Market Overview

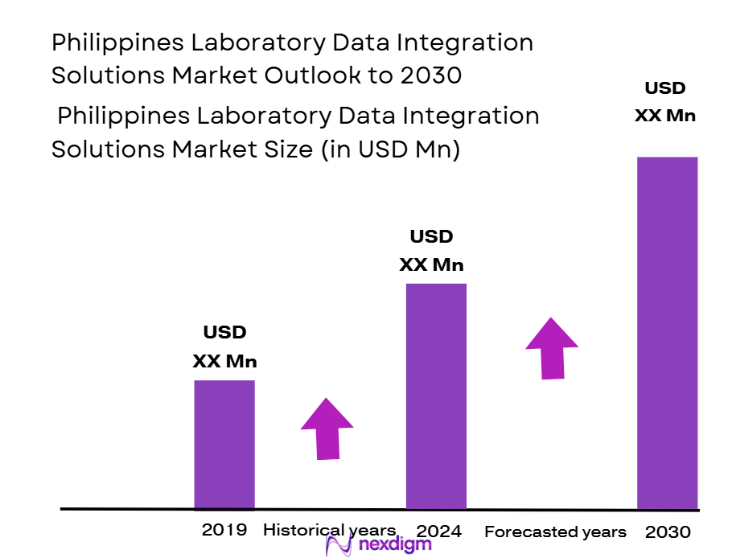

The Philippines Laboratory Data Integration Solutions market is experiencing robust growth, driven by the increasing demand for advanced laboratory management systems and integration solutions. The market size in 2025 is estimated to be valued at approximately USD ~ million. This growth is primarily driven by the rising adoption of laboratory information management systems (LIMS) and electronic laboratory notebooks (ELN), as well as the integration of automated systems for data management, enhancing productivity and compliance in laboratories. The growing need for real-time data access and seamless integration with hospital information systems (HIS) and other healthcare IT solutions has also fueled this trend.

The market is predominantly driven by cities such as Metro Manila, Cebu, and Davao, where there is a concentration of healthcare institutions, research organizations, and government-supported laboratories. Metro Manila, being the capital region, plays a central role in the adoption of technology in laboratory practices, with significant investments in healthcare infrastructure and modernization. Additionally, Davao and Cebu are emerging as key hubs due to increasing private and government healthcare initiatives in these regions, pushing the adoption of laboratory data integration solutions to ensure better data management, compliance, and operational efficiency.

Market Segmentation

By Deployment Type

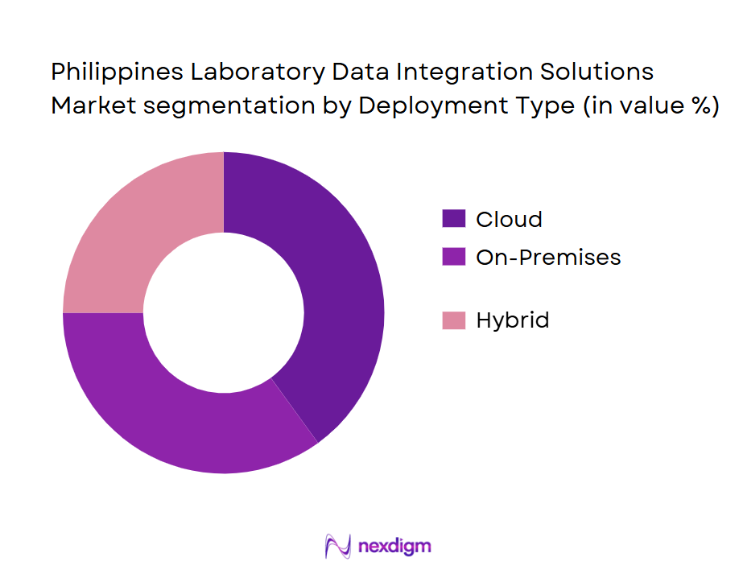

The Philippines Laboratory Data Integration Solutions market is segmented by deployment type into On-Premise, Cloud, and Hybrid models.

