Market Overview

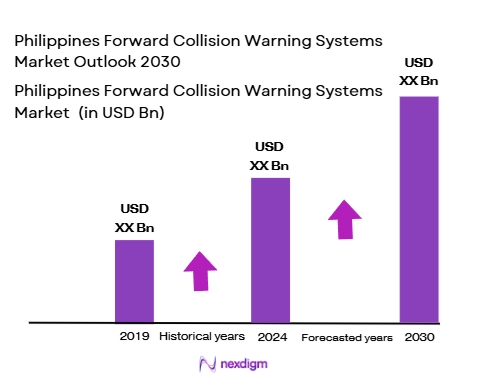

The Philippines Forward Collision Warning (FCW) systems market is expected to reach a market size of approximately USD ~million by 2024. The market is primarily driven by increasing safety concerns on the roads, combined with the growing adoption of advanced driver-assistance systems (ADAS). The Philippine government’s initiatives in promoting road safety, coupled with the increasing number of vehicles on the road, have been significant contributors to the growth of this market.The demand for FCW systems is also fueled by the rising consumer awareness of the benefits of these safety technologies, especially in preventing accidents and reducing fatalities.

Metro Manila, Cebu, and Davao are key cities driving the forward collision warning systems market in the Philippines. Metro Manila, as the economic hub and the most populous region, exhibits the highest adoption rates of advanced automotive technologies. The city’s traffic congestion and high accident rates are significant drivers of the demand for safety systems like FCWs. Additionally, the Philippines’ growing automotive market, which includes a rise in premium vehicle sales, has propelled the demand for such technologies in major cities. These regions dominate due to infrastructure growth, rising vehicle ownership, and the need for improved road safety.

Market Segmentation

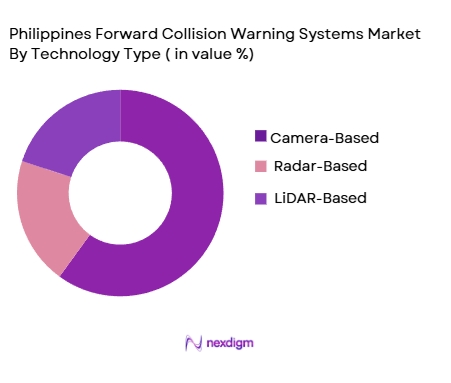

By Technology Type

The Philippines FCW market is segmented by technology into camera-based, radar-based, and LiDAR-based systems. Among these, radar-based systems hold the largest market share in 2024, primarily because they are cost-effective and can work in various weather conditions, providing reliable performance. Radar-based FCWs are increasingly being integrated into mid-range to high-end vehicles, making them the preferred choice for manufacturers. These systems’ ability to function in adverse conditions, such as fog, rain, and darkness, further solidifies their market dominance. The accessibility of radar technology and its performance reliability are key drivers for their widespread adoption in the Philippines.

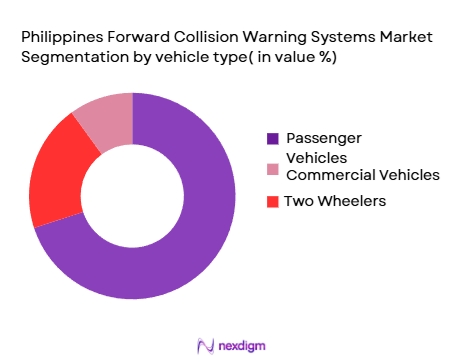

By Vehicle Type

The FCW system market in the Philippines is also segmented by vehicle type into passenger vehicles, commercial vehicles, and two-wheelers. Passenger vehicles dominate the market share in 2024, owing to the rising consumer demand for safer vehicles and the increasing penetration of ADAS in the automotive market. As consumers seek more advanced safety features, the adoption of FCW systems in passenger vehicles has surged. Furthermore, government policies supporting vehicle safety improvements have accelerated the integration of such systems into new vehicles. The growing number of premium vehicles on the road, coupled with rising concerns about road safety, makes passenger vehicles the leading segment for FCWs.

Competitive Landscape

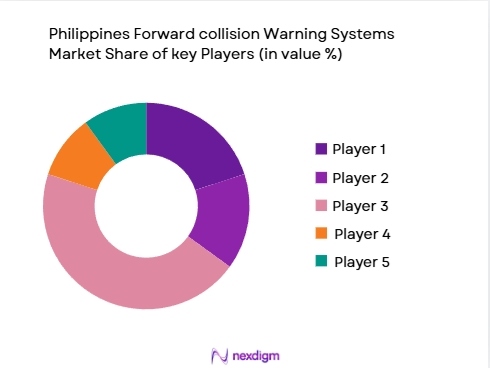

The Philippines FCW market is relatively consolidated, with a few major players taking a dominant position. These include global automotive technology leaders such as Bosch, Continental, and Denso, as well as local players who partner with international manufacturers. These companies dominate the market through innovation, strategic partnerships with OEMs, and their established presence in the automotive safety technology sector. The market competition is expected to intensify as more local and international players enter the sector, particularly with the growing adoption of ADAS.

