Market Overview

The Philippines EV charging software market is valued at USD ~ billion, reflecting the software layer that enables monitoring, control, billing, optimization, and integration of electric vehicle charging infrastructure across the country. This market is structurally critical as charging hardware expansion alone cannot scale efficiently without software platforms that manage energy flow, user access, and operational performance. Demand is driven by the increasing complexity of charging networks, rising expectations for uptime and reliability, and the need to balance grid capacity with growing EV penetration. EV charging software acts as the intelligence backbone of the charging ecosystem, linking utilities, operators, users, and regulators into a coordinated digital framework.

Within the Philippines, Luzon dominates EV charging software deployment due to higher urban density, concentration of commercial activity, and early adoption of electric vehicles in metropolitan corridors. Major cities drive demand for advanced charging management to support mixed-use, high-traffic charging environments. Visayas and Mindanao follow with emerging deployments tied to tourism hubs and logistics corridors. Globally, technology influence comes from countries with mature EV software ecosystems, where scalable cloud platforms, cybersecurity frameworks, and grid-integrated charging solutions are well established. These countries dominate technology supply due to strong software engineering capabilities, early regulatory alignment, and experience managing large-scale charging networks.

Market Segmentation

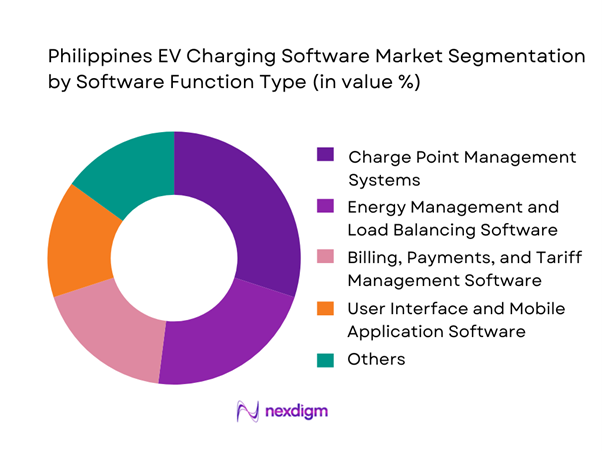

By Software Function Type

Charge point management systems dominate the Philippines EV charging software market as they form the core operational layer required for any charging network. These systems enable real-time monitoring of charger status, remote configuration, fault detection, and performance optimization across distributed assets. As charging stations expand across commercial, fleet, and public environments, operators require centralized platforms to ensure uptime, manage utilization, and reduce operational inefficiencies. The dominance of this segment is reinforced by the need to integrate diverse hardware models under a single software interface, especially in a market with fragmented infrastructure ownership. Charge point management software also acts as the foundation for layering advanced capabilities such as billing, analytics, and load management, making it the first and most essential software investment for most stakeholders.

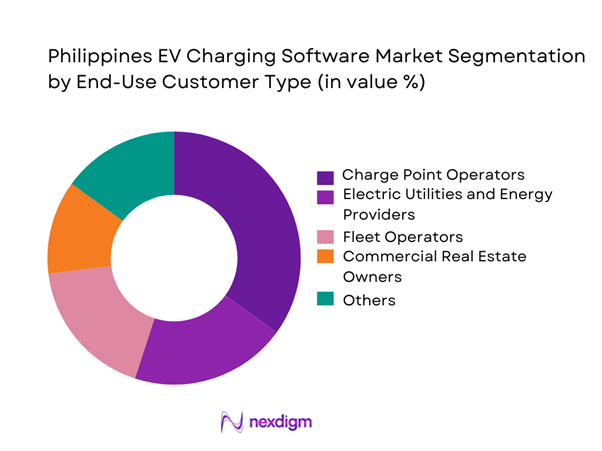

By End-Use Customer Type

Charge point operators represent the dominant end-use customer segment in the Philippines EV charging software market. As the primary owners and operators of charging assets, they bear responsibility for uptime, customer experience, and revenue generation. This drives sustained investment in robust software platforms that can manage multi-site networks, support diverse user groups, and integrate seamlessly with payment systems. Operators also face pressure to optimize asset utilization and energy costs, making advanced analytics and load management critical. The rapid entry of private operators intensifies competition, further increasing reliance on software differentiation. As a result, charging software purchasing decisions are increasingly centralized within operator organizations, reinforcing their leading share of total market demand.

