Market Overview

The Philippines EV charging stations market is valued at USD ~ million, reflecting its foundational role in enabling nationwide electric mobility adoption. Demand is structurally linked to vehicle electrification mandates, urban transport modernization, and private-sector sustainability commitments. Charging infrastructure acts as a system enabler rather than a standalone asset, with utilization dependent on vehicle density, grid readiness, and location economics. The market’s importance lies in its ability to reduce range anxiety, support fleet electrification, and integrate renewable energy into transport, positioning charging stations as critical long-term infrastructure rather than short-cycle equipment investments.

Within the Philippines, Metro Manila dominates demand due to vehicle concentration, higher purchasing power, dense commercial real estate, and early EV adoption by fleets and corporate users. Luzon outside Metro Manila follows, driven by industrial zones and intercity corridors, while Visayas and Mindanao remain nascent due to lower EV penetration and grid constraints. Globally, technology influence is shaped by countries leading in charging hardware manufacturing, power electronics, and charging software platforms. These countries dominate supply because of mature EV ecosystems, scale-driven cost efficiencies, and established charging standards that shape equipment specifications and system architectures adopted locally.

Market Segmentation

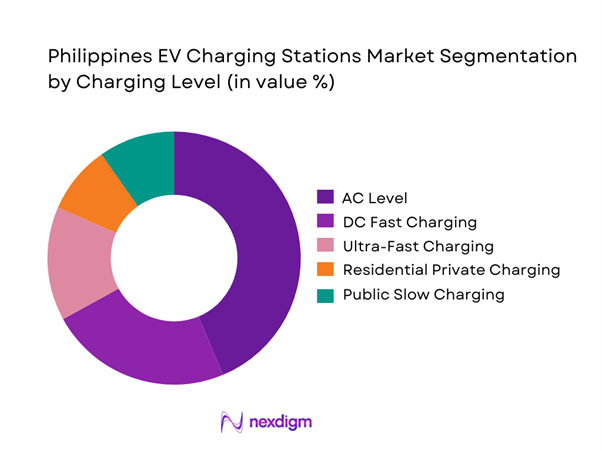

By Charging Level

AC Level charging dominates the Philippines EV charging stations market due to its compatibility with residential and semi-public environments and its relatively lower installation and grid-upgrade requirements. Most early-stage EV users rely on overnight or long-dwell charging at homes, workplaces, and commercial parking facilities, where charging speed is less critical than accessibility and cost efficiency. AC charging aligns well with existing electrical infrastructure and minimizes demand charges, making it attractive for property developers and small operators. Its dominance is further reinforced by lower equipment costs, simpler permitting, and ease of scaling across distributed locations, supporting gradual EV adoption without imposing significant grid stress.

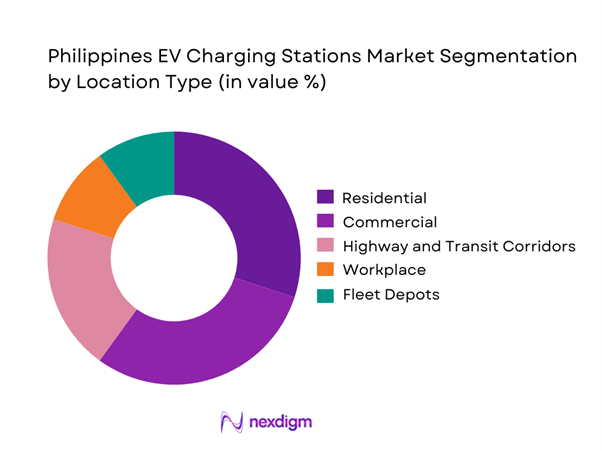

By Location Type

Residential locations represent the largest share of the Philippines EV charging stations market because early adoption is concentrated among private vehicle owners with access to dedicated parking. Home charging offers convenience, predictable usage patterns, and lower electricity tariffs compared to public stations. Real estate developers increasingly integrate chargers into new residential projects to enhance property value and meet sustainability expectations. This segment’s dominance reflects behavioral preferences for charging during off-peak hours and the limited availability of public fast-charging infrastructure outside major urban centers. As EV ownership grows incrementally, residential charging remains the foundational layer supporting daily mobility needs.

