Philippines Context | Key Technology Focus | Primary PH Customer Segments | Telehealth / RPM Integration Focus | Channel & Service Model in PH* |

| 3M Littmann / Solventum | 1902 | Maplewood, Minnesota, USA | ~ | ~ | ~ | ~ | ~ |

| Eko Health Inc. | 2013 | Emeryville, California, USA | ~ | ~ | ~ | ~ | ~ |

| Thinklabs Medical | 1991 | Centennial, Colorado, USA | ~ | ~ | ~ | ~ | ~ |

| HD Medical Inc. | 2005 | Santa Clara, California, USA | ~ | ~ | ~ | ~ | ~ |

| M3DICINE (Stethee) | 2013 | Eight Mile Plains, Australia | ~ | ~ | ~ | ~ | ~ |

Philippines Digital Stethoscopes Market Analysis

Growth Drivers

NCD burden

Noncommunicable diseases constitute the primary health challenge in the Philippines, forming the top 8 of 10 leading causes of death, with cardiovascular diseases, cancers, cerebrovascular diseases, diabetes mellitus, and hypertensive conditions dominating mortality profiles. According to national datasets, NCDs accounted for roughly 68% of total deaths in the Philippines, a figure that aligns with global trends where NCDs cause about 74% of deaths worldwide. The high prevalence of these chronic conditions drives demand for improved cardiovascular and respiratory diagnostics, creating a healthcare environment where advanced auscultation technologies like digital stethoscopes become essential in both urban and rural clinical settings to detect and monitor chronic disease impacts.

Telemedicine expansion

The expansion of telemedicine in the Philippines underpins adoption of connected diagnostic tools like digital stethoscopes. Telemedicine revenues reached USD ~ million, reflecting increasing reliance on remote consultations that inherently demand digital diagnostic support. Growth is buoyed by widespread internet access, with ~ million internet users and 73.6% internet penetration of the population, enabling health professionals and patients to engage through telehealth platforms rather than in-person visits. This shift energizes demand for devices that can transmit clinical auscultation data reliably during remote engagements.

Market Challenges

Device affordability

Affordability constraints remain a barrier to adoption of digital stethoscopes, especially outside affluent urban centres. Even as digital health initiatives grow, uneven broadband and IT infrastructure present cost barriers; fixed broadband household penetration stood at about 33%, with broadband pricing consuming a high share of gross national income that limits home or clinic upgrades. This situation makes acquiring advanced digital diagnostic tools financially challenging for smaller clinics and rural health units, slowing penetration among facilities serving underserved communities who might benefit most from remote diagnostic capabilities.

Clinician adoption

Integration of digital health tools into clinical practice encounters adoption resistance among healthcare professionals due to limited exposure and training. While many physicians engaged with telemedicine platforms post-pandemic, a gap in structured adoption persists. Telemedicine utilization studies show increased interest, but lack of comprehensive, formal training on digital diagnostic hardware and software often limits clinician confidence and uptake, especially for tools like digital stethoscopes that demand new workflows and interpretation skills alongside traditional auscultation training.

Opportunities

Hospital-at-home

The hospital-at-home model, which delivers acute care outside traditional facilities, offers a significant opportunity for digital stethoscopes in the Philippines. With many patients living in rural or remote areas and facing travel costs to urban tertiary hospitals, there is growing demand for advanced remote monitoring technologies that can support clinical decisions from a distance. Telemedicine revenues exceeding USD ~ billion demonstrate the appetite for remote care services, suggesting connected diagnostic tools like digital stethoscopes can play a pivotal role as frontline instruments in home-based clinical workflows, enabling clinicians to listen and assess cardiopulmonary sounds remotely.

Remote patient monitoring (RPM) cohorts

Expanding remote patient monitoring cohorts — patients managed through digital health platforms for chronic conditions — present opportunities for digital stethoscopes to become embedded diagnostic components in RPM toolkits. With widespread internet use supporting telehealth participation, clinicians can track patient cardiopulmonary metrics alongside other vitals remotely, improving chronic disease management. This integration allows care teams to capture auscultation data, enhancing RPM platforms’ diagnostic capabilities beyond basic sensor streams.

