Market Overview

The Philippines injectable drug solutions market is embedded within the broader pharmaceutical segment of the country, which reached a valuation of USD ~ billion in 2024. Within this, injectable formulations—including vials, ampoules, prefilled syringes and lyophilised powders for injection—are driven by growing incidence of chronic and acute diseases (oncology, autoimmune disorders, infectious diseases), rising hospitalisation and specialist care demand, and increasing adoption of biologics and biosimilar injectables. The expansion of hospital infrastructure and public health procurement programmes are accelerating demand.

Within the Philippines, major metropolitan regions such as Metro Manila (Luzon), particularly areas around Quezon City and Makati, dominate the injectable drug solutions market due to the high concentration of tertiary hospitals, specialist clinics, and advanced sterile-manufacturing and distribution infrastructure. In addition, Luzon acts as the logistics hub for pharmaceutical imports and regional fill-finish operations, ensuring faster access and often preferential distribution compared to more remote Visayas and Mindanao regions.

Market Segmentation

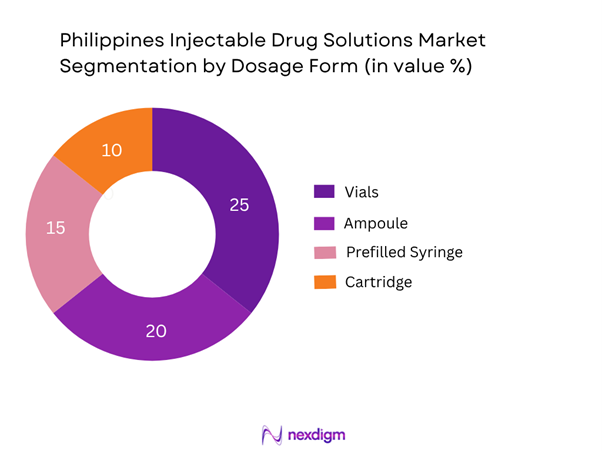

By Dosage Form

By dosage form, the vial format continues to dominate the Philippines injectable drug solutions market due to its long-standing use across hospitals for intravenous, intramuscular and subcutaneous therapies. Vials remain cost-effective for multi-dose administration in high-volume hospital settings, and local hospital formularies favour the traditional vial over newer cartridge or prefilled systems due to lower unit cost, simpler cold-chain requirements and established procurement infrastructure. As the hospital network expands, especially in tertiary care, the vial’s dominance is sustained.

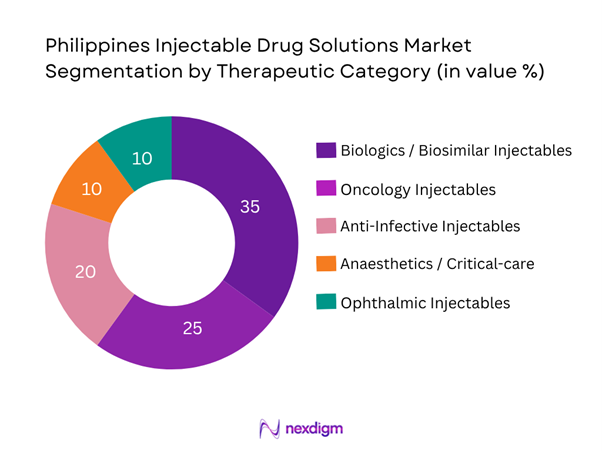

By Therapeutic Category

Within therapeutic categories, biologics/biosimilar injectables command the largest share of the pharmaceutical injectable solutions market in the Philippines. This is driven by the global shift towards high-value injectable biologic therapies (monoclonal antibodies, fusion proteins) for oncology, autoimmune disorders and specialty care, coupled with increasing local demand for biosimilars as cost-effective alternatives. Government procurement of biosimilars and increasing hospital adoption of biologic injectables for chronic conditions have elevated this sub-segment ahead of traditional small-molecule injectables.

