Market Overview

The Philippines hypertension therapeutics market is valued at approximately USD ~ million for 2024, based on bottom-up analysis of the national pharmaceutical market size. This value reflects growth driven by rising prevalence of hypertension, increasing healthcare access under the country’s Universal Health Care reforms and expanding generic drug availability. For 2023 the broader cardiovascular/traditional drug segment showed stable revenues, which underpin the hypertension therapy segment.

Major urban-centres in the Philippines—particularly the National Capital Region (Metro Manila) and Luzon provinces—dominate the hypertension therapeutics market due to their concentration of tertiary hospitals, specialist cardiology/hypertension clinics, higher per-capita healthcare spending and stronger distribution infrastructure. These regions also have superior diagnostic infrastructure and private-care penetration, which amplifies adoption of advanced antihypertensive therapies.

Market Segmentation

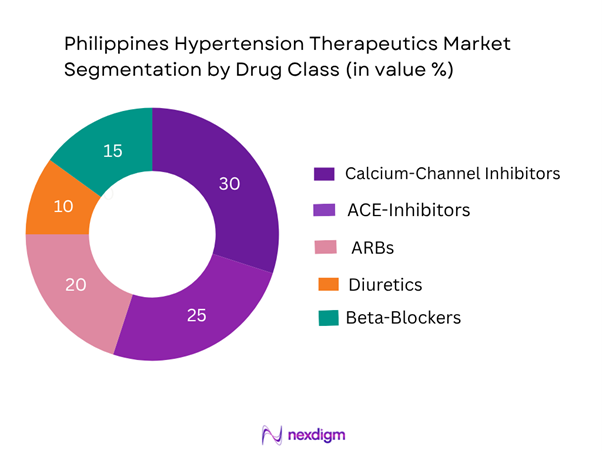

By Drug Class

In the Philippines the Calcium-Channel Blockers (CCBs) sub-segment is dominating the hypertension therapeutics market, capturing an estimated 30 % share. This dominance is driven by widespread physician preference for CCBs as first-line therapy in Asian populations, extensive generic availability, affordability and familiarity among both public and private providers. The robust manufacturing footprint of local generic CCB products, combined with high usage in outpatient settings and the region’s higher incidence of hypertension complications, has reinforced the CCB segment’s lead over newer ARBs or premium branded ACE-Inhibitors.

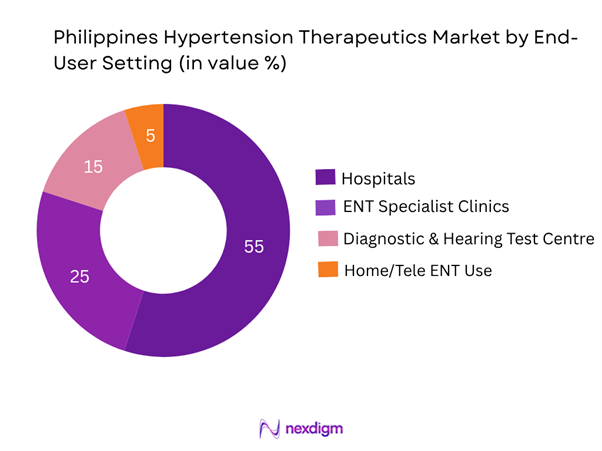

By End-User Setting

Hospitals (cardiology and hypertension units) dominate the Philippines hypertension therapeutics market, with about 45 % share in 2024, because they serve the majority of complex, newly diagnosed hypertensive patients, manage comorbidities (diabetes, renal disease) and deploy branded/high-cost combination therapies. Hospitals have stronger purchasing power, tenders and formulary access, and can roll out newer fixed-dose combinations ahead of smaller clinics. Specialist clinics follow, serving chronic maintenance patients, while retail pharmacies facilitate retail generic dispensing, and homecare/remote monitoring remains nascent.

Competitive Landscape

The competitive environment for hypertension therapeutics in the Philippines is characterised by several global pharmaceutical companies, regional generics manufacturers and local distributors. The market shows moderate consolidation, with a mix of branded innovators and generics players.

| Company | Establishment Year | Headquarters | Philippines Footprint | Hypertension Portfolio | Distribution / Channel Strength | Recent Strategic Move |

| Pfizer Inc. | 1849 | New York, USA | – | – | – | – |

| Novartis AG | 1996 (merger) | Basel, Switzerland | – | – | – | – |

| Sanofi S.A. | 1973 | Paris, France | – | – | – | – |

| AstraZeneca PLC | 1913 | Cambridge, UK | – | – | – | – |

| Unilab, Inc. | 1945 | Mandaluyong, Philippines | – | – | – | – |

Philippines Hypertension Therapeutics Market Analysis

Key Growth Drivers

Rising hypertension prevalence among adults in the Philippines

The Philippines hypertension therapeutics market is strongly driven by growing incidence of raised blood pressure: national survey results show a 37 % prevalence of hypertension among adults in the 2021 study of the Hypertension prevalence-series (PRESYON-4) in the Philippines. Furthermore, recent commentary reported a 69.1 % rate of hypertension among older Filipino adults. This heightened disease burden increases demand for antihypertensive medications, bolstering therapy usage and volume in clinical and outpatient settings nationwide.

