Market Overview

The Philippines E-Call Systems Market recorded an estimated market size of USD ~ million based on a recent historical assessment. Market expansion is primarily driven by rising vehicle parc volumes, increasing awareness of road safety technologies, and gradual integration of connected vehicle features by automotive OEMs operating in the country. Government-led road safety initiatives and alignment with global automotive safety standards further support adoption. Growth is also supported by expanding mobile network coverage, enabling reliable emergency communication infrastructure essential for e-call system functionality across urban and semi-urban regions.

The market is geographically concentrated in Metro Manila, Central Luzon, and CALABARZON due to higher vehicle ownership, stronger automotive distribution networks, and better telecommunications infrastructure. Metro Manila dominates due to dense traffic conditions and higher accident exposure, driving demand for emergency response technologies. CALABARZON benefits from the presence of automotive manufacturing and assembly facilities, while Central Luzon shows rising adoption supported by logistics corridors and fleet operations. These regions collectively benefit from faster emergency response capabilities and stronger enforcement of vehicle safety compliance.

Market Segmentation

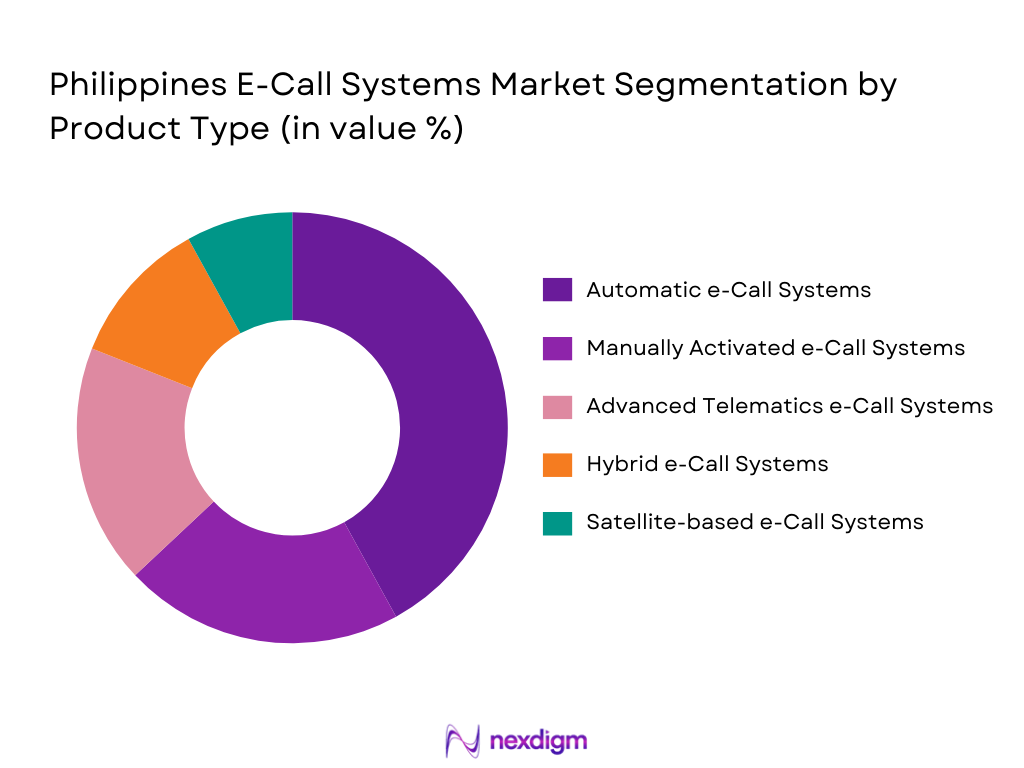

By Product Type

Philippines E-Call Systems Market is segmented by product type into manually activated e-call systems, automatic e-call systems, advanced e-call systems with telematics integration, satellite-based e-call systems, and hybrid e-call systems. Recently, automatic e-call systems have a dominant market share due to their ability to trigger emergency alerts without driver intervention during severe collisions, improving survival outcomes. OEM preference for automated solutions is driven by compliance alignment, lower response times, and seamless integration with vehicle sensors. Insurance companies also favor automatic systems due to reliable accident data capture. Growing consumer awareness and inclusion of automatic e-call features in mid-range vehicles further reinforced dominance.