Competitive Landscape

The Philippines injectable drug solutions market is shaped by a mix of domestic pharmaceutical manufacturers, regional contract manufacturing/sterile-fill specialists and global multinational players. Consolidation is moderate with a few dominant firms controlling supply to hospitals, clinics and government tenders, while CDMO/sterile fill-finish players are emerging.

| Company | Establishment Year | Headquarters | Injectable Portfolio Focus | Local Fill-Finish Capacity | Import vs Domestic Injectable Mix | Distribution Network Reach (Philippines) | Recent Injectable-Segment Development |

| Unilab, Inc. | 1945 | Mandaluyong, Metro Manila | – | – | – | – | – |

| The Cathay Drug Co., Inc. | 1952 | Manila | – | – | – | – | – |

| Pfizer Inc. | 1849 | New York, USA | – | – | – | – | – |

| Sanofi S.A. | 1973 | Paris, France | – | – | – | – | – |

| Roche Holding AG | 1896 | Basel, Switzerland | – | – | – | – | – |

Philippines Injectable Drug Solutions Market Analysis

Growth Drivers

Rising oncology incidence

The increasing burden of cancer in the Philippines directly elevates demand for injectable drug solutions used in oncology therapies. In the Philippines, an estimated 188,976 new cancer cases were reported, with an age-standardised incidence rate of 185.4 per 100,000 people. Breast cancer in particular holds a high incidence: women in the Philippines registered an age-standardised incidence rate of 60.34 per 100,000 in 2022. Additionally, cancer is the third leading cause of death in the country, with around 96 cancer-related deaths per day reported. Such epidemiological trends drive procurement of oncology injectables (vials, ampoules, biologics) in hospital and specialist settings. As oncology protocols increasingly require intravenous therapies, infusion solutions, monoclonal antibody injectables and supportive care injectables, the injectable drug solutions segment captures a larger share of hospital formularies. The combination of rising incidence, mortality and improved access to cancer diagnostics compounds pressure on supply of sterile injectable formats, making cancer treatment one of the primary levers for market growth.

Growth of biologics requiring injectable formats

Biologic drugs and biosimilars are increasingly becoming the standard of care for many chronic and specialty indications (e.g., autoimmune disorders, oncology, oncology supportive therapy), and the Philippines is part of this global shift. The country’s pharmaceutical industry remains heavily reliant on imported finished medicines, including biologics and injectable therapies – underlining that local adoption is increasing and supply chains must support high-value sterile formats. Meanwhile, the infrastructure for cold storage and sterile manufacturing is underdeveloped, but external demand for biologics injectables continues to grow in the Asia-Pacific region, which influences the Philippines market indirectly. For instance, the Philippines has only around 1.0 hospital beds per 1,000 people according to World Bank data for 2021. While this may seem like a restraint, it also implies that hospitals in the Philippines are adopting higher-cost, higher-tech therapies (like biologics injectables) to maximise value per bed. As biologics require injectable administration (vials, pre‐filled syringes, infusion), their uptake leads to higher usage of sterile injectable drug solutions, driving market growth in this segment.

Market Challenges

Sterile-manufacturing cost

Producing sterile injectable drug solutions requires high investment in clean-room infrastructure, validation, quality assurance, and regulatory compliance. In the Philippines, local manufacturers face steep cost burdens relative to imports, as they must meet GMP standards, sterilisation validation and end-to-end sterile fill-finish operations. Given the country’s import dependence on finished medicines domestic plants often operate at higher per‐unit cost, which constrains margin and scale. For example, the Philippines pharmaceutical industry reported only 46 registered manufacturers versus 650 importers, underlining the limited domestic manufacturing base. These cost pressures limit the entry of domestic players in high-tech injectable segments, and raise barriers for new sterile-fill ventures. Consequently, the high cost of sterile manufacturing remains a key structural challenge for the injectable drug solutions market.

Regulatory/sterility/validation burden

Sterile injectables demand rigorous validation and regulatory oversight—sterility assurance, clean-room certification, batch release controls—all of which impose significant lead times and costs. In the Philippines, regulatory procedures are noted as lagging: the pharmaceutical sector “continues to face significant challenges due to slow regulatory procedures and bureaucratic inefficiencies.” Delays in registration, inspection and licensing slow market entry of new injectable therapies and discourage investment in manufacturing. Moreover, manufacturers must demonstrate sterility validation according to global standards (e.g., ISO 14644, Annex 1) and localized Good Manufacturing Practice (GMP) guidelines. These burdens inflate timeline and cost of sterile injectable development and supply chain readiness, making it a non-trivial challenge for the market.

