Market Overview

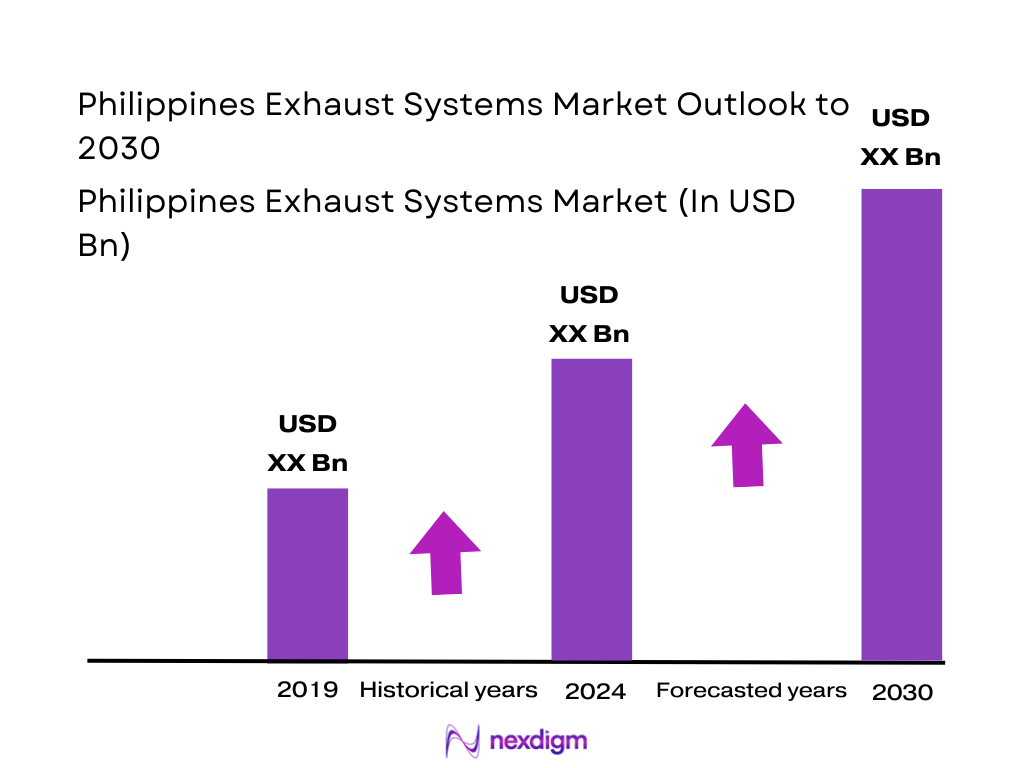

The Philippines Exhaust Systems Market is anchored in a sub-billion-dollar revenue pool closely tied to the country’s expanding vehicle base and rising new car sales. Road motor vehicles now total about ~ units, with vehicle density at roughly ~ per 1,000 inhabitants, underscoring a sizeable installed base requiring maintenance and replacement exhaust components. New vehicle sales have climbed from ~ units to ~ units, according to CAMPI and TMA statistics, illustrating strong replacement and OEM fitment demand for exhaust manifolds, catalytic converters, mufflers and tailpipes.

The Philippines Exhaust Systems Market is dominated by dense urban and industrial corridors where vehicles, logistics and public transport are concentrated. Metro Manila and the broader Luzon corridor (including CALABARZON and Central Luzon) host most vehicle dealerships, assembly operations, logistics hubs and jeepney fleets, making them the primary consumption centers for exhaust parts and systems. Cebu and Davao act as secondary hubs, with strong regional truck, bus and motorcycle activity. These regions see heavy daily traffic, intensive stop-go driving and stricter enforcement of emission checks, all of which accelerate exhaust wear and replacement cycles.

