Market Overview

The Philippines Electric Vehicle (EV) Insulation Materials market is valued at USD ~ million, driven primarily by the rapid growth of the country’s electric vehicle market. The increasing adoption of EVs, bolstered by government incentives, a rising focus on energy efficiency, and a shift toward environmental sustainability, has significantly influenced demand for high-quality insulation materials. The market is fueled by both the demand for safer, more efficient battery systems and the growing necessity for thermal and electrical insulation in EV components, such as batteries, motors, and power electronics.

Metro Manila, being the economic and industrial hub, plays a central role in driving demand for EV insulation materials in the Philippines. Cities such as Quezon City, Pasig, and Makati contribute significantly to the sector due to their proximity to large automotive OEMs, Tier-1 suppliers, and infrastructure developers. The government’s push towards EV adoption in key urban centers and industrial zones further enhances demand for insulation materials. Additionally, the rapid growth of EV charging stations across these cities accelerates the need for advanced insulation technologies to support safe, high-voltage electrical systems.

Market Segmentation

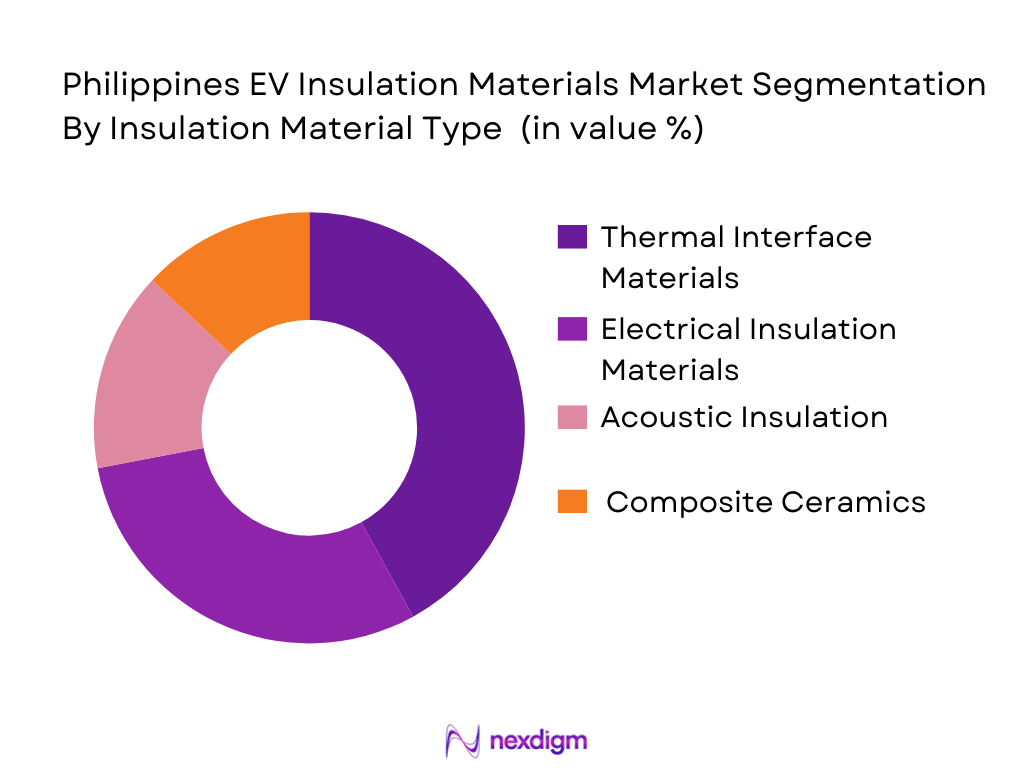

By Insulation Material Type

The market for EV insulation materials is divided into several types, each serving specific functions in various components of electric vehicles. The primary segments include thermal interface materials (TIM), electrical insulation materials, acoustic insulation, and composite ceramics.Thermal interface materials dominate the market due to the increasing demand for enhanced thermal management in EV batteries and motors. These materials, such as silicone and polyimide, are crucial for maintaining battery temperature, ensuring safety, and improving the performance of EVs. With the rise of high-performance lithium-ion batteries, the demand for high thermal conductivity materials is expected to continue to rise.