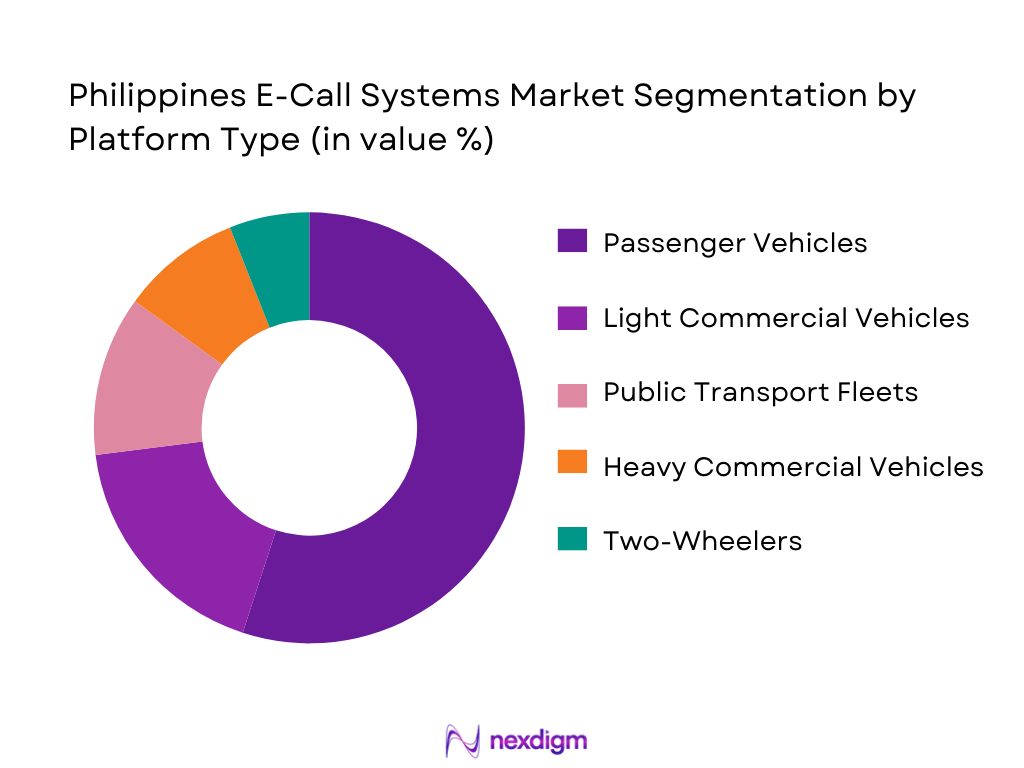

By Platform Type

Philippines E-Call Systems Market is segmented by platform type into passenger vehicles, light commercial vehicles, heavy commercial vehicles, two-wheelers, and public transport fleets. Recently, passenger vehicles dominated market share due to higher ownership volumes, faster adoption of connected car features, and stronger OEM-driven safety feature bundling. Urban commuting patterns and increasing accident risks have pushed private vehicle owners toward safety technologies. Automotive brands increasingly integrate e-call systems as standard or optional features in passenger cars, while financing and insurance incentives accelerate uptake. This platform dominance is reinforced by better cellular connectivity coverage for passenger vehicle usage patterns.

Competitive Landscape

The Philippines E-Call Systems Market shows moderate consolidation, with global automotive electronics suppliers partnering with local distributors and telecom operators. Major players leverage strong OEM relationships, proprietary telematics platforms, and integration capabilities to maintain competitive positioning, while smaller firms focus on aftermarket and fleet-based solutions.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Bosch | 1886 | Germany | ~ | ~ | ~ | ~ | ~ |

