Philippines EV Axles Market Overview

The Philippines Electric Vehicle (EV) Axles Market, valued at USD ~ billion in 2025, is experiencing growth driven by the country’s push for sustainable mobility and its growing commitment to reducing carbon emissions. The demand for electric vehicles (EVs) is expanding rapidly due to government incentives, the rising cost of fuel, and the increasing environmental awareness among consumers. Additionally, the local government is promoting the development of a greener transportation system through various initiatives, such as tax breaks and rebates for EV purchases and infrastructure projects like charging stations. With the increasing adoption of electric mobility, the EV axles market in the Philippines is poised for substantial growth in the coming years.

Metro Manila remains the dominant region for EVs and EV axles in the Philippines, accounting for a significant share of the market. The metropolitan area is home to a growing number of EVs due to the higher concentration of consumers with purchasing power and the government’s focus on reducing pollution. Additionally, the region has a well-established automotive infrastructure and the highest demand for green transport solutions. Other key regions driving the market include Cebu and Davao, where the implementation of EV-friendly policies and infrastructure expansion is encouraging the transition to electric mobility. The Philippines’ commitment to green transportation initiatives, including incentives for manufacturers, is fueling the demand for EVs, thus impacting the market for EV axles.

Market Segmentation

By Vehicle Type

The Philippines EV Axles Market is segmented by vehicle type into passenger cars, two-wheelers, commercial EVs, and three-wheelers. Passenger cars dominate the market due to the increasing consumer interest in personal electric mobility solutions. This segment has seen a notable uptick due to the growing middle class, increasing fuel prices, and government incentives. The demand for electric passenger vehicles in Metro Manila, in particular, has seen a surge as consumers become more aware of the environmental benefits and cost-effectiveness of electric cars. Major manufacturers like Nissan and Hyundai are expanding their EV offerings in this segment, which further drives the growth of passenger cars.

By Axle Architecture

The market is segmented into front axles, rear axles, and all-wheel/drive axles. Among these, rear axles hold the dominant market share due to the prevalent design of rear-wheel-drive EVs, which offer better handling and weight distribution. Rear axles are often preferred for high-performance and luxury electric vehicles. Manufacturers, including international OEMs and local players, favor this axle design in passenger EVs, where performance is a key selling point. Additionally, the cost-effectiveness of rear axle production makes it a popular choice, with mass-market EVs often utilizing rear-wheel drive configurations.

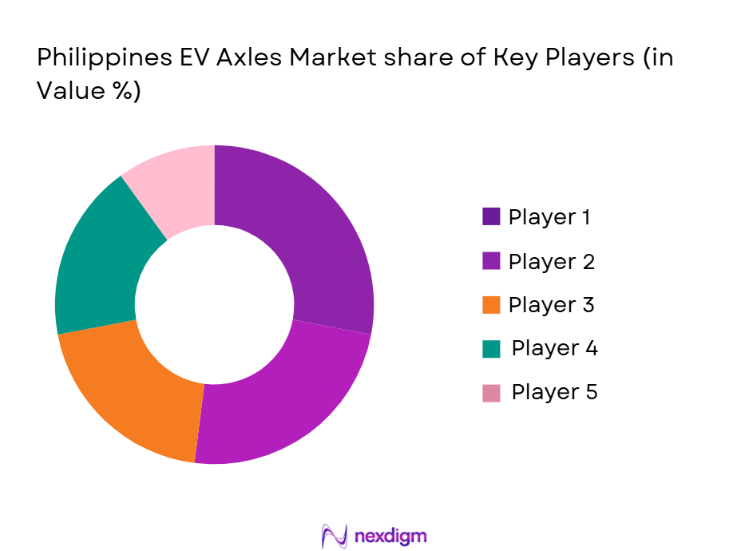

Competitive Landscape

The Philippines EV Axles Market is dominated by a few key players, both local and global, who contribute to the production and development of electric vehicle components. Major players such as Magna International, Bosch, and Continental are well-established, providing a wide range of high-quality EV axles, while local suppliers are emerging to cater to the growing demand for EVs in the Philippines. The market sees an increasing shift towards collaboration between global suppliers and local manufacturers to enhance product offerings and ensure supply chain sustainability.

