Market Overview

The Philippines laboratory reporting systems market is projected to experience robust growth, driven by increasing healthcare infrastructure development and a growing demand for more efficient diagnostics. The market size is valued at USD ~ million in 2024, with significant investments in healthcare IT and laboratory technologies. The rise in healthcare awareness and the government’s efforts to improve healthcare services, along with the increasing prevalence of chronic diseases, have contributed significantly to the market’s growth. Key drivers include the adoption of Laboratory Information Systems (LIS) and advanced diagnostic reporting tools by hospitals and diagnostic centers across the country, along with the expanding role of Artificial Intelligence (AI) and machine learning in diagnostic reporting and automation.

Metro Manila and Cebu are the dominant regions in the Philippines laboratory reporting systems market due to their high population density, advanced healthcare facilities, and technological infrastructure. Metro Manila, the capital region, houses the largest concentration of hospitals and diagnostic centers, which are investing heavily in digital transformation. Cebu, being a major economic hub in the Visayas, also sees significant adoption of laboratory reporting systems due to expanding healthcare services in both public and private sectors. The dominance of these cities is a result of their strategic importance in the healthcare industry, coupled with government initiatives focusing on healthcare digitization.

Market Segmentation

By Solution Type

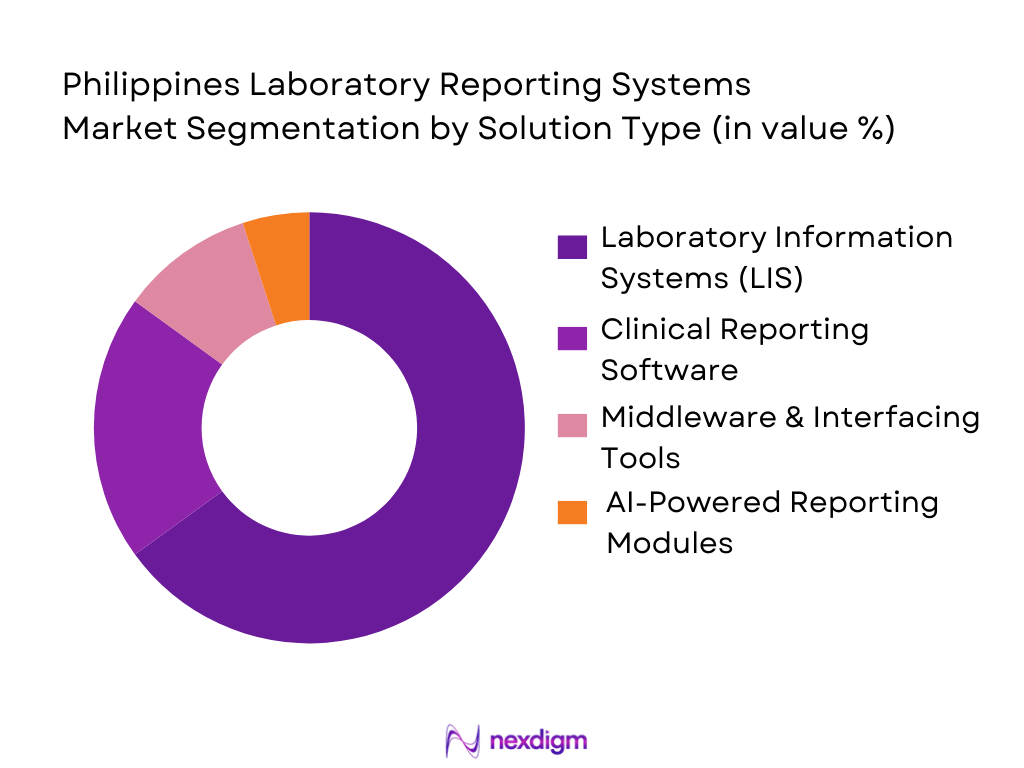

The Philippines laboratory reporting systems market is segmented by solution type into Laboratory Information Systems (LIS), Clinical Reporting Software, Middleware & Interfacing Tools, and AI-Powered Reporting Modules. Among these, LIS has the largest share, driven by its widespread adoption across hospitals and diagnostic laboratories. LIS facilitates seamless integration of diagnostic data and improves laboratory workflow, making it the preferred choice for healthcare providers. Clinical Reporting Software also has strong market traction, particularly in hospitals, as it enhances diagnostic report generation and supports clinical decision-making. Middleware and AI-Powered Reporting Modules are emerging trends in the market, but their adoption is still in the nascent stage compared to traditional LIS solutions.

