Market Overview

The Philippines EV Power Electronics Market is valued at USD ~ in 2024. The market has been driven primarily by government policies encouraging electric vehicle adoption, including tax exemptions, incentives, and regulations favoring the shift toward environmentally friendly transportation solutions. Additionally, rising consumer awareness about environmental sustainability and increasing urbanization contribute significantly to the demand for EVs and consequently, EV power electronics. The local adoption of electric vehicles and supporting infrastructure is also being fostered by a growing number of local and international manufacturers of EVs and components, which is further stimulating the market’s growth.

In the Philippines, Metro Manila, Cebu, and Davao are the dominant cities driving the market for EV power electronics. Metro Manila, as the economic hub, has witnessed substantial growth in electric vehicles due to the concentration of both infrastructure and potential buyers. The growing demand for electric public transport like electric jeepneys in these cities also influences the market. The Philippines’ strategic position in Southeast Asia further enables it to tap into global EV supply chains and manufacturing hubs, solidifying its place in the growing market for electric vehicles and power electronics within the region.

Philippines EV Power Electronics Market Segmentation

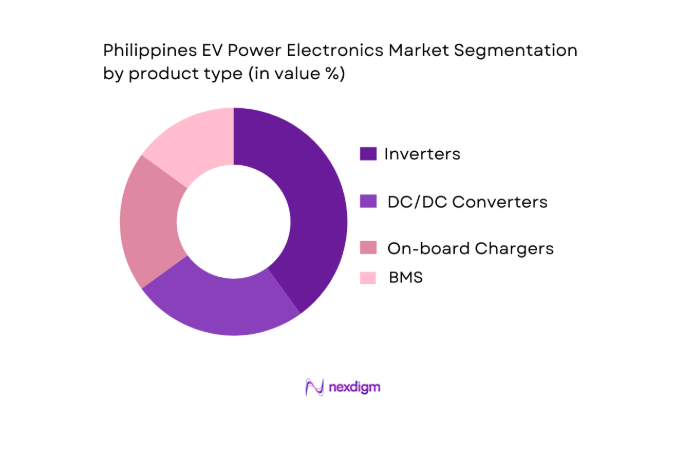

By Product Type

The Philippines EV Power Electronics market is segmented into inverters, DC/DC converters, on-board chargers (OBC), and battery management systems (BMS). Among these, inverters dominate the market share in 2024. This is because inverters are crucial for converting DC power from batteries to AC power required by the vehicle’s electric motor. As the Philippines ramps up its EV infrastructure, the demand for highly efficient and cost-effective inverters is skyrocketing. Companies focusing on enhancing the power density and thermal management capabilities of inverters are tapping into the EV market’s growing needs. The increasing number of electric vehicles, particularly electric public transportation, boosts the demand for advanced inverters.

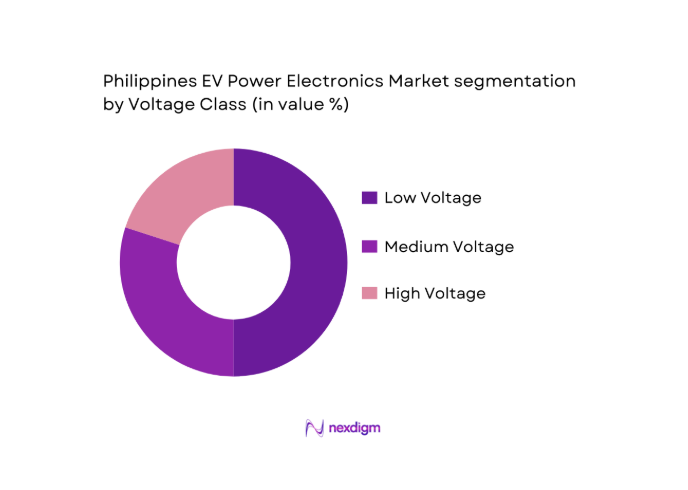

By Voltage Class

The market is segmented by voltage class into low voltage, medium voltage, and high voltage. Among these, low voltage EV systems dominate the Philippines EV Power Electronics market in 2024. This is primarily due to the increasing adoption of electric vehicles in urban environments where low-voltage systems are ideal for small to medium-sized electric cars and motorcycles. These vehicles are more cost-effective and have relatively simpler electronic systems, making them a popular choice for first-time EV buyers and fleet operators. As the adoption of electric motorcycles and compact EVs rises, low-voltage EV power systems are becoming the dominant segment.

