Market Overview

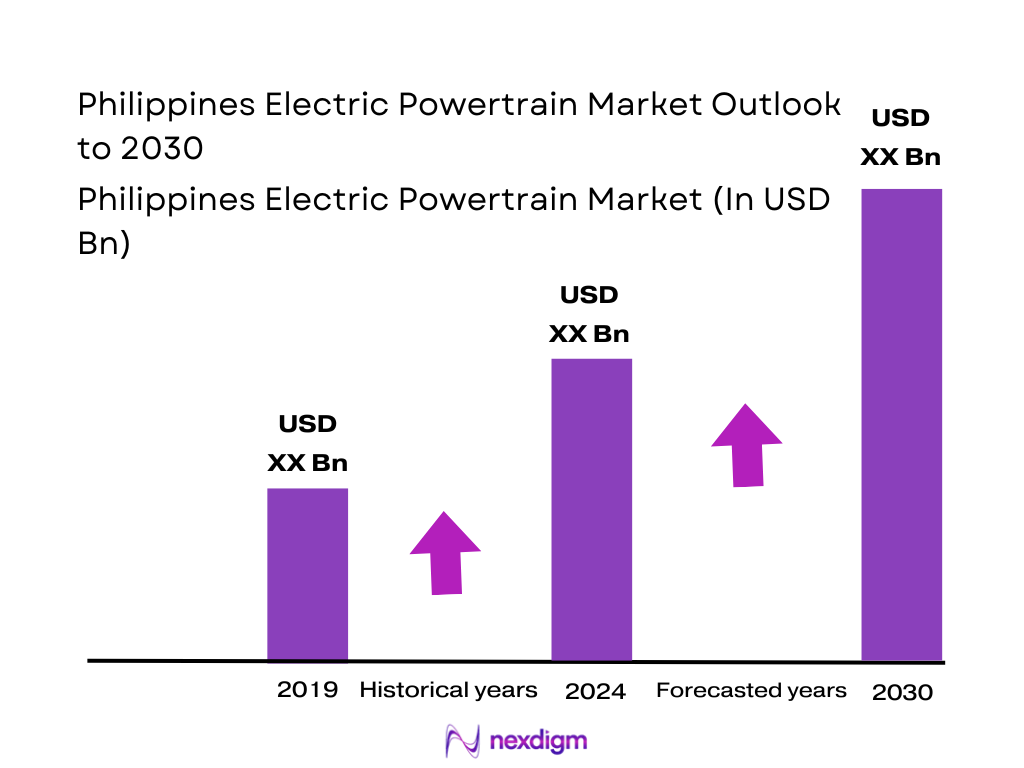

The Philippines electric vehicle market, which anchors demand for electric powertrains, is valued at about USD ~ billion, based on a multi-year analysis of EV sales, fleet deployment and charging investment. Registered EVs have grown to over 16,000 units out of more than 13 million vehicles on the road, with registrations increasing by about half over the latest one-year period, supported by tax incentives under the Electric Vehicle Industry Development Act (EVIDA) and zero-tariff policies on many EV imports. Global benchmarks showing around 51% of EV value concentrated in the powertrain indicate an electric powertrain opportunity near USD ~ billion in the country today.

The Philippines electric powertrain market is heavily concentrated in Metro Manila and surrounding growth corridors, where higher incomes, denser traffic and aggressive mall-based charging rollouts drive early EV adoption. As of the latest data, public charging stations number around 500–600, with an estimated 5,000 needed to support projected EV uptake, and roughly 80% of chargers located in Metro Manila, creating a strong geographic pull for powertrain demand. Emerging secondary hubs include Cebu and Davao, where airport corridors, industrial parks and tourism-led fleets are piloting e-buses, e-PUVs and electric corporate fleets linked to the national CREVI roadmap under EVIDA.

