Market Overview

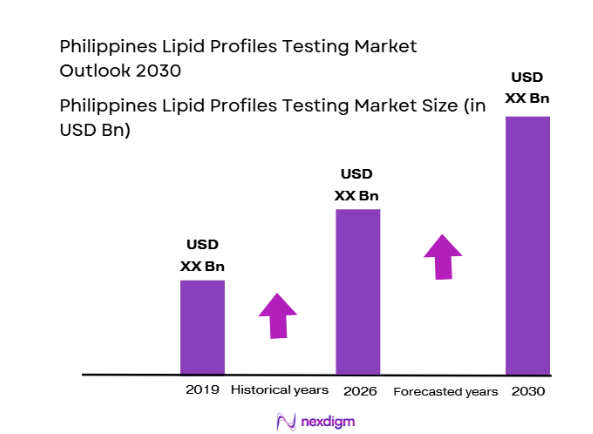

The Philippines Lipid Profiles Testing Market was valued at approximately USD ~million in 2025, driven by increasing health awareness, rising cardiovascular diseases, and government health initiatives. The market is propelled by the growing focus on preventive healthcare and early detection of lipid-related disorders such as cholesterol imbalances, which can lead to cardiovascular diseases. The government’s push for universal health coverage through programs such as PhilHealth has made these testing services more accessible, further expanding market growth. The increasing number of healthcare institutions offering lipid profile testing and technological advancements in diagnostic tools are significant contributors to the market’s growth.

Metro Manila dominates the Philippines Lipid Profiles Testing Market due to its concentration of healthcare facilities, advanced diagnostic laboratories, and a higher proportion of health-conscious individuals. In addition to Metro Manila, regions such as Cebu and Davao are seeing significant growth due to their increasing healthcare infrastructure and urbanization. The prevalence of lifestyle diseases, such as hypertension and diabetes, which are commonly associated with lipid profile imbalances, is also higher in urban areas. This leads to a greater demand for diagnostic testing services in these regions.

Market Segmentation

By Test Type

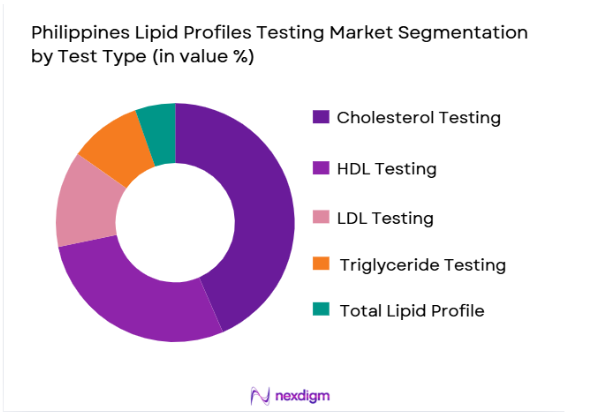

The Philippines Lipid Profiles Testing Market is primarily segmented into cholesterol testing, HDL testing, LDL testing, triglyceride testing, and total lipid profile. Among these, cholesterol testing holds the dominant market share. Cholesterol testing is particularly popular due to its widespread use in diagnosing cardiovascular risk factors and the easy availability of testing equipment in both public and private healthcare institutions. Moreover, with rising awareness about the dangers of high cholesterol levels leading to heart attacks and strokes, individuals are increasingly opting for regular cholesterol testing as part of preventive healthcare. This has driven the growth of cholesterol testing over other types of lipid profile tests.