| Company Name | Establishment Year | Headquarters | Product Range | Market Strategy | Recent Innovations | Partnerships |

| Bosch | 1886 | Germany | ~ | ~ | ~ | ~ |

| Continental | 1871 | Germany | ~ | ~ | ~ | ~ |

| Denso | 1949 | Japan | ~ | ~ | ~ | ~ |

| Valeo | 1923 | France | ~ | ~ | ~ | ~ |

| Mobileye | 1999 | Israel | ~ | ~ | ~ | ~ |

Philippines Forward Collision Warning Systems Market

Growth Drivers

Urbanization

The rapid urbanization of the Philippines is a major driver for the adoption of advanced vehicle safety systems, including Forward Collision Warning (FCW) systems. The urban population in the Philippines has been steadily growing, with projections indicating that 70% of the population will reside in urban areas by 2025 (World Bank). As cities like Metro Manila continue to expand, road traffic congestion increases, leading to higher risks of accidents. The government’s infrastructure projects, such as the “Build, Build, Build” initiative, are improving road networks, which will further drive the demand for safety technologies like FCW systems in urban areas to mitigate accidents

Industrialization

Industrialization is another key factor propelling the growth of the FCW market in the Philippines. The Philippines’ industrial sector grew by 7.6% in 2022, and the manufacturing output is expected to increase in the coming years (Philippine Statistics Authority). With this growth, there is an increasing demand for commercial vehicles and logistics fleets, which often require advanced safety technologies like FCWs to enhance driver safety and reduce accidents. Additionally, industrialization contributes to economic growth, leading to a higher rate of vehicle ownership and subsequently higher demand for safety systems.

Market Challenges

Emission Reduction Targets

The Philippines has set ambitious emission reduction targets as part of its commitment to the Paris Agreement. By ~, the country aims to reduce its carbon footprint through a variety of environmental initiatives, including the adoption of cleaner technologies in the automotive sector. The push for greener vehicles, which includes the implementation of advanced safety technologies like FCWs to reduce road accidents and energy consumption, aligns with the country’s emission reduction goals. This regulatory environment encourages the adoption of technologies that improve vehicle efficiency and safety.

Clean Air Initiative

The Philippine government’s Clean Air Initiative, implemented by the DENR, aims to improve air quality across the country. As part of this initiative, the government is advocating for the use of cleaner, more efficient vehicles that incorporate advanced technologies like FCWs to reduce accidents and improve road safety. The initiative aligns with the Philippines’ broader goal of reducing road fatalities and emissions, both of which are key aspects of vehicle safety technology

Opportunities

Technological Advancements

Technological advancements in automotive safety systems present a significant opportunity for growth in the Philippines FCW market. Recent developments in radar, camera, and LiDAR technologies have made FCW systems more reliable and affordable. Moreover, the ongoing research into artificial intelligence and machine learning can enhance the capabilities of FCWs, making them more adaptable to different driving conditions. As technology becomes more integrated into vehicles, there is a growing opportunity to embed these systems into a wider range of vehicles, including entry-level cars, thereby broadening the market base.

International Collaborations

International collaborations between local manufacturers and global automotive companies present opportunities for the Philippines FCW market. Partnerships with leading global players such as Bosch, Denso, and Continental could lead to the localization of FCW technology, making it more affordable and accessible to local consumers. These collaborations would also bring in international expertise, improving the overall quality and performance of FCW systems. By tapping into international supply chains, local manufacturers can scale their production to meet the growing demand for safety technologies in the Philippine automotive market.

Future Outlook

Over the next 5 years, the Philippines FCW market is expected to experience significant growth, driven by rising road safety concerns, government regulations promoting vehicle safety, and the increasing adoption of advanced safety systems in vehicles. The demand for FCW systems will be bolstered by the growing number of vehicles, particularly in urban areas like Metro Manila. Additionally, technological advancements in radar and camera systems will further accelerate the market’s expansion. With more consumers opting for vehicles with ADAS technologies, the market is poised to witness increased penetration in both premium and mass-market vehicles.

Major Players

- Continental

- Denso

- Valeo

- Mobileye

- Autoliv

- ZF Friedrichshafen AG

- Aptiva PLC

- Magna International

- Hyundai Mobis

- Panasonic Corporation

- NXP Semiconductors

- Texas Instruments

- Infineon Technologies

- Garmin Ltd.

