Market Overview

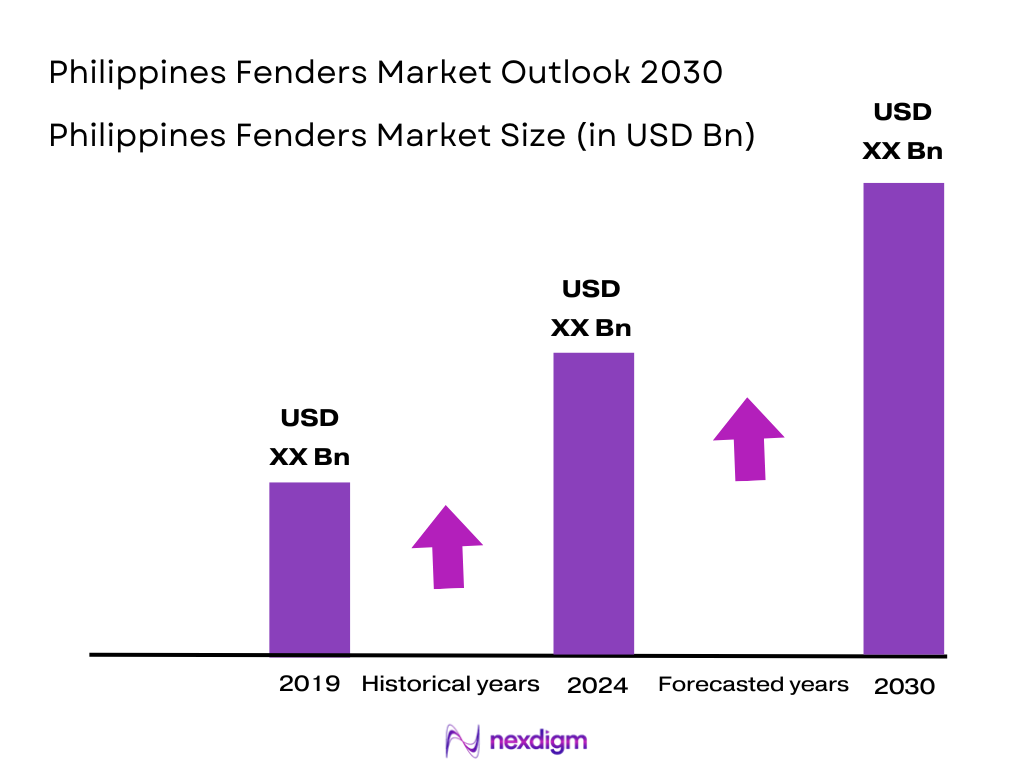

The Philippines Fenders Market is experiencing steady growth, valued at approximately USD ~ million in 2025 and projected to continue expanding in 2025. The growth is largely driven by robust demand from both the automotive and marine sectors. In the automotive sector, the rising production of vehicles and the expanding number of car owners directly contribute to the demand for fenders. Meanwhile, the marine sector, with increasing port activities and infrastructure development, fuels the requirement for dock and marine fenders. The demand for fender systems in both industries is reinforced by government policies and ongoing infrastructure investments.

The dominant regions in the Philippines Fenders Market are centered around the capital city, Metro Manila, and key port cities like Cebu and Davao. Metro Manila leads due to its concentration of automotive manufacturing plants, repair facilities, and major import-export ports, which are critical drivers for fender demand. Cebu, a prominent regional hub for shipbuilding, plays a vital role in the marine fender market, while Davao’s increasing industrial activities also contribute significantly. These regions are characterized by strong industrial growth, expanding automotive demand, and well-established port infrastructure.