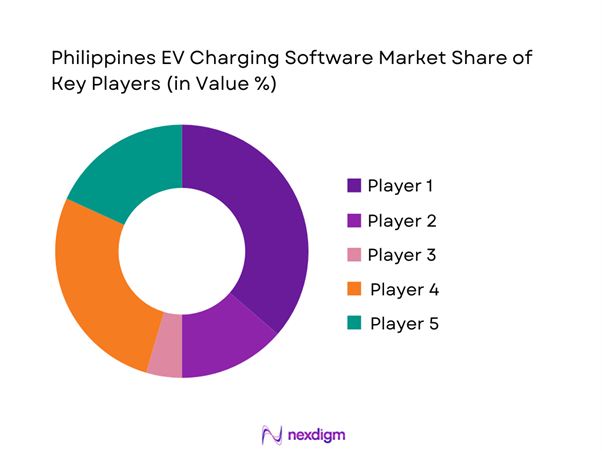

Competitive Landscape

The Philippines EV Charging Software market is dominated by a few major players, including ABB and global or regional brands like Siemens, Schneider Electric, and ChargePoint. This consolidation highlights the significant influence of these key companies.

| Company | Est. year | HQ | Standards depth (OCPP/OCPI/ISO 15118) | Payments & billing stack | Energy/load mgmt | Roaming/clearing | Fleet depot features | Observability & uptime tooling | Integration breadth (ERP/CRM/utility) |

| Driivz | 2013 | Israel | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| AMPECO | 2019 | Bulgaria | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| EV Connect (Schneider Electric) | 2009 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Shell Recharge Solutions (Greenlots) | 2010 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Hubject | 2012 | Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines EV Charging Software Market Analysis

Growth Drivers

Expansion of public charging infrastructure programs

The expansion of public charging infrastructure programs significantly increases the complexity of managing distributed charging assets. As charging stations are deployed across expressways, metropolitan business districts, retail locations, and mixed-use developments, operators require robust software platforms to monitor uptime, manage access control, and ensure consistent service quality. Manual or fragmented systems become impractical at scale, especially when multiple charger types and vendors are involved. Charging software enables centralized diagnostics, remote firmware updates, pricing configuration, and compliance reporting, making it a foundational layer for sustaining large-scale infrastructure rollout and operational continuity.

Increasing EV adoption across private and fleet segments

Rising electric vehicle adoption across private ownership and commercial fleets intensifies charging demand, session frequency, and operational variability. This growth places pressure on charging operators to manage authentication, queueing, billing, and energy distribution efficiently. Fleet operators, in particular, require software-driven scheduling, priority allocation, and charging performance analytics to avoid downtime and route disruptions. As utilization patterns become more complex, software platforms play a critical role in balancing user experience, infrastructure availability, and operational costs, making advanced charging management solutions essential for sustained ecosystem functionality.

Challenges

Fragmented charging infrastructure ownership

Charging infrastructure ownership in the Philippines is distributed across utilities, independent operators, property developers, and fleet owners, creating a fragmented operational environment. Each stakeholder group often adopts different technical standards, commercial objectives, and integration requirements. This diversity complicates software deployment, limits interoperability, and increases customization costs for platform providers. The absence of unified operational frameworks slows nationwide standardization and makes cross-network coordination difficult. As a result, charging software providers must support heterogeneous environments, increasing complexity and extending deployment timelines.

Grid stability and power quality constraints

Grid stability and power quality constraints pose significant challenges for charging software deployment, particularly in high-density urban areas and fleet depots. Voltage fluctuations, limited transformer capacity, and peak-load sensitivity require software platforms to incorporate adaptive load management and real-time monitoring capabilities. These requirements increase system design complexity and demand close coordination with utilities and site operators. Inconsistent grid conditions also necessitate site-specific configurations, slowing standardized rollouts and increasing implementation costs, which can act as a restraint on rapid software adoption across the charging ecosystem.

Opportunities

Development of unified national charging platforms

The development of a unified national charging software platform represents a major opportunity to reduce fragmentation and improve ecosystem efficiency. A standardized platform could enable interoperability across operators, simplify roaming, and create a consistent user experience nationwide. For regulators and infrastructure planners, unified platforms offer improved visibility, data transparency, and performance monitoring. For software providers, this creates opportunities to deliver scalable, compliance-ready solutions that serve multiple stakeholder groups while lowering integration complexity and accelerating adoption across public and private charging networks.

Fleet-focused charging optimization solutions

Fleet electrification is creating demand for specialized charging software tailored to operational efficiency and cost control. Fleet-focused solutions that enable route-based charging schedules, energy cost optimization, vehicle prioritization, and performance analytics offer high strategic value. Logistics operators, delivery fleets, and corporate mobility programs increasingly require software that integrates charging with dispatch and asset management systems. Providers that deliver purpose-built fleet optimization capabilities can capture premium contracts, build long-term client relationships, and position themselves as critical enablers of commercial electrification.