Market Segmentation

By Vehicle Type

The Philippines Exhaust Systems Market is segmented by vehicle type into light commercial vehicles, passenger cars, buses and heavy trucks, jeepneys and UV Express vehicles, and motorcycles and tricycles. Light commercial vehicles hold the dominant share, reflecting CAMPI and TMA data showing commercial vehicles account for roughly three-quarters of new vehicle sales, driven by goods transport, provincial buses and construction fleets. These vehicles typically clock higher annual mileage than private cars and often operate under heavy load in congested corridors, accelerating exhaust wear, corrosion and thermal fatigue. Fleet operators prioritise uptime and noise control, supporting demand for higher-grade mufflers, aftertreatment units and robust piping. Jeepneys, UV Express and provincial buses also contribute heavily, as aging fleets transition towards cleaner, quieter exhausts under modernization and emission-inspection initiatives.

By Sales Channel

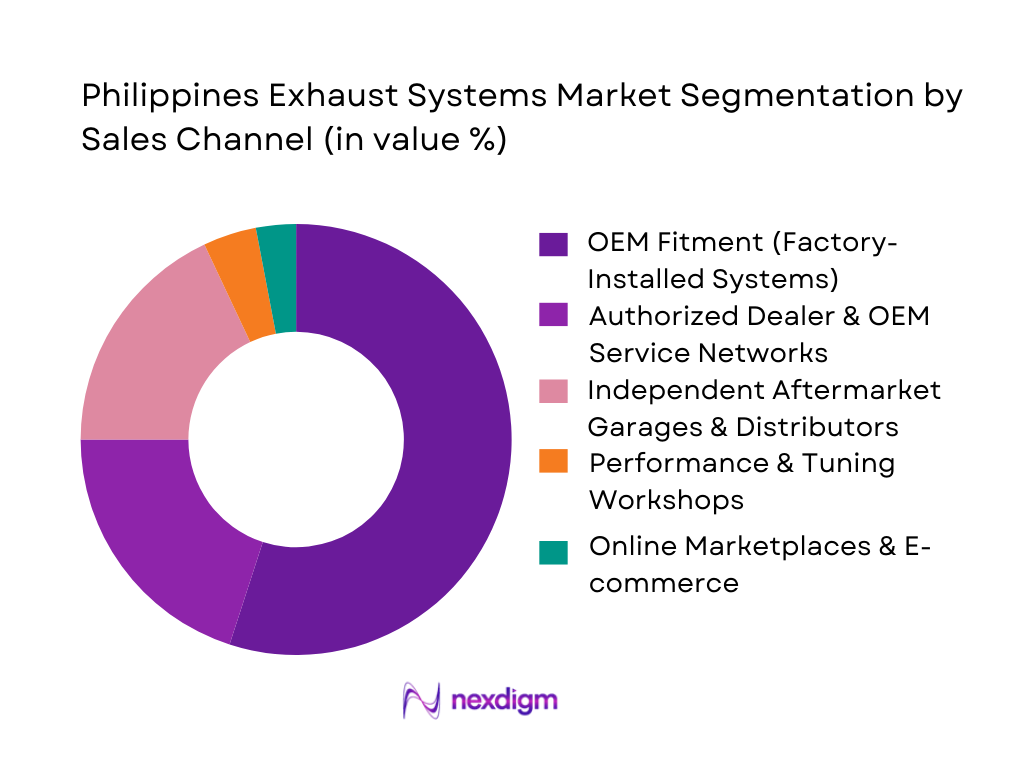

The Philippines Exhaust Systems Market is segmented by sales channel into OEM fitment, authorized dealer and OEM service networks, independent aftermarket garages and distributors, performance and tuning workshops, and online marketplaces. OEM fitment currently dominates, reflecting the fact that nearly all of the ~ new vehicles sold are delivered with factory-specified exhaust systems supplied by global Tier-1s and local manufacturers. Warranty coverage and rising awareness of emission compliance encourage owners to remain within OEM service networks during early vehicle life, sustaining demand for genuine mufflers, catalysts and sensors. Independent garages and parts distributors capture much of the replacement demand once vehicles age out of warranty, especially in provincial cities where price sensitivity is high. Performance workshops and online channels are still niche but growing, serving enthusiasts seeking sound-tuning, stainless cat-back systems and imported Japanese or US-origin brands.