By Deployment Model

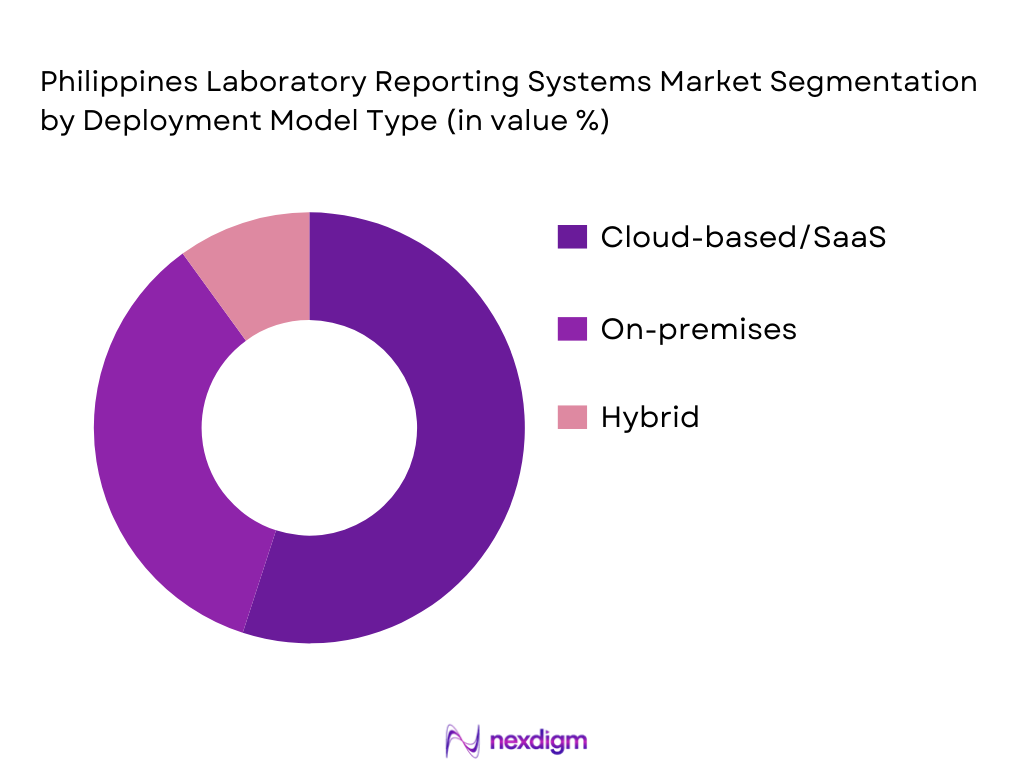

The deployment model segment in the Philippines laboratory reporting systems market is divided into Cloud-based/SaaS, On-premises, and Hybrid solutions. Cloud-based/SaaS solutions dominate the market due to their cost-effectiveness, ease of scalability, and flexibility in handling large volumes of data. Many smaller laboratories and healthcare centers are increasingly adopting cloud-based systems as they offer a subscription-based model with lower upfront costs. On-premises deployment is more common in larger hospitals and reference laboratories, where data security concerns and integration with existing infrastructure are paramount. Hybrid solutions are gaining traction as they combine the benefits of both cloud and on-premises systems, offering better control and flexibility for healthcare providers.

Competitive Landscape

The Philippines laboratory reporting systems market is competitive, with both local and international players offering a wide range of products and services. The market is dominated by key global players such as Cerner, Siemens Healthineers, and Oracle, alongside local companies like Healthcare IT Philippines. These companies dominate due to their strong market presence, technological expertise, and ability to customize their offerings for the unique needs of the Philippine healthcare market.

| Company | Establishment Year | Headquarters | Product Offerings | Technological Focus | Market Reach | Customer Base |

| Cerner Corporation | 1979 | Kansas City, USA | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Erlangen, Germany | ~ | ~ | ~ | ~ |

| Oracle | 1977 | Redwood Shores, USA | ~ | ~ | ~ | ~ |

| Healthcare IT Philippines | 2015 | Quezon City, Philippines | ~ | ~ | ~ | ~ |

| McKesson | 1833 | Irving, Texas, USA | ~ | ~ | ~ | ~ |

Philippines Laboratory Reporting Systems Market Analysis

Growth Drivers

Urbanization

Urbanization in the Philippines continues to accelerate, with the urban population in Metro Manila reaching ~ million in 2025, constituting approximately ~ of the total Philippine population of ~ million (World Bank). The expansion of cities like Cebu and Davao also contributes to this trend, leading to increased demand for healthcare services and advanced laboratory reporting systems. Urbanization enhances accessibility to healthcare facilities, where modern laboratory reporting tools are crucial for improved diagnostics. As healthcare infrastructure expands to meet the needs of the growing urban population, the demand for automation in laboratories is poised to rise. The availability of urban healthcare services strengthens the need for efficient, digital solutions like Laboratory Information Systems (LIS).

