Market Overview

The Philippines HbA1c Monitoring Devices market is valued at USD ~million in 2025, driven primarily by the growing diabetes prevalence in the country, with an estimated ~ million people living with diabetes in 2024. The market is also boosted by increasing awareness regarding diabetes management, which emphasizes regular monitoring. With advancements in point-of-care devices and government support in terms of public health campaigns, the market continues to expand, seeing a compound annual growth rate (CAGR) of ~ from 2026 to 2035.

Metro Manila and key urban centers such as Cebu and Davao dominate the Philippines HbA1c Monitoring Devices market. These areas benefit from better healthcare infrastructure, access to advanced diagnostic tools, and a higher population of individuals with diabetes. The demand is further fueled by a concentrated number of healthcare providers, government healthcare initiatives, and urban populations that have better access to modern medical technology compared to rural areas, making these regions the focal points for the deployment of HbA1c monitoring devices.

Market Segmentation

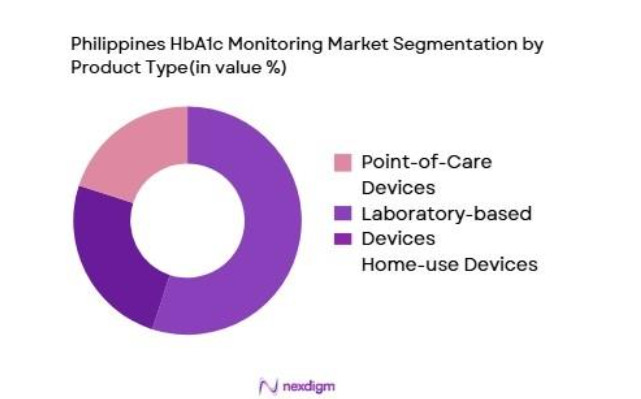

By Product Type

The Philippines HbA1c Monitoring Devices market is segmented by product type into point-of-care devices, laboratory-based devices, and home-use devices. Among these, point-of-care devices hold the dominant market share, driven by the convenience and rapid results they offer for diabetes management. With the increasing trend toward self-monitoring, point-of-care devices such as handheld analyzers are highly favored for their portability and accuracy. These devices are widely used in clinics, healthcare facilities, and homes, making them the primary choice for both patients and healthcare providers.

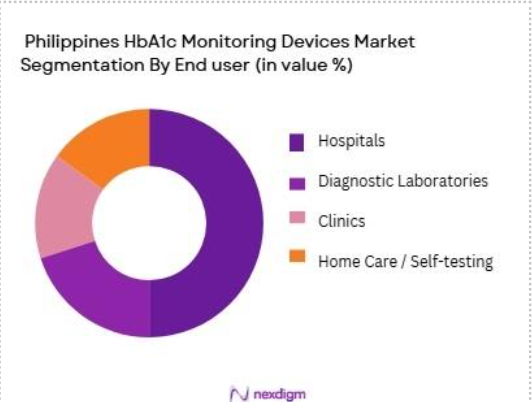

By End-user

The market is also segmented by end-user into hospitals, diagnostic laboratories, clinics, and home care/self-testing. The hospitals segment commands the highest market share, owing to the extensive use of HbA1c tests for patient management in diabetes care units. Hospitals have high demand for both point-of-care devices and laboratory-based devices, as they cater to a large number of diabetes patients and require high-volume testing. The presence of advanced healthcare facilities and specialized care for chronic conditions like diabetes makes hospitals the primary buyers of these devices.

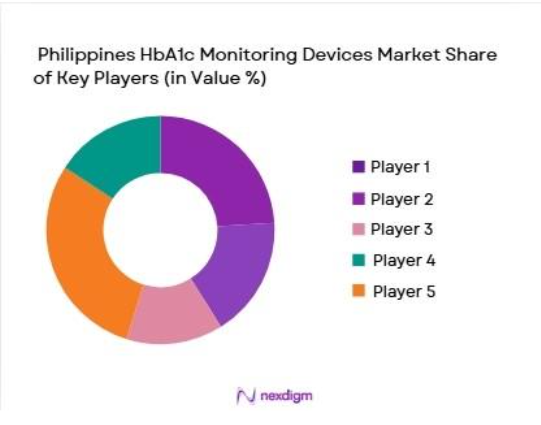

Competitive Landscape

The Philippines HbA1c Monitoring Devices market is characterized by a competitive landscape with several leading players offering a range of products. Key players include both international giants and local manufacturers who compete on technology, cost, and distribution networks. Some of the leading companies include Abbott Laboratories, Roche Diagnostics, and Siemens Healthineers, who dominate the market with their established presence, product portfolios, and distribution channels.