| Continental | 1871 | Germany | ~ | ~ | ~ | ~ | ~ |

| Denso | 1949 | Japan | ~ | ~ | ~ | ~ | ~ |

| Valeo | 1923 | France | ~ | ~ | ~ | ~ | ~ |

| Harman | 1980 | USA | ~ | ~ | ~ | ~ | ~ |

Philippines E-Call Systems Market Analysis

Growth Drivers

Expansion of Connected Vehicle and Telematics Infrastructure

Expansion of connected vehicle and telematics infrastructure explanation continues in the same sentence. Expansion of connected vehicle and telematics infrastructure: This growth driver underpins the Philippines E-Call Systems Market as automotive OEMs increasingly embed connectivity solutions to enhance safety and data-driven services. The growing penetration of LTE and improving cellular reliability enable consistent emergency call transmission during accidents. Vehicle manufacturers are aligning local offerings with global connected car platforms, accelerating integration of e-call systems. Fleet operators adopt telematics to improve driver safety monitoring and compliance. Insurance firms promote connected systems for claims efficiency and risk profiling. Government support for intelligent transport systems reinforces infrastructure readiness. Consumer preference for smart vehicle features further boosts adoption. Integration with navigation and infotainment systems increases perceived value and acceptance.

Strengthening Road Safety Regulations and Policy Alignment

Strengthening road safety regulations and policy alignment explanation continues in the same sentence. Strengthening road safety regulations and policy alignment drives the Philippines E-Call Systems Market by encouraging adoption of standardized emergency response technologies. Authorities increasingly focus on reducing road fatalities through technology-backed interventions. Alignment with international vehicle safety frameworks influences OEM compliance strategies. Regulatory discussions around mandatory safety features create long-term demand for certainty. Public safety agencies advocate faster emergency response mechanisms supported by automated alerts. Increased enforcement of vehicle inspection standards encourages system installation. Collaboration between transport and telecom regulators supports interoperability. These measures collectively sustain market momentum.

Market Challenges

High System Cost and OEM Integration Complexity

High system cost and OEM integration complexity explanation continues in the same sentence. High system cost and OEM integration complexity constrain market growth as advanced e-call systems require sensor integration, software calibration, and backend connectivity. Smaller OEMs face cost pressures when localizing global platforms. Aftermarket solutions struggle with compatibility across vehicle models. Maintenance and subscription costs limit adoption among cost-sensitive buyers. Limited local technical expertise increases reliance on imported components. Price sensitivity in the domestic vehicle market slows premium feature uptake. Integration timelines affect model launch schedules. These challenges collectively restrict faster penetration.

Dependence on Telecom Network Reliability and Coverage

Dependence on telecom network reliability and coverage explanation continues in the same sentence. Dependence on telecom network reliability and coverage poses challenges, particularly in rural and remote regions. Inconsistent connectivity can delay emergency call transmission. Network congestion in urban areas affects response reliability. Cross-network interoperability issues complicate service continuity. System performance depends on backend infrastructure readiness. Emergency service coordination varies regionally. These factors reduce uniform effectiveness. Market players must invest in redundancy solutions, increasing costs.

Opportunities

Integration with Insurance and Fleet Safety Ecosystems

Integration with insurance and fleet safety ecosystems explanation continues in the same sentence. Integration with insurance and fleet safety ecosystems offers growth opportunities as insurers leverage e-call data for faster claims processing. Fleet operators value real-time incident reporting to reduce liability. Data-driven safety scoring encourages adoption. Partnerships between OEMs and insurers create bundled offerings. Regulatory acceptance of telematics-based insurance supports expansion. Improved analytics enhance risk management. This ecosystem approach broadens addressable demand.

Adoption in Public Transport and Emergency Services

Adoption in public transport and emergency services explanation continues in the same sentence. Adoption in public transport and emergency services presents opportunities driven by government modernization initiatives. Public fleets prioritize passenger safety and rapid response. Integration with centralized command centers improves efficiency. Budget allocations for smart mobility support deployment. Demonstration projects build confidence. Long-term contracts ensure revenue stability. This segment supports scalable growth.

Future Outlook

The Philippines E-Call Systems Market is expected to witness steady growth over the next five years driven by connected vehicle adoption and regulatory focus on road safety. Technological developments in telematics, AI-based crash detection, and network reliability will enhance system effectiveness. Regulatory support for vehicle safety standards will continue to strengthen demand. Rising consumer awareness and insurance-linked incentives are expected to further support market expansion across vehicle segments.

