Market Overview

The Philippines Laboratory Workflow Management Solutions market is valued at approximately USD ~, with significant growth stemming from increasing investments in healthcare infrastructure and technology adoption in laboratories. Driven by the growing demand for laboratory automation, digital transformation in clinical diagnostics, and the increasing need for compliance with global and local regulations, such as those set by the Department of Health (DOH) and the Food and Drug Administration (FDA) Philippines, the market is expanding rapidly. In addition, the rise of e-health solutions and cloud-based laboratory information management systems (LIMS) is propelling the market forward. These advancements are helping laboratories improve efficiency, data accuracy, and operational workflow, and further fueling growth.

Metro Manila and key urban centers, such as Cebu and Davao, dominate the laboratory workflow management solutions market in the Philippines. Metro Manila, being the capital and economic hub, is home to the largest number of hospitals, clinics, and research facilities, which demand the latest laboratory management technologies. Furthermore, Metro Manila’s higher concentration of technology and healthcare startups accelerates the adoption of digital tools and automation in laboratory workflows. The government’s initiatives to modernize public health infrastructure, along with the Philippines’ growing healthcare sector, positions these cities as central players in the market.

Market Segmentation

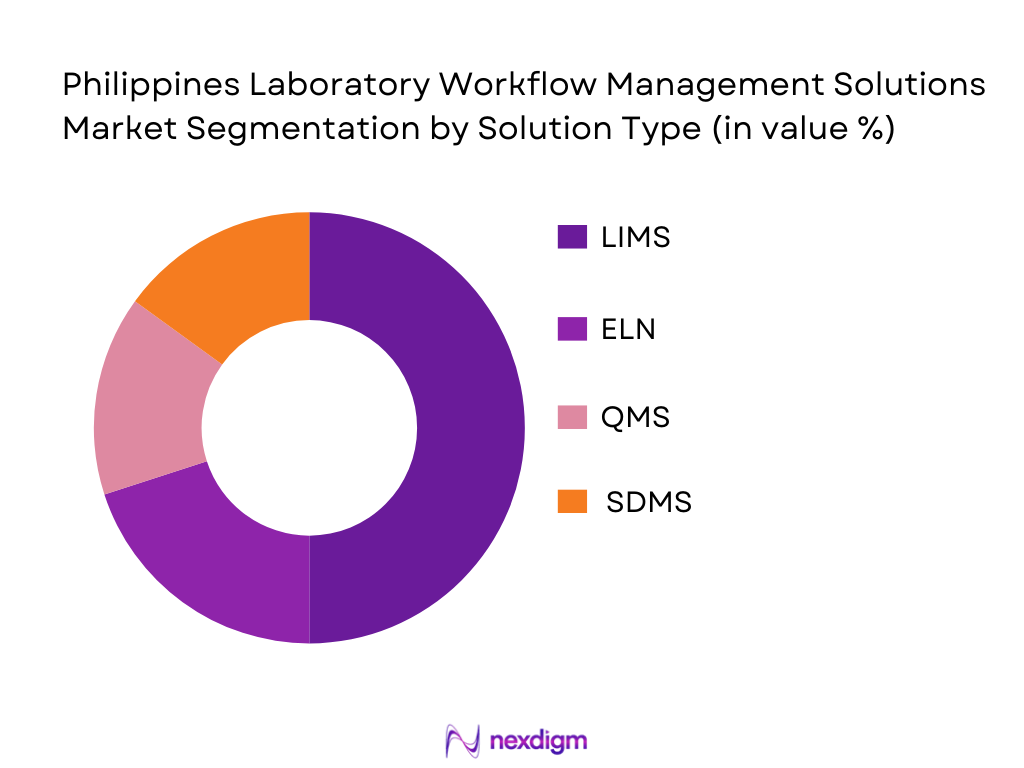

By Solution Type

The Philippines Laboratory Workflow Management Solutions market is segmented by solution type into Laboratory Information Management Systems (LIMS), Electronic Laboratory Notebooks (ELN), Quality Management Systems (QMS), and Scientific Data Management Systems (SDMS). Among these, LIMS has a dominant market share, driven by its widespread adoption across clinical and pharmaceutical laboratories. LIMS solutions offer streamlined sample tracking, regulatory compliance, and efficient data handling, which make them highly suitable for the growing number of diagnostics and research labs in the country. The rise of cloud-based LIMS systems has also increased accessibility and scalability for laboratories of all sizes.

