Market Overview

The Philippines laboratory data security and privacy market is valued at USD ~ million in 2025, with projections to grow at a steady pace. The growth of this market is driven by increasing regulatory requirements for data protection, such as the Data Privacy Act of 2012, and the rise in cybersecurity threats targeting laboratory data. The adoption of cloud computing solutions by healthcare and research laboratories is also contributing to market growth. Furthermore, the integration of advanced technologies such as AI and blockchain in laboratory data management systems plays a key role in improving data security and privacy in the Philippines.

The dominant regions in the Philippines market for laboratory data security and privacy are Metro Manila, Davao, and Cebu. Metro Manila, being the capital region, is the primary hub for business and government activities, including healthcare, research, and pharmaceuticals. As the country’s largest economic zone, it has the highest concentration of laboratories, making it a significant driver of demand for laboratory data security solutions. Meanwhile, Davao and Cebu are emerging as important regional centers for business and healthcare innovation, leading to an increased need for robust data privacy solutions.

Market Segmentation

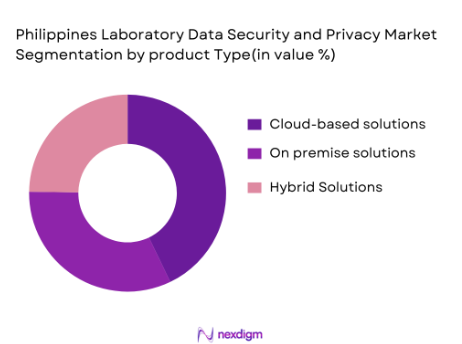

By Product Type

The Philippines laboratory data security market is segmented into cloud-based solutions, on-premise solutions, and hybrid solutions. Cloud-based solutions are currently the dominant product type in the market due to the widespread adoption of cloud computing and storage in laboratories. The flexibility, scalability, and cost-effectiveness of cloud services make them a preferred choice, especially for healthcare and research organizations looking for secure, easily accessible, and cost-efficient data management solutions.

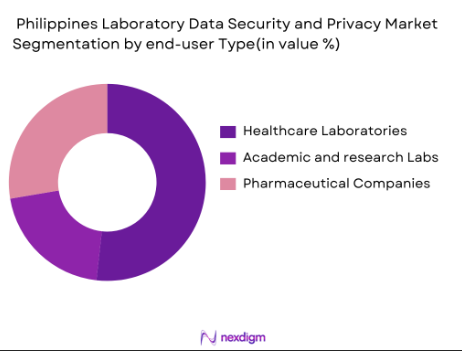

By End User

The end users of laboratory data security solutions in the Philippines are primarily healthcare laboratories, academic and research institutions, and pharmaceutical companies. Healthcare laboratories dominate this segment as they store large volumes of sensitive patient data, requiring stringent security measures. Academic and research institutions are also significant users due to their involvement in high-volume data analysis and the need for compliance with research regulations.

Competitive Landscape

The Philippines laboratory data security and privacy market is moderately fragmented, with both local and international players competing for market share. Major players in this space include global cybersecurity firms such as IBM, Microsoft, and Palo Alto Networks, as well as local cybersecurity providers like Secure Data PH and InfoSec Solutions. These companies offer a wide range of data security services, including cloud encryption, identity management, and compliance with local data privacy laws.

| Company | Establishment Year | Headquarters | Market Presence | Key Product/Service | Security Certifications | Client Types |

| IBM | 1911 | Armonk, NY, USA | – | – | – | – |

| Microsoft | 1975 | Redmond, WA, USA | –

|

–

|

–

|

–

|

| Palo Alto Networks | 2005 | Santa Clara, CA, USA | –

|

–

|

–

|

–

|

| SecureDataPH | 2012 | Makati, Philippines | –

|

–

|

–

|

–

|

| InfoSec Solutions | 2015 | Manila, Philippines | –

|

–

|

–

|

–

|

Philippines Laboratory Data Security and Privacy Market Analysis

Growth Drivers

Increasing Data Breaches and Cybersecurity Concerns

The increasing frequency of data breaches and cybersecurity incidents has become a major driver in the Philippines laboratory data security market. In 2023, the Philippines saw a rise in cyberattacks, with over 80% of data breaches globally being related to healthcare and research data. These breaches pose significant threats to confidential laboratory information, driving the need for advanced security systems. The government and private sector are responding by increasing investments in cybersecurity measures. As of 2024, the Philippines government has allocated funds to implement stronger cybersecurity policies and support technological infrastructure.

Rising Government Regulations on Data Security

Government regulations on data security, such as the Philippine Data Privacy Act of 2012, have significantly contributed to the growth of the laboratory data security market. These regulations mandate that laboratories, especially in healthcare and research sectors, must ensure the protection of sensitive data. Regulatory bodies are enforcing stricter compliance requirements, pushing laboratories to adopt robust data protection systems. By 2024, the Philippines government plans to tighten these regulations to enhance data privacy, thereby driving the demand for specialized data security solutions for laboratories.

Market Challenges

Lack of Skilled Cybersecurity Professionals

One of the major challenges to the growth of the laboratory data security market in the Philippines is the shortage of skilled cybersecurity professionals. In 2023, the Philippines faced a cybersecurity workforce gap of around 50,000 professionals, according to the National Privacy Commission. The lack of trained personnel to implement and manage advanced security systems is hindering laboratories’ ability to fully protect sensitive data. This skill gap is expected to persist, with growing demand for experts in encryption, data privacy laws, and cybersecurity technology solutions, making it harder to address emerging threats efficiently.