Major Players

- Bosch

- Continental

- Denso

- Valeo

- Harman

- ZF

- Panasonic Automotive

- LG Vehicle Solutions

- Mitsubishi Electric

- AISIN

- NXP Semiconductors

- Quectel

- Sierra Wireless

- Teltonika

- Hyundai Mobis

Key Target Audience

- Automotive OEMs

- Automotive Tier-1 suppliers

- Telematics service providers

- Insurance companies

- Fleet operators

- Government and regulatory bodies

- Investments and venture capitalist firms

- Emergency response agencies

Research Methodology

Step 1: Identification of Key Variables

Key variables including vehicle parc, connectivity penetration, safety regulations, and OEM adoption trends were identified to define the market framework and analytical scope.

Step 2: Market Analysis and Construction

Market structure was developed using secondary research, industry databases, and demand-side indicators to estimate market size and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through expert opinions from automotive technology specialists, telematics providers, and safety professionals.

Step 4: Research Synthesis and Final Output

Data insights were consolidated, cross-verified, and structured into a comprehensive market report ensuring internal consistency and relevance.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising road safety regulations and compliance initiatives

Increasing vehicle electrification and connected car adoption

Government focus on emergency response modernization - Market Challenges

High system integration and maintenance costs

Limited standardization across vehicle platforms

Dependence on cellular network reliability in remote areas - Market Opportunities

Expansion of connected vehicle infrastructure

Growth of insurance-linked telematics solutions

Integration with national emergency response platforms - Trends

Shift toward advanced telematics-enabled E-Call systems

Growing adoption of AI-driven crash detection

Increased collaboration between automakers and telecom operators - Government Regulations

Road safety and vehicle compliance mandates

Telecommunications and data privacy regulations

Emergency response system standardization policies - SWOT Analysis

- Porter’s Five Forces

- By Market Value ,2019-2025

- By Installed Units ,2019-2025

- By Average System Price ,2019-2025

- By System Complexity Tier ,2019-2025

- By System Type (In Value%)

Automatic emergency call systems

Manually activated emergency call units

Advanced E-Call with vehicle diagnostics

Satellite-based emergency call systems

Integrated telematics emergency systems - By Platform Type (In Value%)

Passenger vehicles

Commercial vehicles

Two-wheelers

Public transport fleets

Emergency service vehicles - By Fitment Type (In Value%)

OEM-fitted systems

Aftermarket retrofit systems

Dealer-installed solutions

Fleet-installed systems

Insurance-linked installations - By End User Segment (In Value%)

Private vehicle owners

Commercial fleet operators

Public transportation authorities

Emergency response agencies

Insurance and telematics service providers - By Procurement Channel (In Value%)

Direct OEM procurement

Automotive dealers and distributors

Telematics service providers

Government tenders and programs

Online and specialty aftermarket retailers

- Market Share Analysis

- Cross Comparison Parameters (Technology integration level, Network connectivity reliability, Regulatory compliance readiness, Cost competitiveness, After-sales support, OEM partnership strength, Telematics platform scalability, Data security and privacy compliance, Emergency response latency, Local service and installation capability)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Bosch Automotive Electronics Philippines

Continental Automotive Philippines

Denso Philippines Corporation

Valeo Philippines

ZF Philippines

Hyundai Mobis Philippines

Harman Philippines

Panasonic Automotive Philippines

LG Vehicle Component Solutions Philippines

Mitsubishi Electric Philippines

AISIN Philippines

NXP Semiconductors Philippines

Quectel Wireless Solutions Philippines

Teltonika Philippines

Sierra Wireless Philippines

- Demand driven by private vehicle safety awareness

- Fleet operators focusing on liability reduction

- Public agencies emphasizing faster emergency response

- Insurers leveraging E-Call data for risk assessment

- Forecast Market Value ,2026-2030

- Forecast Installed Units ,2026-2030

- Price Forecast by System Tier ,2026-2030

- Future Demand by Platform ,2026-2030