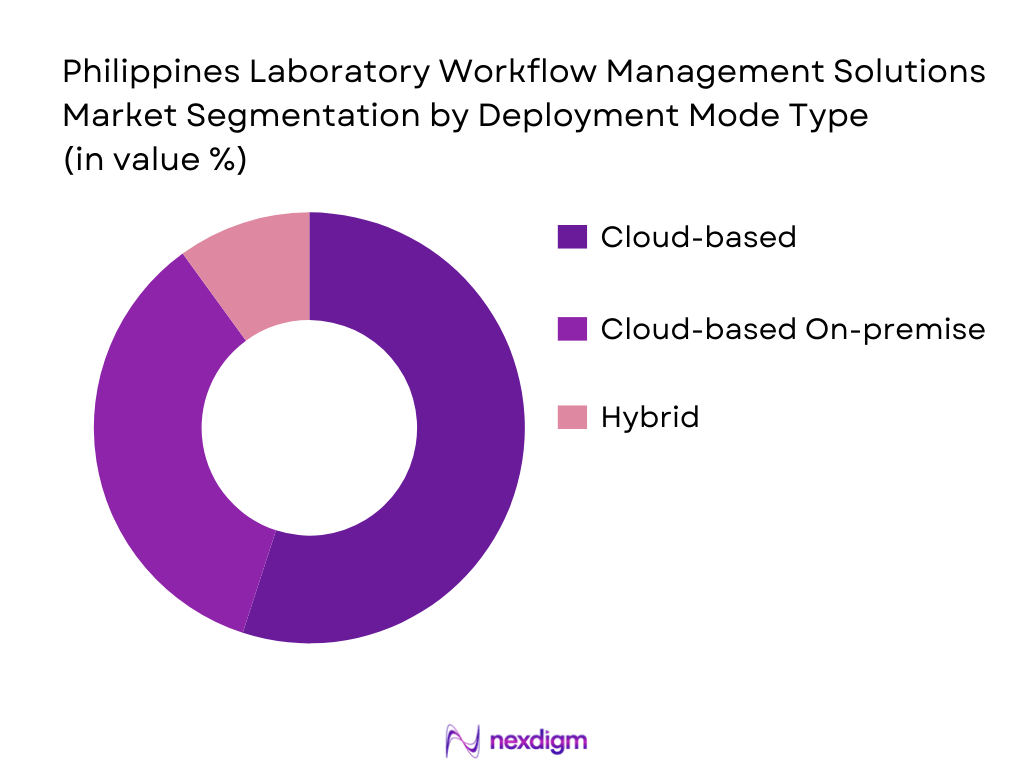

By Deployment Mode

The market is segmented into cloud-based, on-premises, and hybrid deployment models. The cloud-based segment dominates due to its flexibility, scalability, and cost-effectiveness, allowing laboratories to scale their operations without significant upfront capital expenditures. The cloud-based model also facilitates remote access, which has become increasingly important in the wake of the COVID-19 pandemic. Moreover, the ability to integrate cloud systems with laboratory instruments and equipment further enhances the efficiency and automation of laboratory workflows.

