Market Overview

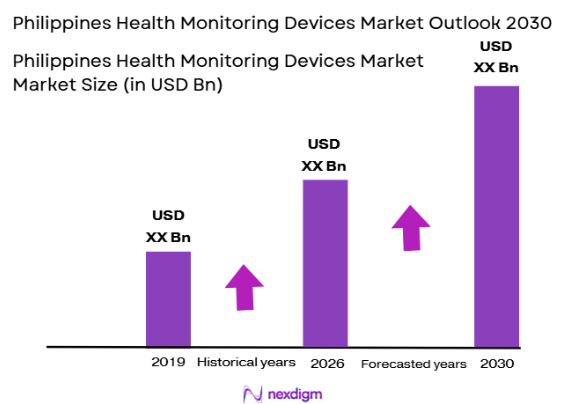

The Philippines Health Monitoring Devices Market is valued at approximately USD ~billion in 2024. This growth is fueled by increasing health consciousness, rising prevalence of chronic diseases such as diabetes and hypertension, and a growing demand for home-based healthcare solutions. The adoption of wearable devices, particularly those for heart rate monitoring and blood pressure management, has gained significant momentum. The market is further supported by technological innovations in remote monitoring and IoT-integrated health devices, enhancing healthcare accessibility across the country.

Metro Manila and key urban areas such as Cebu and Davao are the dominant regions driving the growth of the health monitoring devices market in the Philippines. These cities are home to a significant portion of the population with higher disposable incomes, which allows for increased spending on healthcare technology. Additionally, the presence of well-established healthcare infrastructures and healthcare awareness campaigns has made these cities focal points for the adoption of health monitoring devices.

Market Segmentation

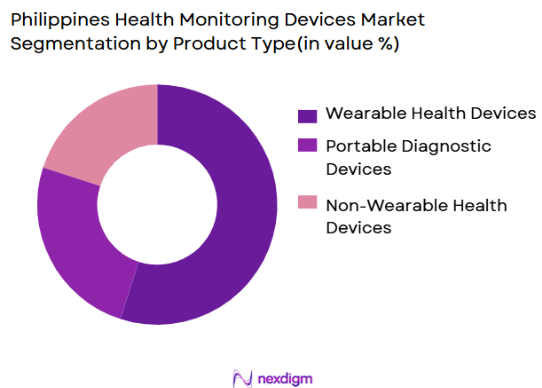

By Product Type

The Philippine health monitoring devices market is segmented into wearable health devices, portable diagnostic devices, and non-wearable health devices. Wearable health devices dominate the market share. This is largely due to the growing adoption of fitness trackers and smartwatches, which offer real-time health monitoring and are increasingly integrated with smartphone apps. The wearable devices segment benefits from the increasing trend of personalized health management and consumer awareness around fitness and health data tracking. Leading brands such as Fitbit, Garmin, and Apple are further driving the segment’s growth with their innovative, user-friendly solutions.

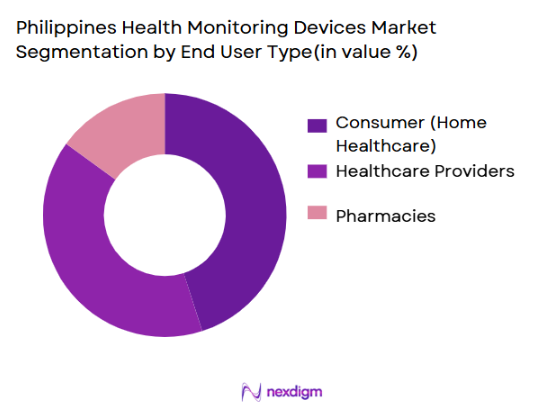

By End-User

The end-user segmentation includes healthcare providers, consumers (home healthcare), and pharmacies. The consumer segment (home healthcare) holds the largest share. The increasing demand for at-home care solutions, along with rising healthcare costs and the growing acceptance of digital health platforms, has contributed to this shift. Consumers, particularly in urban areas, are investing in home health monitoring devices such as blood pressure monitors, glucose meters, and pulse oximeters. The convenience and cost-effectiveness of these devices have made them popular, especially among individuals with chronic health conditions.