Market Segmentation

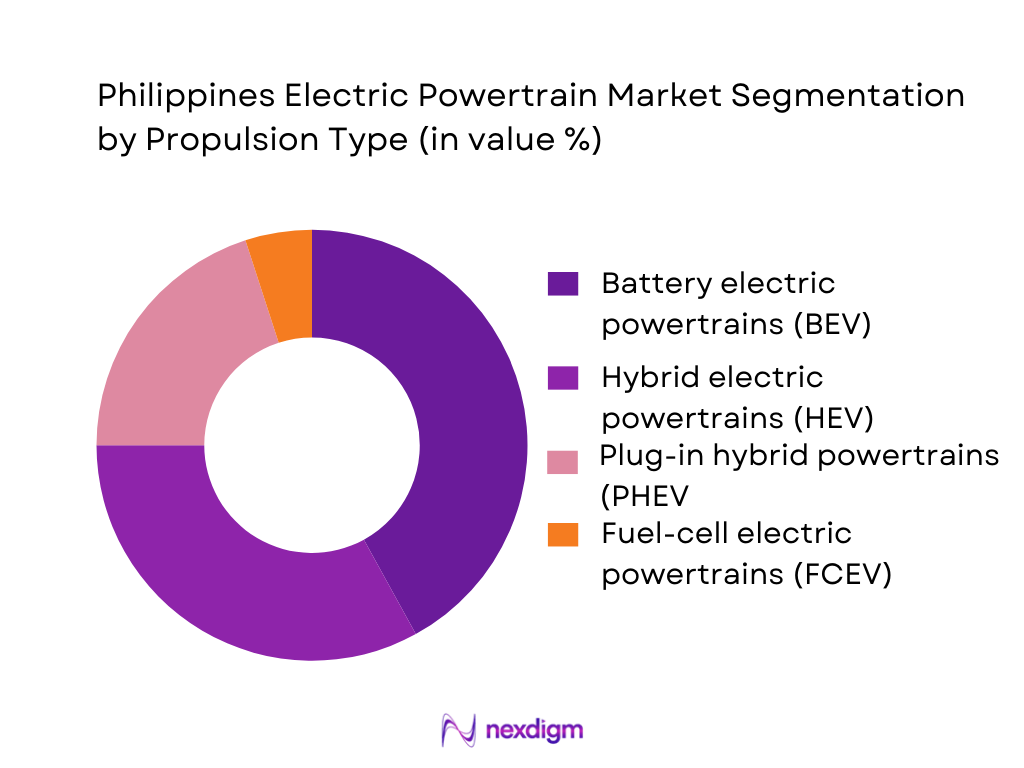

By Propulsion Type

The Philippines electric powertrain market is segmented by propulsion into battery electric powertrains (BEV), hybrid electric powertrains (HEV), plug-in hybrid powertrains (PHEV) and fuel-cell electric powertrains (FCEV). Recent analysis of the country’s EV mix shows BEV powertrains holding the dominant share, driven by aggressive launches of fully electric crossovers and sedans by Chinese and Japanese brands, as well as pure-electric e-jeepneys and e-buses deployed under the Public Utility Vehicle Modernization Program. BEVs benefit from full import duty exemptions, visible urban charging corridors, and strong marketing from brands like BYD and Nissan, while hybrids and PHEVs remain important transition technologies but contribute lower powertrain value per vehicle.

