Market Overview

The Philippines digital therapeutics (DTx) market was valued at USD ~ million in the prior year and aligns to an implied USD ~ million in the latest year when following the same growth trajectory, which references a forecast to USD ~ million by the end of the forecast window. Demand is increasingly anchored in chronic disease self-management and mental health programs, supported by digital access at scale—~ internet users are recorded in the Philippines at the start of the latest year, enabling app-first delivery models outside major hospitals.

Market activity concentrates in Metro Manila (NCR) and secondary urban hubs like Cebu (Central Visayas) and Davao, because these corridors have the densest private provider networks, the highest concentration of employer headquarters and HMOs, and the strongest device retail and service ecosystems. On the supply side, the most visible clinical DTx capability is still imported—U.S. and other global DTx vendors tend to lead on evidence-backed chronic and behavioral programs, while local platforms more commonly bundle DTx-like coaching into broader telehealth and wellness journeys.

Market Segmentation

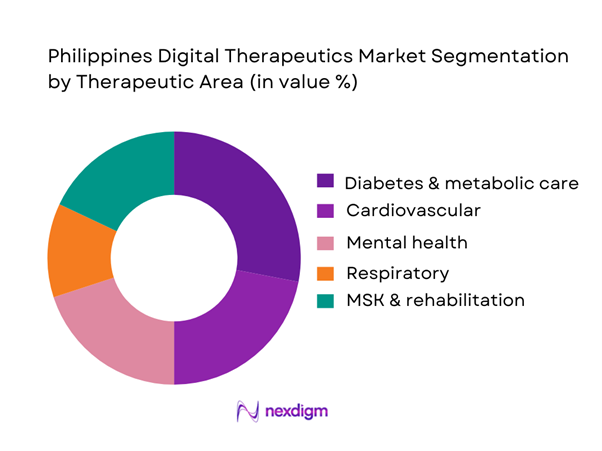

By Therapeutic Area

The strongest demand pull comes from diabetes-linked self-management because the condition base is large and persistent, and DTx can continuously intervene between facility visits through coaching, adherence nudges, diet tracking, and device-linked workflows. Reports indicate ~ adults living with diabetes in the Philippines, giving payers, employers, and providers a clear ROI narrative around preventing complications and stabilizing utilization. DTx programs in this segment are also easier to operationalize: they can start as software-only behavior change and evolve into software + device bundles (glucometers/wearables), making them attractive for employer benefits and HMO wellness-to-care escalation pathways.

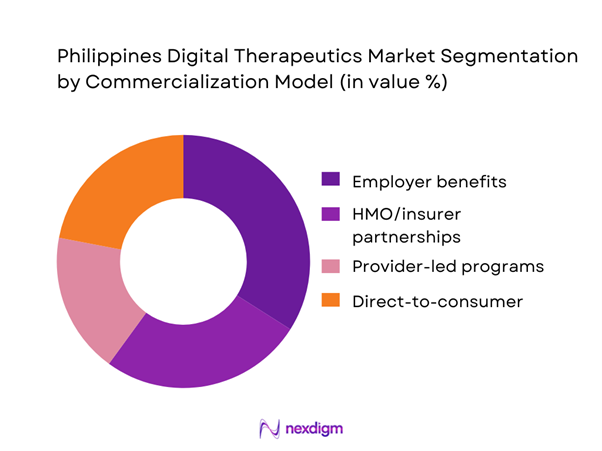

By Commercialization Model

Employer-led rollouts dominate early-stage DTx markets because they bypass reimbursement bottlenecks and can scale faster through HR enrollment and wellness campaigns. It is noted that DTx treatments are not yet covered under PhilHealth, which limits mass affordability through national coverage—this structurally encourages private-sector buyers (corporates and HMOs) to become the primary launchpad. Employers also prefer measurable KPIs (activation, retention, reduced absenteeism proxies) and can bundle DTx inside broader health apps or teleconsult subscriptions, improving adoption versus pure D2C where out-of-pocket willingness is volatile.