The cloud deployment model has seen a notable dominance in the Philippine laboratory market. This is attributed to the growing demand for scalable, cost-effective, and flexible solutions that can be accessed remotely, thus facilitating collaboration across multiple sites. Cloud-based LIMS solutions offer lower upfront costs and provide updates and support more efficiently, making them particularly attractive for research institutions and hospitals with limited IT infrastructure. Furthermore, government incentives supporting digital healthcare transformation have accelerated the shift towards cloud-based solutions.

By End-User

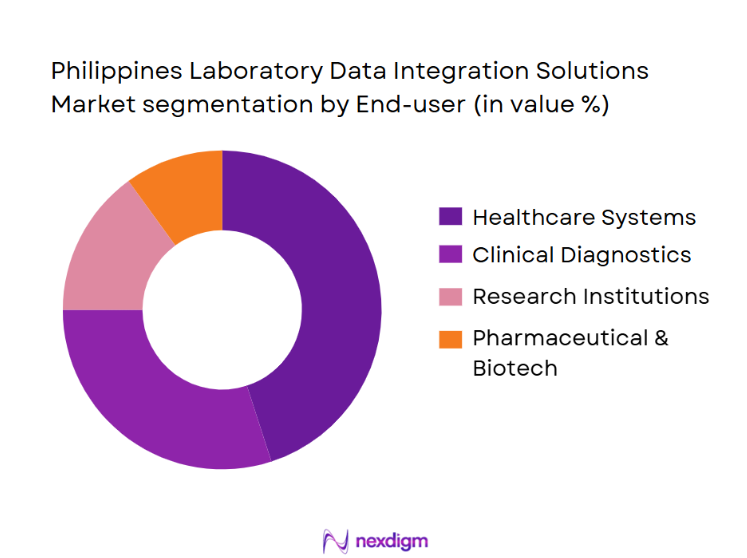

The market is also segmented by end-user, with key segments including clinical diagnostics, healthcare systems, research institutions, and pharmaceutical & biotech companies.

The healthcare system segment holds a significant market share due to the increasing reliance on data integration to improve laboratory workflows, streamline reporting, and ensure regulatory compliance. Hospitals, particularly in Metro Manila, are at the forefront of adopting advanced laboratory information systems. These hospitals require high-level integration with electronic health records (EHRs) and other hospital systems to ensure that laboratory data can be easily accessed, analyzed, and shared across departments, driving the demand for robust laboratory data integration solutions.

Competitive Landscape

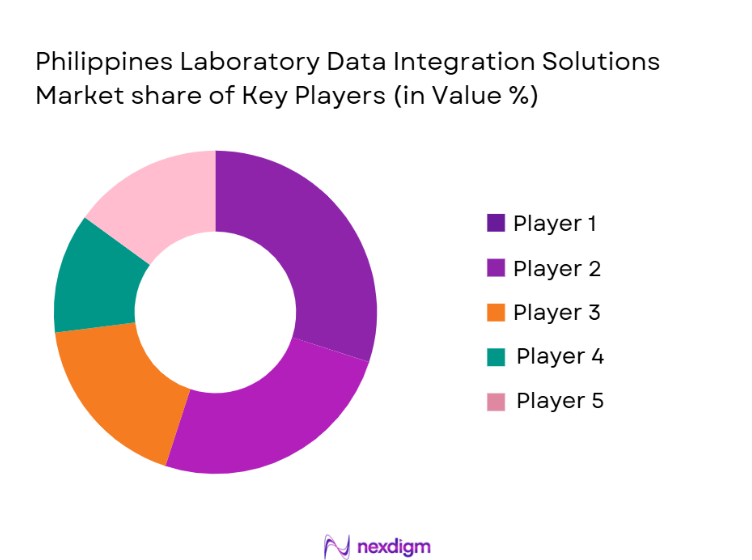

The Philippines Laboratory Data Integration Solutions market is characterized by a mix of global and local players, offering a variety of integrated solutions. The market is dominated by a few major international players, including Thermo Fisher Scientific, LabWare, and local companies like CrelioHealth and HiAdvance, which provide tailored solutions for the Philippine healthcare and research markets. These key players are focusing on innovation, service quality, and integration capabilities to maintain their competitive edge. Additionally, partnerships and collaborations with government agencies, healthcare organizations, and research institutions are helping players expand their presence in the market.