Competitive Landscape

The Philippines EV charging stations market is dominated by a few major players, including local energy-linked operators and global or regional brands like multinational charging solution providers and power equipment manufacturers. This consolidation highlights the significant influence of these key companies.

| Company | Est. Year | HQ | Primary Network Role (PH) | Typical Site Strategy | Charger Mix Focus | Max Power / High-Power Positioning | Customer Access & Payment Layer | Partnerships / Ecosystem Angle |

| Shell Pilipinas (Shell Recharge) | — | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Tesla Philippines (Supercharger) | 2003 (global) | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Meralco / Movem Electric | 1903 (Meralco) | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Mober (Central Charge) | — | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| ChargeEuropa (with Movem) | — | Europe | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines EV Charging Stations Market Analysis

Growth Drivers

Government electrification initiatives

National electrification and electric mobility policies are creating a strong structural foundation for EV charging infrastructure expansion. Government-backed roadmaps for transport decarbonization, public transport modernization, and energy transition encourage coordinated deployment of charging assets across cities and highways. Regulatory clarity around charging operations, licensing, and tariff structures reduces uncertainty for private operators. Support for electric public transport fleets, government vehicles, and pilot charging corridors further accelerates adoption. These initiatives signal long-term commitment, improving investor confidence and aligning charging infrastructure development with broader national sustainability, energy security, and urban mobility objectives.

Urban congestion and air quality pressures

Severe traffic congestion and deteriorating urban air quality are pushing cities toward cleaner mobility alternatives. Electric vehicles are increasingly positioned as part of urban transport reform strategies, requiring accessible and reliable charging infrastructure. Dense metropolitan areas face heightened pressure to reduce emissions from private vehicles, ride-hailing fleets, and commercial transport. Charging stations therefore become critical enablers of low-emission zones, fleet electrification programs, and transit-oriented developments. As cities prioritize livability and environmental performance, charging infrastructure is increasingly viewed as essential urban infrastructure rather than optional mobility support.

Challenges

Grid capacity and reliability constraints

Power grid limitations present a significant barrier to large-scale charging deployment. High-power chargers place concentrated demand on local distribution networks, often requiring transformer upgrades, switchgear enhancements, and load management systems. In areas with grid reliability concerns, maintaining consistent charger uptime becomes operationally complex. Coordination with utilities adds lead time and regulatory steps, slowing project execution. These constraints are more pronounced in secondary cities and highway corridors, where grid reinforcement investments lag urban centers, limiting the pace and scale of charging infrastructure expansion.

High upfront infrastructure costs

Developing EV charging stations involves substantial upfront expenditure, including chargers, civil construction, electrical upgrades, backend software, and ongoing maintenance capabilities. Additional costs arise from land access, permitting, and compliance requirements. For operators, utilization uncertainty—especially during early adoption phases—extends payback periods and increases financial risk. Smaller players often face capital constraints, while larger networks must carefully sequence investments to avoid stranded assets. These cost pressures slow aggressive rollouts and favor phased deployment strategies tied closely to proven demand clusters.

Opportunities

Public–private infrastructure partnerships

Public–private partnerships offer a practical pathway to accelerate charging infrastructure deployment while mitigating investment risk. Governments can provide access to strategic land, regulatory facilitation, and long-term policy stability, while private operators contribute capital, technology, and operational expertise. Such collaborations are well suited for transport hubs, government facilities, and high-visibility public spaces. Risk-sharing frameworks improve project viability and shorten deployment timelines. These partnerships also support equitable infrastructure distribution by extending charging access beyond commercially attractive urban cores into priority mobility corridors.

Renewable-integrated charging hubs

Renewable-integrated charging hubs represent a strategic opportunity to improve operational resilience and sustainability. Combining charging stations with on-site solar generation and energy storage reduces dependence on grid peak power and mitigates demand charges. Storage systems support load balancing and improve service reliability during grid disturbances. These hubs align charging infrastructure with renewable energy goals and corporate sustainability commitments. For operators, renewable integration enhances long-term cost efficiency and creates differentiated offerings for fleets, municipalities, and environmentally focused consumers seeking cleaner charging solutions.