| Company | Establishment Year | Headquarters | Technology Focus | Annual Revenue | Key Product Lines | Regional Presence |

| Abbott Laboratories | 1888 | USA | ~ | ~ | ~ | ~ |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | USA | ~ | ~ | ~ | ~ |

| B. Braun Melungeon | 1839 | Germany | ~ | ~ | ~ | ~ |

Air Quality Monitoring System Market Analysis

Growth Drivers

Urbanization

Indonesia’s rapid urbanization is driving the demand for air quality monitoring systems. With the urban population exceeding ~ million in 2024, the growth of cities like Jakarta, Surabaya, and Bandung has led to increased pollution levels, necessitating more robust monitoring solutions. Urban centers, including Jakarta, consistently exceed WHO-recommended air quality levels, particularly PM~. As urbanization accelerates, local governments and industries are investing in air quality monitoring infrastructure to manage the environmental challenges posed by increased traffic and industrial emissions.

Industrialization

Indonesia’s industrialization has significantly contributed to air pollution, especially in the manufacturing, mining, and energy sectors. The country’s industrial output is valued at USD ~ billion in 2024, with industrial regions like East Java being major contributors to air pollution. The proliferation of factories, power plants, and mining operations, especially in resource-rich areas, has led to rising emissions, making air quality monitoring a critical part of the country’s environmental management strategies. These industrial hotspots are now adopting advanced monitoring systems to track air pollution levels.

Restraints

High Initial Costs

The high initial costs of implementing air quality monitoring systems pose a significant barrier to their widespread adoption in Indonesia. The price of advanced air quality monitoring equipment can exceed USD ~ per station in major cities like Jakarta. In 2024, municipal governments and industries face challenges in allocating sufficient funds for such high capital expenditures, especially in lower-income regions. The high cost of infrastructure, coupled with the need for continuous maintenance and calibration, limits the adoption of monitoring systems outside of urban centers.

Technical Challenges

The deployment of air quality monitoring systems in Indonesia is hindered by technical challenges, particularly due to the country’s vast geographical expanse. In 2024, it remains difficult to establish a reliable air quality monitoring network across remote and rural areas. Factors such as inconsistent calibration, connectivity issues in rural areas, and the maintenance of equipment contribute to the technical difficulties faced by both public and private entities. These challenges reduce the effectiveness of monitoring systems and the accuracy of the data collected, limiting their usefulness for policy-making. Source: Indonesian Environmental Protection Agency, 2024

Opportunities

Technological Advancements

Technological advancements in air quality monitoring are opening up new opportunities in Indonesia’s market. In 2024, the development of low-cost sensors, real-time data analysis platforms, and IoT-enabled monitoring devices is making air quality monitoring more accessible and efficient. The adoption of smart sensors and cloud-based solutions is particularly beneficial for monitoring pollution in real time. These advancements make it easier for cities and industries to deploy air quality monitoring systems, even in resource-constrained areas, driving further market growth.

International Collaboration

Indonesia’s ongoing international collaborations are fostering growth in the air quality monitoring systems market. In 2024, partnerships with global environmental organizations, such as the World Bank and the Asian Development Bank, are providing the Indonesian government with funding and expertise to expand its air quality monitoring infrastructure. These collaborations help Indonesia access state-of-the-art technology and knowledge, which is crucial for building and maintaining efficient air quality monitoring networks.

Future Outlook

Over the next decade, the Philippines HbA1c Monitoring Devices market is expected to experience steady growth, fueled by the rising incidence of diabetes and increased government focus on preventive healthcare. Advancements in point-of-care testing devices, such as portable glucose monitors, are likely to boost the market further. With the continuous shift towards self-management of chronic diseases and a more proactive approach to diabetes care, the demand for efficient and user-friendly HbA1c devices is anticipated to increase.

Major Players in the Market

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Medtronic

- B. Braun Melsungen

- LifeScan (Johnson & Johnson)

- Ascensia Diabetes Care

- Trividia Health

- ACON Laboratories

- Dexcom

- Nova Biomedical

- Insulet Corporation

- Diazyme Laboratories

- LabCorp

- Abbott Diabetes Care

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Hospitals and Healthcare Networks

- Diagnostic Laboratories and Medical Centers

- Private Healthcare Providers

- Insurance Providers and Health Plan Administrators

- Pharmaceutical Companies

- Retailers and Distributors of Medical Devices

Research Methodology

Step 1: Identification of Key Variables

The first phase of research involves identifying critical factors affecting the Philippines HbA1c Monitoring Devices market. This is done through comprehensive secondary data collection, including government health reports and industry publications. Primary research methods, such as interviews with key market players, are used to further refine these variables.

