Market Overview

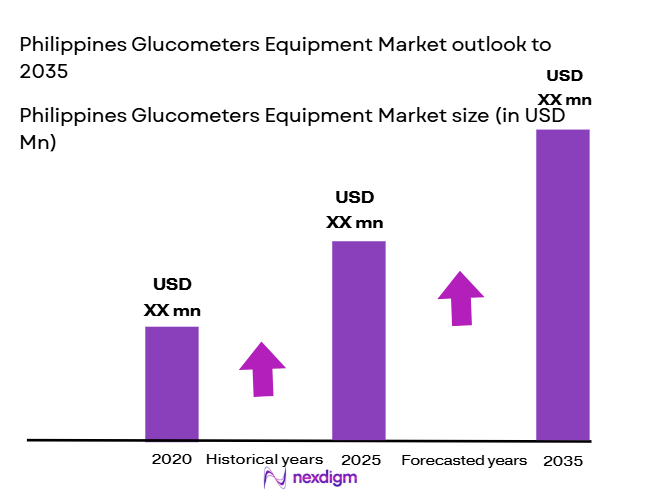

The Philippines glucometers equipment market is valued at approximately USD ~ million in 2024, driven by rising diabetes prevalence and increasing adoption of advanced glucose monitoring systems. The demand for glucometers is primarily spurred by the large diabetic population in the country, alongside a growing preference for more accurate and efficient monitoring devices. Moreover, the transition from traditional to connected devices, such as Continuous Glucose Monitors (CGM), is contributing significantly to the market’s expansion. Healthcare professionals and patients are increasingly inclined toward devices that provide real-time data and integrate with mobile applications for better disease management. Additionally, government initiatives supporting diabetes management and expanding access to healthcare technology are propelling the market’s growth.

Metro Manila stands as the dominant region in the Philippines glucometers equipment market, primarily due to its advanced healthcare infrastructure and high concentration of diabetes patients. Metro Manila hosts a significant number of private hospitals and clinics, which increasingly incorporate advanced glucose monitoring solutions into their practices. In addition to Metro Manila, Cebu and Davao are notable regions contributing to the market, where the adoption of diabetes management technology is accelerating due to growing awareness and better accessibility. The government’s efforts to provide healthcare solutions to underserved rural areas further promote market growth in secondary cities, though urban centers remain the primary drivers.

Market Segmentation

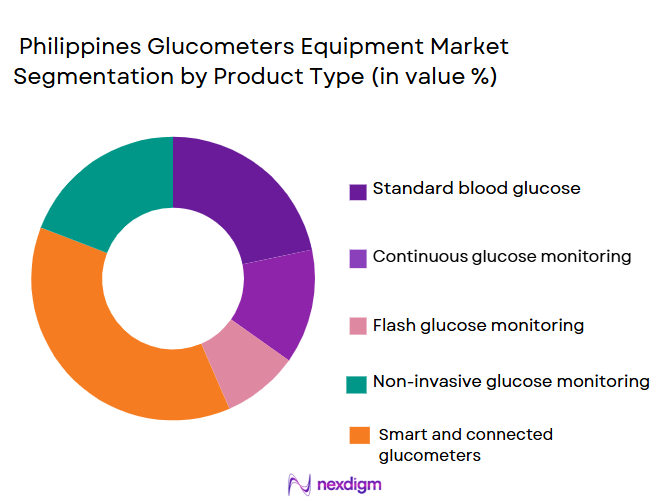

By Product Type

The Philippines glucometers market is segmented into several device types: traditional self-monitoring blood glucose (SMBG) devices, connected glucometers, and continuous glucose monitoring (CGM) systems. Among these, connected glucometers are currently dominating the market. This is largely due to the growing trend of digitization in healthcare, where consumers and healthcare providers prefer devices that offer real-time data integration with mobile apps. These glucometers enable users to track their glucose levels effortlessly and share data with doctors remotely, making them a popular choice among tech-savvy diabetic patients. The convenience, better accuracy, and integration with digital health ecosystems have made connected glucometers a preferred choice over traditional models.