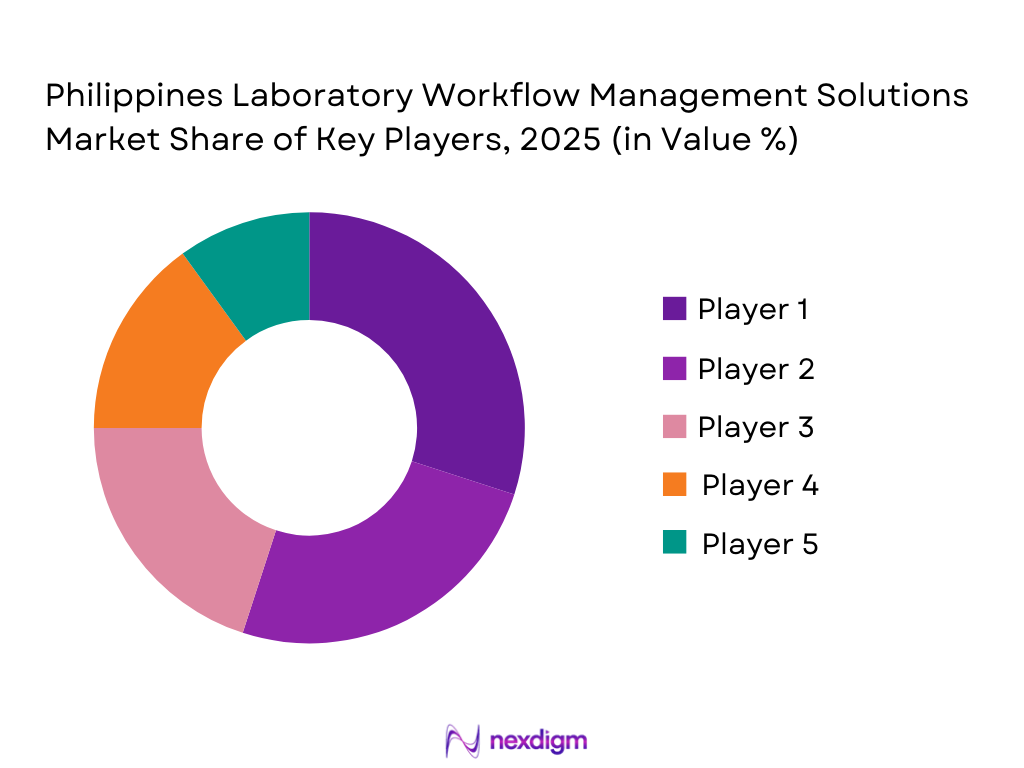

Competitive Landscape

The Philippines Laboratory Workflow Management Solutions market is competitive, with a few key players dominating the landscape. Companies such as Thermo Fisher Scientific, LabWare, and LabVantage Solutions are at the forefront, offering a range of solutions from LIMS to ELN and SDMS. Local players, like CrelioHealth and Manila-based tech companies, are also gaining traction due to their tailored solutions for the Philippine market. The competitive landscape emphasizes the importance of local market knowledge and regulatory compliance, which gives companies a regional presence a significant advantage.

| Company | Establishment Year | Headquarters | Deployment Options | Market Focus | Regulatory Compliance | Revenue |

| Thermo Fisher Scientific | 1956 | USA | ~ | ~ | ~ | ~ |

| LabWare | 1999 | USA | ~ | ~ | ~ | ~ |

| LabVantage Solutions | 1999 | USA | ~ | ~ | ~ | ~ |

| CrelioHealth | 2016 | Philippines | ~ | ~ | ~ | ~ |

| Scispot | 2016 | USA | ~ | ~ | ~ | ~ |

KSA Automotive Chassis Market Analysis

Growth Drivers

Urbanization

Urbanization in the Philippines continues to accelerate, which positively impacts the demand for laboratory workflow management solutions, especially in Metro Manila and other key cities. According to the World Bank, over ~% of the Philippines population resides in urban areas, with significant growth expected in urban populations. This urbanization is creating a higher demand for modern healthcare infrastructure, including laboratories that require efficient and automated workflow management solutions. As cities grow, healthcare facilities need to cater to more patients, thereby increasing the demand for automated and streamlined laboratory processes. The ongoing urban expansion directly supports the growth of laboratory management solutions.

Industrialization

The Philippines has seen significant industrialization, particularly in its manufacturing and pharmaceutical sectors. As industrial activities expand, there is an increased need for laboratories to meet testing, quality control, and research demands. Industrialization leads to the creation of more labs within various sectors, which in turn drives the need for automated solutions. As of 2024, the industrial sector in the Philippines contributed nearly ~ of GDP, reflecting the growing demand for more laboratory processes in research and development. Laboratories are adopting workflow management solutions to streamline operations, ensure compliance, and maintain high standards of quality control, thus propelling market growth.