By Application

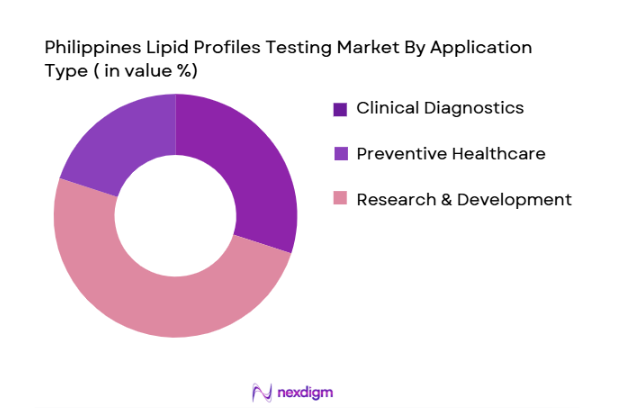

The market is segmented by application into clinical diagnostics, preventive healthcare, and research & development. Preventive healthcare holds a significant share of the market, as individuals increasingly seek lipid profile testing to monitor their cholesterol levels and prevent cardiovascular diseases. Preventive healthcare has gained traction due to heightened awareness about lifestyle diseases and their management through early detection. Healthcare providers and diagnostic centers emphasize preventive care, especially in urban areas where chronic conditions are more prevalent. Preventive lipid testing is promoted by both public health initiatives and private healthcare companies as part of wellness checks for various age groups.

Competitive Landscape

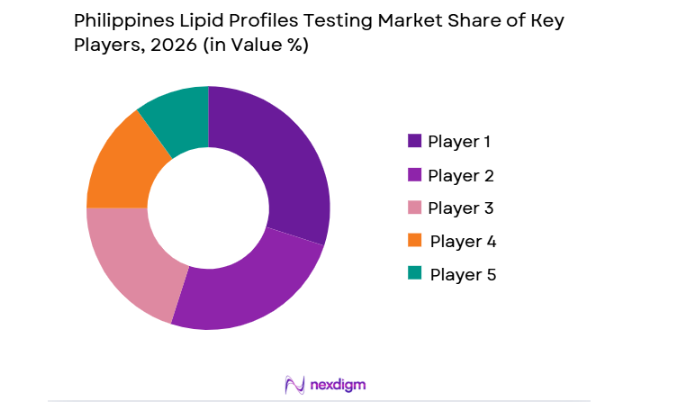

The Philippines Lipid Profiles Testing Market is characterized by competition among both local and international players offering diagnostic services. Major players in the market include diagnostic chains and hospitals that provide lipid testing services. These organizations often have a robust network of healthcare professionals and modern testing technologies, ensuring accurate results and widespread availability. Local players dominate the market with their familiarity with regulatory guidelines and tailored services for the Filipino population. Additionally, global players such as LabCorp and Quest Diagnostics have expanded their footprint in the country, offering advanced testing methods and international standardization.

| Company Name | Establishment Year | Headquarters | Testing Technology | Market Reach | R&D Investment | Customer Base |

| Unilab | 1945 | Quezon City | ~ | ~ | ~ | ~ |

| St. Luke’s Medical | 1995 | Quezon City | ~ | ~ | ~ | ~ |

| The Medical City | 1975 | Metro Manila | ~ | ~ | ~ | ~ |

| LabCorp | 1969 | USA | ~ | ~ | ~ | ~ |

| Quest Diagnostics | 1967 | USA | ~ | ~ | ~ | ~ |

Philippines Lipid Profiles Testing Market Analysis

Growth Drivers

Urbanization

Urbanization in the Philippines has rapidly increased over the past decade, with Metro Manila’s population growing by approximately ~% annually. In 2025, around ~million people were residing in Metro Manila, accounting for nearly ~% of the country’s total population. The rise in population density is correlated with an increased demand for healthcare services, including lipid profile testing, as urban areas experience higher rates of cardiovascular diseases. This urbanization trend boosts demand for regular health check-ups and preventive tests, including lipid profiles. As cities grow, public and private healthcare facilities continue to expand their testing services, especially in urban centers. According to the Philippine Statistics Authority, the urban population reached ~million in 2025, contributing significantly to the growth of the healthcare market.

Industrialization

The Philippines has experienced robust industrial growth in recent years. In 2025, the country’s industrial sector contributed approximately ~% to the national GDP, with manufacturing and construction being the largest contributors. The rise of industrialization has led to higher rates of lifestyle diseases, including obesity and hypertension, which are closely linked to lipid profile disorders. As industries grow, employees increasingly seek lipid profile testing to monitor their cholesterol levels, especially in urban centers where industrial activity is concentrated. The demand for lipid profile testing services is further heightened by the industrial sector’s adoption of employee wellness programs that emphasize early health diagnostics.