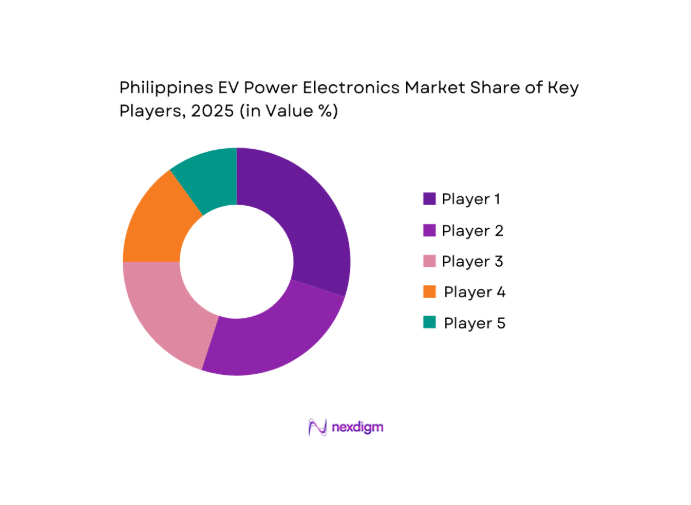

Philippines EV Power Electronics Market Competitive Landscape

The Philippines EV Power Electronics market is dominated by key players who have established their presence due to their technological capabilities and regional influence. Companies such as Infineon Technologies, STMicroelectronics, and NXP Semiconductors are leading the market. Their dominance is attributed to their broad product portfolios, strong manufacturing capabilities, and extensive global presence in the automotive sector. Additionally, local players such as First Philec are gaining traction due to their increased focus on local manufacturing and partnerships with Philippine-based EV OEMs. The consolidation of these major players highlights the highly competitive nature of the market, where innovation, supply chain management, and regulatory alignment are key competitive factors.

| Company | Establishment Year | Headquarters | Product Focus | Market Share (%) | R&D Investment | Manufacturing Footprint | Regional Partnerships |

| Infineon Technologies | 1999 | Germany | Power Modules, ICs | ~ | ~ | Global | ~ |

| STMicroelectronics | 1987 | Switzerland | Power Electronics, Automotive ICs | ~ | ~ | Global | ~ |

| NXP Semiconductors | 2006 | Netherlands | Power ICs, Sensors | ~ | ~ | Global | ~ |

| First Philec | 1993 | Philippines | Power Modules, BMS | ~ | ~ | Philippines | ~ |

| Delta Electronics | 1992 | Taiwan | Power Conversion Systems | ~ | ~ | Global | ~ |

Philippines EV Power Electronics Market Analysis

Growth Drivers

EV Policy Support (Zero‑tariff & Incentive Impact)

The Philippine government has implemented policies that encourage the adoption of electric vehicles, which have a significant impact on the growth of the EV power electronics market. For instance, the Philippine government introduced zero tariffs for electric vehicles and their components as part of its comprehensive strategy to boost the electric vehicle (EV) sector. In 2022, the Department of Finance announced the continuation of tariff-free policies on EVs, including a significant reduction in duties on electric vehicle imports, fostering a favorable environment for EV manufacturers and power electronics suppliers. Additionally, the country’s Clean Energy Act and comprehensive national plans aim to enhance energy sustainability and support EVs through incentives like tax exemptions and subsidies for EV manufacturers. By 2025, it is projected that the Philippines will have a stronger EV market due to these policies, which have already resulted in increased imports of electric vehicles and a stronger interest in electric public transport solutions. This policy shift is expected to drive both domestic and international investments into the EV power electronics sector.

Renewable Energy Synergy & Low‑Cost Power Expectations

The integration of renewable energy sources into the Philippines’ power grid has created a favorable environment for the growth of the EV sector, particularly for EV power electronics. As of 2023, the Philippines’ renewable energy capacity reached approximately ~ of total electricity production, with substantial investments in solar and wind power projects. The Philippines has set a target of achieving 35% renewable energy in its energy mix by 2030, further driving down the cost of power generation. With increased renewable energy penetration, the cost of electricity is expected to remain competitive, benefiting electric vehicle owners and manufacturers who rely on lower operational costs for sustainable transportation. This synergy between renewable energy and electric vehicle adoption is especially critical in powering EVs through green energy, which will likely increase demand for power electronics that support EV charging infrastructure and energy storage systems.