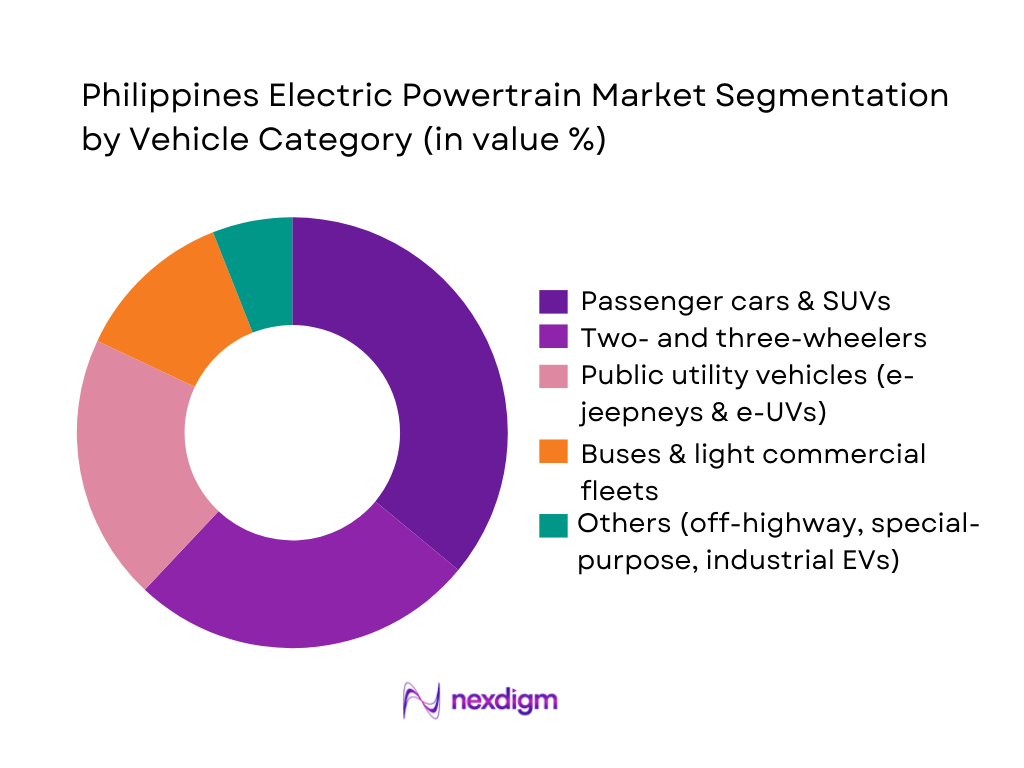

By Vehicle Category

The Philippines electric powertrain market is segmented into passenger cars & SUVs, two- and three-wheelers, public utility vehicles (e-jeepneys & e-UVs), buses & light commercial vehicles, and others (off-highway and special-purpose EVs). Passenger cars & SUVs currently dominate powertrain value, as each unit carries larger battery packs, higher-power e-motors and more advanced inverters than mass-market e-trikes. Chinese BEVs and Japanese electrified models targeting urban professionals and corporate fleets boost this segment, while premium imports and fleet purchases by conglomerates and utilities further raise average powertrain content per vehicle. Two- and three-wheelers and e-PUVs are rapidly scaling volumes under e-mobility and jeepney-modernization pilots, but still trail passenger cars in total powertrain value because of lower per-unit content despite a sizeable electric two-wheeler market already above USD ~ million.

Competitive Landscape

The Philippines electric powertrain market is shaped by a mix of global EV leaders and local e-PUV pioneers. Global OEMs such as BYD, Nissan and Toyota drive high-value powertrain demand via BEVs, strong hybrids and range-extender architectures, while Filipino firms like Global Electric Transport (GET) and ToJo Motors focus on e-jeepneys and e-buses aligned with the PUV Modernization Program. The market remains fragmented on the component side, with most traction batteries, motors and inverters imported, but local body builders and integrators increasingly specifying battery chemistry, e-axle suppliers and inverter platforms, giving them growing influence over powertrain choices.

| Company | Establishment Year | Headquarters (Global / Local) | Core Role in PH Electric Powertrain Market | Dominant Vehicle / Application Segment | Key Powertrain Technology Focus | Local Manufacturing / Assembly Presence | Partnerships / Ecosystem Role | Differentiating Edge in PH Electric Powertrain Space |

| BYD Company / BYD PH | 1995 | Shenzhen, China / PH dealer network | ~ | ~ | ~ | ~ | ~ | ~ |

| Nissan Philippines | 1933 (global) | Yokohama, Japan / Manila, Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Toyota Motor Philippines | 1988 | Santa Rosa, Laguna, Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Global Electric Transport (GET) | 2010s | Quezon City, Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| ToJo Motors Corporation | 2014 | Laguna, Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Electric Powertrain Market Analysis

