Market Overview

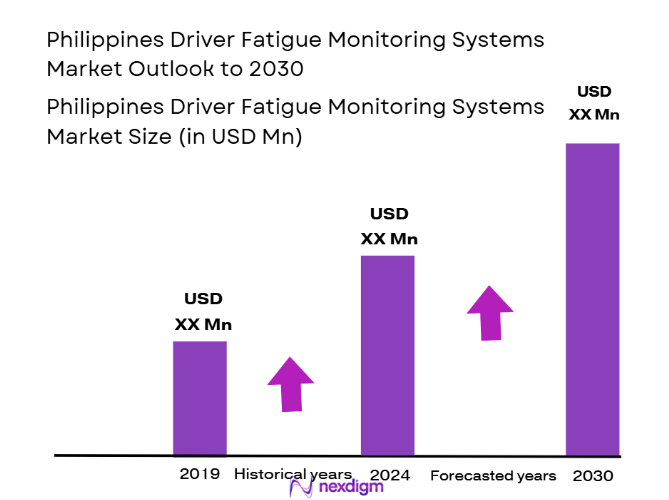

The Philippines Driver Fatigue Monitoring Systems Market is valued at USD ~ million in 2025, driven by an increasing emphasis on road safety and government regulations aimed at reducing road accidents. The market is supported by the rapid adoption of advanced driver-assistance systems (ADAS), growing awareness about the importance of driver monitoring, and technological advancements in fatigue detection sensors. Increased accidents due to driver fatigue have spurred demand for integrated systems that use sensors and cameras for real-time monitoring, resulting in a shift toward higher demand in both OEM and aftermarket segments.

Metro Manila, Cebu, and Davao are the primary regions dominating the Philippines Driver Fatigue Monitoring Systems Market. Metro Manila, with its dense traffic and high number of commercial fleets, is the focal point for implementing driver safety technologies. Cebu, as a hub for logistics, and Davao, with its increasing road infrastructure development, are also key regions where driver fatigue monitoring systems are gaining traction. The growth in these cities is attributed to high traffic volumes, rising concerns over road safety, and the government’s push toward safer transport solutions.

Market Segmentation

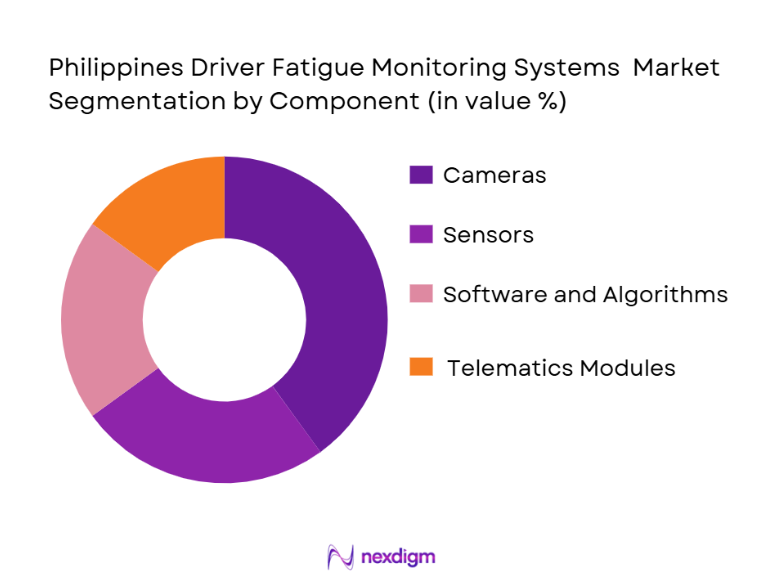

By Component

The Philippines Driver Fatigue Monitoring Systems Market is segmented by components, which include cameras, sensors, software and algorithms, and telematics modules. In this segment, cameras dominate the market. This is because advanced fatigue detection technologies, including facial recognition and eye-tracking, have become critical in ensuring driver alertness. Cameras enable real-time fatigue alerts by capturing facial cues and eye movements, which are the most reliable indicators of drowsiness and driver fatigue. The growing penetration of ADAS in vehicles, coupled with decreasing camera costs, further supports the dominance of this component.