High Costs of Data Security Infrastructure

Laboratories in the Philippines face high upfront costs when implementing comprehensive data security solutions. In 2023, the average cost of setting up a secure data infrastructure for laboratories was approximately USD 200,000, including expenses related to system installation, software, and ongoing maintenance. While this investment is necessary, it remains a significant barrier, especially for smaller institutions with limited budgets. Despite the government’s support in cybersecurity funding, the financial burden continues to challenge widespread adoption of high-end data security measures across the sector.

Opportunities

Adoption of AI in Data Security Solutions

AI-powered solutions are rapidly being adopted in laboratory data security systems due to their ability to detect potential threats and breaches in real-time. AI can analyze large volumes of data quickly, allowing for faster identification of security issues. In 2023, the global market for AI-driven cybersecurity solutions was valued at over USD 10 billion, with the Philippines witnessing a rise in adoption in sectors like healthcare and research. The country’s push towards digitalization of its healthcare infrastructure is expected to accelerate the demand for AI-integrated data security systems, providing a substantial growth opportunity.

Government Support for Cloud Data Security

The Philippine government’s support for cloud-based security solutions is a significant growth opportunity for the laboratory data security market. The government’s digital transformation initiatives are promoting cloud adoption across various sectors, including healthcare and research. In 2023, the government introduced initiatives to encourage cloud data security solutions for laboratories to enhance data privacy and management. By 2024, the government plans to provide further funding and resources for cloud data security solutions, fostering a safer and more secure digital environment for laboratories.

Future Outlook

The market for laboratory data security and privacy in the Philippines is expected to experience steady growth over the next five years. This growth is primarily driven by the increasing volume of sensitive data generated by healthcare laboratories, along with stricter government regulations on data protection. Additionally, the growth of the digital healthcare sector and the rise of connected devices in laboratories are expected to further fuel demand for robust security solutions.

The rise in cybersecurity threats, particularly data breaches and ransomware attacks, also points toward the continued demand for advanced data security measures in the laboratory sector. As the healthcare and pharmaceutical industries continue to digitize, laboratories will prioritize secure cloud-based solutions that offer real-time access while maintaining compliance with data protection laws.

Major Players

- IBM

- Microsoft

- Palo Alto Networks

- SecureDataPH

- InfoSec Solutions

- Cisco Systems

- Fortinet

- FireEye

- Symantec

- Check Point Software Technologies

- McAfee

- Trend Micro

- CrowdStrike

- Bitdefender

- Kaspersky

Key Target Audience

- Investments and Venture Capitalist Firms

- Healthcare Laboratories (e.g., Diagnostic Centers, Medical Labs)

- Academic and Research Institutions

- Pharmaceutical Companies

- Government and Regulatory Bodies (e.g., Data Privacy Commission of the Philippines, Department of Health)

- Cybersecurity Solution Providers

- IT Consulting Firms Specializing in Data Security

- Cloud Service Providers (e.g., Amazon Web Services, Microsoft Azure)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves defining key variables influencing the Philippines laboratory data security and privacy market. This includes an assessment of market dynamics, key players, regulatory landscape, and the technological ecosystem in laboratory data security. We leverage secondary data, including government reports and industry publications, to map the critical factors driving market trends.

Step 2: Market Analysis and Construction

We gather and analyze historical data to construct a detailed picture of the laboratory data security landscape. This phase involves reviewing adoption rates of cloud and on-premise data security solutions and analyzing market penetration across various end-user industries such as healthcare, academic research, and pharmaceuticals.

Step 3: Hypothesis Validation and Expert Consultation

We validate market hypotheses by conducting expert consultations with industry leaders, IT professionals, and laboratory operators. These consultations provide insights into the demand for specific data security features and the challenges faced by laboratories in securing their data. These insights help refine and confirm the market trends identified.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data into a comprehensive market report. We combine primary and secondary research findings to ensure accuracy and reliability, providing actionable insights for stakeholders. The analysis is backed by quantitative data, providing clarity on the market’s current state and future prospects.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Data Breaches and Cybersecurity Concerns

Rising Government Regulations on Data Security

Growth in Healthcare and Research Labs - Market Challenges

Lack of Skilled Cybersecurity Professionals

High Costs of Data Security Infrastructure - Opportunities

Adoption of AI in Data Security Solutions

Government Support for Cloud Data Security - Trends

Adoption of Cloud-Based Security Solutions

Rise in Remote Work Leading to Increased Data Security Risks - Government Regulation

Data Protection Law Compliance

Healthcare Data Security Regulations

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Cloud-Based Solutions

On-Premise Solutions

Hybrid Solutions - By End User (In Value %)

Healthcare and Clinical Laboratories

Academic and Research Laboratories

Pharmaceuticals and Biotech Labs - By Deployment Model (In Value %)

Private Cloud

Public Cloud

Hybrid Cloud - By Region (In Value %)

Metro Manila

Cebu

Davao

Other Regions - By Security Type (In Value %)

Data Encryption

Identity & Access Management

Data Masking

Security Information and Event Management (SIEM)

- Market Share Analysis

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Product Type, Margins, Production Plant, Capacity, Unique Value Offering and Others)

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

IBM

McAfee

Microsoft

Palo Alto Networks

Trend Micro

Check Point Software Technologies

Fortinet

Cisco Systems

FireEye

Bitdefender

Crowd Strike

Symantec

Sophos

Kaspersky

Forcepoint

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030