Competitive Landscape

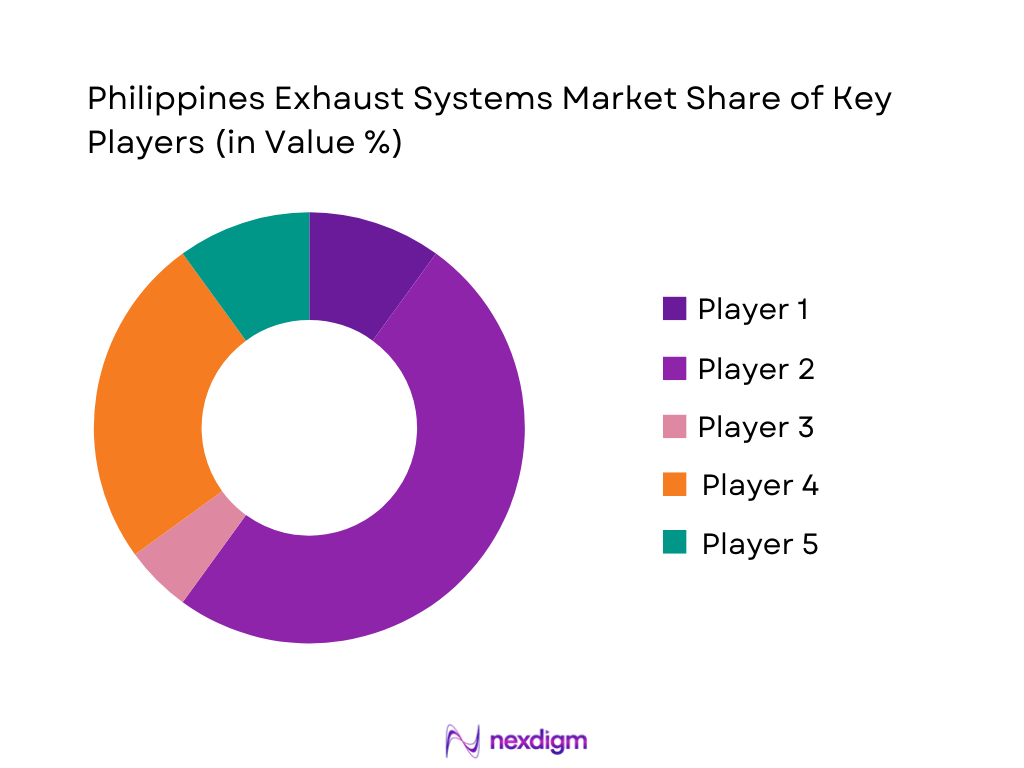

The Philippines Exhaust Systems Market features a mix of global Tier-1 suppliers, specialized aftermarket brands and at least one major local manufacturer producing mufflers and full exhaust assemblies. 6Wresearch highlights Tenneco, Yutaka Giken, Eberspächer, Futaba and Bosal among key companies addressing the Philippines market, while Roberts Automotive & Industrial Parts Manufacturing Corp. manufactures main muffler assemblies and other components locally from its Cabuyao, Laguna plant. Imports have diversified, with top supplying countries including Japan, Thailand, Indonesia, China and Malaysia, and import concentration shifting from very high to moderate, indicating broader sourcing and competitive intensity.

| Company | Establishment Year | Headquarters | Philippines Presence Model | Key Exhaust Product Focus | Primary Customer Segments in PH | Technology / Material Focus | Channel Focus (OEM / Aftermarket / Performance) |

| Roberts AIPMC | 1992 | Cabuyao, Laguna, Philippines | ~ | ~ | ~ | ~ | ~ |

| Tenneco Inc. (Walker Exhaust) | 1940s | Lake Forest, Illinois, USA | ~ | ~ | ~ | ~ | ~ |

| Bosal International N.V. | 1923 | Belgium (European HQ) | ~ | ~ | ~ | ~ | ~ |

| Eberspächer Group | 1865 | Esslingen am Neckar, Germany | ~ | ~ | ~ | ~ | ~ |

| Futaba Industrial Co., Ltd. | 1945 | Aichi Prefecture, Japan | ~ | ~ | ~ | ~ | ~ |