| Company | Establishment Year | Headquarters | Deployment Model | Target Sector | Key Features | Market Strategy |

| Thermo Fisher Scientific | 1956 | Waltham, MA, USA | ~ | ~ | ~ | ~ |

| LabWare | 1999 | Philadelphia, PA, USA | ~ | ~ | ~ | ~ |

| CrelioHealth | 2017 | Quezon City, Philippines | ~ | ~ | ~ | ~ |

| HiAdvance | 2008 | Manila, Philippines | ~ | ~ | ~ | ~ |

| Sapio Sciences | 2002 | Boston, MA, USA | ~ | ~ | ~ | ~ |

Philippines Laboratory Data Integration Solutions Market Analysis

Growth Drivers

Increasing Demand for Real-Time Data Integration

As laboratories in the Philippines seek to improve efficiency and accuracy in data handling, there is a growing demand for seamless integration across multiple platforms, including LIMS, ELN, and HIS. The push towards real-time access to data for faster decision-making is fueling the adoption of laboratory data integration solutions.

Government Support for Healthcare Digitalization

The Philippine government’s ongoing efforts to modernize the healthcare sector through digital transformation initiatives are driving the adoption of advanced laboratory information systems (LIMS). Policies encouraging healthcare digitization, particularly in hospitals and diagnostic centers, promote the integration of laboratory data solutions to enhance service delivery and compliance.

Market Challenges

High Initial Implementation Costs

The cost of implementing on-premise or hybrid laboratory data integration solutions remains a barrier for smaller and mid-sized laboratories in the Philippines. The upfront investment in hardware, software, and employee training can be prohibitive, especially for institutions with limited budgets.

Lack of Skilled IT Workforce

The Philippines faces a shortage of skilled IT professionals who can manage, implement, and maintain laboratory data integration solutions. The absence of a trained workforce skilled in healthcare IT integration is a key challenge, slowing down the market’s growth, particularly in remote or underserved areas.

Opportunities

Cloud-based Integration Solutions

With the growing trend towards cloud adoption in the Philippines, there is a significant opportunity for cloud-native laboratory data integration solutions. These platforms provide cost-effective, scalable, and flexible alternatives to traditional on-premise solutions, especially for smaller laboratories and healthcare institutions.

Adoption of AI and Machine Learning for Predictive Analytics

Laboratories are increasingly looking for ways to enhance data analysis through advanced technologies such as AI and machine learning. By integrating predictive analytics into LIMS systems, labs can improve decision-making, anticipate trends, and enhance patient care, creating opportunities for software vendors to develop next-generation solutions.

Future Outlook

Over the next few years, the Philippines Laboratory Data Integration Solutions market is poised for significant growth. The rapid advancement of healthcare IT infrastructure, government support for digital transformation in healthcare, and the increasing need for regulatory compliance will drive further adoption of laboratory data integration solutions. Moreover, the push for cloud-based systems and the integration of AI and machine learning for predictive analytics in laboratories are expected to be major drivers for future market developments.

Major Players

- Thermo Fisher Scientific

- LabWare

- CrelioHealth

- HiAdvance

- Sapio Sciences

- L7 Informatics

- Datamine Software

- Autoscribe Informatics

- HashMicro

- LabLynx

- StarLIMS

- OmniLytics

- PerkinElmer

- Agilent Technologies

- Eppendorf

Key Target Audience

- Healthcare Providers

- Clinical Laboratories

- Pharmaceutical and Biotech Companies

- Public Health Authorities

- Research Institutions

- Hospitals and Diagnostic Centers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

This step involves mapping out the ecosystem of laboratory data integration solutions within the Philippines, identifying key stakeholders such as laboratory managers, hospital IT departments, and solution providers. A mix of secondary research and expert interviews helps define these critical variables.