Industrialization

The rapid industrialization of the Philippines is driving economic growth, with the industrial sector accounting for ~ of the GDP in 2025 (Philippine Statistics Authority). The growth of industrial hubs such as Cebu and Davao is expanding the demand for skilled labor and efficient diagnostic solutions, particularly in sectors like healthcare, pharmaceuticals, and manufacturing. Industrialization contributes to the growing demand for high-tech medical infrastructure, including advanced diagnostic laboratories. With increasing industrial output, there is also an associated rise in environmental and health concerns, further boosting the need for precise diagnostic reporting. As the industrial sector grows, so does the necessity for robust laboratory reporting systems to maintain public health standards.

Restraints

High Initial Costs

The initial cost of deploying advanced laboratory reporting systems remains a significant barrier for smaller healthcare facilities. Hospitals and diagnostic centers, particularly in rural areas, face challenges in justifying the high upfront capital required for these systems. With healthcare spending estimated at PHP ~ billion in 2025, the allocation for digital infrastructure remains limited, especially in lower-income regions (Department of Health, Philippines). The cost of installation, training, and maintenance for systems like LIS can range from PHP ~ million to PHP ~ million, which is a significant financial burden for smaller labs that rely on manual reporting methods. As the government focuses on expanding healthcare services, this cost remains a key restraint to wider adoption.

Technical Challenges

Technical challenges, including data interoperability and system integration, pose a significant hurdle for the Philippines’ laboratory reporting systems market. Hospitals often have legacy systems that are not compatible with modern LIS, making it difficult to streamline data exchange. In addition, ~ of hospitals in the Philippines still rely on paper-based records for patient data management. These technical issues lead to inefficiencies and delays in reporting, which undermine the benefits of adopting advanced systems. Furthermore, a lack of skilled IT personnel to manage complex laboratory reporting systems exacerbates this problem, slowing down digital transformation efforts.

Opportunities

Technological Advancements

Technological advancements present a significant opportunity for the Philippines laboratory reporting systems market. In 2025, the country saw a surge in cloud adoption, with cloud-based IT services accounting for PHP 50 billion in revenue (National ICT Confederation of the Philippines). These advancements are particularly important for the healthcare sector, where cloud-based LIS can reduce costs, enhance data security, and enable real-time reporting across multiple healthcare centers. As hospitals and diagnostic centers modernize their infrastructure, the need for innovative, scalable solutions is growing. Additionally, AI and machine learning applications in diagnostic reporting are increasingly being implemented, offering further market growth opportunities.

International Collaborations

International collaborations in healthcare technology are poised to drive the Philippines laboratory reporting systems market forward. In 2025, the Philippines signed multiple agreements with international healthcare tech providers, focusing on enhancing the country’s healthcare digital infrastructure. These partnerships provide access to advanced laboratory technologies, which are essential for the modernization of reporting systems. For instance, the Philippine government collaborated with the World Health Organization (WHO) and other international entities to implement health IT systems designed to improve data accuracy and management. This trend is expected to foster the integration of more advanced laboratory reporting systems, providing a significant growth opportunity for the market

Future Outlook

Over the next 5 years, the Philippines laboratory reporting systems market is expected to witness substantial growth, driven by continuous advancements in healthcare IT, government initiatives for health sector modernization, and increasing demand for automation and AI-based solutions. The market will likely see increased adoption of cloud-based solutions and AI-powered clinical reporting tools as healthcare providers look to enhance operational efficiency, improve diagnostic accuracy, and comply with regulatory standards. Additionally, the expansion of regional healthcare infrastructures, particularly in Metro Manila and the Visayas, will propel the market forward.

Major Players in the Market

- Cerner Corporation

- Siemens Healthineers

- Oracle

- McKesson

- Healthcare IT Philippines

- GE Healthcare

- Fujifilm

- LabWare

- SoftTech

- Meditech

- Honeywell Healthcare

- Philips Healthcare

- Cognizant

- Change Healthcare

- Optum

Key Target Audience

- Healthcare Providers (Hospitals, Diagnostic Labs, Research Facilities)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (DOH – Department of Health)

- Medical Equipment and Healthcare IT Integrators

- Medical Device Manufacturers

- Pharmaceutical Companies

- Healthcare Insurance Providers

- Private Health Clinics and Laboratory Owners

Research Methodology

Step 1: Identification of Key Variables

The first step in our research process involves identifying the core factors influencing the laboratory reporting systems market in the Philippines. These include the adoption rates of LIS, regulatory challenges, the impact of AI technology, and infrastructure development within healthcare. Extensive desk research is conducted to create an ecosystem map to analyze the various stakeholders and their role in the market.