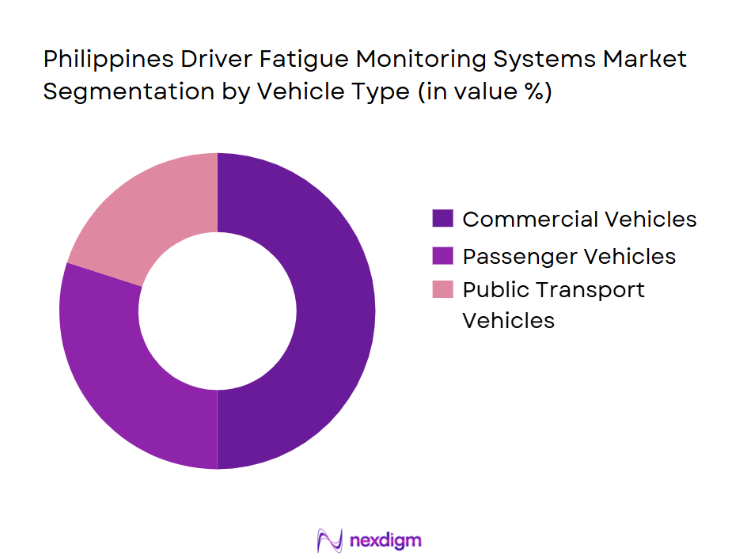

By Vehicle Type

The vehicle type segmentation in the Philippines Driver Fatigue Monitoring Systems Market includes passenger vehicles, commercial vehicles, and public transport vehicles. Commercial vehicles dominate this segment due to the increasing number of freight and logistics companies adopting fatigue monitoring systems. These systems help mitigate risks related to long-distance driving, which is a significant issue in commercial transport. Additionally, fleet managers prioritize driver safety to minimize insurance costs and liability, boosting the demand for such systems in commercial vehicles.

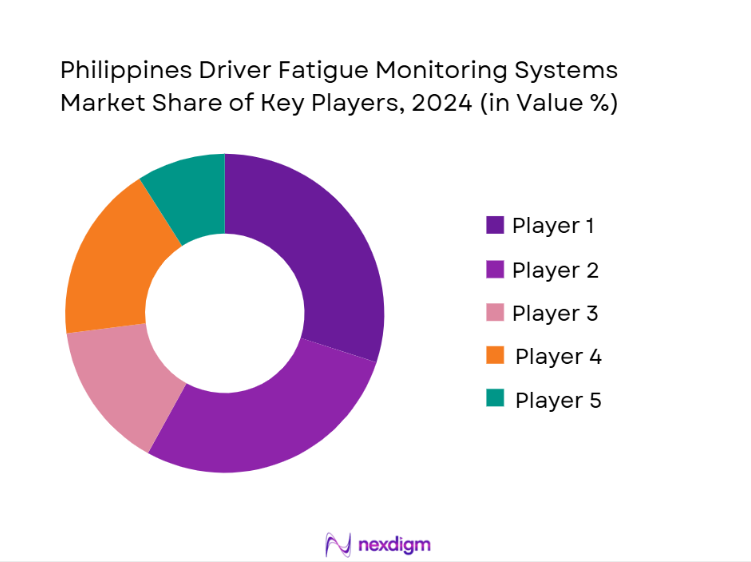

Competitive Landscape

The Philippines Driver Fatigue Monitoring Systems Market is dominated by a few key players, including both global companies and regional players. These companies are increasingly focusing on integrating advanced AI algorithms and sensor technologies to provide comprehensive solutions. The market is competitive, with companies like Mobileye, Bosch, and Seeing Machines leading the way in technology development and deployment.

