Market Overview

The Philippines EV Thermal Interface Materials (TIM) market is growing steadily, driven by the increasing adoption of electric vehicles (EVs) and the expanding need for advanced thermal management solutions. As of 2024, the market was valued at USD ~ million, reflecting significant demand for TIM solutions due to the country’s efforts to bolster its EV sector. The market is primarily propelled by government incentives, rising consumer interest in eco-friendly technologies, and the urgent need for effective battery and power electronics cooling. A key factor driving the market is the growing penetration of electric vehicles in Southeast Asia, coupled with the demand for high-performance thermal management materials that help maintain optimal battery temperatures, ensuring vehicle reliability and safety.

The Philippines, with its developing automotive sector, is becoming one of the focal points for EV adoption in Southeast Asia. Metro Manila, Cebu, and Davao are the primary cities dominating the market due to their increasing investments in EV infrastructure and manufacturing. Metro Manila, as the political and economic hub, leads with its growing number of EV charging stations and manufacturing plants. Moreover, the Philippine government’s commitment to zero-emissions vehicle policies further strengthens these regions’ market dominance. The combination of local initiatives, such as tax breaks for EV manufacturers and the rising demand for electric public transport solutions, boosts the prominence of these regions in the TIM market.

Market Segmentation

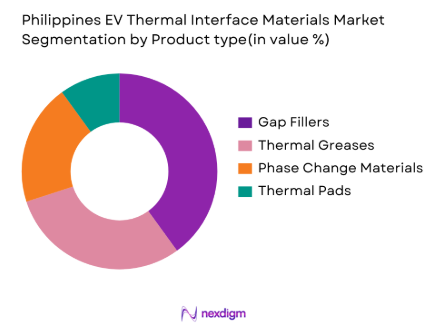

By Product Type

The Philippines EV Thermal Interface Materials market is segmented by product type into gap fillers, thermal greases, phase change materials, and thermal pads. Among these, gap fillers dominate the market due to their versatility and efficiency in filling the spaces between EV battery modules and the housing. These materials ensure effective thermal management by improving heat transfer while also offering electrical insulation. Their widespread usage can be attributed to their compatibility with a range of EV battery sizes and configurations. Gap fillers, with their customizable properties, are increasingly favored by both OEMs and Tier-1 suppliers, ensuring their place as the leading product in the market.

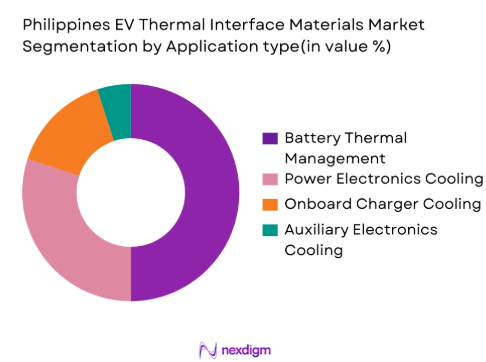

By Application Type

The application of thermal interface materials is crucial in various EV components, including batteries, power electronics, and onboard chargers. Among these, battery thermal management systems account for the largest share in the Philippines market. The need for maintaining optimal battery temperatures is critical to ensure long battery life, safety, and performance. As the Philippines EV market continues to expand, the demand for reliable battery cooling systems grows, pushing the need for specialized TIMs. Battery cooling solutions help prevent overheating, ensuring the efficiency and safety of the electric vehicle, making this sub-segment the most significant contributor to the TIM market.

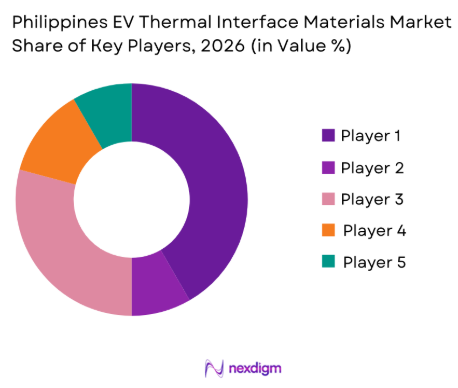

Competitive Landscape

The Philippines EV Thermal Interface Materials market is dominated by several key players, both local and global. These companies are leveraging advanced materials and technologies to cater to the increasing demand for thermal management solutions in the EV sector. Notable players in the market include global manufacturers such as Henkel AG, Dow Chemical, and 3M, as well as regional suppliers like TOYOTA Tsusho, which offers tailored TIM solutions for the Southeast Asian market. The consolidation of these players highlights the significant influence they have on the growth trajectory of the market, from material innovation to local manufacturing capacity.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Production Capacity | Market Focus | R&D Capabilities |

| Henkel AG | 1876 | Düsseldorf, DE | ~ | ~ | ~ | ~ |

| Dow Chemical Company | 1897 | Midland, US | ~ | ~ | ~ | ~ |

| 3M | 1902 | Saint Paul, US | ~ | ~ | ~ | ~ |

| TOYOTA Tsusho | 1948 | Tokyo, JP | ~ | ~ | ~ | ~ |

| Laird Performance | 1997 | Reading, UK | ~ | ~ | ~ | ~ |

Philippines EV Thermal Interface Materials market Analysis

Growth Drivers

Rapid Electric Vehicle Adoption & Policy Support (Zero EV Tariffs)