Future Outlook

The Philippines EV charging software market is expected to evolve toward more integrated, interoperable, and analytics-driven platforms. As charging networks scale and grid interaction becomes more complex, software will play a central role in balancing energy demand, enhancing reliability, and enabling new business models. Strategic partnerships between utilities, operators, and software providers will shape long-term market development.

Major Players

- ABB

- Siemens

- Schneider Electric

- ChargePoint

- Enel X

- EVBox

- Shell Recharge Solutions

- Huawei Digital Power

- Delta Electronics

- Wallbox

- BP Pulse

- Greenlots

- Kempower

Key Target Audience

- Charge point operators

- Electric utilities

- Fleet operators

- Commercial property developers

- Smart city authorities

- EV manufacturers

- Investments and venture capitalist firms

- Government and regulatory bodies (Philippines)

Research Methodology

Step 1: Identification of Key Variables

Key variables include software functionality, deployment models, customer adoption drivers, and regulatory influence across the Philippines EV charging ecosystem.

Step 2: Market Analysis and Construction

Market structure is developed by mapping software value creation across charging use cases, customer types, and regional deployments within the country.

Step 3: Hypothesis Validation and Expert Consultation

Findings are validated through expert consultations with industry participants, operators, and technology providers to ensure relevance and accuracy.

Step 4: Research Synthesis and Final Output

Insights are synthesized into a coherent market narrative, aligning quantitative indicators with qualitative industry dynamics.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- EV Charging Software Usage and Value-Chain Mapping

- Business Cycle and Demand Seasonality

- Philippines EV Charging Industry Architecture

- Growth Drivers

Expansion of public charging infrastructure programs

Increasing EV adoption across private and fleet segments

Utility-led grid digitization initiatives

Rising demand for energy optimization and load management

Entry of private charge point operators

Integration of digital payments and mobility platforms - Challenges

Fragmented charging infrastructure ownership

Grid stability and power quality constraints

Limited interoperability standards

High integration complexity across hardware platforms

Cybersecurity and data privacy risks

Skills gap in software deployment and maintenance - Opportunities

Development of unified national charging platforms

Advanced analytics for grid and demand forecasting

Fleet-focused charging optimization solutions

Integration with renewable energy management systems

Localization of software customization and support

Partnerships with smart city initiatives - Trends

Cloud-native charging management platforms

AI-driven load balancing and predictive analytics

Open API ecosystems for third-party integration

User-centric mobile and payment applications

Real-time monitoring and diagnostics solutions

Utility-operator software collaboration models - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Managed Ports, 2019–2024

- By Sessions Processed, 2019–2024

- By Software Function Type (in Value %)

Charge Point Management Systems

Energy Management and Load Balancing Software

Network Monitoring and Diagnostics Platforms

User Interface and Mobile Application Software

Billing, Payments, and Tariff Management Software

Data Analytics and Reporting Software - By Application Type (in Value %)

Public Charging Networks

Commercial and Workplace Charging

Fleet and Depot Charging

Residential Charging Management

Highway and Intercity Fast-Charging Operations - By Platform Architecture (in Value %)

Cloud-Based Platforms

On-Premise Software

Hybrid Deployment Platforms

API-First Modular Software

Proprietary Integrated Platforms - By Deployment Model (in Value %)

Subscription-Based SaaS

License-Based Deployment

Transaction-Based Revenue Models

Utility-Integrated Software Deployment - By End-Use Customer Type (in Value %)

Charge Point Operators

Electric Utilities and Energy Providers

Fleet Operators

Commercial Real Estate Owners

Municipal and Public Authorities

EV Manufacturers and OEM Ecosystems - By Region (in Value %)

Luzon

Visayas

Mindanao

- Competition ecosystem overview

- Cross Comparison Parameters (platform scalability, interoperability readiness, billing flexibility, grid integration capability, cybersecurity compliance, analytics depth, API openness, local support availability)

- SWOT analysis of major players

Pricing and commercial model benchmarking - Detailed Profiles of Major Companies

ABB

Siemens

Schneider Electric

ChargePoint

Enel X

EVBox

Shell Recharge Solutions

Huawei Digital Power

Delta Electronics

Wallbox

BP Pulse

Greenlots

IoTecha

Kempower

Tritium

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Managed Ports, 2025–2030

- By Sessions Processed, 2025–2030