Opportunities

Local manufacturing / contract-manufacturing growth

The Philippines host opportunities for local sterile manufacturing and CDMO (contract development and manufacturing organisation) services for injectable drug solutions. Given the heavy import dependency of finished injectables and APIs, building domestic capacity for fill-finish, prefilled syringes and vials can reduce supply risk and cost. As of recent reporting, the Philippines had only 46 registered pharmaceutical manufacturers versus 650 importers. The government (via the Board of Investments) has listed the pharma industry as a priority, highlighting the opportunity in sterile manufacturing. As hospitals and clinics expand regionally, local contract-manufacturing of injectable solutions creates shorter lead times, lower logistics costs and better responsiveness to demand. Domestic CDMO growth thus represents a strategic growth lever for the injectable drug solutions market in the Philippines.

Biosimilar injectables

With biologic therapies rising globally, the Philippines presents a strategic market for biosimilar injectable development and uptake. The trend toward cost-effective biologics stimulates demand for biosimilar vials, prefilled syringes and cartridges. The Philippines pharmaceutical sector’s import-based nature underscores the opportunity: strengthening local development and introduction of biosimilar injectables would address affordability and access gaps. Given the high incidence of oncology and autoimmune conditions (e.g., cancer incidence ~188,976 cases) local healthcare payers will be increasingly driven toward biosimilars. Thus, biosimilar injectable products offer a growth corridor for manufacturers and suppliers within the Philippines injectable drug solutions space.

Future Outlook

Over the next six years the Philippines injectable drug solutions market is poised for robust growth, driven by increasing demand for biologic injectables, expansion of hospital networks outside major metros, and rising government procurement of advanced therapies. Local CDMO/sterile-fill-finish capabilities are expected to grow, aiding supply-chain resilience and local production share. Additionally, self-injectable formats and prefilled systems will gradually gain traction in outpatient and home-care settings, creating new growth vectors.

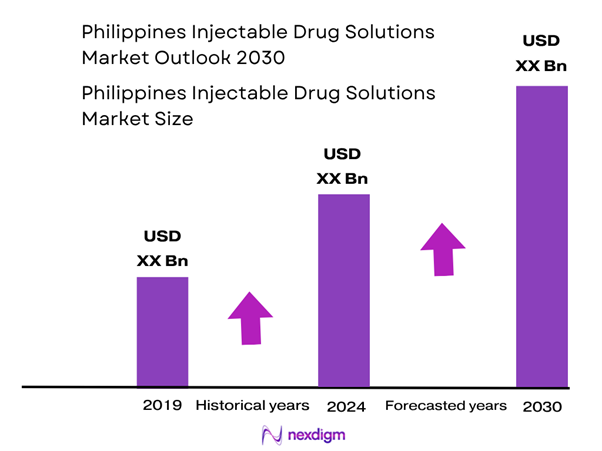

Based on curated analysis and available data, the injectable drug solutions market in the Philippines is estimated at USD approximately 0.6 billion in 2024 (given available specific sterile-injectables CDMO data of USD 28.9 million for 2024 in Philippines context but recognising overall injectable solutions market is broader). Forecasting a conservative CAGR of 8.5% for 2024–2030, the market is expected to reach approximately USD ~0.99 billion by 2030 (baseline used 2024 = USD 0.6 billion). This growth is supported by increasing biologics uptake, regulatory incentives for local manufacturing, and rising hospital bed capacity.

Major Players

- Unilab, Inc.

- The Cathay Drug Co., Inc.

- Pfizer Inc.

- Sanofi S.A.

- Roche Holding AG

- Novartis AG

- Bristol-Myers Squibb Company

- Amgen Inc.

- Boehringer Ingelheim International GmbH

- Fresenius Kabi AG

- Sandoz International GmbH

- Hospira, Inc. (a Pfizer company)

- Cipla Limited

- GlaxoSmithKline plc

- Baxter International Inc.

Key Target Audience

- Hospital procurement directors, tertiary care networks (Philippines)

- Pharmaceutical formulation & sterile-fill manufacturing companies

- Contract manufacturing/sterile-fill solutions providers (CDMOs)

- Investments and venture capital firms (focusing on injectable biologics/sterile HPR Philippines)

- Government and regulatory bodies (Department of Health Philippines, FDA Philippines)

- Hospital supply chain & logistics service providers

- Biologics/biosimilar development companies

- Hospital pharmacy chains and healthcare group purchasing organisations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all stakeholders in the Philippines injectable drug solutions market—pharmaceutical manufacturers, CDMOs, hospital end-users, government procurement units and distribution networks. Extensive desk research was undertaken across secondary sources, company reports and industry databases to define critical variables (e.g., fill-finish capacity, import versus domestic mix, dosage form adoption).