Step 2: Market Analysis and Construction

Market analysis involves collecting and analyzing both historical data and current market trends. Revenue estimates, market shares, and product distribution channels are examined to construct the market size for the Philippines HbA1c Monitoring Devices sector. Trends such as increasing demand for self-monitoring devices and point-of-care systems are also factored into the analysis.

Step 3: Hypothesis Validation and Expert Consultation

The next step includes validation of initial hypotheses and assumptions through expert interviews. We consult with industry professionals, including medical device manufacturers, healthcare providers, and diabetes specialists, to gain insights on emerging trends, consumer preferences, and technology innovations in the HbA1c monitoring sector.

Step 4: Research Synthesis and Final Output

The final phase of research involves consolidating data collected from industry reports, expert consultations, and market analysis. A comprehensive report is created that integrates findings from both the bottom-up approach and the top-down analysis to offer actionable insights into the future trajectory of the HbA1c Monitoring Devices market in the Philippines.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach,

Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Historical Development

- Timeline of Major Players’ Entry and Technological Advancements

- Business Cycle and Key Market Phases

- Supply Chain and Value Chain Analysis

- Healthcare Infrastructure and Policy Context

- Growth Drivers

Increasing Prevalence of Diabetes and Hypertension

Rising Healthcare Expenditure

Technological Advancements in Monitoring Devices

Government and Public Health Programs for Diabetes Awareness - Market Challenges

Limited Access in Rural Areas

High Cost of Advanced Testing Devices

Regulatory Barriers and Market Access Issues - Opportunities

Shift to Point-of-care Testing

Rising Demand for At-home Monitoring Devices

Expansion of Telemedicine and Digital Health Solutions - Trends

Growing Adoption of Wearable HbA1c Devices

Integration with Mobile Health Applications

Real-time Data Sharing and Patient Monitoring - Government regulations

Regulations around medical device certifications

Government healthcare funding for diabetes management

Standards for data privacy in remote monitoring - SWOT analysis

Strength: Strong demand for accurate and timely diagnostics

Weakness: High cost of advanced devices

Opportunity: Growing healthcare awareness and prevention program - Porters 5 forces

Threat of new entrants: Moderate due to high regulatory

Bargaining power of buyers: High due to multiple available options

Bargaining power of suppliers: Moderate as few manufacturers dominate

- By Value,2026-2030

- By Volume ,2026-2030

- By Average Price of Devices,2026-2030

- By Product Type (In Value %)

Point-of-care Devices

Hemoglobin A1c Testing Kits

Mobile/Portable Devices

Laboratory Instruments

Wearable Monitoring Devices

- By End-user (In Value %)

Hospitals

Diagnostic Laboratories

Clinics and Ambulatory Services

Home Care (Self-testing)

- By Distribution Channel (In Value %)

Direct Sales (B2B)

Online Retailers

Wholesale Distribution

Healthcare Institutions

- By Region (In Value %)

Metro Manila

Northern Luzon

Visayas

Mindanao - By Technology (In Value %)

Biosensors and Electrochemical Sensors

Photometric Methods

Enzymatic Assays

Immunoassays

- Market Share of Major Players

By Type of HbA1c Device

By End-user Segment

By Distribution Channel

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent, Developments, Strength, Weakness, Organizational Structure, Revenues by Device, Type and Sales Channel, Number of Dealers, Distributors, and Regional Presence, Production Capacity and Technological Capabilities, Unique Value Propositions and Product Differentiation,Key Partnerships, Joint Ventures, and Collaborations)

- SWOT Analysis of Major Players

- Pricing Analysis(Cost per Test or Device: Variations Based on Type, Technology, and Region)

- Detailed Profiles of Key Companies

Abbott Laboratories

Roche Diagnostics

Siemens Healthineers

LifeScan (Johnson & Johnson)

Medtronic

B. Braun Melsungen

Trividia Health

Ascensia Diabetes Care

ACON Laboratories

DCA Vantage (Siemens)

Nova Biomedical

Dexcom

Insulet Corporation

Diazyme Laboratories

LabCorp

- Market Demand and Utilization by Healthcare Providers

- Analysis of Patient Adoption in Hospitals, Clinics, and Home Care Settings

- Regulatory and Compliance Requirements Impacting End Users

- Needs and Pain Point Analysis of Healthcare Providers and Consumers

- Decision-making Process in Device Purchase

- By Value (Revenue) Forecast,2026-2030

- By Volume (Units Sold) Forecast,2026-2030

- By Average Price Forecast,2026-2030

- Impact of Market Dynamics and Technological Evolution,2026-2030