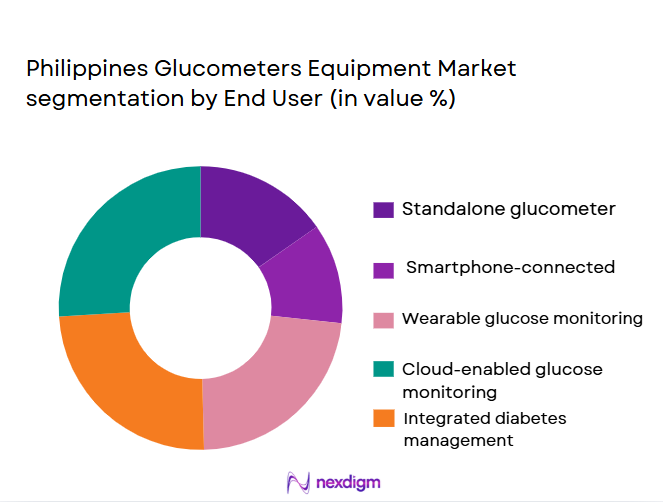

By End-User

The market is segmented based on end-user categories such as home care, clinics, and hospitals. Among these, home care is the largest segment, contributing significantly to the market share. This dominance can be attributed to the increasing number of patients who prefer self-management of their diabetes due to convenience, privacy, and cost-effectiveness. With the growing penetration of mobile health apps and remote patient monitoring tools, home-based testing solutions have become more accessible and affordable. Furthermore, the shift towards preventive healthcare and the increasing adoption of digital health solutions have bolstered the demand for home care glucometers.

Competitive Landscape

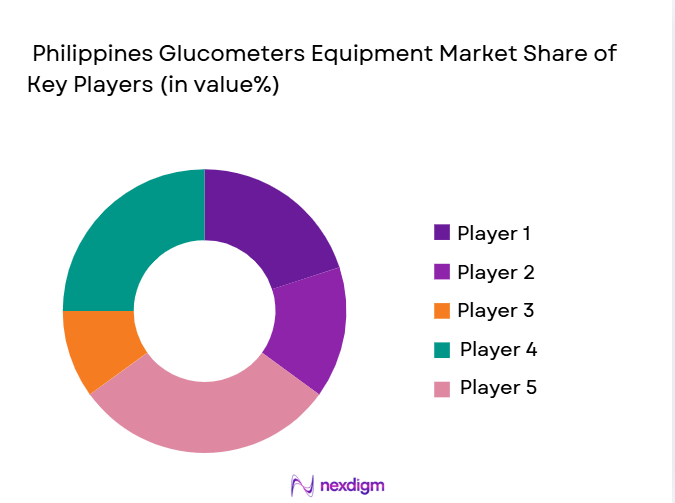

The Philippines glucometers equipment market is characterized by the presence of both global giants and local players. Major international players such as Abbott, Roche, and Medtronic dominate the market due to their advanced product portfolios and strong distribution networks. These players are continuously innovating, offering devices with better accuracy, ease of use, and connectivity to mobile apps and health platforms. Local players, while contributing to the overall competition, face challenges from international brands in terms of technology and market penetration. The competition remains robust, with companies focusing on product differentiation, customer education, and partnerships with healthcare providers to maintain market leadership.

| Company | Establishment Year | Headquarters | Product Portfolio | Distribution Network | Technology Focus | Market Strategy |

| Abbott | 1888 | USA | ~ | ~ | ~ | ~ |

| Roche | 1896 | Switzerland | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | USA | ~ | ~ | ~ | ~ |

| LifeScan | 1981 | USA | ~ | ~ | ~ | ~ |

| Ascensia | 2006 | Switzerland | ~ | ~ | ~ | ~ |

Philippines Glucometers Equipment Market Analysis

Growth Drivers

Urbanization

Philippines rapid urbanization is a fundamental driver for demand in air quality monitoring systems, as dense urban populations generate significant air pollution requiring continuous tracking. The Jakarta metropolitan area alone has an estimated ~ residents living within the greater urban zone in 2024, spread across Jakarta, Bekasi, Depok, Bogor, and Tangerang, making it one of the most concentrated urban regions in the country. Monitoring systems are crucial to manage deteriorating air quality in these built‑up zones where transport, industrial emissions, and energy use intensify pollutant levels. According to IQAir and other assessments, cities within Java regularly record ambient particulate matter levels that exceed safe limits, highlighting the need for extensive monitoring infrastructure to inform policy and protect public health.