Step 2: Market Analysis and Construction

In this phase we compiled historical data (2019-2023) for injectable drug solutions in the Philippines—covering market value, unit volumes, dosage form trends and therapeutic uptake. We analysed hospital procurement trends, import/export data, and distribution dynamics, and applied a bottom-up model leveraging sub-segment shares (dosage form, therapeutic category) to build market value estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses (e.g., increasing biologic injectable share, shift to prefilled cartridges) were validated through interviews with pharmaceutical manufacturers and hospital pharmacy heads in Metro Manila and Luzon. These CATI/virtual interviews provided operational, capacity and pricing insights which informed refinement of our model assumptions.

Step 4: Research Synthesis and Final Output

The final phase involved triangulation of bottom-up and top-down estimates, integration of local Philippines data with regional benchmarks (Asia-Pacific injectable markets), and finalisation of segment-level forecasts. All data were checked for consistency and aligned with known public industry inputs to deliver a robust market outlook.

- Executive Summary

- Research Methodology (Definition and scope, Abbreviations & terminology, Market sizing approach, Data sources: secondary (Philippines DOH, FDA Philippines, industry associations, company annual reports), primary interviews (manufacturers, distributors, hospitals, payers), Forecasting model assumptions & growth drivers mapping, Limitations and disclaimers)

- Definition & scope of “injectable drug solutions”

- Market genesis and evolution in the Philippines

- Regulatory & policy ecosystem

- Supply chain & value-chain schematic

- Business cycle dynamics

- COVID-19 / pandemic impact & recovery in the injectable space

- Growth Drivers

Rising oncology incidence

Growth of biologics requiring injectable formats

Increasing hospital bed capacity in Philippines - Market Challenges

Sterile-manufacturing cost

Regulatory/sterility/validation burden

Import dependency

Cold-chain logistics gaps - Opportunities

Local manufacturing / contract-manufacturing growth

Biosimilar injectables

Hospital tender consolidation

Self-injectables - Key Trends

Prefilled syringes gaining share

Long-acting depot injectables

Shift to outpatient/in-home injection

Digital monitoring - Regulatory & reimbursement environment

Government programmes

Pricing controls

Public hospital procurement

Import duties - SWOT Analysis

- Porter’s Five Forces

- Stakeholder ecosystem (pharma companies, CDMOs, contract manufacturing organisations, distributors, hospital buyers)

- Market value (USD million) by year, 2019-2024

- Market volume (million units / vials or dosage equivalents), 2019-2024

- Average price per dosage unit (localised pricing), 2019-2024

- By Dosage Form ((In Value %)

Vial

Ampoule

Prefilled syringe,

Cartridge - By Drug Type (In Value %)

Therapeutic Category

Oncology injectables

Biologics/biosimilars

Anti-infective injectables

Anaesthetics/critical-care injectables

Ophthalmic injectables - By Distribution Channel (In Value %)

Hospital pharmacy

Retail pharmacy

Clinic/ambulatory centre

Government tenders - By Manufacturing Origin (In Value %)

Locally produced – domestic fill/finish

Imported finished injectables - By End-User Setting (In Value %)

Hospitals—tertiary

Regional ambulatory surgery centres

Home-care/self-injectables - By Region (In Value %)

Luzon

Visayas

Mindanao

- Market share of major players by value/volume (latest base year)

- Cross-Comparison Parameters (Company overview, Core injectable product portfolio, Manufacturing/fill-finish capacity, Domestic versus imported mix, Revenue from injectable segment in Philippines, Geographic reach, Contract manufacturing activities, Distribution network strength, Margins in injectable segment, R&D/innovation pipeline in injectable solutions)

- Detailed Profiles of Major Companies

Unilab, Inc. (Philippines)

Med Laboratories, Inc. (Philippines)

The Cathay Drug Co., Inc. (Philippines)

Pfizer Inc.

Sanofi S.A.

Roche Holding AG

Novartis AG

Bristol‑Myers Squibb Company

Amgen Inc.

Boehringer Ingelheim International GmbH

Fresenius Kabi AG

Sandoz International GmbH

Hospira, Inc. (a Pfizer company)

Cipla Limited

GlaxoSmithKline plc

- Hospital demand (tertiary & regional)

- Ambulatory clinics / specialist centres

- At-home/self-injectable segment

- Purchasing behaviour & budget allocation

- Key unmet needs, pain points

- Decision-making process and stakeholder mapping

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030