Philippines Exhaust Systems Market Analysis

Growth Drivers

Vehicle parc expansion

Vehicle parc growth in the Philippines is a core structural driver for exhaust systems demand. The country has about ~ road motor vehicles, equivalent to ~ vehicles per 1,000 inhabitants, based on recent international motorization data for the Philippines. This is underpinned by rising incomes, with GDP reaching USD ~ billion and GDP per capita USD ~, reflecting stronger purchasing power in urban centers. New motor vehicle sales reached ~ units in one year and ~ units the following year according to CAMPI–TMA consolidated reports, indicating sustained replacement and first-time buyer demand that continually refreshes the exhaust-relevant parc and supports aftermarket volumes.

Emissions trajectory

The Philippines is tightening its emissions trajectory, directly impacting exhaust aftertreatment demand. Transport already contributes 21.6% of national fossil CO₂ emissions, according to the Asian Transport Outlook climate profile, while the Philippines accounts for 0.4% of global fuel-combustion emissions. The government’s nationally determined contribution commits to a 75% projected reduction and avoidance of greenhouse gas emissions across sectors, including transport, over the current decade. A complementary policy has extended zero import tariffs on electric vehicles and parts until 2028, expanding coverage to hybrids, e-motorcycles and e-bicycles. These policy signals, combined with urban air-quality pressure, push OEMs and importers toward cleaner, compliant exhaust hardware and catalyzed systems even as internal combustion vehicles remain the dominant parc segment.

Challenges

Counterfeit parts

Counterfeit and smuggled parts are a persistent risk factor in the Philippines exhaust systems market, undermining safety and brand integrity. The Bureau of Customs reported 709 seizures of smuggled goods valued at PHP ~ billion in one year, including approximately PHP ~ billion in counterfeit goods alone, highlighting the scale of illicit trade affecting multiple product categories. Independent analysis on illicit trade notes counterfeit goods remain widely available in Manila’s wholesale and retail markets, with documented seizures exceeding PHP ~ million of counterfeit apparel in just one month, underscoring enforcement gaps. Although these statistics cut across sectors, the same channels are used for non-compliant exhaust components, silencers and pipes which do not meet emissions or durability standards, posing reputational and warranty risks to legitimate manufacturers and distributors in the Philippine market.

Fitment variation

Fitment variation is structurally high because the Philippine vehicle fleet is supplied by a diverse mix of import sources and brands. Automotive imports are dominated by vehicles and components coming from Thailand, Indonesia, Japan, China, and the United States, as reflected in official trade statistics for transmissions and seats; for example, transmissions imports total USD ~ million and ~ kg, with Japan alone supplying USD ~ million and ~ kg, while motor-vehicle seat imports reach USD ~ million with ~ units from China and ~ units from Japan in a single year. Brand concentration in retail sales is also skewed toward Toyota, Mitsubishi, Ford, Nissan, Suzuki, Isuzu and others, with Toyota alone selling 200,031 units in one year, according to brand-wise sales tallies. This multi-origin mix creates large platform diversity in exhaust routing, mounting points and NVH characteristics, complicating stocking, cataloguing and installation for aftermarket exhaust suppliers and local fabricators.

Opportunities

Stainless-steel upgrades

High humidity, intense rainfall and coastal salinity together create a strong case for stainless-steel exhaust upgrades in the Philippine market. With annual rainfall consistently around 2,700–3,000 mm and relative humidity peaking at 85%, conventional aluminized or low-grade carbon-steel systems are prone to early perforation, especially in coastal cities and low-elevation floodplains. At the same time, trade data show the Philippines is already integrated into regional auto-parts value chains: exports of motor-vehicle parts and accessories (HS 8701–8705) reached USD ~ million in a recent year, and mufflers and exhaust pipes exports (HS 870892) alone amounted to USD ~ million and ~ kg. This manufacturing and trade base can be leveraged to scale production of stainless and coated exhaust assemblies tailored to local climate stress, enabling upselling from basic replacements to higher-life, corrosion-resistant product lines in both OEM and independent aftermarket channels.