Restraints

High Initial Costs

The high initial costs associated with setting up lipid profile testing labs and acquiring the necessary diagnostic equipment have been a barrier to the widespread availability of such tests, particularly in rural areas. In 2025, the average cost of setting up a fully equipped diagnostic laboratory in the Philippines ranged from PHP 5 million to PHP ~ million, depending on the scale of operations. This cost does not include ongoing operational expenses such as skilled labor, maintenance, and reagent procurement. Despite this, government incentives and the push towards Universal Health Coverage (UHC) have helped mitigate costs for certain demographic groups, though affordability remains a challenge in remote areas.

Technical Challenges

The technical challenges related to lipid profile testing include the need for highly specialized diagnostic tools and laboratory technicians with expertise in lipid testing procedures. In the Philippines, the number of skilled lab technicians is insufficient to meet the growing demand for accurate and timely lipid profile tests, especially in rural areas. According to the Professional Regulation Commission (PRC), only about ~% of medical laboratories meet the required standards for operating lipid testing equipment, contributing to a lack of standardized practices in some areas. This issue hampers the reliability and accessibility of lipid profile testing services.

Opportunities

Technological Advancements

Technological advancements in lipid profile testing equipment and automation offer significant growth opportunities for the Philippines market. In 2025, diagnostic technologies such as point-of-care testing (POCT) and home testing kits began gaining traction in the Philippines. The market for these technologies is expected to grow due to their affordability and convenience, especially in rural areas where access to healthcare facilities is limited. Furthermore, innovations in mobile health solutions are making lipid testing more accessible and less time-consuming, driving demand among health-conscious consumers.

International Collaborations

International collaborations between the Philippines and foreign healthcare institutions present new opportunities for expanding lipid profile testing services. For example, in 2025, the Philippine government partnered with the World Health Organization (WHO) to implement nationwide cardiovascular disease screening programs. These collaborations are expected to drive growth by improving access to advanced lipid testing technologies and fostering knowledge transfer to local health professionals. Additionally, partnerships with international diagnostic companies like Roche and Abbott could help expand testing infrastructure and standardize diagnostic practices across the country

Future Outlook

The Philippines Lipid Profiles Testing Market is poised for steady growth over the next 5 years. The continued rise in cardiovascular diseases and the increasing shift toward preventive healthcare will drive the market. The government’s commitment to improving healthcare access and infrastructure, along with advancements in diagnostic technology, will further boost the demand for lipid testing services. Increased collaborations between diagnostic laboratories, healthcare providers, and insurance companies will facilitate more widespread testing and screenings, contributing to the market’s positive trajectory. With rising disposable incomes and an aging population, the market is expected to experience sustained growth through 2030.

Major Players

- Unilab

- St. Luke’s Medical Center

- The Medical City

- LabCorp

- Quest Diagnostics

- Metro Manila Diagnostics

- Biolab Diagnostics

- Veritas Health

- PhilHealth

- Makati Medical Center

- Diagnostic Laboratory Services, Inc.

- Medi-Scan

- San Miguel Corporation Health Services

- Philippine Heart Center

- Healthway Medical

Key Target Audience

- Healthcare Providers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (

- Medical Equipment Suppliers

- Insurance Companies

- Pharmaceutical Companies

- Healthcare Technology Providers

- Public Health Organizations

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out all relevant stakeholders in the Philippines Lipid Profiles Testing Market. This includes healthcare providers, diagnostic labs, technology suppliers, and government bodies. Secondary research will gather information about the current market dynamics, including size, growth drivers, and regulatory factors.

Step 2: Market Analysis and Construction

We will analyze historical data to understand market growth trends, adoption rates, and pricing trends for lipid profile testing in the Philippines. Data from hospitals, diagnostic labs, and public health surveys will be evaluated for constructing accurate market estimates and forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Primary interviews will be conducted with key industry stakeholders such as diagnostic lab operators, healthcare providers, and technology vendors to validate hypotheses. This step helps refine the understanding of market trends, challenges, and opportunities.