Growth Drivers

Fuel Price Volatility and Operating Cost Pressures

Frequent fluctuations in petroleum product prices in the Philippines are a strong catalyst for electric powertrain adoption. Government data shows that as of 17 December 2024, oil companies raised petrol and diesel prices by ₱0.80 per liter. Later in December 2024, another adjustment pushed diesel up by ₱1.45 per liter and gasoline by ₱0.50 per liter. For public utility vehicles (PUVs), delivery vans, and private cars — which travel hundreds of kilometers monthly — such recurring hikes significantly increase operating costs. This volatility undermines cost predictability and makes total cost-of-ownership (TCO) for internal-combustion-engine (ICE) vehicles less attractive, thereby strengthening the business case for electric powertrain-equipped vehicles whose “fuel” costs are tied to per-kWh electricity rates rather than volatile oil prices. Given the Philippines’ dependence on imported oil (reflected in persistent trade-deficits, with 2024 goods imports at around US$125,394 million per World Bank data) switching to electric drivetrains offers hedging against global oil price swings. For fleet operators, predictable energy costs — especially when combined with future renewable-charged grids — make electric powertrains more economically defensible.

Public Utility Vehicle Modernization and Route Rationalization Programs

The national Public Utility Vehicle Modernization Program (PUVMP), started in 2017, aims to phase out old jeepneys, buses and other PUVs older than 15 years and replace them with safer, more efficient, and environmentally friendlier vehicles — including electric variants. The program targets replacement of roughly 220,000 jeepney units nationwide. Given the scale of this vehicle fleet and the high daily mileage of jeepneys, electric powertrains represent a compelling alternative to traditional combustion engines. As transport cooperatives transition fleet inventories, demand for traction batteries, inverters, e-motors, and associated high-voltage systems rises correspondingly. Electrified jeepneys and UVs also align with mandated safety, emissions compliance and route rationalization standards. The modernization drive — backed by financing incentives and regulatory support — creates a structural demand anchored in public transport renewal. This institutional push provides powertrain suppliers and integrators with a stable, long-term pipeline rather than small, scattered individual purchases, thereby accelerating scale, lowering per-unit component costs, and attracting local assembly interest.

Challenges

High Upfront Vehicle and Powertrain Costs

Despite policy incentives, electric vehicles and their associated powertrains remain significantly more expensive upfront than conventional ICE vehicles. For many Filipinos — including public transport operators and small fleet owners — the initial capital required to purchase an EV or e-PUV remains a barrier. Although EVIDA provides fiscal incentives and EV import duties have been waived, the base cost of batteries, inverters, and high-voltage components remains high due to import dependency and lack of large-scale local manufacturing. Many transport cooperatives operate on thin margins, and converting an entire fleet requires substantial upfront investment; repayment over time depends heavily on fuel savings, which may not fully materialize in short operational cycles. The lack of affordable financing schemes, especially for small operators, limits broader uptake. Even with registration fee reductions and tax breaks for BEVs and HEVs, the baseline capital barrier for powertrain-equipped vehicles remains substantial — hampering the broader transition to electrified mobility.