Future Outlook

Over the next six years, the Philippines Digital Stethoscopes Market is expected to expand steadily, supported by structural drivers in the broader digital-health ecosystem. Telemedicine revenues already exceed USD ~ billion and are forecast to grow at mid-teens rates, offering a natural pull for connected auscultation devices as part of tele-exam kits and RPM bundles. Government-backed investment of roughly USD ~ billion in digital healthcare transformation, combined with a healthcare market of about USD ~ billion, sets the foundation for higher penetration of AI-ready stethoscopes across public and private facilities. As hospital groups pilot hospital-at-home models and expand specialist outreach into underserved regions, smart stethoscopes will move from “nice-to-have” to core diagnostic tools within tele-enabled workflows. In this context, a high single-digit CAGR for 2024–2030 appears realistic, with upside if reimbursement and procurement frameworks explicitly recognize device-supported tele-auscultation.

Major Players

- 3M Littmann / Solventum

- Eko Health Inc.

- Thinklabs Medical

- HD Medical Inc.

- M3DICINE

- eKuore

- Sonavi Labs

- CliniCloud

- Cardionics / 3B Scientific

- Philips

- Welch Allyn

- AMD Global Telemedicine

- Sunmeditec

- Minttihealth

Key Target Audience

- Medical device manufacturers and OEMs

- Private hospital groups and healthcare chains

- Public sector hospitals and DOH-retained facilities

- Telehealth and virtual-clinic platforms

- Health insurers, HMOs and payers

- Investments and venture capitalist firms

- Government and regulatory bodies

- International development agencies and health NGOs

Research Methodology

Step 1: Identification of Key Variables

The initial phase constructs an ecosystem map for the Philippines Digital Stethoscopes Market covering OEMs, importers, distributors, hospitals, clinics, RHUs, telehealth platforms, payers and regulators. Extensive desk research across WHO, World Bank, DOH, PhilHealth, telemedicine and med-tech sources is used to profile healthcare infrastructure, telehealth usage, digital-health funding and global device benchmarks. The objective is to define critical variables such as device penetration by facility type, telehealth intensity, procurement models and replacement cycles that shape demand.

Step 2: Market Analysis and Construction

In this phase, historical trends for global digital stethoscopes and Philippines digital-health spending are compiled to anchor a structured market model. Global revenue curves for digital stethoscopes, Philippines healthcare and telemedicine markets, and hospital/clinic counts are combined to estimate installed base and annual device flows by segment. Ratios such as devices per physician, devices per telehealth workstation, and replacement intervals are analysed to build a coherent bottom-up and top-down cross-checked revenue estimate for 2024 and the 2024–2030 horizon.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses around adoption curves (by care setting), dominant product architectures, price bands and usage intensity are validated through structured interviews and online consultations with Filipino clinicians, biomedical engineers, hospital procurement managers, telemedicine platform operators and local distributors. These discussions focus on real-world deployment scenarios, preferred brands, barriers (price, IT integration, training), and expectations for AI-enabled auscultation. Feedback from APAC-level product managers at global OEMs is also incorporated to refine assumptions about regional mix and the Philippines’ share of global device volumes.

Step 4: Research Synthesis and Final Output

Finally, model outputs are stress-tested against alternative scenarios on telemedicine growth, public-sector procurement and device pricing, and then synthesised into a coherent narrative. The Philippines Digital Stethoscopes Market is segmented by architecture and care setting, with indicative 2024 share splits and a working CAGR for 2024–2030 derived from macro-digital-health trajectories. Detailed qualitative insights on clinical workflows, telehealth integration and competitive dynamics are layered over the quantitative framework, creating a decision-ready view for investors, OEMs, hospital groups and policymakers.