Market Segmentation

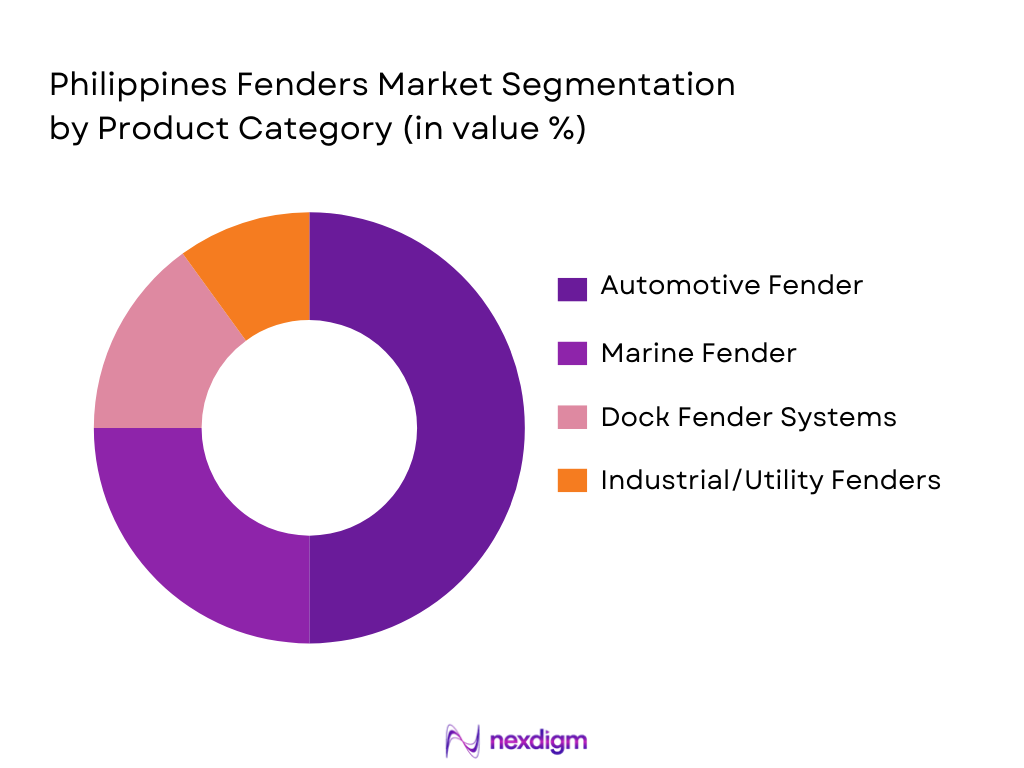

By Product Category

The Philippines Fenders Market is segmented into automotive fenders, marine fenders, dock fender systems, and industrial/utility fenders. Among these, automotive fenders dominate the market due to the rapidly increasing automotive production and aftermarket demand. This is driven by the Philippines’ expanding middle class, which boosts vehicle ownership and the demand for replacement parts. Local manufacturers, in addition to global automotive brands, fuel this segment’s growth by providing both OEM and aftermarket fenders, creating strong competition among fender suppliers.