Charging Infrastructure Availability, Grid Capacity and Reliability Constraints

Electric powertrain adoption is tightly linked to availability of EV-charging infrastructure. According to government sources, as of 2025 there are reportedly 992 active EV charging points nationwide: 450 AC chargers, 60 DC chargers, and 482 battery-swapping stations. While this marks progress, this infrastructure remains heavily concentrated in major urban centers — especially Metro Manila — with sparse coverage in many provinces and rural areas. Many small islands or remote regions are outside main grid coverage or suffer from weak grid reliability, including frequent outages and power-supply insecurity. According to energy-sector analyses, more than 120 small islands and isolated grids remain outside the main transmission network. Without robust, stable power supply and wide availability of public charging or swapping stations, range anxiety and operational risk remain significant deterrents for both private and fleet buyers. For fleet operators needing overnight depot charging or consistent uptime, grid unreliability and limited charging spots hamper feasibility of electric powertrain adoption on a large scale.

Opportunities

Powertrain Platforms for Public Transport and Fleet Electrification

Given the size and age profile of existing public transport fleets — especially jeepneys, UVs, tricycles and minibuses — there is a large latent demand for modernized vehicles. Under PUVMP, thousands of units need replacement or upgrading. Electric powertrain platforms tailored for Jeepneys, e-UVs, shuttles, minibuses and corporate fleets therefore present a major growth opportunity. As operators seek predictable operating costs, reduced maintenance and exemption from ICE-related price volatility, electric powertrains bundled with locally assembled bodies (through integrators) can offer a cost- effective alternative over vehicle life cycles. Government support via EVIDA and CREVI also reduces import duty and lowers regulatory hurdles, making such platforms financially and institutionally viable. For suppliers and integrators, this represents a multi-year, recurring demand pipeline tied to public transport modernization, corporate fleet conversion and institutional procurement — a more reliable growth base compared to sporadic private EV purchases.

Electrification of Two-Wheelers, Three-Wheelers and Urban Delivery Fleets

Urban mobility in many Philippine cities relies heavily on two- and three-wheeled vehicles (motorcycles, tricycles, e-trikes) for commuting, last-mile delivery, and informal transport services. Historically, this segment has been almost entirely powered by ICE, contributing to emissions and fuel import dependency. As electricity becomes more affordable (compared with volatile fuel prices) and under the enabling environment of EVIDA — which includes import and duty exemptions for EVs, charging stations, and components — electrification of this mass-mobility segment becomes a compelling opportunity. Given the lower battery and powertrain content per vehicle, initial barrier to entry is lower, and total number of two- and three-wheelers in the country (tens of millions) provides a vast target base. For urban delivery companies, SMEs, logistics providers and informal transport operators — shifting to electric two- and three-wheelers can substantially cut fuel costs, reduce maintenance, and contribute to environmental commitments. For powertrain suppliers, this mass-volume segment offers a high-volume, lower-margin opportunity, helping to build scale, standardize components (motors, battery packs, BMS systems) and lay groundwork for future electrification across vehicle categories.

Future Outlook

The government’s EV mandate for public and private vehicle fleets, zero-tariff treatment for most EVs, and targeted fiscal incentives for EV components are expected to improve the economics of local powertrain assembly. Infrastructure will remain a constraint in the short term, with only a few hundred public charging stations versus an estimated requirement of around 5,000 by the end of the decade; however, rising investment from utilities, malls and energy players, combined with donor-backed e-bus and e-PUV programs, is likely to unlock demand for high-voltage traction batteries, e-axles, inverters and on-board chargers. As global technology trends move toward higher-efficiency power electronics, integrated battery-inverter packs and LFP chemistries, the Philippines market will increasingly import or assemble these advanced powertrain architectures for both passenger and public-transport segments.

Major Players

- BYD Company / BYD Philippines

- Nissan Philippines Inc.