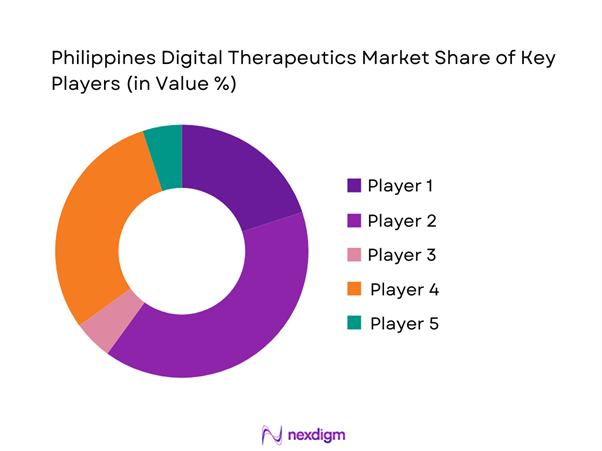

Competitive Landscape

The Philippine DTx market remains in an early commercialization phase and is best described as ecosystem-led rather than “single-product dominated.” Current prominent players include KonsultaMD, MediCard, Welldoc, and Canary Health, while also signaling white space for more specialized programs in cardiovascular, respiratory, weight management, mental health, and rehab. In practice, competitive advantage is shaped less by “features” and more by enterprise contracting readiness, evidence credibility, and the ability to embed into provider/HMO workflows with low integration burden.

| Company | Est. Year | HQ | Philippines Coverage Model | Priority Therapeutic Focus | Commercialization Motion | Evidence Posture | Integration Depth | Localization Readiness |

| KonsultaMD | 2015 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| MediCard | 1986 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Welldoc | 2008 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Canary Health | 2007 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| mWell (Metro Pacific Health Tech) | 2020 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Digital Therapeutics Market Analysis

Growth Drivers

Rising non-communicable disease burden

Clinical demand for digital therapeutics (DTx) in the Philippines is anchored in the country’s heavy, measurable load of NCD events that require long- duration behavior change, monitoring, and medication support—use-cases where DTx is most clinically “sticky” (diabetes, hypertension, cardiac rehab, COPD, obesity). On the mortality side, government vital statistics show ischemic heart diseases alone recorded ~ deaths in the country during the Jan–Nov period cited in the provisional cause-of-death release, keeping cardiovascular disease among the most persistent drivers of follow-up needs across primary care, outpatient cardiology, and chronic pharmacy pathways. This disease load scales with macro fundamentals that keep absolute service demand high: the Philippines’ nominal GDP reached USD ~ (current US$ series) and GDP per capita reached USD ~, sustaining a larger base of employed and insured consumers who can access employer plans, HMOs, and private providers that increasingly experiment with app-enabled chronic programs instead of clinic-only follow-ups. For providers and payers, the practical DTx pull is the “repeat-touchpoint” nature of NCD management: when national claims volumes run into the tens of millions, even modest diversion of follow-ups into structured digital programs becomes operationally relevant for appointment capacity, nurse time, and adherence reinforcement, strengthening the business case for regulated SaMD/DTx pathways that sit between wellness apps and traditional care.

Mental health access gaps

DTx demand is also being structurally pulled by measurable capacity constraints in mental health delivery and the high fixed-cost nature of scaling face-to-face therapy across fragmented local systems. Country mental health profiles document ~ total mental health workers and ~ child & adolescent mental health workers, while also reporting government mental health spending of PHP ~ per capita—a level that forces prioritization, long waiting lists, and uneven geographic coverage, especially when care requires multi-session therapy, relapse prevention, and medication monitoring. In this environment, DTx products (e.g., CBT-based digital therapeutics, digital relapse-prevention modules, clinician-supervised digital programs) become a pragmatic “capacity extender,” converting part of therapy delivery into structured, trackable modules while reserving clinician time for higher acuity cases. Macro conditions reinforce the scale argument: with GDP per capita at USD ~ and GDP at USD ~, the system has growing private-sector purchasing power—but not nearly enough specialized workforce to match demand with traditional visit-based scaling, particularly outside major urban centers. This creates a market logic where DTx adoption is strongest when linked to employer benefits, HMO add-ons, hospital outpatient psych, or teletherapy networks that can prescribe or supervise digital programs while documenting outcomes and engagement.

Challenges

Lack of dedicated DTx reimbursement coverage

A key commercialization brake is that DTx often sits in a “coverage gap”: it is more clinical than wellness apps, but not consistently treated as a reimbursable benefit category across public schemes, and private reimbursement is fragmented across employers and HMOs. The Philippines’ claims system illustrates why formal reimbursement categorization matters: reports show ~ paid claims and PHP ~ in claims payments, showing how benefit design drives what scales nationally and what remains pilot-only. Without a dedicated DTx benefit class, DTx vendors must sell through enterprise contracts or embed into provider-funded programs, which limits reach beyond insured employee cohorts. At the same time, overall health financing is large and measurable—health expenditure research notes PHP ~ in Primary Health Care Expenditure—yet funding allocation does not automatically translate into DTx coverage unless benefit packages explicitly recognize SaMD/DTx interventions, evidence standards, and payment rules. Macro indicators (GDP USD ~; GDP per capita USD ~) suggest capacity for expanded health financing mechanisms, but the reimbursement “plumbing” needs codified pathways (coverage criteria, outcomes documentation, provider billing rules) for DTx to scale like drugs and procedures do.