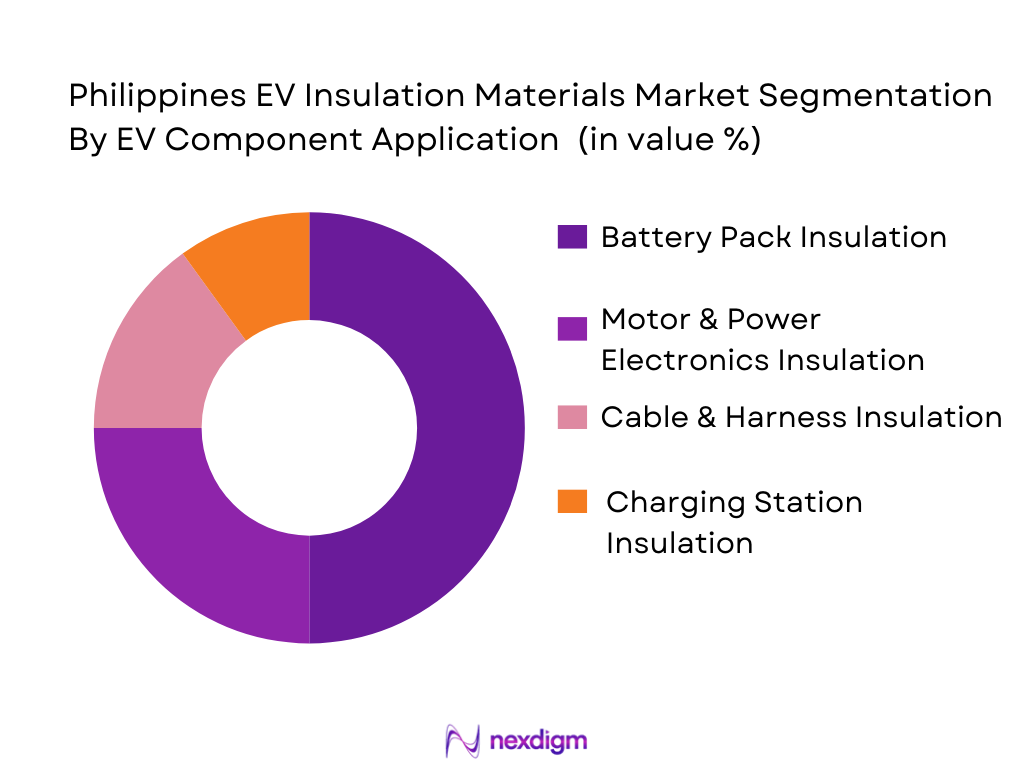

By EV Component Application

The demand for insulation materials is driven by various EV components, including battery packs, motors, power electronics, and cables. Among these, battery packs account for the largest share due to their critical role in energy storage and safety. Insulation materials, such as thermally conductive foams and ceramics, help maintain the optimal temperature for batteries, reducing the risk of thermal runaway and extending battery life. The increasing demand for EVs with longer ranges and improved battery performance further supports the growing need for high-quality insulation.

Competitive Landscape

The Philippines EV insulation materials market is marked by intense competition, with both local manufacturers and international suppliers vying for market share. Companies like DuPont, 3M, and local players dominate the market due to their extensive product portfolios, research capabilities, and strong relationships with OEMs. The competition in the market is centered around technological innovation, cost-efficiency, and sustainable product offerings. Several key players, both large and medium-sized, are focusing on improving insulation properties, including thermal conductivity and high-voltage insulation, to meet the rising demand from the EV sector.

| Company | Establishment Year | Headquarters | Revenue (USD) | Production Capabilities | Research & Development | Key Products |

| DuPont | 1802 | Wilmington, USA | ~ | ~ | ~ | ~ |

| 3M | 1902 | St. Paul, USA | ~ | ~ | ~ | ~ |

| ITW Formex | 1912 | Glenview, USA | ~ | ~ | ~ | ~ |

| Heraeus | 1851 | Hanau, Germany | ~ | ~ | ~ | ~ |

| Johns Manville | 1858 | Denver, USA | ~ | ~ | ~ | ~ |

Philippines EV Insulation Materials Market Analysis

Growth Drivers

Urbanization

Urbanization is a significant growth driver for the Philippines EV insulation materials market. The urban population in the Philippines has been increasing steadily, with approximately ~% of the total population residing in urban areas in 2025, according to the Philippine Statistics Authority. This urbanization trend is expected to continue, driving demand for electric vehicles (EVs) and the need for advanced insulation materials to meet the growing demand for safer and more efficient transportation. Increased urban mobility and infrastructure development, including EV charging stations and smart city initiatives, further fuel the need for specialized EV components like insulation materials. Furthermore, rapid city expansion, particularly in Metro Manila, increases the demand for sustainable and energy-efficient transportation solutions, further propelling the adoption of EVs and insulating technologies.