- Toyota Motor Philippines Corporation

- Hyundai Motor Philippines

- Mitsubishi Motors Philippines

- Global Electric Transport

- ToJo Motors Corporation

- BEMAC Electric Transportation Philippines

- Meralco / MPT Mobility & eSakay

- Chery / Jetour & other Chinese EV brands

- Great Wall Motor (ORA brand) and other Chinese OEMs

- Foton Motor Philippines

- Local body-builders and integrators of e-PUVs

- Battery and charging solution providers

Key Target Audience

- Global and regional EV powertrain component manufacturers

- Automotive OEMs and national distributors

- Public transport cooperatives and PUV fleet operators

- Bus and truck fleet operators, logistics and delivery companies

- Utilities, energy retailers and charging-network developers

- Investment and venture capital firms

- Government and regulatory bodies

- Commercial banks and green-finance institutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map covering all stakeholders in the Philippines Electric Powertrain Market—EV OEMs, e-PUV builders, component suppliers, fleet operators, utilities and regulators. Extensive desk research using secondary databases, official statistics, regulatory documents (EVIDA, CREVI, PUVMP) and credible industry reports is undertaken to quantify EV stock, new registrations, charging infrastructure, and powertrain cost structure. The objective is to define the key variables that drive revenue: powertrain value per vehicle, technology mix, vehicle-segment mix, and policy-linked fleet conversions.

Step 2: Market Analysis and Construction

In this phase, historical data on EV sales, fleet composition and charging deployment in the Philippines are compiled to build a bottom-up model of electric powertrain demand. This includes using EV market size estimates (value), EV stock (units), and typical powertrain content ratios derived from global benchmarks. Segmentation is constructed by propulsion type and vehicle category, with powertrain value allocated according to vehicle pricing, battery sizes and motor ratings. Scenario analysis is then run to reconcile the bottom-up powertrain value with top-down EV market assessments, ensuring internal consistency across base, conservative and aggressive cases.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses around technology adoption (BEV vs HEV vs PHEV), fleet-conversion pace under PUVMP, and localization potential for powertrain components are validated through structured interviews with OEMs, e-PUV integrators, transport cooperatives, utilities and policymakers. Computer-assisted interviews are used to capture data on actual battery sizes, powertrain import vs local integration, charging behavior, and fleet-level economics. These insights refine assumptions on powertrain value per vehicle, uptake curves in public transport, and investment appetite for local assembly of batteries, motors and inverters.

Step 4: Research Synthesis and Final Output

Finally, model outputs are cross-checked with selected EV manufacturers and fleet operators to validate powertrain content estimates, utilization patterns and technology roadmaps (e.g., shift to LFP batteries, integrated battery-inverter systems). Quantitative forecasts for the Philippines Electric Powertrain Market are then produced, including base-year market size, segmentation by propulsion and vehicle category, and forward CAGR aligned with credible EV market projections. All findings are stress-tested against policy scenarios (e.g., stricter PUVMP enforcement, faster CREVI rollout) and synthesized into strategic insights, opportunity maps and risk assessments for investors and industry participants.

- Executive Summary

- Research Methodology (Market definitions and system boundary for electric powertrain, segmentation framework and taxonomy, data sources – local transport and energy agencies, registration databases, EV industry associations and multilateral datasets, bottom-up EV parc and powertrain stock modeling, top-down macro and energy linkage, primary expert and fleet interviews, scenario design and stress-testing, validation and triangulation approach, assumptions, limitations and sensitivity checks)

- Definition and Scope of Electric Powertrain in the Philippines Mobility Context

- Evolution of Electric Powertrain and E-Mobility in the Philippines Transport System

- Role of Electric Powertrain in National Transport, Energy Security and Climate Policy

- Electric Powertrain Value Chain and Ecosystem Map in the Philippines

- Technology Building Blocks – Traction Motors, Inverters, Battery Systems, Control Electronics, Thermal Systems

- Growth Drivers

Fuel Price Volatility and Operating Cost

Public Utility Vehicle Modernization and Route Rationalization Programs

Electric Vehicle Industry Development Policies and Fiscal Incentives

Air Quality, Health and Climate Commitments Influencing Transport Electrification

Energy Security, Oil Import Dependence and Power Sector Developments - Challenges