Modernization kits

Modernization kits for exhaust systems—combining corrosion-resistant pipes, compliant mufflers and, where relevant, aftertreatment modules—are positioned to benefit from ongoing policy and fleet shifts. The country’s transport NDC includes sectoral measures forecast to reduce transport-related emissions by significant megatonnes of CO₂ by 2030, while an e-mobility profile notes electricity generation emits 581 kgCO₂ per MWh, underscoring the need to decarbonize both vehicles and power. At the same time, national new-vehicle sales have rebounded to over ~ units annually, and the EV and parts zero-tariff regime through 2028 is encouraging operators to replace or retrofit vehicles to meet cleaner standards. For the large jeepney and light-duty diesel fleet—where at least ~ units operate—bolt-on exhaust and aftertreatment modernization kits provide a practical transition option, enabling operators to comply with local emissions and noise norms without waiting for full vehicle replacement.

Future Outlook

Over the next several years, the Philippines Exhaust Systems Market is expected to expand steadily, broadly in line with the 4.8% forecast CAGR. Import data showing an automotive exhaust systems import CAGR of 15.86% over recent years, with single-year growth around 8, signals robust replacement and value-added component demand. Enforcement of the Clean Air Act, gradual tightening of emission standards towards Euro-equivalent benchmarks, and renewed focus on roadworthiness inspections will push OEMs and the aftermarket towards more sophisticated catalysts, particulate traps and oxygen sensors. Parallel jeepney-modernization and fleet-renewal programs will accelerate the retirement of older, noisy systems in favour of cleaner, quieter exhausts. While the long-term shift to electric vehicles will cap upside after the forecast horizon, the current parc of internal combustion vehicles ensures a long replacement tail for manufacturers and distributors active in exhaust systems.

Major Players

- Tenneco Inc.

- Yutaka Giken Co., Ltd.

- Eberspächer Group

- Futaba Industrial Co., Ltd.

- Bosal International N.V.

- MagnaFlow LLC / MagnaFlow Exhaust Products

- AP Exhaust Technologies, LLC

- FORVIA Faurecia

- Sejong Industrial Co., Ltd.

- Donaldson Company, Inc.

- Roberts Automotive & Industrial Parts Manufacturing Corp.

- Toyota Motor Philippines Corporation

- Mitsubishi Motors Philippines Corporation

- Isuzu Philippines Corporation

Key Target Audience

- Passenger vehicle OEMs and local assemblers

- Commercial vehicle OEMs, bus body builders and jeepney fabricators

- Exhaust system Tier-1 and Tier-2 suppliers

- Independent aftermarket distributors, parts retailers and multi-brand service chains

- Performance tuning garages, motorsport workshops and enthusiast shops

- Fleet operators, logistics companies and bus cooperatives

- Investment and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of key variables

The initial phase involves mapping the full ecosystem of the Philippines Exhaust Systems Market, including OEMs, Tier-1 suppliers, importers, local manufacturers, distributors, workshops and regulatory agencies. Extensive desk research is undertaken using secondary sources such as CAMPI/TMA vehicle statistics, World Bank transport indicators and trade databases to identify the variables that shape demand: vehicle parc, new registrations, import trends, emission standards and fleet-age profiles.

Step 2: Market analysis and construction

In this phase, we compile and analyse historical data on exhaust system imports, local manufacturing output and vehicle sales, linking exhaust demand to the stock and flow of vehicles by type and fuel. We benchmark revenue per vehicle across segments (passenger cars, LCVs, buses, jeepneys) and calibrate volume-to-value ratios using global exhaust benchmarks and country-specific replacement cycles. This bottom-up modelling is cross-checked against top-down indicators such as macroeconomic growth, logistics activity and urbanisation.