Evolving SaMD regulatory clarity

DTx in the Philippines is highly sensitive to how regulators classify and authorize medical device software (including SaMD and software in/with devices) because commercialization depends on whether products can be marketed as clinical interventions versus general wellness tools. The Food and Drug Administration has a live draft process for Guidelines on the Regulation of Medical Device Software (MDSW) with a stated comment deadline of ~, indicating that regulatory requirements are actively being refined—an uncertainty that affects product roadmaps, quality management systems, local authorization strategy, and contracting with providers who often require regulatory clarity before prescribing or integrating software into care plans. Regulatory uncertainty becomes more material when scaled across a large economy: GDP at USD ~ signals a sizeable health and digital market where regulatory definitions can unlock or constrain major investment flows into clinical software. For DTx firms, the challenge is not only “approval,” but the operational chain that follows: classification drives documentation burden, clinical evidence expectations, post-market obligations, and how hospitals’ procurement committees treat products. It also affects payer confidence—because reimbursement buyers prefer products with clear regulatory standing.

Opportunities

Employer and HMO bundled care models

The strongest near-term scaling opportunity is bundling DTx into employer and HMO chronic-care packages because this channel already manages large claims volumes, has a clear ROI narrative (reduced complications, fewer ER visits, improved productivity), and can contract faster than broad public coverage reform. The underlying utilization base is proven: reports show ~ paid claims and PHP ~ in claims payments in a year—an indicator of the operational scale that benefit buyers want to manage more efficiently. At the same time, national health financing has large “primary-care” allocation signals—health expenditure research cites PHP ~ in Primary Health Care Expenditure—supporting a market direction where payers prioritize interventions that improve long-term disease control and continuity. Macro expansion (GDP USD ~; GDP per capita USD ~) increases the addressable base of formal workers and insured families who can be reached via employment-linked benefits. The commercial implication is that DTx products positioned as “bundled care”—combining digital modules with nurse coaching, teleconsult access, medication adherence support, and outcomes reporting—can scale rapidly across corporate accounts and insurer portfolios without relying on a single nationwide DTx reimbursement code. This opportunity is “future growth” oriented while backed by current numbers: buyers already pay for millions of claims; bundling aims to reshape that spend toward earlier intervention and more stable chronic control using clinically governed digital pathways.

Localized Filipino-language digital therapeutics

Localization is a high-impact growth lever because DTx outcomes depend on comprehension, cultural fit, and sustained participation—factors that improve when content is delivered in Filipino languages and aligned to local care pathways. The “scale to localize” business case is supported by the size of reachable endpoints: over ~ SIMs have been cited in circulation and ~ SIMs registered under official SIM registration reporting windows, creating a large addressable base for language-specific onboarding, reminders, and coaching content delivered through app + SMS hybrids. On the supply side, the provider footprint is broad—registry-linked references cite ~ health facilities—meaning patient journeys vary by locality; localized DTx can standardize education and self-management protocols while still integrating with local referral patterns. Macro conditions (GDP USD ~; GDP per capita USD ~) support ongoing digital consumption growth, but localization becomes the practical differentiator that converts “download” into “completion,” especially for multi-week programs like CBT modules, diabetes self-management, and hypertension lifestyle protocols. The commercial opportunity is therefore not just translation; it is localization of clinical pathways (medication naming conventions, local diet examples, culturally relevant stress management) and multi-channel delivery (app modules + SMS nudges + coach calls) that can be deployed through employers, HMOs, and provider networks.

Future Outlook

Over the next five years, the Philippines DTx market is positioned to expand from “early adoption” into structured enterprise scaling, led by chronic disease programs, mental health demand, and employer/HMO channel maturity. Digital access fundamentals remain supportive—reports note ~ internet users at the start of the latest year, and smartphone market shipments of ~ units in the same period, strengthening the reachable user base for app-centric interventions. The major swing factors will be clearer SaMD/MDSW regulatory expectations, integration pathways into payer/provider workflows, and credible local evidence and outcomes reporting that unlock longer-term contracting.