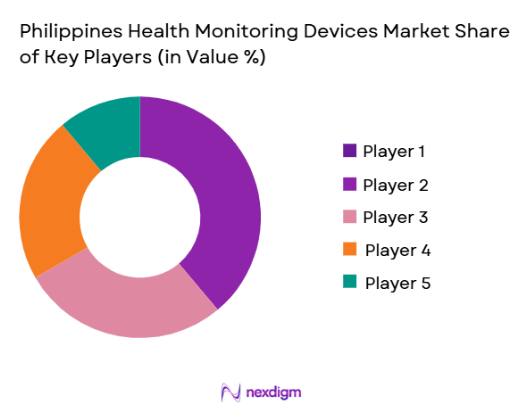

Competitive Landscape

The Philippines Health Monitoring Devices Market is characterized by the presence of both international and local players. Major companies such as Omron Healthcare, Philips Healthcare, and Fitbit dominate the market. These players lead due to their brand recognition, extensive distribution networks, and continuous innovation in health-monitoring technologies.The competitive landscape highlights the dominance of tech giants like Apple and Samsung, whose health-oriented smartwatches and fitness trackers are gaining significant traction. Local companies like Bio-Gene Technologies are also contributing to market growth with affordable health-monitoring solutions tailored to Filipino consumers.

| Company | Establishment Year | Headquarters | Product Portfolio | Market Strategy | Distribution Network | R&D Investment |

| Omron Healthcare | 1933 | Japan | ~ | ~ | ~ | ~ |

| Philips Healthcare | 1891 | Netherlands | ~ | ~ | ~ | ~ |

| Fitbit (Google) | 2007 | USA | ~ | ~ | ~ | ~ |

| Apple | 1976 | USA | ~ | ~ | ~ | ~ |

| Bio-Gene Technologies | 2010 | Philippines | ~ | ~ | ~ | ~ |

Philippines Health Monitoring Devices Market Analysis

Growth Drivers

Urbanization

The rapid pace of urbanization in Indonesia is a significant driver for the growth of the air quality monitoring system market. As the country experiences increasing urban populations, particularly in cities like Jakarta and Surabaya, the demand for monitoring systems is expected to rise. Jakarta, with an urban population exceeding 10 million, has been experiencing air pollution levels above WHO-recommended thresholds. The urban population in Indonesia is projected to reach 73.8% by 2025, up from 56% in 2020, highlighting the need for real-time air quality monitoring systems to address environmental and public health challenges. The increasing urbanization leads to greater demand for air quality data in managing pollution levels and urban planning.

Industrialization

Indonesia’s industrial sector is a key factor contributing to the growth of air quality monitoring systems. The country is seeing significant industrial development, particularly in sectors like manufacturing, energy, and mining, which are known for their high emissions. Indonesia’s industrial output has been growing steadily, with manufacturing accounting for 20.9% of GDP in 2022. This industrial growth results in increased air pollution levels, making air quality monitoring systems essential for regulatory compliance, safety, and public health. Additionally, large-scale industrial projects like the Smelter development in East Kalimantan further emphasize the need for advanced air quality monitoring systems to ensure sustainable industrial practices.

Restraints

High Initial Costs

The high initial cost of setting up air quality monitoring systems is a major restraint in Indonesia’s market. Many businesses, local government authorities, and smaller municipalities are hesitant to adopt advanced monitoring technologies due to the significant capital investment required. The cost of installing a comprehensive air quality monitoring network, including sensors, software, and maintenance, can be substantial, especially for less affluent regions. In a country with an average per capita GDP of USD 4,000, spending on environmental monitoring is often deprioritized in favor of other sectors. However, as air quality concerns grow, this may change over time.

Technical Challenges

Air quality monitoring systems in Indonesia face several technical challenges, primarily related to the calibration and maintenance of monitoring equipment. Indonesia’s geographic diversity, with its dense urban centers and remote rural areas, makes it difficult to maintain consistent air quality data coverage. Additionally, technical issues such as sensor accuracy, calibration challenges, and the need for frequent maintenance in harsh environmental conditions pose barriers to widespread adoption. Despite advancements in sensor technology, these challenges continue to hinder the implementation of widespread, accurate air quality monitoring systems in both urban and rural areas.

Opportunities

Technological Advancements

Technological advancements present significant opportunities for the growth of Indonesia’s air quality monitoring system market. Innovations in low-cost, high-accuracy sensors and IoT-enabled monitoring devices offer a new era of affordable and real-time air quality data collection. These developments, such as smaller, portable sensors capable of detecting a wide range of pollutants, are expected to drive adoption across various sectors, including government, business, and consumer applications. The increasing availability of mobile air quality monitoring units that can be deployed in diverse locations also opens new opportunities for market expansion, particularly in rural and industrial areas.

International Collaborations

International collaborations offer significant opportunities for Indonesia to enhance its air quality monitoring efforts. Partnerships between Indonesia and international organizations such as the UN Environment Programme (UNEP) and the World Bank can bring in both funding and expertise for air quality monitoring initiatives. These collaborations will likely result in improved access to advanced technologies, international funding for large-scale monitoring programs, and shared knowledge on best practices in environmental management. Such collaborations have already facilitated successful air quality programs in other countries, and Indonesia can leverage similar strategies to boost local efforts.