The Philippines government has committed to advancing the adoption of electric vehicles (EVs) by introducing supportive policies such as zero tariffs on electric vehicle imports. This initiative has been a catalyst for growth in the EV sector. In 2024, the government implemented the Electric Vehicle Industry Development Act (EVIDA), aiming to boost EV adoption. The Philippines has been a part of the ASEAN Free Trade Area (AFTA), which further promotes EVs with the zero-tariff policy. In 2023, the Philippines imported 5,500 electric vehicles, showing a steady increase in demand. According to the Department of Energy, this policy has helped the EV market transition toward more sustainable transportation options in the country.

Demand for Effective EV Battery Thermal Management

As the Philippines continues to expand its electric vehicle fleet, there is an increasing demand for high-efficiency battery thermal management solutions. According to the Department of Energy’s 2023 report, the Philippines has set a target of ~ million electric vehicles on the road by 2030, driving the need for improved battery systems to handle the thermal load of increasingly powerful batteries. In 2024, the number of EVs in the country grew by 15%, and with the push for better electric transportation solutions, the demand for effective thermal management materials, such as TIMs, is expected to grow in parallel. Given that EV battery overheating is a major concern, the emphasis on thermal management in EV batteries is expected to continue as manufacturers seek to address performance and safety.

Market Challenges

High Material Import Dependence

Despite the government’s push to localize production, the Philippines still faces significant challenges in reducing its dependence on imported materials. As of 2024, the country relied heavily on imports for specialized materials, including those used in thermal management solutions for electric vehicles. The Philippines’ import bill for automotive components reached USD ~billion in 2024, with thermal interface materials accounting for a portion of these imports. This reliance creates vulnerabilities in the supply chain and puts pressure on manufacturers to secure materials, especially in the face of global supply chain disruptions. Reducing this dependency is crucial to support local EV production in the long run.

Quality Standardization & Testing Infrastructure Gaps

The Philippines is facing challenges related to the standardization and testing infrastructure for thermal interface materials. While the demand for TIMs continues to grow, the lack of comprehensive national testing standards for these materials hampers consistent product quality assurance. In 2024, only 35% of the country’s EV-related components were tested under internationally recognized standards, leading to variations in product quality. Without a robust infrastructure for testing TIMs to ensure performance and reliability under high temperatures, manufacturers may face hurdles in meeting the growing demand for these critical materials. The government has started addressing this with initiatives to upgrade testing facilities, but progress remains slow.

Market Opportunities

Local R&D & Material Innovation Hubs

The Philippines is positioning itself to become a leader in the development of thermal interface materials (TIMs) through the establishment of local R&D and innovation hubs. As of 2024, the government allocated PHP 10 billion for the development of advanced materials and manufacturing technologies. This investment supports the growth of local R&D centres focused on the innovation of high-performance materials such as advanced graphene composites and thermal pastes designed for EV battery management. The growing number of partnerships between Philippine universities and international research organizations is expected to fuel the development of locally sourced, cost-effective TIMs, strengthening the local market and reducing reliance on imports.

Partnerships with Global Tier-1 EV Battery Suppliers

Partnerships between local manufacturers and global Tier-1 EV battery suppliers present a significant growth opportunity for the Philippine TIM market. The Philippines has seen increasing interest from multinational companies, including BYD and LG Energy Solutions, which have begun to invest in local battery production. This presents an opportunity for local TIM suppliers to partner with these global companies and provide materials that meet the specific requirements of cutting-edge EV batteries. As the demand for high-quality EV batteries continues to rise, these partnerships will allow local suppliers to establish a strong foothold in the EV supply chain, creating a win-win scenario for both the local and global stakeholders.

Future Outlook

Over the next 5 years, the Philippines EV Thermal Interface Materials market is expected to experience substantial growth, driven by government incentives for EV manufacturing, rising demand for eco-friendly transportation, and advancements in thermal management technologies. With continued investments in EV infrastructure, particularly in key urban centres like Metro Manila and Cebu, the need for efficient thermal solutions will continue to grow. Innovations in TIMs, particularly those offering enhanced thermal conductivity and better battery protection, will further fuel market expansion. Additionally, the growing presence of global players and local manufacturers advancing production capabilities is set to bolster the country’s position in the regional EV ecosystem.