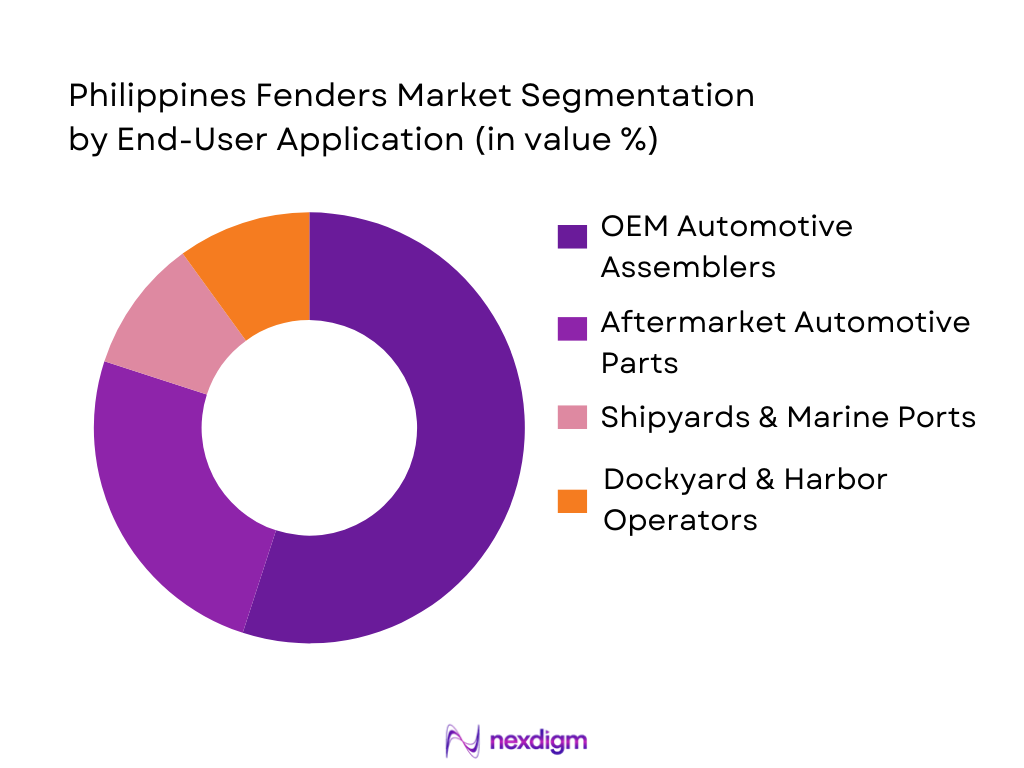

By End-User Application

This segment includes OEM automotive assemblers, aftermarket automotive parts, shipyards & marine ports, and dockyard & harbor operators. The OEM automotive assemblers hold the dominant share due to the continuous production of vehicles, particularly for local manufacturers. As the local automotive market grows, the demand for both front and rear fenders from OEMs becomes critical. The strong presence of major automotive brands like Toyota and Mitsubishi, alongside growing domestic vehicle production, sustains the dominance of this sub-segment.

