Market Overview

The Philippines Health Monitoring Wearables Market (healthcare wearables + IoT) is valued at USD ~ billion (base year), supported by rising adoption of digital health solutions and chronic-disease monitoring use cases. In the prior year, YouTube’s ad-reachable audience was ~ million users, rising to ~ million users in the latest reading—an indicator of sustained smartphone-led reach that supports app-tethered wearables onboarding, coaching content, and device ecosystem lock-in.

Dominance is concentrated in Metro Manila, Cebu, and Davao, driven by the densest concentration of hospitals/clinics, higher device retail availability, and larger pools of digitally active consumers. This is reinforced by platform-scale digital attention: the adult ad-reachable audience on TikTok rose from ~ million to ~ million between the prior-year baseline and the latest reading, expanding performance-marketing efficiency for wearable brands and distributor-led launches in these urban demand hubs.

Market Segmentation

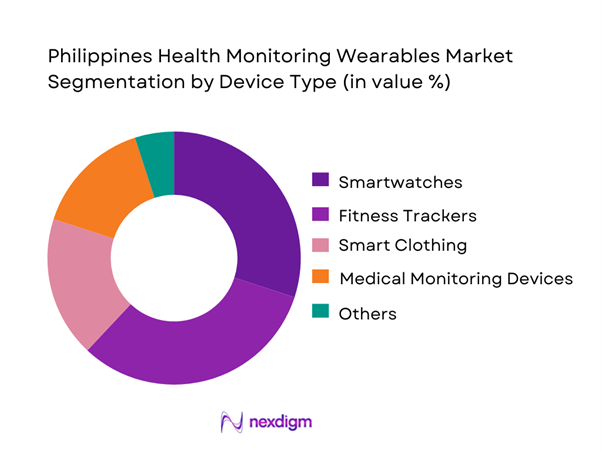

By Device Type

Smartwatches lead because they bundle “always-on” consumer use with clinically adjacent signals (heart rate, SpO₂ in many models, sleep staging, activity load), and they ride established smartphone ecosystems that simplify onboarding, cloud sync, and retention. In the Philippines context, smartwatches also benefit from carrier/device-financing bundles, strong e-commerce demand, and high social-driven discovery—where health, lifestyle, and coaching content fuels trial. Compared with single-purpose fitness bands, smartwatches justify higher ASPs through multi-function value (communications, payments in supported ecosystems, safety features, and app extensibility), while still serving wellness tracking needs. For distributors and retailers, smartwatch SKUs provide clearer laddering (entry to premium) and predictable refresh cycles, which improves merchandising and promotional planning. These dynamics collectively push smartwatches to the top of value share even when fitness trackers remain high in unit volumes.

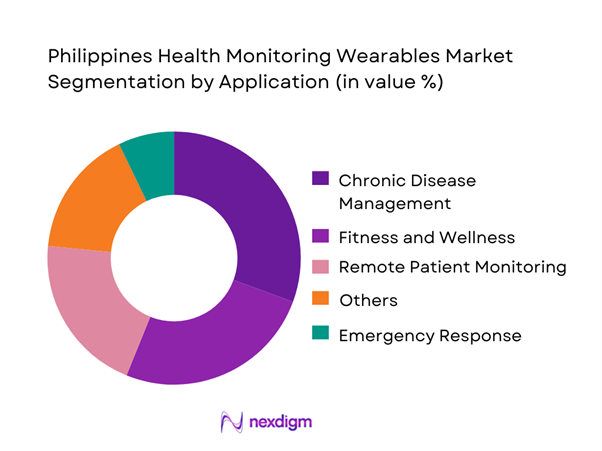

By Application

Chronic disease management leads because it has the clearest “monitoring frequency” requirement (recurring, longitudinal vitals) and the strongest justification for device attachment beyond lifestyle motivation. The Philippines’ rising chronic-disease burden increases the addressable base for BP/heart-rate monitoring, rhythm screening adjuncts, and remote follow-up workflows, especially where provider capacity constraints push care into hybrid models. On the supply side, chronic-care applications attract device + platform bundling (dashboards, alerts, adherence nudges) and create repeat touchpoints for payers/providers and corporate health programs. These use cases are also easier to “prove” operationally—reducing episodic visits via remote check-ins—so hospital groups, clinics, and employer plans can rationalize procurement faster than purely discretionary wellness spend. As telehealth acceptance expands, RPM-linked chronic pathways further strengthen this segment’s value share.