Expanding universal health-coverage and insurance membership

The national healthcare reform under the Universal Health Care (UHC) Act mandates automatic enrolment of all Filipinos in the national insurance programme, with the Philippine Health Insurance Corporation reporting 108,505,167 covered beneficiaries as of December 2023. In addition, 69.7 % of Philippine households in 2022 had PhilHealth membership Greater insurance penetration lowers financial barriers and supports increased prescription-therapy uptake for hypertension, driving overall market expansion.

Market Challenges

Persistent high out-of-pocket spending and constrained public funding

Despite reforms, about 44.4 % of the country’s current health expenditure in 2023 remained out-of-pocket payments by households. Government funding accounted for 42.6 % of health spending in the same year. The result is that many hypertensive patients may defer or sub-optimally treat their condition due to cost, limiting uptake of newer or higher-cost antihypertensive therapies and slowing growth of premium‐priced segments of the hypertension therapeutics market.

Weak treatment awareness and remote access barriers

Although hypertension prevalence is high, awareness and treatment rates remain relatively low: older Filipino populations show elevated hypertension prevalence (e.g., 69.1 % among older adults) yet many are untreated. Many households delay care or bypass primary care systems in the Philippines. Furthermore, remote islands and underserved regions face logistical and infrastructure barriers, limiting distribution and access of hypertension therapies which affects market penetration outside urban centres.

Market Opportunities

Fixed-dose combination therapies gaining traction

As the Filipino hypertensive patient base expands and comorbidity with diabetes/renal disease rises, there is growing opportunity for fixed-dose combination (FDC) antihypertensive drugs. The shift in therapy from monotherapy to combination regimens is documented in local studies (e.g., usage of ARBs increasing). For manufacturers and distributors, FDCs offer differentiation and improved adherence—an opportunity to capture value in established and emerging therapy segments of the market.

Digital/remote blood-pressure monitoring and tele-cardiology integration

The Philippines healthcare system’s push toward universal health coverage and digital health programmes opens avenues for remote-monitoring solutions in hypertension care. Expansion of outpatient and mobile health services accentuates the need for connected therapy adherence tools, allowing pharmaceutical players and therapy-service providers to bundle antihypertensive products with monitoring solutions to enhance value-proposition and reach formerly underserved populations.

Future Outlook

Over the next six years, the Philippines hypertension therapeutics market is expected to continue robust expansion driven by the increasing prevalence of hypertension in both urban and rural populations, enhancements in universal healthcare coverage under the UHC Act, and rising adoption of fixed-dose combination therapies and generics. Improved screening programmes, growth in outpatient cardiology services and the integration of remote monitoring tools will boost treatment volumes. Additionally, pricing pressures, generic substitution and government cost-containment efforts will shape competitive dynamics. Pharmaceutical companies with differentiated portfolios and strong distribution networks are poised to capture growth in underserved regions and patient cohorts.

Major Players

- Pfizer Inc.

- Novartis AG

- Sanofi S.A.

- AstraZeneca PLC

- Boehringer Ingelheim International GmbH

- Bayer AG

- Takeda Pharmaceutical Company Limited

- GlaxoSmithKline plc

- Roche Holding AG

- United Laboratories

- Mercury Drug Corporation

- The Cathay Drug Co., Inc.

- Ajanta Pharma Limited

- Philippine Pharmaco, Inc.

- Lupin Limited

Key Target Audience

- Pharmaceutical manufacturers of hypertension therapeutics

- Generic drug producers and distributors in the Philippines

- Private hospital chains and cardiology/ hypertension clinics

- Retail pharmacy chains and wholesale distributors

- Investments & venture-capitalist firms (focusing on cardiovascular/therapeutics space)

- Government and regulatory bodies (e.g., Philippine Food and Drug Administration (FDA), Philippine Health Insurance Corporation (PhilHealth))

- Tele-health and remote monitoring solution providers in the cardiovascular arena

- Procurement officers in public health systems and large outpatient service networks

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing major stakeholders within the Philippines hypertension therapeutics market: drug manufacturers (innovator/generics), wholesalers, hospitals, clinics, pharmacies, patients, regulators. This was supported by desk research via published country macro-data, import/export data, healthcare facility data and treatment pattern literature.