Key Target Audience

- Automotive OEMs

- Tier-1 Automotive Suppliers

- Insurance Companies

- Automotive Aftermarket Distributors

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Automotive Safety Technology Integrators

- Fleet Management Companies

Research Methodology

Step1: Identification of Key Variables

The first step involves developing a comprehensive ecosystem map that includes stakeholders such as vehicle manufacturers, component suppliers, and regulatory bodies. This phase incorporates secondary research from credible sources like industry reports, company publications, and government data, which will help identify the key factors influencing the growth of the FCW market.

Step2: Market Analysis and Construction

Market construction involves the collection and analysis of historical and current data to evaluate the market’s trajectory. This includes assessing the adoption rate of FCW systems in different vehicle segments and regions, analyzing regulatory frameworks, and studying technological advancements. Quantitative and qualitative factors are analyzed to validate revenue projections.

Step3: Hypothesis Validation and Expert Consultation

Hypotheses about the market’s future growth are validated through consultations with industry experts, including OEMs, component manufacturers, and key decision-makers. These consultations provide operational insights and help refine market estimates. They also offer a clearer understanding of market dynamics and future trends.

Step4: Research Synthesis and Final Output

The final step involves synthesizing the data obtained from multiple sources, including expert consultations, to create a comprehensive market report. This phase ensures that all insights and forecasts are accurate, reliable, and reflective of real-time market conditions.

- Executive Summary

- Research Methodology (Market specific parameters in brackets, Market Definitions and Technical Scope ADAS & FCW, Philippines Automotive Market Boundaries Abbreviations and Safety Standards, Glossary Market Sizing Approach, Data Source Validation Primary Research Framework Limitations and Boundary Conditions)

- FCW as a subset of ADAS Driver Alert Timing Accuracy, False Alarm Rate Specs

- Market Genesis & Catalysts Local safety goalposts, accident rate triggers

- Historical Adoption Timeline

- Automotive Safety Ecosystem Mapping

- Supply Chain & Value Chain Analysis

Philippines Forward Collision Warning Systems Market Analysis

- Growth Drivers

Rising Vehicle Safety Awareness

Regulatory Push & NCAP Influence

Urban Traffic Congestion & Accident Prevention Focus

- Market Challenges

High System Cost Sensitivity

Infrastructure & Calibration Skill Gaps

Aftermarket Quality Standardization Risks - Market Opportunities

Fleet Safety Contracts & Telematics Integratio

Insurance Incentive Programs

Local Assembly & Import Value Optimization - Market Trends

Sensor Fusion & AI Advances

EV & Hybrid Vehicle Safety Feature Bundling

Connected Car Safety Services - Government Regulation & Policy Impact

- SWOT Analysis

- By Value,2019-2025

- By Volume,2019-2025

- By Average Selling Price,2019-2025

- By Technology Stack (In Value %)

Camera‑centric FCW

Lidar‑augmented FCW

Ultrasonic + Fusion

Sensor Fusion Suites

SUVs / Crossovers

Light Commercial Vehicles

Heavy Commercial Vehicles

Public Transport Buses - By Sales Channel, (In Value%)

OEM Factory Fitment Build‑rate Penetration

Aftermarket Retrofitted Systems Installation Base Growth

Online & eCommerce Safety

Distributors / Dealer Networks

Calibration & Service Centers

- By End User Category,2019-2025(In Value%)

Commercial Fleet Operators

Individual Vehicle Owners

Car Rental Businesses

Government & Public Sector Purchasers

OEM Tier‑2 Buyers - By Integration Level,2019-2025(In Value%)

Standalone FCW Modules

FCW + AEB

Comprehensive ADAS Suite

V2X Enabled FCW

OEM Integrated Sensor Fusion Platforms

- Market Share by Value & Volume

Market Share by OEM/Aftermarket Channel

Market Share by Technology Tier

- Cross‑Comparison Parameters

Company Overview

Product Portfolio Breadth

Philippines Revenue Contribution

OEM Partnership Footprint

Technology Leadership Index

Distribution & Calibration Network Density

Pricing & ASP Structure

Certification & Compliance Credentials

- SWOT Analysis of Key Players

Pricing & SKU Benchmarking by Channel

Profiles of Key Competitors

Mobileye

ZF Friedrichshafen AG

Continental AG

Robert Bosch GmbH

Denso Corporation

Aptiva PLC

Magna International Inc.

Valeo Group

Autoliv Inc.

NVIDIA Corporation

Qualcomm Automotive

Panasonic Automotive Systems

Infineon Technologies AG

Hitachi Asteco Ltd

- Market Demand & Utilization Patterns

- Purchasing Power & Budget Allocation Insights

- Regulatory/Compliance Requirements for End Users

- Consumer Needs, Pain Points & Feature Desirability

- End‑User Decision Making Framework

- By Value,2026-2030

- By Volume,2026-2030

- By Average Selling Price,2026-2030