High Upfront Vehicle and Powertrain Costs

Charging Infrastructure Availability, Grid Capacity and Reliability Constraints

Technology Readiness for Local Road, Climate and Topographical Conditions

After-Sales, Spare Parts and Technical Skills Gaps for High-Voltage Systems

Supply Chain, Localization and Scale Limitations for Key Components - Opportunity

Powertrain Platforms

Electrification of Two-Wheelers, Three-Wheelers and Urban Delivery Fleets

Retrofit and Conversion Opportunities

Export Potential

Digital and Telematics-Enabled Powertrain Optimization and Services - Trends

Shift Toward Integrated E-Axles and Highly Integrated Drive Units

Evolution of Battery Chemistries, Form Factors and Second-Life Use Cases

Higher-Voltage Architectures and Fast-Charging Ready Powertrains

Connected, Telematics and Over-the-Air Update Capabilities in Powertrain Control

Vehicle-to-Grid and Vehicle-to-Building Pilots and Implications for Powertrain Design - Regulatory, Policy and Standards Landscape

- Stakeholder Ecosystem Analysis

- Porter’s Five Forces Analysis

- Country Macroeconomic and Energy Context

- Electric Powertrain Technology and Market Roadmap

- By Value, 2019-2024

- By Volume, 2019-2024

- By Segment and Configuration, 2019-2024

- Installed Base vs New Registrations, 2019-2024

- By End-Use Sector and Vehicle Class, 2019-2024

- By Electric Powertrain Configuration (in Value %)

Battery Electric Powertrains

Plug-in Hybrid Electric Powertrains

Hybrid Electric Powertrains

Fuel Cell Electric Powertrains

Low-Speed and Neighborhood Electric Vehicle Drivetrains - By Vehicle Category (in Value %)

Electric Two-Wheelers and Micro-Mobility

Electric Three-Wheelers and Tricycles

Passenger Cars and SUVs with Electric Powertrains

Light Commercial Vehicles and Urban Delivery Vans

Buses, Minibuses, Modernized PUVs and Electric Jeepneys - By Voltage and Power Class (in Value %)

Low-Voltage Systems

Medium-Voltage Systems

High-Voltage Systems

Ultra-High-Voltage Systems - By Key Powertrain Component (in Value %)

Traction Motor Systems and Motor Controllers

Inverters and Power Electronics Modules

Battery Packs, Battery Management Systems and Thermal Interfaces

Integrated E-Axles, Reduction Gearboxes and Transmissions

DC-DC Converters, On-Board Chargers and High-Voltage Distribution Units - By Application and Duty Cycle (in Value %)

Urban Passenger Commuting and Ride-Hailing

Public Utility Vehicles, Franchised Routes and Fixed-Route Fleets

Logistics, Last-Mile Delivery and E-Commerce Fulfilment

Corporate, Institutional and Government Fleet Operations

Tourism, Estates, Campuses and Closed-Loop Environments - By Ownership and Business Model (in Value %)

Privately Owned Electric Vehicles

Transport Cooperatives and Fleet Aggregators

Leasing, Fleet Management and Mobility-as-a-Service Operators

Government, Local Government Unit and State-Linked Fleets - By Geographic Region (in Value %)