Industrialization

Industrialization in the Philippines is accelerating, with the country’s manufacturing sector contributing significantly to GDP. As of 2025, manufacturing accounted for around ~% of the country’s total GDP, according to the Philippine Statistics Authority. The rise of local EV manufacturing and the government’s support for electric vehicle production is helping the market for insulation materials grow. The Philippines is also experiencing an influx of foreign investment in industrial activities related to EV manufacturing, including the establishment of EV battery and component production facilities. This trend is expected to drive demand for high-performance insulation materials used in EVs, such as battery packs, electrical cables, and power electronics. Industrial growth supports both the production and integration of advanced materials into the EV supply chain, further boosting market opportunities for insulation solutions.

Restraints

High Initial Costs

The high initial costs associated with EV insulation materials remain a significant restraint in the Philippines market. Insulation materials, particularly advanced thermal interface materials (TIM) and high-performance electrical insulation used in EV battery packs, require significant investment in both production and R&D. While the price of raw materials may fluctuate, specialized insulation products like silicone-based thermal pads and epoxy-based electrical insulation are costly to produce. The Philippines, as a developing economy, faces challenges in making such high-end materials affordable for mass adoption. According to the Asian Development Bank, the Philippines’ manufacturing sector still grapples with high electricity costs, which affects the overall production cost structure of advanced materials. These cost challenges inhibit the widespread adoption of insulation materials that could enhance the performance and safety of EVs.

Technical Challenges

Technical challenges surrounding the development and production of EV insulation materials are another major restraint. The Philippines lacks a highly specialized local supply chain for high-performance insulation materials required for the rapidly evolving EV market. Advanced insulation materials, such as those for high-voltage cable coatings and motor insulation, require sophisticated manufacturing processes and high-tech expertise. The Philippines still faces limitations in local R&D investments for these specialized materials. In addition, the technology required to produce such materials to meet stringent safety standards for EV applications, such as thermal management and electrical insulation, remains a challenge. These technical barriers are slowing the growth of the insulation materials market, as industry players must rely heavily on imports from more technologically advanced regions.

Opportunities

Technological Advancements

Technological advancements present a significant opportunity for the Philippines EV insulation materials market. The evolution of battery technologies, particularly solid-state batteries, and advancements in motor efficiency are creating new demands for insulation materials with higher thermal stability and electrical resistance. In 2025, the Department of Energy (DOE) reported a ~% increase in the development of new EV technologies within the country, leading to a growing need for advanced insulation materials capable of handling higher voltages and extreme temperatures. As EV manufacturers move towards high-performance, energy-efficient vehicles, the demand for high-quality insulation solutions is set to rise. With the government’s push for sustainable energy technologies, coupled with a growing focus on improving the reliability and safety of EV components, insulation manufacturers in the Philippines will have increased opportunities for innovation in this sector.

International Collaborations

International collaborations represent a key growth opportunity for the Philippines EV insulation materials market. With the Philippines increasingly becoming a hub for EV production in Southeast Asia, international partnerships are likely to boost the local supply chain. For example, recent initiatives with Japan and South Korea have focused on establishing advanced manufacturing capabilities for high-performance insulation materials in the Philippines. According to the Board of Investments (BOI), foreign direct investment (FDI) in the EV sector has seen a steady rise, with joint ventures and collaborations expected to further accelerate local material production. These international partnerships not only bring in advanced technology but also open up new markets for the local insulation material producers. Additionally, these collaborations provide an opportunity for knowledge transfer, enabling local manufacturers to adopt new production methods that meet global standards for EV insulation.

Future Outlook

Over the next 5 years, the Philippines EV insulation materials market is expected to exhibit strong growth. The continuous expansion of EV adoption, coupled with government support for green transportation, will drive the demand for high-quality insulation materials. Furthermore, advancements in battery technology, increasing consumer awareness about energy efficiency, and the expanding EV charging infrastructure will provide new opportunities for material innovations. As the market matures, the focus will shift toward sustainable and recyclable materials, in line with global trends toward eco-friendly manufacturing practices.

Major Players

- DuPont

- 3M

- ITW Formex

- Heraeus

- Johns Manville

- BASF

- Nitto Denko

- Saint-Gobain

- Dow Chemical

- Flextronics

- Covestro

- Henkel

- Sumitomo Electric Industries

- ARLANXEO

- Mitsubishi Chemical Corporation

Key Target Audience

- Automotive OEMs and Tier-1 Suppliers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Energy, Department of Transportation)

- EV Battery Manufacturers

- EV Component Manufacturers

- Green Technology Investors

- Infrastructure Development Firms (for Charging Stations)

- Regional Development Authorities

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the key stakeholders across the Philippines EV insulation materials ecosystem, including automotive manufacturers, insulation material suppliers, and government agencies. This step is crucial for understanding the direct and indirect influences on market dynamics.