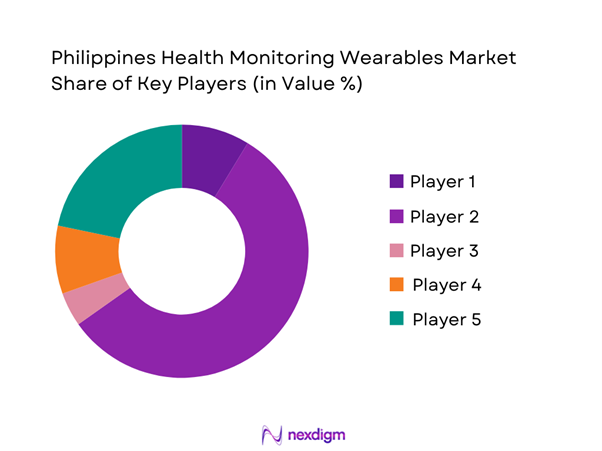

Competitive Landscape

The Philippines health monitoring wearables market is led by global consumer-electronics brands and medical-device incumbents, creating a barbell structure: high-volume consumer wearables (smartwatches/trackers) alongside clinically oriented monitoring wearables (ECG, glucose/CGM-adjacent ecosystems, BP, and remote telemetry). This consolidation means channel power (e-commerce, telco bundles, modern retail) and ecosystem stickiness (apps, subscriptions, OS integration) are as decisive as sensor performance.

| Company | Est. Year | HQ | Core PH Wearables Proposition | Health Sensor Depth (typical) | Ecosystem / App Layer | PH Route-to-Market Strength | Clinical / Regulated Adjacency | After-Sales & Warranty Posture |

| Apple Inc. | 1976 | Cupertino, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Samsung Electronics | 1969 | Seoul, South Korea | ~ | ~ | ~ | ~ | ~ | ~ |

| Garmin Ltd. | 1989 | Olathe, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips Healthcare | 1891 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Fitbit (Google) | 2007 | San Francisco, USA | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Health Monitoring Wearables Market Analysis

Growth Drivers

Smartphone-Led Ecosystem Readiness

The Philippines’ wearables demand is structurally enabled by a device-first digital economy where smartphones act as the control hub for onboarding, syncing, coaching, and alerts. Macroeconomically, the country’s output expanded from USD ~ billion to USD ~ billion, while GDP per capita reached USD ~, indicating improving capacity for discretionary tech upgrades among the urban middle class and the employed workforce. On the connectivity layer that wearables rely on, mobile cellular subscriptions were ~ per ~ people, supporting always-connected app ecosystems that drive daily “active use” rather than one-time device purchase. At the identity and SIM-security layer, government-led SIM registration reached ~ registrants, improving account integrity for app logins, OTP flows, and device pairing—critical for health alerts and caregiver-linked features. These macro and infrastructure realities convert wearables from “gadgets” into persistent, app-managed monitoring nodes—especially for heart-rate, sleep, and activity tracking that require daily data continuity.

Urban Consumer Health Focus

Wearables usage in the Philippines is pulled by a health-risk backdrop that is highly visible to consumers and employers in major urban centers (Metro Manila, Cebu, Davao), where the clinical ecosystem and retail access are densest. A hard market anchor is cardiovascular burden: ~ deaths were attributed to cardiovascular diseases, keeping “heart” and “vitals” monitoring top-of-mind and making heart-rate/sleep/arrhythmia features more relevant in purchase decisions. Complementing this, reported mortality patterns show ischemic heart disease as a leading cause of death, reinforcing consumer receptivity to monitoring claims—even when buyers remain cautious about accuracy. On the macro side, the economy moved from USD ~ billion to USD ~ billion, creating a broader base of consumers who can justify multi-purpose smartwatches that combine communications + health tracking. The same urban environments also concentrate licensed hospitals and corporate HQs, making health messaging, product demos, and after-sales support more accessible—factors that increase sustained device usage (replacement bands, warranty service, app re-onboarding) rather than churn after initial novelty.

Challenges

Accuracy Skepticism

Accuracy skepticism persists because wearables operate at the boundary of lifestyle tech and clinical expectations, and Filipino consumers are repeatedly exposed to real health risk signals that raise the bar for trust. Data highlights the stakes: ~ deaths tied to cardiovascular diseases and prominence of ischemic heart disease as a leading cause of death make heart metrics emotionally salient, so users are less tolerant of “approximate” readings when the outcome feels consequential. At the macro level, the economy’s growth from USD ~ billion to USD ~ billion increases adoption of higher-end devices—but it also increases expectations: buyers paying more want medically credible performance (signal quality, artifact reduction, consistent sleep staging). When accuracy is doubted, adoption becomes “trial-and-drop”: device purchase happens, but ongoing wear declines, reducing ecosystem value for insurers/employers/providers. This pushes brands and channels in the Philippines to emphasize validated features, clearer user education, and cautious marketing language—especially for heart rhythm, SpO₂, and sleep apnea-adjacent claims where misinterpretation can be high.