National Capital Region and Mega Manila Corridors

Rest of Luzon Metropolitan and Secondary Cities

Visayas Growth Corridors and Island Urban Centers

Mindanao Urban Hubs and Emerging Industrial Clusters

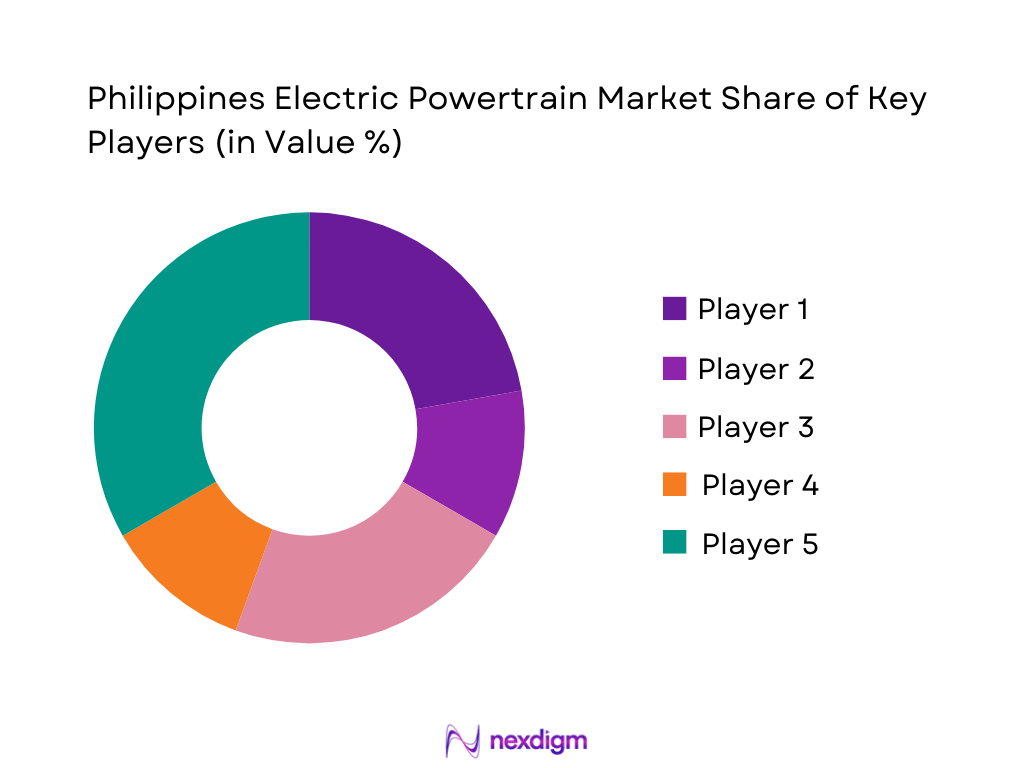

- Market Share of Major Players by Electric Powertrain-Equipped Vehicles in Operation

Market Share by OEM and Assembler Across Vehicle Categories

Market Share by Electric Drivetrain Configuration - Market Share of Major Players by Powertrain Component and Integration Focus

Traction Motors and Inverters

Battery Packs and BMS Solutions

Integrated E-Axles, Reduction Gearboxes and Retrofit Kits - Cross Comparison Parameters (Philippines electric powertrain portfolio breadth across vehicle and voltage classes, penetration in e-jeepney, e-bus and modern PUV routes, depth of localization in powertrain assembly and after-sales support, supported voltage and power ranges of traction systems, integration level from discrete components to fully integrated e-axe systems, ecosystem partnerships with utilities, charging operators and local government units, participation in national EV and public transport modernization programs and incentive schemes, technology differentiation in tropicalized thermal management, battery durability and digital monitoring capabilities)

- Detailed Profiles of Major Companies

Global Electric Transport

BEMAC Electric Transportation Philippines

Philippine Utility Vehicle Inc.

ToJo Motors Corporation

Star 8 Green Technology Philippines

Meralco eSakay

Nissan Philippines

Mitsubishi Motors Philippines Corporation

Toyota Motor Philippines Corporation

Hyundai Motor Philippines Inc.

BYD Cars Philippines

GAC Motor Philippines

Kia Philippines

ESTTDI – Electric Saving Transportation Technology & Development Inc.

- Public Utility Vehicle and Transport Cooperative Segment

- Logistics and Last-Mile Delivery Fleets

- Corporate, Institutional and Government Fleets

- Retail Private Vehicle Owners

- Financing and Ownership Models

- By Value, 2019-2024

- By Volume, 2019-2024

- By Segment and Configuration, 2019-2024

- Installed Base vs New Registrations, 2019-2024

- By End-Use Sector and Vehicle Class, 2019-2024