Major Players

- KonsultaMD

- MediCard

- Welldoc

- Canary Health

- mWell

- Teladoc Health

- Omada Health

- DarioHealth

- Virta Health

- Noom

- Headspace Health

- Wysa

- Kaia Health

- Big Health

Key Target Audience

- HMOs and private health insurers

- Private hospital chains and hospital-owned outpatient networks

- Large employer groups and HR benefits owners

- Corporate health & wellness program aggregators / EAP buyers

- Pharmacy chains and omnichannel health retailers

- Connected device distributors and wearable ecosystem partners

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We first build a Philippines DTx ecosystem map across providers, HMOs, employers, device partners, and app platforms. Desk research is combined with structured screening to separate DTx from telehealth and wellness, and to define prescription-oriented vs. non-prescription clinical programs. We also codify SaMD/MDSW implications based on available consultation materials.

Step 2: Market Analysis and Construction

We compile historical commercialization signals including enterprise contracts, covered lives proxies, paid subscription signals, and partner distribution footprints. A bottom-up model is built by mapping DTx offerings to monetization models (PMPM/license/D2C) and validating plausible paid-user ranges through channel interviews.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on therapeutic demand (diabetes, mental health, cardio) and channel dominance (employer/HMO) are validated through CATI-style interviews with medical directors, HMO product heads, and employer benefits owners, supported by structured questionnaires on KPIs like activation, retention, and escalation rates.

Step 4: Research Synthesis and Final Output

We triangulate findings with secondary references to produce a consistent market model and competitive benchmark. Final outputs include segmentation shares, buyer decision frameworks, and go-to-market recommendations aligned to Philippines channel realities.

- Executive Summary

- Research Methodology (market definitions and scope boundaries, DTx vs telehealth vs wellness delineation, prescription vs non-prescription taxonomy, SaMD decision tree and risk tiers, bottom-up build using SKU and paid user mapping, top-down build using digital health spend attach rates, triangulation protocol, primary interviews with providers HMOs employers and LGUs, inclusion and exclusion criteria, limitations and sensitivity checks, abbreviations)

- Definition and Scope

- Market Genesis and Evolution

- Policy and Ecosystem Timeline

- Care Pathway Fit (primary care → specialist → chronic management)

- Value Chain and Stakeholder Map

- Growth Drivers

Rising non-communicable disease burden

Mental health access gaps

Employer-led digital health benefits adoption

High smartphone and internet penetration

Care continuity challenges in archipelagic geography - Challenges

Lack of dedicated DTx reimbursement coverage

Evolving SaMD regulatory clarity

Provider workflow integration friction

Patient engagement and adherence drop-offs

Data privacy and hosting compliance - Opportunities

Employer and HMO bundled care models

Localized Filipino-language digital therapeutics

Device-linked chronic disease programs

Outcomes-based contracting pilots - Trends

Hybrid DTx and teleconsult bundles

AI-driven behavior change engines

Digital coaching and adherence analytics

Remote monitoring enabled care pathways - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Revenue, 2019–2024

- By Paying Users, 2019–2024

- By Deployment Type, 2019–2024

- By Application (in Value %)

Diabetes and metabolic care

Cardiovascular including hypertension and lipid management

Mental health including CBT anxiety and depression

Respiratory including asthma and COPD

Musculoskeletal and rehabilitation - By Technology Architecture (in Value %)

Software-only digital therapeutics

Software plus connected medical devices

AI-enabled triage and clinical decision support

Digital biomarker and passive monitoring platforms - By End-Use Industry (in Value %)

Private hospitals and clinics

Health maintenance organizations and insurers

Employers and corporate health programs

Government and LGU public health programs - By Connectivity Type (in Value %)

Smartphone app-based standalone

Bluetooth-enabled device integration

Cloud-based analytics and dashboards

Offline-first hybrid deployments - By Region (in Value %)

Metro Manila (NCR)

CALABARZON

Central Visayas

Davao Region

Rest of Philippines

- Competitive Structure

Market Share Framework - Cross Comparison Parameters (therapeutic indications covered, clinical evidence depth, prescription orientation, employer and HMO contracting readiness, provider referral workflow support, localization and language readiness, integration depth, engagement and adherence KPIs, data privacy and hosting posture)

- SWOT Analysis of Key Players

- Competitive Benchmarking

- Company Profiles

KonsultaMD

MediCard

Welldoc

Canary Health

mWell

Teladoc Health

Omada Health

DarioHealth

Virta Health

Noom

Headspace Health

Wysa

Kaia Health

Big Health

Glooko

- Buyer Personas

- Buying Criteria

- Utilization & Engagement

- Pain Points

- By Revenue, 2025–2030

- By Paying Users, 2025–2030

- By Deployment Type, 2025–2030

- By Prescription Orientation, 2025–2030

- By Care Setting, 2025–2030