Future Outlook

The Philippines EV charging stations market is expected to evolve from fragmented early-stage deployment toward coordinated network development aligned with vehicle growth, grid modernization, and urban planning strategies. Strategic focus will shift toward reliability, interoperability, and utilization optimization rather than sheer site count expansion.

Major Players

- Shell Pilipinas

- Tesla Philippines

- Meralco / Movem Electric

- ACMobility / Evro Network

- Mober

- SM Supermalls

- Robinsons Land

- Megaworld Lifestyle Malls

- Unioil

- Petron

- ParkNCharge

- EEI Power Corporation

- ABB Philippines

- Delta Electronics Philippines

- QEV Philippines

Key Target Audience

- EV charging infrastructure operators

- Electric utility companies

- Real estate developers

- Commercial fleet operators

- Automotive OEMs and distributors

- Technology and software providers

- Investments and venture capitalist firms

- Government and regulatory bodies (Philippines)

Research Methodology

Step 1: Identification of Key Variables

Core demand drivers, infrastructure types, deployment models, and end-user categories were defined to establish market boundaries and analytical scope.

Step 2: Market Analysis and Construction

Supply-side capabilities and demand-side adoption patterns were mapped to structure the market and define segmentation logic.

Step 3: Hypothesis Validation and Expert Consultation

Industry interviews and expert inputs were used to validate assumptions related to deployment economics and adoption constraints.

Step 4: Research Synthesis and Final Output

Insights were consolidated into a structured narrative aligned with client decision-making requirements.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- EV Charging Usage and Value-Chain Mapping

- Business Cycle and Demand Seasonality

- Philippines EV Charging Infrastructure Architecture

- Growth Drivers

Government electrification initiatives

Urban congestion and air quality pressures

Corporate fleet electrification

Real estate–led infrastructure deployment

Technology cost optimization - Challenges

Grid capacity and reliability constraints

High upfront infrastructure costs

Limited standardization

Land access and permitting delays

Uneven regional EV adoption - Opportunities

Public–private infrastructure partnerships

Renewable-integrated charging hubs

Fleet-focused charging networks

Smart grid and load management solutions

Tourism and intercity corridor charging - Trends

Shift toward fast and ultra-fast charging

Integration of charging management software

Co-location with commercial developments

Energy storage-backed charging stations

Interoperability and roaming platforms - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Charging Fee, 2019–2024

- By Utilization Indicators, 2019–2024

- By Charging Level (in Value %)

AC Level 3.3-22 kW

DC Fast Charging

Ultra-Fast Charging

Residential Private Charging

Public Slow Charging - By Location Type (in Value %)

Residential

Commercial

Highway and Transit Corridors

Workplace

Fleet Depots - By Technology / Product Type (in Value %)

Standalone Chargers

Networked Smart Chargers

Battery-Integrated Chargers

Renewable-Linked Chargers

Modular Charging Systems - By Deployment / Distribution Model (in Value %)

Utility-Led Deployment

Private Operator Deployment

Public–Private Partnerships

Fleet-Owned Infrastructure - By End-Use Industry / Customer Type (in Value %)

Private EV Owners

Commercial Fleet Operators

Public Transport Operators

Real Estate Developers

Retail and Hospitality Operators - By Region (in Value %)

Metro Manila

Luzon (Non-Metro)

Visayas

Mindanao

- Competition ecosystem overview

- Cross Comparison Parameters (site density, charger uptime, power rating range, grid integration capability, pricing model flexibility, software interoperability, installation lead time, after-sales support depth)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Shell Pilipinas

Tesla Philippines

Meralco / Movem Electric

ACMobility / Evro Network

Mober

SM Supermalls

Robinsons Land

Megaworld Lifestyle Malls

Unioil

Petron

Pilipinas Shell Mobility Sites

ABB Philippines

Delta Electronics Philippines

QEV Philippines

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Charging Fee, 2025–2030

- By Utilization Indicators, 2025–2030