Step 4: Research Synthesis and Final Output

The final phase involves compiling findings from both secondary and primary research and synthesizing them into a comprehensive market report. This will include validation through consultations with industry experts and statistical analysis to ensure accuracy and reliability of data.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Philippines-Specific Terminologies, Abbreviations, Market Sizing Logic, Bottom-Up & Top-Down Validation, Triangulation Framework, Primary Interviews Across Diagnostic Labs, Healthcare Providers, Government Agencies, and Industry Experts, Demand-Side & Supply-Side Weightage, Data Reliability Index, Limitations & Forward-Looking Assumptions)

- Definition and Scope

- Market Genesis and Evolution Pathway Philippines Lipid Profile Testing Industry

- Timeline

- Lipid Profile Testing Business Cycle

- Supply Chain & Value Chain Analysis

- Market Trends Shaping the Lipid Profile Testing Landscape

- Regulatory Landscape Impacting Lipid Profile Testing Systems

- Key Growth Drivers

Increasing Incidence of Cardiovascular Diseases

Rising Health Awareness Among Filipinos

Government Health Initiatives and Campaigns

Growth in Preventive Healthcare Services

- Market Challenges

Cost Barriers in Rural Areas

Limited Availability of Modern Diagnostic Equipment in Remote Areas

Regulatory Hurdles and Compliance Issues

- Market Opportunities

Growing Demand for Preventive Health Screening

Innovations in Point-of-Care Testing Solutions

Increasing Healthcare Investments in Diagnostic Services

- Key Trends

Advancements in Automated Testing Systems

Shift Toward Mobile and Telemedicine-Based Testing

Growing Popularity of Online Health Platforms and Virtual Health Consultations

- Regulatory & Policy Landscape

Philippine FDA Regulations for Medical Laboratories

Guidelines on Lab Certifications and Accreditation

Government Support for Health Initiatives

- SWOT Analysis (Market Level)

Stakeholder Ecosystem

Porter’s Five Forces

Competition Ecosystem

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Vehicle Type Adoption, 2019-2025

- By Testing System Type, 2019-2025

- By Region, 2019-2025

- By Test Type (In Value %)

Cholesterol Testing

HDL Testing

LDL Testing

Triglyceride Testing

Total Lipid Profile

- By Application (In Value %)

Clinical Diagnostics

Preventive Healthcare

Research and Development

By End User (In Value %)

Hospitals

Diagnostic Laboratories

Ambulatory Surgical Centers

- By Region (In Value %)

Luzon

Visayas

Mindanao

- By Testing Mode (In Value %)

Manual Testing

Automated Testing

- Market Share Analysis Value & Volume Contribution

Market Share of Major Players by Test Type

Market Share by Region Luzon, Visayas, Mindanao - Cross Comparison Parameters (Product Portfolio Breadth, Technology Integration, Distribution Footprint, Regulatory Approvals, R&D Investment & Technological Advancements, Strategic Partnerships & Collaborations, Customer Reach, Testing Accuracy, Cost-Effectiveness)

- SWOT Analysis of Key Players

- Competitive Benchmarking of Key Players

- Pricing Analysis Price Trends for Different Testing Solutions

- Comparison of Prices Across Major Diagnostic Providers and Hospitals

- Detailed Company Profiles

Unilab

St. Luke’s Medical Center

The Medical City

Metro Manila Diagnostics

LabCorp Philippines

Biolab Diagnostics

Veritas Health

Philippine Heart Center

PhilHealth

Quest Diagnostics

Healthway Medical

Makati Medical Center

Diagnostic Laboratory Services, Inc.

Medi-Scan

San Miguel Corporation Health Services

- Demand Pattern & Utilization Metrics

- Procurement Models & Purchasing Cycles for Testing Solutions

- Compliance & Certification Expectations

- Consumer Needs, Desires & Pain-Point Mapping

- Decision-Making Framework for Healthcare Providers and Suppliers

- Cost vs. Security Prioritization

- By Value, 2026-2030

- By Volume, 2026-2030

- By Average Price, 2026-2030