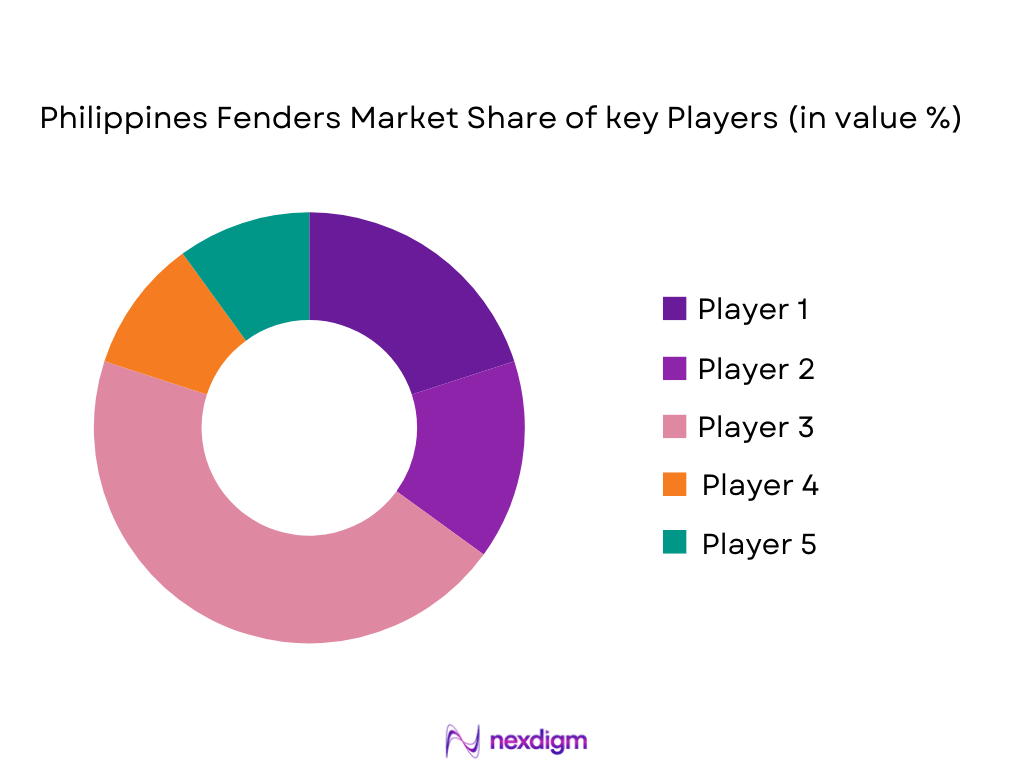

Competitive Landscape

The Philippines Fenders Market is dominated by both global and local players who cater to the automotive, marine, and industrial sectors. Key players include local manufacturers such as Philippine Fender Systems and Escos Rubber, as well as global brands like Toyota and Denso for automotive fenders. These companies hold a competitive edge due to their established networks, technological expertise, and long-term relationships with both OEMs and aftermarket distributors.

| Company Name | Establishment Year | Headquarters | Product Focus | R&D Investment | Market Share in Segment | Revenue |

| Toyota Motor Philippines | 1988 | Metro Manila | ~ | ~ | ~ | ~ |

| Denso Philippines | 1995 | Metro Manila | ~ | ~ | ~ | ~ |

| Escos Rubber | 1990 | Cebu | ~ | ~ | ~ | ~ |

| Philippine Fender Systems | 2000 | Davao | ~ | ~ | ~ | ~ |

| G-Tech Fenders | 2005 | Metro Manila | ~ | ~ | ~ | ~ |

Philippines Fenders Market Analysis

Growth Drivers

Urbanization

Urbanization in the Philippines is rapidly reshaping economic and infrastructure demand, which in turn drives the fenders market—especially for automotive and industrial applications. In 2025, the urban population reached approximately ~ % of the total population, according to World Bank data, indicating a significant shift of people into cities such as Metro Manil, Cebu , and Davao. Growing urban corridors necessitate expanded transportation networks, increased vehicle ownership, and enhanced port infrastructure—from passenger vehicles to logistics fleets and marine operations—which collectively boost the demand for automotive, dock, and marine fender systems used in traffic, harbor protection, and industrial zones.

Industrialization

Industrialization across the Philippines strongly supports the fenders market by expanding manufacturing activity, port operations, and logistics infrastructure. Industrial production data shows industrial output at USD ~ in constant terms for 2025, highlighting substantial production capacity and activity in sectors such as automotive assembly, machinery, and maritime equipment. As industrial facilities and export-import terminals expand—backed by broader economic growth where GDP expanded by ~ % with GDP per capita at USD ~ —there is heightened demand for protective equipment including fenders used in dockyards, vehicle fleets, and heavy machinery. These macroeconomic forces directly underpin market expansion by creating infrastructure and maintenance needs that fender solutions address.

Restraints

High Initial Costs

One significant restraint for the Philippines fenders market is the high upfront investment required for advanced fender systems, especially in marine and industrial deployments. High‑quality pneumatic, composite, or specialized rubber fenders involve considerable manufacturing and installation expenses, which can be prohibitive for mid‑sized ports and local shipyards. For example, infrastructure rehabilitation accounts for a large share of public capital spending in 2025, where the Philippine government’s capital outlay expanded by ~ %, driven by maintenance and operating costs, indicating that high‑cost infrastructure items compete directly with essential public investments. These upfront cost barriers often delay tender awards or adoption of premium protective fender systems despite their long‑term value, slowing market acceleration among cost‑sensitive buyers.