Step 2: Market Analysis and Construction

In this phase, historical data for the Philippines pharmaceutical market and cardiovascular/antihypertensive segments were compiled, including total market size for 2024 (USD 3.30 billion) antihypertensive segment value estimates, unit volumes, average pricing levels and treatment adoption trends. The data was reconciled via bottom-up estimations (drug class usage, number of hypertensive patients, average treatment cost) and top-down allocations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses (e.g., dominance of CCBs, hospital end-user share, generics uptake) were validated through secondary literature and supplemented by interviews with local cardiologists, pharmacy procurement leads and distributors to refine assumptions, treatment patterns and device/therapeutic substitution behaviour.

Step 4: Research Synthesis and Final Output

The final phase integrates bottom-up and top-down analyses, aligns segmentation and competitive data, applies forecast modelling across 2024-2030, and delivers comprehensive insights including market size, shares, segmentation, competitive landscape and strategic recommendations for market stakeholders in the Philippines hypertension therapeutics space.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Abbreviations, Market-Sizing Approach, Consolidated Research Approach, Primary Research & Expert Interviews, Limitations & Future Considerations)

- Definition & Scope

- Market Genesis & Evolution

- Timeline of Regulatory & Reimbursement Milestones

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising hypertension prevalence

Expanding universal health coverage

Increased patient awareness - Market Challenges

Price‐control/regulation

Generic substitution pressure

Access in remote islands - Opportunities

Fixed‐dose combination therapies

Digital/remote patient-monitoring

Private-pay market expansion - Trends

Generics penetration increase

Combination therapy uptake

Tele-medicine linkage - Regulatory & Reimbursement Landscape

Drug Price Regulation

PhilHealth reimbursement policies

Essential Medicines List updates - SWOT Analysis

- Stakeholder Ecosystem (Manufacturers, Wholesalers, Retailers, Government Procurement, Private Payers)

- Porter’s Five Forces Analysis

- By Value (USD million), 2019-2024

- By Volume (Number of Dosage Units/Defined Daily Doses), 2019-2024

- By Average Selling Price (ASP) per therapeutic class, 2019-2024

- By Drug Class (In value %)

Calcium-Channel Blockers

ACE-Inhibitors

ARBs (Angiotensin-Receptor Blockers)

Beta-Blockers

Diuretics - By Formulation & Distribution Channel (In value %)

Branded Prescription Drugs

Branded Generic Prescription Drugs

Generic Prescription Drugs

Retail Pharmacy Dispensed (Out-patient)

Hospital Pharmacy Dispensed (In-patient) - By Patient Segment / Treatment Setting (In value %)

Newly Diagnosed Patients

Established Hypertensive Patients (Chronic Therapy)

Resistant Hypertension / Combination Therapy Patients

Private-Pay Patients

Government-Insured Patients - By Geography – Region / Island-Group (In value %)

Luzon (including Metro Manila)

Visayas

Mindanao

Other Islands & Remote Areas - By Price Tier/Segment (In value %)

Premium Branded Drugs

Mid-Tier Branded Generics

Low-Cost Generics

- Market Share of Major Players (by value / volume)

- Cross-Comparison Parameters (Company Overview, Business Strategy, Recent Developments, Strengths, Weaknesses, Organizational Structure, Philippines & ASEAN Revenue, Revenue by Drug Class, Number of SKUs in Philippines, Distribution Channel Reach, Service & Support Infrastructure, Pricing & Margins, Local Manufacturing or Import Status)

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

Pfizer Inc.

Novartis AG

Sanofi S.A.

AstraZeneca PLC

Boehringer Ingelheim International GmbH

Bayer AG

Takeda Pharmaceutical Company Limited

GlaxoSmithKline plc

Roche Holding AG

United Laboratories, Inc. (Unilab)

Mercury Drug Corporation

The Cathay Drug Co., Inc.

Ajanta Pharma Limited

Philippine Pharmaco, Inc.

Lupin Limited

- Demand & Utilisation Patterns

- Budget Allocations & Purchasing Behaviour

- Patient Pathways & Treatment Adherence

- Key Purchasing Criteria

- Access & Distribution Challenges

- By Value (USD million), 2025-2030

- By Volume (Number of Dosage Units), 2025-2030

- By Average Selling Price (ASP), 2025-2030