Industrialization

Industrialization in Philippines has expanded the need for comprehensive air quality monitoring due to emissions from manufacturing facilities, power plants, and mining activities. Manufacturing accounts for an estimated approximately ~% of Philippines’s GDP in 2024, reflecting a large industrial base where air pollutants are byproducts of energy consumption and industrial output. Moreover, industries like nickel ore production and coal power generation contribute to emission profiles that necessitate surveillance to enforce regulatory compliance and pollution control. These emissions, along with contributions from transportation and land use change, elevate pollutants such as PM2.5, nitrogen oxides, and sulfur oxides, which in turn drive the installation of advanced monitoring systems to provide accurate data for mitigation planning.

Challenges

Philippine’s air quality

Technical complexity presents another restraint for Philippine’s air quality monitoring market, as many systems require sophisticated calibration, data integration, and continuous maintenance to deliver reliable real‑time pollution readings. Accurate air quality data depend on precision instruments that must be regularly serviced and calibrated to meet national and international standards, and these processes often demand specialized knowledge and technological infrastructure that may not be readily available across Indonesia’s dispersed archipelago.

Low‑Cost Sensor Networks

Furthermore, integrating real‑time data streams from both fixed stations and low‑cost sensor networks into unified platforms poses software and connectivity challenges, particularly in areas with inconsistent power or telecommunications infrastructure. These technical barriers reduce the pace at which monitoring networks can be deployed and scaled nation‑wide.

Opportunities

Technological Advancements

Technological innovation offers significant opportunities to enhance Indonesia’s air quality monitoring capabilities by introducing affordable, scalable, and precise solutions. Recent advancements in IoT sensor networks, mobile monitoring units, and AI‑driven data analytics allow for expanded spatial and temporal resolution of pollution data, overcoming limitations of traditional fixed stations. For example, IoT‑based mobile systems can provide detailed hotspot mapping and near‑continuous readings across urban and peri‑urban areas, augmenting existing networks. The potential integration of these technologies can empower local authorities to make data‑driven policy decisions, improving air quality management with more granular insights. Adoption of these advanced systems opens avenues for public‑private collaboration and encourages innovation in environmental technology sectors.

International Collaborations

International collaborations present notable opportunities for strengthening Indonesia’s air quality monitoring infrastructure through knowledge exchange, funding, and technical assistance from global partners. Indonesia’s participation in regional air quality forums and partnerships with multilateral institutions can facilitate access to best‑in‑class monitoring technologies and capacity‑building programs. For instance, collaboration with international agencies and environmental organizations can support training for Indonesian technical staff, establishment of standardized data protocols, and joint research initiatives. These partnerships can also attract international investment and development funds geared toward enhancing environmental monitoring, which would accelerate the adoption of advanced systems and improve national data quality standards.

Future Outlook

Over the next six years, the Philippines glucometers equipment market is expected to grow at a healthy pace, driven by technological advancements in connected and continuous glucose monitoring systems. The transition from basic SMBG devices to more advanced, integrated solutions will be a key factor contributing to this growth. Additionally, increasing awareness of diabetes management and the government’s healthcare policies promoting technological solutions for chronic diseases will support market expansion. The rise in healthcare digitization, mobile health apps, and remote monitoring will further enhance patient outcomes and foster growth in the market.

Major Players in the Market

- Abbott Laboratories

- Roche Diagnostics

- Medtronic

- LifeScan (Johnson & Johnson)

- Ascensia Diabetes Care

- Dexcom

- Bayer AG

- Terumo Corporation

- i-SENS

- ForaCare Inc.