Major Players

- Henkel AG

- Dow Chemical Company

- 3M

- TOYOTA Tsusho

- Laird Performance Materials

- Fujipoly

- Momentive Performance Materials

- Indium Corporation

- Henkel Adhesive Technologies

- Bergquist (Henkel)

- Shin‑Etsu Chemical

- Panasonic

- Thermacool

- Parker Hannifin

- DuPont

Key Target Audience

- Electric Vehicle Manufacturers

- Battery Manufacturers

- Automotive OEMs

- EV Component Suppliers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Automotive Aftermarket and Retrofit Solution Providers

- Energy and Utilities Companies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves gathering extensive secondary research to identify the critical factors influencing the Philippines EV TIM market. This includes studying material types, market dynamics, application segments, and customer needs. Relevant data is gathered from proprietary and publicly available industry databases, with focus on local market trends and technological developments.

Step 2: Market Analysis and Construction

Historical data pertaining to the EV TIM market is analyzed, focusing on trends in material adoption, application expansion, and emerging technologies. Detailed segmentation of the market by product type and application type is conducted to ensure accurate market size estimates and trend analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through expert interviews, including conversations with industry practitioners, EV manufacturers, and thermal materials suppliers. This phase helps refine the data and confirms the accuracy of initial projections, particularly for material specifications and their market applications.

Step 4: Research Synthesis and Final Output

Final analysis is based on direct engagement with EV manufacturers and TIM suppliers to cross-check market trends, demand patterns, and consumer preferences. This interaction further enriches the study and ensures that the final report reflects an accurate representation of the Philippines EV TIM market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Philippines EV TIM Market Boundaries, Material Classification, Application Definitions, Supply & Demand Metrics, Forecast Models, Primary & Secondary Data Process, Data Quality Metrics)

- Definition and Scope of EV Thermal Interface Materials

- Philippines EV TIM Ecosystem Genesis & Adoption Timeline

- EV TIM Product Taxonomy

- Material Categories

- Application Spectrum

- EV Battery Thermal Management Systems Landscape

- Growth Drivers

Rapid Electric Vehicle Adoption & Policy Support

Demand for Effective EV Battery Thermal Management

Innovation in High‑Performance TIM Materials

Localization of EV Components & Manufacturing

- Market Challenges

High Material Import Dependence

Quality Standardization & Testing Infrastructure Gaps

Price Sensitivity in EV Supply Chain

- Market Opportunities

Local R&D & Material Innovation Hubs

Partnerships with Global Tier‑1 EV Battery Suppliers

Export Opportunities to ASEAN EV Manufacturing Clusters - Trends

High Thermal Conductivity Nanofillers

TIMs Compatible with Sic Power Electronics

Integrated Thermal Material Systems

- Market Size – Value (USD) & Volume, 2019-2025

- Market by Material Thermal Conductivity Tiers, 2019-2025

- Market by TIM Technology Segments, 2019-2025

- By Material Type (In Value%)

Silicone‑based TIMs

Graphite‑enhanced TIMs

Metal Particle Fillers

Polymer Composite TIMs

Phase‑Change Materials - By Product Form Process (in value%)

Gap Fillers

Thermal Pastes / Greases

Tapes & Film

Pads & Sheets

Die‑Attach TIMs

- By EV Application (In Value %)

Battery Pack Cooling Interfaces

Power Electronics & Inverter TIMs

Electric Motor TIMs

On‑Board Charger Thermal Interfaces

Auxiliary Electronics Cooling - By End Customer (In Value %)

EV OEMs & Assembly Plants

Battery Module & Pack Manufacturers

Aftermarket & Retrofit Solutions

Engineering & Service Providers

- By Distribution Channel (In Value %)

Direct OEM Contracts

Authorized Distributors & Technical Rep Networks

Local Specialized Resellers

E‑Commerce & Digital Platforms

- Market Share – By Value & Volume (National & Global)

- Cross Comparison Parameters (Thermal Conductivity Rating, Dielectric Strength Class, Material Cost per kg, Process Compatibility Index, OEM Qualification Status, Production Capacity in Philippines/Asia, Supply Flexibility Score, Warranty & Reliability Performance)

- SWOT Analysis

- Pricing Dynamics & Benchmarking

- Porte’s Five Force

- Detailed Profiles

Henkel AG & Co. KGaA

Company

Dow Chemical Company

Parker Hannifin

Shin‑Etsu Chemical

DuPont

Laird Performance Materials

Indium Corporation

Fujipoly

Bergquist (Henkel)

Momentive Performance Materials

Master Bond

S & I Corporation

Tera‑Global Materials

Panasonic EV TIM Solutions

- TIM Adoption Rates by OEM Segment

- Spec’ing Criteria & Technical Requirements

- Procurement Processes & Technical Evaluation Barriers

- Total Cost of Ownership (TCO) & Lifecycle Performance

- Replacement & Aftermarket Demand Patterns

Philippines EV Thermal Interface Materials Market Future Size, 2026-2030

Market Value & Volume Outlook, 2026-2030

Material Mix Forecast & Growth Scenarios, 2026-2030

Product Form & Application Growth Projections, 2026-2030