Restraints

High Initial Costs

Despite the numerous benefits of laboratory workflow management solutions, the high initial costs associated with the adoption of these systems are a significant restraint for many laboratories in the Philippines. According to the Philippine Economic Zone Authority (PEZA), the high upfront investment required for purchasing and implementing advanced LIMS and related systems remains a key barrier for smaller laboratories, particularly in rural or less developed areas. In 2022, the Philippines government reported that the average cost of implementing a fully integrated system in a medium-sized laboratory could exceed PHP 1 million, which is a substantial burden for many labs that are operating under tight budgets.

Technical Challenges

The adoption of laboratory workflow management solutions is hindered by technical challenges, including the integration of new systems with existing legacy equipment. A report from the Department of Science and Technology (DOST) highlighted that over ~% of laboratories in the Philippines still rely on outdated systems, making it difficult to incorporate modern, automated workflows. This slow adoption rate stems from the incompatibility of old infrastructure with newer, more advanced solutions, causing delays and higher implementation costs. Additionally, the shortage of skilled technicians to maintain and troubleshoot these systems further compounds the technical difficulties.

Opportunities

Technological Advancements

Technological advancements offer significant opportunities for growth in the Philippines Laboratory Workflow Management Solutions market. The ongoing rise of AI and machine learning, coupled with advancements in cloud computing, is transforming laboratory operations. A recent study by the National Economic and Development Authority (NEDA) showed that as of 2024, ~% of Philippine laboratories have adopted cloud-based systems, with AI-powered solutions enhancing data accuracy and processing speed. The government’s initiatives to boost digital infrastructure and promote the adoption of tech-driven solutions in laboratories are expected to drive the widespread adoption of advanced laboratory management systems.

International Collaborations

International collaborations present a major opportunity for the Philippines to enhance its laboratory infrastructure and adopt advanced workflow management solutions. The Philippines is increasingly participating in global partnerships aimed at improving healthcare technology. As of 2024, the Philippines has engaged in over ~ bilateral agreements related to healthcare modernization, including collaborations with international organizations for technology transfer and training. These partnerships help Philippine laboratories access state-of-the-art solutions and methodologies, accelerating the adoption of laboratory workflow management solutions. Such collaborations are expected to stimulate further market development and adoption of advanced systems.

Future Outlook

The Philippines Laboratory Workflow Management Solutions market is expected to experience robust growth over the next several years. This growth is driven by a continued push towards digitalization in healthcare and laboratory settings. Government initiatives aimed at improving healthcare infrastructure, including funding for the adoption of automated solutions, will accelerate this trend. Additionally, increasing demand for higher accuracy, faster turnaround times, and improved compliance in laboratories will further boost market growth. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) in laboratory workflows is set to reshape the industry, introducing advanced data analytics and predictive capabilities that enhance laboratory efficiency and decision-making.

Over the next 5 years, the Philippines Laboratory Workflow Management Solutions market is projected to expand significantly, supported by advancements in technology and increased government support for modernization in the healthcare sector.

Major Players in the Market

- Thermo Fisher Scientific

- LabWare

- LabVantage Solutions

- CrelioHealth

- Scispot

- STARLIMS

- PerkinElmer

- Agilent Technologies

- Dassault Systèmes BIOVIA

- Watson-Marlow

- Bio-Rad Laboratories

- Becton Dickinson

- Medtronic

- Siemens Healthineers

- Abbott Laboratories

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Health [DOH], Food and Drug Administration [FDA])

- Healthcare Providers (Hospitals, Diagnostic Centers)

- Pharmaceutical Companies

- Biotech Research Firms

- Contract Research Organizations (CROs)

- IT Decision-Makers in Healthcare

- Laboratory Equipment Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that identifies key stakeholders within the Philippines laboratory workflow management solutions market, such as healthcare providers, biotech firms, and government bodies. Secondary research and proprietary databases are used to gather insights on market trends, competitor actions, and the regulatory landscape.

Step 2: Market Analysis and Construction

We collect and analyze historical data to determine market size and segmentation by solution type, deployment mode, and region. We also assess the adoption rates of laboratory automation solutions across different sectors, including diagnostics and research labs, ensuring the accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

We will validate market hypotheses through expert interviews with industry professionals, such as laboratory managers and decision-makers in the healthcare sector. These consultations will provide operational and financial insights, ensuring the data aligns with real-world market behavior.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with laboratory solution vendors to validate the research data and gain deeper insights into product performance, client needs, and market penetration. This interaction, combined with industry data, will provide a comprehensive and accurate analysis of the Philippines laboratory workflow management solutions market.