Step 2: Market Analysis and Construction

This phase includes analyzing historical market data and penetration levels of electric vehicles, focusing on insulation material demand across various segments. A detailed assessment of production volumes, service providers, and revenue generation is conducted.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert consultations with industry stakeholders, such as manufacturers, suppliers, and key government agencies. These consultations provide insights into market trends and challenges that cannot be captured through secondary data alone.

Step 4: Research Synthesis and Final Output

In the final phase, market data from various sources, including OEMs and insulation material suppliers, is synthesized. Interviews with industry experts and end-users help refine the findings and validate the conclusions regarding market size and forecast.

- Executive Summary

- Research Methodology (Market Definitions & Taxonomy (Insulation Materials, Thermal vs Electrical vs Acoustic, Battery vs Motor vs Cable), Assumptions & Benchmarking Rationales, Primary Research Approach (OEMs, Tier‑1 Suppliers, Material Providers), Secondary Sources & Data Normalization, Bottom‑Up Market Sizing & Cross‑Market Validation, Limitations & Data Confidence Measures)

- Market Genesis & Evolution (EV Adoption, Policy Levers)

- Role of Insulation in EV Performance, Safety & Thermal Management

- EV Insulation Value Chain — From Polymer & Ceramic Producers to OEMs & Aftermarket

- Supply Chain Mapping — Raw Materials to Component Integration

- Policy & Incentive Framework Impacting Insulation Demand (Import Tariff Waivers, EV Parts, Safety Standards)

- Growth Drivers

Rapid Rise of EV Adoption in Philippines

Importance of Thermal Management for Battery Safety & Longevity

Safety & Regulatory Compliance (High‑Voltage Insulation Standards)

Local Manufacturing & Assembly Growth - Market Challenges

Raw Material Cost Volatility

Technology Gaps in Advanced Insulation Manufacturing

Limited Local Material Production

Skills & Workforce Constraints in Precision Insulation Components - Key Opportunities

Next‑Gen Battery Tech (Solid‑State, Higher Energy Density)

High‑Performance Lightweight Insulation Demand

Local OEM & Tier‑1 Material Partnership Models - Trends Shaping the Philippines EV Insulation Materials Market

Shift to High‑Temperature Stable Polymers

Integration of Multi‑Functional Insulation Systems

Sustainable & Recyclable Insulation Solutions - Regulatory & Standards Landscape

Philippines Automotive & EV Safety Regulations

International Standards Adopted (ISO, IEC, UL Related to EV Insulation)

Trade & Import Policy Impact on Material Costs

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Insulation Material Type (In Value %)

Thermal Interface Materials (TIM) (Polyimide, Silicone, etc.)

Electrical & Dielectric Insulation (Epoxy, Polyester Films)

Acoustic & Vibration Damping Insulation

Composite/Advanced Ceramic Insulation

Bio‑Derived / Sustainable Insulation - By EV Component Application (In Value %)

Battery Pack Thermal Insulation

Cables & High‑Voltage Harness Insulation

Electric Motor & Stator Insulation

Power Electronics/ Inverter Insulation

Charging Station Infrastructure Insulation - By End‑User Channel (In Value %)

OEM Tier‑1 Supply

Aftermarket & Retrofit

EV Charging OEMs

Infrastructure Builders - By Geographic Demand Zones (In Value %)

Metro Manila & Luzon Industrial Clusters

Visayas EV Logistics Corridors

Mindanao EV Hubs

Free Trade & Port Zones

- Market Share by Revenue & Volume

- Cross‑Comparison Parameters (Company Overview, Material Technology Portfolio, Application, Component Coverage, Production & R&D Footprint in APAC/Philippines, Revenue & Growth Trajectory, Pricing Strategy & ASP Trends)

- SWOT for Major Competitors

- Pricing & SKU Analysis Across Key Insulation Types

- Detailed Profiles of Major Companies

DuPont

3M

ITW Formex

Tesa SE

Heraeus

Johns Manville

NGK Insulators

BASF

Honeywell

Nitto Denko

Von Roll

TE Connectivity

Sumitomo Riko Co. Ltd.

Hankuk Carbon

Flextronics/Local Tier‑1 Integration Partners

- Demand and Utilization Patterns

- Budget Allocations and Purchasing Power

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030