Technical Challenges

Technical challenges present another restraint in the Philippines fenders market—particularly around locally adapting advanced materials and technologies. Highly engineered fender systems (such as high‑performance composites or pneumatic marine fenders) require skilled design integration and maintenance expertise, which can be limited in regional shipyards and smaller service providers. The structural and marine sectors often struggle with technical standards compliance and lifecycle maintenance planning due to constraints in formalized technical training and certified facilities. For instance, while industrial sectors contribute roughly ~ % of GDP in 2025, the intricate requirements of advanced equipment manufacturing and engineering services lag behind more service‑oriented sectors, creating bottlenecks for sophisticated fender installation and support.

Opportunities

Technological Advancements

Technological progress in materials and fender design presents a clear opportunity for the Philippines fenders market to modernize infrastructure and interface with global supply chains. Innovations in composite polymers, lightweight elastomers, and high‑strength rubber technologies are increasingly adopted worldwide for improved durability, energy absorption, and corrosion resistance. In the broader Philippine context, macroeconomic performance remains solid with GNI per capita exceeding USD ~ , enabling corporate and public investors to allocate funds toward upgraded infrastructure systems. Integrating these advanced technologies can reduce lifecycle maintenance costs, appeal to OEM and port authorities seeking long‑lasting solutions, and position local suppliers to compete with international providers, thereby growing the market’s technical breadth and business prospects.

International Collaborations

International collaborations offer notable opportunities to expand capabilities and market reach within the Philippines fenders industry. With foreign direct investment stock rising—total FDI at USD ~ billion in 2025, led by investments from the UK, Japan, and regional partners—joint ventures or technical partnerships can facilitate technology transfer, quality certification, and access to global supply networks. Collaborations with international marine equipment manufacturers or automotive part producers can bring best practices in fender design, materials science, and logistics integration. These partnerships not only enhance product portfolios but also boost local competitiveness, enabling Filipino firms to fulfill larger contracts for infrastructure projects and expatriate OEM segment orders, thereby strengthening the overall market ecosystem.

Future Outlook

Over the next 5 years, the Philippines Fenders Market is expected to grow significantly, driven by expanding automotive production, port infrastructure upgrades, and growing industrial activities in key regions. As demand for both OEM and aftermarket fenders continues to rise, particularly in the automotive sector, innovations in material technologies (such as lightweight composites and recycled rubbers) are likely to shape the market. Additionally, with continued investments in ports and marine infrastructure, the market for dock fenders is poised for further growth. By 2030, the market is expected to expand at a compound annual growth rate (CAGR) of ~ %, reflecting the robust and sustainable growth in these industries.

Major Players in the Market

- Toyota Motor Philippines

- Mitsubishi Motors Philippines Corporation

- Escos Rubber

- Philippine Fender Systems

- G-Tech Fenders

- Honda Philippines

- Isuzu Philippines Corporation

- Ford Motor Company Philippines

- Escalante Enterprises

- Nissan Philippines

- Denso Philippines

- General Motors (GM) Philippines

- Yokohama Rubber Co. Ltd.

- Sumitomo Rubber Industries Ltd.

- Goodyear Philippines

Key Target Audience

- Automotive OEMs (e.g., Toyota, Mitsubishi)

- Marine Equipment Suppliers

- Port Infrastructure Companies

- Automotive Aftermarket Dealers

- Shipyard Operators (e.g., Shipyards in Cebu)

- Dockyard & Harbor Authorities (e.g., Philippine Ports Authority)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Department of Transportation (DOTr), Maritime Industry Authority (MARINA))

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves conducting secondary research to identify and define the key market variables that drive the Philippines Fenders Market. This includes understanding the demand from automotive and marine sectors, materials used, and local production capacities.

Step 2: Market Analysis and Construction

Historical data from reliable databases will be used to assess market size, regional demand, and segment performance. The aim is to capture a complete market landscape to create a reliable growth forecast.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses derived will be validated through expert consultations, including industry interviews and data from major fender manufacturers. This helps cross-check data and align assumptions with market realities.