- Executive Summary

- Research Methodology (Definitions of market sizing, assumptions, data sources, primary research taxonomy, data integrity checks, estimation models)

- Solution Landscape (LIMS, ELN, SDMS, QMS, Workflow Automation)

- Technology Stack Overview (Cloud, On‑Premise, Hybrid, AI‑enabled)

- Workflow Management Value Proposition

- Industry Genesis & Evolution in Philippine

- Early Adoption Patterns in Clinical & Research Labs

- Migration from Paper & Legacy Systems to Digital Platforms

- Timeline of Major Technology Milestones

- Business Cycle Analysis

- Buyer Procurement Cycle (Enterprise Labs, CROs, Academic Labs)

- Renewal & Upgrade Cycles

- Growth Drivers

Demand for Workflow Standardization & Quality Traceability

Regulatory Compliance (DOH, FDA Philippines, ISO 17025)

Cloud Adoption for Collaboration & DR/BCP - Market Challenges

Legacy System Integration Friction

Budget Constraints in Public Labs

Skills Gap for Informatics Platforms - Opportunities

AI‑Enabled Analytics & Predictive Maintenance

Mobile & Field‑Enabled Laboratory Workflows

Biotech Expansion & Genomics Workflows - Trends

Rise of SaaS‑First Workflow Platforms

IoT & Instrument Connectivity

Real‑Time Remote Monitoring - Regulatory & Compliance

Regulatory Standards Overview (Philippines DOH, FDA)

Data Security & Audit Trail Requirements - SWOT Analysis

- Ecosystem Mapping (Stakeholders)

- Porter’s Five Forces

- Value Chain Profit Pools

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Solution Type (In Value %)

Laboratory Information Management Systems (LIMS)

Electronic Laboratory Notebooks (ELN)

Quality Management Systems (QMS)Scientific Data Management Systems (SDMS)

Integrated Workflow Platforms - By Deployment Mode (In Value %)

Cloud‑Hosted (SaaS/PaaS)

On‑Premise

Hybrid - By End User (In Value %)

Clinical Diagnostic Laboratories

Pharmaceutical & Biotechnology Labs

Contract Research Organizations (CROs)

Academic & Government Research Labs

Environmental & Food Testing Labs - By Organization Size (In Value %)

SMEs & Regional Labs

Large Enterprise Labs

Multi‑Location Networks

- Market Share Analysis (Value & Volume)

- Cross Comparison Parameters (Product Portfolio Breadth (LIMS, ELN, QMS, SDMS), Workflow Automation Capabilities, Cloud vs On‑Premise Deployment Strength, Regulatory Compliance Support (DOH/FDA Philippines, ISO), Integration with Instruments & IoT Devices, Pricing & Licensing Models, Local Support & Service Footprint (Philippines presence), Customer Retention & Renewal Rates)

- SWOT of Key Competitors

- Pricing & SKU Analysis (Software Tiering, Support, Add‑ons, Subscription vs Perpetual)

- Detailed Company Profiles

Thermo Fisher Scientific (LIMS & Workflow Solutions)

LabWare (Global LIMS Leader)

LabVantage Solutions (Integrated LIMS & ELN)

STARLIMS (Advanced Workflow Automation)

Agilent Technologies (Lab Informatics & Integration)

Scispot (Next‑Gen Workflow Platform)

CrelioHealth LIMS (Philippines‑focused Adoption)

CloudLIMS (Cloud‑Native LIMS)

L7 Informatics (Unified Scientific Data Layer)

Dassault Systèmes BIOVIA (Enterprise Workflow Suite)

PerkinElmer (Lab Informatics)

SAPio Sciences (Workflow & SDMS)

Abbott Informatics (TrakCare/LIMS Integrations)

LabLynx (Modular LIMS Solutions)

Autoscribe Informatics (Configurable LIMS)

- Adoption Drivers by User Segment

- Budget Allocations & IT Procurement Patterns

- Unmet Needs & Workflow Pain Points

- Decision Making Buying Process

- ROI Assessment by Lab Type

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030