Step 2: Market Analysis and Construction

This phase involves gathering historical data from government reports, healthcare provider surveys, and market intelligence reports to create a comprehensive market model. The focus is on tracking the market dynamics, adoption rates of laboratory reporting systems, and pricing trends among key segments.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are tested and refined through consultations with industry experts in hospital IT, diagnostic labs, and software vendors. These consultations help validate the assumptions made during the market construction phase and provide critical insights into the real-time market scenario.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all gathered data and insights into a cohesive and actionable market report. Direct engagements with stakeholders, including lab managers and healthcare providers, further refine the analysis to ensure the findings are practical and relevant to business decisions in the Philippines laboratory reporting systems market.

- Executive Summary

- Research Methodology (Definitions and Assumptions, Abbreviations and Acronyms, Market Sizing & Forecast Methodology (Value, Volume, Adoption Rate), Data Collection Framework (Primary Interviews, Lab IT Adoption Surveys), Forecast Confidence and Error Margins, Secondary Data Sources, Limitations and Validation)

- Market Genesis & Evolution Drivers

- Product & Technology Lifecycle (LIS, Diagnostic Reporting Tools, Middleware, AI‑assisted Reporting)

- Healthcare Ecosystem Integration (Hospital IT, Diagnostic Lab Networks, Public Health Reporting Interfaces)

- Laboratory Reporting Value Chain & Workflow Mapping

- Market Drivers

Digital Health System Push (Health IT Modernization)

Demand for Rapid, Accurate Clinical Diagnostics

Regulatory Compliance Requirements (Data Standards, DOH Reporting)

Universal Health Care Policy Impacts

Chronic Disease Prevalence & Diagnostic Testing Growth (Cancer, Diabetes, CVD)

- Market Restraints

Interoperability Complexities (HIS/EHR/LIS)

Implementation Cost Barriers

Cybersecurity & Data Privacy Risks

Skilled IT Workforce Shortage

Legacy Lab Process Resistance

- Technology & Innovation Trends

AI/ML‑Assisted Reporting & Predictive Diagnostics

Cloud‑Native & Edge Computing Reporting Platforms

Mobile & Remote Reporting Access

Interoperable APIs and Standardized Data Exchange (FHIR, HL7)

Real‑Time Data Analytics dashboards & KPI monitoring

- Regulatory Framework & Compliance

Philippine DOH IT Standards

Data Security & PH Health Privacy Laws

Accreditation Requirements (Clinical & Reporting Accuracy)

Reporting Mandates for Public Health Surveillance

Quality Management System Standards (ISO, CLSI0

Industry Structure & Ecosystem

Stakeholder Mapping (Labs, Providers, Governments)

Healthcare IT Channel Partnerships

Training & Support Networks

Value Chain Interactions

- SWOT & Strategic Framework

- Porter’s Five Forces Analysis

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Solution Type (In Value %)

Laboratory Information Systems (LIS)

Clinical Reporting Software

Middleware & Interfacing Tools

AI/ML‑Powered Reporting Modules

Cloud vs On‑Premise Platforms

- By Deployment Model (In Value %)

Cloud‑Hosted / SaaS

On‑Premises

Hybrid

- By End User (In Value %)

Hospital Lab Networks

Standalone Diagnostic Laboratories

Public Health & Government Clinics

Research & Academic Labs

Specialized Reference Testing Centers

- By Integration Type (In Value %)

HIS/LIS Integration

EHR / EMR Linked ReportingPoint‑of‑Care Reporting Interfaces

External Lab Data Sharing

- Competitive Analysis – Market Share & Performance

- Market Share by Value & Deployments (Local & Multinational)

- Cross‑Comparison Parameters (Market Position, Product Innovations, Regulatory Compliance Features, Client Coverage, Integration Capabilities, Pricing Models, Deployment Speed, Support & Training, Cloud Adoption, Reporting Accuracy Benchmarks)

- Detailed Profiles of Key Industry Player

Cerner Corporation

Epic Systems

McKesson (Change Healthcare)

Siemens Healthineers (LIS Solutions)

Oracle Health / Sunquest Information Systems

Thermo Fisher Scientific (LIS & Reporting)

LabWare

Orchard Software

CompuGroup Medical

MEDITECH

Healthcare IT Philippines / Local Integrators

iQor (Healthcare Reporting)

Qure.ai / AI Reporting Platforms

Nucleus Software Systems (Regional)

Local Startups in Cloud LIS & Reporting

- Data Security Certification Levels

- Local Support Footprint

- Custom Analytics Modules

- Mobile Access & Offline Capabilities

- AI Reporting Modules

- User Satisfaction Index

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030