Future Outlook

Over the next 5 years, the Philippines Health Monitoring Devices Market is expected to show significant growth, driven by increased healthcare spending, the adoption of telemedicine, and technological advancements in wearable health devices. Government initiatives promoting health and wellness, as well as rising awareness of preventive healthcare, will further fuel market expansion. Additionally, the increasing demand for remote patient monitoring due to aging demographics and lifestyle diseases will continue to play a key role in the market’s growth trajectory.

Major Players in the Philippines Health Monitoring Devices Market

- Omron Healthcare

- Philips Healthcare

- Fitbit (Google)

- Apple

- Garmin

- Withing

- Medtronic

- Samsung Electronics

- Bio-Gene Technologies

- Abbott Laboratories

- Xiaomi

- Beurer

- Huawei Technologies

- AliveCor

- iHealth Labs

Key Target Audience

- Healthcare Providers (e.g., Hospitals, Clinics, Care Facilities)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Department of Health, Food and Drug Administration of the Philippines)

- Pharmaceutical Companies

- Technology Providers in Healthcare

- Insurance Companies

- Retail Chains and E-commerce Platforms

- Private Healthcare Centers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map that includes all the key players, stakeholders, and major forces driving the Philippines health monitoring devices market. This is achieved through secondary research using industry reports, government publications, and public databases.

Step 2: Market Analysis and Construction

We gather and analyze historical data concerning the market’s growth patterns, demand-supply dynamics, and key economic indicators influencing the sector. This phase also assesses the development of consumer behavior and purchasing patterns.

Step 3: Hypothesis Validation and Expert Consultation

The formulated hypotheses are tested through interviews with market experts, manufacturers, and key distributors within the health technology space. These consultations help validate the initial data and refine market assumptions.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the findings from expert interviews and secondary research to create a comprehensive report. We then validate the output through discussions with industry stakeholders to ensure all insights are relevant and accurate.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Technological Advancements and Disruptions

- Business Cycle and Lifecycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increase in Health Consciousness

Rising Prevalence of Chronic Diseases

Technological Advancements in Wearable Devices

Government Initiatives and Health Programs - Market Challenges

Lack of Healthcare Infrastructure in Rural Areas

Regulatory Barriers and Compliance Issues

High Cost of Advanced Health Monitoring Devices - Opportunities

Expansion of Remote Patient Monitoring Systems

Rising Adoption of AI-Based Monitoring Tools

Collaborations between Tech and Healthcare Companies - Trends

Personalized Healthcare through Wearable Devices

Integration of IoT and AI in Health Monitoring

Telemedicine and Remote Patient Monitoring Integration - Government Regulation

Healthcare Device Regulatory Framework

Quality Assurance and Certification Standards

Data Protection and Privacy Laws - SWOT Analysis of the Health Monitoring Devices Market

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- Competition Ecosystem

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Product Type (In Value %)

Wearable Health Monitoring Devices

Non-Wearable Health Monitoring Devices

Portable Diagnostic Devices

Chronic Disease Monitoring Devices

Emergency Monitoring Devices - By End-User (In Value %)

Healthcare Providers (Hospitals, Clinics)

Consumers/Home Healthcare

Pharmacies/Drugstores

Government Healthcare Initiatives - By Application (In Value %)

Chronic Disease Management (Hypertension, Diabetes, etc.)

Post-Surgical Recovery Monitoring

Emergency Monitoring and Ambulance Services

Pregnancy & Childbirth Monitoring - By Distribution Channel (In Value %)

Online Retail

Hospitals and Clinics

Pharmacies and Drugstores

Direct Sales from Manufacturers - By Region, (In Value %)

Luzon Region

Visayas Region

Mindanao Region

Metro Manila

- Market Share Analysis

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Market Penetration, Distribution Networks, Revenue, Revenue by Product Category, Pricing, Technological Advancements, Partnerships, and Collaborations, Production and Manufacturing Capacities)

- SWOT Analysis of Major Players

- Pricing Analysis by Device Type for Major Players in the Philippines Market

- Detailed Profiles of Major Companies

Philips Healthcare

Omron Healthcare

Medtronic

GE Healthcare

Fitbit (Google)

Garmin

Apple

Samsung Health

Withings

Huawei Technologies

Beurer

Bosch Healthcare Solutions

iHealth Labs

AliveCor

Abbott Laboratories

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2026-2030

- By Volume, 2026-2030

- By Average Price, 2026-2030