Claim Substantiation

Claim substantiation is a structural barrier because a wearable can be marketed as a wellness tracker, but once claims edge toward diagnosis/monitoring, regulatory scrutiny and consumer expectations rise. This is especially sensitive in the Philippines given the scale of disease burden that makes medical-sounding claims highly persuasive. Reporting that ischemic heart disease leads mortality counts (e.g., ~ deaths reported for a major slice of a calendar-year window in one summary) increases risk of misuse if claims are overstated. Macroeconomically, rising national output from USD ~ billion to USD ~ billion supports broader retail reach, which in turn increases exposure to marginal products and aggressive claims via e-commerce and social channels. The practical outcome is a “trust tax”: brands with clearer substantiation (clinical validation, conservative phrasing, traceable after-sales) convert better in channels that face educated buyers (corporate procurement, hospitals, premium retailers), while unsubstantiated products face higher return rates, complaints, and reputational drag for marketplaces. In the Philippines, where category growth is rapid, disciplined substantiation becomes a competitive moat rather than a compliance checkbox.

Opportunities

Remote Patient Monitoring Adjacency

RPM adjacency is a high-potential pathway because it links wearables to real care workflows (follow-ups, triage, adherence), converting “wellness” signals into clinically meaningful monitoring and engagement—without needing future-looking statistics to justify the logic. The Philippines’ health-risk environment provides the demand pull: figures show ~ cardiovascular deaths, reinforcing why clinicians and families value continuous vitals and alerting for at-risk populations. The system also has growing operational readiness: licensed hospital lists reflect a wide provider footprint where RPM partnerships can be piloted through hospital networks and clinic chains. On the macro-enabler side, national output moved to USD ~ billion, and the mobile network base remains massive (e.g., ~ mobile subscribers in one datapoint), supporting app-based monitoring, caregiver notifications, and clinician dashboards over cellular data. The opportunity for vendors is to package wearables as part of hybrid care programs, aligning with privacy compliance expectations and reducing friction for providers who need “actionable” data rather than raw charts.

Insurer and HMO-Linked Programs

Insurer/HMO-linked programs are a scalable growth lever because they tie wearables to incentives, risk scoring, and preventive engagement, shifting adoption from discretionary spending to “benefit-backed” behavior change—supported by current, observable macro signals. The Philippines’ employed base is large (~ employed), giving insurers and HMOs a broad group-policy surface for structured programs (activity goals, sleep hygiene, check-in adherence) where wearables provide verifiable engagement signals. The digital rails required for incentives and claims-adjacent flows are already operating at national scale: reporting shows InstaPay and PESONet transaction value of ₱~ trillion, meaning rewards, reimbursements, and premium-linked nudges can be executed digitally rather than through manual processes. Finally, macro capacity supports program viability: GDP per capita of USD ~ and GDP of USD ~ billion indicate an economy where risk-pooling products and add-on wellness riders can expand alongside middle-class growth. For the wearables market, the “now” opportunity is to design privacy-compliant programs with clear consent, minimal data collection, and clinically aligned escalation logic to build trust and long-term stickiness.

Future Outlook

Over the next five to six years, the Philippines health monitoring wearables market is expected to expand through a combination of (i) deeper sensor stacks and better algorithms (sleep, arrhythmia signals, stress proxies), (ii) stronger integration into telehealth and chronic-care workflows, and (iii) wider affordability via price ladders, promotions, and bundle financing. Growing urban demand in Metro Manila, Cebu, and Davao should continue to anchor early adoption, while employer-sponsored wellness and insurer-linked programs can widen usage beyond affluent early adopters.

Major Players

- Philips Healthcare

- Fitbit Inc.

- Garmin Ltd.

- Apple Inc.

- Samsung Electronics

- Xiaomi Corporation

- Huawei Technologies Co., Ltd.

- Withings

- Medtronic plc

- Abbott Laboratories

- Omron Corporation

- AliveCor, Inc.

- BioTelemetry, Inc.

- Zephyr Technology Corporation

Key Target Audience

- Device OEMs & brand owners

- E-commerce platforms & electronics retail chains

- Telecom operators & device-financing distributors

- Hospital groups & private clinic networks

- Corporate employers & HMO buyers

- Health insurers / payers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We build a Philippines-specific ecosystem map covering OEMs, telcos, e-commerce, distributors, providers, and regulators. Desk research consolidates device types, app ecosystems, clinical adjacency, and channel economics to define the variables that move adoption and value capture.