- ACON Laboratories

- Arkray

- GlucoWise

- Prodigy Diabetes Care

- Omron Healthcare

Key Target Audience

- Diabetes Care Providers

- Hospital Networks

- Healthcare Equipment Distributors

- Pharmaceutical Companies

- Private Hospitals

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

- Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

The research process begins by identifying key variables influencing the glucometers equipment market. These variables include market drivers such as diabetes prevalence, technological advancements, government healthcare initiatives, and user preferences. The analysis is based on secondary research, including data from industry reports, medical journals, and market intelligence platforms.

Step 2: Market Analysis and Construction

In this phase, historical data related to the glucometers market in the Philippines is collected. This includes the market size, revenue trends, device types, and end-user segments. Data from various sources like hospitals, distributors, and government publications will be analyzed to form a coherent understanding of the market’s current state.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through primary research, which includes structured interviews with healthcare professionals, distributors, and technology experts. These consultations will provide insights into product adoption, pricing models, and future trends in the market. Industry experts will also provide perspectives on evolving patient needs and government regulations.

Step 4: Research Synthesis and Final Output

Finally, all research findings will be synthesized into a comprehensive report. This will involve verifying data through discussions with key stakeholders such as manufacturers and distributors to ensure accuracy and reliability. The final output will incorporate detailed market segmentation, competitive analysis, and future projections.

- Executive Summary

- Philippines Glucometers Equipment Market Research Methodology

Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising prevalence of diabetes and prediabetes

Increasing awareness of regular blood glucose monitoring

Growing adoption of home-based healthcare devices - Market Challenges

High cost of advanced monitoring systems

Limited reimbursement coverage for consumables

Accuracy concerns in low-cost devices - Market Opportunities

Expansion of continuous and flash glucose monitoring adoption

Integration with digital health and telemedicine platforms

Rising demand in underserved rural and semi-urban regions - Trends

Shift toward connected and app-based glucose monitoring

Growing preference for minimally invasive monitoring solutions

Use of data analytics for personalized diabetes management

- By Market Value 2019–2024

- By Installed Units 2019–2024

- By Average System Price 2019–2024

- By System Complexity Tier 2019–2024

- By System Type (In Value%)

Standard blood glucose meters

Continuous glucose monitoring systems

Flash glucose monitoring systems

Non-invasive glucose monitoring devices

Smart and connected glucometers - By Platform Type (In Value%)

Standalone glucometer devices

Smartphone-connected glucometers

Wearable glucose monitoring platforms

Cloud-enabled glucose monitoring platforms

Integrated diabetes management platforms - By Fitment Type (In Value%)

Handheld portable glucometers

Wearable sensor-based systems

Implantable glucose monitoring sensors

Strip-based testing devices

Sensor-based strip-free systems - By EndUser Segment (In Value%)

Home healthcare and self-monitoring users

Hospitals and inpatient care facilities

Clinics and primary care centers

Diagnostic laboratories

Diabetes care and specialty centers - By Procurement Channel (In Value%)

Retail pharmacies and drug stores

Hospital and clinic procurement

Online and e-commerce platforms

Government and public health tenders

Direct manufacturer and distributor sales

- Market Share Analysis

- Cross Comparison Parameters

(Measurement accuracy, Product range, Connectivity features, Pricing strategy, Distribution reach) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Abbott

Roche Diabetes Care

LifeScan

Ascensia Diabetes Care

Medtronic

Dexcom

Terumo

Arkray

Nova Biomedical

EKF Diagnostics

Sinocare

i-SENS

AgaMatrix

Nipro

Ypsomed

- Home users prioritize affordability and ease of use

- Hospitals focus on accuracy and reliability

- Clinics demand compact and rapid testing solutions

- Diabetes centers value data integration and long-term monitoring

- Forecast Market Value 2025–2030

- Forecast Installed Units 2025–2030

- Price Forecast by System Tier 2025–2030

- Future Demand by Platform 2025–2030