Step 3: Hypothesis validation and expert consultation

Market hypotheses on segment shares, price tiers, replacement intervals and technology mix are validated through structured interviews and computer-assisted telephone interviews with OEM procurement managers, local manufacturers, major distributors, fleet maintenance heads and workshop owners. These conversations provide operational insight into preferred brands, failure modes, typical replacement frequencies and the real-world impact of emission checks, enabling refinement of the revenue model and competitive mapping for the Philippines Exhaust Systems Market.

Step 4: Research synthesis and final output

The final phase involves synthesising quantitative outputs with qualitative insights to produce segment-wise forecasts, competitive positioning matrices and strategic recommendations. Direct discussions with exhaust manufacturers and importers are used to validate assumptions on product mix (e.g., stainless versus aluminized, standard versus performance systems), margin structures, and channel strategies. The results are consolidated into a coherent narrative that explains current market structure, expected growth path and strategic options for stakeholders in the Philippines Exhaust Systems Market.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Exhaust Architecture Classifications, Emission Compliance Benchmarks, Hot-End vs Cold-End Delineation, Material Grade Mapping, Market Sizing Framework, Consolidated Research Approach, Expert Interviews, Primary Research Flow, Limitations & Forward Assumptions)

- Definition and Scope

- Market Genesis and Evolution

- Exhaust System Architecture Landscape

- Business & Demand Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Vehicle parc expansion

Emissions trajectory

Fleet modernization - Challenges

Counterfeit parts

Fitment variation

Corrosion burden due to humidity - Opportunities

Stainless-steel upgrades

Modernization kits

Low-NVH designs - Trends

Modular hot-end assemblies

Thermal coatings

Bolt-on performance kits - Government Regulations

- Stake Ecosystem

- Porter’s Five Forces

- SWOT Analysis

- Competition Ecosystem

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Replacement Frequency, 2019-2024

- By Vehicle Type (in Value %)

Passenger Cars (A/B/C segment)

SUVs & Pickups

Light Commercial Vehicles

Heavy Commercial Vehicles

Public Utility Vehicles (PUJ, UV Express, Jeepney modernization fleet)

- By Component Type (in Value %)

Exhaust Manifolds

Catalytic Converters

Resonators

Mufflers / Silencers

Tailpipes & Exhaust Tips - By Material Type (in Value %)

Aluminized Steel

Stainless Steel 409

Stainless Steel 304

Stainless Steel 316

Composite/Hybrid Lightweight Assemblies - By Sales Channel (in Value %)

OEM

Authorized Service Networks

Independent Aftermarket Garages

Online Parts Retailers

Fleet Maintenance Contracts (PUV, logistics) - By Vehicle Fuel & Powertrain (in Value %)

Gasoline Vehicles

Diesel Vehicles

CNG/LPG Vehicles

Mild Hybrid Vehicles

Hybrid/Plug-in Hybrid Vehicles

- By Region (in Value %)

NCR

Luzon (North, Central, South)

Visayas

Mindanao

- Market Share of Major Players

- Market Share by Component Type

- Cross Comparison Parameters (Heat-Cycle Durability Benchmark, Corrosion Resistance Index, Acoustic Performance, Fitment Accuracy & Platform Compatibility, Coating Technology Capability, Catalytic Converter Technology Strength, Distribution Depth, Repairability & Modular Assembly Design)

- SWOT Analysis of Major Players

- Price Benchmarking Across SKUs

- Detailed Profiles of Major Companies

Faurecia

Tenneco

Eberspächer

Bosal

Walker Exhaust

AP Exhaust Technologies

Cherry Bomb

MagnaFlow

Donaldson Company

Flowmaster

local Fabrication Networks

Roberts Automotive and Industrial Parts Manufacturing Corp.

Masuma Auto Parts

PartsPro / Online Aftermarket Importers

- Demand & Utilization Patterns

- Purchasing Criteria

- Compliance Requirements

- Pain Points & Replacement Triggers

- End-User Decision-Making Journey

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Replacement Frequency, 2025-2030