Step 2: Market Analysis and Construction

We compile historical market development using a bottom-up structure across device types and applications, validating category boundaries (consumer wellness vs medically oriented monitoring) and mapping ASP ladders, attach rates, and channel mix to construct revenue logic.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses via structured interviews with distributors, retailer category managers, hospital digital health teams, and platform stakeholders. Inputs focus on demand drivers, procurement criteria, tender patterns, and the practical barriers in onboarding and compliance.

Step 4: Research Synthesis and Final Output

We triangulate findings against credible secondary sources and finalize segmentation, competition positioning, and forward scenarios. The output prioritizes decision-useful insights: go-to-market pathways, partnership maps, and execution risks for entrants and incumbents.

- Executive Summary

- Research Methodology (Market Definitions & Inclusion Criteria, Wearable vs Medical-Grade Boundary Setting, Assumptions for Device-to-User Mapping, Bottom-Up Shipments/Revenues Build, Top-Down Spend & Device Penetration Triangulation, Primary Interviews Mix, Channel Checks & Price-Point Sampling, Data Privacy and Consent Lens, Data Validation & Limitations, Abbreviations)

- Definition and Scope

- Market Genesis and Adoption Path in the Philippines

- Consumer-Tech to Health-Tech Convergence

- Market Context Snapshot

- Market Ecosystem at a Glance

- Growth Drivers

Smartphone-Led Ecosystem Readiness

Urban Consumer Health Focus

Employer Wellness Budgets

Telco Attach Strategies

Platform Stickiness - Challenges

Accuracy Skepticism

Claim Substantiation

Data Privacy Friction

Interoperability Gaps

Counterfeit and Grey-Market Pressure

Price Sensitivity - Opportunities

Remote Patient Monitoring Adjacency

Insurer and HMO-Linked Programs

Corporate Health Scoring

Elder Care Packages

Pharmacy and Provider Partnerships - Trends

Shift to Multi-Sensor Fusion

AI Coaching

Ring and Patch Category Emergence

Device-to-Service Bundles

Privacy-by-Design Messaging - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Units, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price Bands, 2019–2024

- By Connected Users, 2019–2024

- By Subscription and Services Attach, 2019–2024

- By Fleet Type (in Value %)

Smartwatches

Fitness Bands

Smart Rings

Smart Patches and Continuous Monitoring Wearables

Smart Clothing and Sensor-Embedded Accessories - By Application (in Value %)

Wellness and Preventive Tracking

Fitness and Performance Training

Chronic Care Support

Maternal and Women’s Health Tracking

Elderly Monitoring and Safety - By Technology Architecture (in Value %)

Heart Rate and HRV Monitoring

SpO₂ and Respiratory Proxy Monitoring

Skin Temperature and Fever Screening

Blood Pressure Monitoring

ECG and Arrhythmia Screening - By Connectivity Type (in Value %)

iOS Ecosystem

Android Ecosystem

Standalone and eSIM-Capable Wearables

BLE-Only Companion-App Dependent Devices

Multi-Platform Compatible Devices - By End-Use Industry (in Value %)

Individual Consumers

Corporate and Employer Wellness Programs

Healthcare Providers and Clinics

Insurers and HMOs

Elder Care and Assisted Living - By Region (in Value %)

Metro Manila

Luzon

Visayas

Mindanao

Emerging Urban Centers

- Competitive Intensity Map

Market Share of Major Players - Cross Comparison Parameters (Ecosystem Stickiness Index, Sensor Stack Depth Score, Clinical and Claims Substantiation Level, App Engagement and Retention Signals, Channel Coverage and Authorized Service Depth, Data Privacy and Governance Readiness, Enterprise and B2B Program Capability, Price Ladder Breadth and Promo Elasticity)

- Competitive Moat Analysis

- Pricing and SKU Architecture

- Partnership and Distribution Benchmark

- SWOT of Major Players

- Detailed Profiles of Major Companies

Apple

Samsung

Huawei

Xiaomi

OPPO

realme

Garmin

Google Fitbit

Amazfit

Polar

Withings

Suunto

Oura

WHOOP

- Consumer Segments

- Corporate Buyers and Wellness Program Design

- Providers and Networks

- Payers, HMOs, and Insurers

- Decision Journey Mapping

- Pain Points and Drop-Off Diagnostics

- By Value, 2025–2030

- By Units, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price Bands, 2025–2030

- By Services and Subscription Attach, 2025–2030