| Company Name | Establishment Year | Headquarters | Technology Focus | Regional Presence | R&D Investment | Partnerships |

| Mobileye | 1999 | Israel | ~ | ~ | ~ | ~ |

| Bosch | 1886 | Germany | ~ | ~ | ~ | ~ |

| Seeing Machines | 2000 | Australia | ~ | ~ | ~ | ~ |

| Continental AG | 1871 | Germany | ~ | ~ | ~ | ~ |

| Denso | 1949 | Japan | ~ | ~ | ~ | ~ |

Market Analysis

Growth Drivers

Increasing Road Safety Regulations

Governments worldwide, including in the Philippines, are emphasizing road safety, particularly for commercial and public transport vehicles. This has led to the implementation of stricter safety regulations, mandating driver monitoring systems (DMS) in certain vehicle categories. Such regulations have accelerated the adoption of driver fatigue monitoring systems to enhance driver safety and reduce accidents caused by fatigue.

Technological Advancements in AI and Sensors

The continuous evolution of AI and sensor technology has significantly improved the accuracy and affordability of driver fatigue monitoring systems. With innovations such as facial recognition, eye tracking, and heart-rate monitoring, fatigue detection systems are becoming more reliable and widely adopted across different vehicle types, from passenger cars to commercial fleets.

Market Challenges

High Initial Implementation Costs

The integration of driver fatigue monitoring systems requires substantial upfront investment, particularly for fleet operators in developing markets like the Philippines. The high cost of hardware, sensors, and software, along with installation charges, makes it challenging for small and medium-sized fleets to adopt such technologies.

Lack of Consumer Awareness and Trust

While fatigue monitoring technology is proven to enhance safety, there remains a lack of awareness among both fleet operators and individual drivers about the benefits of these systems. Additionally, concerns over the reliability of the systems and privacy issues related to in-cabin monitoring have slowed the widespread adoption of these solutions.

Opportunities

Growth in Commercial Fleets and Logistics Sector

The rapidly expanding logistics and transportation sector in the Philippines presents a significant opportunity for the growth of driver fatigue monitoring systems. With rising concerns over driver safety and long-haul transportation, fleet operators are increasingly investing in advanced technologies to ensure compliance with safety regulations and reduce accident rates.

Integration with Telematics and ADAS Solutions

The growing demand for integrated safety systems has opened up opportunities for driver fatigue monitoring systems to be bundled with telematics and advanced driver-assistance systems (ADAS). This integration not only enhances the functionality of fatigue monitoring but also provides fleet operators with comprehensive data for real-time monitoring, ultimately improving overall fleet safety and operational efficiency.

Future Outlook

Over the next 5 years, the Philippines Driver Fatigue Monitoring Systems Market is expected to show substantial growth, driven by increasing adoption of ADAS in passenger and commercial vehicles, heightened concerns about road safety, and regulatory pressure on fleet operators. As the demand for safer driving solutions intensifies, vehicle manufacturers and fleet operators will increasingly integrate driver fatigue monitoring systems to minimize accidents and improve driver well-being. The growth will also be supported by technological advancements, making these systems more accessible and affordable to a broader range of vehicle types and market segments.

Major Players in the Market

- Mobileye

- Bosch

- Seeing Machines

- Continental AG

- Denso

- Valeo

- Harman International

- Aisin Corporation

- Vayeca

- Autoliv

- ZF Friedrichshafen

- Gentex Corporation

- Voxx International

- Mirle Automation

- Wabco

Key Target Audience

- Vehicle Manufacturers (OEMs)

- Fleet Operators & Logistics Companies

- Insurance Companies

- Government and Regulatory Bodies (e.g., Department of Transportation, Land Transportation Office)

- Automotive Telematics Providers

- Investments and Venture Capitalist Firms

- Technology Developers in AI & Machine Vision

- Commercial Vehicle Safety Managers

Research Methodology

Step 1: Identification of Key Variables

The research process begins with mapping out all relevant variables impacting the Philippines Driver Fatigue Monitoring Systems Market, including regulatory frameworks, technological advancements, and consumer adoption rates. Secondary research sources such as industry reports, expert consultations, and publicly available data will be used to gather insights into these variables.