Step 4: Research Synthesis and Final Output

The synthesis phase involves integrating findings from various research steps and company consultations to produce an actionable market report, ensuring comprehensive coverage of all variables and a refined market outlook.

- Executive Summary

- Research Methodology (Market Definitions and Local Industry Scope, Philippines Market Sizing Approach, Trade Data Sources and Customs Import/Export Methodology, Primary Surveys with Philippine OEMs & Marine Port Operators, Limitations and Data Validation Protocol)

- Philippines Fenders Market structure (Marine, Automotive, Dock, Pneumatic)

- Demand drivers (vehicle ownership, port throughput & shipping industry)

- Import dependency and local production dynamics

- Industry Genesis & Development in Philippines

- Evolution of fender adoption in automotive body parts

- Growth of maritime and dock fender systems

- Port modernization and infrastructure expansion

- Value Chain and Supplier Ecosystem

- Raw materials sourcing (rubber, composites, steel)

- Local manufacturers vs imported supply share

- Logistics & distribution flows across Luzon, Visayas, Mindanao

- Growth Drivers

Rising light vehicle ownership and aftermarket demand

Port expansions & increase in international marine traffic

Growing ship repair & maintenance activity

- Market Challenges

Import cost volatility and tariff considerations

Infrastructure bottlenecks

Limited local manufacturing scale

- Trend Analysis

Shift toward lightweight composite fenders (automotive)

Pneumatic and cell fenders for deep seaports

E‑commerce distribution for automotive parts

- Regulatory & Standards Framework

Philippine Standard (PS) and ISO compliance for fenders

Safety requirements for marine fendering systems

Import‑export policies affecting parts entry

- SWOT Analysis

- Port & Shipping Fleet Influence on Demand

- By Value, 2019 –2025

- By Volume, 2019 -2025

- By Average Price of Platforms/Services, 2019 -2025

- By Product Category (In Value %)

Automotive Fender

Marine Fender

Dock Fender Systems

Industrial/Utility Fenders

- By End‑User Application (In Value %)

OEM Automotive Assemblers

Aftermarket Automotive Parts

Shipyards & Marine Ports

Dockyard & Harbor Operators

- By Material Type (In Value %)

Steel / Aluminum (Automotive)

High‑grade Rubber (Marine & Dock)

Composite / Polymer Fender Systems

- By Distribution Channel (In Value %)

OEM Direct Supply

Aftermarket Dealerships

E‑commerce & Parts Retail Platforms (e.g., PartsPro.PH)

Marine Equipment Suppliers

- Market Share Analysis

- Cross‑Comparison (Company Overview, Product Portfolio Breadth (Automotive / Marine / Industrial), Philippines Import Footprint & HS Code Trade Volume Dealer & Distributor Network Intensity, Material Technology (Rubber, Composite, Metal), Aftermarket vs OEM Sales Ratio, Quality & Compliance Certifications, Price Positioning & Margin)

- Detailed Profiles of Key Industry Players

Toyota Motor Philippines Corporation

Mitsubishi Motors Philippines Corporation

Fender Philippines (G.A. Yupangco & Co.)

PartsPro.PH

RK Rubber Enterprise (Visayas & Mindanao)

ESC Steel Philippines

AVS Global Ship Supply

LDC‑Korea Co. Ltd

Nanjing Shuncheng Intelligent Technology

Concord Shipping Agency

Shanghai Goddaton Shipping Technology

Aftermarket Auto Parts Philippines

Manila Harbor Dock Systems Inc.

Cebu Marine & Industrial Supply

Philippines Dock & Marine Services Co.

- Demand patterns in automotive service centers

- Decision‑making factors for OEM purchasing

- Port authorities and dock infrastructure procurement criteria

- Pain points and unmet needs in local supply chains

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030