Market Challenges

High Thermal & Reliability Demands for EV Power Electronics

As the demand for electric vehicles increases, so do the challenges associated with the thermal management and reliability of EV power electronics. Power electronics in EVs, such as inverters and battery management systems, face considerable strain due to the high currents and power densities they must handle. In 2022, the automotive sector reported that thermal management challenges were one of the key reasons for component failures, with a reported failure rate of 5-7% in power electronics used in electric vehicles. This is particularly concerning in tropical regions like the Philippines, where high temperatures exacerbate these issues. Manufacturers are being pushed to develop innovative cooling technologies and more durable components that can withstand higher temperatures while maintaining efficiency. This ongoing challenge requires significant investments in research and development to enhance the thermal properties of power electronics in EVs, and the growing demand for EVs places additional pressure on manufacturers to meet these high standards.

Limited Local Wide Bandgap R&D & Manufacturing Base

While the global demand for wide-bandgap (WBG) semiconductors, such as silicon carbide (SiC) and gallium nitride (GaN), is on the rise, the Philippines faces a significant challenge in developing a local R&D and manufacturing base for these advanced materials. WBG semiconductors are crucial for improving the efficiency and thermal performance of EV power electronics. Despite being a major player in the global semiconductor market, the Philippines’ local capacity for WBG semiconductor production remains underdeveloped. In 2022, the Philippines ranked 12th globally in semiconductor exports, but the domestic production of WBG materials was limited. This reliance on imports for WBG semiconductors places constraints on the Philippines’ ability to fully capitalize on the growing demand for efficient EV power electronics.

Market Opportunities

Rise of GaN & SiC for High‑Efficiency EV Power Systems

Gallium nitride (GaN) and silicon carbide (SiC) semiconductors are key to improving the efficiency of EV power systems. These wide-bandgap materials enable higher power densities, faster switching speeds, and improved thermal performance compared to traditional silicon-based semiconductors. As of 2023, the global adoption of GaN and SiC technologies in power electronics has increased significantly, driven by the growing demand for high-efficiency systems in electric vehicles. In the Philippines, the government’s push for energy efficiency and lower carbon emissions is expected to boost the demand for these advanced materials. Local manufacturers and international players are expected to increase their focus on integrating these semiconductors into the local EV power electronics market, creating significant growth opportunities in the coming years.

Integration with Smart Charging & V2G Grid Interfaces

Smart charging infrastructure and vehicle-to-grid (V2G) systems are becoming integral to the development of the Philippines’ electric vehicle ecosystem. The adoption of smart grids and V2G technology allows EVs to not only consume power but also supply electricity back to the grid, offering a potential solution for grid stability and renewable energy integration. As of 2023, the Philippines has started implementing pilot projects for smart charging systems and V2G technology in select urban areas, with plans for expansion. This growing trend presents significant opportunities for power electronics manufacturers to develop advanced charging stations and smart grid systems. With the increasing availability of renewable energy in the country, integrating EVs into the grid can enhance energy storage and distribution, driving demand for specialized EV power electronics.

Future Outlook

Over the next five years, the Philippines EV Power Electronics market is expected to show significant growth driven by continuous government support, advancements in EV technology, and increasing consumer demand for eco-friendly transportation solutions. The government’s commitment to reducing carbon emissions and its incentives for EV adoption are expected to continue to fuel market expansion. The rapid development of local EV manufacturing and public transportation solutions, especially electric jeepneys, alongside improvements in power electronics efficiency, will contribute to the market’s positive growth trajectory.