| Company | Establishment Year | Headquarters | Production Capacity | R&D Investment | Technological Capabilities | Regional Presence | Supply Chain Partners |

| Magna International | 1957 | Canada | ~ | ~ | ~ | ~ | ~ |

| Bosch | 1886 | Germany | ~ | ~ | ~ | ~ | ~ |

| Continental AG | 1871 | Germany | ~ | ~ | ~ | ~ | ~ |

| ZF Friedrichshafen AG | 1915 | Germany | ~ | ~ | ~ | ~ | ~ |

| Nidec Corporation | 1973 | Japan | ~ | ~ | ~ | ~ | ~ |

Market Analysis

Growth Drivers

Government Support and Incentives

The Philippine government has introduced various policies and incentives to promote the adoption of electric vehicles (EVs), which, in turn, boosts the demand for EV axles. Programs such as tax breaks, rebates on EV purchases, and infrastructure development for EV charging stations are essential in accelerating the transition to electric mobility. These government-backed initiatives encourage both consumers and manufacturers to shift towards electric vehicles, thereby increasing the market demand for EV components like axles.

Rising Fuel Costs and Environmental Awareness

As fuel prices continue to rise globally and environmental concerns grow, there is a stronger inclination towards adopting electric vehicles, which offer long-term savings on fuel and contribute to reducing carbon footprints. Consumers are increasingly becoming environmentally conscious and seeking sustainable alternatives, which drives the demand for EVs and, consequently, the need for reliable, efficient EV axles to support the growing EV fleet.

Market Challenges

High Cost of EV Components

One of the significant barriers to the growth of the EV axles market in the Philippines is the high cost of EV components, including axles. The advanced technology required for electric axles, such as integrated e-axle systems and modular solutions, comes with a hefty price tag. The cost can hinder the affordability of electric vehicles for many consumers, limiting the market’s growth potential. Furthermore, local manufacturing capabilities for these high-tech components remain underdeveloped, resulting in a reliance on expensive imported parts.

Underdeveloped EV Infrastructure

While government policies are aimed at accelerating EV adoption, the lack of widespread charging infrastructure remains a significant challenge in the Philippines. Insufficient charging stations, especially in rural areas, hampers the adoption of electric vehicles, making potential EV owners hesitant to transition from traditional vehicles. This infrastructure gap impacts the overall growth of the EV market, which in turn limits the demand for EV axles.

Opportunities

Expanding EV Infrastructure and Charging Stations

As the government and private sector continue to invest in the expansion of EV infrastructure, especially charging stations, the Philippines is set to experience increased EV adoption. This will create a strong demand for EV components, including axles. With the rise of the EV infrastructure, more consumers will feel confident in transitioning to electric vehicles, providing a significant growth opportunity for the EV axles market in the long term.

Local Manufacturing and Partnerships

There is an opportunity for local manufacturers to partner with global players in the EV industry to establish local production facilities for EV components, including axles. These collaborations can help reduce production costs and make electric vehicles more affordable for the Filipino market. Additionally, local manufacturing would cater to the increasing demand for EV axles, as well as strengthen the supply chain and improve delivery timelines for OEMs and aftermarket suppliers.

Future Outlook

Over the next 5 years, the Philippines EV Axles Market is expected to show substantial growth, driven by the government’s increasing support for sustainable mobility, advancements in EV technology, and a steady rise in consumer demand for eco-friendly transportation solutions. The market is also influenced by global shifts toward electrification, the expansion of EV infrastructure, and the growing integration of EV axles in mass-market electric vehicles. As the Philippines continues to urbanize and focus on green technologies, the demand for high-performance, cost-effective EV axles will increase. Furthermore, local manufacturing will see a boost as global suppliers partner with domestic players, ensuring more localized production of EV components.

Major Players

- Magna International

- Bosch

- Continental AG

- ZF Friedrichshafen AG

- Nidec Corporation

- Aisin Seiki Co.

- Valeo S.A.

- Hitachi Astemo Ltd.

- Dana Incorporated

- American Axle & Manufacturing

- IMI – Integrated Micro-Electronics, Inc.

- Hyundai Mobis

- Tesla Inc.