- Executive Summary

- Research Methodology (Market Definitions, Scope & Taxonomy, Data Sources & Triangulation Approach, Market Sizing & Forecasting Framework, Sample Profile & Stakeholder Coverage, Assumptions, Limitations & Sensitivity Checks)

- Definition, Scope & Classification

- Evolution of Auscultation & Smart Stethoscopes in the Philippines

- Role in Telemedicine, eHealth & Remote Patient Monitoring

- Positioning within the Philippines Diagnostic & Monitoring Device Landscape

- Business & Replacement Cycle for Digital Stethoscopes

- Growth Drivers

NCD burden

Telemedicine expansion

Workforce shortages

eHealth policy support - Market Challenges

Device affordability

Clinician adoption

IT integration

Connectivity gaps - Opportunities

Hospital-at-home

RPM cohorts

Pediatric & geriatric care

Training & simulation - Trends

AI-assisted auscultation

Cloud analytics

Subscription models

Bundled kits - Regulatory & Reimbursement Landscape

- Stakeholder Ecosystem

- SWOT Analysis – Philippines Digital Stethoscopes Market

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- Installed Base of Digital / Smart Stethoscopes, 2019-2024

- Average Realization per Device & by Configuration, 2019-2024

- Mix of New Installations vs Replacement / Upgrades, 2019-2024

- By Product Architecture (in Value %)

Tube-Based Electronic Stethoscopes

Fully Digital Smart Stethoscopes with Display / Onboard Processing

Wireless / Bluetooth-Enabled Stethoscopes

USB / PC-Based Digital Stethoscopes

Telehealth & RPM Kit-Integrated Stethoscopes - By Clinical Application (in Value %)

Cardiology & Internal Medicine

Pulmonology & Respiratory Clinics

General / Family Medicine & Primary Care

Emergency, ICU & Critical Care

Pediatrics & Neonatal Intensive Care - By Care Setting (in Value %)

Public DOH & LGU Hospitals

Private Tertiary Hospitals & Hospital Chains

Specialty & Multi-Specialty Clinics

Rural Health Units (RHUs), Barangay Health Stations & Primary Care Facilities

Medical, Nursing & Allied Health Schools / Simulation Centers - By Connectivity & Integration Level (in Value %)

Standalone Digital Stethoscopes (No Connectivity)

App-Connected Devices (Mobile / Tablet)

Hospital Information System / EHR-Integrated Devices

Remote Patient Monitoring & Home-Care Platform-Integrated Devices

Teaching / Simulation Software-Integrated Systems - By Procurement & Funding Model (in Value %)

DOH & National-Level Tenders

LGU-Funded & Hospital-Managed Procurement

PhilHealth-Linked or Reimbursed Programs

Private Hospital & Clinic Direct Capex Purchases

Donor, NGO & Development Partner-Funded Acquisitions - By Region (in Value %)

National Capital Region

Balance of Luzon

Visayas

Mindanao

- Market Share of Major Players

Positioning by Product Type & Clinical Focus - Cross Comparison Parameters (company overview, product & architecture portfolio, AI & decision-support capabilities, regulatory approvals & certifications, interoperability & integration stack, local channel & service coverage in the Philippines, pricing & commercial model (device, software, subscription), strategic partnerships with telehealth / RPM / eHealth platforms)

- SWOT Snapshot of Major Players

- Pricing & Commercial Model Benchmarking

- Go-to-Market & Channel Strategy Analysis

- Detailed Profiles of Major Companies

Solventum / 3M Littmann

Eko Health, Inc.

Thinklabs Medical LLC

HD Medical, Inc.

eKuore

M3DICINE Pty Ltd.

Sonavi Labs

Steth IO

Medline Industries, LP

Cardionics

CliniCloud

Stemoscope / Smart Sound

Meditech Equipment Co., Ltd.

Philips

- Adoption by Facility Type

- Clinical Workflow Integration

- Purchasing Power & Budget Allocation

- User Persona & Pain Point Analysis

- Digital Maturity & IT Infrastructure Readiness

- By Value, 2025-2030

- By Volume, 2025-2030

- Installed Base of Digital / Smart Stethoscopes, 2025-2030

- Average Realization per Device & by Configuration, 2025-2030

- Mix of New Installations vs Replacement / Upgrades, 2025-2030