Major Players

- Infineon Technologies

- STMicroelectronics

- NXP Semiconductors

- First Philec

- Delta Electronics

- Texas Instruments

- ON Semiconductor

- Renesas Electronics

- Mitsubishi Electric

- Toshiba Corporation

- Panasonic Corporation

- Broadcom Inc

- Qualcomm Technologies

- Analog Devices

- Cree Inc

Key Target Audience

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

- Electric Vehicle OEMs

- Power Electronics Manufacturers

- Automotive Component Suppliers

- Energy Providers

- Public Transport Operators

- Battery Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase of the research involves identifying key drivers within the Philippines EV Power Electronics market. This will include analyzing historical data related to EV penetration, the adoption of electric mobility solutions, and the power electronics used within the Philippine EV ecosystem. Secondary and proprietary data sources will be used to collect comprehensive industry-level information.

Step 2: Market Analysis and Construction

In this phase, historical market data on EV adoption, government policies, and infrastructure developments will be analyzed. This includes assessing market penetration, key regional players, revenue generation, and service quality. Comprehensive data sources will be integrated to construct an accurate representation of the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts, including EV OEMs, suppliers of power electronics, and government representatives. This consultation will provide operational and financial insights, validating and refining the market data further.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered data into a comprehensive analysis of the market. This will include detailed insights into product segment performance, growth drivers, and future market predictions. Interviews with key stakeholders in the EV ecosystem will also provide a final validation of the research findings.

- Executive Summary

- Research Methodology (Market Definitions & EV Power Electronics Scope, Abbreviations, Data Sources & Forecast Models, Primary & Secondary Research Framework, Assumptions on EV Penetration & Local Supply Chain Dynamics, Limitations)

- Philippines EV Adoption Landscape

- Power Electronics Role in EV Value Chain

- EV Powertrain vs. Conventional ICE Electronics Requirements

- Philippines Power Electronics Ecosystem

- Growth Drivers

EV Policy Support (Zero‑tariff & Incentive Impact)

Renewable Energy Synergy & Low‑Cost Power Expectations

Nickel Local Supply Opportunity (Battery‑EV Value Chain)

Growing Localization of Assembly & EMS Capacity - Market Challenges (2026-2030)

High Thermal & Reliability Demands for EV Power Electronics

Limited Local Wide Bandgap R&D & Manufacturing Base

Supply Chain Dependencies on Imported Semiconductors - Future Opportunities (2026-2030)

Rise of GaN & SiC for High‑Efficiency EV Power Systems

Integration with Smart Charging & V2G Grid Interfaces

Local OEMs & Tier‑1 Partnership Models - Value Chain & Supply Chain Analysis (2026-2030)

Power Electronics Ecosystem Mapping

Supplier Network & Tier‑1 Partnerships

Logistics & Import Dynamics

- Application‑Level Value Breakdowns (2019-2025)

- Material & Technology Mix – Historical (2019-2025)

- Component Segmentation – Historical (2019-2025)

- By EV Power Electronics Component Type (in value %)

Inverters

DC/DC Converters

OBC

BMS Power Modules - By Semiconductor Material Technology (in value %)

Silicon

Silicon Carbide

Gallium Nitride - By Voltage Class (in value %)

Low Voltage EV

Medium Voltage EV

High Voltage EV - By End Use (in value %)

Passenger EVs

Commercial EVs

Two‑Wheel EVs

E‑Public Transport - By Distribution Channel (in value %)

OEM Direct Supply

Tier‑1 Integration Suppliers

Aftermarket Electronics

- Market Share of Key Players

- Cross‑Comparison Parameters (Company Strategy, Product Portfolio Breadth, R&D Intensity, Local Presence/Assembly Footprint, Revenue by Segment, Material Tech Focus [Si/SiC/GaN], Channel Reach, Aftermarket Support, Integration with EV OEMs)

SWOT – Leading Corporates in Philippines EV Power Electronics - Detailed Company Profiles

Infineon Technologies AG

Texas Instruments Incorporated

STMicroelectronics NV

ON Semiconductor

Renesas Electronics Corporation

NXP Semiconductors

Mitsubishi Electric Corporation

Siemens AG

ABB Ltd

Delta Electronics, Inc

Panasonic Corporation

Broadcom Inc

Analog Devices, Inc

Integrated Micro‑Electronics, Inc

First Philec, Inc

- EV OEMs

- Tier‑1 Suppliers

- Local EMS/SMS

- Regulatory Bodies

- Market Size Forecast (2026-2030)

- Component Forecasts & Material Mix Trends (2026-2030)

- Technology Diffusion Scenarios (2026-2030)