Step 2: Market Analysis and Construction

We will analyze historical data from the Philippines Driver Fatigue Monitoring Systems Market to assess market dynamics, focusing on trends, segment growth, and technological adoption. The analysis will also include an assessment of emerging technologies like AI-driven fatigue detection and facial recognition systems.

Step 3: Hypothesis Validation and Expert Consultation

We will validate our market hypotheses through expert consultations, including interviews with key industry players such as OEMs, fleet operators, and technology developers. This phase ensures the accuracy of our data and adds industry-specific insights into the market’s future trajectory.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all findings, including data from expert consultations and secondary research. This comprehensive analysis will be used to produce the final report, ensuring it is both accurate and relevant to market stakeholders.

- Executive Summary

- Research Methodology (Definitions of Market Metrics and Industry Taxonomy, Abbreviation Glossary, Market Sizing & Forecasting Methodology, Data Quality Assurance & Validation, Limitations and Data Confidence Scores, Primary Research Protocol)

- Market Dynamics Overview

- Ecosystem Framework

- Value Chain and Supply Chain Mapping

- Regulatory Landscape

- Technology Maturity Curves

- Growth Drivers

Safety Mandates & Regulatory Push

Rising Road Fatality Awareness

Fleet Operational Risk Management

Integration with ADAS and Advanced Telematics - Market Challenges

High Cost of Integration

Sensor/Algorithm Calibration Needs

Aftermarket Reliability Perception - Opportunities

Predictive Analytics for Fleet Safety

Insurance Risk Reduction Programs

Partnerships with Telematics Service Providers - Trends

AI/MLDriven Predictive Detection

Vehicle OEM Shift toward Embedded DMS

CrossPlatform Data Sharing - Regulatory & Standards Landscape

Philippines Traffic Safety Policies

ASEAN Harmonized Vehicle Safety Standards

Data Privacy & Incab Monitoring Rules

- Total Market Value 2019-2025

- Unit Shipments 2019-2025

- Average Selling Price Trends 2019-2025

- Market Growth Contributions by Major Segments 2019-2025

- By Component (in Value %)

Cameras

Sensors

Software & Algorithms

Connectivity & Telematics Modules

Others - By Technology (in Value %)

Facial Recognition & Eye Tracking

Steering Pattern Analysis

Heart/Physiological Monitoring

Multimodal Fusion Systems

Prediction & Alert Algorithms - By Vehicle Type (in Value %)

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

Public Transport Vehicles

TwoWheelers - By Sales Channel (in Value %)

OEM Integrated

Aftermarket Installed

Telematics Subscription Bundles

Fleet Managed Services - By End User (in Value %)

Individual Consumers

Commercial Fleets

Logistic & Delivery Services

Public Transport Operators

Insurance Telematics Customers - By Region (In Value%)

Luzon

Visayas

Mindanao

- Market Share Analysis (Philippines & Global)

- By Revenue

By Installed Base

By Segment Strengths - Cross Comparison Parameters (Company Overview, Product Portfolio Breadth, Regional Deployment Footprint, Partnership Ecosystems, R&D Investment in AI/ML Algorithms, Technology IP & Patents, Sales & Aftermarket Support Networks, Certification / Compliance Achievements)

- SWOT – Major Players

- Pricing & SKU Analysis

ASP by Component & Package Tier

OEM vs Aftermarket Pricing Matrix - Competitive Company Profiles

Robert Bosch GmbH

Continental AG

Valeo

Denso Corporation

ZF Friedrichshafen AG

Mobileye (Intel)

Magna International

HARMAN (Samsung)

Aisin Corporation

Panasonic Automotive

Seeing Machines

Smart Eye AB

Eyesight Technologies Ltd

Neusoft Reach Automotive

NXP Semiconductors

- Purchasing Intent & Buyer Personas

- Fleet Buyer Decision Criteria

- Pain Points: Latency, False Positives, Integration Complexity

- CostBenefit Analysis

- Market Value by Forecast Period, 2026, 2030

- Unit Projections, 2026-2030

- Forecast ASP Trends, 2026-2030