- BYD Auto

- Toyota Motor Corporation

Key Target Audience

- Automotive OEMs

- Tier-1 Suppliers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Automotive Component Manufacturers

- EV Infrastructure Developers

- EV Fleet Operators

- Automotive Aftermarket Service Providers

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing a detailed ecosystem map for the Philippines EV Axles Market. The key objective is to identify variables such as vehicle types, axle systems, and major stakeholders influencing market dynamics. Secondary research using industry reports and databases provides insights into historical market trends, while primary research through expert interviews will refine our data and identify key factors affecting growth.

Step 2: Market Analysis and Construction

We gather historical data related to the Philippines EV Axles Market by evaluating market penetration, EV adoption rates, and axle technology adoption. This phase involves collecting data on the performance and sales of electric vehicles, as well as the types of axles utilized in different EV segments. Data from OEMs, tier-1 suppliers, and distributors will be critical for constructing market projections.

Step 3: Hypothesis Validation and Expert Consultation

We will develop hypotheses on key market drivers and barriers, such as government incentives and infrastructure challenges. These hypotheses will be validated by interviewing industry experts, including manufacturers, tier-1 suppliers, and government officials. Expert consultations help refine the data and ensure accuracy in projecting market growth.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data collected through both bottom-up and top-down approaches. In this stage, we validate insights gathered from industry reports, expert interviews, and secondary sources. Detailed insights into the EV axle components, such as axle designs, manufacturers, and end-user preferences, will be analyzed and presented to create a comprehensive market outlook.

- Executive Summary

- Research Methodology (Market Definitions & Terminology, Abbreviations & Nomenclature, Data Sources & Validation, BottomUp and TopDown Estimation Approaches, Supply Chain Mapping Method, Primary & Secondary Research Protocols, Limitations & Assumptions)

- Market Definition & Scope

- Role of Axles in EV Powertrain Architecture

- Industry Genesis & Local EV Transition Chronology

- EV Axle Ecosystem – Manufacturing, Sourcing, Localization

- Value Chain Analysis

- Growth Drivers

EV Adoption

Government Policy

Fuel Price Economics - Market Challenges

Cost

Standards

Localization Hurdles - Market Opportunities

Localized Manufacturing

Aftermarket Growth - Technology & Innovation Trends

Lightweight Materials

NVH Optimization

- Market Value 2019-2025

- Market Volume 2019-2025

- Average Axle Value & ASP Trends 2019-2025

- CAGR & Growth Drivers 2019-2025

- Market Penetration by EV Types 2019-2025

- Vehicle Type (In Value%)

Passenger Cars

Two-Wheelers EVs

Commercial EVs

Three-Wheelers

Special Purpose EVs - Axle Architecture (In Value%)

Front Axle

Rear Axle

All-Wheel/Drive Axle - System Type (In Value%)

Hub Motor Axle

Integrated E-Axle

Mid Drive Axle

Modular E-Axle - Power Rating (In Value%)

Low Power (≤5kW)

Medium Power (5–15kW)

High Power (15–30kW)

Ultra High Power (30kW+) - Technology (In Value%)

Permanent Magnet Motors

Induction Motors

Switched Reluctance Motors - Sales Channel (In Value%)

OEM Direct

Aftermarket Parts

Replacement & Service Channels

- Market Shares of Leading Players

- Competitive Positioning

- Innovation & R&D Benchmarking

- Pricing Competitiveness & ASP Trends

- CrossComparison Parameters (Company Overview, Axle Technology Portfolio, Manufacturing Footprint in SEA, Local Content %, Tier1 OEM Ties, Production Capacity for EAxle Systems, Average Selling Price by Segment, Warranty & Aftermarket Support)

- Key Market Players

Magna International

Robert Bosch GmbH

Continental AG

ZF Friedrichshafen AG

Nidec Corporation

Vitesco Technologies

Aisin Seiki Co.

Valeo S.A.

BorgWarner Inc.

Hitachi Astemo Ltd.

Dana Incorporated

American Axle & Manufacturing

IMI – Integrated MicroElectronics, Inc.

Local EV Component Assemblers/Integrators

Emerging Regional Innovators - SWOT & Porter’s Five Forces Analysis

- EndUser Adoption Patterns

- Purchase Decision Drivers

- Buyer Price Sensitivity & Feature Expectations

- Fleet Electrification Needs

- Market Size Forecast 2026-2030

- Upside/Baseline/Conservative Scenarios 2026-2030

- Adoption Curve & Saturation Estimates 2026-2030