Step 2: Market Analysis and Construction

Here, we will analyze historical and current market data, including the adoption rates of various deployment models like cloud, on-premise, and hybrid, along with key growth drivers such as regulatory requirements and technology advancements.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market growth and trends are validated through discussions with industry experts, including LIMS software providers and healthcare IT professionals, to ensure the data’s reliability and real-world applicability.

Step 4: Research Synthesis and Final Output

In this final phase, direct feedback from laboratory professionals, healthcare IT stakeholders, and solution providers will be used to finalize the market analysis, focusing on specific trends and emerging opportunities within the Philippines market.

- Executive Summary

- Research Methodology (Market Definitions, Assumptions & Scope, Data Sources & Validation, Quantitative Model, Data Normalization, Bias & Limitations)

- Market Genesis & Evolution

- Value Chain & Data Lifecycle Map

- Role of Laboratory IT in Healthcare & Research Workflows

- Regulatory & Compliance Framework

- Growth Drivers

Rising volume of laboratory testing and highthroughput genomics data

Demand for automated data pipelines and sampletoreport cycle reduction

Interoperability with Hospital Information Systems & EHRs - Market Restraints

High initial deployment cost

Lack of certified IT talent for integration projects - Opportunities

Cloudnative LIMS deployments

AI/MLenabled predictive analytics for labs - Market Trends

Standardization of HL7/FHIR data exchange protocols

Integration of IoT sensors and digital instruments

- By Value 2019-2025

- By Volume 2019-2025

- By Average Contract Value 2019-2025

- By Data Throughput 2019-2025

- By Deployment Type (In Value%)

OnPremise LIS/LIMS

Cloud Native Data Integration Platforms

Hybrid Integration Solutions - By Integration Category (In Value%)

LIMS Interconnectivity

ELN Integration

SDMS & Data Lake Sync

API / Middleware Integration Suites

APIBased Interoperability - By EndUser (In Value%)

Clinical Diagnostic Laboratories

Hospital & Healthcare Systems

Research & Academic Institutions

Pharmaceutical & Biotech R&D

Independent & Specialty Labs - By Industry Vertical (In Value%)

Healthcare Diagnostics

Life Sciences R&D

Pharma Manufacturing QA/QC

Environmental Testing Labs

Food & Agriculture Testing - By Integration Drivers (In Value%)

Workflow Automation Intensity

Data Volume Class (High, Medium, Low)

Integration Scope (Internal, External, MultiFacility)

- Philippines Laboratory Data Integration Solutions Market Competitive Landscape & Analysis

- Market Share by Solution Category

- Competitive Positioning Matrix

- Pricing Benchmark

- CrossComparison Parameters (Company Overview, Product Portfolio Breadth, Interoperability Protocol Support, Deployment Footprint, Customer Retention & Renewal Rates, Average Integration Time, Cloud Adoption Score, Data Security & Compliance Capabilities)

- Major Players

STARLIMS

Sapio Sciences

Thermo Fisher Scientific

LabWare

LabLynx

Autoscribe Informatics

CrelioHealth

HiAdvance

Datamine Software

L7 Informatics

HashMicro

SAP

Oracle Health

IBM Watson Health

Microsoft Azure Health Data Services

- Laboratory Data Usage Patterns

- Procurement & Budget Cycles

- Integration Criteria & Buying Triggers

- Pain Points & Decision Drivers

- Case Studies

- Forecast by Revenue 2026-2030

- Forecast by Deployment Trends 2026-2030

- Adoption Scenarios 2026-2030

- Expected Growth by Segment 2026-2030